Professional Documents

Culture Documents

Content of Bunesss Plan

Uploaded by

RhythmLama0 ratings0% found this document useful (0 votes)

13 views7 pagesBusiness plan

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBusiness plan

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views7 pagesContent of Bunesss Plan

Uploaded by

RhythmLamaBusiness plan

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

Introduction

Planning is a process leading to the formulation of a plan

A plan is the outcome of the planning process

The planning process (thinking, researching, consulting, discussing) is at least as important as

the final written plan

Business plans

A business plan is:

A report showing the plans of the business, often used to attract finance from investors and

creditors

A document that is designed to provide information about a new business or venture to

persuade financial backer to invest in a business

The business plan describes out the market opportunities the business intends to exploit, how it will do

so and what resources are required

Business plans & raising finance

A business plan is essential to:

Persuade people to invest in an enterprise

Convince creditors about the credit worthiness of the enterprise

To persuade banks and others to lend or invest money it is necessary to:

Demonstrate the lender/investor has a good chance of being repaid or getting a good return on

their investment

Build confidence about the firm and owners capabilities

Demonstrate that there is a good market for the product or service

Internal uses of a business plan

Clarify objectives

Provide a sense of direction, purpose and urgency

Plan all aspects and ensure that nothing is overlooked

Provide a checklist to help run and control the business

Monitor progress and success

Improve performance

Improve motivation and communication

Allocate responsibility

Better control and co-ordination and greater consistency

Failing to plan makes an organisation reactive, vulnerable to threats and closed to

opportunities

Key planning questions

Where are we now?

How did we get here?

Where would we like to be?

How do we get there?

Are we on course?

Stages in business planning

(1) Situational analysis

Analyse the external environment

Analyse the internal environment

(2) Objectives

Define the business and mission

Set corporate objectives

(3) Strategy

Formulate strategies

(4) Tactics

Make tactical plans

(5) Actions

Implement the plan

(6) Control

Build in procedures for monitoring and controlling

Charactertistics of effective business plans

Business plans are more effective if

They are carefully researched

They contain detailed market analysis

They are used as a reference point for decisions

Actual performance is compared with objectives and objectives are regularly updated

They evolve over time to ensure that growth targets are realistic and challenging

Ten common mistakes in producing a business plan

1. Failing to plan in the first place

2. Shrugging off values and vision - these are there to remind the entrepreneur where he/she

wants to go

3. Second guessing the customer - ignore your customer at your peril

4. Underestimating the competition

5. Ignoring the firms own strengths and weaknesses

6. Mistaking a budget for a plan

7. Shying away from reasonable risk

8. Allowing one person to dominate the plan

9. Being afraid to change

10. Forgetting to motivate and reward

A well-prepared, attractive written business plan is an essential document in the quest for either

debt or equity financing, to provide a benchmark against which to compare actual company

performance, and to refine strategies and develop ideas on how the business should be

conducted. Although the written business plan of a start-up venture must be tailored to the

particular business and industry, the essential items in a written business plan include the

following:

COVER PAGE

The cover page should include the following:

A. Company Name

B. Logo

C. Contact Person

D. Address and Phone Number

E. Date and State of Incorporation

F. Confidentiality and Nondisclosure Statement

TABLE OF CONTENTS AND TABLE OF APPENDICES

The table of contents and table of appendices should refer the reader to the sections and

subsections of the business plan.

EXECUTIVE SUMMARY

The executive summary is the first part of the business plan to be read by potential lenders and

investors. In the case of a poorly written executive summary, the executive summary is often the

only part of the business plan that gets read. Accordingly, you should take the time necessary to

prepare a dynamic executive summary that describes the business, identifies the stage of the

company and its strategic direction, describes the company's market and marketing plan, briefly

discusses the background of management, and states the company's revenue and profit

expectations. Remember, you only get one chance to make a good first impression.

BODY OF BUSINESS PLAN

The body of the business plan should include detailed discussions of the following subjects:

I. Background and Purpose

A. History - a brief overview of the history of the company

B. Current Status of Company

C. The Product or Service Concept

D. Business Objectives

II. Market Analysis

A. Overall Industry or Market

B. Specific Market Segment

C. Competition

D. Sales Forecasts

III. Product or Service Development

A. Research and Development

B. Production Requirements and Process

C. Proprietary Features and Protections Thereof

D. Quality Assurance Measures

E. Contingency Plans

IV. Marketing

A. Survey Results

B. Marketing Strategy

C. Contingency Plans

V. Financial Data

A. Current Financial Position

B. Accounts Payable

C. Accounts Receivable

D. Cost Control Measures

E. Break-Even Analysis

F. Financial Ratios

G. Financial Projections

VI. Organization Structure and Management

A. Key Personnel -- describe the qualifications and responsibilities of management. The quality of

management is often the key factor in obtaining debt or equity funding.

B. Other Personnel

C. Directors and Advisors

D. Professional Advisors.

E. Key Future Personnel

F. Forecasted Labor Force

VII. Ownership

A. Business Structure

B. Current Capitalization

C. Forecasted Capitalization -- how much money will be sought, the form of the proposed investment,

how the funds will be used, and the percentage of ownership to be provided in exchange for the

investment

D. Exit Strategy -- how and when investors will be able to get their money out of the business

E. Royalty or Licensing Arrangements

VIII. Risk Factors

Describe the key risks facing the company, including risks presented by:

A. Cost Overruns

B. Failure to Meet Production Deadlines

C. Problems with Labor, Suppliers, or Distributors

D. Sales Projections not Met

E. Unforeseen Industry Trends

F. Competition

G. Unforeseen Economic, Social, or Political Developments

H. Technological Developments

I. Inadequate Capital

J. Business Cycles

K. Other Risks

IX. Conclusion

A. Summary

B. Timetable for Funding and Future Developments

APPENDICES

A. Photograph of Product or Service

B. Sales and Profitability Objectives

C. Market Surveys

D. Production Flowchart

E. Marketing Materials

F. Advertisements

G. Press Releases

H. Historical Financial Statements

I. Table of Current Profit and Loss Statement

J. Projected Profit and Loss Statement

K. Cashflow Projections

L. Balance Sheet

M. Projected Balance Sheet

N. Asset Acquisition Schedule

O. Break-Even Statement

P. Key Contracts

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- HPLicenDocument2 pagesHPLicenJaya MalathyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Economics of Financial System: by Bharat Singh Thapa Apex CollegeDocument48 pagesEconomics of Financial System: by Bharat Singh Thapa Apex CollegeRhythmLamaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

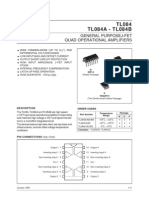

- TL084Document11 pagesTL084Jose Adrian MarquezNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Action VerbsDocument1 pageAction VerbsRhythmLamaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Government SecuritiesDocument9 pagesGovernment SecuritiesRhythmLamaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Government SecuritiesDocument9 pagesGovernment SecuritiesRhythmLamaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- PromotionDocument26 pagesPromotionRhythmLama100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Family Business Is A Business in Which One or More Members of One or More Families Have A Significant Ownership Interest and Significant Commitments Toward The BusinessDocument4 pagesA Family Business Is A Business in Which One or More Members of One or More Families Have A Significant Ownership Interest and Significant Commitments Toward The BusinessRhythmLamaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- HRM3Document49 pagesHRM3RhythmLamaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Family Business Is A Business in Which One or More Members of One or More Families Have A Significant Ownership Interest and Significant Commitments Toward The BusinessDocument4 pagesA Family Business Is A Business in Which One or More Members of One or More Families Have A Significant Ownership Interest and Significant Commitments Toward The BusinessRhythmLamaNo ratings yet

- Human Resource ManagementDocument53 pagesHuman Resource ManagementRhythmLamaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Human Resource ManagementDocument38 pagesHuman Resource ManagementRhythmLama0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Al Arafah Islamic BankDocument8 pagesAl Arafah Islamic Bankmd. Piar Ahamed100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 3) Proof of Funds - Bundesrepub Deut - 2BB Bond - De0001135275Document58 pages3) Proof of Funds - Bundesrepub Deut - 2BB Bond - De0001135275Thomas Dye100% (1)

- Islamic Banking AssignmentDocument3 pagesIslamic Banking AssignmentNadia BaigNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- China Microfinance Industry Assessment ReportDocument72 pagesChina Microfinance Industry Assessment Reportapi-17447836No ratings yet

- Pnadk 970Document64 pagesPnadk 970Kasolo DerrickNo ratings yet

- Ace of Capital MarketsDocument4 pagesAce of Capital MarketsAmit GuptaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Security DepositDocument10 pagesSecurity DepositshirishNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BDO Card AppliFormDocument1 pageBDO Card AppliFormGilbert BoadillaNo ratings yet

- Merger and AcquisitionDocument17 pagesMerger and AcquisitionSonalNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 2021 09 21 - StatementDocument9 pages2021 09 21 - StatementDebra TaylorNo ratings yet

- Federal Reserve Opinion On Timothy Fletcher of JPMorganChase and Hiring Chinese Elite ChildrenDocument22 pagesFederal Reserve Opinion On Timothy Fletcher of JPMorganChase and Hiring Chinese Elite ChildrenBeverly TranNo ratings yet

- Goldman SachsDocument2 pagesGoldman SachsChrisNo ratings yet

- Top Largest Central Bank Rankings by Total AssetsDocument24 pagesTop Largest Central Bank Rankings by Total AssetsMayank AhujaNo ratings yet

- Banking SectorDocument8 pagesBanking SectorSupreet KaurNo ratings yet

- The Bank For International Settlements (BIS)Document1 pageThe Bank For International Settlements (BIS)Rey DavidNo ratings yet

- G.R. No. L-16106 December 30, 1961Document1 pageG.R. No. L-16106 December 30, 1961Mildred Donaire Cañoneo-ClemeniaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Open Banking White Paper PDFDocument16 pagesOpen Banking White Paper PDFAlexNo ratings yet

- Tops Bankruptcy DocumentsDocument83 pagesTops Bankruptcy DocumentsAnonymous vhwDL2u100% (1)

- Mensah EvansDocument85 pagesMensah EvansHadyan WidyadhanaNo ratings yet

- ISC Accounts Self Balancing SystemDocument2 pagesISC Accounts Self Balancing SystembcomNo ratings yet

- SB Order 2022Document113 pagesSB Order 2022Reshmi PillaiNo ratings yet

- Relatório SAPLDocument46 pagesRelatório SAPLMateus OliveiraNo ratings yet

- About Goldman SachsDocument2 pagesAbout Goldman SachsanujNo ratings yet

- ARGOS Cape - Adequate - ExplanationDocument3 pagesARGOS Cape - Adequate - Explanationlomaxpl1No ratings yet

- Aspiration Bank 2020Document6 pagesAspiration Bank 2020SAM0% (1)

- Best of Mobile Pos 2014 PDFDocument127 pagesBest of Mobile Pos 2014 PDFAndalynaNo ratings yet

- Circular 1 Switching Fee AePS EKYC Card 0 0Document2 pagesCircular 1 Switching Fee AePS EKYC Card 0 0Sharanya KunduNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hostel Letter & Fee 2019-21Document2 pagesHostel Letter & Fee 2019-21Vignesh Waran0% (1)

- CMA Part1EDocument27 pagesCMA Part1EMaria100% (1)

- Test Bank For Essentials of Investments 11th Edition Zvi Bodie Alex Kane Alan Marcus Isbn10 1260013928 Isbn13 9781260013924Document30 pagesTest Bank For Essentials of Investments 11th Edition Zvi Bodie Alex Kane Alan Marcus Isbn10 1260013928 Isbn13 9781260013924davidfinnianyouo1No ratings yet