Professional Documents

Culture Documents

Fiance Unit 1

Uploaded by

KUNALJAYOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fiance Unit 1

Uploaded by

KUNALJAYCopyright:

Available Formats

1/uts

Chapter I

Financial Management and Planning

Aim

The aim of this chapter is to:

explain the concept of fnancial management

elucidate proft maximisation

explicate fnancial planning

Objectives

The objectives of this chapter are to:

explain the concept of management planning

enlist various fnancial decisions

explain the concept of capitalisations

Learning outcome

At the end of this chapter, you will be able to:

identify the types of fnancial decisions- investment, fnancing and dividend

understand the process, benefts, factors of fnancial planning

describe the merits and demerits of cost and earnings theory

Financial Management

2/uts

1.1 Introduction to Financial Management

Financial management "is the operational activity of a business that is responsible for obtaining and effectively

utilising the funds necessary for effcient operations".

Financial management is concerned with three key activities namely:

Anticipating fnancial needs

Acquiring fnancial resources

Allocating funds in business

Traditional approach to fnancial management

Traditionally, fnancial management was considered as a branch of knowledge with focus on the procurement of

funds. Instruments of fnancing, formation, merger and restructuring of frms, legal and institutional frame work

involved therein occupied the prime place in this approach.

Modern approach to fnancial management

Modern phase has shown the commendable development with combination of ideas from economic and statistics

that led the fnancial management more analytical and quantitative. The key work area of this approach is rational

matching of funds to their uses, which leads to the maximisation of shareholders' wealth.

1.2 Goals of Financial Management

Goal of fnancial management of a frm is maximisation of economic welfare of its shareholders. Shareholders' wealth

maximisation is refected in the market value of the frms' shares. A frms' contribution to the society is maximised

when it maximises its value. Two widely accepted goals of fnancial management are:

Proft maximisation

Proft is primary motivating force for any economic activity. Firm is essentially being an economic organisation,

it has to maximise the interest of its stakeholders. To this end the frm has to earn proft from its operations. The

overall objective of business enterprise is to earn at least satisfactory return on the funds invested, consistent with

maintaining a sound fnancial position.

Wealth maximisation:

Wealth maximisation refers to maximising the net wealth of the company's share holders. Wealth maximisation is

possible only when the company pursues policies that would increase the market value of shares of the company.

1.3 Financial Decisions

The functions performed by a fnance manager are known as fnance functions. In the course of following these

functions fnance manager takes the following decisions:

Limitations of Proft Maximisation

The term proft is vague and it doesn't clarify what exactly it means. It has different interpretations

for different people.Time value of money refers a rupee receivable today is more valuable than a

rupee, which is going to be receivable in future period. The proft maximisation goal does not help in

distinguishing between the returns receivable in different periods.The concept of proft maximisation

fails to consider the fuctuation in the profts from year to year.

3/uts

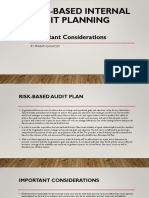

Financial

Decisions

Dividend

Decisions

Financing

Decisions

Investment

Decisions

Fig. 1.1 Financial decisions

Investment decisions

It begins with a determination of the total amount of assets needed to be held by the frm. It relates to the selection

of assets, on which a frm will invest funds. The required assets fall into two groups namely:

Long-term assets: This involves huge investment and yield a return over a period of time in future. It is also

termed as 'capital budgeting' and can be defned as the frm's decision to invest its current funds most effciently

in fxed assets with an expected fow of benefts over a series of years.

Short-term assets: These are the current assets that can be converted into cash within a fnancial year without

diminution in value. Investment in current assets is termed as 'working capital management'.

Financing decisions

Financing decisions relate to the acquisition of funds at the least cost. The cost has two dimensions which have been

illustrated in the below mentioned table.

Explicit cost Implicit cost

It refers to the cost in the form of

coupon rate, cost of foating and

issuing the securities and so on

It refers to the cost which is not visible

but it may seriously affect the company's

operations especially when it is exposed to

business and fnancial risk

Table 1.1 Cost dimension

The challenge before the fnance manager is to arrive at a combination of debt and equity for fnancing decisions

which would attain an optimal structure of capital.

Dividend decisions

Dividend decision is a major decision made by the fnance manager on the formulation of dividend policy. Since

the goal of fnancial management is maximisation of wealth of shareholders, dividend policy formulation demands

the managerial attention on the impact of its policy on dividend on the market value of shares. Optimum dividend

policy requires decision on dividend payment rates so as to maximise the market value of shares. The payout ratio

means what portion of earnings per share is given to the shareholders in the form of cash dividend.

Financial Management

4/uts

1.4 Interface between Finance and Other Business Functions

Financial management has relationship with almost all functional departments. But it has close relationship with

economics and accounting.

Relationship to economics

The relationship between fnance and economics is studied under two prime areas of economics. They are

macroeconomics and microeconomics:

Macroeconomics: It is the environment in which an industry operates, which is not controllable. It is important

for fnancial managers to understand changes in macroeconomics and their impact on the frm's operating

performance. External environment analysis helps in identifying opportunities and threats.

Microeconomics: It is concerned with the determination of optimum operational strategies. All fnancial decisions

of a frm are made on the basis of marginal cost, and marginal revenue. Therefore it is necessary to understand

the relationship between fnance and economics.

Relationship to accounting

Accounting and fnance are closely related. For computation of return-on-investment, earnings per share of various

ratios for fnancial analysis, the data base will be accounting information. Without proper accounting system, an

organisation cannot administer effectively function of fnancial management. The purpose of accounting is to report

the fnancial performance of the business for the period under consideration.

Relationship to HR (Human Resource)

HR activities include recruitment, training, development, fxing compensation and so on for which we need fnance.

HR managers need to consult fnance managers. Finance managers take decision after studying the impact of HR

activity on organisation.

Relationship to production

Production department is another functional area that involves huge investment on fxed assets. The production

manager and the fnance manager need to work closely for effective investment on plant and machinery.

Relationship to marketing

Marketing functions involves selection of distribution channel and promotion policies. These two are the primary

activities of marketing department and involves huge cash outfows. Therefore fnance and marketing managers

need to work with coordination to maximise value of the frm.

1.5 Financial Planning

Financial Planning is a process by which funds required for each course of action is decided. A fnancial plan has

to consider capital structure, capital expenditure and cash fow. Financial planning generates fnancial plan which

indicates:

The quantum of funds required to execute business plans

Composition of debt and equity

Formulation of polices for giving effect to the fnancial plans under consideration

Process of fnancial planning

Projection of fnancial statements

Determination of funds needed

Forecast the availability of funds

Establish and maintain systems of controls

Develop procedures

Establish performance-based compensation system

5/uts

Benefts of fnancial planning

Effective utilisation of funds

Flexibility in capital structure is given adequate consideration

Formulation of policies and instituting procedures for elimination of all types of wastages in the process of

execution of strategic plans.

Maintaining the operating capability of the frm through the evolution of scientifc replacement schemes for

plant and machinery and other fxed assets.

Factors affecting fnancial plan

Nature of the industry

Size of the company

Status of the company in the industry

Sources of fnance available

The capital structure of a company

Matching the sources with utilisation

Flexibility

Government policy

1.6 Capitalisations

Capitalisation of a frm refers to the composition of its long-term funds. It refers to the capital structure of the frm.

It has two components, viz., debt and equity.

After estimating the fnancial requirements of a frm, the next decision that the management has to take is to arrive

at the value at which the company has to be capitalised. The two theories of Capitalisation are:

1.6.1 Cost Theory

According to the cost theory of capitalisation, the value of a company is arrived at by adding up the cost of fxed

assets like plants, machinery patents, the capital that regularly required for the continuous operation of the company

(working capital), the cost of establishing business and expenses of promotion. The original outlays on all these

items become the basis for calculating the capitalisation of company.

Merits of cost approach Demerits of cost approach

It helps promoters to estimate the amount

of capital required for various activities like

incorporation of company, conducting market

surveys and so on.

It the frm establishes its production facilities at

infated prices; productivity of the frm will be

less than that of the industry.

If done systematically it will lay foundation for

successful initiation of the working of the frm.

Net worth of a company is decided by the

investors by the earnings of a company. Earning

capacity based net worth helps a frm to arrive

at the total capital in terms of industry specifed

yardstick cost theory fails in this respect.

Table 1.2 Merits and demerits of cost approach

Financial Management

6/uts

1.6.2 Earnings Theory

The earnings theory of capitalisation recognises the fact that the true value (capitalisation) of an enterprise depends

upon its earnings and earning capacity. According to it, the value or capitalisation of a company is equal to the

capitalised value of its estimated earnings. For this purpose a new company has to prepare an estimated proft and

loss account. For the frst few years of its life, the sales are forecast and the manager has to depend upon his/her

experience for determining the probable cost. The earnings so estimated may be compared with the actual earnings

of similar companies in the industry and the necessary adjustments should be made. Then the promoters will study

the rate at which other companies in the same industry similarly situated are earning. The rate is then applied to the

estimated earnings of the company for fnding out the capitalisation.

Merits of earnings theory Demerits of earnings theory

It is superior to cost theory because there are

the least chances of neither under nor over

capitalisation.

The major challenge that a new frm faces is in

deciding on capitalisation and its division thereof

into various procurement sources.

Comparison of earnings with that of cost

approach will make the management to be

cautious in negotiating the technology and

cost of procuring and establishing the new

business.

Arriving at capitalisation rate is equally a formidable

task because the investors' perception of established

companies cannot be really representative of what

investors perceive of the earning power of new

company.

Table 1.3 Merits and demerits of earnings theory

1.7 Over-capitalisation

A company is said to be overcapitalised, when its total capital exceeds the true value of its assets. The correct

indicator of overcapitalisation is the earnings capacity of the frm. If the earnings of the frm are less then that of

the market expectation, it will not be in position to pay dividends to its shareholders as per their expectations. It is

a sign of overcapitalisation.

Effects of over-capitalisation

Decline in the earnings of the company

Fall in dividend rates

Market value of company's share falls, and company loses investors confdence

Company may collapse at any time because of anemic fnancial conditions

Remedies for over-capitalisation

Restructuring the frm is to be executed to avoid the situation of company becoming sick. It involves the

following:

Reduction of debt burden

Negotiation with term lending institutions for reduction in interest obligation

Redemption of preference shares through a scheme of capital reduction

Reducing the face value and paid-up value of equity shares

Initiating merger with well managed proft making companies interested in taking over ailing company

7/uts

1.8 Under-capitalisation

A company is considered to be under-capitalised when its actual capitalisation is lower than its proper capitalisation

as warranted by its earning capacity.

Causes of under-capitalisation

Under estimation of future earnings at the time of promotion of the company

Abnormal increase in earnings from new economic and business environment

Under estimation of total funds requirements

Maintaining very high effciency through improved means of production of goods or rendering of services

Use of low capitalisation rate

Purchase of assets at exceptionally low prices during recession

Effects of under-capitalisation

Encouragement to competition

It encourages the management of the company to manipulate the company's share prices

Higher profts will attract higher amount of taxes

Higher profts will make the workers demanding higher wages

High margin of proft may create among consumers an impression that the company is charging high prices

for its product

Remedies

Splitting up of the shares- This will reduce the dividend per share

Issue of bonus share This will reduce both the dividend per share and earnings per share.

Financial Management

8/uts

Summary

Financial management "is the operational activity of a business that is responsible for obtaining and effectively

utilising the funds necessary for effcient operations.

Wealth maximisation refers to maximising the net wealth of the company's share holders.

Financial Planning is a process by which funds required for each course of action is decided.

A fnancial plan has to consider capital structure, capital expenditure and cash fow.

Capitalisation of a frm refers to the composition of its long-term funds. It refers to the capital structure of the

frm. It has two components, viz., debt and equity.

The earnings theory of capitalisation recognises the fact that the true value (capitalisation) of an enterprise

depends upon its earnings and earning capacity.

A company is said to be overcapitalised, when its total capital exceeds the true value of its assets.

References

Reddy, G. S., 2008. Financial Management. Himalaya publications, Mumbai.

Correia, C., Flynn, D. K., Uliana, E. & Wormald, M., 2012. Financial Management, 6th ed., Juta and Company

Ltd.

Financial Planning - Definition, Objectives and Importance, [Online] Available at: <http://www.

managementstudyguide.com/fnancial-planning.htm> [Accessed 27 May 2013].

Masters of Business Administration Notes , [Online] Available at: <http://freemba.in/articlesread.php?artcode=

299&substcode=19&stcode=10> [Accessed 27 May 2013].

2008. Financial Management, [Video online] Available at: <http://www.youtube.com/watch?v=iDlFPm3fqbs>

[Accessed 27 May 2013].

2011. Financial Management - Lecture 01, [Video online] Available at: <http://www.youtube.com/

watch?v=iDlFPm3fqbs> [Accessed 27 May 2013].

Recommended Reading

Brigham, E. F., 2010. Financial Management: Theory & Practice. 13th ed., South-Western College Pub.

Shim, J. K., 2008. Financial Management (Barrons Business Library). 3rd ed., Barrons Educational Series.

Brigham, E. F., 2009. Fundamentals of Financial Management. 12th ed., South-Western College Pub.

9/uts

Self Assessment

Wealth maximisation refers to maximising the ___________ of the company's share holders 1.

proft a.

net wealth b.

assets c.

liabilities d.

A company is said to be ____________, when its total capital exceeds the true value of its assets. 2.

under-capitalised a.

capitalised b.

overcapitalised c.

proft maximisation d.

Which of the following statements is false? 3.

Capitalisation of a frm refers the composition of its short-term funds. a.

A fnancial plan has to consider Capital structure, Capital expenditure and cash fow. b.

Wealth maximisation refers to maximising the net wealth of the company's share holders c.

Goal of fnancial management of a frm is maximisation of economic welfare of its shareholders d.

The earnings theory of Capitalisation recognises the fact that the _________ of an enterprise depends upon its 4.

earnings and earning capacity.

false value a.

total value b.

true value c.

half value d.

Which of the following cost is not visible but it may seriously affect the company's operations especially when 5.

it is exposed to business and fnancial risk.

Explicit cost a.

Implicit cost b.

Direct cost c.

Indirect cost d.

Match the following 6.

Concept Description

A. Explicit cost 1. A process by which funds required for each course of action is decided

B. Financial Planning

2. This involves huge investment and yield a return over a period of time in

future.

C. Long-term assets

3. The current assets that can be converted into cash within a fnancial year

without diminution in value

D. Short-term assets 4. The cost in the form of coupon rate, cost of foating and issuing the securities

A-2, B-1, C-4, D-3 a.

A-4, B-3, C-1, D-2 b.

A-4, B-1, C-2, D-3 c.

A-1, B-2, C-3, D-4 d.

Financial Management

10/uts

___________ is the operational activity of a business that is responsible for obtaining and effectively utilising 7.

the funds necessary for effcient operations.

Financial planning a.

Financial management b.

Asset management c.

Budget management d.

______________is a major decision made by the fnance manager on the formulation of dividend policy. 8.

Investment decision a.

Financing decision b.

Dividend decision c.

Accounting decision d.

Financing decisions relate to the acquisition of funds at the _________ cost. 9.

maximum a.

less b.

more c.

least d.

Which among the following is the primary goal of fnancial management of a frm? 10.

Maximisation of economic welfare of its shareholders a.

Encouragement to competition b.

Fall in dividend rates c.

Effective utilisation of funds d.

11/uts

Chapter II

Time Value of Money

Aim

The aim of this chapter is to:

explain the concept of time, value and money

explain simple and compound interest

elucidate variable compounding periods

Objectives

The objectives of this chapter are to:

explain the compound value of series of cash fows

elucidate the concept of doubling period and sinking fund factor

explicate the concept of present value

Learning outcome

At the end of this chapter, you will be able to:

describe the sinking fund factor with its formula for calculation

understand the concept of loan amortisation

identify shorter discounting periods

Financial Management

12/uts

2.1 Introduction to Time Value of Money

One of the most fundamental concepts in fnance is that money has a time value. That is to say that money in

hand today is worth more than money that is expected to be received in the future. This leads us to summarise the

concept of time value: A Rupee today is worth more than a Rupee tomorrow."

Concept - Time value of money

A rupee, which is received today, is more valuable than a rupee receivable in future. The amount that is received

earlier period can be reinvested and it can earn an additional amount. Therefore, people prefer to receive the rupee

that is receivable at the earliest.

Rationale of time preference for money

Individual prefers value opportunity to receive money now rather than waiting for one or more years to receive the

same. It is referred to as an individual's time preference for money. There are three reasons that may be attributed

to the individual's time preference for money:

Uncertainty: Future is uncertain and it involves risk. An individual is not certain about future cash infows.

Hence, the individual would prefer to receive cash toady instead of future.

Current consumption: Most of the people prefer to use the present money for satisfying existing present

needs.

Possibility of investment opportunity: The reason why individuals prefer present money is due to the possibility

of investment opportunity through which they can earn additional cash.

2.2 Simple Interest

Simple interest is the interest paid on only the original amount, or principle borrowed. Simple amount is a function

of three components such as principle amount borrowed or lent, interest per annum and the number of years for

which the interest rate is calculated. Symbolically:

SI = Po (I) (n)

Where,

SI= Simple interest, Po= Principle amount at year '0', I= Interest rate per annum

n=Number of year for which interest is calculated

For instance

Mr. Dorabjee has deposited Rs.1,00,000 in a Savings bank account at 7 per cent simple interest and interest and

interested to keep the deposit for a period of 5 years. He requested you to give accumulated interest end of the

years.

Solution: SI = Po (I) (n) = Rs.1, 00,000 X 0.07 X 5 years= Rs. 35,000

If an investor wants to know his total future value at the end of 'n' years. Future value is the sum of accumulated

interest and the principal amount. Symbolically:

FVn = Po + Po (I) (n) OR SI + Po

For instance

Manish annual savings are Rs. 1000, which is invested in a bank saving fund account that pays a 5 % simple interest.

Krishna wants to know his total future value or terminal value at the end of 8 years period.

Solution: FVn = Po + Po (I) (n) OR SI + Po

FVn = Rs. 1000 + Rs. 1000 (0.05) (8) = Rs. 1,400

13/uts

2.3 Compound Interest

Here the future values of all cash infows at the end of the time horizon at a particular rate of interest are found,

interest is compounded when the amount earned on an initial deposit becomes part of the principal at the end of the

frst compounding period.

There is no difference between simple interest and compound interest when there is only one time investment yearly

compounding, and for only one year maturity. But the difference can be seen only when the investment is made for

more than two years. Compounding interest is also referred as future value (FV).

2.3.1 Compounding Value of a Single Amount

Compound value or future value on an account can be calculated by the following formula.

CV = Po (1 + I) n

Where,

CV = Compound value, Po = Principal amount, I = Interest per annum,

n = Number of years for which compound is done

(1 + I) n = CVIF I..n or future value inter factor for interest and 'n' years.

For instance: Suppose you have Rs. 10, 00,000 today and you deposit it with a fnancial institute, which pay 8 %

compound interest for a period of 5 years. Show how the deposit will grow.

Solution: CV = Po (1 + I) n

CV5 = 10, 00,000(1+0.08)5

= 10, 00,000 (1.469*)

CV5 = Rs. 14, 69,000

Note: * See compound value of one rupee Table for 5 years at 8 % rate of interest.

2.3.2 Variable Compounding Periods

Generally compounding is done once in a year. In the above problem, we assumed that the compounding is done

annually. If the investor promised to pay compound interest for variable periods, compound value with variable

compound periods is determined with the following formula.

Where,

CVn = Compound value at the end of year 'n', Po = Principal amount at the year '0', I = Interest per annum,

m = Number of times per year compounding is done

n = Maturity period

For instance (Semi compounding): How much does a deposit of Rs. 40,000 grow to at the end of 10 year at the rate

of 6 % interest and compounding is done semi-annually. Determine the amount at the end of 10 years.

Solution:

= Rs. 40,000 [*1.86] = Rs. 72,240

Note: * See compound value of one rupee Table for 20 years at 3 % rate of interest.

For Instance (Quarterly compounding): Suppose that a frm deposits Rs. 50 lakhs at the end of each year for 4 years

at the rate of 8 % interest and compounding is done on quarterly basis. What is the compound value at the end of

4 year?

Solution:

= Rs. 50, 00,000 [CVIF 2%..........16y]

= Rs. 50, 00,000 x 1.373 = Rs. 68, 65,000

Financial Management

14/uts

Calculation of Compound Growth Rate

Compound growth rate can be calculated with the following formula:

gr:

Where gr= Growth rate in percentage

V= Variable for which the growth rate is needed to found (i.e. sales, revenue, dividend at the end of year '0')

Vo = Variable value at the end of year 1

Vn = Variable value (amount) at the end of year 'n'

For instance:

From the following dividend data of a company calculate compound rate of growth for period (1998-2003).

Year 1998 1999 2000 2001 2002 2003

Dividend per share (Rs.) 21 22 25 26 28 31

Solution:

gr= 8%

Note

See compound one rupee Table for 5 years (total years one year) till you fnd closest value to the compound factor,

at closest value see upward to the table to get growth rate.

Compound Value of Series of cash Flows

Annuity means a series of cash fows (infow or outfow) of a fxed amount for a specifed number of years. Compound

value of a series of cash fows can be calculated by the following formula (uneven cash fows)

Where CVn= Compound value at the end of' 'n' year

P1 = Payment at the end of year 1, P2 = Payment at the end of year 2

Pn = Payment at the end of year 'n', I = Interest rate

CVn = P1 (CVIF I.1) + P2 (CVIF I.2) + Pn (1+I I.n)

For instance

Mr. Shyam deposits Rs. 5,000, Rs. 10,000, Rs. 15,000, Rs. 20,000 and Rs. 25,000 in his savings bank account in

year 1,2,3,4 and 5 respectively. Interest rate of 6 %, he wants to know his future value of deposits at the end of 5

years.

Solution: +

+

= 6,610 + 11,910 + 16,860 + 21,200 + 25,000

= Rs. 81,280

Compound Value of Annuity (Even Cash Flow)

Annuity is a series of even cash fows for a specifed duration. It involves a regular cash outfow or infow. For

instance like the payment of LIC premium, depositing in a recurring deposit account, and the like. Cash fows may

happen either at the end of year or beginning of the year. If cash fows happen at the beginning of the year, it is called

as an annuity due, where as when the cash fows happen at the end it is called as a regular or deferred annuity.

15/uts

Compound Value of Deferred Annuity

For instance: Mr. Ram deposits Rs. 500 at the end of every year for 6 years at 6 % interest. Determine Ram's money

value at the end of 6 years.

Solution:

+

= 500(1.338) + 500(1.262) + 500(1.191) + 500(1.124) + 500(1.060) + 500(1.00)

= 669 + 631 + 595.5 + 562 + 530 + 500

= Rs. 3487.5

Short cut formula for the above is:

Where,

P = Fixed periodic cash fow, I Interest rate

n = duration of the amount

= (CVIFA I.n)

(CVIFA I.n) = Future value for interest fact or annuity at 'I' interest and for 'n' years.

For the example above this formula can be used as below.

= 500(6.975)

= Rs. 3,487.5

Note: See compound value interest factor annuity Table of one rupee Table for 6 years at 6 % interest.

Compound Value of Annuity Due

When the cash fows involves at the beginning of the year compound value of annuity is calculated with the following

formula:

OR

For instance

Suppose you deposit Rs. 2,500 at the beginning of every year for 6 years in a saving bank account at 6 % compound

interest. What is your money value at the end of 6 years?

Solution:

= 2,500 (6.975) (1+0.06)

= Rs. 18, 4863.75

2.4 Doubling Period

Doubling period is the period required to double the amount invested at a given rate of interest.

Doubling period can be computed by adopting two rules:

Rule of 72: To get doubling period, 72 is dividend by interest rate.

Doubling period (DP) = 72 I

Where I = Interest rate, (%)

DP = Doubling period in years

Financial Management

16/uts

For instance:

If you deposit Rs. 500 today at 10 % of interest in how many years will this amount double?

Solution: DP = 72 I = 72 10 = 7.2 years (approx.)

Rule of 69

Rule of 72 may not give exact doubling period, but rule of 69 gives a more accurate doubling period. The formula

to calculate doubling period is

DP =0.35 + 69/I

For instance: If you deposit Rs. 500 today at 10 % of interest in how many years will this amount double?

Solution: 035 + 69/10 = 7.25 years

Effective rate of interest (ERI) in case of doubling period

Effective rate of interest can be defned with the use of following formula.

In case of rule of 72

ERI = 72 Doubling period (DP)

Where ERI = effective rate of interest, DP = Doubling period

In case of rule of 69

For instance

A fnancial institute has come with an offer to the public, where the institute pays double the amount invested in

the institute at the end of 8 years. Mr. A who is interested to deposit with institute wants to know the effective rate

of interest that will be given by institute.

Solution as per rule of 72: 72 8 years = 9 %

Solution as per rule of 69:

= 9 % (approx.)

2.5 Present Value

The present value of a future cash infow (or outfow) is the amount of current cash that is of equivalent value to the

present value. The processes of determining present value of future cash fows are called discounting. It is concerned

with determining the present value of a future amount, assuming that the decision maker has an opportunity to earn a

certain return on individual's money. This return is referred as discount rate, cost of capital or an opportunity cost.

Present value of a single amount

Present value can be calculated by the following formula:

OR

PV = Present value

= Future value receivable at the end of 'n' years

I = Interest rate or discounting factor or cost of capital

n = Duration of the cash fow

= present value interest facts at 'I' interest and for 'n' years

For instance

An investor wants to fnd the present value of Rs. 40,000 due 3 years. His interest rate is 10 %.

Solution:

= Rs. 40,000 [1

= Rs. 40,000 (0.751*)

17/uts

= Rs. 30,040

Note: * Present value of one rupee Table at 3 years for the arte of 10 %

Present value of a series of cash fows

We have calculated the present value of a single amount to be received after a specifed period. In many cases, we

may need to calculate present value of series cash fows. For example, in capital budgeting decisions, there is a need

to convert the future cash infows into present values to take decision and in case of raising funds through debt also

needs to convert the future cash outfows into present values. Cash fows over a period may be even or uneven.

Present Value of Uneven Cash Flows

OR + +

PV = Present value

I = Interest rate or discounting factor or cost of capital

n = Duration of the cash infows stream

t = Year in which cash infows are receivable

For instance

From the following information, calculate the present value at 10% interest rate.

Year 0 1 2 3 4 5

Cash infow (Rs.) 2,000 3,000 4,000 5,000 4,500 5,500

Solution:

= 2,000+ 2,727 + 3,304 + 3,755 + 3,073.5 + 3,415.5

= Rs. 18,275

Present Value of even Cash Flows (annuity)

PVA = Present value of annuity

I = Interest rate or discounting factor

n = Duration of the annuity

CIF = Cash infows

For instance

Mr. Ram wishes to determine the PV of the annuity consisting of cash fows of Rs. 40,000 per annum for 6 years.

The rate of interest he can earn from his investment is 10 %.

Solution:

= Rs. 40,000 X

= Rs. 4000 X * 4.355 = Rs. 17,420

*See present value of annuity for 6 years at 10 %

Financial Management

18/uts

Present Value of Annuity Due

(1+I)

For instance: Mr. Krishna has to receive Rs. 500 at the beginning of each year for 4 years. Calculate present value

of annuity due assuming 10 % rate of interest.

Solution:

= Rs. 1,743.5

2.6 Effective Vs Nominal Rate

Nominal rate of interest or rate of interest per year is equal. Effective and nominal rate are equal only when the

compounding is done yearly once, but there will be a difference, that is effective rate is greater than the nominal

rate for shorter compounding periods. Effective rate of interest can be calculated with the following formula.

Where, I = Nominal rate of interest

m = Frequency of compounding per year.

For instance

Mr. Y deposited Rs. 1,000 in a bank at 10% of rate of interest with quarterly compounding. He wants to know the

effective rate of interest.

Solution:

= 1.1038-1

= 0.1038 OR 10.38 %

2.7 Sinking Fund Factor

Financial manager may need to estimate the amount of annual payments so as to accumulate a predetermined

amount after a future date to purchase assets or to pay a liability. The following formula is useful to calculate the

annual payment.

Where, = Annual payment, , I = Interest rate

For instance: Finance manager of a company wants to buy an asset costing Rs. 1, 00,000 at the end of 10 years. He

Requests you to fnd out the annual payment required, if the savings earn an interest rate of 12% per annum.

Solution:

= 1, 00,000 (0.12/2.1058)

= Rs. 5.689

Present Value of Perpetuity

Perpetuity is an annuity of infnite duration. It may be expressed as:

Where: PV = Present value of a perpetuity

CIF = Constant annual cash infow

= PV interest factor for perpetuity

= CIF/I

For instance: Mr. X an investor expects a perpetual amount of Rs. 1000 annually from his investment. What is his

present value of perpetuity if the interest rate is 8 %?

Solution: = CIF/I

19/uts

= 1000/0.08 = Rs. 12,500

2.8 Loan Amortisation

Loan is an amount raised from outsiders at an interest and repayable at a specifed period. Payment of loan is known

as amortisation. Financial manager may take loan and may be interested to know the amount of equal installment

to be paid every year to repay the complete loan amount including interest. Installment can be calculated with the

following formula.

OR LI

Where: LI = Loan installment, = Principal amount, I = Interest, n = Loan repayment period at specifed interest

rate.

For instance: ABC company raised Rs. 10, 00,000 lakhs for an expansion program from IDBI at 7% interest per

year. The amount has to be repaid in 6 equal annual installments. Calculate the installment amount.

Solution:

= 10, 00,000 7.767

= Rs. 1, 28,750

Present Value of Growing Annuity

Growing annuity means the cash fows that grow at a constant rate for a specifed period of time.

Steps involved in calculation of growing annuity:

Calculate the series of cash fows

Convert the series of cash fows into present values at a given discount factor

Add all the present values of series of cash fows to get total PV of a growing annuity

Formula:

PVG

A

= PV of growing annuity

CIF = Cash infows

g= Growth rate

I = discount factor

n= Duration of the annuity

For instance: A Real estate Agency has rented out one of their apartment for 5 years at an annual rent of Rs. 6,00,000

with the stipulation that rent will increase by 5% in every year. If the agency's required rate at return is 14%. What

is the PV of expected (annuity) rent?

Solution: Calculate on series of annual rent

Year Amount of Rent (Rs.)

1 6,00,000

2 6,00,000 X (1+0.05) 6,30,000

3 6,30,000 X (1+0.05) 6,61,500

4 6,61,500 X (1+0.05) 6,94,575

5 6,94,575 X (1+0.05) 7,29,303.75

Financial Management

20/uts

2.9 Shorter Discounting Periods

Generally cash fows are discounted once a year, but some times cash fows have to be discounted less than one

(year) time, like, semi-annually, quarterly, monthly or daily. The general formula used for calculating the PV in the

case of shorter discounting period is:

Where, PV = Present vale, = Cash infow after 'n' year, m= No. of times per year discounting is done

I= Discount rate

For instance: Mr. P expected to receive Rs. 1, 00,000 at the end of 4 years. His required rate of return is 12% and

he wants to know PV of Rs. 1, 00,000 with quarterly discounting.

Solution:

= 1, 00,000 X

= 1, 00,000 X 0.623

= Rs. 62,300

21/uts

Summary

One of the most fundamental concepts in fnance is that money has a time value. That is to say that money

in hand today is worth more than money that is expected to be received in the future.

Simple interest is the interest paid on only the original amount, or principle borrowed.

Simple amount is a function of three components such as principle amount borrowed or lent, interest per annum

and the number of years for which the interest rate is calculated.

Doubling period is the period required to double the amount invested at a given rate of interest.

The present value of a future cash infow (or outfow) is the amount of current cash that is of equivalent value

to the present value.

Effective and nominal rate are equal only when the compounding is done yearly once, but there will be a

difference, that is effective rate is greater than the nominal rate for shorter compounding periods.

Loan is an amount raised from outsiders at an interest and repayable at a specifed period. Payment of loan is

known as amortisation.

References

Introduction to the Time Value of Money, [Online] Available at: <https://www.boundless.com/accounting/time-

value-money/introduction-to-time-value-money/> [Accessed 27 May 2013].

Introduction to the Time Value of Money , [Pdf] Available at: <http://www2.fu.edu/~changch/Chapter2_4.pdf>

[Accessed 27 May 2013].

Paramasivan, C. & Subramanian, T., 2009. Financial Management, New Age International.

Ramagopal, C., 2008. Financial Management, New Age International.

2013. Financial Management: Lecture 2, Chapter 5: Part 1 - Time Value of Money, [Video online] Available

at: <http://www.youtube.com/watch?v=vpJszYCLH3o> [Accessed 27 May 2013].

Prof. Ahmed, M., 2010. Time Value of Money, [Video online] Available at: <http://www.youtube.com/

watch?v=CnRJ6Jypsj4> [Accessed 27 May 2013].

Recommended Reading

Drake, P. P., 2009. Foundations and Applications of the Time Value of Money. Wiley

Benninga, S., 2006. Principles of Finance with Excel. Oxford University Press, USA

Block, S., 2008. Foundations of Financial Management w/S&P bind-in card + Time Value of Money bind-in

card. 13th ed., McGraw-Hill/Irwin.

Financial Management

22/uts

Self Assessment

Individual prefers ________opportunity to receive money now rather than waiting for one or more years to 1.

receive the same

value a.

money b.

interest c.

principle d.

________ is an amount raised from outsiders at an interest and repayable at a specifed period 2.

Money a.

Loan b.

Principle c.

Value d.

________ rate of interest or rate of interest per year is equal 3.

Sinking a.

Present value b.

Nominal c.

Principle d.

The present value of a future cash infow (or outfow) is the amount of _________ cash that is of equivalent 4.

value to the present value

current a.

future b.

past c.

lost d.

Which of the following statements is false? 5.

Annuity is a series of odd cash fows for a specifed duration a.

Simple interest is the interest paid on only the original amount b.

Growing annuity means the cash fows that grow at a constant rate for a specifed period of time c.

The processes of determining present value of future cash fows are called discounting d.

Compounding interest is also referred as __________. 6.

future value a.

current value b.

asset value c.

amount value d.

________ period is the period required to double the amount invested at a given rate of interest. 7.

Compounding a.

Growth b.

Discounting c.

Doubling d.

23/uts

If cash fows happen at the beginning of the year, it is called as an? 8.

Annuity due a.

Deferred annuity b.

Regular annuity c.

Mixed annuity d.

A rupee, which is received today, is more valuable than a rupee receivable in ______. 9.

past a.

present b.

future c.

today d.

The process of determining present value of future cash fows is called? 10.

Sinking a.

Billing b.

Discounting c.

Amounting d.

Financial Management

24/uts

Chapter III

Valuation of Bonds and Shares

Aim

The aim of this chapter is to:

explain the concept of valuation

explicate types of values

elucidate the basic bond valuation model

Objectives

The objectives of this chapter are to:

explain various types of bonds

explicate bond valuation

elucidate redeemable bond

Learning outcome

At the end of this chapter, you will be able to:

understand relationship between bond value and time to maturity period

identify zero coupon bonds

describe current yield

25/uts

3.1 Introduction to Valuation

Valuation is the process of linking risk with returns to determine the worth of an asset. The value of an asset depends

on the cash fow it is expected to provide over the holding period. The fact is that, as on date there is no method by

which prices of shares and bonds can be accurately predicted. It should be kept in mind by an investor before one

decides to take an investment decision.

3.2 Nature of Value

Book value: It is an accounting concept. Assets are recorded in balance sheet at their book values. Book value

of an asset is cost of acquisition less accumulated depreciation. It is determined by the formula below.

Market value: Market value of an asset is the price at which the asset is bought or sold in the market. Market

value per share is generally higher than the book value per share for proftable and growing frms.

Going concern value: It is the value that a frm can be realised if it sells its business as a continuing operating

business. This value would be higher than the liquidation and book value. Valuation of securities is always

considered as going concern, because if the frm is not running, investors would not invest in securities

Liquidation value: Liquidation value is the actual amount that can be realised when an asset is sold. Liquidation

value of a equity stock is the actual amount that would be received if all of the frm's assets were sold at their

market value, liabilities were paid, and the remaining proceeds were by number of equity shares outstanding.

Intrinsic value: Investors invest on equity stock with an expectation of intrinsic cash infow stream. The present

value of the cash infows expected from a security over its holding period. Present value is computed by

discounting future cash infows at an appropriate rate. It is also called economic value.

3.3 Bond Valuation

A bond is a legal document issued by the issuing company under is common seal acknowledging a debt and setting

forth the terms under which they are issued and are to be paid. Bond is also known as 'debenture'. Bonds are issued

by different types of organisations like the government, fnancial institutions, public sector undertaking and private

sector organisations.

Few important terms in bond valuation are as follows:

Par value: The par value (Face Value) is stated on the face of the bond. It is the amount at which a bond is issued

to public, and promises to pay either at the end of maturity period or in pre-decided installments.

Coupon rate: Coupon rate is the interest rate with which a bond is issued. The interest payable at regular intervals

is the product of the par value and the coupon rate broken down to the relevant time horizon.

Maturity period: Refers to the number of years after which the par value becomes payable to the bond-holder.

Redemption value: It is the amount the bond-holder gets on maturity. A bond may be redeemed at par, at a

premium (bond-holder gets more than the par value of the bond) or at a discount (bond-holder gets less than

the par value of the bond)

Market value: It is the price at which the bond is traded in the stock exchange. Market price is the price at which

the bonds can be bought and sold and this price maybe different from par value and redemption value.

Financial Management

26/uts

3.3.1 Types of Bonds

Following are the types of bonds:

Redeemable Bond

A bond which the issuer has the right to redeem prior to its maturity date, under certain conditions. The appropriate

discount rate is cost of debt (kd) required rate of return on bond (debenture).

OR

Where,

BVo = Value of bond (debenture) at time 'zero'

I = Annual interest paid per year

M = Maturity of bond

N = Number of years to maturity

kd= Required rate of return, or cost of debt

PVIF = Present value interest factor

PVIFA = Present value interest factor annuity

For instance: AB company issues Rs. 1,000 par value bond at 12%. The bond is redeemable after 10 years. Determine

value of bond assuming required rate of return is 14%.

Solution:

BVo = (Rs.120 X 5.216) + (Rs. 1,000 X 0.270)

BVo = Rs. 625.92 + Rs. 270

BVo = Rs. 895.92

Bond values with semi-annual interest

With the effect of compounding, the value of bonds with semi-annual interest is much more than the ones with

annual interest payments. Hence the bond valuation equation can be modifed as:

OR

For instance: MNC company issues bonds with face value of Rs. 1,000 each, at 12% per coupon rate with interest

payable semi-annually. The bonds are redeemable after 5 years. Determine value of bond if required rate of return

on this type of bond is 14%.

Solution:

BVo = (Rs. 60 X 7.024) + (Rs. 1,000 X 0.508

= Rs. 421.44 + Rs. 508

= Rs. 929.44

Irredeemable Bond

Irredeemable bond is the bond which is not repaid till closing of the frm. It is the bond without maturity period.

Value of perpetual bond is determined by the following formula.

OR

For instance: A company has issued 12 % perpetual bond of Rs. 1,000 each. Determine value of bond assuming 15

% cost of debt.

Solution: BVo = = Rs.120/.015 = Rs.800

27/uts

Zero Coupon Bonds

In India Zero coupon bonds are also known as Deep discount bonds. These bonds have no coupon rate, that is, there

is no interest to be paid out. Instead, these bonds are issued at a discount to their face value, and the face value is

the amount payable to the holder of the instrument on maturity. The difference between the discounted issue price

and face value is effective interest earned by the investor. These are called deep discount bonds because these bonds

are long term bonds whose maturity some time extends up to 25 to 30 years.

3.4 Bond Yields

Along with the bond value, investors are also interested in knowing the yield on bonds. Yields on bonds can be

measured by applying various measures. They are:

Yield to Maturity (YTM)

It is the rate of return that an investor earns if they buy a bond at a specifc price and hold it until maturity.

If bond is sold at par and realised par value fully then yield to maturity equals to interest rate YTM is computed

by using the following formulae.

Where,

SP = Sales proceeds a bond (price of bond)

I = Annual Interest payment (Rs.)

M = Maturity value of bond

n= Maturity period

Kd= Yield to maturity

Illustration: XYZ company bond, currently sells for Rs.1, 000 (Face value 900) it has a 10% interest rate, and with

a maturity period of 10 years.

OR

Alternatively

Years CIFs (Rs.) DF PV (Rs.)

10% 6% 10% 6%

1 to 10 90 6.145 7.360

553.05

347.40

662.4

502.2

10 900 0.386 0.558

900.45

1000.00

1164.6

1000.00

(-) Sales price (-)99.55 164.6

Yield to maturity:

=

= 6% +

= 6% + 2.49

Financial Management

28/uts

= 8.49 %

Yield to Call (YTC)

Yield to call is exactly similar to YTM, but here yield is found till the call of the bond. Some corporate issues bonds

with call feature that allows the company call back the bond before maturity period. In such cases bond holder would

not have the option of holding the bond until the maturity period. Therefore, YTM would not ne earned. YTC is

computed with the following formula:

Where, CP = Call price of bond, n*= Number of years until the assumed call date

For instance: ABC company issues 10 % callable bonds with a face value of Rs. 1000. The bond is currently selling

of Rs. 1,100. Maturity period is 10 years. Determine YTC assuming company calls bonds after 5 years because

interest rate has fallen by 2% at Rs. 1000.

Solution:

Years CIFs (Rs.) DF PV (Rs.)

10% 5% 10% 5%

1 to 5 100 100 3.791

379.1

621.0

432.9

784

5 1000 1000 0.621

1000.1

1100

1216.9

1100.00

(-) Current price (-)99.55 116.9

Yield to Call =

= 5% +

= 5% + 2.69

= 7.69 %

Current yield

It is the yield that relates to the annual interest to the annual interest to the current market price.

Current Yield = I CMP

Where: I = Annual Interest (Rs.)

CMP = Current market price

For instance: From the following determine current yield on a bond

Face value of bond Rs.1200

Interest Rate 13 %

Maturity 10Years

Current market price Rs. 1000

Solution:

29/uts

From the above calculation we can see that yield represents analyse interest rate, it excludes capital gain or loss. It

ignores time value of money. Therefore, it is not a accurate measure of the bonds expected return.

3.5 Bond Value Behaviors

Following are the bond values discussed below.

3.5.1 Required Rate of Return and Bond Values

Whenever there is change in the required rate of return, bond value shows fuctuations from its par value. Required

rate of return may change, due to shift in the basic cost of long-term sources of fnance, and the change in the frm's

risk level.

Let us determine value of bond considering the following three cases.

Value of bond when interest-rate equals to required rate of return in this case value of bond is equals to par

value.

For instance: A public lid company issued 2 years ago 12% bond with a face value of Rs. 1,000 for 8 years. Investors

required rate of return is 12%. Determine value of bond.

Solution:

B = (Rs.120 X4.111) + (Rs. 1,000 X 0.507)

= Rs. 493.32 + 507

= Rs. 1,000

Value of bond when required rate of return is higher than the interest- rate in this case value of bond would

be less than par value

For instance: A public lid company issued 2 years ago 12% bond with a face value of Rs. 1,000 for 8 years. Investors

required rate of return is 15%. Determine value of bond

Solution:

B = (Rs.120 X3.784) + (Rs. 1,000 X 0.432)

= Rs. 454.08 + 432

= Rs. 886.08

Value of bond when required rate of return is less than interest rate In this case, value of bond would be above

par value.

For instance: A public lid company issued 2 years ago 12% bond with a face value of Rs. 1,000 for 8 years. Investors

required rate of return is 10%. Determine value of bond

Solution:

B = (Rs.120 X4.355) + (Rs. 1,000 X 0.564)

= Rs. 522.60 + 564

= Rs. 1086.6

Financial Management

30/uts

In nutshell the relationship between bond values and required rate of return is given below:

Interest Rate > Required Rate: Bond Value > Par Value

Interest Rate = Required Rate: Bond Value = Par Value

Interest Rate < Required Rate: Bond Value < Par Value

3.5.2 Time to Maturity and Bond Values

Value of Bond: When I (%) = Kd (%) and change in the time period- In this case value of bond is equals to par

value, whatever may be the maturity period.

For instance: A company issues bond at 10% coupon rate, and with a face value of Rs. 1,000 maturity period

is 10 year. Required rate of return is 10%. Determine value of bond when time period is (i) 5 years, and (ii) 15

years.

Solution: Value Bond: I(%) = Kd (%) [10%=10%]

Maturity Period Equation Value of Bond (Rs.)

(i) 5 years

10 years

(ii) 15 years

(100 X3.79)+(1000X0.621)

(100 X6.145)+(1000X0.386)

(100 X7.606)+(1000X0.239)

379 + 621= 1,000

614 + 386 = 1,000

761 + 239 = 1,000

Value of bond remains same (at par value) when interest rate equals to required rate of return, with the change

in time period to maturity.

Value of Bond: When I (%) < Kd (%) and change in the time period - In this case, value of bond decreases

when the time period to maturity increases and vice versa.

For instance: A company issues bond at 10% coupon rate, and with a face value of Rs. 1,000 maturity period

is 10 year. Required rate of return is 12%. Determine value of bond when time period is (i) 5 years, and (ii) 15

years.

Solution: Value Bond: I(%)< Kd (%) [10% < 12%]

Maturity Period Equation Value of Bond (Rs.)

(i) 5 years

10 years

(ii) 15 years

((100 X3.605)+(1000X0.567)

(100 X5.650)+(1000X0.322)

(100 X6.811)+(1000X0.183)

360.5 +567 = 927.5

565 + 322 = 887

681.1 + 183 = 864.1

Value of bond decreases with the increase time period of maturity.

Value of Bond: When I (%) > Kd (%) and change in the time period to maturity In this case value of bond

increases when time period to maturity increases.

For instance: A company issues bond at 10% coupon rate, and with a face value of Rs. 1,000 maturity period

is 10 year. Required rate of return is 6%. Determine value of bond when time period is (i) 5 years, and (ii) 15

years.

Solution: Value Bond: I (%)>Kd (%) [10% > 6%]

Maturity Period Equation Value of Bond (Rs.)

(i) 5 years

10 years

(ii) 15 years

(100 X4.212)+(1000X0.747)

(100 X7.360)+(1000X0.558)

(100 X9.712)+(1000X0.417)

421.2 + 747 = 1,168.20

736 + 558 = 1,294

971.2 + 417 = 1,388.2

31/uts

Value of bond increased when increase in time period for maturity

3.5.3 Relationship between Bond Value and Time to Maturity Period

Figure below shows the relationship between time to maturity period; required return and bond value.

1,600

1,400

1297

1,200

1000

1168

800

887

600

400

200

10 9 8 7 6 5 4 3 2 1 0

Premium Bond

Required Rate 6%

Face value bond

Required Rate 10%

Discount Bond

Required Rate 12%

Fig. 3.1 Bond value and time to maturity

Following points can be extracted from the fgure above:

When required rate of return equals to coupon rate, a bond will sell at face value. At the time of issue of bond

interest rate is set at par with required rate of return, to sell bond of par initially.

When required rate of return increases above coupon rate then, the bond value falls below par value. Such bond

is known as 'discount bond'.

When required rate of return falls below the interest rate, then the band values goes above par value. This bond

is called as 'premium bond'

Increase in required rate of return affects bond values (go up or fall below par value).

Market value of bond will always reach its face value by the end of its maturity period, provided the frm does

not go bankrupt.

3.6 Valuation of Shares

A company's shares may be categorised as

Ordinary / Equity shares

Preference shares

The returns these shareholders receive are called dividends. Preference shareholders get a preferential treatment

as to the payment of dividend and repayment of capital in the event of winding up. Such holders are eligible for a

fxed rate of dividends. Some important features of preference and equity shares are.

Dividends

Rate is fxed for preference shareholders. They can be given cumulative rights, that is, the dividend can be paid off

after accumulation. The dividend rate is not fxed for equity shareholders. The dividend rate is not fxed for equity

shareholders.

Financial Management

32/uts

Claims

In the event of the business closing down, the preference shareholders have a prior claim on the assets of the company.

Their claims shall be settled frst and the balance if any will be paid off to equity shareholders.

Redemption

Preference shares have a maturity date on which day the company pays off the face value of the share to the holders.

Preference shares are of two types redeemable and irredeemable.

Conversion

A company can issue convertible preference shares. After a particular period as mentioned in the share certifcate,

the preference shares can be converted into ordinary shares.

3.6.1 Valuation of Preference Shares

Preference share gives some preferential rights to preference stockholders. The preferential rights are payment of fxed

rate of dividend and payment of principal amount at the time of liquidation, before paying to equity stockholders.

Value of preference stock is the present value of fxed annual dividends expected and he principal amount.

OR

Where, = Value of Preference stock

= Preference dividend (Rs.)

= Required rate of return (%) or cash of preference share

PVIFA = Present value interest factor annuity

PVIF = Present value interest factor

For instance

ABC company issued 12% perpetual preference stock with a face value of Rs. 100. Compute value of preference

stock assuring 14% require rate of return.

Solution: = = Rs. 85.71

For instance

A company issued 12% preference stock with a face value of Rs. 100, redeemable after 5 years. Required rate of

return is 10%. Determine value of preferred stock.

Solution:

= (Rs.12 X 3.791) + (100x 0.621)

= Rs. 45.492 + 62.1

= Rs. 107.592

3.6.2 Valuation of Equity/Ordinary Shares

People hold common stocks for two reasons:

To obtain dividends in a timely manner

To get a higher amount when sold.

33/uts

The value of a share which an investor is willing to pay is linked with the cash infows expected and risks associated

with these infows. Intrinsic value of a share is associated with the earnings (past) and proftability (future) of the

company, dividends paid and expected and future defnite prospects of the company.

Basic share valuation model

Stock value is present value of future cash infows (dividends) that it is expected to provide over an infnite time

horizon. An investor who buys a stock with the intention of holding in forever, on this case the value of equity stock

is the present value of a stream of dividends expected over an infnite period.

Where: ESo = Value of equity stock

Dt = Expected dividend per share at the end of year 't'

Ke = Required return on equity (cash of equity)

Under this we learn valuation of equity share using three models:

Zero growth

Constant growth

Variable growth

Single period valuation

Here the value of the equity share is determined assuming an investors holds stock for one year period.

Where, = Value of stock

= expected dividend at the end of one year

= Price of the share at the end of one year

= Required rate of return

For instance

Mr. A purchased an equity stock of Gokul Company at Rs. 100 per share, it is expected to provide a dividend of Rs.

10 per share, and fetch a price of Rs. 110 after one year. Compute stock value assuming required date of return.

Solution:

= (Rs. 10x0.877) + (Rs. 110 X 0.877)

= Rs.8.77 + Rs. 96.47

= Rs. 105.24

Zero Growth Model: It is the model under which value of stock is determined assuming dividends are not

expected to grow, (non-growing). Here value of equity stock is the present value of perpetuity of dividends:

Constant Growth (Gorden) Model: In this model value of equity stock is valued assuming that dividends would

growth at a constant rate.

Financial Management

34/uts

Variable Growth Model: Growth of the frm should be different life cycle. That is in the early stages growth's much

be faster than that of economy as a whole. Economic growth in the later stages the growth comes down.

It is calculated in four step process.

Compute the value of the dividends at the end of each year during the super normal growth period.

Compute the present value of the dividends expected during the initial growth period

Determine PV value of stock at the end of the initial growth period.

PV of stock is

Add the PV found in step 2 and step 3 to get intrinsic value of stock. (ESo)

35/uts

Summary

Valuation is the process of linking risk with returns to determine the worth of an asset. The value of an asset

depends on the cash fow it is expected to provide over the holding period.

Book value is an accounting concept. Assets are recorded in balance sheet at their book values. Book value of

an asset is cost of acquisition less accumulated depreciation.

Market value of an asset is the price at which the asset is bought or sold in the market. Market value per share

is generally higher than the book value per share for proftable and growing frms.

Liquidation value of a equity stock is the actual amount that would be received if all of the frm's assets were

sold at their market value, liabilities were paid, and the remaining proceeds were by number of equity shares

outstanding.

A bond is a legal document issued by the issuing company under is common seal acknowledging a debt and

setting forth the terms under which they are issued and are to be paid.

Irredeemable bond is the bond which is not repaid till closing of the frm. It is the bond without maturity

period.

References

Introduction to Bond Valuation , [Pdf] Available at: <http://www.arts.uwaterloo.ca/~kvetzal/AFM271/bond.

pdf> [Accessed 28 May 2013].

Bond Valuation, [Online] Available at: <http://www.prenhall.com/divisions/bp/app/cf/BV/BondValuation.html>

[Accessed 28 May 2013].

Jonathan, B., 2010. Financial Management, Pearson Education India.

Shim, J. K. & Siege, J. G., 2008. Financial Management, 3rd ed., Barron's Educational Series.

Prof. Ahmed, M., 2012. Bond Valuation, [Video online] Available at: <http://www.youtube.com/

watch?v=tid0RVUmY3M>[Accessed 28 May 2013].

2012. Value a Bond and Calculate Yield to Maturity (YTM), [Video online] Available at: <http://www.youtube.

com/watch?v=pfhjJ00IuW4>[Accessed 28 May 2013].

Recommended Reading

Staff, I., 2005. Stocks, Bonds, Bills, and Infation 2005 Yearbook. Ibbotson Associates

Agarwal, O.P., 2009. International Financial Management. Global Media.

Satyaprasad, B.G. & Raghu, G.A. 2010. Advanced Financial Management.Global Media.

Financial Management

36/uts

Self Assessment

_________ is divided by the number of equity shows outstanding to get book value per share. 1.

Net worth a.

Yield b.

Equity stock c.

Premium bond d.

Value of bond equals to __________ value when required rate equals to interest rate. 2.

present a.

current b.

par c.

net d.

Which of the following statements is false? 3.

Preference stock is also known as hybrid security. a.

Liquidation value equals to value of assets minus value of liabilities b.

Value of bond is less than par value when required rate of return than interest rate. c.

Cash infows, timing and required return are the three inputs required to value any asset. d.

Bond value equals to par value when it reaches to __________ period. 4.

maturity a.

premium b.

value c.

completion d.

Current yield relates to the annual interest to the current________. 5.

cost price a.

asset price b.

market price c.

specifc price d.

A bond is said to be premium bond when its value is: 6.

Higher than the par value a.

Less than the par value b.

Equal to than the par value c.

Higher than the present value d.

Intrinsic value is the __________ value of cash fows expected over a series years of holding an asset. 7.

coming a.

going b.

present c.

net d.

37/uts

Preference stock is also known as: 8.

Equity stock a.

Ordinary stock b.

Hybrid security c.

Security stock d.

When required rate of return is different from the interest rate the length of time to maturity effects _______ 9.

values.

bond a.

equity b.

share c.

net d.

Value of bond is less than par value when required rate of return higher than ________ rate. 10.

interest a.

return b.

required c.

present d.

You might also like

- Top Ten Helicopter Checkride TipsDocument35 pagesTop Ten Helicopter Checkride TipsAbhiraj Singh SandhuNo ratings yet

- Financial ManagementDocument33 pagesFinancial ManagementAkash k.cNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementJohnykutty JosephNo ratings yet

- Financial Management Class Notes Bba Iv Semester: Unit IDocument49 pagesFinancial Management Class Notes Bba Iv Semester: Unit IGauravs100% (1)

- You Wouldnt Want To Sail On A 19th-Century Whaling Ship 33 Grisly EnglishareDocument36 pagesYou Wouldnt Want To Sail On A 19th-Century Whaling Ship 33 Grisly EnglishareDušan MićovićNo ratings yet

- Audit Process - Performing Substantive TestDocument49 pagesAudit Process - Performing Substantive TestBooks and Stuffs100% (1)

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Financial Management and ControlDocument31 pagesFinancial Management and Controljeof basalof100% (1)

- Corporate Finance - MBA IIDocument80 pagesCorporate Finance - MBA IIAnmol Srivastava100% (1)

- Motor TestingDocument26 pagesMotor TestingGas Gas DucatiNo ratings yet

- Cable Sizing Charts RevADocument8 pagesCable Sizing Charts RevAKUNALJAYNo ratings yet

- Coal Explosions in Cement IndustryDocument17 pagesCoal Explosions in Cement Industrymareymorsy2822No ratings yet

- 400-200 KV Substation DesignDocument62 pages400-200 KV Substation DesignMousum91% (22)

- SFM PDFDocument328 pagesSFM PDFZainNo ratings yet

- Digital ExciterDocument80 pagesDigital ExciterKUNALJAY100% (2)

- Introduction To Financial ManagementDocument23 pagesIntroduction To Financial ManagementLifeatsiem Rajpur100% (6)

- Financial ManagementDocument14 pagesFinancial ManagementMru SurveNo ratings yet

- Nature, Scope, Objectives and Functions of Financial ManagementDocument38 pagesNature, Scope, Objectives and Functions of Financial Managementrprems6No ratings yet

- Financial Management AssignmentDocument12 pagesFinancial Management AssignmentSoumya BanerjeeNo ratings yet

- Reactor ProtectionDocument25 pagesReactor Protectiongkpalepu90% (10)

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- Abb Excitation 1Document45 pagesAbb Excitation 1Erbil KeskinNo ratings yet

- HRM OmantelDocument8 pagesHRM OmantelSonia Braham100% (1)

- Carpio V ValmonteDocument2 pagesCarpio V ValmonteErvin John Reyes100% (2)

- Unit 1 Introduction To Financial ManagementDocument12 pagesUnit 1 Introduction To Financial ManagementPRIYA KUMARINo ratings yet

- Nature Purpose and Scope of Financial ManagementDocument18 pagesNature Purpose and Scope of Financial ManagementmhikeedelantarNo ratings yet

- Financial Management - Meaning, Objectives and Functions Meaning of Financial ManagementDocument9 pagesFinancial Management - Meaning, Objectives and Functions Meaning of Financial ManagementGely MhayNo ratings yet

- Computer Graphics Mini ProjectDocument25 pagesComputer Graphics Mini ProjectGautam Singh78% (81)

- Finacial Management Full NotesDocument114 pagesFinacial Management Full NotesBhaskaran BalamuraliNo ratings yet

- Quiz1 2, PrelimDocument14 pagesQuiz1 2, PrelimKyla Mae MurphyNo ratings yet

- Advantages of Low Volatile Coals For PCIDocument24 pagesAdvantages of Low Volatile Coals For PCIKUNALJAYNo ratings yet

- ABB Protection Application HandbookDocument356 pagesABB Protection Application HandbookSyed Muhammad Munavvar HussainNo ratings yet

- AssignmentDocument15 pagesAssignmentagrawal.sshivaniNo ratings yet

- CH 1financial ManagementDocument7 pagesCH 1financial ManagementᎮᏒᏗᏉᏋᏋᏁ ᏦᏬᎷᏗᏒNo ratings yet

- Aims of Finance FunctionDocument56 pagesAims of Finance FunctionBV3S100% (1)

- Financial ManagementDocument14 pagesFinancial ManagementTaher KagalwalaNo ratings yet

- ACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyDocument3 pagesACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyAdrienne Nicole MercadoNo ratings yet

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDocument74 pagesChapter 1 Introduction - Chapter 2 Industrial Profilebalki123No ratings yet

- Meaning, Scope & Objectives of Financial ManagementDocument3 pagesMeaning, Scope & Objectives of Financial ManagementAmanDeep SinghNo ratings yet

- Chap 1. Financial Management 1.1 Finance and Related DisciplineDocument13 pagesChap 1. Financial Management 1.1 Finance and Related DisciplineBarkkha MakhijaNo ratings yet

- Financial MGMT BasicsDocument61 pagesFinancial MGMT BasicsLokesh GowdaNo ratings yet

- UntitledDocument3 pagesUntitledZeyNo ratings yet

- Scope and Objective of Financial Management NewDocument3 pagesScope and Objective of Financial Management NewArafathNo ratings yet

- Bba FM Notes Unit IDocument15 pagesBba FM Notes Unit Iyashasvigupta.thesironaNo ratings yet

- Introduction To Financial ManagementDocument29 pagesIntroduction To Financial Managementraymundojr.junioNo ratings yet

- UNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument15 pagesUNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- Chapter-1 Nature of Financial ManagementDocument32 pagesChapter-1 Nature of Financial ManagementNoor AlamNo ratings yet

- Financial ManagementDocument17 pagesFinancial ManagementSmita PriyadarshiniNo ratings yet

- SFM NotesDocument11 pagesSFM NotesHanuma GonellaNo ratings yet

- 1 FM - PPTMDocument23 pages1 FM - PPTMMohini BhangdiyaNo ratings yet

- Mb0045 Financial ManagementDocument242 pagesMb0045 Financial ManagementAnkit ChawlaNo ratings yet

- Chapter One 13th Batch Lecture OneDocument13 pagesChapter One 13th Batch Lecture Oneriajul islam jamiNo ratings yet

- Financial ManagementDocument28 pagesFinancial ManagementAkash ArvikarNo ratings yet

- Introduction To Financial ManagementDocument61 pagesIntroduction To Financial ManagementLokesh GowdaNo ratings yet

- FM MaterialDocument32 pagesFM MaterialSree Harsha VardhanNo ratings yet

- SFM-chapter 1Document24 pagesSFM-chapter 1animut silesheNo ratings yet

- Ch-1 Introduction of FMDocument30 pagesCh-1 Introduction of FMNavneetNo ratings yet

- 1st Chapter Accounts NotesDocument4 pages1st Chapter Accounts Notessahil rajNo ratings yet

- Exm 12970Document17 pagesExm 12970Pavan JpNo ratings yet

- Q. Introduction, Meaning and Definition of Financial Management?Document8 pagesQ. Introduction, Meaning and Definition of Financial Management?Rizwana BegumNo ratings yet

- FM - Ramesh Sirs PortionDocument15 pagesFM - Ramesh Sirs PortionTejas DesaiNo ratings yet

- FM - Ramesh Sirs PortionDocument13 pagesFM - Ramesh Sirs PortionTejas DesaiNo ratings yet

- Meaning of Financial Management: Scope/ElementsDocument9 pagesMeaning of Financial Management: Scope/ElementsLovida AspilaNo ratings yet

- Unit 1 Fundamentals of Financial ManagementDocument24 pagesUnit 1 Fundamentals of Financial Managementmayaverma123pNo ratings yet

- FM 1Document7 pagesFM 1Rohini rs nairNo ratings yet

- StockDocument3 pagesStockSUKHDEEPSINGH BIRDINo ratings yet

- (FM02) - Chapter 1 The Role and Environment of Financial ManagementDocument12 pages(FM02) - Chapter 1 The Role and Environment of Financial ManagementKenneth John TomasNo ratings yet

- Unit - 2 (Hotel Accounts)Document5 pagesUnit - 2 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Financial Management Module I: Introduction: Finance and Related DisciplinesDocument4 pagesFinancial Management Module I: Introduction: Finance and Related DisciplinesKhushbu SaxenaNo ratings yet

- Financial Management - Its Meaning, Scope & Objectives. By: Anurag ChakrabortyDocument17 pagesFinancial Management - Its Meaning, Scope & Objectives. By: Anurag Chakrabortymdr32000No ratings yet

- Financial Management: Unit IDocument72 pagesFinancial Management: Unit Isubhash_92No ratings yet

- Financial Management: Unit IDocument72 pagesFinancial Management: Unit IE-sabat RizviNo ratings yet

- Financial Policy and Corporate Strategy: Learning OutcomesDocument10 pagesFinancial Policy and Corporate Strategy: Learning Outcomesमोहित शर्माNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet