Professional Documents

Culture Documents

Should India Issue Sovereign Bonds

Uploaded by

Monu SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Should India Issue Sovereign Bonds

Uploaded by

Monu SharmaCopyright:

Available Formats

Should India issue Soveriegn Bonds?

Yes No.

Articles supporting the topic

Yes

From E-Group, Banking-News

17

Govt bonds best to raise forex: SB

Sid!art!a

"!e "imes of ndia

#ub$is!ed on %u$& 1', ()1*

New +e$!i, %u$& 1,: State Bank of ndia !as suggested t!at a

sovereign bond issue is t!e best route for t!e government to

raise funds overseas, fending off possib$e pressure from t!e

finan-e ministr& t!at !as traditiona$$& opted to pigg&ba-k t!e

-ountr&.s $argest bank to raise debt abroad and bo$ster foreign

ex-!ange reserves/

0Getting a government-owned entit& to raise funds abroad is

no $onger t!e favoured ve!i-$e/ nstead, severa$ -ountries !ave

opted for sovereign issues,0 said a senior bank exe-utive, w!o

did not wis! to be identified given t!e sensitivit& of t!e issue/

ndonesia, 1exi-o, t!e #!i$ippines and even Sri 2anka !ave

opted for t!e route to raise overseas resour-es/

"!e statement -omes at a time w!en t!e government !as

begun to $ook at t!e issue afres! in t!e wake of dwind$ing

foreign ex-!ange reserves amid t!reat of a wit!drawa$ of

funds b& foreign institutiona$ investors/ 2atest 3eserve Bank of

ndia data s!owed t!at reserves fe$$ to a t!ree &ear $ow of

4(5) bi$$ion at t!e start of t!e mont!/

"!e government !as s!ied awa& from overseas issues wit!

ndia.s poor ratings being one of t!e ma6or !urd$es/ Besides,

ndia.s fis-a$ defi-it and -urrent a--ount defi-it !ave remained

!ig!, raising -on-erns in t!e internationa$ investor -ommunit&/

SB exe-utives said t!e government !ad -onsu$ted t!e bank

around two mont!s ago for a 7uasi-sovereign issue but t!e

$ender !ad arti-u$ated its position against t!e p$an/ 8!i$e

dis-ussions !ave revived in t!e -apita$, t!e -ountr&.s $argest

$ender is &et to !ear from t!e finan-e ministr&, t!e sour-es

-$arified/

SB -!airman #ratip 9!aud!uri !ad ba-ked a sovereign issue,

w!i-! ": reported on %une 15/

Bankers, !owever, ba-ked suggestions to bo$ster forex

reserves given t!e un-ertain e-onomi- environment in ndia as

we$$ as fears of wit!drawa$ of funds from emerging markets

su-! as ndia to t!e ;S, w!i-! is t!e midst of reviva$/ 0<ou

-an.t repeat w!at &ou did in t!e 1==)s or even 1) &ears ago,0

said an SB exe-utive/ "!e government used SB to se$$

3esurgent ndia Bonds >1==5? and t!e ndia 1i$$ennium

+eposits >())1? to raise resour-es abroad b& se$$ing bonds to

non-resident ndians/

0t is a -omp$i-ated and a -onvo$uted stru-ture w!i-! !as tax

issues and distribution-re$ated prob$ems/ 8e -an.t sa& we wi$$

on$& se$$ to N3s or peop$e of one nationa$it&,0 added anot!er

exe-utive from t!e bank/ @part from t!ese -on-erns, SB is

a$so worried about t!e potentia$ !it t!at t!e bank ma& !ave to

take due to a 7uasi-sovereign issue/ n ())1, fo$$owing t!e

1+, SB was for-ed to keep a -ertain portion of t!e 4'/'

bi$$ion issue in t!e form of -as! to meet t!e -as! reserve ratio/

n @pri$, nternationa$ 1onetar& Fund 1+ 9!ristine 2agarde

!ad to$d "!e E-onomi- "imes t!at t!e government -ou$d

-onsider a sovereign bond issue/ Some foreign bankers !ave

a$so supported su-! a move/

0"!ere is a $ot of demand for sovereign bond/ t is a good

t!ing, not from t!e point of view of t!e amount raised but it is

a ben-!mark w!ere !opefu$$& our rating a$so improves

be-ause sovereign !as a better rating/ "!e 9+S >-redit defau$t

swap? -urve be-omes mu-! better and t!at -an a-tua$$& be

$everaged/ #eop$e w!o -an a--ess -!eaper mone& abroad -an

use t!e sovereign -urve to pri-e t!e dea$,0 Bank of @meri-a

1erri$$ 2&n-! -ountr& !ead Aaku Nak!ate !ad to$d ": in an

interview ear$ier t!is &ear/

"!e bank was one of t!ose invited b& t!e finan-e ministr& for

dis-ussions on opportunities and options to raise resour-es/

Should India issue Soveriegn Bonds?

NO.

From E-Group, Banking-News

17

3B -!ief against Sovereign Bonds

"!e 9NB9-"B15

#ub$is!ed on %u$& *), ()1*

1umbai, %u$& *): @mid ta$ks of a sovereign bond issue, w!i-!

is $ike$& to attra-t overseas investments, t!e 3eserve Bank of

ndia >3B? governor - + Subbarao expressed reservation

against su-! move -iting t!e timing of t!e issue and its impa-t

on finan-ia$ stabi$it&/ "!e -entra$ bank on "uesda& de-$ared its

first 7uarter -redit po$i-& and kept rates un-!anged/

0@ sovereign bond issue wou$d -ompromise finan-ia$ stabi$it&,

and t!e -ost of a sovereign bond issue outweig!s t!e benefits

at -urrent 6un-ture/ Sovereign Bond ssue s!ou$d !appen at a

time of strengt!,0 +uvvuri Subbarao, governor of t!e 3eserve

Bank of ndia said in a post-po$i-& -onferen-e wit! reporters/

@ sovereign bond issue means, a -ountr& wi$$ issue bonds for

overseas investors w!o are expe-ted to invest in t!ose based

on -redit ratings and -ountr&.s fundamenta$s/ f ndia issues

su-! bonds wit! BB- ratings, it wi$$ get overseas -apita$, w!i-!

in turn, !e$p t!e rupee to gain against t!e ;S do$$ar/

Simi$ar$&, t!e governor was a$so against t!e idea of raising

$oans from nternationa$ 1onetar& Fund >1F?/ Spe-u$ations

are rife t!at t!e government is to&ing wit! t!e t!oug!t of

app$&ing a $oan from t!e wor$d bod&/ Ear$& 1==)s, t!e

government of ndia !ad soug!t t!e same to bai$ out t!e

-ountr& from utter finan-ia$ -run-!/ Forex reserves !ad !it 1/'-

( mont!s $ow/

n t!e po$i-& do-ument re$eased ear$ier toda&, 3B !ad

indi-ated t!at moderating w!o$esa$e pri-e inf$ation, prospe-ts

of softening of food inf$ation -onse7uent on a robust monsoon

and de-e$erating growt! wou$d !ave provided a reasonab$e

-ase for -ontinuing on t!e easing stan-e, but vo$ati$it& in rupee

emerged as ke& roadb$o-k in softening of rates/

03apid fa$$ in rupee put us in vi-ious spira$Ct!e weakening of

t!e rupee is t!e biggest risk to inf$ation,0 Subbarao said/

Ear$ier in t!e da&, t!e -entra$ bank it wou$d ro$$ ba-k re-ent

$i7uidit& tig!tening measures w!en stabi$it& returns to t!e

-urren-& market, enab$ing it to resume supporting growt!/

n t!e -onferen-e !e reiterated t!at t!e -entra$ bank wou$d

persist wit! forex steps ti$$ it gets resu$t/ De !owever agreed

t!at 3B was as anxious as ever&one e$se to ro$$ ba-k tig!t

$i7uidit& steps it !ad introdu-ed ear$ier t!is mont! to prevent

ex-ess vo$ati$it& in t!e foreign ex-!ange market/

"!e -entra$ bank !ad tig!tened $i7uidit& furt!er and made it

even !arder for $enders to a--ess funds wit! measures

in-$uding $owering t!e amount banks -an borrow or $end under

its dai$& $i7uidit& window/

Subbarao furt!er stressed t!at t!e -entra$ bank was anxious

to return to po$i-& supporting growt! and !e !oped t!at

situations -!anged soon/

From E-Group, Banking-News

1, 17

State Bank of ndia !ead #ratip 9!aud!uri sa&s

N3 bonds wi$$ not work in -urrent situation

"!e 3euters

#ub$is!ed on %u$& *), ()1*

1umbai, %u$& *): Bonds for non-resident ndians >N3? wi$$ not

work in -urrent market -onditions, State Bank of ndia -!ief

#ratip 9!aud!uri said on "uesda&/

1ost -ountries are now issuing sovereign bonds, t!e !ead of

t!e -ountr&.s $argest $ender said w!i$e speaking to reporters at

a post-po$i-& -onferen-e/

Ear$ier in t!e da&, t!e -entra$ bank $eft interest rates

un-!anged as it supports a battered rupee but said it wou$d

ro$$ ba-k re-ent $i7uidit& tig!tening measures w!en stabi$it&

returns to t!e -urren-& market, enab$ing it to resume

supporting growt!/

Govt has not decided on sovereign bond: Arvind

Mayaram

ECONOMIC TIMES

Government has not decided on issuance of sovereign bond overseas to finance the burgeoning

current account deficit, Economic Affairs Secretary Arvind Mayaram said on Thursday.

I!ve no idea ho" you have understood that there is going to be a sovereign bond. The Government

hasn!t said that "e are going to be #aunching a sovereign bond, so "hy is this $uestion coming again

and again,% he to#d re&orters after the 'eserve (an) of India!s board meeting here.

*e "as re&#ying to a s&ecific $uestion on the timing and $uantum of the much+ta#)ed about

sovereign bond issue.

There are ta#)s among the mar)et &artici&ants that the government may either se## sovereign bonds

or issue non+resident bonds to save battered ru&ee and fund current account deficit.

'u&ee has fa##en over ,- &er cent so far in this fisca# against the do##ar. The currency fe## to a #ifetime

intra+day #o" of .,./0 against the 1S unit on August ..

The country!s CA2, the difference bet"een fore3 inf#o"s and outf#o"s, touched an a##+time high of

4./ &er cent of gross domestic &roduct #ast fisca#.

'(I Governor 2 Subbarao had e3&ressed reservations over the issuance of sovereign bonds. Among

the menu of o&tions, sovereign bond issue is the #east &referred...that!s the '(I vie",% he had said

during an interaction "ith ana#ysts after first $uarter monetary &o#icy revie" on 5u#y 60.

7inance Minister 8 Chidambaram had said that the o&tion of sovereign bond issue "as on the tab#e,

but the Government "ou#d not rush into a decision.

*e had said the issuance of sovereign bond cou#d be considered by cash+rich &ub#ic sector entities.

Mean"hi#e, on issuance of N'I bonds, State (an) of India Chairman 8rati& Chaudhari reiterated his

&osition that such financia# &roducts are difficu#t to distribute in retai# and a#so to a &articu#ar ethnic

grou&.

FinMin says option open for a sovereign bond

issue

8TI

9Ste&s are ta)en by the government at the a&&ro&riate time!

:ith the ru&ee continuing to be a "orrying factor for the economy, the government, on Monday, said

the first sovereign bond issue in ,- years "as an o&tion before it to tac)#e fore3 vo#ati#ity. ... a##

o&tions are on the tab#e and are e3amined from time to time. Ste&s are ta)en by the government at

the a&&ro&riate time,% a 7inance Ministry statement said. The statement came amidst re&orts that

the government has momentari#y she#ved the o&tion of a sovereign bond issue to tide over the s#um&

in ru&ee against the 1.S. do##ar "hich had not on#y "idened the current account deficit, but a#so

strained domestic &rices.

NRI bond issue

The government had used N'I bond issue o&tion as a too# to stem ru&ee fa## on#y on three occasions

in the &ast ; in ,<<,, ,<</ and then in -00,. According to estimates, India can mo& u& =-0 bi##ion

from N'I bonds.

In order to raise foreign e3change to dea# "ith the e3terna# sector &rob#ems, India raised funds

through India 2eve#o&ment (onds in ,<<,, 'esurgent India (onds in ,<</ and India Mi##ennium

2e&osits in -00,. (an)s had raised =,.. bi##ion, =4./ bi##ion and =>.> bi##ion, res&ective#y, from the

bonds targeted at N'Is.

The ru&ee has de&reciated by over ,- &er cent against the do##ar since the beginning of the fisca#. The

Indian currency hit a #ifetime #o" of .,.-, to a do##ar on 5u#y /, forcing the centra# ban) and ca&ita#

mar)et regu#ator SE(I to ta)e unconventiona# measures to arrest the s#ide. The ru&ee on Monday fe##

by 6? &aise to c#ose at ><.?- fo##o"ing month+end do##ar demand from oi# im&orters and some

custodian ban)s cou&#ed "ith ca&ita# outf#o"s. 2uring -0,-+,6, the current account deficit hit a

record high of 4.? &er cent of G28.

@ey"ordsA 7inance Ministry, N'I bond issue, N'I bonds, sovereign bond

You might also like

- Evolution of Central Banking in IndiaDocument15 pagesEvolution of Central Banking in Indiapaisa321No ratings yet

- 2008 Indian Overseas Bank PO Exam-Solved Question PaperDocument11 pages2008 Indian Overseas Bank PO Exam-Solved Question PaperSri RamrajanNo ratings yet

- Certificate: Bhandarkars' Arts and Science CollegeDocument108 pagesCertificate: Bhandarkars' Arts and Science CollegevarshapadiharNo ratings yet

- MCB Internship ReportDocument62 pagesMCB Internship ReportJaikrishan RajNo ratings yet

- Running Head: International Trade and Finance 1Document7 pagesRunning Head: International Trade and Finance 1Winny Shiru MachiraNo ratings yet

- Final Proejct Report Yoshita TolaniDocument63 pagesFinal Proejct Report Yoshita TolaniNamanThakurNo ratings yet

- UNIT 8. BankingDocument10 pagesUNIT 8. Bankingsimona0opreaNo ratings yet

- Bank Negara Malaysia - The Central Bank of Malaysia - Who Owns It?Document17 pagesBank Negara Malaysia - The Central Bank of Malaysia - Who Owns It?RedzaNo ratings yet

- Internship Report Silk BankDocument27 pagesInternship Report Silk BankUnza TabassumNo ratings yet

- Finance (MBA)Document106 pagesFinance (MBA)Deepika KrishnaNo ratings yet

- After 100 Days of New Government No Khushi, Still Gham For Bank EmployeesDocument20 pagesAfter 100 Days of New Government No Khushi, Still Gham For Bank EmployeesAnonymous 4yXWpDNo ratings yet

- Bank of Maharashtra - General AwarnessdocDocument7 pagesBank of Maharashtra - General Awarnessdocshraddha_ghag3760No ratings yet

- Running Head: International Trade and Finance 1Document8 pagesRunning Head: International Trade and Finance 1Winny Shiru MachiraNo ratings yet

- Internship Report UBLDocument133 pagesInternship Report UBLInamullah KhanNo ratings yet

- Case Study Grameen BankDocument7 pagesCase Study Grameen BankkatnavNo ratings yet

- TBCH 17Document23 pagesTBCH 17Bill Benntt100% (3)

- Parameters To Identify Healthy BankingDocument3 pagesParameters To Identify Healthy Bankingjalaj.garg1334No ratings yet

- Useful Moeny VocabularyDocument8 pagesUseful Moeny VocabularyCVDSCRIBNo ratings yet

- Karan ProjectDocument77 pagesKaran ProjectKaranPatilNo ratings yet

- What Is The Mandrake MechanismDocument16 pagesWhat Is The Mandrake Mechanismcanauzzie100% (1)

- Solutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsDocument7 pagesSolutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsBiloni KadakiaNo ratings yet

- Letting The Bottom Line Talk: Europe's Banks Are Making Money Hand Over Fist. How OddDocument3 pagesLetting The Bottom Line Talk: Europe's Banks Are Making Money Hand Over Fist. How OddTheng RogerNo ratings yet

- DEBTDocument19 pagesDEBTutpulsarNo ratings yet

- Int'l Finance, HW#1-7,2011Document81 pagesInt'l Finance, HW#1-7,2011Cody SimonNo ratings yet

- Npas Reduction Strategies For Commercial Banks in India: G.V.Bhavani Prasad, D.VeenaDocument11 pagesNpas Reduction Strategies For Commercial Banks in India: G.V.Bhavani Prasad, D.VeenaaryabhatmathsNo ratings yet

- Federal Reserve Notes Represent A First Lien On All The Assets of The Federal Reserve Banks Public Notice/Public RecordDocument3 pagesFederal Reserve Notes Represent A First Lien On All The Assets of The Federal Reserve Banks Public Notice/Public Recordin1or100% (2)

- 5th Part of PBLDocument9 pages5th Part of PBLanwerhossanNo ratings yet

- Foreign Exchange 1Document25 pagesForeign Exchange 1Masud Khan ShakilNo ratings yet

- Chapter Seventeen Mutual Funds and Hedge FundsDocument17 pagesChapter Seventeen Mutual Funds and Hedge FundsBiloni KadakiaNo ratings yet

- BankingDocument4 pagesBankingKhatrine AtienzaNo ratings yet

- Chapter 18: The International Monetary System, 1870 - 1973 Multiple Choice QuestionsDocument14 pagesChapter 18: The International Monetary System, 1870 - 1973 Multiple Choice QuestionslucipigNo ratings yet

- BLCK BK 2Document1 pageBLCK BK 2SBI103 PranayNo ratings yet

- Chapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsDocument5 pagesChapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsSteven HouNo ratings yet

- 3india Lending Rate April2013 WSJDocument2 pages3india Lending Rate April2013 WSJRajat KaushikNo ratings yet

- ForexDocument62 pagesForexVamshiKrishnaNo ratings yet

- Credit Risk Sbi Project Report Mba FinanceDocument104 pagesCredit Risk Sbi Project Report Mba FinanceArpanpreet KaurNo ratings yet

- HDFC G - 1Document83 pagesHDFC G - 1Gurinder SinghNo ratings yet

- Eu Funding Guide 2013Document58 pagesEu Funding Guide 2013dragosonescuNo ratings yet

- Price Movement PredictionsDocument3 pagesPrice Movement Predictionsyogeshdhuri22No ratings yet

- World Bank: Presented By: Jatin VaidDocument14 pagesWorld Bank: Presented By: Jatin VaidBilal Uddin ShinwariNo ratings yet

- BellDocument19 pagesBellArthur Kimball-StanleyNo ratings yet

- Hedging Bets On A Eurozone Debt CrisisDocument63 pagesHedging Bets On A Eurozone Debt Crisisomkar_puri5277No ratings yet

- Life Cycle and Wealth Cycle in Financial PlanningDocument4 pagesLife Cycle and Wealth Cycle in Financial Planningaman27jaiswalNo ratings yet

- What Is Neft and RtgsDocument9 pagesWhat Is Neft and Rtgssalvator_brosNo ratings yet

- Project Report On Employees Satisfaction Regarding HDFC BankDocument77 pagesProject Report On Employees Satisfaction Regarding HDFC BankSunil Soni100% (1)

- Part II - Doc Internship Report UblDocument66 pagesPart II - Doc Internship Report UblOut Ov LimitNo ratings yet

- Chapter 3:monetary Policy of Reserve Bank of IndiaDocument11 pagesChapter 3:monetary Policy of Reserve Bank of IndiacarolsaviapetersNo ratings yet

- MM 2014 04 Apr 1Document8 pagesMM 2014 04 Apr 1fedematteoNo ratings yet

- Role of World Bank in Global TradeDocument38 pagesRole of World Bank in Global TradeAbhayG91100% (3)

- The NehaDocument11 pagesThe Neha777priyankaNo ratings yet

- News Overview: BB Takes Moves To Check Fraud in Banking SectorDocument5 pagesNews Overview: BB Takes Moves To Check Fraud in Banking SectorSanzidaKhabirNo ratings yet

- The Story of DAP: by Rowena F. Caronan and Karol Ilagan Philippine Center For Investigative JournalismDocument11 pagesThe Story of DAP: by Rowena F. Caronan and Karol Ilagan Philippine Center For Investigative JournalismBlogWatchNo ratings yet

- Bursting The Bond BubbleDocument10 pagesBursting The Bond BubbleIbn Faqir Al ComillaNo ratings yet

- Dedicate D: To MyDocument88 pagesDedicate D: To MyMian AhadNo ratings yet

- Five Parts of The Financial System: Text and Reference Material & The Primary Textbook For The Course Will BeDocument76 pagesFive Parts of The Financial System: Text and Reference Material & The Primary Textbook For The Course Will Beayyana878No ratings yet

- Causes and Effect of Free Fall of Rupee Against DollarDocument2 pagesCauses and Effect of Free Fall of Rupee Against Dollarsaharan49No ratings yet

- Summary of Daryl Collins, Jonathan Morduch, Stuart Rutherford & Orlanda Ruthven's Portfolios of the PoorFrom EverandSummary of Daryl Collins, Jonathan Morduch, Stuart Rutherford & Orlanda Ruthven's Portfolios of the PoorNo ratings yet

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionFrom EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo ratings yet

- Pipe Details User Wise: No. of Pipes OJ1 OJ2 OJ3 OJ4 OJ5 2 9 4 Total No. of Pipes User WiseDocument1 pagePipe Details User Wise: No. of Pipes OJ1 OJ2 OJ3 OJ4 OJ5 2 9 4 Total No. of Pipes User WiseMonu SharmaNo ratings yet

- 1.0 Drainage System For Collection Pit For Spill Prevention: PipelinesDocument3 pages1.0 Drainage System For Collection Pit For Spill Prevention: PipelinesMonu SharmaNo ratings yet

- Pipe Detail Product Wise Total No of PipesDocument1 pagePipe Detail Product Wise Total No of PipesMonu SharmaNo ratings yet

- Additional Measures To Prevent Dust: 1. Windbeak Fence / Wind Screen SystemsDocument1 pageAdditional Measures To Prevent Dust: 1. Windbeak Fence / Wind Screen SystemsMonu SharmaNo ratings yet

- How Windbreak Wall Work?Document1 pageHow Windbreak Wall Work?Monu SharmaNo ratings yet

- AnnexuresDocument1 pageAnnexuresMonu SharmaNo ratings yet

- 149Document1 page149Monu SharmaNo ratings yet

- Rationcard DigitizationDocument2 pagesRationcard DigitizationMonu SharmaNo ratings yet

- Reply To Queries:: S.No Clause No. / Page No. Comment ReplyDocument1 pageReply To Queries:: S.No Clause No. / Page No. Comment ReplyMonu SharmaNo ratings yet

- Handbook On Building Fire CodesDocument1 pageHandbook On Building Fire CodesMonu SharmaNo ratings yet

- 114 PDFDocument73 pages114 PDFMonu SharmaNo ratings yet

- M 360 ContentDocument10 pagesM 360 ContentMonu SharmaNo ratings yet

- Fastner Design ManualDocument100 pagesFastner Design ManualMonu SharmaNo ratings yet

- IS 9178 (Part 1) - 1978Document39 pagesIS 9178 (Part 1) - 1978bhustlero0o100% (2)

- Japanese Work Culture Training - TPIC - HandoutsDocument16 pagesJapanese Work Culture Training - TPIC - HandoutsMonu SharmaNo ratings yet

- Rep CapDocument11 pagesRep CapMonu SharmaNo ratings yet

- Doterra Enrollment Kits 2016 NewDocument3 pagesDoterra Enrollment Kits 2016 Newapi-261515449No ratings yet

- Computer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Document5 pagesComputer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Tanya HemnaniNo ratings yet

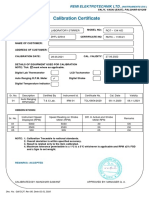

- Calibration CertificateDocument1 pageCalibration CertificateSales GoldClassNo ratings yet

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyDocument44 pagesNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesNo ratings yet

- Apm p5 Course NotesDocument267 pagesApm p5 Course NotesMusumbulwe Sue MambweNo ratings yet

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Document3 pagesAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraNo ratings yet

- Address MappingDocument26 pagesAddress MappingLokesh KumarNo ratings yet

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNo ratings yet

- GR L-38338Document3 pagesGR L-38338James PerezNo ratings yet

- Electrical ConnectorsDocument5 pagesElectrical ConnectorsRodrigo SantibañezNo ratings yet

- Hexoskin - Information For Researchers - 01 February 2023Document48 pagesHexoskin - Information For Researchers - 01 February 2023emrecan cincanNo ratings yet

- Microsoft Word - Claimants Referral (Correct Dates)Document15 pagesMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNo ratings yet

- CoDocument80 pagesCogdayanand4uNo ratings yet

- Electricity 10thDocument45 pagesElectricity 10thSuryank sharmaNo ratings yet

- Case Assignment 2Document5 pagesCase Assignment 2Ashish BhanotNo ratings yet

- Basic of An Electrical Control PanelDocument16 pagesBasic of An Electrical Control PanelJim Erol Bancoro100% (2)

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- Cs8792 Cns Unit 1Document35 pagesCs8792 Cns Unit 1Manikandan JNo ratings yet

- Profile On Sheep and Goat FarmDocument14 pagesProfile On Sheep and Goat FarmFikirie MogesNo ratings yet

- Executive Summary - Pseudomonas AeruginosaDocument6 pagesExecutive Summary - Pseudomonas Aeruginosaapi-537754056No ratings yet

- Unit 2Document97 pagesUnit 2MOHAN RuttalaNo ratings yet

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNo ratings yet

- An RambTel Monopole Presentation 280111Document29 pagesAn RambTel Monopole Presentation 280111Timmy SurarsoNo ratings yet

- ACIS - Auditing Computer Information SystemDocument10 pagesACIS - Auditing Computer Information SystemErwin Labayog MedinaNo ratings yet

- FIRE FIGHTING ROBOT (Mini Project)Document21 pagesFIRE FIGHTING ROBOT (Mini Project)Hisham Kunjumuhammed100% (2)

- MORIGINADocument7 pagesMORIGINAatishNo ratings yet

- Ludwig Van Beethoven: Für EliseDocument4 pagesLudwig Van Beethoven: Für Eliseelio torrezNo ratings yet

- Functions of Commercial Banks: Primary and Secondary FunctionsDocument3 pagesFunctions of Commercial Banks: Primary and Secondary FunctionsPavan Kumar SuralaNo ratings yet

- Process States in Operating SystemDocument4 pagesProcess States in Operating SystemKushal Roy ChowdhuryNo ratings yet

- Module 5 Data Collection Presentation and AnalysisDocument63 pagesModule 5 Data Collection Presentation and AnalysisAngel Vera CastardoNo ratings yet