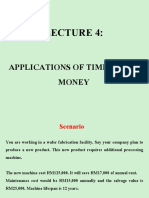

Professional Documents

Culture Documents

Rate of Return One Project: Engineering Economy

Uploaded by

Emran Janem0 ratings0% found this document useful (0 votes)

68 views20 pagesROR is the unique I rate at which a PW, FW, or AW Relation equals exactly 0 PW = -100K+1.2M(P / f,i)) I = 1.9% I = $-200,000 a = $-15,000 n = 12 F = $435,000 Using the rate function = RATE(12,-15000,-200000,450000) find the I value in the relation PW = 0 or AW =

Original Description:

Original Title

Ch7_RateofReturnOneProject

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentROR is the unique I rate at which a PW, FW, or AW Relation equals exactly 0 PW = -100K+1.2M(P / f,i)) I = 1.9% I = $-200,000 a = $-15,000 n = 12 F = $435,000 Using the rate function = RATE(12,-15000,-200000,450000) find the I value in the relation PW = 0 or AW =

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views20 pagesRate of Return One Project: Engineering Economy

Uploaded by

Emran JanemROR is the unique I rate at which a PW, FW, or AW Relation equals exactly 0 PW = -100K+1.2M(P / f,i)) I = 1.9% I = $-200,000 a = $-15,000 n = 12 F = $435,000 Using the rate function = RATE(12,-15000,-200000,450000) find the I value in the relation PW = 0 or AW =

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 20

7-1

Lecture slides to accompany

Engineering Economy

7

th

edition

Leland Blank

Anthony Tarquin

Chapter 7

Rate of Return

One Project

2012 by McGraw-Hill All Rights Reserved

7-2

LEARNINGOUTCOMES

1. Understand meaning of ROR

2. Calculate ROR for cash flow series

3. Understand difficulties of ROR

4. Determine multiple ROR values

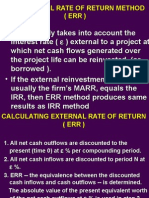

5. Calculate External ROR (EROR)

6. Calculate r and i for bonds

2012 by McGraw-Hill All Rights Reserved

7-3

Interpretation of ROR

Rate paid on unrecovered balance of borrowed money

such that final payment brings balance to exactly zero

with interest considered

ROR equation can be written in terms of PW, AW, or FW

Numerical value can range from -100% to infinity

Use trial and error solution by factor or spreadsheet

2012 by McGraw-Hill All Rights Reserved

ROR Calculation and Project Evaluation

To determine ROR, find the i* value in the relation

PW = 0 or AW = 0 or FW = 0

Alternatively, a relation like the following finds i*

PW

outflow

= PW

inflow

For evaluation, a project is economically viable if

i* MARR

7-4

2012 by McGraw-Hill All Rights Reserved

Finding ROR by Spreadsheet Function

Using the RATE function

= RATE(n,A,P,F)

P = $-200,000 A = $-15,000

n = 12 F = $435,000

Function is

= RATE(12,-15000,-200000,450000)

Display is i* = 1.9%

Using the IRR function

= IRR(first_cell, last_cell)

2012 by McGraw-Hill All Rights Reserved

7-5

= IRR(B2:B14)

A company bought a certain amount of shares

for $100,000 in a new startup company. The

company was able to sell its shares for $1.2

Million after 7 years, find the rate of return for

this investment.

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-6

ROR is the unique i* rate at which a PW, FW, or AW relation equals exactly 0

PW = -100K+1.2M(P/F,i*,7)

ROR Calculation Using PW, FW or AW

Relation

7-7

ROR is the unique i* rate at which a PW, FW, or AW relation equals exactly 0

ROR Calculation Using PW, FW or AW Relation

Since i* > MARR = 15%, the company should buy the machine

Example: An investment of $20,000 in new equipment will

generate income of $7000 per year for 3 years, at which time the

machine can be sold for an estimated $8000. If the companys

MARR is 15% per year, should it buy the machine?

Solution:: The ROR equation, based on a PW relation, is:

Solve for i* by trial and error or spreadsheet: i* = 18.2% per year

0 = -20,000 + 7000(P/A,i*,3) + 8000(P/F,i*,3)

2012 by McGraw-Hill All Rights Reserved

7-8

Incremental analysis necessary for multiple

alternative evaluations (discussed later)

Special Considerations for ROR

May get multiple i* values (discussed later)

i* assumes reinvestment of positive cash flows

earn at i* rate (may be unrealistic)

2012 by McGraw-Hill All Rights Reserved

7-9

Multiple ROR Values

Multiple i* values may exist when there is more than one sign

change in net cash flow (CF) series.

Such CF series are called non-conventional

Two tests for multiple i* values:

Descartes rule of signs: total number of real i* values

is the number of sign changes in net cash flow series.

Norstroms criterion: if the cumulative cash flow starts off

negatively and has only one sign change, there is only one

positive root .

2012 by McGraw-Hill All Rights Reserved

7-10

2012 by McGraw-Hill All Rights Reserved

Plot of PW for CF Series with Multiple ROR Values

i* values at

~8% and ~41%

7-11

Example: Multiple i* Values

Solution:

Determine the maximum number of i* values for the cash flow shown below

Year Expense Income

0 -12,000 -

1 -5,000 + 3,000

2 -6,000 +9,000

3 -7,000 +15,000

4 -8,000 +16,000

5 -9,000 +8,000

Therefore, there is only one i* value ( i* = 8.7%)

Net cash flow

-12,000

-2,000

+3,000

+8,000

-1,000

+8,000

Cumulative CF

-12,000

-14,000

-11,000

-3,000

+5,000

+4,000

The cumulative cash flow begins

negatively with one sign change

The sign on the net cash flow changes

twice, indicating two possible i* values

2012 by McGraw-Hill All Rights Reserved

7-12

Removing Multiple i* Values

Two approaches to determine External ROR (EROR)

(1) Modified ROR (MIRR)

(2) Return on Invested Capital (ROIC)

Two new interest rates to consider:

Investment rate i

i

rate at which extra funds

are invested external to the project

Borrowing rate i

b

rate at which funds are

borrowed from an external source to provide

funds to the project

2012 by McGraw-Hill All Rights Reserved

7-13

Modified ROR Approach (MIRR)

Four step Procedure:

Determine PW in year 0 of all negative CF at i

b

Determine FW in year n of all positive CF at i

i

Calculate EROR = i by FW = PW(F/P,i,n)

If i MARR, project is economically justified

2012 by McGraw-Hill All Rights Reserved

7-14

Example: EROR Using MIRR Method

For the NCF shown below, find the EROR by the MIRR method if

MARR = 9%, i

b

= 8.5%, and i

i

= 12%

Year 0 1 2 3

NCF +2000 -500 -8100 +6800

Solution: PW

0

= -500(P/F,8.5%,1) - 8100(P/F,8.5%,2)

= $-7342

FW

3

= 2000(F/P,12%,3) + 6800

= $9610

PW

0

(F/P,i,3) + FW

3

= 0

-7342(1 + i)

3

+ 9610 = 0

i = 0.0939 (9.39%)

Since i > MARR of 9%, project is justified

2012 by McGraw-Hill All Rights Reserved

7-15

Example: EROR Using MIRR Method

For the NCF shown below, find the EROR by the MIRR method if

MARR = 9%, i

b

= 8.5%, and i

i

= 12%

Year 0 1 2 3 4

NCF +2000 -500 -8100 +6800 +1207

2012 by McGraw-Hill All Rights Reserved

7-16

Return on Invested Capital Approach

Measure of how effectively project uses funds that remain internal to project

ROIC rate, i, is determined using net-investment procedure

Three step Procedure

(1) Develop series of FW relations for each year t using:

F

t

= F

t-1

(1 + k) + NCF

t

where: k = i

i

if F

t-1

> 0 and k = i if F

t-1

< 0

(2) Set future worth relation for last year n equal to 0 (i.e., F

n

= 0); solve for i

(3) If i MARR, project is justified; otherwise, reject

2012 by McGraw-Hill All Rights Reserved

ROIC Example

7-17

For the NCF shown below, find the EROR by the ROIC method if

MARR = 9% and i

i

= 12%

Year 0 1 2 3

NCF +2000 -500 -8100 +6800

Solution:

Year 0: F

0

= $+2000 F

0

> 0; invest in year 1 at i

i

= 12%

Year 1: F

1

= 2000(1.12) - 500 = $+1740 F

1

> 0; invest in year 2 at i

i

= 12%

Year 2: F

2

= 1740(1.12) - 8100 = $-6151 F

2

< 0; use i for year 3

Year 3: F

3

= -6151(1 + i) + 6800 Set F

3

= 0 and solve for i

-6151(1 + i) + 6800 = 0

i= 10.55%

Since i > MARR of 9%, project is justified

2012 by McGraw-Hill All Rights Reserved

ROIC Example

7-18

For the NCF shown below, find the EROR by the ROIC method if

MARR = 9% and i

i

= 12%

Year 0 1 2 3 4

NCF +2000 -500 -8100 +6800 +1207

Solution:

2012 by McGraw-Hill All Rights Reserved

i = 26%

Important Points to Remember

About the computation of an EROR value

EROR values are dependent upon the

selected investment and/or borrowing rates

Commonly, multiple i* rates, i from MIRR and

i from ROIC have different values

About the method used to decide

For a definitive economic decision, set the

MARR value and use the PW or AW method

to determine economic viability of the project

7-19

2012 by McGraw-Hill All Rights Reserved

7-21

Summary of Important Points

More than 1 sign change in NCF may cause multiple i* values

Descartes rule of signs and Norstroms criterion useful when

multiple i* values are suspected

ROR equations can be written in terms of PW, FW, or AW and

usually require trial and error solution

i* assumes reinvestment of positive cash flows at i* rate

EROR can be calculated using MIRR or ROIC approach.

Assumptions about investment and borrowing rates is required.

General ROR equation for bonds is

0 = - P + I(P/A,i*,nxc) + V(P/F,i*,nxc)

2012 by McGraw-Hill All Rights Reserved

You might also like

- Rate of Return One Project: Engineering EconomyDocument22 pagesRate of Return One Project: Engineering Economyann94bNo ratings yet

- Chapter 7 - ROR Analysis For A Single AlternativeDocument18 pagesChapter 7 - ROR Analysis For A Single AlternativeBich Lien Pham100% (1)

- Rate of Return: One ProjectDocument19 pagesRate of Return: One ProjectScribd MeNo ratings yet

- Chap. 7Document15 pagesChap. 7Khuram MaqsoodNo ratings yet

- Rate of Return: Engineering Economics 1Document24 pagesRate of Return: Engineering Economics 1王泓鈞No ratings yet

- Chapter 7 - ROR Analysis For A Single AlternativeDocument28 pagesChapter 7 - ROR Analysis For A Single Alternativemuhammad naqiNo ratings yet

- Chapter 7 RORDocument29 pagesChapter 7 RORAbdulrahman ezzaldeenNo ratings yet

- INE 320 Chapter 7Document18 pagesINE 320 Chapter 7Antonio kheirNo ratings yet

- Rate of Return One ProjectDocument18 pagesRate of Return One ProjectMalek Marry Anne100% (1)

- Engineering Economics (MS-291) : Lecture # 21Document22 pagesEngineering Economics (MS-291) : Lecture # 21M Ali AsgharNo ratings yet

- Eng Econ Internal and External RORDocument20 pagesEng Econ Internal and External RORMohammad AlmafrajiNo ratings yet

- EFM - Capital Budgeting Techniques Ctnd. - Lec 12-MSESPM2019Document60 pagesEFM - Capital Budgeting Techniques Ctnd. - Lec 12-MSESPM2019Raut SumeshNo ratings yet

- The Internal Rate of Return MethodDocument4 pagesThe Internal Rate of Return MethodMùhammad TàhaNo ratings yet

- IEDA 3230: Engineering Economy Comparing Engineering Project (Deterministic Models)Document36 pagesIEDA 3230: Engineering Economy Comparing Engineering Project (Deterministic Models)jnfzNo ratings yet

- Ch8 - RateofReturnMultipleAlternatives (Compatibility Mode)Document17 pagesCh8 - RateofReturnMultipleAlternatives (Compatibility Mode)ann94bNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- Chapter 6: Alternate Investment Tools I. Payback Period: Original Cost of The ProjectDocument7 pagesChapter 6: Alternate Investment Tools I. Payback Period: Original Cost of The ProjectmajorkonigNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- Chapter 7&8: Rate of Return of A Single Alternative Rate of Return Multiple AlternativesDocument17 pagesChapter 7&8: Rate of Return of A Single Alternative Rate of Return Multiple AlternativesBlessing FajemirokunNo ratings yet

- IRR, ERR and Payback - pptx-1470084967Document41 pagesIRR, ERR and Payback - pptx-1470084967Alexie GonzalesNo ratings yet

- WK 3 DQ 1Document4 pagesWK 3 DQ 1Bharat PanthiNo ratings yet

- 5.1 Economic IndicatorsDocument57 pages5.1 Economic IndicatorsAlex CoolNo ratings yet

- IEDA 3230: Engineering Economy Evaluating An Engineering Project (Deterministic Models)Document32 pagesIEDA 3230: Engineering Economy Evaluating An Engineering Project (Deterministic Models)jnfzNo ratings yet

- Solutions - Capital BudgetingDocument6 pagesSolutions - Capital BudgetingFarzan Yahya Habib100% (1)

- Chapter 8 - ROR Analysis For Multiple AlternativesDocument13 pagesChapter 8 - ROR Analysis For Multiple AlternativesBich Lien PhamNo ratings yet

- Benefit CostDocument14 pagesBenefit CostWidi NugrahaNo ratings yet

- Dba 302 Accounting Rate of Return, NPV and Irr PresentationsDocument12 pagesDba 302 Accounting Rate of Return, NPV and Irr Presentationsmulenga lubembaNo ratings yet

- P1 Investment Appraisal MethodsDocument3 pagesP1 Investment Appraisal MethodsSadeep Madhushan0% (1)

- Rate of Return - v2 1Document18 pagesRate of Return - v2 1Merlyn AytonaNo ratings yet

- Capital BudgetingDocument75 pagesCapital BudgetingfreshkidjayNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisDejene HailuNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisMobin NasimNo ratings yet

- 01 - Adv Issues in Cap BudgetingDocument17 pages01 - Adv Issues in Cap BudgetingMudit KumarNo ratings yet

- Lecture9 IRRDocument29 pagesLecture9 IRRsuraj bhandariNo ratings yet

- Investment Valuation Criteria: Lecture 9thDocument49 pagesInvestment Valuation Criteria: Lecture 9thMihai StoicaNo ratings yet

- Arr 2Document5 pagesArr 2Rohit GandhiNo ratings yet

- Chapter 13 - HW With SolutionsDocument9 pagesChapter 13 - HW With Solutionsa882906100% (1)

- Capital Budgeting - I: Gourav Vallabh Xlri JamshedpurDocument64 pagesCapital Budgeting - I: Gourav Vallabh Xlri JamshedpurSimran JainNo ratings yet

- Capital Expenditure - ReportDocument8 pagesCapital Expenditure - Reportmagoimoi100% (1)

- Lecture No21Document23 pagesLecture No21Sajid IqbalNo ratings yet

- MIN 100 Investment Analysis: University of Stavanger E-MailDocument52 pagesMIN 100 Investment Analysis: University of Stavanger E-MailSonal Power UnlimitdNo ratings yet

- Capital BudgetingDocument52 pagesCapital Budgetingrabitha07541No ratings yet

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Chapter 8Document7 pagesChapter 8Namita RazdanNo ratings yet

- Ch8 RateofReturnMultipleAlternativesDocument13 pagesCh8 RateofReturnMultipleAlternativesquik silvaNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRhonita Dea AndariniNo ratings yet

- Annuity (Continuous Compounding) and MARRDocument31 pagesAnnuity (Continuous Compounding) and MARRJordan Ronquillo100% (1)

- Internal Rate of Return (IRR) Analysis: Lecture No. 24 Contemporary Engineering EconomicsDocument22 pagesInternal Rate of Return (IRR) Analysis: Lecture No. 24 Contemporary Engineering EconomicsDanielRaoNo ratings yet

- Rate of Returns-IRR, MIRRDocument3 pagesRate of Returns-IRR, MIRRsanits591No ratings yet

- Chapter 5Document46 pagesChapter 5xffbdgngfNo ratings yet

- Lecture 4 2016 - RamzanDocument33 pagesLecture 4 2016 - RamzanQed VioNo ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- Chapter 8 - ROR Analysis For Multiple AlternativesDocument13 pagesChapter 8 - ROR Analysis For Multiple AlternativesDejene HailuNo ratings yet

- Module 7 Incremental Method PDFDocument14 pagesModule 7 Incremental Method PDFRizki AnggraeniNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRizki AnggraeniNo ratings yet

- Corporate LawDocument104 pagesCorporate LawMoaaz Ahmed100% (1)

- Chapter 7 Asset Investment Decisions and Capital RationingDocument31 pagesChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNo ratings yet

- Investment Decision CriteriaDocument71 pagesInvestment Decision CriteriaBitu GuptaNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Module 5: Evaluating A Single ProjectDocument50 pagesModule 5: Evaluating A Single Project우마이라UmairahNo ratings yet

- Pre-Feasibility Study: Men FootwearDocument18 pagesPre-Feasibility Study: Men FootwearYasir RafiqNo ratings yet

- RETScreen Help-Sensitivity and Risk AnalysisDocument17 pagesRETScreen Help-Sensitivity and Risk AnalysisAbolfazl PezeshkzadehNo ratings yet

- Cap Bud ProbDocument9 pagesCap Bud ProbJulie Mark JocsonNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Financial Modeling, 4 Edition Chapter 1: Fundamental Functions and ConceptsDocument19 pagesFinancial Modeling, 4 Edition Chapter 1: Fundamental Functions and ConceptsMALAKNo ratings yet

- Euro LandDocument4 pagesEuro Landhelloyou0619No ratings yet

- Aurora TextilesDocument14 pagesAurora TextilesYale Brendan CatabayNo ratings yet

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

- Project Planning, Appraisal and Control - 1 PDFDocument117 pagesProject Planning, Appraisal and Control - 1 PDFArchna RaiNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingD Y Patil Institute of MCA and MBANo ratings yet

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetJordanVeroNo ratings yet

- F. Y. B. Com - Sem Ii - Mcqs of Business Economics Ii: Module 1 - Market Structures: Perfect Competition & MonopolyDocument15 pagesF. Y. B. Com - Sem Ii - Mcqs of Business Economics Ii: Module 1 - Market Structures: Perfect Competition & MonopolyOmkar KhutwadNo ratings yet

- Thermo-Economic Study of Hybrid Cooling Tower Systems: Full Length Research PaperDocument15 pagesThermo-Economic Study of Hybrid Cooling Tower Systems: Full Length Research PapertaghdirimNo ratings yet

- ACC501 Solved Current Papers McqsDocument36 pagesACC501 Solved Current Papers Mcqssania.mahar100% (2)

- Ch08 - Principles of Capital InvestmentDocument7 pagesCh08 - Principles of Capital InvestmentStevin GeorgeNo ratings yet

- Upstream Petroleum EconomicsDocument124 pagesUpstream Petroleum Economicsjhon berez223344No ratings yet

- All SlidesDocument31 pagesAll SlidessinginiwizNo ratings yet

- JNPT Final Volume2v2Document311 pagesJNPT Final Volume2v2Samir DhrangdhariyaNo ratings yet

- Advanced Business Calculations/Series-4-2011 (Code3003)Document12 pagesAdvanced Business Calculations/Series-4-2011 (Code3003)Hein Linn Kyaw100% (12)

- Aligning Corporate and Financial StrategyDocument46 pagesAligning Corporate and Financial StrategyDr-Mohammed FaridNo ratings yet

- MCQ Unit 2Document10 pagesMCQ Unit 2Jc Duke M Eliyasar100% (1)

- Recent Technology Has Made Possible A Computerized Vending Machine ThatDocument1 pageRecent Technology Has Made Possible A Computerized Vending Machine ThatLet's Talk With HassanNo ratings yet

- Feasibility Study Smeda Slaughter HouseDocument28 pagesFeasibility Study Smeda Slaughter HouseDr AbdulNo ratings yet

- BVH - Final Project ProfileDocument96 pagesBVH - Final Project ProfileAiman RahabarNo ratings yet

- Err and Comparing AlternativeDocument19 pagesErr and Comparing AlternativeJomer GiraoNo ratings yet

- Fma Past Paper 3 (F2)Document24 pagesFma Past Paper 3 (F2)Shereka EllisNo ratings yet

- Module 2 - 3 Cost Benefit Evaluation TechniquesDocument15 pagesModule 2 - 3 Cost Benefit Evaluation TechniquesKarthik GoudNo ratings yet

- LPG Marketing and Distribution Business Rs. 48.52 Million Dec-2020Document21 pagesLPG Marketing and Distribution Business Rs. 48.52 Million Dec-2020Ayan NoorNo ratings yet

- Assignment 6 1 Warm-Up Exercises Chapter 12Document4 pagesAssignment 6 1 Warm-Up Exercises Chapter 12Irene ApriliaNo ratings yet