Professional Documents

Culture Documents

Haqsyeda

Uploaded by

api-256554999Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Haqsyeda

Uploaded by

api-256554999Copyright:

Available Formats

It is a delayed annuity

a)

Step 1

PMT 120000

N 32

i 6.50%

PV(28) ??

PV(28) $1,600,071.51

Step 2

FV(28) $1,600,071.51

N 28

i 6.50%

PV(0) ??

PV(0) $274,378.69

b)

PMT ??

N 28

i 6.50%

PV $274,378.69

PMT $21,525.85

You plan on retiring in 29 years. To support your retirement, you want to be able to

make 32 annual withdrawals of $120,000 each year, with the first withdrawal on the

day you retire and your last withdrawal at the end of year 60. Assuming you can earn

6.5% on your retirement account:

a) How large of a deposit do you have to make today to be able to achieve

retirement goal?

b) If you decide to save for your retirement by making annual deposits

lump sum today, how much should your annual deposits be, if

made at the end of this year and your last deposit one year before you retire (end of

year 28)?

You plan on retiring in 29 years. To support your retirement, you want to be able to

make 32 annual withdrawals of $120,000 each year, with the first withdrawal on the

day you retire and your last withdrawal at the end of year 60. Assuming you can earn

6.5% on your retirement account:

a) How large of a deposit do you have to make today to be able to achieve your

b) If you decide to save for your retirement by making annual deposits instead of a

lump sum today, how much should your annual deposits be, if your first deposit is

made at the end of this year and your last deposit one year before you retire (end of

Winter Park Web Design

Income Statements

For the Years 2010 and 2011

2011 2010

Sales 186,946 150,000

Cost of Goods Sold 102,819 82,500

Gross Profit 84,127 67,500

Depreciation Expense 3,530 3,098

Selling & Admin Expense 550 480

Net Operating Income 80,047 63,923

Interest Expense 680 540

Earnings Before Taxes 79,367 63,383

Taxes 29,366 22,184

Net Income 50,001 41,199

Notes:

Tax Rate 37% 35%

Shares Outstanding 5,000 5,000

Dividends per Share 6 6

Dividend 30,000

Addition to Retained Earning 20,001

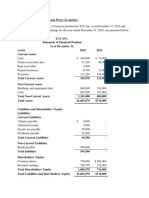

Winter Park Web Design

Balance Sheets

For the Years 2010 and 2011

Assets 2011 2010 Change

Cash 10,150 7,500

Accounts receivable 12,504 11,000 1,504

Inventories 8,607 7,550 1,057

Total Current Assets 31,261 26,050

Gross fixed assets 29,020 8,850 20,170

Accumulated depreciation 7,230 3,700

Net Fixed Assets 21,790 5,150

Total assets 53,051 31,200

Liabilities and Owner's Equity

Accounts payable 8,201 6,851 1,350

Notes payable 2,000 3,000 (1,000)

Total Current Liabilities 10,201 9,851

Long-term debt 7,115 5,615 1,500

Total Liabilities 17,316 15,466

Common stock 5,000 5,000 -

Additional paid in capital 500 500 -

Retained earnings 30,235 10,234

Total Equity 35,735 15,734

Total Liabilities & Equity 53,051 31,200

Check 0 0

Direction

2,650

-

-

-

+

-

+

Winter Park Web Design

Statement of Cash Flows

For the Year 2011

Cash Flows from Operations

Net Income 50,001

Depreciation Expense 3,530

Change in Accounts Receivable (1,504)

Change in Inventories (1,057)

Change in Accounts Payable 1,350

Total Cash Flows from Operations 52,320

Cash Flows from Investing

Change in fixed assets (20,170)

Total Cash Flows from Investing (20,170)

Cash Flows from Financing

Change in Notes Payable (1,000)

Change in Long-Term Debt 1,500

Change in Common Stock -

Change in Paid-In Capital -

Cash Dividends (30,000)

Total Cash Flows from Financing (29,500)

Check answer against Balance Sheet

Beginning Cash From Balance Sheet 7,500

Ending Cash From Balance Sheet 10,150

Net Change in Cash Balance 2,650

Winter Park Web Design

Common-size Balance Sheet

As of Dec. 31, 2011

Assets 2011 2010

Cash 19% 24%

Accounts receivable 24% 35%

Inventories 16% 24%

Total Current Assets 59% 83%

Gross fixed assets 55% 28%

Accumulated depreciation 14% 12%

Net Fixed Assets 41% 17%

Total assets 100% 100%

Liabilities and Owner's Equity

Accounts payable 15% 22%

Notes payable 4% 10%

Total Current Liabilities 19% 32%

Long-term debt 13% 18%

Total Liabilities 33% 50%

Common stock 9% 16%

Additional paid in capital 1% 2%

Retained earnings 57% 33%

Total Equity 67% 50%

Total Liabilities & Equity 100% 100%

a)

PV 20000

PMT 60000

N 7

i 5.50%

PV of payments ??

PV of payments $340,978.03

Total deposit today $360,978.03

b)

PMT 60000

N 4

i 5.50%

PV ??

PV $210,309.01

c)

PMT 60000

N 0

i 5.50%

PV ??

PV $0.00

d)

FV ??

PV 20000

PMT 60000

N 7

i 5.50%

FV of lump sum $29,093.58

FV of payments $496,013.63

Total FV $525,107.21 $525,107.21

To complete your degree and then go through graduate school, you will need $20,000 today and $60,000 per year for 7 years. Yo

Aunt offered to put you through school, and she will deposit in a bank paying 5.5% interest a sum of money that is sufficient

provide the $20,000 you need today and the 7 payments of $60,000 each.

a) How large of a deposit must she make today?

b) How much will be in the account immediately after you make the 3

c) How much will be in the account immediately after you make the last withdrawal in 7 years?

d) Now, if you decide to drop out of school today and not make any of the seven withdrawals, but keep your aunts money in th

account that is earning 5.5%, how much would you have in your account at the end of 7 years?

To complete your degree and then go through graduate school, you will need $20,000 today and $60,000 per year for 7 years. Your

Aunt offered to put you through school, and she will deposit in a bank paying 5.5% interest a sum of money that is sufficient to

provide the $20,000 you need today and the 7 payments of $60,000 each.

a) How large of a deposit must she make today?

b) How much will be in the account immediately after you make the 3

rd

$60,000 withdrawal?

c) How much will be in the account immediately after you make the last withdrawal in 7 years?

d) Now, if you decide to drop out of school today and not make any of the seven withdrawals, but keep your aunts money in the

account that is earning 5.5%, how much would you have in your account at the end of 7 years?

2)

FV 100

N 0% 6% 12%

0 $100.00 $100.00 $100.00

1 $100.00 $94.34 $89.29

2 $100.00 $89.00 $79.72

3 $100.00 $83.96 $71.18

4 $100.00 $79.21 $63.55

5 $100.00 $74.73 $56.74

6 $100.00 $70.50 $50.66

7 $100.00 $66.51 $45.23

8 $100.00 $62.74 $40.39

9 $100.00 $59.19 $36.06

10 $100.00 $55.84 $32.20

11 $100.00 $52.68 $28.75

12 $100.00 $49.70 $25.67

13 $100.00 $46.88 $22.92

14 $100.00 $44.23 $20.46

15 $100.00 $41.73 $18.27

16 $100.00 $39.36 $16.31

17 $100.00 $37.14 $14.56

18 $100.00 $35.03 $13.00

19 $100.00 $33.05 $11.61

20 $100.00 $31.18 $10.37

2) Plot the PV, over time, of $100 at different interest rates (0%, 6%, 12%)

$0.00

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

0

P

r

e

s

e

n

t

V

a

l

u

e

2) Plot the PV, over time, of $100 at different interest rates (0%, 6%, 12%)

5 10 15 20 25

Years (N)

0% Interest Rate

6% Interest Rate

12% Interest Rate

1)

Settlement 1/1/2000

Maturity 1/1/2008

Coupon 8.50%

frequrncy 2

Face 1000 how many 100s in par 10

discount rate 5.50%

years 8

Price 1,192.07 $

PV $1,192.07

2)

Settlement 8/15/2013 28-13=15*2=30 periods

Maturity 8/15/2028

Callable date 2/15/2018

Coupon 7%

frequrncy 2

Face 250 how many 100s in par 2.5

call premium 4%

Price 300 120

a)

YTM 5.08%

b)

Current Yeild 5.83%

c)

Yeild to call 3.05%

D)

YTM using PV 5.08%

1) As an investor, you are considering an investment in a bond that pays 8.5% semiannual coupon. This

bond has a $1,000 face value and will mature in eight years. If your required rate of return is 5.5% for bonds

in this risk class, what is the highest price you would be willing to pay? (Use Excel Price built in function)

2) On Aug 15

th

Face value $250 (par value)

Coupon rate 7%

Coupon frequency semiannual (8/15 & 2/15)

Maturity date Aug 15, 2028

First call date February 15, 2018

Call premium 4% of the face value

Bond current market price $300

a) Calculate YTM using the Yield function

b) Calculate the current yield

c) Calculate Yield to Call using the yield function

As an investor, you are considering an investment in a bond that pays 8.5% semiannual coupon. This

bond has a $1,000 face value and will mature in eight years. If your required rate of return is 5.5% for bonds

in this risk class, what is the highest price you would be willing to pay? (Use Excel Price built in function)

On Aug 15

th

, 2013 you are offered the following bond:

Face value $250 (par value)

Coupon rate 7%

Coupon frequency semiannual (8/15 & 2/15)

Maturity date Aug 15, 2028

First call date February 15, 2018

Call premium 4% of the face value

Bond current market price $300

Calculate YTM using the Yield function

Calculate the current yield

Calculate Yield to Call using the yield function

You might also like

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Chapter 2 SolutionsDocument19 pagesChapter 2 SolutionsSorken75No ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Chapter 2 7ed Problem SolutionsDocument20 pagesChapter 2 7ed Problem SolutionsAlvaro LopezNo ratings yet

- Course Folder Fall 2022Document26 pagesCourse Folder Fall 2022Areeba QureshiNo ratings yet

- AsdasdDocument20 pagesAsdasdTanvir Ahmad ShourovNo ratings yet

- Fin Mid Fall 2020Document2 pagesFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630No ratings yet

- FIN300 Homework 1Document7 pagesFIN300 Homework 1JohnNo ratings yet

- Mock Test - 2023Document3 pagesMock Test - 2023Phuoc TruongNo ratings yet

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Cortez Exam in Business FinanceDocument4 pagesCortez Exam in Business FinanceFranchesca CortezNo ratings yet

- Financial StatmentDocument2 pagesFinancial StatmentMohammed ademNo ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- Chapter 8Document6 pagesChapter 8ديـنـا عادلNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument36 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manualandrewnealobrayfksqe100% (23)

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Assignment Part OneDocument3 pagesAssignment Part Onetovi0821No ratings yet

- Practice Questions For Ratio Analysis2Document13 pagesPractice Questions For Ratio Analysis2Crazy FootballNo ratings yet

- Midterm Fin 254 Summer 2020Document5 pagesMidterm Fin 254 Summer 2020Salauddin Imran MumitNo ratings yet

- First 1302020Document9 pagesFirst 1302020fNo ratings yet

- Lecture 9Document21 pagesLecture 9Hồng LêNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Chapter 1. Exhibits y AnexosDocument15 pagesChapter 1. Exhibits y AnexoswcornierNo ratings yet

- Soal Uts Lab Ak. KeuanganDocument3 pagesSoal Uts Lab Ak. KeuanganAltaf HauzanNo ratings yet

- Review FinalDocument10 pagesReview FinalNguyen Minh QuanNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- Part III Ratio AnalysisDocument7 pagesPart III Ratio AnalysisamahaktNo ratings yet

- Mock Test 02Document12 pagesMock Test 02ANH NGUYỄN HẢINo ratings yet

- Assets: Café Richard Balance Sheet As at 31 December 2019 & 2020Document3 pagesAssets: Café Richard Balance Sheet As at 31 December 2019 & 2020Jannatul Ferdousi PrïtyNo ratings yet

- Financial Plan: Start-Up Capital:: Profit Loss StatementDocument6 pagesFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23No ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- Financial ModelingDocument18 pagesFinancial ModelingGabriella Elizabeth Khoe MunandarNo ratings yet

- Case Study #3Document5 pagesCase Study #3Jenny OjoylanNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument8 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualChelseaPowelljscna100% (17)

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- Financial Control-1-Master Budgeting CS-Gordon Com. - SolutionDocument3 pagesFinancial Control-1-Master Budgeting CS-Gordon Com. - SolutionQuang NhựtNo ratings yet

- Casos FinanzasDocument20 pagesCasos FinanzasPepe La PagaNo ratings yet

- C. Net Cash Flow From Operating Activities in 2009: Income Statement 2009Document4 pagesC. Net Cash Flow From Operating Activities in 2009: Income Statement 2009BảoNgọcNo ratings yet

- Maf605 - Final Exam 24.09.2022Document6 pagesMaf605 - Final Exam 24.09.2022sanjuladasanNo ratings yet

- Practice Questions For Final W Brick FinancialsDocument7 pagesPractice Questions For Final W Brick FinancialsJoana SilvaNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Financial Statement Analysis - Illustrative Problem - FOR STUDENTSDocument6 pagesFinancial Statement Analysis - Illustrative Problem - FOR STUDENTShobi stanNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- Income Statement: Company NameDocument9 pagesIncome Statement: Company NameAkshay SinghNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Salesman ReportDocument10 pagesSalesman ReportJaninne BianesNo ratings yet

- Solution Manual For Principles of Managerial Finance Brief 8th Edition ZutterDocument36 pagesSolution Manual For Principles of Managerial Finance Brief 8th Edition Zutterkatevargasqrkbk100% (27)

- Basic Economics Task Performance (Prelims)Document1 pageBasic Economics Task Performance (Prelims)godwill oliva0% (1)

- Working Capital ManagementDocument14 pagesWorking Capital ManagementSara Ghulam Muhammed SheikhaNo ratings yet

- A Study On Asset Liability Management in Yes BankDocument29 pagesA Study On Asset Liability Management in Yes BankSurabhi Purwar0% (1)

- BPO Module 2 3Document4 pagesBPO Module 2 3Brielle GabNo ratings yet

- Prospectus: El Tucuche Fixed Income FundDocument34 pagesProspectus: El Tucuche Fixed Income FundDillonNo ratings yet

- Chapter 4 Question Review 11th EdDocument9 pagesChapter 4 Question Review 11th EdEmiraslan MhrrovNo ratings yet

- Marketinf Final ProjectDocument9 pagesMarketinf Final ProjectAhsan SaniNo ratings yet

- Accounting MS1 2022Document18 pagesAccounting MS1 2022Faaz SheriffdeenNo ratings yet

- Ethical MarketingDocument11 pagesEthical MarketingNatasha LeeNo ratings yet

- Retail PricingDocument14 pagesRetail PricingSouvik Roy ChowdhuryNo ratings yet

- BMA101B Tutor Slides 5-2020Document16 pagesBMA101B Tutor Slides 5-2020sicelo ncubeNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Channel Management SlideDocument25 pagesChannel Management SlideMuhammad HarisNo ratings yet

- Investor Presentation - April 2021: Asx AnnouncementDocument28 pagesInvestor Presentation - April 2021: Asx AnnouncementALNo ratings yet

- Basics of Retailing Practical-1 PDFDocument6 pagesBasics of Retailing Practical-1 PDFŔøhãň ĆhNo ratings yet

- Material Requirements Planning (MRP)Document11 pagesMaterial Requirements Planning (MRP)ajeng.saraswatiNo ratings yet

- Education Allendale School Marketing PlanDocument29 pagesEducation Allendale School Marketing PlansethasarakmonyNo ratings yet

- Theory of ProductionDocument19 pagesTheory of ProductionJessica Perez Pastorfide II100% (1)

- MTRDocument12 pagesMTRAshish Patel100% (2)

- Assignment 1 Eco-Asyiq, Azzim, Aqil, Aikal, FaizDocument10 pagesAssignment 1 Eco-Asyiq, Azzim, Aqil, Aikal, FaizAikal ZaharozeeNo ratings yet

- Primary MarketDocument39 pagesPrimary Market微微No ratings yet

- Marketing Project - JOLIDONDocument8 pagesMarketing Project - JOLIDONionela23cosNo ratings yet

- Advanced Marketing IssuesDocument14 pagesAdvanced Marketing IssuesLara Nicole PajaroNo ratings yet

- The Six Key Components of A Business Strategy IncludeDocument6 pagesThe Six Key Components of A Business Strategy IncludeFoysal Ahmed AfnanNo ratings yet

- of DettolDocument15 pagesof DettolFerdows Abid ChowdhuryNo ratings yet

- Case StudyDocument3 pagesCase Studynazia malikNo ratings yet

- EPC, E-Commerce (ENG) Ch1, 1.3Document11 pagesEPC, E-Commerce (ENG) Ch1, 1.3Andres RodriguezNo ratings yet

- Nature of Corporate PersonalityDocument18 pagesNature of Corporate Personalitypokandi.fbNo ratings yet