Professional Documents

Culture Documents

Indonesia Pharma Industry Overview

Uploaded by

vijayendar4210%(1)0% found this document useful (1 vote)

436 views6 pagesIndonesia pharmaceutical industry overview and list of companies in indonesia

Original Title

Indonesia pharma industry overview

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIndonesia pharmaceutical industry overview and list of companies in indonesia

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

436 views6 pagesIndonesia Pharma Industry Overview

Uploaded by

vijayendar421Indonesia pharmaceutical industry overview and list of companies in indonesia

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

PHARMACEUTICAL INDUSTRY IN INDONESIA

Population: 246.9 million (2012)

Life expectancy: 69.32 years (2011)

Age Groups:

0-14 years: 27.3% (male 34,165,213/female 32,978,841)

15-64 years: 66.5% (male 82,104,636/female 81,263,055)

65 years and over: 6.1% (male 6,654,695/female 8,446,603) (2011 EST.)

Gross domestic product: 878 billion USD (2012)

Pharmaceutical market size: 6.5bn USD in 2012

Introduction:

Indonesias pharmaceutical sector has been growing steadily with double digit

compound growth since 2009 and projections of 14% growth for 2011 according to the

Indonesian Pharmaceutical Association. Indonesia is a highly attractive market for the

pharmaceutical industry given its large population as the fourth most populous country in

the world, but spending on healthcare is very low in comparison to neighboring countries of

similar GDP

Regulatory or Governing body:

The authority on Indonesia pharmaceutical regulations is the National Agency of Drug and

Food Control (NADFC). Registering drugs can be an extremely lengthy and taxing process.

Registration can take from one to three years

The Association of Southeast Asian Nations (ASEAN) Common Technical Documents (CTD)

must be used, and ASEAN standards should be followed. Generic pharmaceutical pricing is

regulated by the government. Pharmaceuticals included in the Essential Drugs List -- 92% of

which are generic and 2.5% of which are innovator -- cannot be sold for more than a 50%

margin. Other generics are also subject to pricing restrictions.

Pharmaceuticals are classified as indicated below:

Narcotics (category O),

Prescription medicines (category G),

OTC medicine with warning labels (category W), and

General OTC products (category F).

The NADFC also regulates drug advertising. All advertising materials must be approved by

the NADFC. Category G prescription drugs are not permitted to be advertised to the public.

Category W drugs can be advertised to consumers, provided they have warning labels on

packages. There is no restriction on the advertising of category F products.

Pharmaceutical companies in Indonesia:

The Indonesian Pharmaceutical Association states that 95% of locally produced drugs are

being consumed domestically, with the remaining 5% exported.

Domestic pharmaceutical firms have 70% of the Indonesian drug market. Almost 60 foreign

pharmaceutical companies control the remaining 30% of the Indonesian drug market; the

largest are Bayer, Pfizer, and GlaxoSmithKline (GSK).

Almost all pharmaceutical products registered in Indonesia must be manufactured in

country.

The only exceptions are patented products and drugs that cannot be manufactured

in Indonesia.

Foreign applicants for product registration must have an Indonesian manufacturing

facility or appoint an intermediary.

Indonesias Kalbe Farma, founded in 1966, has a market capitalization of $7 billion and is the

largest listed drug company in the Association of Southeast Asian Nations (ASEAN).

Foreign companies in Indonesia

More and more foreign drug companies are looking to Indonesia for future profits. Despite

restrictions on manufacturing and ownership, more than 50 international pharmaceutical

companies have business in Indonesia.

Foreign ownership in domestic drug companies is limited to 75 percent. The other 25

percent of a company must be owned by an Indonesian national.

Opportunities:

With the continuing expansion of the healthcare sector, demand for low-cost drugs

is likely to increase.

The Indonesian pharmaceutical market is largely import-driven, exports are likely to

increase as more domestic producers adhere to Good Manufacturing Practice (GMP)

standards.

To improve Indonesia pharmaceutical regulations and Good Clinical Practice (GCP)

standards, the country is becoming an increasingly attractive location for clinical

trials.

Indonesia Pharmaceutical and Healthcare Industry SWOT

Strengths

Significant market growth potential, with a fast-growing population.

Well-established local industry, with domestic players especially prominent in

manufacturing.

Sizeable and strong generic drug market, largely owing to the low-income

population.

Introduction of Good Manufacturing Practice (GMP) standards.

Weaknesses

The market is among the least developed in Asia.

No private insurance and no pharmaceutical reimbursement.

Lack of formal price controls leading to delays or rejections of marketing applications

if the proposed price is deemed too high.

Low purchasing power of large section of the population.

Regulatory system biased in favour of local drug producers.

Pharmaceutical sales through illegal channels.

Reliance on imported active pharmaceutical ingredients (APIs), which makes the

industry sensitive to currency fluctuations.

Opportunities

Demand for low-cost drugs to increase with the continuing expansion of the

healthcare sector and rising cost awareness.

Trade liberalisation within the Association of South East Asian Nations (ASEAN)

regional group to potentially speed up growth, as could government subsidies of

healthcare costs.

Exports likely to rise as more producers meet GMP standards.

The proposed privatisation of the local manufacturing industry holds considerable

benefits for the industry from private control and funding.

Rising attractiveness of Indonesia as a clinical trials base.

Government encouragement of exports.

Despite some problems with the programme, the government is planning to

consolidate the local industry in order to reduce costs.

Potential removal of the pharmaceutical industry from the negative investment list.

Threats

Poor intellectual property (IP) protection leading to reduced foreign investment

(FDI).

Poor efficacy of counterfeit drugs leading to a distrust of pharmaceuticals.

Inadequate healthcare coverage and lack of disease monitoring leading to epidemics.

Recently introduced regulation stipulating that all foreign companies must have local

manufacturing facilities.

Escalating raw material cost and taxation of imports resulting in pharmaceutical

products becoming prohibitively expensive.

Widespread corruption continuing to deter foreign investment.

Reduction of tariffs on drugs under ASEAN harmonization programme posing threat

to local industry.

DRL business in Indonesia:

crp name and product name 100490.15 10450204.73

Epic Ingredients Sdn. Bhd. 60734 6320098.215

Clopidogrel Bisulphate Form 1 6938.5 4942610.418

Desloratadine 0.5 750

Lansoprazole Pellets 8.5% 32000 846667.0081

Omeprazole Pellets 8.5% 150 2100

Ondansetron Hydrochloride 100 70000

Ondansetron Hydrochloride Dihydrate 145 102375.1013

Ranitidine Hydrochloride Form 2 21400 355595.6876

Pt. Tatarasa Primatama 38430.35 3145884.933

Amlodipine Besilate Ph Eur 700 141388.9844

Amlodipine Besilate Ph.Eur 500 99278.11036

Amlodipine Besylate 270 41481.35728

Atorvastatin Calcium ( Form - P ) 8.85 6603.989843

Cetirizine Dihydrochloride Ph.Eur. 100 20139.77276

Cetirizine Hydrochloride 1425 218476.2608

Cetirizine Hydrochloride EP 50 4250

Cetirizine Hydrochloride USP 80 16000

Ciprofloxacin Base (DMF) 150 22500

Ciprofloxacin Hydrochloride 1500 49493.25563

Ciprofloxacin Hydrochloride USP 6000 174000

Ciprofloxacin Lactate Monohydrate 700 56161.06742

Dextromethorphan Hydrobromide 4900 830277.518

Diltiazem Hydrochloride 298 23936.87937

Enalapril Maleate 5 866.1736773

Enalapril Maleate USP 5 875

Fluoxetine 150 16500

Fluoxetine Hydrochloride 124.55 12512.13837

Ibandronate Sodium 1 1237.390968

Itraconazole Pellets 22% 350 37961.98401

Ketorolac - USP 100 20000

Ketorolac Tromethamine 520 158882.5463

Levofloxacin 150 15500

Levofloxacin Hemi Hydrate 774.1 68167.31673

Loratadine 260 64659.73609

Moxifloxacin Hydrochloride (MOA2) 146 218804.6683

Naproxen Sodium 1370 55143.52345

New Products 0 87871.55411

Olanzapine Form 1 (Canada) 20 40000

Olanzapine Form-I 5 14221.12347

Omeprazole Pellets 3000 48000

Omeprazole Pellets 8.5% 9010 135473.5959

Ondansetron Hydrochloride 15 10976.98445

Ondansetron Hydrochloride Dihydrate 73 53421.10173

Pantoprazole Sodium USP 2 700

Rabeprazole Sodium 6 2200

Rabeprazole Sodium ( Form Y ) 3 1187.358078

Ramipril 50 40000

Ramipril Ph.Eur. 30 30812.6949

Ranitidine Hydrochloride Form 2 5250 89094.52162

Repaglinide 1.9 7506.843484

Risperidone 118.5 122317.1999

Risperidone Form 1 21 36986.37927

Rosuvastatin Calcium 0.45 2204.923982

Sertraline Hcl - LRM 50 7500

Sertraline HCl - Others 12 2160

Sparfloxacin 45 7499.004121

Telmisartan(CIP) 25 13506.15668

Valsartan 55 17147.81696

DLS Pharma Limited 1300 931902.8109

Clopidogrel Bisulphate Form 1 1300 931902.8109

Pt.Dexa Medica 25.8 52318.77662

Atorvastatin Calcium ( Form - P ) 6 4500

Febuxostat 14.8 30830

Moxifloxacin Hydrochloride 5 16988.77662

You might also like

- Pharamaceutical Industry Analysis of PakistanDocument89 pagesPharamaceutical Industry Analysis of PakistantazeenseemaNo ratings yet

- Introduction To Pharma IndustryDocument9 pagesIntroduction To Pharma Industryvijayendar421No ratings yet

- Consumer Health in IndonesiaDocument99 pagesConsumer Health in IndonesiaJohannes ArdiantNo ratings yet

- Indonesia PharmaDocument167 pagesIndonesia PharmaKapil KoNo ratings yet

- Potential Exports and Nontariff Barriers to Trade: Maldives National StudyFrom EverandPotential Exports and Nontariff Barriers to Trade: Maldives National StudyNo ratings yet

- 2006 Euromonitor Packaged Foods - IndonesiaDocument252 pages2006 Euromonitor Packaged Foods - IndonesiaDanar Aditya100% (2)

- Asian Health Wellness Trends Euromonitor PDFDocument39 pagesAsian Health Wellness Trends Euromonitor PDFKhánhNguyễnHữuNo ratings yet

- 805 Venezuela Pharmaceutical PDFDocument128 pages805 Venezuela Pharmaceutical PDFKhushboo Mehta100% (1)

- Kenya Pharmaceutical ManufacturersDocument3 pagesKenya Pharmaceutical ManufacturersBen Lu 陆源No ratings yet

- Cheese in IndonesiaDocument10 pagesCheese in IndonesialinggaraninditaNo ratings yet

- Import Study Metalworking Vietnam 2014Document206 pagesImport Study Metalworking Vietnam 2014Minh Hoàng Nguyễn HữuNo ratings yet

- External Strategic Management Audit (40/40Document22 pagesExternal Strategic Management Audit (40/40Emeey ConneryNo ratings yet

- Pharma-MD-Cosmetic Registration (HHP21062016) PDFDocument48 pagesPharma-MD-Cosmetic Registration (HHP21062016) PDFReagen Lodeweijke MokodompitNo ratings yet

- Oleochemical ReportDocument3 pagesOleochemical ReportAkshay KhandelwalNo ratings yet

- SECTOR REPORT: KEY TAKEAWAYS ON INDIA'S PHARMACEUTICAL INDUSTRYDocument17 pagesSECTOR REPORT: KEY TAKEAWAYS ON INDIA'S PHARMACEUTICAL INDUSTRYRajendra BhoirNo ratings yet

- India's Growing Packaging IndustryDocument10 pagesIndia's Growing Packaging IndustryAdhip Pal ChaudhuriNo ratings yet

- Management Development Institute, Gurgaon Graduate Programmes Course OutlineDocument3 pagesManagement Development Institute, Gurgaon Graduate Programmes Course OutlinePuneet GargNo ratings yet

- Indian Edible Oil Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument13 pagesIndian Edible Oil Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- China Cutting Tools Market ReportDocument10 pagesChina Cutting Tools Market ReportAllChinaReports.comNo ratings yet

- Fotile Case PDFDocument13 pagesFotile Case PDFLilianKuoNo ratings yet

- Lubricant Market Report 2010Document8 pagesLubricant Market Report 2010Shyam SrinivasanNo ratings yet

- The New Lubricant Trade in Asean A Promising New Era PDFDocument11 pagesThe New Lubricant Trade in Asean A Promising New Era PDFPleum SimachayaNo ratings yet

- Final Report FerreroDocument45 pagesFinal Report Ferrerokohli430No ratings yet

- Group 5 - Marquette Case 8Document7 pagesGroup 5 - Marquette Case 8Bimly Shafara100% (1)

- 1772HK ProspetusENG LTN20180927025 PDFDocument602 pages1772HK ProspetusENG LTN20180927025 PDFGene LauNo ratings yet

- Philippine Pharmaceutical IndustryDocument13 pagesPhilippine Pharmaceutical IndustryjoeybundocNo ratings yet

- Strategy Sumitomo Heavy IndustriesDocument17 pagesStrategy Sumitomo Heavy IndustriesSomyata RastogiNo ratings yet

- Instant Noodles in Thai MarketDocument12 pagesInstant Noodles in Thai MarketMaiBằng100% (1)

- Brand ExtensionDocument22 pagesBrand ExtensionAnuranjanSinha100% (3)

- Annual Report 2016 220617-8.53pm CompressedDocument333 pagesAnnual Report 2016 220617-8.53pm CompressedAbdy D'LufiasNo ratings yet

- CleanWell Hand Sanitizer Marketing PlanDocument38 pagesCleanWell Hand Sanitizer Marketing PlanManal Al AlawiiNo ratings yet

- Brand Audit of Britannia BourbonDocument17 pagesBrand Audit of Britannia Bourbonrishi_khemka100% (1)

- Applications and Market Research of PtfeDocument16 pagesApplications and Market Research of PtfeHarsh GuptaNo ratings yet

- Stevia Global MarketDocument12 pagesStevia Global MarketPratibha Singh50% (2)

- Malaysia Fertiliser MarketDocument21 pagesMalaysia Fertiliser MarketRamkannan Parasumanna Chandrasekaran0% (1)

- Pakan - Final Indonesia ReportDocument51 pagesPakan - Final Indonesia ReportPatricia NorevaNo ratings yet

- Gdpindonesiadigitaltrend 180307070444 PDFDocument46 pagesGdpindonesiadigitaltrend 180307070444 PDFSigit Hariyanto100% (1)

- Growth Drivers - GCCDocument22 pagesGrowth Drivers - GCCRahul MandalNo ratings yet

- Honda Case StudyDocument11 pagesHonda Case StudySarjodh SinghNo ratings yet

- BTG Pactual - Meliuz PDFDocument4 pagesBTG Pactual - Meliuz PDFRenan Dantas SantosNo ratings yet

- Executive Summary of Imperial AutoDocument73 pagesExecutive Summary of Imperial AutoAnshul Dhawan100% (1)

- Steel Industry in IndiaDocument23 pagesSteel Industry in IndiaAnna KruglovaNo ratings yet

- Pharmaceutical Industry of BangladeshDocument32 pagesPharmaceutical Industry of BangladeshPratikBhowmick100% (1)

- FMCG Sector Cost StructureDocument10 pagesFMCG Sector Cost StructureManoj Kumar Meena100% (1)

- Brazil Baby FoodDocument9 pagesBrazil Baby Foodrachitraj28No ratings yet

- Aboout Sogo SoshaDocument8 pagesAboout Sogo SoshaEko TjahjantokoNo ratings yet

- Food and Beverage Market Profile Indonesia 2012Document14 pagesFood and Beverage Market Profile Indonesia 2012Endot PurbaNo ratings yet

- India Biscuit IndustryDocument57 pagesIndia Biscuit IndustryGAYATHRI0923100% (9)

- FAQ On InvestmentDocument80 pagesFAQ On InvestmentIrka PlayingNo ratings yet

- EXIDEIND Stock AnalysisDocument9 pagesEXIDEIND Stock AnalysisAadith RamanNo ratings yet

- Current Trends of Tata SteelDocument2 pagesCurrent Trends of Tata SteelSaibal DasNo ratings yet

- Pharmaceutical IndustryDocument34 pagesPharmaceutical Industryalizain8000% (1)

- Pakistan Pharmaceutical Industry Challenges & Future ProspectsDocument30 pagesPakistan Pharmaceutical Industry Challenges & Future ProspectsarifmukhtarNo ratings yet

- Sectorial Analysis of The Indian Pharmaceutical IndustriesDocument16 pagesSectorial Analysis of The Indian Pharmaceutical IndustriesyeshwanthchordiaNo ratings yet

- The Pharmaceutical IndustryDocument21 pagesThe Pharmaceutical IndustryLopa BhagawatiNo ratings yet

- Pharmaceutical Marketing Strategy of Pharmaceutical IndustryDocument98 pagesPharmaceutical Marketing Strategy of Pharmaceutical IndustryRajendra Singh ChauhanNo ratings yet

- New Cut ProjectDocument40 pagesNew Cut ProjectSaurabh PaulNo ratings yet

- Pharmaceutical Marketing Strategy of Pharmaceutical IndustryDocument116 pagesPharmaceutical Marketing Strategy of Pharmaceutical Industryavtarsinghsadaf76% (38)

- Comparative Position of Indonesian Pharma Industry With India and Gujarat IndexDocument39 pagesComparative Position of Indonesian Pharma Industry With India and Gujarat IndexmakvanabhaveshNo ratings yet

- EferozDocument57 pagesEferozMehwish QureshiNo ratings yet

- Effective Advertising and Its Influence On Consumer Buying BehaviorDocument12 pagesEffective Advertising and Its Influence On Consumer Buying BehaviorLouana DavidNo ratings yet

- Hofstede's Cultural Dimensions China & GermanyDocument3 pagesHofstede's Cultural Dimensions China & Germanyvijayendar421No ratings yet

- Marketing Strategy of Indian Pharmaceutical IndustryDocument61 pagesMarketing Strategy of Indian Pharmaceutical Industryvijayendar421No ratings yet

- AP SI Recruitment 2011 Total 2296 PostsDocument36 pagesAP SI Recruitment 2011 Total 2296 Postsgovtjobsdaily100% (1)

- Cardiac Glycosides Natural OccurrenceDocument18 pagesCardiac Glycosides Natural OccurrenceMuhammad JavedNo ratings yet

- Vancomycin Protocol: A Protocol To Guide The Dosing and Monitoring of Vancomycin in AdultsDocument5 pagesVancomycin Protocol: A Protocol To Guide The Dosing and Monitoring of Vancomycin in AdultsSaadia MahmoodNo ratings yet

- Pre-Course MCQ ..................................Document1 pagePre-Course MCQ ..................................Arslan SiddiquiNo ratings yet

- New and Revised USP Chapters and MonographsDocument2 pagesNew and Revised USP Chapters and MonographsRodriguito Gabriel FloresNo ratings yet

- Brilinta RXDocument10 pagesBrilinta RXravi_bhateja_2No ratings yet

- Drug study of Erceflora and Albuterol Sulfate for diarrhea and bronchospasmDocument4 pagesDrug study of Erceflora and Albuterol Sulfate for diarrhea and bronchospasmKrisia Castuciano50% (2)

- Introduction to Pharmacokinetics: Basic ConceptsDocument7 pagesIntroduction to Pharmacokinetics: Basic ConceptsJeraldiin BeltranNo ratings yet

- Formularium CitamaDocument37 pagesFormularium Citamars citamaNo ratings yet

- Asthma MagnesiumDocument24 pagesAsthma MagnesiumAj BrarNo ratings yet

- University Hospitals of Leicester NHS Trust ChartDocument12 pagesUniversity Hospitals of Leicester NHS Trust ChartBella LunaNo ratings yet

- Pharmacology For Nurses Third Canadian Edition 3Rd Edition Full ChapterDocument41 pagesPharmacology For Nurses Third Canadian Edition 3Rd Edition Full Chaptermuriel.moreno949100% (26)

- PF25433 Intraosseous Needle Set Kit IFUDocument2 pagesPF25433 Intraosseous Needle Set Kit IFUFarbodNo ratings yet

- Practice Guidelines: Enteral Nutrition Delivery For The Adult PatientDocument15 pagesPractice Guidelines: Enteral Nutrition Delivery For The Adult Patientdamondouglas100% (1)

- Neurofeedback Technician or Psychotherapist or Career CounselorDocument3 pagesNeurofeedback Technician or Psychotherapist or Career Counselorapi-121357186No ratings yet

- AbbVie Products & Contact Information - MIMSDocument3 pagesAbbVie Products & Contact Information - MIMSKhoaNo ratings yet

- Oncology Scope of ServicesDocument2 pagesOncology Scope of ServicesJaisurya SharmaNo ratings yet

- Kuliah Terminologi MedisDocument36 pagesKuliah Terminologi MedissuyokoNo ratings yet

- InsulinaDocument1 pageInsulinaRICARDO DEL ANGEL HERNANDEZNo ratings yet

- Aina Shahirah Binti Mohd Shafri - Group BDocument6 pagesAina Shahirah Binti Mohd Shafri - Group BMOHD MU'IZZ BIN MOHD SHUKRINo ratings yet

- Pharmaceutical AnalysisDocument4 pagesPharmaceutical AnalysisYuri DryzgaNo ratings yet

- Walmart Drug ListDocument6 pagesWalmart Drug ListShirley Pigott MDNo ratings yet

- Module 2: Drug Classes and Schedules: Learning OutcomesDocument5 pagesModule 2: Drug Classes and Schedules: Learning OutcomesShaina JavierNo ratings yet

- Health The Basics 11th Edition Donatelle Test BankDocument21 pagesHealth The Basics 11th Edition Donatelle Test Banktaylorheathnidyzgpxtw100% (14)

- Wisconsin Amphetamine Rule PDFDocument2 pagesWisconsin Amphetamine Rule PDFBrian HarrisNo ratings yet

- Society For Obesity and Bariatric Anaesthesia: OS-MRS Calculator Tools - Farmacologiaclinica.infoDocument1 pageSociety For Obesity and Bariatric Anaesthesia: OS-MRS Calculator Tools - Farmacologiaclinica.infoHizami Norddin100% (2)

- P.T Acacia Mitra Abadi price list 02-13 May 2023Document26 pagesP.T Acacia Mitra Abadi price list 02-13 May 2023Afif SetiawanNo ratings yet

- Anexa CANAMED Fișier Transparență OriginalDocument449 pagesAnexa CANAMED Fișier Transparență Originalcristina ovidenieNo ratings yet

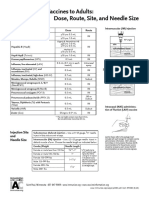

- Administering Vaccines To Adults: Dose, Route, Site, and Needle SizeDocument1 pageAdministering Vaccines To Adults: Dose, Route, Site, and Needle SizeAkashNo ratings yet

- Top 15 Cancer Drugs Expected to Reach $90 Billion by 2022Document16 pagesTop 15 Cancer Drugs Expected to Reach $90 Billion by 2022Soma YasaswiNo ratings yet