Professional Documents

Culture Documents

Intl Banking

Uploaded by

karan_mib0 ratings0% found this document useful (0 votes)

46 views3 pagesUCO presently has four overseas branches in two important international financial centres in Singapore and Hong Kong and representative office at Kuala Lumpur, Malaysia and Guangzhou, China. The international linkage from India is supported by a large Indian network through Integrated Treasury Branch and Authorised Forex Branches. This international network is further augmented by correspondent arrangements with leading Banks at all important world centres in various countries.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUCO presently has four overseas branches in two important international financial centres in Singapore and Hong Kong and representative office at Kuala Lumpur, Malaysia and Guangzhou, China. The international linkage from India is supported by a large Indian network through Integrated Treasury Branch and Authorised Forex Branches. This international network is further augmented by correspondent arrangements with leading Banks at all important world centres in various countries.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views3 pagesIntl Banking

Uploaded by

karan_mibUCO presently has four overseas branches in two important international financial centres in Singapore and Hong Kong and representative office at Kuala Lumpur, Malaysia and Guangzhou, China. The international linkage from India is supported by a large Indian network through Integrated Treasury Branch and Authorised Forex Branches. This international network is further augmented by correspondent arrangements with leading Banks at all important world centres in various countries.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

UCOBANK has international presence for over 50 years

now. UCO presently has four overseas branches in two

important international financial centres in Singapore and

Hong Kong and representative office at Kuala Lumpur,

Malaysia and Guangzhou, China.

The international linkage from India is supported by a large

Indian network through Integrated Treasury Branch and

Authorised Forex Branches. Our other branches in India

also provide international banking facilities through the

Authorised Branches of our bank.This international network

is further augmented by correspondent arrangements with

leading Banks at all important world centres in various

countries.Thus UCO has a true global presence and can

offer a variety of international banking products, services

and financial solutions to all cross-section of clients, tailor-

made to their banking requirements through one of the

best international banking relationship networks both in

terms of strength and spread.

1. PRODUCTS & SERVICES

The international banking services in India is provided for

the benefit of Indian customers, corporates, NRIs,

Overseas Corporate Bodies, Foreign Companies/

Individuals as well as Foreign Banks etc. by our

International Banking Branches, Authorised Forex Branches

and Integrated Treasury Branch. Our other branches in

India also provide international banking facilities through

the aforesaid network of our branches.

All the facilities are subject to the prevalent rules &

guidelines of the Bank and RBI. Brief details of

services provided are as under:-

1. NRI Banking (Please visit NRI Corner)

2. Foreign Currency Loans

3. Finance/Services to Exporters

4. Finance/Services to Importers

5. Remittances

6. Forex & Treasury Services

7. Resident Foreign Currency (Domestic) Deposits

8. Correspondent Banking Services

9. All General Banking Services (Please visit Domestic

Banking Sections)

2. FOREIGN CURRENCY LOANS

a) In India (FCNR 'B' Loans):

The foreign currency denominated loans in India are

granted out of the pool of foreign currency funds of the

Bank in FCNR(B) Deposit etc. accounts as permitted by

Reserve Bank of India. These loans are commonly known

as FCNR(B) Loans.

UCO has a broad base of NRI customers/depositors.

Therefore, with the resource base of FCNR(B) deposits etc.

UCO is in a position to offer the Foreign Currency Loans in

India to our customers as an alternative to loans in

Rupees.

These loans are denominated in foreign currency such as

US Dollars and are offered as short term loans. The

interest is fixed with a reasonable spread over LIBOR

UCO also allows loans in foreign currency to NRIs

against their FCNR(B) Deposits at the Indian

Branches. The details are available in NRI Banking

section.

b) From Outside India:

With presence at two major financial centers of the world,

UCO has foreign currency resources to arrange /grant

Foreign Currency Loans to Indian as well as multinational

corporates at the competitive rates.

The foreign currency denominated loans are granted by

our overseas branches to Indian Corporates as per

External Commercial Borrowing (ECB) Policy of Govt. of

India/RBI.

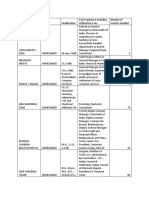

3. FINANCE/SERVICES TO EXPORTERS

UCOGOLD CARD FOR EXPORTERS

UCO launches Goldcard for creditworthy exporters -

Simplified access to export credit on very good terms:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- DCH PalemDocument13 pagesDCH PalemPrashantNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- SUBCONTRACTOR PREQUALIFICATION QUESTIONNAIREDocument18 pagesSUBCONTRACTOR PREQUALIFICATION QUESTIONNAIREEy-ey ChioNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Automotive components survey BangladeshDocument103 pagesAutomotive components survey Bangladeshjony_nsu022No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Digipay GuruDocument13 pagesDigipay GuruPeterhill100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Market Strategy Comparison of HDFC Bank and ICICI BankDocument66 pagesMarket Strategy Comparison of HDFC Bank and ICICI BankKamal Bamba100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Exim Bank of India: A Comprehensive Guide to Products and ServicesDocument21 pagesExim Bank of India: A Comprehensive Guide to Products and ServicesPrathap AnNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Other Bank Functions Estrella, Jin Paula CDocument6 pagesOther Bank Functions Estrella, Jin Paula CJin EstrellaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Tender DocumentDocument29 pagesTender DocumentPrakash ArthurNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Funds - Transfer V1 PDFDocument46 pagesFunds - Transfer V1 PDFTanaka MachanaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Estatement20230706 000233440Document3 pagesEstatement20230706 000233440Mia NahilaNo ratings yet

- Investment Portfolio Analysis of Fewa Finance CompanyDocument130 pagesInvestment Portfolio Analysis of Fewa Finance CompanyBijaya DhakalNo ratings yet

- KRISHNA POWER CENTRE statementDocument17 pagesKRISHNA POWER CENTRE statementsukhdev bhattarNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- SAP Business ByDesign - ServiceDocument136 pagesSAP Business ByDesign - ServicekameswarkumarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- HP Analyst ReportDocument11 pagesHP Analyst Reportjoycechan879827No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- FILE 20231105 224350 KIỂM-TRA-T6Document60 pagesFILE 20231105 224350 KIỂM-TRA-T6vanpth20404cNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Terms and Conditions EToroDocument42 pagesTerms and Conditions EToroZhess BugNo ratings yet

- DH3050 Tenancy Assistance Application 03.21Document16 pagesDH3050 Tenancy Assistance Application 03.21Sarah VirziNo ratings yet

- Creditable Tax ReportDocument131 pagesCreditable Tax ReportJieve Licca G. FanoNo ratings yet

- Arb PanelDocument46 pagesArb PanelKarthik VelletiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Managing Distressed AssetsDocument37 pagesManaging Distressed Assetsodumgroup100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- FI Group AssignmentDocument20 pagesFI Group AssignmentLilyNo ratings yet

- Corporate Books and Records Chapter 11Document17 pagesCorporate Books and Records Chapter 11NingClaudioNo ratings yet

- Union Bank of IndiaDocument58 pagesUnion Bank of Indiadivyesh_variaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Exam Type Question of Accountancy, Class XiDocument3 pagesExam Type Question of Accountancy, Class Xirobinghimire100% (7)

- Cashless Society - The Future of Money or A Utopia?: Nikola FabrisDocument14 pagesCashless Society - The Future of Money or A Utopia?: Nikola FabrisDominika VitárNo ratings yet

- Business Ethics ProjectDocument23 pagesBusiness Ethics ProjectGarima SinghalNo ratings yet

- Banking Financial Services Management - MBA Notes PDFDocument132 pagesBanking Financial Services Management - MBA Notes PDFNithin Tomy100% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Qualified theft conviction upheld for abuse of confidenceDocument9 pagesQualified theft conviction upheld for abuse of confidenceIvy PazNo ratings yet

- Chapter 14Document12 pagesChapter 14Aditi SenNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)