Professional Documents

Culture Documents

Chapter 15 16 Problems and Answers

Uploaded by

Patch AureOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 15 16 Problems and Answers

Uploaded by

Patch AureCopyright:

Available Formats

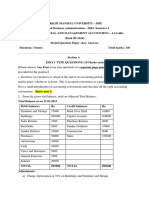

Chapter 15

Problems

The Nature of Management

Accounting

Problem 15-1

Following is a management accounting report for the Anders Ford

Company. Contrast this report with a financial accounting report

according to the list of differences given in the text.

ANDERS FORD COMPANY

Service Department Report

November

Planned Actual Difference *

Number of jobs completed 400 366 (34)

Number of employee days 740 736 4

Expenses:

Employee Wages $ 22,000 $ 22,772 $(772)

Parts Used 16,000 12,574 3,426

Supplies used 5,000 4,824 176

Other Expenses 6,000 6, 624 (624)

Total Expenses 49,000 46,794 2,206

Revenue 60,000 54, 468 (5,532)

Profit $ 11, 000 $ 7,674 $ (3, 326)

*( ) = unfavorable

Problem 15-1

MA FA

Information

Content

nonmonetary

information (jobs

& number of

employees)

Monetary form

Time

orientation

Has future

(planned)

information as

well as past

(actual)

Reports financial

history

Necessity

Optional Must be done

Report

Entity

Focuses on a

segment (service

department)

Describes the

organization as a

whole

Information

Precision

Less emphasis on

precision (planned

numbers are

rounded)

Emphasis on

precision

Users

useful only as

manager uses it

Relatively large

groups and mostly

unknown to

managers

ANDERS FORD COMPANY

Service Department Report

November

Planned Actual

Difference

*

Number of jobs completed 400 366 (34)

Number of employee days 740 736 4

Expenses:

Employee Wages $ 22,000 $ 22,772 $(772)

Parts Used 16,000 12,574 3,426

Supplies used 5,000 4,824 176

Other Expenses 6,000 6, 624 (624)

Total Expenses 49,000 46,794 2,206

Revenue 60,000 54, 468 (5,532)

Profit $ 11, 000 $ 7,674 $ (3, 326)

Problem 15-2

As controller of Patriot Steel, you have been asked to provide information to

management that would be helpful in answering a variety of questions.

Required:

a. For each of the questions below, classify the needed information as being an

example of either full cost accounting, differential accounting, or responsibility

accounting.

(1) Should the company own and operate its own iron ore mines or buy the one from

another firm?

(2) As a result of a new labor contract with the United Steel Workers Union, what will be

the profit margin on a ton of steel at current prices?

(3) Is the supervisor of the maintenance shop doing a good job?

Differential accounting

Responsibility accounting

Full-cost accounting

Problem 15-2

As controller of Patriot Steel, you have been asked to provide information to

management that would be helpful in answering a variety of questions.

Required:

(4) How much money does the company have invested in finished goods inventory?

(5) Should the company consider replacing its old open-hearth furnaces with news

ones?

(6) Which district sales manager is doing the best job?

b. In addition to management accounting information, what other types of information

might be useful in attempting to answer each of the above questions?

Full-cost accounting

Differential accounting

Responsibility accounting

Nonquantitative, nonaccounting, operating, and financial

accounting

Problem 15-3

As controller of the city of Oakly Heights, you have been asked to provide

information to the mayor and city council that would be helpful in answering a

variety of questions.

Required:

For each of the questions bellow, classify the needed information as an example of full

cost accounting, differential accounting, or responsibility accounting.

(1) As a result of a recent wage increase for airport workers, what does it now cost to

operate the municipal airport?

(2) Should the city continue to own and operate its own garbage trucks or contract with

a private firm?

(3) What does it cost to prepare and mail annual tax notices to property owners?

Full-cost accounting

Differential accounting

Full-cost accounting

Problem 15-3

As controller of the city of Oakly Heights, you have been asked to provide

information to the mayor and city council that would be helpful in answering a

variety of questions.

Required:

For each of the questions bellow, classify the needed information as an example of full

cost accounting, differential accounting, or responsibility accounting.

(4) Is the new police chief doing a better job than the former one?

(5) Should the city close its jail and contract with the country for detention of prisoners?

(6) Which department head is doing the best job of staying within his or her budget?

b. In addition to management accounting information, what other types of information

might be useful in attempting to answer each of the questions above?

Responsibility accounting

Differential accounting

Responsibility accounting

Nonquantitative, nonaccounting, operating, and financial accounting.

Problem 15-4

FINEST NATIONAL BANK

Eastside Branch Office Report

October 1

Planned Actual Difference

Number of new

accounts opened

225 180 (45)

Number of

prospect calls

made

113 84 (29)

Increase in

deposit volume

$100,000 $80,000 $(20,000)

Increase in loan

volume

$80,000 $90,000 $10,000

Expenses:

Wages and

salaries

$15,000 $12,800 $2,200

Utilities 1,450 1,420 30

Rent on building 3,675 3,675 0

Supplies 225 230 (5)

Advertising 450 338 112

Other expenses 75 76 (1)

Total expenses: 20,875 18,539 2,336

Revenue from

interest and

service charges

20,500 20,000 (500)

Profit (loss) $(375) $1,461 $1,836

Following is a monthly report for a

new branch office that the Finest

National Bank recently opened in a

rapidly developing section of the

city. The branch manager is

pleased that the report shows a

$1,461 profit instead of the

expected loss of $375.

Required:

What questions can be raised

about the performance of the

Eastside Branch and its

manager based on information

in the report?

*( ) = unfavorable

Problem 15-4

FINEST NATIONAL BANK

Eastside Branch Office Report

October 1

Planned Actual Difference

Number of new

accounts opened

225 180 (45)

Number of

prospect calls

made

113 84 (29)

Increase in

deposit volume

$100,000 $80,000 $(20,000)

Increase in loan

volume

$80,000 $90,000 $10,000

Expenses:

Wages and

salaries

$15,000 $12,800 $2,200

Utilities 1,450 1,420 30

Rent on building 3,675 3,675 0

Supplies 225 230 (5)

Advertising 450 338 112

Other expenses 75 76 (1)

Total expenses: 20,875 18,539 2,336

Revenue from

interest and

service charges

20,500 20,000 (500)

Profit (loss) $(375) $1,461 $1,836

1. Why did the manager fail to make the

planned number of prospect calls?

*( ) = unfavorable

2. Was this the reason for the failure to obtain

the planned number of new accounts and

increase in deposit volume?

3. Could the savings in advertising expense

have contributed to the failure to achieve the

planned growth in new accounts and deposit

volume?

4. Was the $2,200 savings in wages and

salaries the result of operating with one

employee less than needed? If so, could this

have helped prevent the manager from

making the planned number of prospect calls?

5. Why was revenue lower than planned?

Did the manager emphasize loans more

than deposits?

Chapter 16

Problems

The Behavior of Costs

Problem 16-1

The following graphs relate to the behavior of certain costs involved in the

operation of a mechanical arts course offered by a local corporation in a

program of adult education.

Required:

a. Title each graph to show the type of

cost it describes (fixed, variable,

semivariable, etc.)

b. From the list of costs on the next

page, select those that each graph

describes.

Costs

1. Cost of raw materials used by

students.

2. Depreciation of machinery and

equipment used.

3. Cost of blueprints and manuals.

Extra copies must be acquired for

every 6 students who enroll over the

minimum number of 24.

4. Utilities and maintenance. Utilities

remain constant each month, but

maintenance tends to vary with the

usage of machinery and equipment.

Fixed cost

Variable cost

Semivariable

cost

Semivariable

cost

2. Depreciation of machinery and

equipment used.

1. Cost of raw materials

used by students.

4. Utilities and

maintenance. Utilities

remain constant each

month, but maintenance

tends to vary with the

usage of machinery and

equipment.

3. Cost of blueprints and manuals.

Extra copies must be acquired for

every 6 students who enroll over

the minimum number of 24.

Problem 16-2

Doyle's Candy Company is a wholesale distributor of candy. The company services groceries,

convenience stores, drugstores in a large metropolitan area. Small but steady growth in sales has

been achieved over the past few years while candy prices have been increasing. The company is

formulating its plan for the coming fiscal year. Presented below are the data used to project the current

year's after-tax net income of $264,960.

Manufacturers of candy have

announced that they will

increase prices of their

products an average 15

percent in the coming year due

to increases in raw materials

(sugar, cocoa, peanuts, etc.)

and labor costs. Doyle's Candy

Company expects that all other

costs will remain at the same

rates or levels as the current

year.

Problem 16-2

Required:

a. What is Doyle's Candy Company's break-even point in boxes of candy

for the current year?

Break-even volume

= Fixed costs / Unit contribution

= $1,056,000 / $9.60 - $5.76

= $1,056,000 / $3.84 = 275,000 boxes

b. What selling price per box must Doyle's Candy Company charge to

cover the 15 percent increase in variable production costs of candy and

still maintain the current contribution margin percentage?

Current contribution margin percentage = $3.84 / $9.60 = 40%.

UR

UVC UR

CMP

Solving for UR (Selling Price):

CMP 1

UVC

UR

With a l5% increase in variable production costs (to

$5.52, giving total UVC of $6.48), the selling price

per box is:

80 . 10 $

60 .

48 . 6 $

40 . 1

48 . 6 $

UR

Problem 16-2

c. What volume of sales in dollars must Doyle's Candy Company achieve

in the coming year to maintain the same net income after taxes as

projected for the current year if the selling price of candy remains at

$9.60 per box and the variable production costs of candy increase 15

percent?

Problem 16-3: Mike Solids

Pizzeria

Mike Solid started a pizzeria in 1999. For

this purpose he rented a building for

$1,800 per month. Two persons were

hired to work full-time at the restaurant

and six college students were hired to

work 30 hours per week delivering pizza.

An outside accountant was hired for tax

and bookkeeping purposes at a cost of

$900 per month. The necessary

restaurant equipment and delivery cars

were purchased with cash. Mr. Solid has

noticed that expenses for utilities and

supplies have been rather constant.

Mr. Solid increased his business

between 1999 and 2001. Profits have

more than doubled since 1999. Mr. Solid

does not understand why his profits have

increased faster than his volume.

A projected income statement for 2002

has been prepared by the accountant

and is shown below:

Projected Income Statement

For the Year Ended Dec.31, 2002

Sales $308,000

Cost of goods sold $92,400

Wages and fringe benefits of

restaurant help

26,650

Wages and fringe benefits of

delivery persons

54,100

Rent 15,500

Accounting Services 10,900

Depreciation of delivery

equipment

16,000

Depreciation of restaurant

equipment

8,000

Utilities 7,165

Supplies (soap, floor wax, etc.) 10,645 241,360

Income before taxes 66,640

Income taxes 19,992

Net Income $ 45,648

Note: The average pizza sells for $8.50.

Assume that Mr. Solid pays out 30 percent of his income in income taxes.

Problem 16-3: Mike Solids

Pizzeria

Required:

a. What is the break-even point in number of pizzas that must be sold?

Breakeven sales volume

*$308,000 / $8.50 = 36,235 pizzas

Variable Cost / Pizza:

$92,400 / 36,235 = $2.55.

Problem 16-3: Mike Solids

Pizzeria

b. What is the cash flow break-even point in number of pizzas that must be sold?

Cash fixed costs

= total fixed costs depreciation

= $148,960 - ($16,000 + $8,000)

= $148,960 - ($24,000) = $124,960

depreciation tax shield ($24,000 x 30%) = $7,200

Therefore,

Net Cash Fixed Cost = $124,960 - ($7,200)= $117,760.

So,

Break-even volume = $117,760 $5.95 = 19,792 pizzas

Cash Breakeven Point = (fixed costs - depreciation) / contribution margin per unit

Problem 16-3: Mike Solids

Pizzeria

c. If Mr. Solid withdraws $14,400 for personal use, how much cash will be left

from the 2002 income-producing activities?

Cash generated by operations

= net income + noncash expenses

= $46,648 + $24,000 = $70,648

$70,648 - $14,400 = $56,248

Problem 16-3: Mike Solids

Pizzeria

d. Mr. Solid would like an after-tax net income of $60,000, what volume must be

reached in number of pizzas in order to obtain the desired income?

The easiest way to approach this question is to treat the target pretax income as a fixed cost.

target pretax income

= $60,000 70% = $85,713

dollar sales at target pretax income

$85,713 + $148,960 fixed costs = $234,673

So

required volume = (dollar sales at target pretax income) / (unit contribution

margin)

= $234,673 / $5.95

= 39,441 pizzas.

Problem 16-3: Mike Solids

Pizzeria

e. Briefly explain to Mr. Solid why his profits have increased at a faster rate

than his sales.

Most of the expenses are fixed.

Therefore a large volume of sales

is required before any profit is

made. Once this point is reached

(break-even), each sale

contributes $5.95 to profits, a

larger change in profits since

profits begin at zero at this point

while the $8.50 change in sales is

a smaller proportion of sales

because of the large amount of

sales required to reach the break-

even point.

$5.95 Unit contribution margin (SC-VC)

Projected Income Statement

For the Year Ended Dec.31, 2002

Sales $308,000

Cost of goods sold $92,400

Wages and fringe benefits of

restaurant help

26,650

Wages and fringe benefits of

delivery persons

54,100

Rent 15,500

Accounting Services 10,900

Depreciation of delivery equipment 16,000

Depreciation of restaurant

equipment

8,000

Utilities 7,165

Supplies (soap, floor wax, etc.) 10,645 241,360

Income before taxes 66,640

Income taxes 19,992

Net Income $ 45,648

Note: The average pizza sells for $8.50.

Assume that Mr. Solid pays out 30 percent of his income in income

taxes.

Problem 16-3: Mike Solids

Pizzeria

f. Briefly explain to Mr. Solid why his cash flow for 2002 will exceed his

profits.

The cash flow from operations

will exceed his profits because

$24,000 of the expense

(depreciation) is not a current

cash-consuming cost.

Projected Income Statement

For the Year Ended Dec.31, 2002

Sales $308,000

Cost of goods sold $92,400

Wages and fringe benefits of

restaurant help

26,650

Wages and fringe benefits of

delivery persons

54,100

Rent 15,500

Accounting Services 10,900

Depreciation of delivery

equipment

16,000

Depreciation of restaurant

equipment

8,000

Utilities 7,165

Supplies (soap, floor wax, etc.) 10,645 241,360

Income before taxes 66,640

Income taxes 19,992

Net Income $ 45,648

END

You might also like

- Complete Guide To Value InvestingDocument35 pagesComplete Guide To Value Investingsweetestcoma100% (4)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Trade Me analysis reveals stock valuationDocument20 pagesTrade Me analysis reveals stock valuationCindy YinNo ratings yet

- Assignment No. 3Document4 pagesAssignment No. 3Sherren Marie Nala100% (2)

- Accounting Decisions Workbook Covers Financials, Costing, AnalysisDocument96 pagesAccounting Decisions Workbook Covers Financials, Costing, AnalysisSatyabrataNayak100% (1)

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- Ma1 Specimen j14Document17 pagesMa1 Specimen j14Shohin100% (1)

- Chapter 15&16 Problems and AnswersDocument22 pagesChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- Ma1 PilotDocument17 pagesMa1 PilotKu Farah Syarina0% (1)

- CA Certificate For VisaDocument4 pagesCA Certificate For VisaVamshi Krishna Reddy Pathi0% (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- P1 Management Accounting Performance EvaluationDocument31 pagesP1 Management Accounting Performance EvaluationSadeep MadhushanNo ratings yet

- ACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Document9 pagesACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Hannah NazirNo ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Unpaid Share Subscription Enforced Through Court ActionDocument2 pagesUnpaid Share Subscription Enforced Through Court ActionASGarcia24100% (1)

- 02 Task Performance 1Document3 pages02 Task Performance 1Ralph Louise PoncianoNo ratings yet

- Vodafone Hutchison Australia Pty LTD ABN 76Document8 pagesVodafone Hutchison Australia Pty LTD ABN 76himal91No ratings yet

- ANSOFFDocument2 pagesANSOFFAntonio Paraschivoiu0% (2)

- 9706 s16 QP 32 PDFDocument12 pages9706 s16 QP 32 PDFFarrukhsgNo ratings yet

- 2012 Specimen PaperDocument18 pages2012 Specimen Paperkevin1811No ratings yet

- Cima C01 Samplequestions Mar2013Document28 pagesCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- F1 Answers May 2013Document15 pagesF1 Answers May 2013Chaturaka GunatilakaNo ratings yet

- t4 2008 Dec QDocument8 pagest4 2008 Dec QShimera RamoutarNo ratings yet

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- POA 2008 ZA + ZB CommentariesDocument28 pagesPOA 2008 ZA + ZB CommentariesEmily TanNo ratings yet

- Accountancy and Auditing-2007Document10 pagesAccountancy and Auditing-2007BabarNo ratings yet

- PM Sect B Test 3Document5 pagesPM Sect B Test 3FarahAin FainNo ratings yet

- F2 Mha Mock 3Document12 pagesF2 Mha Mock 3Annas SaeedNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Ma2 Mock 1Document11 pagesMa2 Mock 1sameerjameel678No ratings yet

- 1Document10 pages1Tariq AbdulazizNo ratings yet

- Accounting (IAS) /series 4 2007 (Code3901)Document17 pagesAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Accounting Quiz YP 51 BDocument4 pagesAccounting Quiz YP 51 Bnicasavio2725No ratings yet

- F 2 BLPDFDocument20 pagesF 2 BLPDFEmon D' CostaNo ratings yet

- MB0041 MQP Answer KeysDocument21 pagesMB0041 MQP Answer Keysajeet100% (1)

- Ma2 Mock 3Document10 pagesMa2 Mock 3yashwant ashokNo ratings yet

- Mba B0205Document3 pagesMba B0205Ashwani BhallaNo ratings yet

- PREP COF Sample Exam QuestionsDocument10 pagesPREP COF Sample Exam QuestionsLNo ratings yet

- Acca f5 2012 DecDocument8 pagesAcca f5 2012 DecgrrrklNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- BSMAN3009 Accounting For Managers 20 June 2014 Exam PaperDocument8 pagesBSMAN3009 Accounting For Managers 20 June 2014 Exam Paper纪泽勇0% (1)

- Sample Mid Semester Exam With AnswersDocument15 pagesSample Mid Semester Exam With AnswersjojoinnitNo ratings yet

- MCD2010 - T8 SolutionsDocument9 pagesMCD2010 - T8 SolutionsJasonNo ratings yet

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument18 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelsagarnitishpirtheeNo ratings yet

- D15 Hybrid F5 QPDocument7 pagesD15 Hybrid F5 QPadad9988No ratings yet

- Introduction To Accounting: The Association of Business Executives QCFDocument11 pagesIntroduction To Accounting: The Association of Business Executives QCFBayoh ShekouNo ratings yet

- Ma1 Mock 1 QUESTION PDFDocument21 pagesMa1 Mock 1 QUESTION PDFfurtech550No ratings yet

- 9706 Y16 SP 2Document18 pages9706 Y16 SP 2Wi Mae RiNo ratings yet

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgNo ratings yet

- Bcom 5 Sem Cost Accounting 1 20100106 Feb 2020Document4 pagesBcom 5 Sem Cost Accounting 1 20100106 Feb 2020sandrabiju7510No ratings yet

- MA2 Mock 3Document10 pagesMA2 Mock 3sameerjameel678No ratings yet

- Ma2 Mock 3 DecDocument11 pagesMa2 Mock 3 Decahmed saeedNo ratings yet

- Cost & Manag Ement Accounting: Mode 011 L Test Paper 2 BBA Part IIIDocument2 pagesCost & Manag Ement Accounting: Mode 011 L Test Paper 2 BBA Part IIIGuruKPONo ratings yet

- March 2010 Part 2 InsightDocument92 pagesMarch 2010 Part 2 InsightLegogie Moses AnoghenaNo ratings yet

- CPGA QP May 2010 For PrintDocument20 pagesCPGA QP May 2010 For PrintfaizthemeNo ratings yet

- 9706 s16 QP 22 PDFDocument16 pages9706 s16 QP 22 PDFFarrukhsgNo ratings yet

- Homework 2: Q1:: Is Should IncludeDocument35 pagesHomework 2: Q1:: Is Should IncludeMichael MaNo ratings yet

- 2018 Financial Accounting Paper 2 SolutionDocument15 pages2018 Financial Accounting Paper 2 Solutiontetteh godwinNo ratings yet

- Advanced Performance Management (APM) : Strategic Professional - OptionsDocument11 pagesAdvanced Performance Management (APM) : Strategic Professional - OptionsNghĩa VõNo ratings yet

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Tax Invoice for Grill Set PurchaseDocument1 pageTax Invoice for Grill Set PurchasePradeep BiradarNo ratings yet

- BrokersDocument4 pagesBrokersAkansha AgarwalNo ratings yet

- Macroeconomics Canadian 14th Edition Mcconnell Test BankDocument32 pagesMacroeconomics Canadian 14th Edition Mcconnell Test Bankadeleiolanthe6zr1100% (27)

- Morning Session Q&ADocument50 pagesMorning Session Q&AGANESH MENONNo ratings yet

- Chen 2020Document20 pagesChen 2020KANA BITTAQIYYANo ratings yet

- Investor Perception About Systematic Investment Plan (SIP) Plan: An Alternative Investment StrategyDocument7 pagesInvestor Perception About Systematic Investment Plan (SIP) Plan: An Alternative Investment StrategyUma Maheswar KNo ratings yet

- FEDEX - Stock & Performance Analysis: Group MembersDocument15 pagesFEDEX - Stock & Performance Analysis: Group MembersWebCutPasteNo ratings yet

- Smes of Pakistan: Syed Arshanali Shah Faheem Hussain Sario Sushmitabachani JashwantimaheshwariDocument21 pagesSmes of Pakistan: Syed Arshanali Shah Faheem Hussain Sario Sushmitabachani JashwantimaheshwariMUHAMMAD JAMILNo ratings yet

- Understand The Flows of Significant Classes of Transactions, Including Walk-Through - Cash DisbursementsDocument11 pagesUnderstand The Flows of Significant Classes of Transactions, Including Walk-Through - Cash DisbursementsmohihsanNo ratings yet

- Capital Structure of Ranbaxy PharmaDocument40 pagesCapital Structure of Ranbaxy PharmaNooral Alfa100% (1)

- CFAS - M3P2 AssignmentDocument12 pagesCFAS - M3P2 AssignmentMay OriaNo ratings yet

- WCL/SEC/2021 Related Party DisclosuresDocument5 pagesWCL/SEC/2021 Related Party DisclosuresVivek AnandNo ratings yet

- Writing Up A Case StudyDocument3 pagesWriting Up A Case StudyalliahnahNo ratings yet

- BF 120Document11 pagesBF 120Dixie Cheelo100% (1)

- Finance-Careers VVFDocument51 pagesFinance-Careers VVFRay FBNo ratings yet

- Silo PDFDocument3 pagesSilo PDFEko SetiawanNo ratings yet

- Salary Loan/Advance - Application Form: Personal InformationDocument2 pagesSalary Loan/Advance - Application Form: Personal InformationJohn Ray Velasco100% (1)

- Commentary JANUARY 2018: Grid Connected Solar Power ProjectsDocument3 pagesCommentary JANUARY 2018: Grid Connected Solar Power ProjectsTrần Thục UyênNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument3 pagesExamination: Subject SA3 General Insurance Specialist Applicationsdickson phiriNo ratings yet

- The Ratio Analysis Technique Applied To PersonalDocument15 pagesThe Ratio Analysis Technique Applied To PersonalladycocoNo ratings yet

- HDFC Bank provides nationwide banking services with 2000+ branchesDocument16 pagesHDFC Bank provides nationwide banking services with 2000+ branchesVenkateshwar Dasari NethaNo ratings yet

- What Is KYCDocument3 pagesWhat Is KYCPrateek LoganiNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Syazliana KasimNo ratings yet