Professional Documents

Culture Documents

Financial Statement Sivaswathi TEXTILES

Uploaded by

Sakhamuri Ram'sCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Sivaswathi TEXTILES

Uploaded by

Sakhamuri Ram'sCopyright:

Available Formats

1

INTRODUCTION

A financial statement is a collection of data organized according

logical and consistent accounting procedures. Its purpose is to convey an

understanding of some financial aspects of a business firm. It may show a

position at a moment in time, as in the case of an income statement, thus the

term financial statements generally refers to the two statements, these are:

Income statement (or) Profit and loss account.

Position statement (or) Balance sheet.

These statements are used to convey to management and other interested

outsiders the profitability and financial position of the firm.

Financial statements are the outcome of summarizing process of

accounting. In the words of john N.Her, the financial statements provide a

summary of the accounts of a business enterprise, the balance sheet

reflecting the asset, liabilities and capital as on a certain date and the income

statement showing the results of operations during a certain period.

Financial statements are also called financial reports. In the words of

Anthony, financial statements, essentially, are interim reports, presented

annually and reflect a division of the life of an enterprise onto more or less

arbitrary accounting period- more frequently a year.

2

Meaning of Financial Statements:-

A financial statement is a collection of data organized according

logical and consistent accounting procedures. Its purpose is to convey an

understanding of some financial aspects of a business firm. It may show a

position at a moment in time, as in the case of an income statement, thus the

term financial statements generally refers to the two statements: (I) the

position statement or the balance sheet, and (ii) the income statement or the

profit and loss account. These statements are used to convey to management

and other interested outsiders the profitability and financial position to a firm

Financial statements are the outcome of summarizing process of

accounting. In the words of John N. Her, the financial statements provide a

summary of the accounts of a business enterprise, the balance sheet

reflecting the asset, liabilities and capital as on a certain date and the income

statement showing the results of operations during a certain period. Financial

statements are prepared as an end result of financial accounting and are the

major sources of financial information of an enterprise Smith and Ashburn

define financial statements as. The product of financial accounting in asset

of financial statements prepared by the accountant of a business enterprise

that purport to reveal the financial position of the enterprise, the result of its

recent activities, and an analysis of what has been done with earnings.

Financial statements are also called financial reports. In the words of

Anthony, financial statements, essentially, are interim reports, presented

annually and reflect a division of the life of an enterprise onto more or less

arbitrary accounting period- more frequently a year.

3

Objectives of Financial Statements:-

Financial statements are the sources of information on the basis of which

conclusions are drawn about the profitability and financial position of a

concern. they are the major means employed by firms to present their

financial situation of owners, creditors and the general public, the primary

objective of financial statements is to assist in decision making,. The

accounting principles board of America (APB) sates the following objectives

of financial statements.

1. To provide reliable financial information about economic resources and

obligations of a business firm.

2. To provide other needed information about changes in such economic

resources and obligations.

3. To provide reliable information about changes in net resources

(resources less obligations) arising out of business activities.

4. To provide financial information that assists in estimating the earning

potentials of business.

5. To disclose, to the extent possible, other information related to the

financial statements that is relevant to the needs of the users of these

statements.

4

Types of Financial Statements:-

Financial statements primarily comprise two basic statements: (1) the

position statement or the balance sheet and (2) the income statement or the

profit and loss account. However, (Generally Accepted Accounting

Principles (GAAP) specifies that a complete set of financial statements must

include:

(1). A Balance Sheet.

(2). an Income Statement (Profit and Loss Account).

(3). A Statement of Changes in Financial Position.

1. Balance Sheet:-

The America institute of certified public accountants defines balance

sheet as. A tabular statement of summary of balances (debits and credits)

carried forward after an actual and constructive closing of books of account

and kept according to principles of accounting. The purpose of the balance

sheet is to show the resources that the company has, i.e. its assets, and from

where those resources come from i.e., its liabilities and investments by

owners and outsiders.

The balance sheet is one of the important statements depicting the

financial strength of the concern. It shows on the one hand the properties

that it utilizes and on other hand the sources of those properties. The balance

sheet shows all the assets owned by the concern and all the liabilities and

claims it owes to owners and outsiders.

5

2. Income Statement (or) Profit and Loss Account:-

Income statement is prepared to determine the operational position

of the concern. It is a statement of revenues earned and the expenses

incurred for earning that revenue, if there is excess of revenues over

expenditures it will show a profit and if the expenditures are more than the

income then there will be a loss. The income statement is prepared for a

particular period, generally a year. When income statement is prepared for

the year ending, then all revenues and expenditures falling due in that year

will be taken into account irrespective of their receipt or payment.

The income statement may be prepared in the form of a

manufacturing account to find out the cost of production, in the form of

trading account to determine gross profit or gross loss. In the form of a profit

and loss account determine net profit or net loss, a statement of retained

earnings may also be prepared to show the distribution of profits.

3. Statement of Changes in Owners Equity (Retained Equity):-

The term owners equity refers to the claims of the owners of the

business shareholders against the assets or the firm. It consists of two

elements (1) paid-up share capital, I.e. the initial amount of funds invested

by the shareholders and (2) retained earnings/reserves and surplus

representing undistributed profits. The statement of changes in owners

equity simply shows the beginning balance of each owners equity account

the reasons for increases and decreases in each, and its ending balance.

However in most cases, the only owners equity account that changes

6

significantly is retained earnings and hence the statement of changes in

owners equity becomes merely a statement of retained earnings.

A statement of retained earnings is also known as profit and loss

Appropriation Account or income Disposal Statement. As the name suggests

it shows appropriations of earnings. The previous years balance is first

brought toward. The net profit during the current year is added to this

balance. On the debt side, appropriations like interim dividends paid.

Proposed dividend in preference and equity share capital, amounts

transferred to debenture redemption fund, capital redemption funds. General

reserves etc are shown. The balance in tills account will show this amount of

profit retained in hand and carried forward. The appropriations cannot lie

more than the profits so this account will not have a debit balance. There

cannot be appropriations without profits.

4. Statement of Changes in Financial Position:-

The basic financial statements, I.e., the balance sheet and the profit

and loss account or income statement of a business reveal the net effect of

the various transactions on the operational and financial position of the

company.

The balance sheet gives a static view of the resources of a business and the

uses to which these resources have been put at a certain point of time. The

profit and loss account in a general way. Indicates the resources provided by

operations. But there are many transactions that do not operate through

profit and loss account. Thus, for a better understanding another statement

called statement of changes in financial position has to be prepared show the

7

changes in assets and liabilities from the end of one period to the end of

another point of time. The objective of this statement is to showing the

movement of funds (working capital or cash) during a particular period. The

statement to changes in financial position may take any of the following two

forms.

(a) Funds Flow Statement:-The funds flow statements is designed to

analyze the changes in the financial conditions of a business enterprise

between two periods. The word fund is used to denote working capital.

This statement will show the sources from which the funds are received and

the uses which these have been put. I his statement enable the management

to have an idea about the sources of funds and their uses for various

purposes. I ills statement helps the management in policy formulation and

performance appraisal.

(b) Cash Flow Statements:-a statement of changes in the financial

position of a firm on cash basis is called cash flow statement. It summarizes

the causes of changes in has position of a lousiness enterprise between states

of two balances sheets. This statement is very much similar to the statement

of changes in working capital I.e., funds flow statement. A cash flow

statement focuses attention on cash changes only.

8

Characteristics of Ideal Financial Statements:-

The financial statements are prepared with a view to depict financial

position of the concern. A proper analysis and interpretation of these

statements enables a person to judge the profitability and financial strength

of the business. The financial statements should be prepared in such a way

that they are able to give a clear and orderly picture of the concern. The

ideal financial statements have the following characteristics.

1. Depict True Financial Position:-

The information contained in the financial statements should be such that a

true and correct idea is taken about the financial position of the concern. No

material information should be with held while preparing position of the

concern. No material information should be with held while preparing these

statements.

2. Effective Presentation:-

The financial statements should be presented in a simple and lucid way so

as to make them easily understandable. A person who is not well versed with

accounting terminology should also be able to understand the statements

without much difficulty. This characteristic will enhance the utility of these

statements.

3. Relevance: -

Financial statements should be relevant to the objectives of the enterprises.

This will be possible when the person preparing these statements is able to

properly utilize the accounting information. The information which is not

relevant to the statements should be avoided; otherwise it will be difficult to

make a distinction between relevant and irrelevant data.

9

4. Attractive:-

The financial statements should be prepared in such a way that important

information is underlined so that it attracts the eye of the reader.

5. Easiness:-

Financial statements should be easily prepared. The balances of different

ledger accounts should be easily taken to these statements. The calculation

work should be minimum possible while preparing these statements. The

size of the statements should not be very large. The columns to be used for

gibing the information should also be less. This will enable the saving of

time in preparing the statements.

6. Comparability:-

The results of financial analysis should be in a way that can be compared to

the previous years statements. The statement can also be in compared with

the figures of other concerns of the same nature. Sometimes budgeted

figures are given along with the present figures. The comparable figures will

make the statements more useful. The Indian companies Act. 1956 has made

it obligatory to give previous years figures in the balance sheet. The

comparison of figures will enable a proper assessment for the working of the

concern.

7. Analytical representation:-

The information should be analyzed in such a way that similar date is

presented at the same place. A relationship can be established in similar type

of information. This will be helpful in analysis and interpretation.

10

8. Brief:-

If possible, the financial statements should be presented in brief. The reader

will be able to form an idea about the figures. On the other hand, it figures

are given in details then it will become difficult to judge the working of the

business.

9. Promptness:-

The financial statements should be prepared and presented at the earliest

possible. Immediately at the close of the financial year, statements should be

ready.

Limitations of Financial Statements:-

Though financial statements are relevant and useful for the concern,

still they do not present a final picture of the concern. The utility of these

statements is dependent upon a number of factors. The analysis and

interpretation of these statements should be done very carefully otherwise

misleading conclusions may be drawn; the financial statements suffer from

the following limitations:

1. Only interim reports:-

These statements don not give a final picture of the concern. The

data given in these statements is only approximate. The actual position can

only be determined when the business is sold or liquidated. However, the

statements have to be prepared for different accounting periods, generally

one year, during the life time of the concern.

11

The costs and incomes are apportioned to different periods with a

view to determine profits etc. the allocation of expenses and incomes will

depend upon the personal judgment of the accountant. The existence of

cotangent assets and liabilities also makes the statements imprecise. So

financial statements do not give the final picture and they are the most

interim reports.

2. Do not give exact position:-

The financial statements are expressed in momentary values so they

appear to give final and accurate position. The value of fixed assets in the

balance sheet neither represents the value for which fixed assets can be sold

nor did the amount, which will lie, require replacing these assets. The

balance sheet is prepared on the presumption of a going concern. The

concern is expected to continue in the figure. So fixed assets are shown all

cost less accumulated depreciation. There are certain assets in the balance

sheet such as preliminary expenses, goodwill, discount on issue of shares

which will realize nothing at the time of liquidation through they are shown

in the balance sheet.

3. Historical Costs:-

The financial statements are prepared on the basis of historical costs

or original costs. The value of assets decreases with the passage of time

current price changes are not taken into account. The statements are not

prepared keeping in view the present economic conditions. The balance

sheet losses the significance of being an index of current economic realities.

Similarly, the profitability shown by the income statement may not represent

12

the earning capacity of the concern. The increase I profits may be due to an

increase in prices or due to sonic abnormal causes and not due to increase in

efficiency. The conclusions drawn from financial statements may not give a

lair picture of the concern.

4. Impact of Non-Monetary Factors Ignored:-

There are certain f actors which have a bearing on the financial

position and operating results of the business but they do not become a pan

of these statement s because they cannot be measured I monetary terms.

Such factors may include the reputations of the management, credit

worthiness of the concern, sources and commitments for purchases and

sales, co-operation of the employees, etc. The financial statements only

show the position of the financial accounting for business and not the

financial position.

5. No Precision:-

The precision of financial statement data is not possible because the

statement deal with matters which cannot be precisely stated. The data are

recorded by convention procedure is followed over the years. Various

conventions, postulates personal judgments etc, are used for developing the

data.

Financial Statements Analysis:-

Financial statements are prepared primarily for decision making.

They play a dominant role in setting the frame work of managerial decision.

But the information provided in the financial statements is not an end in

13

itself as no meaningful conclusions can be drawn from these statements

alone. However, the information provided in the financial statements is of

immense use in making decisions through analysis and interpretation of

financial statements.

Financial analysis is the process of identifying the financial

strengths and weakness of the firm by properly establishing relationship

between the items of the balance sheet and the profit and loss amount. There

are various methods or techniques used in analyzing financial statements,

such as comparative statements, trend analysis, common-size statements,

schedule of changes in working capital, funds flow and analysis, cost

volume profit analysis and ratio analysis.

14

Meaning and Concept of Financial Analysis:-

The term financial analysis also known as analysis and

interpretation of financial statements, refers to the process of determine

financial strengths and weakness of the firm by establishing strategic

relationship between the items of the balance sheet, profit and loss account

and oilier operative data. Analyzing financial statements,

According to Metcalf and Titard. Is a process of evaluating the

relationship between component parts of financial statement to obtain a

better understanding of a firms position and performance? In the words of

Myers, Financial statement Analysis is largely a study of relationship

among the various financial factors in a business as disclosed by a single set

of statements, and study of the trend of these(actors as shown in a series of

statements.)

The purpose of financial analysis is to diagnose the information

contained in financial statements so as to judge the profitability and financial

soundness of the firm, just like a doctor examines ills patient by recording

his body temperature, blood treatment, a financial analyst analysis the

financial statements with various tools of analysis before commenting upon

the financial health or weakness of an enterprise. The analysis and

interpretation of financial statements is essential to bring out the mystery

behind the figures in financial statements. Financial statements analysis is an

attempt to determine the significance and meaning of the financial statement

data so that forecast may be made of the future earnings, ability to pay

interest and debt maturities (both current and long-term) and profitability of

a sound dividend policy.

15

Methods or Devices of Financial Analysis:-

1. Comparative Statements:-

The comparative financial statements are statements of the financial

position at different periods of time. The elements of financial position are

shown in a comparative form so as to give an idea of financial position at

two or more periods. Any statements prepared in a comparative term will be

covered in comparative statements. From practical point of view, generally

two financial statements (balance sheet and income statement) are prepared

in comparative form for financial analysis purposes.

Not only the comparison of the figures of two periods but also be

relationship between balance sheet and income statement enables an in-

depth study of financial position a cooperative results. The comparative

statement may show:

I. Absolute Figures (rupee amounts)

II. Changes in absolute figures i.e., increase or decrease in absolute figures.

III. Absolute data in terms of percentages.

The analyst is able to draw useful conclusions when figures are given in a

comparative position. The figures of sales for a quarter, half-year or one year

may tell only the present position of sales efforts. When sales figures of

previous periods, are given along with the figures of current periods then the

analyst will be able to study the trends of sales over different periods of

time. Similarly, comparative figures will indicate the trend and direction of

financial and operating results.

16

The financial data will be comparative only when same accounting

principles are used in preparing these statements. In case of a deviation in

the use of accounting principles this fact must be mentioned at the foot of

financial statements and the analyst should be careful in using these

statements. The two comparative statements are (I) balance sheet and (ii)

income statement.

I. Comparative income statement:-

The income statement gives the results of the operation of a business. The

comparative income statement gives an idea of the progress of a business

over a period of time. The changes in absolute data in money values and

percentages can be determined to analyze the profitability of the business.

Like comparative balance sheet, income statement also has four columns.

First two columns give figures of various items for two years. Third and

fourth columns are used to show increase is decrease in figures in absolute

amounts and percentages respectively.

ii. Comparative balance sheet:-

The comparative balance sheet analysis is the study of the trend of the same

items, group of items and computed items in two or more balance sheet of

the same business enterprise on different dates. The changes in periodic

balance sheet items reflect the conduct of a business. The changes can be

observed by comparison of the balance sheet at the beginning and at the end

of a period and these changes can help in forming an opinion about the

progress of an enterprise. The comparative balance sheet has two columns

for the data of original valance sheets. A third column is used it show

increases in figures. The fourth column may be added for giving percentages

of increases or decreases.

17

2. Trend analysis:-

The financial statements may be analyzed by computing trends of

series of information; this method determines the direction upwards of

downwards and involves the computation of the percentage relationship that

each statement item bears to the same item in base year. The information for

a number of years is taken up and one year, generally the first year, is taken

as a bad year. The figures of the base year are taken as 100 and trend ratios

for other years are calculated on the bases of base year.

3. Common- size statement:-

The common size statements, balance sheet and income statement

are shown in analytical percentages. The figures are shown as percentages of

total assets, total liabilities and total sales. The total assets are taken as 100

and different assets are expressed as a percentage of the total. Similarly

various liabilities are taken as a part of total liabilities. These statements are

also known as component percentage or 100 percent statement because

every individual item is stand as a percentage of the total 100. The short-

comings in comparative statements and tend percentages where changes in

items could not be compared with the totals have been covered up. The

analyst is able to assess the figures in relation to total values.

4. Funds flow statement:-

The funds flow statement is a statement is a statement which shows

the movement of funds and is a report of the financial operations of the

business under king. It indicates various means by which funds were

obtained during a particular period and the ways, in which these funds were

employed, in simple words, it is a statement of sources and applications of

funds.

18

Meaning and concept funds:-

The term funds has been defined in a number of ways:

A. in a narrow sense: it means cash only and a funds flow statement

prepared on this basis is called a cash flow statement. Such a statement

enumerated net effects of the various business transactions on cash and takes

into account receipts and disbursements of cash.

B. in a broader sense: the term funds refers to money values in

whatever forms it may exist. Here funds mean all financial resources, used

in business whether in the form of men, material, money, machinery and

others.

C. in a popular sense: the term funds means working capital i.e., the

excess of current over current liabilities. The working capital concept of

funds has emerged due the tact that total resources of a business are invested

partly in fixed assets in the form of fixed capital and partly kept in form of

liquid or near liquid form as working capital.

The narrower concept of funds i.e., cash or working capital concept

fails to reveal the changes in the total financial resources of a business.

Some significant items, such as purchase of building in exchange of shares

or payment of bonus in the form of shares which do not directly affect cash

or working capital are not revealed from the analysis based on these

concepts, however, the concept of funds as working capital is the most

popular one and in this chapter we shall refer to funds as working capital

and a funds flow statement as a statement of sources and application of

funds.

19

Meaning and Concept of Flow of Funds :-

The term flow means movement and includes both inflow and

outflow. The term Flow of funds means transfer of economic valued from

one asset of equity to another. Flow of funds is said to have taken placed

when any transaction makes changes in the amount of funds available before

happening of the transaction. If the effect of transaction results in the

increase of funds, it is called sources of funds and if it results in the decrease

of funds, it if known as application of funds, further, in case the transaction

does not change funds it is said to have not resulted in the flow of funds.

According to the working capital concept of funds, the term flow of funds

refers to the movement of funds in the working capital. If any transaction

results in the increase in working capital, it is said to be a source or inflow of

funds and if it results in the decrease if working capital, it is said to be an

application or out-flow of funds.

Rule:-

The flow of funds occurs when a transaction changes on the one

hand a non current account and on the other current account and vice-versa.

When a change in a non current account e.g., fixed assets, long term

liabilities reserves and surplus fictitious assets etc, is followed by a change

in another non-current account, it does not amount to flow of funds.

This is because of the fact that in such cases neither the working

capital increases nor decreases. Similarly, when a change in one current

account results in a change in anther current account it does not affect funds.

Funds move from noncurrent to current transactions or vice-versa only.

20

In simple language funds move when a transaction affects (i) a

current assets and a fixed assets or (ii) a fixed and a current liability or (iii) a

current asset and a fixed liability of (iv) a fixed liability and current liability,

and funds so not move when the transaction affects fixed assets and fixed

liability or current assets and current liability.

Uses, significance and importance of funds flow statement:-

A funds flow statement is an essential tool for the financial analysis

and is of primary importance to the financial management. Now-a-days it is

being widely used by the financial analysts, credit granting institutions and

financial managers. The basic purpose of a funds flow statement is to reveal

the changes in the working capital in the two balance sheet dates. It also

describes the sources from which additional working capital has been

financed and the uses to which working capital has been applied. Such a

statement is particularly useful in assessing the growth of the firm, its

resulting financial needs and in determining the best way of financing these

needs. By making use of projected funds flow statements, the management

can come to know the adequacy or inadequacy of working capital even in

advance. One can plan the intermediate and long-term financing of the firm,

repayment long-term debts, expansion of the business, allocation of

resources, etc. the significance or importance of funds flow statement can be

followed from its various uses given below.

21

1. It helps in the analysis of financial operations:

The financial statements reveal the net effect of various transactions

on the operational and financial position of a concern. The balance sheet

gives a static view of the resources or a business and the uses to which these

resources have been put at a certain point of time. But it does not disclose

the causes for changes in the assets and liabilities between two different

points of time.

The funds flow statement explains causes for such changes and also

the effect of these changes on the liquidity position of the company.

Sometimes a concern may operate profitably and yet its cost position may

become more and worse. The funds flow statement gives a clear answer to

such a situation explains what has happened to the profit of the firm.

It shows light on many perplexing question of general interest which

otherwise may be difficult to be answered, such as:

Why were the net current assets lesser in spite of higher profits and

vice-versa?

Why more dividends could not be declared in spite of available

profits?

How was it possible to distribute more dividends than the present

earnings?

What happened to the net profit? Where did they go?

What happened to the proceeds of sale of fixed assets or issue of

shares? Debentures etc.?

What are the sources of the repayment of debt?

How was the increase in working capital financial and how will it

be financed in future?

22

It helps the formation of a realistic dividend policy, sometimes a firm

has sufficient profits available for distribution as dividend but yet it may

not be advisable to distribute divided for lack of liquid of cash resources.

In such cases, a funds flow statement helps in the formation of a realistic

dividend policy.

4. It helps in the proper allocation of resources: the resources of

a concern are always limited and it wants to make the best use of these

resources. Managerial decisions. The firm can plan the deployment of its

resources and allocate them among various applications.

5. It acts as a future guide; a projected funds flow statement also acts

as a guide for future to the management. The management can come to

know the various problems it is going to lace in near future for want of

funds. The firms future needs of funds can be projected well in advance and

also the timing of these needs. The firm can arrange to finance these needs

more effectively and avoid future problems.

6. It helps in appraising the use of working capital: a funds flow

statement helps in explaining how efficiently the management has used is

working capital and also suggests ways to improve working capital position

of the firm.

7. it helps knowing the overall credit worthiness of a firm: the

financial institutions and banks such as state financial institutions, industrial

Development corporation, industrial financial corporation of India, industrial

development bank of India etc., all ask for funds flow statement constructed

for a number of years before granting loans to know the credit worthiness

and paying capacity of the firm.

23

Limitations of funds flow statement:-

The funds flow statement has a number of uses; however it has certain

limitations also, which are listed below:

1. It should be remembered that a funds how statement is not a substitute of

an income statement or a balance sheet. It provides only some additional

information as regards changes in working capital.

2. It cannot reveal continuous changes.

3. It is not an original statement but simply is arrangement of data given in

the financial statements.

4. It is essentially historic in nature and projected funds flow statement

cannot be prepared with much accuracy.

5. Changes in cash are more important and relevant for financial

management than the working capital.

6. Cash flow statement: a statement of changes in the financial position of

firm on cash basis is called a cash flow statement.

Such a statement enumerates net effects of the various business

transactions on cash and takes into account receipts and disbursements of

cash. A cash flow statement summarizes the causes of changes in cash

position of a business enterprise between dates of two balance sheets. This

statement is very much similar to the statement of changes in financial

position prepared on working capital basis i.e., a funds (low statement,

except that a cash called a cash flow statement because it describes the

inflow (sources) and outflow (uses) of cash.

24

Comparison between Funds Flow and Cash Flow Statement:-

The term funds has a variety of meanings. In a narrow sense it

means cash and the statement of changes in the financial position prepared

on cash basis is called a cash flow statement. In the most popular sense, the

term funds refers to working capital and a statement of changes in the

financial position prepared on tills basis is called a funds flow statement. A

cash flow statement is much similar to a funds flow statement as both are

prepared to summaries the causes of changes in the financial position of a

business. However, following are the main differences between funds and a

cash flow statement.

1. Funds flow statement is based on a wider concept of funds I.e., working

capital while cash flow statement is based in the narrower concept of funds,

i.e., cash only, which is only one element of working capital, the other being

debtors stock, temporary investment, bills receivable etc.

2. Funds flow statement is based on accrual basis of accounting while cash

flow statements are based on cash basis of accounting. In cash flow

statement while calculating operating profits, adjustments for prepaid and

outstanding expenses and income are made to convert the data from accrual

basis to cash basis, but no such adjustments are required to be made while

preparing a funds flow statements.

3. Funds flow statement does not reveal changes in current assets and current

liabilities, rather these appear separately in a schedule of changes in working

capital. No such schedule of change in working capital is prepared for a cash

25

flow statement and changes in all assets and liabilities fixed as well as

current, are summarized in the cash flow statement.

4. Cash flow statement is prepared by taking the opening balance of cash,

adding to this all the inflow of cash and deducting the outflows of cash from

the total. The balance, i.e., opening balance of cash and inflows of cash

minus outflows of cash, is reconciled with closing balance of cash. No such

opening or closing balance appears in a funds flow statement. The net

difference between sources and applications of funds does not represent cash

rather it reveals the net increase or decrease in working capital.

Funds flow statement is useful in planning intermediate and long-term

financing while as cash flow statement is more useful for short-term

analysis and cash planning of the business.

Uses and Significance of Cash flow Statement:-

Cash flow is of vital importance to the financial management. It is an

essential tool of financial analysis for short-term planning. The chief

advantages of cash flow statement are as follows:

1. Since cash flow statement is based on the cash basis of accounting, it is

very useful in the evaluation of cash position of a firm.

2. A projected cash flow statement can be prepared in order to know the

future cash position of a concern so as to enable a firm to plan and

coordinate its financial operations properly. By preparing this statement, a

firm can come to know as to how much cash will be generated into the firm

26

and how much cash will be needed to make various payments and hence the

firm can well plan to arrange for the future requirements of cash.

3. A comparison of the historical and projected cash flow statements can be

made so as to find the variations and deficiency or otherwise in the

performance so as to enable the firm to take immediate and effective action.

4. A series of intra-firm and inter-firm cash statement reveals whether the

firms liquidity (short-term paying capacity) is improving or deteriorating

over a period of time and in comparison to other firms over a given period of

time.

5. Cash flow statement helps in planning the repayment of loans,

replacement of fixed assets and other similar long-term planning of cash. It

is also significant of capital budgeting decisions.

6. It better explains the causes for poor cash position in spite of substantial

profits in a firm by throwing light on various applications of cash made by

the firm. It further helps in answering some intricate questions like what

happened to the net profits. Where did the profits go? Why more dividends

could not be paid in spite of sufficient available profit?

7. Cash flow analysis is more useful and appropriate than funds flow

analysis for short-term financial analysis as in a very short period it is cash

which is more relevant then the working capital for forecasting the ability of

the firm to meet its immediate obligations.

27

Ratio Analysis:-

One of the techniques of analysis of financial statements is to

calculate ratios. Ratio is the numerical or an arithmetical relationship

between two figures. It is expressed when one figure is divided by another.

If 4000 is divided by 10,000 the ration can be expressed as 4 or 2:5 or 40%.

Absolute figures are valuable but they standing alone convey no

meaning unless compared with another. Accounting ration inter-

relationships, which exist among various accounting data? When

relationships among various accounting data supplied by financial

statements are worked out, they are known as accounting ratios.

Accounting ratios can be expressed in various ways such as:

i. A pure ratio say ratio of current assets to current liabilities is 2:I or

ii. A rate say current assets are two times of current liabilities or

iii. A percentage say current assets are 200% of current liabilities.

Each method of expression has distinct advantage over the other. The

analyst will select that mode which wills best-suit his convenience and

purpose.

28

Classification of Ratios:-

1. Liquidity Ratios

2. Activity Ratios

3. Leverage Ratios

4. Profitability Ratios

1. Liquidity ratios. This is the most fundamentally important set of

ratios, because they measure the ability of a company to remain in

business. Click the following links for a thorough review of each

ratio.

o Cash coverage ratio. Shows the amount of cash available to

pay interest.

o Current ratio. Measures the amount of liquidity available to

pay for current liabilities.

o Quick ratio. The same as the current ratio, but does not include

inventory.

o Liquidity index. Measures the amount of time required to

convert assets into cash.

2. Activity ratios. These ratios are a strong indicator of the quality of

management, since they reveal how well management is utilizing

company resources. Click the following links for a thorough review of

each ratio.

o Accounts payable turnover ratio. Measures the speed with

which a company pays its suppliers.

o Accounts receivable turnover ratio. Measures a company's

ability to collect accounts receivable.

29

o Fixed asset turnover ratio. Measures a company's ability to

generate sales from a certain base of fixed assets.

o Inventory turnover ratio. Measures the amount of inventory

needed to support a given level of sales.

o Sales to working capital ratio. Shows the amount of working

capital required to support a given amount of sales.

o Working capital turnover ratio. Measures a company's ability

to generate sales from a certain base of working capital.

3. Leverage ratios. These ratios reveal the extent to which a company is

relying upon debt to fund its operations, and its ability to pay back the

debt. Click the following links for a thorough review of each ratio.

o Debt to equity ratio. Shows the extent to which management is

willing to fund operations with debt, rather than equity.

o Debt service coverage ratio. Reveals the ability of a company

to pay its debt obligations.

o Fixed charge coverage. Shows the ability of a company to pay

for its fixed costs.

4. Profitability ratios. These ratios measure how well a company

performs in generating a profit. Click the following links for a

thorough review of each ratio.

o Breakeven point. Reveals the sales level at which a company

breaks even.

o Contribution margin ratio. Shows the profits left after

variable costs are subtracted from sales.

o Gross profit ratio. Shows revenues minus the cost of goods

sold, as a proportion of sales.

30

o Margin of safety. Calculates the amount by which sales must

drop before a company reaches its breakeven point.

o Net profit ratio. Calculates the amount of profit after taxes and

all expenses have been deducted from net sales.

o Return on equity. Shows company profit as a percentage of

equity.

o Return on net assets. Shows company profits as a percentage

of fixed assets and working capital.

o Return on operating assets. Shows company profit as

percentage of assets utilized.

Plan of the Study:-

From the above description it can be said that the financial statement

analysis, particularly ratio analysis plays an important role in analyzing the

financial position of any organization. N the light of this back ground the

study has been taken up to analyze the ratios to analyze the financial position

of Siva Swati Textile taking ratios analysis as technique study is organized in

the manner described below.

31

INDUSTRY PROFILE

Cotton is a soft, staple fiber that grows around the seeds of

the cotton plant. It is a natural fiber harvested from the cotton plant. The

fiber most often is spun into yarn or thread and used to make a soft,

breathable textile, which is the most widely, used natural-fiber cloth in

clothing today.

Processing of Cotton in India:

In India the raw cotton, also called as Kapas is processed in a

multi-stage process described as below. The Products of processing are

I. Yarn.

II. Cottonseed Oil.

III. Cottonseed Meal.

I. Production of Yarn:

KAPAS TO LINT:

Kapas (also known as raw cotton or seed cotton) is unginned

cotton or the white fibrous substance covering the seed that is obtained

from the cotton plant. The first step in the process is, the cotton is

vacuumed into tubes that carry it to a dryer to reduce moisture and

improve the fiber quality. Then it runs through cleaning equipment to

remove leaf trash, sticks and other foreign matter. In ginning a roller gin is

used to grab the fiber. The raw fiber, now called lint.

32

LINT TO BALE:

The lint makes its way through another series of pipes to a press

where it is compressed into bales (lint packaged for market). After baling,

the cotton lint is hauled to either storage yards, textile mills, or shipped to

foreign countries.

NOTE: The cotton seed is delivered to a seed storage area from where

it is loaded into trucks and transported to a cottonseed oil mill.

BALE TO LAP:

Here the bales are broken down and a worker feeds the cotton

into a machine called a "breaker" which gets rid of some of the dirt. From

here the cotton goes to a "scutcher". (Operated by a worker also called a

scutcher). This machine cleans the cotton of any remaining dirt and

separates the fibers. The cotton emerges in the form of thin "blanket"

called the "lap".

LAP TO CARDING:

Carding is the process of pulling the fibers into parallel

alignment to form a thin web. High speed electronic equipment with wire

toothed rollers performs this task. The web of fibers is eventually

condensed into a continuous, untwisted, rope-like strand called a sliver.

33

SLIVER TO ROVING:

The silver is then sent to combing machine. Here, the fibers shorter

than half-inch and impurities are removed from the cotton. The sliver is

drawn out to a thinner strand and given a slight twist to improve strength,

and then wound on bobbins. This Process is called Roving.

ROVING TO YARN (SPINNING):

Spinning is the last process in yarn manufacturing. Spinning

draws out the short fibres from the mass of cotton and twists them

together into a long. Spinning machines have a metal spike called a spindle

which the thread winds around.

II. Production of Cotton Seed Oil:

Processing of cottonseed in modern mills involves a

number of steps. They are as follows:

The first step is its entry into the shaker room where, through a

number of screens and air equipment, twigs, leaves and other trash are

removed.

The cleaned seed is then sent to gin stands where the linters are

removed from the seed (delinted). The linters of the highest grade,

referred to as first-cut linters are used in manufacturing non-chemical

products, such as medical supplies, twine, and candle wicks. The

second-cut linters removed in further delinting steps, are incorporated

in chemical products, found in various foods, toiletries, film, and

paper.

34

The delinted seeds now go to the huller. The huller removes the tough

seed coat with a series of knives and shakers. The knives cut the hulls

(tough outer shell of the seed) to loosen them from the kernels (the

inside meat of the seed, rich in oil) and shakers separate the hulls and

kernels.

The kernels are now ready for oil extraction. They pass through

flaking rollers made of heavy cast iron, spinning at high speeds. This

presses the meats into thin flakes. These flakes then travel to a cooker

where they are

Cooked at 170 degrees F to reduce their moisture levels. The prepared

meats are conveyed to the extractor and washed with hexane (organic

solvent that dissolves out the oil) removing up to 98% of the oil.

Crude cottonseed oil requires further processing before it may be used

for food. The first step in this process is refining. With the scientific

use of heat, sodium hydroxide and a centrifuge (equipment used to

separate substances through spinning action), the dark colored crude

oil is transformed into a transparent,

Yellow oil. This clear oil may then be bleached with special bleaching

clay to produce transparent, amber colored oil.

35

The refined cotton seed oil has several advantages other than edible

oils. It contains mere advantage over other edible oils. It contains a large

percentage of Poly Unsaturated Fatty Acids (PUFA) which maintain

cholesterol in the blood at a healthy level.

The quality of cotton oil depends on the weather prevailing

during the time that cotton stands in the fields after coming to maturity.

Hence quality of oil varies from place to place and season to season. The

quality of oil is high in dry seasons and low when the seed is exposed to wet

weather in the fields or handled or stored with high moisture. Further

cotton seed cooking oil has a long span of life due to the presence of

vitamin E.

III. Production of Cottonseed Meal/Cake/Kapaskhalli:

Kapaskhalli (cottonseed extraction/meal) is a byproduct of the

cottonseed industry.

Cottonseed is a by-product of the cotton plant, which is primarily

grown for its fiber. Although cotton has been grown for its fiber for

several thousand years, the use of cottonseed on a commercial scale is

of relatively recent origin.

Cottonseed was a raw agricultural product, which was once largely

wasted. Now it is being converted into food for people; feed for

livestock; fertilizer and mulch for plants; fiber for furniture padding;

and cellulose for a wide range of products from explosives to

computer chip boards.

36

The figure showing the products obtained from processing the raw

cotton:

Source: The

Cotton Corporation of India Ltd.

Cotton Varieties in India:

Bengal Deshi mainly produced in the states of Punjab, Haryana, and

Rajasthan.

Jayadhar mainly produced in the state of Karnataka.

Bunny (or) Brahma is mainly produced in the states of Maharashtra,

Madhya Pradesh, Andhra Pradesh, and Karnataka.

Suvin is another variety produced in the state of Tamil Nadu.

H-4 (or) MECH1 is mainly produced in the states of Maharashtra,

Madhya Pradesh, and Andhra Pradesh.

37

Role of Cotton Industry in Indian Economy:

Over the years, country has achieved significant quantitative

increase in cotton production. Till 1970s, country used to import massive

quantities of cotton in the range of 8.00 to 9.00 lakh bales per annum.

However, after Government launched special schemes like intensive cotton

production programmes through successive five-year plans, that cotton

production received the necessary impetus through increase in area and

sowing of Hybrid varieties around mid 70s.

Since then country has become self-sufficient in cotton

production barring few years in the late 90s and early 20s when large

quantities of cotton had to be imported due to lower crop production and

increasing cotton requirements of the domestic textile industry.

Cotton production Areas in India:

India is an important grower of cotton on a global scale. It ranks

third in global cotton production after the United States and China; with 9.50

million hectares grown each year, India accounts for approximately 21% of

the world's total cotton area and 13% of global cotton production. The

Cotton producing areas in India are spread throughout the country. But the

major cotton producing states which account for more than 95% of the area

under and output are:

1. Punjab.

2. Haryana.

3. Rajasthan.

4. Maharastra.

38

5. Gujarat.

6. Madhya Pradesh.

7. Andhra Pradesh.

8. Tamil Nadu.

9. Karnataka.

Of the nine cotton producing States in India, average yields are highest in

Punjab where most of the cotton area is irrigated.

Contribution of Cotton industry for Textile Industry:

Cotton is the most important raw material for India's Rs. 1, 50,

000 cores textile industry, which accounts for nearly 20% of the total

national industrial production. The cotton Industry is the backbone of our

textile industry, accounting for 70% of total fiber consumption in textile

sector. It also accounts for more than 30% of exports, making it India's

largest net foreign exchange industry. India earns foreign exchange to the

tune of $10-12 billion annually from exports of cotton yarn, thread, fabrics,

apparel and made-ups.

The cotton Industry provides employment to over 15 million

people. And the area under cotton cultivation in India (9.5 million ha) is the

highest in the world, i.e., 25% of the world area.

Steps taken by the Cotton Producers in India:

Now-a-days the Indian Cotton producers are continuously

working to up-grade the quality and increase the cotton production to cope

up with the increased global demand for cotton textiles and to meet the

needs of the 39 million spindles capacity of the domestic textile industry

which presently consumes about 12-14 million bales annually.

39

In India, cotton yields increased significantly in the 1980s and

through the first half of 1980s but since 1996 there is no increase in yield.

In the past, the increase in cost of production of cotton was partially offset

by increase in yield but now with stagnant yield the cost of production is

raising. Besides low yield, Indian cotton also suffers from inconsistent

quality in terms of length, micron ire and strength.

Policy of Government of India towards Cotton Industry:

The Cotton production policies in India historically have been

oriented toward promoting and supporting the textile industry. The

Government of India announces a minimum support price for each variety of

seed cotton (kappas) based on recommendations from the Commission for

Agricultural Costs and Prices. The Government of India is also providing

subsidies to the production inputs of the cotton in the areas of fertilizer,

power, etc

Markets for Indian Cotton:

The three major groups in the cotton market are

Private traders,

State-level cooperatives,

The Cotton Corporation of India Limited.

Exports of Cotton:

The main market for Indian cotton export is China. The other

markets also include Taiwan, Thailand and Turkey. In July 2001, the union

government removed all curbs on cotton exports. As a result of these, now

the exporters are not required to obtain any certificate from the Textile

40

Commissioner on the registration, allocation, quality and quantity of export.

India exported around 25 per cent cotton during 2006-07 and it is estimated

nearly 62 per cent exported to China.

During the year 2006-07 the prices of Indian cotton in early part

of the season being lower than the international prices, had been attractive to

foreign buyers and there was good demand for Indian cotton, especially S-6,

H-4 and Bunny, which had resulted in sustained cotton exports, which are

estimated at 55.00 lakh bales

The Cotton Advisory Board estimated an 18-20 percent

increase in cotton exports to 65 lakh bales for Oct 2007- Sep 2008, as

against its Aug 2007 estimate of 58 lakh bales.

Imports of Cotton:

Despite good domestic crops, India is importing cotton because

of quality problems or low world prices particularly for processing into

exportable products like yarns and fabrics.

India imported just 721,000 bales of cotton in 2003-04. The

imports rose to 1,217,000 lakh bales in 2004-05, 4,700,000 lakh bales in

2005-06 and the anticipated imports for the year 2006-07 are 550,000 lakh

bales.

For the year 2006-07 the cotton imports into the country had

once again remained limited mainly to Extra Long staple cottons, like as

previous year, which were in short supply at around 6 lakh bales inclusive of

import of around 2 lakh bales of long staple varieties contracted by mills

during April-May 2007.

41

Role of Cotton seed oil in Indian Economy:

The global production of cottonseed oil in the recent years has

been at around 4-4.5 million tons. Around 2 lakh tons are traded globally

every year. The major seed producers, viz., China, India, United States, and

Pakistan are the major producers of oil. United States (60000 tons) is the

major exporter of cottonseed oil, while Canada is the major importer.

Cottonseed is a traditional oilseed of India. In India the average

production of cotton oil is around 4 lakh tons a year. It is estimated that, if

scientific processing is carried out the oil production can be increased by

another 4 lakh tons.

In India, the oil recovery from cottonseed is around 11%.

Gujarat is the major consumer of cottonseed oil in the country. It is also used

for the manufacture of vanaspati. The price of cottonseed oil is generally

dependent on the price behavior of other domestically produced oils, more

particularly groundnut oil.

India used to import around 30000 tons of crude cottonseed oil,

before palm and soyoil became the only imports of the country. Currently,

the country does not import cottonseed oil.

Role of cottonseed meal in Indian Economy:

India produces around 2 million tons of cottonseed meal a year.

However, in India mainly undecorticated meal is largely produced. Several

associations are promoting the production of decorticated cake in India and

the production of this is expected to increase in the country.

India used to be a major exporter of cottonseed extraction

around two decades ago. However, the demand for other oil meals like

soymeal has lowered the cottonseed demand globally. In addition, the low

42

availability of decorticated meal in India has also been a major reason for the

fall in exports.

The major importers of Indian cottonseed meal (undecorticated)

used to be Thailand. India in 2002-03 exported only 50 tons of decorticated

cottonseed meal. In 2003-04, too there have been no significant exports.

India does not import cottonseed meal.

The Organizations dealing with the promotion of Cotton Industry in

India:

The organizations that try to promote the quantity and quality of Cotton

in India are

I. The Cotton corporation of India Ltd

II. Cotton Advisory Board

III. Cotton Association of India

IV. Central Institute of Cotton Research

I. The Cotton Corporation of India Limited:

The Cotton Corporation of India Ltd. was established on 31st

July 1970 as a Government Company registered under the Companies Act

1956. In the initial period of setting up, as an Agency in Public Sector,

Corporation was charged with the responsibility of equitable distribution of

cotton among the different constituents of the industry and to serve as a

vehicle for the canalisation of imports of cotton.

With the changing cotton scenario, the role and functions of the

Corporation were also reviewed and revised from time to time. As per the

Policy directives from the Ministry of Textiles, Government of India in

1985, the Corporation is nominated as the Nodal Agency of Government of

43

India, for undertaking Price Support Operations, whenever the prices of

kapas (seed cotton) touch the support level.

The Cotton Corporation of India Ltd. Operations covers all the

cotton growing states in the country comprising of:

Punjab, Haryana and Rajasthan in Northern Zone.

Gujarat, Maharashtra and Madhya Pradesh in Central Zone.

Andhra Pradesh, Karnataka & Tamil Nadu in Southern Zone.

II. Cotton Advisory Board:

The Cotton Advisory Board is a representative body of

Government/ Growers/ Industries/ Traders. It advises the Government

generally on matters pertaining to production, consumption and marketing of

cotton, and also provides a forum for liaison among the cotton textile mill

industry, the cotton growers, the cotton trade and the Government. It

functions under the Chairmanship of Textile Commissioner with Deputy

Textile Commissioner as a Member Secretary

III. The Cotton Association of India:

The Cotton Association of India also called as the East India

Cotton Association (EICA) was declared as the statutory body by the

Bombay Cotton Contract Act on 28th December, 1922. Its purpose is to

Provide and maintain suitable buildings or rooms or a Cotton

Exchange in the city of Bombay or elsewhere in India.

Provide forms of contracts and regulate the marketing, etc. of the

contracts.

Fix and adopt standards or classifications of cotton.

44

Adjust by arbitration or otherwise controversies between Persons

engaged in the cotton trade.

Acquire, preserve or disseminate useful information connected with

the cotton interests.

IV. Central Institute of Cotton Research:

With a view to develop a Centre of excellence for carrying out

long term research on fundamental problems limiting cotton production the

Indian Council of Agricultural Research has established the Central Institute

for Cotton Research at Nagpur in April, 1976. CICR was simultaneously

established at Coimbatore to cater to the needs of southern cotton zone.

CICR was established at

Sirsa in the year 1985, to cater to the needs of northern irrigated cotton zone.

All the three research farms are well equipped with tractors and other farm

implements and efforts are underway to initiate further developmental work

in all the farms.

The Vision of the CICR is to improve production and quality of

Indian Cotton with reduced cost to make cotton production cost effective

and competitive in the national and global market. The Mission of CICR is

to develop economically viable and eco-friendly production and protection

technologies for enhancing quality cotton production by 2-3% every year on

a sustainable basis for the next twelve years (till 2020).

45

The Current Scenario of Cotton Industry (2008-09):

The cotton production in the country has been increasing

continuously since last three years and the same has further gone up by

around 11% during cotton season 2008-09 at a record level of 270 lakh bales

as against 244 lakh bales during 2007-08. Gujarat has turned into a largest

cotton producing State with a record production-level of 93 lakh bales

constituting around 34% of the countrys total production.

The area under cotton cultivation during 2008-09 has also gone

up by around 6% at 91.58 lakh hectares as against 86.77 lakh hectares during

2007-08.

With wide usage of hybrid seeds throughout the country as well

as changed mindset of cotton farmers for adoption of better and improved

farm practices, the average productivity of cotton has crossed 503 kgs per

hectare as against 478 kgs during the previous year. The prices of Indian

cotton in early part of the season being lower than the international prices,

had been attractive to foreign buyers and there was good demand for Indian

cotton.

Due to expectation of bumper crop, the mill demand in the

beginning of the season was subdued which put pressure on the cotton prices

right

From the beginning of the season and has resulted into fall in cotton prices

between October 2008 & January 2009. Cotton prices reached its peak level

by end-March 2009 and there was some correction in cotton prices in April

and May 2008. However, on the whole, cotton prices remained better by

almost Rs.1000 per candy in almost all varieties as compared to previous

year.

46

Future of Cotton Industry in India:

The Cotton Advisory Board (CAB) has estimated the cotton

crop at 310 lakh bales for the current season 2008-09. This is a historic high

and represents an 11% jump over last year's crop estimate of 280 lakh bales.

The increase in cotton production area is also expected to increase to 95.30

lakh hectares for the season 2008-09 against 91.42 lakh hectares for the

season 2007-08.

Cotton Advisory Board expects exports to be higher at 65 lakh

bales as against 55 lakh bales in 2007-08. Imports in 2008-09 are projected

at 6.50 lakh bales as compared to 5.50 lakh bales in 2007-08, because mills

have to rely on foreign growths to spin some finer counts of yarn.

It is also estimated that the cotton industry is going to provide

12 million new jobs mainly for the semi-skilled and unskilled labor.

Future Challenges for the Indian Cotton Industry:

The challenges that are going to face by the cotton producers in

India for the season 2009-2010 are:

Rupee appreciation:

The increase in the value of the rupee gives only smaller

import orders to the cotton producers.

Cheaper Imports:

The appreciated rupee value makes the cotton imports cheaper

when compared to past. So this aspect is also required to consider by the

cotton producers.

47

COMPANY PROFILE

INTRODUCTION SIVA SWATI TEXTILE Pvt. Ltd :

The Siva swati textile Pvt. Ltd.,was Established in the year 2005 (60,624

spindles) with STATE OF ART Machinery under supervision of Mr. A. Narendra

Kumar who got 30 years rich experience in the field of Spinning Industry. Spinning

Unit of 60,624 Spindles (Polyester and Polyester Viscose 45,024 and Cotton 15,600)

with latest STATE OF ART Machinery.

We produce 100% Combed Compact Cotton Yarn of Contamination

Controlled Yarn of count ranges from 40

s

to 80

s

Warp and Hosiery Yarns and 100%

Polyester and Polyester Viscose Blend Yarn of counts ranges from 30

s

to 80

s

The unit is situated on NH-5 about 30 K.M. from Guntur. The nearest Air

Port at Gannavaram (Vijayawada). The nearest Railway Station at Guntur

48

MISSION:

The Siva swati textile private Limited are committed to:

Establish their position as a leading and responsible industrial

enterprise. Working towards the development of human needs by providing

quality cotton yarn, polyester yarn viscose yarn and to the textile and clothing

industry. Develop and sustain relationships with their client, employees, and

shareholder

VISION:

Mr. A. Narendra Kumar dream is to see S.S.T.P.L a leading global

player in the world of textile. From its inception the company has always strived

to meet the aspiration of the textile and clothing industry world wide for the finest

quality yarn, denim and the entire range of garments. As responsible corporate

citizens it believes in developing, with a missionary zeal, new and sustaining

existing relationships with all its customers, employees, stakeholders and society

at large in pursuit of overall growth.

Siva swati textile believe that a lasting and fruitful partnership with

every customer is essential. The company truly values this relationship and forges

the growth of collaboration with unwavering support. With a strong marketing

presents backed by a transnationals network, Siva swati textile believes in offering

quality products to its client both in India and abroad.

A customer service cell looks into every aspect of client relation

while on emphasis on quality control at every stage of manufacturing ensures the

superior finish of Siva swati textile products. Recognized as an export house by

the government of India, Siva swati textile exports to discerning market across

Europe, Asia and America.

49

Siva swati textile continues to weave a tradition of innovation and

success. With its contemporary vision, it has not only widened the horizon of the

garment industry but has also infused faith and renewed confidence.

PRODUCT PROFILE:

Development of new textile products is done through production processes

of higher quality and making available modern technologies.

YARN:

Siva swati textile private ltd unit at Ganapavarm, Chilakaluripet in

Andhra Pradesh has a total capacity of 60,624 (Polyester and Polyester Viscose

45,024 and Cotton 15,600) spindles and fully integrated facilities to produce world

class products 100% cotton yarn, polyesters/viscose and fancy yarns. Today Siva

swati offers a wide product mix at par with international standard.

Siva swati textile sophisticated manufacturing and process centres employ

world-class machinery and automated colour matching systems to offer every

shade in the spectrum in dyed yarn as well as colour mlange.

Strategically located close to cotton growing areas, Siva swati textile

has fostered wealth of expertise in cotton in the last five years. A well-equipped

testing laboratory ensures stringent quality control right from the procurement of

raw material to the finished product that may be required.

They manufacture mainly yarn. In that COTTON YARN, POLYSTER

YARN and P V BLEND YARN, 100% VISCOSE YARN.

50

COTTON YARN :

Compact Yarn

Counts 40

s

to 80

s

Warp, Hosiery

Regular, Fancy

POLYSTER YARN AND P V BLEND YARN:

Counts 30

s

to 80

s

Normal, High twist

Warp, Hosiery

Sweing thread

Single, Double Yarn (TFO)

51

POLYSTER YARN AND P V BLEND YARN:

Counts 30

s

to 80

s

Normal, High twist

LATEST EQUIPMENT OF SIVA SWATI TEXTILES PVT LTD

Siva swati textile using latest equipment for manufacturing of yarn. These

equipment are imported from various places in country and from other country

also.

100% Polyester & P.V. Blend yarn are produced with help of Blow Room

to Spinning complete latest machines supplied by

M/s. Lakshmi Machine Works Ltd., Coimbatore & M/s. Rieter, Switzerland

With the help of this machine they produce Bale Plucker,

Unimix, Flexi Clean, Carding LC 300A-V3 Model Pre-Comber Drawing DO/6s

- L.M.W. Ltd., SB2 - Rieter Final Drawing D40 - Rieter, RSB 851 - L.M.W.

Ltd., Simplex LF1400A, LFS 1660 - L.M.W. Ltd., Ring Frames- Spinning LR6s

- L.M.W. Ltd Auto Coners Savio Orion and Polar with Leopfee Zenith Clearers.

COMPACT COTTON YARN & SLUB YARN are produced with

help of Blow Room Bale Plucker, Vario Clean, Unimix, Flexi Clean and Two

sets of Contamination Clearers with Poly Propoline attachement supplied by

Vetal Electronics Carding LC 300A-V3 Model Pre-Comber Drawing SB2 -

Rieter Lap Farmer E32 Rieter Comber E65 - Rieter Auto leveler Draw Frames

RSB D40 - Rieter Simplex LFS 1660 - L.M.W. Ltd., Spinning Zinser Compact

(351 C3) Auto Cones Savio Polar with Leopfee Zenith Clearers with SIRO.

T F O UNIT Cheese Winding PS Metler - Profiler Winder T F O

Veejay Lakshmi - 150 HS Model

52

QUALITY

Our dedicated, committed and involved cotton selectors at different stations headed by

experienced supervisors, spares no pain in the selection of Kapas or Raw cotton

available in the market.

Cotton Yarn

Premium Quality Yarn

Contamination Controlled Yarn

2 No of Contamination Sorters (Vetal) with Polyprolyne Removal

SIRO Clearing in Auto Coner

Packing Carton & Pallet

quality specifications - Cotton Yarn, psf & pv blend

COTTON YARN P S F P V BLEND Viscose 100%

COUNT 40

S

50

S

30

S

30

S

30

S

Count CV % 1.5 1.5 1.5 1.5 1.5

C S P 3250 3200 5800 5000 2400

U % 9.8 10.5 9.8 9.9 10

Imperfections 50 80 25 35 60

R K M 21 20.5 34 30 16

Haireness 3.5 3.0 4.5 4.5 4.0

Laboratory

Equiped with latest Test Equipments

Premier ART

Premier aQURA

Premier IQ

53

MARKET:

Siva Swati Textile believes that a lasting and fruitful partnership with

every customer is essential. The company truly values this relationship and forges

the growth of collaboration with unwavering support. With a strong marketing

presents backed by a transnationals network, Siva Swati Textile believes in

offering quality products to its client both in India and abroad.

A customer service cell looks into every aspect of client relation while on

emphasis on quality control at every stage of manufacturing ensures the superior

finish of Siva Swati Textile products. Recognized as an export house by the

government of India,

Siva Swati Textile exports to discerning market across Europe, Asia and

America. In 2009-2010 exports rose to Rs. 57crores constituting about 4% of the

total turn over

Siva Swati Textile continues to weave a tradition of innovation and

success. With its contemporary vision, it has hot only widened the horizon of the

garment industry but has also infused faith and renewed confidence.

EXPORTS:

Siva swati textile is exporting up to 40% of their products to other counters.

Those countries are

Argentina,

Iran,

54

Bangladesh,

Peru,

Brazil,

Portugal,

Columbia,

Turkey.

55

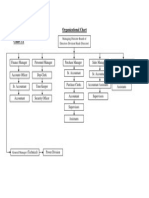

ORGANIZATIONAL CHART

Fig2.5

Management

Director

General

Welfare

Personal

Personal

Safety

Accountant

A/C

Finance

Staff

Export

Asst. plant

Plant

Production

Staff

Staff

56

PERSONNEL DEPARTMENT

Fig 2.4

Personnel

Manager

Welfare

Officer

Medical

Officer

Asst.

(Personal)

Safety

Officer

Chief Time

Keeper

Security

Officer

Supervis

or

(Canteen)

Supervisor

(Co-op

Stores)

Time

Keeper

Typist Compounder

Asst.

Security

Officer

Head

Cook

Security

Head

Guards

Cooks

Supervisor

(Co-op

Stores)

Supervisor

(Co-op

Stores)

Clerk

Asst.

Cooks

Clerks

Nurse

57

Director : A. Narendra Kumar

Cell : +91 9440901234

e-mail : narendrakumar@sivaswatitextile.com

President Technical : K. Venkateswara Rao

Cell : +91 9440901292

e-mail : venkateswararao@sivaswatitextile.com

G.M. Finance : N. Srinivasa Rao

Cell : +91 9441052434

e-mail : srinivasarao@sivaswatitextile.com

Administrative Manager : P. Parameswara Rao

Cell : +91 9440901232

e-mail : parameswararao@sivaswatitextile.com

Sales Manager : Shabbar Khan

Cell : +91 9440901235

e-mail : shabbarkhan@sivaswatitextile.com

Purchase Spares : Kamalakar Rao

Cell : +91 9440901237

e-mail : kamalakar@sivaswatitextile.com

Mill Contact Phones : +91 8647 252243, 259693