Professional Documents

Culture Documents

Presentation Risks Opportunities Solar

Uploaded by

Hemanth Kumar Ramachandran0 ratings0% found this document useful (0 votes)

12 views33 pagesSolar Power Business Outlook

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSolar Power Business Outlook

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views33 pagesPresentation Risks Opportunities Solar

Uploaded by

Hemanth Kumar RamachandranSolar Power Business Outlook

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 33

Risks and Opportunities in securing

Financing Phase I and Phase II

National Solar Energy Summit 2012

Solar Thermal Power

14

th

December 2012

Presented By:

Saurabh Kamdar,

Associate Director, CRISIL Infrastructure Advisory

1

Agenda

2

1

Solar Power Opportunity & Current Adoption Status3

2

Solar Thermal Technologies..16

3

Solar Thermal - Risks and Funding Trends..21

Solar Power Opportunity & Current

adoption status

3

Solar Power Development Potential

India receives on an average 4-7

kWh/m2 of solar energy daily with an

average of 250-300 sunny days in a

year

Rajasthan and Gujarat receive maximum

radiation in the range of 66.6 KWh per

square meter

Solar power potential for India

accessed to be >100,000 MWeq

However, capacity additions in

Indian solar industry have been

miniscule as compared to the

additions globally

4

Solar Power Density in India

Solar Installed Capacity - India Value

Grid connected Solar Power (Cumulative Capacity) 1,035 MW

Additions during last year (FY12) 446 MW

Off-grid Solar PV plants (Cumulative Capacity) 85 MW

Solar Water Heating Collector Area (Cumulative Capacity) 5.63 Mn Sq. m

Source: MNRE (As at June30, 2012)

Grid connected Installed Solar capacity

5

Source: MNRE (As at October, 2012)

Indian Power Generation Capacities

(As on 31

st

March 2012)

Presently, of Total Installed Capacity in the country Solar forms 0.45%, and it

forms 3% of the Total Renewable Energy Capacity in the country

6

Thermal,

131,353,

66%

Hydro,

38,990,

20%

Nuclear,

4,780,

2%

Renewab

le,

24,915,

12%

Total Installed Capacity (MW)

Wind,

17,353,

70%

Small

Hydro,

3,396,

14%

Solar,

905, 3%

Biomass,

3,225,

13%

Installed Renewable

Power Capacity (MW)

Source: MNRE

Solar capacity additions expected to increase

Source: MNRE

Solar power is expected to be ~11% of capacity additions of renewable

capacity additions in XII Plan period (2012-17)

JNNSM is expected to be a major driver for Solar capacity additions

7

3.5

10.2

24.9

55

2002 2007 2012 2017P

Cumulative Renewable

Capacity in GW

400

200 200

500

550

50 200 200 500 550

2012-13 2013-14 2014-15 2015-16 2016-17

Projected Solar Capacity

Additions JNNSM (MW)

Solar PV Solar Thermal

Jawaharlal Nehru National Solar Mission (JNNSM)

JNNSM is one of the major initiatives in promotion of solar energy

technologies, Mission aims to achieve grid tariff parity by 2022

JNNSM (Phase 1) - Capacity allocation between SPV and Solar Thermal was

decided to be 50:50.

Solar PV: Selection of PV projects done in two batches of 150 MW and 350 MW over

two financial years of Phase 1 i.e., 2010-2011 and 2011-2012

Solar Thermal: Given the longer gestation period of Solar Thermal Projects, entire

capacity was selected in Batch 1 (2010-2011)

The various phase wise targets set under the NSM are as follows:

8

Application Phase I (2010-13) Phase II (2013-17) Phase III (2017-22)

Utility grid power, including roof top 1,100 MW 4,000-10,000 MW 20,000 MW

Off Grid Solar Applications 200MW 1000MW 2000MW

Solar Collectors 7 million sqm 15 million sqm 20 million sqm

Various Sale options for Solar

Developers are preferring the PPA route as of now.

Once the REC markets mature and the regulations are put in place to

enforce RPOs, developments based on RECs will also gain traction.

9

Utility

NVVN

Exchange

Solar Radiation

Electricity

Generation

IPP/ Grid Sales

& Captive

Sales

Solar

Power

Plant

Sale to Utility

Bundled Power

Sale through state tariff policy or REC route

(I) FIT + GBI (PPA) (II) APPC + REC (non-PPA)

Merchant Sale

Market Price + REC

Solar Thermal Projects under development in JNNSM

(Phase 1)

10

Sr.

No.

Project Name Promoter Location

Capacity

(MW)

Technology

Tariff

(Rs./KWh)

1

Rajasthan Sun Technique

Energy Private Limited

Reliance Power

Jaisalmer,

Rajasthan

100

Compact Linear

Fresnel Reactor

11.97

2

Diwakar Solar Projects

Private Limited

Lanco Infratech

Jaisalmer,

Rajasthan

100 Parabolic Trough 10.49

3

KVK Energy Ventures

Private Limited

KVK

Jaisalmer,

Rajasthan

100 Parabolic Trough 11.20

4 MEIL Green Power Ltd

Megha

Engineering &

Infrastructure

Anantapur,

Andhra Pradesh

50 Parabolic Trough 11.31

5

Aurum Renewable Energy

Private Limited

Aurum

Mitrala,

Porbandar,

Gujarat

20

Compact Linear

Fresnel Reactor

12.19

6 Corporate Ispat Alloys Abhijeet

Pokaran,

Rajasthan

50 Parabolic Trough 12.24

7

Godavari Green Energy

Limited

Godawari Power

and Ispat Limited

Jaisalmer,

Rajasthan

50 Parabolic Trough 12.20

7 projects for 470 MW selected in December, 2010. Average Tariff Rs. 11.48 per

unit (25% reduction on CERC Tariff)

Other Solar Thermal Projects under development

11

Sr.

No.

Project Name Developer Location

Capacity

(MW)

Technology

1 Rajasthan Solar One Entegra Rajasthan 10 Parabolic Trough

2 Bap Solar Power Plant Dalmia Cements Rajasthan 10

Parabolic Dish

Sterling

3 NTPC Pilot Project NTPC Rajasthan 15 Parabolic Trough

4 Andhra Pradesh Project Sunborne Energy Andhra Pradesh 50 Parabolic Trough

5 Cargo Solar Power Gujarat

Cargo Power &

Infrastructure

Kutch, Gujarat 25

Parabolic Trough with

Thermal Storage

Gujarat has been front runner in Solar Power Adoption

First state to launch an independent solar policy in 2009 (operative till 2014)

PPAs of 969 MW signed. The projects allocated through the MOU route with pre-

qualification criteria

Projects of 690 MW commissioned till 30th June, 2012.

High investor confidence being showcased as

More than 1000MW of projects have pre-registered for future allocations

Applications worth 1715 MW received for allocation of 150MW

12

Tariffs PV project

(Rs. /kWh)

Thermal projects

(Rs. /kWh)

Projects commissioned before

31.12.10

15 (for first 12 years) 10 (for first 12 years)

5 (from 13

th

to 25

th

year) 3 (from 13

th

to 25

th

year)

Projects commissioned after

31.12.14

12 (for first 12 years) 9 (for first 12 years)

3 (from 13

th

to 25

th

year) 3 (from 13

th

to 25

th

year)

Other states have also framed their Solar Policies

13

Particulars Karnataka Rajasthan Madhya Pradesh Tamil Nadu

Policy instrument

Karnataka Solar Policy,

2011-16

Rajasthan Solar Energy

policy, 2011-2017

MP Solar Energy Policy

TN Solar Energy Policy

2012

Target Capacity

200 MW - DISCOMS

upto 2015-16 (40 MW

p.a.)

50 MW Solar

Thermal

100 MW - REC

mechanism

50 MW SPV; 50 MW

ST - DISCOMS

Phase I (upto 2013) -

200MW

Phase II (2013 - 17) -

400MW

200 MW SPV

announced

3000 MW by 2015,

including rooftop

1500 MW utility scale

by 2015

Capacity Cap

SPV : Min 3 MW, Max

10 MW

ST : Min 5 MW

SPV : Min 5 MW, Max

10 MW

ST : Min 5 MW, Max -

50 MW

SPV : Min 5 MW NA

Sale of Energy under

state policy

Reverse bidding

Ceiling tariff :

SPV : INR 14.50 / kWh

ST : INR 11.35 / kWh

Reverse bidding

Ceiling Tariff :

SPV : INR 10.12 / kWh

Reverse bidding

Ceiling Tariff :

SPV : INR 15.35 / kWh

Reverse bidding

Ceiling Tariff :

SPV : INR 15.35 / kWh

Way Forward JNNSM Phase 2

3000 MW capacity to be supported by the Government of India

Bundling with thermal power to the extent the latter is available

Generation Based Incentive

Use of viability gap funding mechanism

Additional 6000 MW is envisaged through Solar RPO requirement

Requirement of solar power capacity by 2017 is estimated to be about 10000 MW

1000 MW off grid solar applications by 2017

15 million square meters solar thermal collector area by 2017

Solar Capacity required to meet Solar RPOs (MW)

14

2011-12 2012-13 2013-14 2014-15 2015-16 2016-17

1465 3018 4659 6387 8204 10109

Solar RPO requirements are expected to provide fillip to

the sector

Solar RPO obligations of these states are higher than installed capacity in

India at present.

Enforcement of RPO obligations will lead to increased demand for solar

power in coming years.

15

State RPO Target Target in MW

Gujarat 1.00% 451

Haryana 0.75% 366

Madhya Pradesh 0.60% 166

Rajasthan 0.50% 152

Karnataka 0.25% 87

Maharashtra 0.25% 182

Tamil Nadu 0.25% 45

Punjab 0.07% 6

Total 1,455

Solar RPO Targets in selected states (2012-13)

Solar Thermal Technologies

16

Technology for Solar power plants

Solar power generation technologies

can be broadly classified into two

broad categories:

Solar Thermal: Thermal power plants

produce electricity by converting the solar

radiation into high temperature heat using

mirrors and reflectors. This energy is used

to heat a working fluid and produce steam.

Steam is then used to rotate a turbine or

power an engine to drive a generator and

produce electricity

Solar Photovoltaic(PV): Photovoltaic

converters are semiconductor devices that

convert part of the incident solar radiation

directly into electrical energy

17

Solar Power Generation

Technologies

Solar Thermal Power

Plants

Parabolic Trough

Solar Tower

Parabolic Dishes

Compact Linear Fresnel

Reflectors

Photovoltaic technologies

Wafer-based crystalline-

silicon

Thin Films

Solar Thermal Technologies

Also referred to as CSP (concentrating solar power) technologies for power

generation

Technology Options include

Parabolic Troughs

Compact Linear Fresnel Reflector systems

Central Receivers or Power towers

Paraboloid dish systems

Thermal storage and hybridization with conventional sources are the

biggest strength

Lot of scope for indigenization, local manufacturing and employment

generation

Of the 470 MW of CSP capacity being developed under JNNSM Phase 1

350 MW is using Parabolic Troughs and 120 MW is using Compact Linear Fresnel

Reflector

Inline with global trends as 88% of worlds CSP is being operated using Parabolic

Troughs

18

Solar Thermal Technology Options (1/2)

Parabolic Trough

Parabolic troughs focus the sun onto a linear

receiver tubes placed in the trough focal line

Gives temperatures up to 400 deg C.

Hot liquid is passed through a series of heat

exchangers to generate steam, and to drive a

turbine

Globally most widely adopted technology

Compact Linear Fresnel Reflector

Similar to parabolic trough however the

parabolic trough sliced into individually tracking

strips of mirrors & installed near ground

Receiver is stationary and does not move with

mirrors as in trough systems thus providing

additional design flexibility

Has advantage of lower production costs and

requires least amount of land per MW capacity

among all solar technologies

19

Solar Thermal Technology Options (2/2)

Central Receivers or Power towers

Uses field of mirrors called heliostats that

individually track sun on two axes and redirect

sunlight to receiver at the top of a tower

Sunlight is concentrated 6001,000 times, and

achieves working fluid temperatures of 500

800C

Paraboloid dish systems

These systems use series of mirrors arranged

in concave plate to focus light onto a point

Usually a Stirling external combustion engine is

placed at the focal point for collecting heat to

drive pistons by continually expanding and

condensing hydrogen gas

20

Solar Thermal -

Risks and Funding Trends

21

Solar Thermal Projects Risks and Challenges (1/3)

22

Some Phase 1 projects encountered imprecise irradiance

data from satellite

Leading to project delays and higher costs because

developers needed to re-design project systems

However reliable DNI data availability is expected in future

with 51 new stations being set up by C-WET for Solar

Radiation Data collection pan India across various states

Limited solar irradiance

data

CSP at early stage of deployment and development in India

thus carrying higher risk on its applicability and performance

record

Lack of trained technicians to build CSP projects: Some

developers have struggled in finding adequately trained

technicians with fabrication and welding skills for CSP

projects leading to project delays

Technology Risk &

Implementation Record

Escalating prices and limited supplies of heat transfer fluid

(HTF) have posed challenges to developers

Several developers have also experienced delays from long

lead times for CSP-specific turbines

Supply Chain & Sourcing

Solar Thermal Projects Risks and Challenges (2/3)

23

The cost of a parabolic trough CSP plant in India ranges

from Rs 10.5 crore to Rs 13 crore per MW

Whereas the prices of Solar PV have come down to Rs 10

crore per MW

Storage increases the capital cost further but also increases

electricity generation

Capital Cost Premium

CSP plants require water predominately for cooling and also

for cleaning similar to thermal plants

Locations suitable for CSP are usually arid regions with

short supply of water

Technology choices to reduce CSPs water demand are

available, but affect the levelized cost of electricity (up to

90% reduction in water consumption possible with 9% rise in

electricity costs)

Water Requirement &

Availability

Projects are located in remote areas which are often not well

connected and lacking in adequate infrastructure

Under JNNSM the developer is required to put the required

infrastructure (land, water, clearance and evacuation) in

place themselves

Adds to project cost and increases risks of timely completion

of projects

Infrastructure Constraints

Solar Thermal Projects Risks and Challenges (3/3)

24

Project developers have struggled to achieve financial

closure (key milestone under the Missions guidelines)

Lenders doubtful about CSP Projects viability: Non recourse

funding is challenge and funding often backed by corporate

guarantee from parent companies

Lenders thus take more time in CSP project evaluations

Financing Difficulties

In JNNSM Batch 1 bids, average quoted tariffs for CSP was

Rs.11.48/unit implying 25% discount to the CERC declared

Feed-in-Tariff of Rs.15.31/unit

CERC determined tariffs included reasonable returns for

developers, however such huge discount in tariffs have

raised number of questions regarding financial feasibility of

projects

Reverse Bidding &

Financial Viability

Regulatory limitation on resources limiting flexibility in

technology adoption (e.g. Tower technology having relatively

lower cost cannot be adopted due to limitation on land area)

Limits prescribed for indigenous sourcing of items leads to

high interest cost on local funding. Alternatively imports can

be funded from Exim bank at lower interest rates

Policy & Regulatory

Limitations

Solar Thermal Projects Lenders Perception & Financing (1/2)

Emerging energy technology Discomfort:

Bankers want to see a CSP project track record in India due to low levels of familiarity

and a discomfort with CSP technology. This can only be resolved when consistent

performance record develops.

Parabolic trough technology deployed in India has been used by more than 80 percent

of international CSP projects with a track record of more than 20 years

Non-recourse project finance:

CSP developers reported securing financing only after parent companies furnished

corporate guarantees

No CSP plant under the Mission has been financed on a non-recourse basis

Endemic power sector issues affecting CSP investment

Banks approaching power sector lending limits and hence unwilling to increase exposure

to the sector

Poor and worsening financial situation of State Discoms increasing credit risks for

lenders

Even in JNNSM PPAs, the responsibility of payment rests with Discoms (and not NVVN)

25

Solar Thermal Projects Lenders Perception & Financing (2/2)

However, loan syndication broadening lender base for solar projects

When financing CSP projects, banks have typically taken 25 percent of the projects debt

and shared the remaining debt and risk among other participating banks

Leading to involvement of a wide range of banks including Power Finance Corporation,

Bank of Baroda-Dubai, Punjab National Bank, and State Bank of Bikaner and Jaipur

Payment Security Scheme

MNRE introduced an additional payment security scheme for grid connected solar

projects under JNNSM to facilitate financial closure of projects under Phase I

Gross Budgetary Support (GBS) amounting to Rs.486 crore in the event of defaults in

payment by the State Discoms to NVVNL

Introduction of this scheme has mitigated the payment risks perceived by the lenders

considerably

26

In Summary.

India has very high solar power potential (>100,000 MWeq) with an average of

250-300 sunny days in a year, which so far has remained largely unutilized

Solar forms only 0.45% of the total Installed Capacity in the country

Of the 1,045 MW of Grid connected solar installed, almost all projects are

using PV technology and are based in Gujarat & Rajasthan

Solar power expected to be ~11% of renewable capacity additions in XII Plan

period with JNNSM expected to be a major driver

470 MW of Solar Thermal Capacities under development in states of

Rajasthan, Gujarat and Andhra Pradesh

Parabolic Trough & Compact Linear Fresnel Reflector technologies being

adopted in India in Phase 1 (JNNSM)

Being new technology, CSP project are subject to various challenges on

account of performance benchmarks, radiation data reliance, supply chain

issues, infrastructure constrains and Difficulty in Financial Closures

Lenders not open to Non-recourse project finance during Phase 1 due to

unproven track record

27

CRIS Credentials

28

About CRISIL Infrastructure Advisory*

CRISIL Infrastructure Advisory is

division of CRISIL Risk and

Infrastructure Solutions Limited

(CRIS), a wholly owned subsidiary of

CRISIL Ltd.

CRISIL Infrastructure Advisory is

associated with infrastructure

development and investment. We are

present across various infrastructure

sectors.

We are the preferred consultant to

governments and leading

organizations.

29

Our Local Presence

Delhi

Ahmedabad

Mumbai

Bengaluru

Chennai

Kolkatta

Hyderabad

Pune

About CRISIL Infrastructure Advisory

CRISIL Infrastructure Advisory is a professionally managed multi-

disciplinary consultancy firm.

Our offerings span the entire spectrum of activities in infrastructure

development.

30

India

Conventional Renewable

Transmission Distribution

Coal Oil & Gas

Minerals

Healthcare

Generation Fuels

Power Natural Resources

St rategy | Val uati ons | Financi al Mar kets | PPP Poli cy | Regul ator y | PPP Project

Deep domain knowledge | Strong analytical skills | Independence of opinion

Companies | Equity Investors | Lenders | Governments | Multilateral Agencies

Urban Development Transport and Logistics

Education

Planning Transport

Urban Finance

& Reforms

Water

Supply &

Sanitation

Solid

Waste

Manage

ment

Ports Airports Roads Logistics

A f r i c a | S o u t h - E a s t A s i a | M i d d l e - E a s t

Key Service Offerings - Power Sector

31

Policy Formulation for

Project Structure, PPP,

Fuel Supply/Pricing, Tariff

Advise to Regulators for

License, Tariff, and reform

implementation and

planning

Bid Process Management

Project Appraisal

Regulatory and Tariff Filings

Power purchase, electrification,

staff, capital investment and

contracts planning

Business Plans & Entry

Strategy

Risks identification,

evaluation & mitigation

plans

Contractual Structuring

Strategic Bid Advisory

Due Diligence & Risk

Analysis

Market assessment &

business intelligence

Project /Portfolio analysis

Valuation

Select Engagement Spread in Power Sector

32

POWER SECTOR ADVISORY

Regulatory and

Policy Advisory

Central and

State Govt. Utilities

Cause 2

Developers Cause 4

Forum of Regulators Assessment of tariff (structure,

rationalization, and MYT), viability of distribution licensee

Coal India Implementation of NCDP

MNRE Generation based incentive

NVVN Power trading and development of Power

Exchange

DEA Risk Management Framework for Infrastructure

Projects

NTPC, PGCIL, BHEL Appraisal of Capital

investment plans

PFC, REC Policy for Promoter Appraisal of

Private Power Project

Extensive work in Mah, Guj, Chhattisgarh,

Raj, UP, Pun, HP, J&K, TN for Tariff

structuring and Bid Process management

Developers

Tata Power Bid Advisory for Successful award of

Mundra UMPP

GMR Market Assessment & Strategy for Power Sale

GVK Escrow ability Study for sale of Power

Adhunik Power Finalization of PPA

Indiabulls, Moser Baer, HCC, Essar, Sembcorp

Strategic and Commercial Advisory

Investors

Morgan Stanley, NVP, 3i, Actis, SC TPG

Successful PE Investment in Power Sector

ICICI Bank, SCB, BTMU, USEXIM Project and

Sector Assessments

GMR, EMCO, DS Construction Acquisition of

majority stake

CRISIL Risk & Infrastructure Solutions Limited

A Subsidiary of CRISIL Limited, a Standard & Poors Company

www.crisil.com

Mr. Saurabh Kamdar

Associate Director, CRISIL Infrastructure Advisory

Contact Numbers-

Direct: + 91 22 3342 3000 (Board)

Email: saurabh.kamdar@crisil.com

You might also like

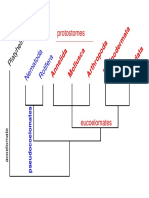

- In TH Es: ProtostomesDocument57 pagesIn TH Es: ProtostomesRodrigo TortillaNo ratings yet

- Haber Gold Proc Des CPDFDocument2 pagesHaber Gold Proc Des CPDFHemanth Kumar RamachandranNo ratings yet

- Water Potential Questions KeyDocument1 pageWater Potential Questions KeyHemanth Kumar RamachandranNo ratings yet

- Model Bankable ProjectDocument10 pagesModel Bankable ProjectAmitNo ratings yet

- Botany MendelDocument53 pagesBotany MendelHemanth Kumar RamachandranNo ratings yet

- Aquaculture Chennai 2014 PamphletDocument2 pagesAquaculture Chennai 2014 PamphletHemanth Kumar RamachandranNo ratings yet

- Absorption RefrigerationDocument6 pagesAbsorption RefrigerationHemanth Kumar RamachandranNo ratings yet

- Ramnad Desalination Specs 3.80 MLD PDFDocument22 pagesRamnad Desalination Specs 3.80 MLD PDFHemanth Kumar RamachandranNo ratings yet

- Concept - Note Aquaponic - SystemsDocument20 pagesConcept - Note Aquaponic - SystemsHemanth Kumar Ramachandran100% (2)

- Solarpowerinindia Afinancialanalysis 130110135901 Phpapp01Document34 pagesSolarpowerinindia Afinancialanalysis 130110135901 Phpapp01Esha VermaNo ratings yet

- Standard Membrane: SystemsDocument51 pagesStandard Membrane: SystemsVenkat RaguNo ratings yet

- Power Production Based On Osmotic PressureDocument10 pagesPower Production Based On Osmotic PressureHemanth Kumar RamachandranNo ratings yet

- How To Run A Self Sufficient Intensive AquariumDocument26 pagesHow To Run A Self Sufficient Intensive AquariumHemanth Kumar RamachandranNo ratings yet

- DesalinationDocument49 pagesDesalinationfalcon724100% (8)

- Chennai Comprehensive Transport StudyDocument154 pagesChennai Comprehensive Transport StudyDevyani GangopadhyayNo ratings yet

- Ramnad Desalination Specs 3.80 MLD PDFDocument22 pagesRamnad Desalination Specs 3.80 MLD PDFHemanth Kumar RamachandranNo ratings yet

- Hydraulic Briquetting Machine Manufacturer IndiaDocument6 pagesHydraulic Briquetting Machine Manufacturer IndiaHemanth Kumar RamachandranNo ratings yet

- Planning A Dairy Plant PDFDocument13 pagesPlanning A Dairy Plant PDFVikas NaikNo ratings yet

- Auto Service StationDocument8 pagesAuto Service StationHemanth Kumar RamachandranNo ratings yet

- Benz Bus Maintenance BookDocument104 pagesBenz Bus Maintenance BookDiego NicolaldeNo ratings yet

- China 1 MW Tower CSP ModelDocument1 pageChina 1 MW Tower CSP ModelHemanth Kumar RamachandranNo ratings yet

- Pondy Dairy ProductsDocument9 pagesPondy Dairy ProductsHemanth Kumar RamachandranNo ratings yet

- SMEDA Auto Repair & Service WorkshopDocument36 pagesSMEDA Auto Repair & Service Workshopvorexxeto50% (2)

- Ausra CLFRDocument3 pagesAusra CLFRHemanth Kumar RamachandranNo ratings yet

- Economics For DairyDocument8 pagesEconomics For DairyHemanth Kumar RamachandranNo ratings yet

- STAGE STE PresentationFISEDocument52 pagesSTAGE STE PresentationFISEHemanth Kumar RamachandranNo ratings yet

- China 1 MW Tower CSP ModelDocument1 pageChina 1 MW Tower CSP ModelHemanth Kumar RamachandranNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PC-II Taftan Master PlanDocument15 pagesPC-II Taftan Master PlanMunir HussainNo ratings yet

- Graphics Coursework GcseDocument7 pagesGraphics Coursework Gcseafiwhlkrm100% (2)

- Human Computer InteractionDocument12 pagesHuman Computer Interactionabhi37No ratings yet

- Norlys 2016Document124 pagesNorlys 2016elektrospecNo ratings yet

- Kitchen in The Food Service IndustryDocument37 pagesKitchen in The Food Service IndustryTresha Mae Dimdam ValenzuelaNo ratings yet

- Duratone eDocument1 pageDuratone eandreinalicNo ratings yet

- Rohini 43569840920Document4 pagesRohini 43569840920SowmyaNo ratings yet

- Deploy A REST API Using Serverless, Express and Node - JsDocument13 pagesDeploy A REST API Using Serverless, Express and Node - JszaninnNo ratings yet

- Mid Semester ExaminationDocument2 pagesMid Semester ExaminationMOHAMMED RIHANNo ratings yet

- Motorola l6Document54 pagesMotorola l6Marcelo AriasNo ratings yet

- A Study of Arcing Fault in The Low-Voltage Electrical InstallationDocument11 pagesA Study of Arcing Fault in The Low-Voltage Electrical Installationaddin100% (1)

- Banking Software System Monitoring ToolDocument4 pagesBanking Software System Monitoring ToolSavun D. CheamNo ratings yet

- Different Aids For TeachingDocument19 pagesDifferent Aids For TeachingPrecious CabarseNo ratings yet

- Foreign Direct Investment in Mongolia An Interactive Case Study (USAID, 2007)Document266 pagesForeign Direct Investment in Mongolia An Interactive Case Study (USAID, 2007)Oyuna Bat-OchirNo ratings yet

- Elasticity of DemandDocument64 pagesElasticity of DemandWadOod KhAn100% (1)

- Stock Futures Are Flat in Overnight Trading After A Losing WeekDocument2 pagesStock Futures Are Flat in Overnight Trading After A Losing WeekVina Rahma AuliyaNo ratings yet

- Py Py y Py Y: The Second-Order Taylor Approximation GivesDocument4 pagesPy Py y Py Y: The Second-Order Taylor Approximation GivesBeka GurgenidzeNo ratings yet

- Marcel Breuer: Hungarian-American Designer, Architect and Bauhaus PioneerDocument8 pagesMarcel Breuer: Hungarian-American Designer, Architect and Bauhaus PioneerYosaphat Kiko Paramore DiggoryNo ratings yet

- 9643 SoirDocument38 pages9643 SoirpolscreamNo ratings yet

- How to Get Nigeria Passport in 40 StepsDocument42 pagesHow to Get Nigeria Passport in 40 Stepsgynn100% (1)

- Web Based Tour Management for Bamboo ParadiseDocument11 pagesWeb Based Tour Management for Bamboo Paradisemohammed BiratuNo ratings yet

- Hutchinson - Le Joint Francais - National O-RingDocument25 pagesHutchinson - Le Joint Francais - National O-RingkikorrasNo ratings yet

- Data IntegrationDocument7 pagesData IntegrationHan MyoNo ratings yet

- Study apparel export order processDocument44 pagesStudy apparel export order processSHRUTI CHUGH100% (1)

- Draft SemestralWorK Aircraft2Document7 pagesDraft SemestralWorK Aircraft2Filip SkultetyNo ratings yet

- Swilliams Lesson6Document11 pagesSwilliams Lesson6api-276783092No ratings yet

- Pumping Station Modification PDFDocument15 pagesPumping Station Modification PDFcarlosnavalmaster100% (1)

- Shrey's PHP - PracticalDocument46 pagesShrey's PHP - PracticalNahi PataNo ratings yet

- TMS Software ProductsDocument214 pagesTMS Software ProductsRomica SauleaNo ratings yet