Professional Documents

Culture Documents

An Iso 9001: 2008 Certified International B-School: Subject:-Banking Management Total Marks-80

Uploaded by

ChaitanyaNaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Iso 9001: 2008 Certified International B-School: Subject:-Banking Management Total Marks-80

Uploaded by

ChaitanyaNaniCopyright:

Available Formats

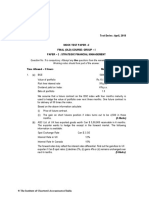

AEREN FOUNDATION REG. NO.

F/11724

SUBJECT:-BANKING MANAGEMENT

Total Marks80

Q.1) The exchange rate and forward rate of rupee against US dollar on 3

rd

November, 2008 is given below:

(20 marks)

Spot rate 1 US dollar Rs 45.36

One month forward 3.72%

Three months forward 3.27%

Six months forward 2.76%

Twelve months forward 2.26%

Calculate the forward rate, forward premium rate and swap rate from the given data.

Q.2) In May beginning you decide that shares in X Ltd. will rise over the next month or so. The current price

is Rs 100 and you hope that the shares will be at Rs. 150 by the end of July. Give your comments if the

Option is traded and if the option is not traded. Make assumptions.

(20 marks)

AN ISO 9001 : 2008 CERTIFIED INTERNATIONAL B-SCHOOL

Q.3) (15 marks)

A) The unit price of TSS scheme of a mutual fund is Rs 10. The public offer price (POP) of the unit is Rs

10.204 and the redemption price is Rs 9.80.

Calculate

i) Front-end load and

ii) Back-end load.

B) Mr. A can earn a return of 16% by investing in equity shares on his own. Now he is considering a recently

announced equity based mutual fund scheme in which initial expenses are 5.5 percent and annual recurring

expenses are 1.5 percent. How much should the mutual fund earn to provide Mr. A a return of 16%

(5 Marks)

Q.4) The closing price of the stock of Veryfine Ltd. at the stock exchange for 20 successive days was as

follows: (20 Marks)

Day 1 2 3 4 5 6 7 8 9 10

Closing

Price(Rs.)

25

26

25

24

26

26

28

26

25

27

You are required to calculate a 7 day moving average of stock price of the company and comment on its short-term

trend

Day 11 12 13 14 15 16 17 18 19 20

Closing

price(Rs)

27

25

26

28

26

26

24

25

26

25

You might also like

- 5 Additional Q in 4th Edition Book PDFDocument76 pages5 Additional Q in 4th Edition Book PDFBikash KandelNo ratings yet

- TEST Paper 1 Full TestDocument9 pagesTEST Paper 1 Full Testjohny SahaNo ratings yet

- 1. OCT19 QUES-1Document5 pages1. OCT19 QUES-1absankey770No ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- Ca Final SFM Test Paper QuestionDocument8 pagesCa Final SFM Test Paper Question1620tanyaNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh JainNo ratings yet

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaNo ratings yet

- International Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80Document3 pagesInternational Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80SANAULLAH SULTANPURNo ratings yet

- BM40002_Introduction_to-Finantial_ManagementDocument4 pagesBM40002_Introduction_to-Finantial_ManagementNitin MauryaNo ratings yet

- Birla Institute of Technology and Science, PilaniDocument4 pagesBirla Institute of Technology and Science, PilaniArjun Jaideep BhatnagarNo ratings yet

- Test Paper -1: Derivatives, IRRM, Forex and IFMDocument7 pagesTest Paper -1: Derivatives, IRRM, Forex and IFMAbhu ArNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Individual Assignment - ACF319Document6 pagesIndividual Assignment - ACF319Bulelwa HarrisNo ratings yet

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- Final Examination Questions Cover Financial, Treasury and Forex ManagementDocument5 pagesFinal Examination Questions Cover Financial, Treasury and Forex ManagementKaran NewatiaNo ratings yet

- AspDocument6 pagesAspCaramakr ManthaNo ratings yet

- List of Favourite SFM Examination QuestionsDocument12 pagesList of Favourite SFM Examination QuestionsAnkit RastogiNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- 27. SEP23 QUES-1Document5 pages27. SEP23 QUES-1absankey770No ratings yet

- Mqp1 10mba Mbafm02 AmDocument4 pagesMqp1 10mba Mbafm02 AmDipesh JainNo ratings yet

- Financial Risk Management Course OutlineDocument3 pagesFinancial Risk Management Course Outlineaon aliNo ratings yet

- 3 Additional Q in 2nd Edition Revised BookDocument29 pages3 Additional Q in 2nd Edition Revised BookVishal AgarwalNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- CA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsDocument4 pagesCA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsNakul GoyalNo ratings yet

- Risk N ReturnDocument6 pagesRisk N ReturnRakesh Kr RouniyarNo ratings yet

- Test-2: New Scheme Final Course - Group I Paper 2: Strategic Financial ManagementDocument6 pagesTest-2: New Scheme Final Course - Group I Paper 2: Strategic Financial Managementshiva kumarNo ratings yet

- SFM Super 100 Part 2 QuestionsDocument29 pagesSFM Super 100 Part 2 Questionsanand kachwaNo ratings yet

- DDW 20201105 PDFDocument1 pageDDW 20201105 PDFVimal SharmaNo ratings yet

- Cost of Capital Calculation and Leverage AnalysisDocument10 pagesCost of Capital Calculation and Leverage Analysisvishal soniNo ratings yet

- 01_Forex- Question for cma final lectureDocument42 pages01_Forex- Question for cma final lecturerehaliya15No ratings yet

- 18542final Old Sugg Paper Nov09 2Document14 pages18542final Old Sugg Paper Nov09 2Atish SahooNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- Eurotex Industries and Exports Limited: Summary of Rated InstrumentsDocument7 pagesEurotex Industries and Exports Limited: Summary of Rated InstrumentsHari KrishnanNo ratings yet

- MTP 1 May 21 QDocument4 pagesMTP 1 May 21 QSampath KumarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument15 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- Business Finance Assignment EnaaDocument4 pagesBusiness Finance Assignment EnaaEna Bandyopadhyay100% (1)

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- CAPM Model QuestionsDocument5 pagesCAPM Model QuestionsMUHAMMAD BILAL RAZA SHAHZADNo ratings yet

- 01B Forex QuestionDocument48 pages01B Forex QuestionrishavNo ratings yet

- MEFA Most Important QuestionsDocument15 pagesMEFA Most Important Questionsapi-26548538100% (5)

- MS&E 247s International Investments Summer 2005 Instructor: Yee-Tien Fu Friday 7/29/05 2:45-4:25pm (100 Mins) Midterm ExaminationDocument14 pagesMS&E 247s International Investments Summer 2005 Instructor: Yee-Tien Fu Friday 7/29/05 2:45-4:25pm (100 Mins) Midterm ExaminationThị Diệu Hương NguyễnNo ratings yet

- ForexDocument20 pagesForexmail2piyush0% (2)

- Analysis of Financial Statement-I - FIN330 (A)Document2 pagesAnalysis of Financial Statement-I - FIN330 (A)Aisha AishaNo ratings yet

- Quiz 1Document46 pagesQuiz 1linerz0% (1)

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Financial Treasury and Forex Management: NoteDocument7 pagesFinancial Treasury and Forex Management: Notesks0865No ratings yet

- AnandRathi On Affle India Pain in Developed Markets Continues MaintainingDocument6 pagesAnandRathi On Affle India Pain in Developed Markets Continues MaintainingamsukdNo ratings yet

- Important Practical Questions New Syllabus SFM by Aaditya Jain SirDocument72 pagesImportant Practical Questions New Syllabus SFM by Aaditya Jain SirVijayaNo ratings yet

- Dividend DecisionsDocument3 pagesDividend DecisionsRatnadeep MitraNo ratings yet

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Document202 pagesMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNo ratings yet

- FIN2601 Study Unit 6 Exam QuestionsDocument6 pagesFIN2601 Study Unit 6 Exam QuestionsLungile SitholeNo ratings yet

- Kamat Hotels (KAMHOT) : Results InlineDocument4 pagesKamat Hotels (KAMHOT) : Results InlinedidwaniasNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- ASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicFrom EverandASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Marketing MGMTDocument7 pagesMarketing MGMTChaitanyaNaniNo ratings yet

- Wal-Mart and Carrefour Strategies in China: A Resource-Based PerspectiveDocument125 pagesWal-Mart and Carrefour Strategies in China: A Resource-Based PerspectiveChaitanyaNaniNo ratings yet

- Curriculum Vitae: Career ObjectiveDocument2 pagesCurriculum Vitae: Career ObjectiveChaitanyaNaniNo ratings yet

- Wal-Mart and Carrefour Strategies in China: A Resource-Based PerspectiveDocument125 pagesWal-Mart and Carrefour Strategies in China: A Resource-Based PerspectiveChaitanyaNaniNo ratings yet

- Management Control SystemsDocument5 pagesManagement Control SystemsChaitanyaNaniNo ratings yet

- The Project GuidelinesDocument3 pagesThe Project GuidelinesSharafNo ratings yet

- Quantitative Methods - 1Document3 pagesQuantitative Methods - 1Meenakshi NeelakandanNo ratings yet

- Some People Think We Should Abolish All Examinations in School. What Is Your Opinion?Document7 pagesSome People Think We Should Abolish All Examinations in School. What Is Your Opinion?Bach Hua Hua100% (1)

- Ricoh MP 4001 Users Manual 121110Document6 pagesRicoh MP 4001 Users Manual 121110liliana vargas alvarezNo ratings yet

- 50 Simple Interest Problems With SolutionsDocument46 pages50 Simple Interest Problems With SolutionsArnel MedinaNo ratings yet

- Perception of People Towards MetroDocument3 pagesPerception of People Towards MetrolakshaymeenaNo ratings yet

- AWS D14.1 - 1997 Specification For Welding of Industrial and Mill Crane and Material Handling EqDocument141 pagesAWS D14.1 - 1997 Specification For Welding of Industrial and Mill Crane and Material Handling EqRicardo Contzen Rigo-Righi50% (2)

- The Bogey BeastDocument4 pagesThe Bogey BeastMosor VladNo ratings yet

- Biffa Annual Report and Accounts 2022 InteractiveDocument232 pagesBiffa Annual Report and Accounts 2022 InteractivepeachyceriNo ratings yet

- Fabric Test ReportDocument4 pagesFabric Test ReportHasan MustafaNo ratings yet

- Causation in CrimeDocument15 pagesCausation in CrimeMuhammad Dilshad Ahmed Ansari0% (1)

- Family Law Final Exam ReviewDocument2 pagesFamily Law Final Exam ReviewArielleNo ratings yet

- Capital Fixed & Working - New SyllabusDocument6 pagesCapital Fixed & Working - New SyllabusNaaz AliNo ratings yet

- Navodaya Vidyalaya Samiti Notice for TGT InterviewsDocument19 pagesNavodaya Vidyalaya Samiti Notice for TGT Interviewsram vermaNo ratings yet

- Client Portfolio Statement: %mkvalDocument2 pagesClient Portfolio Statement: %mkvalMonjur MorshedNo ratings yet

- Pilot Exam FormDocument2 pagesPilot Exam Formtiger402092900% (1)

- Sweetlines v. TevesDocument6 pagesSweetlines v. TevesSar FifthNo ratings yet

- SodaPDF Converted DokumenDocument4 pagesSodaPDF Converted Dokumenzack almuzNo ratings yet

- Mixed 14Document2 pagesMixed 14Rafi AzamNo ratings yet

- AIESEC Experience-MBC 2016Document25 pagesAIESEC Experience-MBC 2016Karina AnantaNo ratings yet

- HRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Document33 pagesHRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Rajkishor YadavNo ratings yet

- CHEM205 Review 8Document5 pagesCHEM205 Review 8Starlyn RodriguezNo ratings yet

- Demonetisation IndiaDocument71 pagesDemonetisation IndiaVinay GuptaNo ratings yet

- Chap1 HRM581 Oct Feb 2023Document20 pagesChap1 HRM581 Oct Feb 2023liana bahaNo ratings yet

- Irregular verbs guideDocument159 pagesIrregular verbs guideIrina PadureanuNo ratings yet

- Subject and Object Questions WorksheetDocument3 pagesSubject and Object Questions WorksheetLucas jofreNo ratings yet

- Growth of Royal Power in England and FranceDocument6 pagesGrowth of Royal Power in England and FrancecharliNo ratings yet

- Aikido NJKS PDFDocument105 pagesAikido NJKS PDFdimitaring100% (5)

- Nifty Technical Analysis and Market RoundupDocument3 pagesNifty Technical Analysis and Market RoundupKavitha RavikumarNo ratings yet

- 79.1 Enrico vs. Heirs of Sps. Medinaceli DigestDocument2 pages79.1 Enrico vs. Heirs of Sps. Medinaceli DigestEstel Tabumfama100% (1)

- REVISION 3 Chuyên đề 1-12 multiple choice questionsDocument11 pagesREVISION 3 Chuyên đề 1-12 multiple choice questionsAn NguyễnNo ratings yet

- Apollo 11tech Crew DebriefDocument467 pagesApollo 11tech Crew DebriefBob AndrepontNo ratings yet