Professional Documents

Culture Documents

Session 1 To 3

Uploaded by

twinkle222singhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session 1 To 3

Uploaded by

twinkle222singhCopyright:

Available Formats

Sanfav K.

Singh

Economics I

ManageriaI Economics

-

Dr. Sanjay K. Singh

ndian nstitute of Management

Lucknow

.

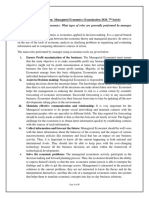

Course OutIine and Session PIan

Session Topics Reading

1 Managerial economics: an introduction Pindyck Chapters 1

Petersen Chapter 1

2-3 Demand, supply, price and elasticity

Pindyck Chapter 2

4-5 Theory oI consumer behaviour Pindyck Chapters 3- 4

6-7 Demand analysis and Iorecasting Petersen Chapters 4-5

Polycopy

8-10 Theory oI production and cost Pindyck Chapters 5-6

11-12 Market structures and price output

determination perIect competition and

monopoly

Pindyck Chapters 7 & 9

Petersen Chapter 12

13-15 Market structures (contd.) monopolistic

competition and oligopoly

Pindyck Chapters 11-12

16 Pricing oI Iactors oI production with

particular reIerence to the labour market

Pindyck Chapter 13

17 Economics oI inIormation asymmetry Pindyck Chapter 17

18 Competition policy and economic regulation Polycopy

19-20 Project presentation and summing up -

Note: Each topic will be supplemented by the articles given in the polycopy.

Sanfav K. Singh

Economics I

.

Readings

Textbooks:

Microeconomics by Robert S. Pindyck, Daniel L.

Rubinfeld, Prem L. Mehta, Pearson-Prentice Hall,

Seventh Edition.

Managerial Economics by H. C. Petersen and W.C.

Lewis, Prentice Hall, Fourth Edition

Reference Book:

Microeconomics: Theory and Applications by D.

Salvatore, Oxford University Press, Fourth edition.

Polycopy containing few useful articles:

.

EvaIuation (PGP)

The course wiII be graded on the foIIowing

components:

Attendance, CIass Participation, Assignments,

and Quizzes: 20%

Group Project: 20%

Mid-term Examination: 20%

End-term Examination: 40%

Sanfav K. Singh

Economics I

.

ManageriaI Economics:

An Introduction

.

Economics is the study of the allocation

of scarce resources.

. . . means that society has limited

resources and therefore cannot produce

all the goods and services people wish to

have.

Scarcity . . .

Sanfav K. Singh

Economics I

.

Economists study. . .

How people make decisions?

How people interact with each other?

1he forces and trends that affect the

economy as a whole.

.

Ten PrincipIes of Economics

1. People face tradeoffs.

Having more of one good means having less of another

Society faces tradeoffs in efficiency versus equity

You face tradeoffs in how best to allocate your time; the

choice to attend B-School rather than being in labor

force

2. People face opportunity cost (cost of something is

what you give up to get it).

What is the opportunity cost of your IIM education?

What is the opportunity cost of attending this lecture?

Undertake an activity if the benefit its opportunity cost

How People Make Decisions?

Sanfav K. Singh

Economics I

.

Ten PrincipIes of Economics

3. Rational people think at the margin (The Marginal

Principle) i.e., the relevant benefits and costs to

consider are marginal.

Marginal cost is the additional cost oI one unit increase

in an activity (MC)

Marginal beneIit is the extra beneIit resulting Irom one

unit increase in an activity (MB)

If the marginal benefit of an activity exceeds its

marginal cost, do it

If the marginal benefit of an activity is less than its

marginal cost, don`t do it

Keep doing the activity until the marginal beneIit just

equals the marginal cost

How People Make Decisions?

.

Ten PrincipIes of Economics

4. People respond to incentives.

People`s behavior may change if costs/benefits change

As petrol / diesel prices rise, people drive less, walk

more, use public transportation more often; purchase

fuel-efficient cars, .

But, sometime, government policy may have unforeseen

consequences

Do seat belts reduce auto deaths/improve auto safety?

Seat belt laws encourage drivers to drive faster, since

risk of death gets reduced (cost of poor driving falls).

There is a higher risk of accidents, but lower risk of

death if you`re in an accident and wearing your seat belt.

Although driver fatality may be reduced due to seat belt

laws, pedestrian fatality is likely to increase.

How People Make Decisions?

Sanfav K. Singh

Economics I

.

Ten PrincipIes of Economics

5. Trade can make everyone better off.

Produce and export a good in which you have a comparative

advantage (if the opportunity cost of producing that good is lower in

the country than it is in other countries).

Even if a country is having absolute advantage (or disadvantage) - the

most (or least) efficient producer of all goods, it still can benefit from

trade.

The benefits of trade do not depend on absolute advantage, rather

they depend on comparative advantage: specializing in industries

that use resources most efficiently.

The competitive advantage of an industry depends not only on its

productivity relative to foreign industry, but also on the domestic

wage rate relative to the foreign wage rate.

Therefore, an absolute productivity advantage is neither a necessary

nor a sufficient condition for having a comparative advantage.

How People Interact

.

Ten PrincipIes of Economics

6. Markets are usually a good way to organize economic

activity.

7. Governments can sometimes improve economic outcomes.

How the Economy as a Whole Works

8. The standard of living depends on a country's production.

9. Prices rise when the government prints too much money.

10. Society faces a short-run tradeoff between inflation and

unemployment.

How People Interact

Sanfav K. Singh

Economics I

.

Macroeconomics versus Microeconomics

Macroeconomics looks at the economy as a

whole and focuses on economic aggregates:

Total economic output, employment

Inflation, unemployment

Trade deficit; budget surplus/deficit

Economic growth and business cycles

Monetary policy, fiscal policy

Microeconomics focuses on the individual parts

of the economy and studies individual decision

makers and their interaction in the market

Households, firms, industries, government

.

Microeconomics helps you understand the world and

predict behavior

Why do monopolistic firms earn higher profits than

more competitive firms?

Why are airline tickets cheaper in lean season?

Can government regulation improve corporate

governance?

Microeconomics is one way of looking at the world

Thus, there is an economics of:

Health care

Sports

Housing and urban policy

Education

International Trade

Energy

Transport

Deregulation

Sanfav K. Singh

Economics I

.

What is manageriaI economics?

Applied micro-economics, but with a Iocus on

decision making

'What shall a manager do in this and that

situation?

Pricing decisions in diIIerent circumstances

Market entry, advertising, innovation, .

Organization oI the Iirm

Personnel policy, how to motivate workers .

.

Positive versus Normative

AnaIysis

Positive statements are statements

that describe the world as it is.

Called descriptive analysis

Normative statements are

statements about how the world

should be.

Called prescriptive analysis

Sanfav K. Singh

Economics I

.

The Market Forces of

SuppIy and Demand

Demand, Supply, Price

and Elasticity

.

Markets

A market is a group of buyers and sellers of

a particular good or service.

The terms supply and demand refer to the

behavior of people . . . as they interact with

one another in markets.

And economics, especially microeconomics

is about how supply and demand interact in

markets.

Sanfav K. Singh

Economics I

.

Market Types or Structures

Competitive Markets

Homogeneous product, large number of

buyers and sellers, no player has any control

on prices, no entry/exit barrier, .

Monopoly

Monopolistic Competition

Oligopoly

.

IndividuaI Demand Curve

$3.00

2.50

2.00

1.50

1.00

0.50

2 1 3 4 5 6 7 S 9 10 12 11

Price of

Ice-Cream

Cone

Quantity of

Ice-Cream

Cones

0

relationship between price and demand

Sanfav K. Singh

Economics I

.

Why does the Demand Curve SIope

Downward?

Law of Demand

Inverse relationship between price and

quantity.

Law of Diminishing Marginal Utility

Utility is the extra satisfaction that one

receives from consuming a product.

Marginal means extra.

Diminishing means decreasing.

.

Market Demand

Market demand refers to the sum of all

individual demands for a particular good or

service.

Graphically, individual demand curves are

summed horizontally to obtain the market

demand curve.

So, market demand curve is the

horizontal sum of the demand curves of

all consumers in the market.

Sanfav K. Singh

Economics I

.

Ceteris Paribus

Ceteris paribus is a Latin phrase that

means all variables other than the ones

being studied are assumed to be

constant. Literally, ceteris paribus

means ~other things being equal.

The demand curve sIopes downward

because, ceteris paribus, Iower prices

impIy a greater quantity demanded!

.

Two SimpIe RuIes for Movements vs.

Shifts

Rule One

When an independent variable changes and that

variable does not appear on the graph, the curve on

the graph will shift.

Rule Two

When an independent variable does appear on the

graph, the curve on the graph will not shift, instead

a movement along the existing curve will occur.

Let`s apply these rules to the following cases of

supply and demand!

Sanfav K. Singh

Economics I

.

Movement aIong the Curve

0

D

1

Price of

Cigarettes

per Pack

Number of Cigarettes

Smoked per Day

A movement occurs when a change

in the quantity demanded is caused

only by a change in its price, and vice

versa.

A

C

20

2.00

$4.00

12

.

Consumer Income

NormaI Good

$3.00

2.50

2.00

1.50

1.00

0.50

2 1 3 4 5 6 7 S 9 10 12 11

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

0

Increase

in demand

An increase in

income...

A shiIt in the demand curve

occurs when a good's

quantity demanded changes

even though price remains

the same.

D

1

D

2

Shift in the Demand Curve

Sanfav K. Singh

Economics I

.

Consumer Income

Inferior Good

$3.00

2.50

2.00

1.50

1.00

0.50

2 1 3 4 5 6 7 S 9 10 12 11

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

0

Decrease

in demand

An increase

in income...

D

1

D

2

Shift in the Demand Curve

.

Prices of ReIated Goods

Substitutes & CompIements

When a fall in the price of one good

reduces the demand for another good, the

two goods are called substitutes.

When a fall in the price of one good

increases the demand for another good,

the two goods are called complements.

Sanfav K. Singh

Economics I

.

VariabIes that affect quantity demanded

Variables that

affect Quantity

Demanded

A Change in

this Variable . . .

Price Represents a movement

along the demand curve

Income Shifts the demand curve

Prices of related

goods

Shifts the demand curve

Tastes Shifts the demand curve

Expectations Shifts the demand curve

.

SuppIy Curve

$3.00

2.50

2.00

1.50

1.00

0.50

2 1 3 4 5 6 7 S 9 10 12 11

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

0

The suppIy curve sIopes

upward, demonstrating that

at higher prices firms

wiII increase output

Sanfav K. Singh

Economics I

.

Market SuppIy

Market suppIy refers to the sum of aII

individuaI suppIies for aII seIIers of a

particuIar good or service.

GraphicaIIy, individuaI suppIy curves

are summed horizontally to obtain

the market suppIy curve.

.

Movement aIong the SuppIy Curve

1 5

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

0

S

1.00

A

C

$3.00 A rise in the price

of ice cream cones

resuIts in a

movement aIong

the suppIy curve of

ice cream cones.

Sanfav K. Singh

Economics I

.

Shift in the SuppIy Curve

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

0

S

1

S

2

S

3

Increase in

Supply

Decrease in

Supply

A shiIt in the supply curve

occurs when a good's

quantity supplied changes

even though price remains

the same.

.

VariabIes that affect quantity suppIied

Var|ab|es that

Affect 0uant|ty 8upp||ed

A 6hange |n Th|s Var|ab|e . . .

Pr|ce Represerls a rovererl a|org

lre supp|y curve

lrpul pr|ces 3r|lls lre supp|y curve

Tecrro|ogy 3r|lls lre supp|y curve

Expeclal|ors 3r|lls lre supp|y curve

Sanfav K. Singh

Economics I

.

The Market Mechanism

The market mechanism is the

tendency in a free market for price to

change untiI the market cIears

Markets cIear when quantity

demanded equaIs quantity suppIied

at the prevaiIing price

Market cIearing price - price at which

markets cIear

.

Supply

Demand

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

EquiIibrium of

SuppIy and Demand

2 1 3 4 5 6 7 S 9 10 12 11 0

$3.00

2.50

2.00

1.50

1.00

0.50

Equilibrium

The curves intersect at

equiIibrium, or market-

cIearing price.

Quantity demanded

equaIs quantity

suppIied at P=$2.

Sanfav K. Singh

Economics I

.

Price of

Ice-Cream

Cone

Quantity of Ice-

Cream Cones

2 1 3 4 5 6 7 S 9 10 12 11 0

$3.00

2.50

2.00

1.50

1.00

0.50

Supply

Demand

Surplus

Excess SuppIy

When price is higher

than market cIearing

price, say,

P = $2.50 (> $ 2.0).

UnsustainabIe in free

market.

.

Excess Demand

Quantity of

Ice-Cream Cones

Price of

Ice-Cream

Cone

$2.00

0 1 2 3 4 5 7 8 9 10 11 12 13

Supply

Demand

$1.50

Shortage

When price is Iower than

market cIearing price, say,

P = $1.50 (< $ 2.0).

UnsustainabIe in free market.

Sanfav K. Singh

Economics I

.

Three Steps To AnaIyzing

Changes in EquiIibrium

Decide whether the event shifts the

supply or demand curve (or both).

Decide whether the curve(s) shift(s) to

the left or to the right.

Examine how the shift affects

equilibrium price and quantity.

.

How an Increase in Demand

affects the EquiIibrium

Price of

Ice-Cream

Cone

2.00

0 7 Quantity of

Ice-Cream Cones

Supply

Initial

equilibrium

D

1

1. Hot weather increases

the demand for ice cream...

D

2

2. ...resulting

in a higher

price...

$2.50

10

3. ...and a higher

quantity sold.

New equilibrium

Sanfav K. Singh

Economics I

.

S

2

How a Decrease in SuppIy affects

the EquiIibrium

Price of

Ice-Cream

Cone

2.00

0 1 2 3 4 7 S 9 11 12 Quantity of

Ice-Cream Cones

13

Demand

Initial equilibrium

S

1

10

1. An earthquake reduces

the supply of ice cream...

New

equilibrium

2. ...resulting

in a higher

price...

$2.50

3. ...and a lower

quantity sold.

.

D'

5'

How an increase in both Demand and

SuppIy affects the EquiIibrium

Income increases

and raw material

prices fall

Quantity increases

If the increase in D

is greater than the

increase in S price

also increases

F

Q

5

F

2

Q

2

D

F

1

Q

1

Sanfav K. Singh

Economics I

.

What determines the equiIibrium

outcome when there is a shift in both

Demand and SuppIy curves?

The reIative size and direction of the

change and

The shape of the suppIy and demand

curves

.

An exampIe: The Price of a CoIIege

Education in the US

The reaI price of a coIIege education rose 105

percent from 1970 to 2007

Increases in the costs of equipping and

maintaining modern cIassrooms, Iaboratories,

and Iibraries, aIong with increases in facuIty

saIaries, pushed the suppIy curve up.

The demand curve shifted to the right as a Iarger

percentage of a growing number of high schooI

graduates decided that a coIIege education was

essentiaI.

Sanfav K. Singh

Economics I

.

Market for CoIIege

Education

The supply curve for a

college education shifted

up as the costs of

equipment, maintenance,

and staffing rose.

The demand curve shifted

to the right as a growing

number of high school

graduates desired a

college education.

As a result, both price and

enrollments rose sharply.

An exampIe: The Price of a CoIIege

Education in the US

.

Another exampIe: The Price of

Copper

Consumption of copper has increased

about a hundredfoId from 1880 through

2002

The Iong term reaI price for copper has

remained reIativeIy constant

Increased demand as worId economy

grew

Decreased production costs increased

suppIy

Sanfav K. Singh

Economics I

.

5

2002

D

2002

D

100

5

100

5

150

D

150

Long-kun Foth o|

Fr|ce ond Consumpt|on

Quont|ty

Fr|ce

Another exampIe: The Price of

Copper

.

EIasticity and Its

AppIication

Sanfav K. Singh

Economics I

.

EIasticity . . .

. is percentage change in one variabIe with respect

to percentage change in another variabIe.

Economists want to compare appIes and oranges aII

the time.

Is oiI market demand more price sensitive than wheat

demand? (no)

Is the Iabor suppIy of women more wage sensitive

than the Iabor suppIy of men? (yes)

EIasticities aIIow economists to quantify the

differences among markets without standardizing the

units of measurement (it does not matter how we

measure the price or the quantity in different markets).

.

Price EIasticity of Demand

Price eIasticity of demand is the percentage

change in quantity demanded given a percent

change in the price.

P = the current price of a good

Q = the quantity demanded at that price

P = small change in the current price

Q = small change in the quantity demanded

Price Elasticity of Demand = (Percentage Change

in Quantity) / (Percentage Change in Price)

Price Elasticity of Demand = ((Q/Q)/(P/P)) =

dlnQ/dlnP (from the calculus).

Sanfav K. Singh

Economics I

.

Computing the Price EIasticity of Demand

price in change Percentage

demanded quatity in change Percentage

demand of elasticity Price =

Example: If the price of an ice cream cone increases from

$2.00 to $2.20 and the amount you buy falls from 10 to 8

cones then your elasticity of demand would be calculated as:

2

10

20

100

00 . 2

) 00 . 2 20 . 2 (

100

10

) 10 8 (

=

percent

percent

.

Computing the Price EIasticity of

Demand Using the Midpoint FormuIa

Although the exact formula for calculating an

elasticity is useful for theory, in practice economists

usually calculate an approximation called the

symmetric midpoint formula elasticity.

This is also called arc elasticity (is the elasticity of one

variable with respect to another between two given points).

Formula used for this is a bit different from that of point

elasticity.

)J2] P )J[{P P {P

)J2] Q )J[{Q Q {Q

= Demand of Elasticity Price

1 2 1 2

1 2 1 2

+

+

Sanfav K. Singh

Economics I

.

Computing the Price EIasticity of Demand

Example: f the price of an ice cream cone increases from

$2.00 to $2.20 and the amount you buy falls from 10 to 8

cones the your elasticity of demand, using the midpoint

formula, would be calculated as:

32 . 2

5 . 9

22

2 / ) 20 . 2 00 . 2 (

) 00 . 2 20 . 2 (

2 / ) 8 10 (

) 10 8 (

=

=

+

percent

percent

)J2] P )J[{P P {P

)J2] Q )J[{Q Q {Q

= Demand of Elasticity Price

1 2 1 2

1 2 1 2

+

+

Arc elasticity value is different from point elasticity value because point

elasticity is for an infinitesimally small change in price and quantity. The

point elasticity can be approximated by calculating the arc elasticity for a

very short arc, e.g., 0.01% change in price.

.

Ranges of EIasticity

Inelastic Demand

Percentage change in price is greater than

percentage change in quantity demand.

(Absolute value of ) price elasticity of demand

is less than one.

Elastic Demand

Percentage change in quantity demand is

greater than percentage change in price.

(Absolute value of) price elasticity of demand

is greater than one.

Sanfav K. Singh

Economics I

.

PerfectIy IneIastic Demand

- EIasticity equaIs 0

0uant|ty

Pr|ce

4

$5

0emand

100

2. ...|eaves the quant|ty demanded unchanged.

1. An

|ncrease

|n pr|ce...

.

IneIastic Demand

- EIasticity is Iess than 1

0uant|ty

Pr|ce

4

$5

1. A 257

|ncrease

|n pr|ce...

0emand

100 90

2. ...|eads to a 107 decrease |n quant|ty.

Sanfav K. Singh

Economics I

.

Unit EIastic Demand

- EIasticity equaIs 1

0uant|ty

Pr|ce

4

$5

1. A 257

|ncrease

|n pr|ce...

0emand

100 75

2. ...|eads to a 257 decrease |n quant|ty.

.

EIastic Demand

- EIasticity is greater than 1

0uant|ty

Pr|ce

4

$5

1. A 257

|ncrease

|n pr|ce...

0emand

100 50

2. ...|eads to a 507 decrease |n quant|ty.

Sanfav K. Singh

Economics I

.

PerfectIy EIastic Demand

- EIasticity equaIs infinity

0uant|ty

Pr|ce

0emand

$4

1. At any pr|ce

above $4, quant|ty

demanded |s zero.

2. At exact|y $4,

consumers w|||

buy any quant|ty.

3. At a pr|ce be|ow $4,

quant|ty demanded |s |nf|n|te.

.

Price EIasticity of Demand

Therefore,

The steeper the demand curve, the more

inelastic the demand for the good becomes.

The flatter the demand curve, the more

elastic the the demand for the good becomes.

Two extreme cases of demand curves:

Perfectly inelastic demand vertical

Perfectly elastic demand horizontal

Sanfav K. Singh

Economics I

.

P

r

i

c

e

Elasticity along

demand curve as one

moves toward the

quantity axis

$10

9

8

7

6

5

4

3

2

1

0 1 2 3 4 5 6 7 8 9 10

E

d

=

E

d

= 1

E

d

= 0

Quantity

Elasticity along a Linear Demand Curve

E

d

< 1

E

d

> 1

(perfectly elastic)

(elastic)

(unitary elastic)

(inelastic)

(perfectly inelastic)

.

Determinants of

Price EIasticity of Demand

Necessities versus Luxuries

Availability of Close Substitutes

Definition of the Market

Time Horizon

Personal Income

Sanfav K. Singh

Economics I

.

Determinants of Price EIasticity of Demand

Demand tends to be more elastic

if the good is a luxury.

the longer the time period (n general, consumers take time

to adjust consumption habits and more substitutes are usually

available in the long run).

the larger the number of close substitutes.

the more narrowly defined the market.

This is because, in narrowly defined markets, close

substitutes are more likely to exist.

For example, market for camel cigarettes vs. market for all

cigarettes. The demand for camel cigarettes is likely to be

relatively more elastic.

the lower is personal income (Those in poverty have little

money and are likely to be relatively more responsive to price

changes.).

.

Determinants of Price EIasticity of Demand

Demand tends to be more inelastic

f the good is a necessity.

f the time period is shorter.

The smaller the number of close substitutes.

The more broadly defined the market

(because very few close substitutes exist for broadly

defined market).

The higher is personal income (Perhaps the

elasticity of demand decreases with income. That is

because the wealthy have so much money that they

are relatively insensitive to price changes.).

Sanfav K. Singh

Economics I

.

Is the Iong run eIasticity higher than

short run eIasticity for aII the goods?

5k

Lk

No.

Although it is true for most of the

goods.

For example, gasoline demand is

relatively more elastic in the long

run. Why?

n the long run, people tend to drive

smaller and more fuel efficient cars.

But what about automobiles?

Quont|ty o| goso||ne

Fr|ce

.

D

5k

D

Lk

When car price increases, initially, people

may put off immediate car purchase.

n the long run, older cars must be replaced.

n fact, if goods are durable, then when price

increases, consumers choose to hold on to the

good instead of replacing it.

But in the long run, older durable goods will

have to be replaced.

So, for durable goods, demand is more elastic

in the short run.

Demand eIasticity for cars in the short

run and Iong run

Quont|ty o| cors

Fr|ce

Sanfav K. Singh

Economics I

.

Demand for GasoIine

Demand for AutomobiIes

.

Demand EIasticity and TotaI

Revenue

If E

d

is elastic (E

d

> 1), a rise in price

lowers totaI revenue

If E

d

is inelastic (E

d

< 1), a rise in price

increases totaI revenue

If E

d

is unit elastic (E

d

= 1), a rise in price

Ieaves totaI revenue unchanged.

Sanfav K. Singh

Economics I

.

A

P

r

i

c

e

EIastic Demand

E

d

> 1

Quantity

$10

8

6

4

2

0

1 2 3 4 5 6 7 8 9

Elasticity and Total Revenue

C

B

K

J

Lost

revenue

Gained

revenue

.

A

P

r

i

c

e

IneIastic Demand

E

d

< 1

Quantity

$10

8

6

4

2

0

1 2 3 4 5 6 7 8 9

Elasticity and Total Revenue

C

H

B

G

Lost

revenue

Gained

revenue

Sanfav K. Singh

Economics I

.

P

r

i

c

e

Elastic range E

d

> 1

E

d

= 1

nelastic range

E

d

1

Q

0 Quantity

(a)

0 0

Quantity

(b)

How Total Revenue Changes

Along a Linear Demand Curve

Q

0

T

o

t

a

l

r

e

v

e

n

u

e

.

EIasticity and Revenue

For a Iinear dd

curve, P = a -

bQ, revenue wiII

be maximum

when P = a/2

i.e., price

eIasticity of

demand = -1.

Sanfav K. Singh

Economics I

.

Income EIasticity of Demand

Income eIasticity of demand measures

how much the quantity demanded of a

good responds to a change in consumers'

income.

It is computed as the percentage change

in the quantity demanded divided by the

percentage change in income.

Elasticity of demand wrt income,

.

Income EIasticity - Types of Goods -

Normal Goods

ncome Elasticity is positive.

Necessity Goods

ncome Elasticity is positive but less than 1.

Luxury or Superior Goods

ncome Elasticity is more than 1.

Sticky Goods

ncome Elasticity is zero.

Inferior Goods

ncome Elasticity is negative.

Higher income raises the quantity demanded

for normal goods but lowers the quantity

demanded for inferior goods.

Sanfav K. Singh

Economics I

.

Cross Price EIasticity of Demand

Elasticity measure that looks at the impact a

change in the price of one good has on the

demand of another good.

Elasticity of demand of product A wrt Price of

product B,

Positive Goods are Substitutes

Negative Goods are Complements

Zero Goods are ndependent

.

Price Elasticity of Supply

The price elasticity of supply measures the

reIationship between change in quantity

suppIied and a change in price and

is defined as the percentage change in

quantity suppIied divided by the percentage

change in price.

Sanfav K. Singh

Economics I

.

Price EIasticity of SuppIy

The value of price elasticity of supply is positive, because an

increase in price is likely to increase the quantity supplied in the

market.

Demand curve

.

Price EIasticity of SuppIy

When supply is

relatively inelastic a

change in demand

affects the price more

than the quantity

supplied.

When supply

is perfectly

inelastic, a

shift in the

demand curve

has no effect

on the

equilibrium

quantity

supplied

{supply of

tickets for

sports

venues}.

When supply

is perfectly

elastic a firm

can supply

any amount at

the same

price. Firm

can supply at

a constant

unit cost and

has no

capacity

constraint. A

change in

demand alters

the

equilibrium

quantity but

not the

market

clearing price.

When supply is

relatively elastic a

change in demand can

be met without a

significant change in

market price.

Sanfav K. Singh

Economics I

.

Determinants of the Price EIasticity of SuppIy

SPARE CAPACTY

f there is plenty of spare capacity, the firm should be able to

increase output quite quickly without a rise in costs and

therefore supply will be elastic.

STOCKS

f stocks (or inventories) of raw materials, components and

finished products are high then supply will be elastic.

EASE OF FACTOR SUBSTTUTON

f capital and labour resources are occupationally mobile

then the elasticity of supply for a product is likely to be

higher.

TME PEROD

Supply is likely to be more elastic, the longer the time period

a firm has to adjust its production. n the short run, the firm

may not be able to change its factor inputs.

.

An AppIication of EIasticity Concept:

Prices of BraziIian Coffee

Why are coffee prices very volatile?

Most of the world's coffee is produced in

Brazil

Changing weather conditions affect the

crop of coffee, thereby affecting price

Price following bad weather conditions is

usually short-lived

n long run, prices come back to original

levels, all else equal

Sanfav K. Singh

Economics I

.

Prices of BraziIian Coffee

.

Demand and supply are more elastic in the

long run

n the short run, supply is completely inelastic

Weather may destroy part of the fixed

supply, decreasing supply

Demand is relatively inelastic as well

Price increases significantly whenever supply

gets reduced due to bad weather

An AppIication of EIasticity Concept:

Prices of BraziIian Coffee

Sanfav K. Singh

Economics I

.

0

5

0

Quont|ty

Fr|ce

A freeze or drought

decreases the suppIy

of coffee

5'

1

Price increases

significantIy due to

ineIastic suppIy and

demand

1

Prices of BraziIian Coffee in the short run

.

Understanding and Predicting the Effects of

Changing Market Conditions: An ExampIe of

Copper Market

After reaching a level of about $1.00 per pound in 1980, the

price of copper fell sharply to about 60 cents per pound in

1986.

Worldwide recessions in 1980 and 1982 contributed to the

decline of copper prices.

Why did the price increase sharply in 20052007?

First, the demand for copper from China and other Asian

countries began increasing dramatically.

Second, because prices had dropped so much from 1996

through 2003, producers closed unprofitable mines and cut

production.

Sanfav K. Singh

Economics I

.

Copper prices are shown in both nominal (no adjustment for inflation) and real

(inflation-adjusted) terms. n real terms, copper prices declined steeply from the

early 1970s through the mid-1980s as demand fell. n 19881990, copper prices

rose in response to supply disruptions caused by strikes in Peru and Canada but

later fell after the strikes ended. Prices declined during the 19962002 period but

then increased sharply during 20052007.

Copper Prices, 1965-2007

Understanding and Predicting the Effects of

Changing Market Conditions: An ExampIe of

Copper Market

.

8upply, Demand, and 8upply, Demand, and 8upply, Demand, and 8upply, Demand, and

Governmen Governmen Governmen Government Policies t Policies t Policies t Policies

In a free, unreguIated market system, market

forces estabIish equiIibrium prices and

exchange quantities.

One of the things government can do is to

set price controIs when the market price is

seen as unfair to either buyers or seIIers.

Sanfav K. Singh

Economics I

.

Price CeiIings and Price FIoors

Price CeiIing

A IegaIIy estabIished maximum price at which a

good can be soId. (Fee charged by private

engineering coIIeges, say, in UP)

You can't charge more than the set price.

Price FIoor

A IegaIIy estabIished minimum price at which a good

can be soId. (Price Supports for wheat, sugarcane,

etc.)

You can't charge Iess than this price.

.

Price CeiIings

Two outcomes are possibIe when the

government imposes a price ceiIing:

The price ceiIing is not binding if set above

the equiIibrium price.

The price ceiIing is binding if set below the

equiIibrium price, Ieading to a shortage.

Binding means that there is an economic

impact.

Sanfav K. Singh

Economics I

.

A Price Ceiling That Is Binding...

$3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

2

Demand

Supply

Equilibrium

price

Price

ceiling

Shortage

125

Quantity

demanded

75

Quantity

supplied

.

A Price Ceiling That Is Not Binding...

$4

3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

Demand

Supply

Price

ceiling

Equilibrium

price

100

Equilibrium

quantity

Sanfav K. Singh

Economics I

.

Effects of Price CeiIings

A binding price ceiIing creates ...

shortages because Q

D

> Q

S

.

ExampIe: LPG shortage

nonprice rationing

ExampIes: Long Iines, Discrimination

by seIIers, etc.

.

Price FIoors

When the government imposes a

price fIoor, two outcomes are

possibIe.

The price fIoor is not binding if set

below the equiIibrium price.

The price fIoor is binding if set above

the equiIibrium price, Ieading to a

surpIus.

Sanfav K. Singh

Economics I

.

A Price Floor That Is Not Binding...

$3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

100

Equilibrium

quantity

Equilibrium

price

Demand

Supply

Price

floor

2

.

A Price Floor That Is Binding...

$3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

Equilibrium

price

Demand

Supply

Price floor $4

120

Quantity

supplied

S0

Quantity

demanded

Surplus

Sanfav K. Singh

Economics I

.

Effects of a Price FIoor

A binding price fIoor causes . . .

a surpIus because Q

S

>Q

D

.

ExampIes: The minimum wage,

agricuIturaI price supports, ..

.

The Minimum Wage

Quantity of

Labor

0

Wage

Equilibrium

wage

Labor

demand

Labor

supply

A Free Labor Market

Equilibrium

employment

Sanfav K. Singh

Economics I

.

Minimum

wage

The Minimum Wage

Quantity of

Labor

0

Wage

Labor

demand

Labor

supply

Quantity

supplied

Quantity

demanded

Labor surplus

{unemployment)

A Labor Market with a

Minimum Wage

.

What are some potentiaI

impacts of taxes?

Taxes are used to raise

money for the government.

Taxes discourage market

activity.

When a good is taxed, the

quantity soId is smaIIer.

Buyers and seIIers share

the tax burden.

But who bears the greater

burden-tax incidence.

Sanfav K. Singh

Economics I

.

3.00

Quantity of

Ice-Cream Cones

0

Price of

Ice-Cream

Cone

100 90

$3.30

Price

buyers

pay

D

1

D

2

Equilibrium

with tax

Supply, S

1

Equilibrium without tax

Impact of a 50 Tax Levied on Buyers...

2.S0

Price

sellers

receive

Price

without

tax

Tax {$0.50)

Demand Iunction, P a bQ where P price per unit charged

by sellers and paid by buyers.

P0.5 a bQ P (a-0.5) bQ, where buyers pay P0.5 per

unit, out oI which, sellers get P, and the government gets 0.5.

.

3.00

Quantity of

Ice-Cream Cones

0

Price of

Ice-Cream

Cone

100 90

S

1

S

2

Demand, D

1

Impact of a 50 Tax on Sellers...

Price

without

tax

2.S0

Price

sellers

receive

$3.30

Price

buyers

pay

Equilibrium without tax

A tax on sellers

shifts the

supply curve

upward by the

amount of the

tax {$0.50).

Tax {$0.50)

Equilibrium

with tax

Supply Iunction, P a bQ where P price per unit received.

P-0.5 a bQ P (a0.5) bQ, where buyers pay P per unit,

out oI which, sellers get P-0.5, and the government gets 0.5.

Sanfav K. Singh

Economics I

.

The Incidence of Tax

The incidence of a tax refers to who bears the burden

of a tax.

In what proportions is the burden of the

tax divided?

How do the effects of taxes on seIIers

compare to those Ievied on buyers?

The answers to these questions depend

on the eIasticity of demand and the

eIasticity of suppIy.

.

Elastic Supply, Inelastic Demand...

Quantity 0

Price

Demand

Supply

Tax

1. When supply is more

elastic than demand...

2. ...the

incidence of the

tax falls more

heavily on

consumers...

3. ...than on

producers.

Price without tax

Price buyers pay

Price sellers receive

Sanfav K. Singh

Economics I

.

Inelastic Supply, Elastic Demand...

Quantity 0

Price

Demand

Supply

Price without tax

Tax

1. When demand is more

elastic than supply...

2. ...the

incidence of

the tax falls more

heavily on producers...

3. ...than on consumers.

Price buyers pay

Price sellers receive

.

ELASTICITY AND TAX INCIDENCE

So, how is the burden of the tax

divided?

The burden of a tax faIIs more heaviIy

on the side of the market that is Iess

eIastic.

The incidence of a tax does not

depend on whether the tax is Ievied on

buyers or seIIers.

Sanfav K. Singh

Economics I

.

ELASTICITY AND ITS APPLICATION:

A Case Study of The Times Newspaper

There are Iour major national newspapers in UK:

The Times, Guardian, Dailv Telegraph, and

Independent.

They sell around 2.5 million copies daily.

In September 1993, The Times unilaterally lowered

its price by one-third Irom 45 pence to 30 pence.

Initially all the major competing newspapers kept their

prices constant as iI nothing had happened. Only later did

a price war break out.

.

A Case Study of The Times Newspaper

Price

(in pence)

Avg. daily sales Percentage

change (mid-

point Iormula)

Price Sales

Pre-

Sept. 93

Post-

Sept. 93

Pre-

Sept. 93

Post-

Sept. 93

1he 1imes

45 30 376836 448962 -40(30-

45)*100/((

4530)/2)

17.5

Cuardian

45 45 420154 401705 0 -4.5

Daily

1elegraph

45 45 1037375 1017326 0 -1.95

Independent

50 50 362099 311046 0 -15.2

Changes in the demand for newspapers

2196464 2179039

Sanfav K. Singh

Economics I

.

price elasticity of demand of 1he 1imes -17.5/40

-0.44

What will happen to the revenue of 1he 1imes

after price reduction?

It`ll obviously go down (inelastic demand). Daily sales

revenue of 1he 1imes fell from 169,576 to 134,689.

Remember, revenue will increase with reduction in

price only when absolute value of price elasticity of

demand is greater than 1.

The competing papers suffered, and the

Independent suffered most (15.2 loss of sales).

Independent was the closest substitute for the 1he

1imes (cross elasticity of demand +0.38).

A Case Study of The Times Newspaper

.

A Case Study of The Times Newspaper

Applying demand and supply concepts

Each newspaper sells all the copies that are

demanded at the price that it sets.

So, supply curve for each newspaper is horizontal (the

elasticity of supply is effectively infinite at the set price).

What will be the effect of 1he 1imes' price cut both

on 1he 1imes and on the Independent?

Aote: Since each newspaper is a distinct product, there is

no industry supply curve. Each supplier simply sets a price

and lets demand determine its sales.

Sanfav K. Singh

Economics I

.

A Case Study of The Times Newspaper

Demand for 1he 1imes and the Independent

Movement along the curve ShiIt oI the curve

.

A Case Study of The Times Newspaper

Since demand is inelastic for newspapers in the UK, it was

a good strategy for rival newspapers not to reduce their

prices.

Although the Independent suffered a daily loss of revenue a

little over 25000, it would have lost more by cutting its

price.

But, why 1he 1imes persisted with its price drop?

Increase in advertising revenue (which depends on

circulation) could be one of the important reasons.

Increase in daily advertising revenue should be more than

35000 (which is drop in sales revenue) to make price cut

profitable.

Sanfav K. Singh

Economics I

.

A Case Study of The Times Newspaper

Predatory pricing (charge a low price to force the rivals out

of business) could be another reason.

The Independent was indeed in financial difficulty before 1he

1imes' price cut announcement.

Since Independent was the closest substitute, predatory pricing can`t

be ruled out.

However, the Independent was taken over by the Mirror group,

which had more financial resources. Later it was sold to an Irish

newspaper group.

Therefore, if 1he 1imes had been following a predatory pricing

strategy, it failed.

Another possibility - 1he 1imes' manager might have

expected that its demand elasticity would increase over

time (that is, sales will increase at greater rate in the long-

run).

.

A Case Study of The Times Newspaper

Indeed, The Times did continue to increase its market

share.

In June 1994 the Telegraph reacted to The Times

growing market share by cutting its price, and the

Independent Iollowed.

The Times reduced its price Iurther, although prices

settled down at slightly higher levels soon aIter.

By July 1998 The Times price was 35p while other three

major papers were at 45p.

By July 1998 The Times sales were 800,000, almost double

what was in early 1994. In contrast, the Independent`s sales

were just 210,000, less than 60 .(long run elasticity ...)

Sanfav K. Singh

Economics I

.

A Case Study of The Times Newspaper

Market share oI major newspapers was virtually

unchanged during the next 5 years.

During mid-2002, sales oI The Times were running

just over 700,000 daily, the Guardian at just under

400,000, the Independent at about 220,000 and the

Telegraph just over 1 million.

From 2002 onwards, The Times has to compete not

only with other newspapers but also with the internet

and 24 hours news channels.

.

A Case Study of The Times Newspaper

Now, strategy to gain market share may be diIIerent than just

price cut (value added services, bundling and tying, etc.).

However, the aggressive pricing strategy adopted by The Times

in the early 1990s does appear to have had a very long lasting

eIIect on the sales pattern oI the UK newspapers.

The changes in the sales pattern established in the mid-1990s

are still evident, even though the price war is over. (In early

2007, The Times was priced at 65p while others at 70p.)

Think of a network good, once vou gain the market, vou can

continue to be market leader (unless product becomes

obsolete).

Sanfav K. Singh

Economics I

.

THANKS

You might also like

- 10 Principles of EconomicsDocument3 pages10 Principles of EconomicsGrace Carrasco100% (3)

- Economics Principles of Management: ME0401 - PurposeDocument19 pagesEconomics Principles of Management: ME0401 - PurposePradeepvenugopalNo ratings yet

- Upper Intermediate End of Course Test A: PronunciationDocument7 pagesUpper Intermediate End of Course Test A: PronunciationSebastian EndoNo ratings yet

- Euroexam Writing GenresDocument4 pagesEuroexam Writing GenresZsofia Kurucz-FarkasNo ratings yet

- Ammo OracleDocument53 pagesAmmo Oraclesuasponte2100% (1)

- News and How To Use It by Alan Rusbridger PDFDocument344 pagesNews and How To Use It by Alan Rusbridger PDFSPICEFW LibraryNo ratings yet

- Hunter S. Thompson BiographyDocument323 pagesHunter S. Thompson BiographyangelrizoNo ratings yet

- Teaching Interest InventoryDocument5 pagesTeaching Interest InventoryclaudiodiazlarenasNo ratings yet

- 2014-15 Sample Language Answer BookletDocument24 pages2014-15 Sample Language Answer Bookletjian tong0% (1)

- Microeconomics: Recommended Text Box Course AssessmentDocument34 pagesMicroeconomics: Recommended Text Box Course AssessmentsalmanNo ratings yet

- Principles of Economics & Bangladesh Economy (PBE)Document13 pagesPrinciples of Economics & Bangladesh Economy (PBE)Joshua SmithNo ratings yet

- Chapter 1 Intro To Macro and Measuring Macro VariablesDocument87 pagesChapter 1 Intro To Macro and Measuring Macro VariablesK60 Nguyễn Mai ChiNo ratings yet

- 38826589257Document3 pages38826589257Sutirtha DasguptaNo ratings yet

- Engineering EconomicsDocument19 pagesEngineering Economicsq.u.in.tosun.aNo ratings yet

- What Is Economics About?: Theoratical ImportanceDocument7 pagesWhat Is Economics About?: Theoratical ImportanceMuhammad Salim Ullah KhanNo ratings yet

- Ten Principles of EconomicsDocument29 pagesTen Principles of EconomicsyuyiiNo ratings yet

- Microeconomics Class NotesDocument79 pagesMicroeconomics Class Notesdec100% (2)

- Class 1 - Principles of Economics (1introduction)Document34 pagesClass 1 - Principles of Economics (1introduction)Sourav Halder100% (8)

- SEE 001 Task 1Document8 pagesSEE 001 Task 1Syed IbadNo ratings yet

- Lecture 01 Ten Principles of EconomicsDocument43 pagesLecture 01 Ten Principles of Economicsdeegiitemuulen0No ratings yet

- Lớp BDKT Cho GVNN - Chuyên Đề 1Document29 pagesLớp BDKT Cho GVNN - Chuyên Đề 1Pham Hong NhungNo ratings yet

- Chapter 01Document8 pagesChapter 01karina2227No ratings yet

- Economic PrinciplesDocument6 pagesEconomic PrinciplesRockacerNo ratings yet

- Microeconomics Introduction To EconomicsDocument13 pagesMicroeconomics Introduction To EconomicsAnanthi BaluNo ratings yet

- Abu Naser Mohammad Saif: Assistant ProfessorDocument29 pagesAbu Naser Mohammad Saif: Assistant ProfessorSH RaihanNo ratings yet

- Unit 1 ECONOMICS MbaDocument54 pagesUnit 1 ECONOMICS MbaRitu MishraNo ratings yet

- Chapter 1 The Central Problem of Economics and Economic SystemDocument11 pagesChapter 1 The Central Problem of Economics and Economic SystemcsanjeevanNo ratings yet

- Self Assessment Exercise MacroeconomicsDocument8 pagesSelf Assessment Exercise MacroeconomicsDavora LopezNo ratings yet

- Managerial EconomicsDocument248 pagesManagerial EconomicsGaurav gusaiNo ratings yet

- Reading Questions For Mankiw, Chapter OneDocument5 pagesReading Questions For Mankiw, Chapter OneAnushkaa DattaNo ratings yet

- Ten Principles of EconomicsDocument32 pagesTen Principles of Economicsmoriji100% (1)

- Ch01 Ten Priciples of EconomicsDocument27 pagesCh01 Ten Priciples of EconomicsMonal PatelNo ratings yet

- Online - Uwin.ac - Id: Bachelor in Economics (S.E) : ManajemenDocument34 pagesOnline - Uwin.ac - Id: Bachelor in Economics (S.E) : ManajemenelearninglsprNo ratings yet

- Business Economics: Mid Term SyllabusDocument37 pagesBusiness Economics: Mid Term SyllabusZaigham AbbasNo ratings yet

- IntroductionDocument27 pagesIntroductionvisala30No ratings yet

- MUN ECON 1010 Lectures CH 01 2020 21fDocument5 pagesMUN ECON 1010 Lectures CH 01 2020 21fnotjeremyhallNo ratings yet

- Definition of Managerial Economics: 1. Art and ScienceDocument18 pagesDefinition of Managerial Economics: 1. Art and ScienceABHISHEK SHARMANo ratings yet

- N. Gregory Mankiw: Powerpoint Slides by Ron CronovichDocument36 pagesN. Gregory Mankiw: Powerpoint Slides by Ron CronovichTook Shir LiNo ratings yet

- Reflective Note - Economics For ManagersDocument5 pagesReflective Note - Economics For ManagersRuwan SilvaNo ratings yet

- Engineering Economics Imon11Document7 pagesEngineering Economics Imon1181No ratings yet

- Ten Principles of EconomicsDocument5 pagesTen Principles of Economicshjpa2023-7388-23616No ratings yet

- Mod 1 MicroecoDocument23 pagesMod 1 MicroecoHeina LyllanNo ratings yet

- Chapter 1 - Principles of EconomicsDocument27 pagesChapter 1 - Principles of Economicsdaniel chuaNo ratings yet

- Ba 112 - Module 2 FinalDocument8 pagesBa 112 - Module 2 FinalMARY MAXENE CAMELON BITARANo ratings yet

- Summary of MicroeconomicsDocument37 pagesSummary of MicroeconomicsMuhammad FaizanNo ratings yet

- Ten Principles of Economics: ConomicsDocument34 pagesTen Principles of Economics: ConomicsNathtalyNo ratings yet

- Lecture 1 Ten Principles of EconomicsDocument12 pagesLecture 1 Ten Principles of EconomicsChristine BolocanNo ratings yet

- 10 Principles of EconomicsDocument18 pages10 Principles of EconomicsanujjalansNo ratings yet

- Introduction To Economics 1Document89 pagesIntroduction To Economics 1Jely Taburnal Bermundo100% (1)

- Mefa Unit 1Document17 pagesMefa Unit 1prasanna anjaneyulu tanneruNo ratings yet

- General Economics - 1st WeekDocument33 pagesGeneral Economics - 1st WeekVật Tư Trực TuyếnNo ratings yet

- 1 Mankiew Chapter 1Document35 pages1 Mankiew Chapter 1Thành Đạt Lại (Steve)No ratings yet

- Micro Economics NotesDocument28 pagesMicro Economics NotestawandaNo ratings yet

- Managerial EconomicsDocument14 pagesManagerial EconomicsRishi DubeyNo ratings yet

- Presentation 1Document66 pagesPresentation 1lalith vamsiNo ratings yet

- Assignment EconomicsDocument5 pagesAssignment Economicsprateek25.035460No ratings yet

- Macro FirstDocument139 pagesMacro Firstbharat0978No ratings yet

- Macro SummmaryDocument116 pagesMacro SummmaryJeevikaGoyalNo ratings yet

- Princ Ch01 PresentationDocument35 pagesPrinc Ch01 PresentationArun GhatanNo ratings yet

- Micro Economic Chap 1 - PresentationDocument35 pagesMicro Economic Chap 1 - PresentationNgọc Ánh PhThị100% (1)

- Princ ch01 PresentationDocument35 pagesPrinc ch01 PresentationNhư ÝNo ratings yet

- Principles of EconomicsDocument38 pagesPrinciples of EconomicsAnthony LeNo ratings yet

- Macroeconomics Class NotesDocument83 pagesMacroeconomics Class NotesGreta Schneider100% (1)

- Why Should Engineers Study Economics?: Macroeconomics Microeconomics Microeconomics MacroeconomicsDocument5 pagesWhy Should Engineers Study Economics?: Macroeconomics Microeconomics Microeconomics MacroeconomicsSachin SadawarteNo ratings yet

- Chapter 1 & 2: Normal Good Elasticity 1 Inferior Good Elasticity 1Document7 pagesChapter 1 & 2: Normal Good Elasticity 1 Inferior Good Elasticity 1Assetou SinkaNo ratings yet

- Managerial Economics, Exam 2020Document15 pagesManagerial Economics, Exam 2020Md Nahiduzzaman NahidNo ratings yet

- David ChaterDocument2 pagesDavid ChaterJorge MonteroNo ratings yet

- Ulysses in The Little ReviewDocument18 pagesUlysses in The Little ReviewSteven Lomazow M.D.100% (1)

- Light Railways No. 75Document32 pagesLight Railways No. 75Ahlhorn118100% (1)

- Spring 2018 Laurence King Children's CatalogDocument41 pagesSpring 2018 Laurence King Children's CatalogChronicleBooks100% (1)

- Superman Man of SteelDocument210 pagesSuperman Man of SteelMatthew Evans100% (1)

- 2018-03-08 St. Mary's County TimesDocument32 pages2018-03-08 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- March 19, 2015Document10 pagesMarch 19, 2015The Delphos HeraldNo ratings yet

- Capstone GuidelinesDocument16 pagesCapstone Guidelines420bpsNo ratings yet

- Corruption in The Nigerian Media FULL LENGTH CHAPTERDocument28 pagesCorruption in The Nigerian Media FULL LENGTH CHAPTERlanre idowu100% (2)

- T3 E 060 Writing A Newspaper Report PowerPoint - Ver - 4Document10 pagesT3 E 060 Writing A Newspaper Report PowerPoint - Ver - 4Manal SalamiNo ratings yet

- EphemeridesDocument216 pagesEphemeridesGabriel Luca PereteanuNo ratings yet

- 2nd Grading Grade 8Document25 pages2nd Grading Grade 8Rosemarie Acuña MacalamNo ratings yet

- Structure D: English Extension Course Sanata Dharma UniversityDocument2 pagesStructure D: English Extension Course Sanata Dharma UniversityRisang BaskaraNo ratings yet

- Summary List of Newspapers: at Shropshire Archives and LibrariesDocument7 pagesSummary List of Newspapers: at Shropshire Archives and LibrariesPrimalni ZevNo ratings yet

- Apa Formal Research PaperDocument7 pagesApa Formal Research PaperAngelica RicoNo ratings yet

- World English 3 InformationDocument4 pagesWorld English 3 InformationMaca.Jara100% (1)

- CommissargumentativeessayDocument8 pagesCommissargumentativeessayapi-304638446No ratings yet

- HV BushingDocument3 pagesHV BushingEdison SelvarajNo ratings yet

- TangierDocument15 pagesTangierYosnier ViñalsNo ratings yet

- One Hand ClappingDocument811 pagesOne Hand ClappingwriterhariNo ratings yet

- Mla FormattingDocument3 pagesMla Formattingapi-270513539No ratings yet

- 201335681Document84 pages201335681The Myanmar TimesNo ratings yet