Professional Documents

Culture Documents

Beta Calculation - Completed

Uploaded by

squishytoyzzz0 ratings0% found this document useful (0 votes)

38 views3 pagesfin 300 bond project

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfin 300 bond project

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views3 pagesBeta Calculation - Completed

Uploaded by

squishytoyzzzfin 300 bond project

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

BETA CALCULATION:

While dividends contribute a stocks rate of return, Salesforce.com doesnt payout

dividend. The company has an average monthly return of 0.99% over the past three years.

Though having low return, Salesforce.com has a high standard deviation (SD) of 14.05%. A high

SD means high range of rate of returns that also leads to higher risk since investors cannot

estimate the return with ease. We can illustrate how risky this stock is by comparing

Salesforce.com with the market proxy we chose: the S&P 500. The S&P500 is a good proxy of

the market as it consists of hundreds of companies values, including Salesforce.com.

1

The

market has negative rate of return (-0.79%) but with lower SD (4.36%). Note that investors want

low risk investment with high rate of return.

Based on the high low close graph of Salesforce.com, we observed significant

difference in the companys stock price over the past three years. The graph indicates the stock

price at the low and high points of each

month, marking the actual closing prices.

The bigger range proves that the

companys stock price is quite volatile

compared to the market. This volatility

also means that we cannot predict what

will happen to the stock price accurately.

By looking at the appendix, with an

R^2 of 42.49%, 42.49% of the variation on

1

Yahoo Finance, S&P 500 INDEX, RTH (^GSPC). http://finance.yahoo.com/q/cp?s=^GSPC&alpha=C (accessed

February 23, 2009)

$0

$10

$20

$30

$40

$50

$60

$70

$80

High Low Close Chart on Salesforce.com

(CRM)

December 2005 - December 2008

returns is explained by our return in Salesforce. We calculated a 0.03 coefficient of relationship,

which means that the return in market has a weak positive impact to the return in Salesforce

stock. If the return on market goes up, the return on Salesforce stock will go up as well. The test

of significance (T-test/ T-stat), returned a number of 1.4312. It is to test that the coefficient is not

zero. Meanwhile, we received a P-value of 0.1615. In economics discipline, a value below 10%

indicates how significant a variable is. The higher the T-statistic and the lower the P-value, the

more accurate and reliable our calculation is.

2

(Check Footnote here).

The beta that we calculated is different from the published beta from ValueLine.com (2.1

versus 1.15). Neither of these betas is incorrectly calculated. The difference lies on the selection

of data used to calculate the beta. ValueLine.com uses NYSE as the market proxy. Also, the

timeline for rates of return from ValueLine.com is longer; five instead of three years.

Furthermore, Value Line uses the most recent five years of returns, whereas we analyzed three

years ending December 2008. In addition, we utilized monthly rates of return while

ValueLine.com uses weekly percentage changes in stock price.

3

2

Davies, Simon. "4 and 5." http://www.simon-davies.org.uk/Interpreting_OLS_Output(cross-sectional).pdf

(accessed February 23 2009).

3

Value Line, Glossary of Investment Terms. http://valueline.com/sup_glossb.html (accessed February 23, 2009)

3.48%

-3.02%

-9.52%

-29.03%

CLH

Portfolio

CRM

0.49%

-23.83%

-11.61%

Market Index

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

0.00 0.50 1.00 1.50 2.00 2.50 3.00

E

[

R

]

Beta

Security Market Line

We used monthly Treasury-Bill rates from the St. Louis Federal Reserve as the risk free

rate because it is backed by the full faith and credit of the U.S. Government. It is free from

unsystematic risk that comes from the market.

To calculate the expected return, E(x), we use the CAPM method:

CAPM: E[R] = 3.48% + beta(-9.52% - 3.48%)

which derives from: E[R] = R (f) + [ R(Mp) ]

@ E[R] = R (f) + [ R (f) R (M) ] ;

Where R(f) is risk free rate, is beta, R(M) is market risk return, and R(Mp) is market risk

premium.

Negative 23.83% is the annual E(x) one would expect from investing in Salesforce.com. Yet, the

actual observed return is 11.87%. This leads to an abnormal positive return of 35.70%, a figure

that would attract the investors to hold the stocks (see appendix). The variance for

Salesforce.coms returns too is higher than T-Bills which means the Salesforce.coms stock is

more volatile compared to T-Bills. As we explained before, this shows that the security is

unpredictable.

You might also like

- Beta CalculationDocument2 pagesBeta CalculationAnn KareninNo ratings yet

- Time Series Momentum For Improved Factor TimingDocument22 pagesTime Series Momentum For Improved Factor TimingLydia AndersonNo ratings yet

- Cost of Capital at AmeritradeDocument3 pagesCost of Capital at AmeritradeAnkur JainNo ratings yet

- Determining Share Prices: Stock Share Financial Ratios Earnings YieldDocument8 pagesDetermining Share Prices: Stock Share Financial Ratios Earnings Yieldapi-3702802No ratings yet

- Trading System EvaluationDocument5 pagesTrading System EvaluationOm PrakashNo ratings yet

- Ameritrade Case ConsolidatedDocument5 pagesAmeritrade Case Consolidatedyvasisht3100% (1)

- 2.2.1 Price/Earnings (P/E) RatioDocument5 pages2.2.1 Price/Earnings (P/E) Ratiomino eatineNo ratings yet

- What Is 'Beta': Volatility Systematic Risk Portfolio Capital Asset Pricing Model Expected ReturnDocument11 pagesWhat Is 'Beta': Volatility Systematic Risk Portfolio Capital Asset Pricing Model Expected ReturnVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- Fama-French Three FactorsDocument4 pagesFama-French Three FactorsAshish BhallaNo ratings yet

- Beta CalculationDocument2 pagesBeta CalculationNidhin ThomasNo ratings yet

- AndersonmiquelawrittenreportprojectstockvaluationDocument4 pagesAndersonmiquelawrittenreportprojectstockvaluationapi-631992517No ratings yet

- Equity Valuation Using MultiplesDocument47 pagesEquity Valuation Using MultiplesSankalpKhannaNo ratings yet

- Yes BankDocument12 pagesYes BankBijay AgrawalNo ratings yet

- Sortino - A "Sharper" Ratio! - Red Rock CapitalDocument6 pagesSortino - A "Sharper" Ratio! - Red Rock CapitalInterconti Ltd.No ratings yet

- Roedecomposition 000Document8 pagesRoedecomposition 000tjl84No ratings yet

- User Guide: Intrinsic Value CalculatorDocument7 pagesUser Guide: Intrinsic Value CalculatorfuzzychanNo ratings yet

- Investment Theory #16 - Performance Appraisal - Wiser DailyDocument4 pagesInvestment Theory #16 - Performance Appraisal - Wiser DailyVovan VovanNo ratings yet

- P - E Ratio - Price-to-Earnings Ratio Formula, Meaning, and ExamplesDocument9 pagesP - E Ratio - Price-to-Earnings Ratio Formula, Meaning, and ExamplesACC200 MNo ratings yet

- CaseDocument4 pagesCaseRaghuveer ChandraNo ratings yet

- Instructions Docx656ad785b1c4817646Document2 pagesInstructions Docx656ad785b1c4817646danielwikwatyo701No ratings yet

- SmartPhone Data AnalysisDocument6 pagesSmartPhone Data AnalysisChakravarthy Narnindi SharadNo ratings yet

- EMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONDocument31 pagesEMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONbuffon100% (1)

- Treynor Performance MeasureDocument8 pagesTreynor Performance MeasureAshadur Rahman JahedNo ratings yet

- In FinanceDocument8 pagesIn FinanceSsahil KhanNo ratings yet

- Sharpe Treynor N JensenDocument4 pagesSharpe Treynor N JensenjustsatyaNo ratings yet

- FNCE317 No Names Assignment2 PDFDocument11 pagesFNCE317 No Names Assignment2 PDFhashir9970No ratings yet

- What Is The Price-to-Sales (P/S) Ratio?Document4 pagesWhat Is The Price-to-Sales (P/S) Ratio?Jonhmark AniñonNo ratings yet

- 303 Project Final PDFDocument7 pages303 Project Final PDFHira ParachaNo ratings yet

- Calculation of Sharpe RatioDocument23 pagesCalculation of Sharpe RatioVignesh HollaNo ratings yet

- Fast Graph Howtoknowpart2Document21 pagesFast Graph Howtoknowpart2Sww WisdomNo ratings yet

- Valuation Gordon Growth ModelDocument25 pagesValuation Gordon Growth ModelwaldyraeNo ratings yet

- Measure Your Portfolio's Performance: Cathy ParetoDocument5 pagesMeasure Your Portfolio's Performance: Cathy ParetoShivani InsanNo ratings yet

- Multifactor Models and The CapmDocument6 pagesMultifactor Models and The CapmNguyễn Dương Trọng KhôiNo ratings yet

- Forecasting MethodsDocument11 pagesForecasting MethodsIntiial Secure - ManagersNo ratings yet

- Catch Me If You Can: Improving The Scope and Accuracy of Fraud PredictionDocument54 pagesCatch Me If You Can: Improving The Scope and Accuracy of Fraud PredictionDian IslamiyatiNo ratings yet

- Portfolio Management Research AssignmentDocument14 pagesPortfolio Management Research AssignmentNoora Al ShehhiNo ratings yet

- Rank Correlation Index Spearman (RCI)Document1 pageRank Correlation Index Spearman (RCI)alexandremorenoasuarNo ratings yet

- 10YR Examination of Active Investment in Emerging Markets CA PDFDocument10 pages10YR Examination of Active Investment in Emerging Markets CA PDFTylerSVNo ratings yet

- Forecasting Stock Price With The Residual Income ModelDocument32 pagesForecasting Stock Price With The Residual Income ModelcomaixanhNo ratings yet

- ThePerformance s1 AllenDocument8 pagesThePerformance s1 AllenBilly JoshuaNo ratings yet

- CAPMDocument6 pagesCAPMAhsaan KhanNo ratings yet

- Stock Evaluation PDFDocument11 pagesStock Evaluation PDFmaxmunirNo ratings yet

- Assignment: Submitted Towards The Partial Fulfillment ofDocument16 pagesAssignment: Submitted Towards The Partial Fulfillment ofHarsh Agarwal100% (2)

- FinanceDocument3 pagesFinancekushwah_paNo ratings yet

- Calculation of BetaDocument4 pagesCalculation of BetaarmailgmNo ratings yet

- Relative or Comparable ValuationDocument21 pagesRelative or Comparable ValuationYash SankrityayanNo ratings yet

- General Presentation GuidelinesDocument3 pagesGeneral Presentation GuidelinesMD Abu Hanif ShekNo ratings yet

- The FaceBook FutureDocument24 pagesThe FaceBook FutureVJLaxmananNo ratings yet

- Measuring The Beta Using Historical Stock PricesDocument30 pagesMeasuring The Beta Using Historical Stock PricesArwok RangonNo ratings yet

- Notes About How To Treat The TopicDocument7 pagesNotes About How To Treat The TopicAuréllia GnindjouenNo ratings yet

- Driving Innovation at A Mature FirmDocument17 pagesDriving Innovation at A Mature FirmSaniyaMirzaNo ratings yet

- Beta (Finance) : From Wikipedia, The Free EncyclopediaDocument11 pagesBeta (Finance) : From Wikipedia, The Free Encyclopediashruthid894No ratings yet

- Capm & SMLDocument14 pagesCapm & SMLAbhi SharmaNo ratings yet

- Regression Analysis Application in LitigationDocument23 pagesRegression Analysis Application in Litigationkatie farrellNo ratings yet

- WP Stock Market WorthDocument5 pagesWP Stock Market WorthGeorge AllenNo ratings yet

- Private Equity Hong Kong InsightsDocument4 pagesPrivate Equity Hong Kong InsightseezmathNo ratings yet

- Palepu Books (5-2)Document8 pagesPalepu Books (5-2)ivrielNo ratings yet

- SSRN Id3646575Document26 pagesSSRN Id3646575toubon.sNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Wec11 01 Rms 20230112Document27 pagesWec11 01 Rms 20230112Shafay SheikhNo ratings yet

- Low Floor Bus DesignDocument10 pagesLow Floor Bus DesignavinitsharanNo ratings yet

- CHAPTER 18 Multiple Choice Answers With ExplanationDocument10 pagesCHAPTER 18 Multiple Choice Answers With ExplanationClint-Daniel Abenoja75% (4)

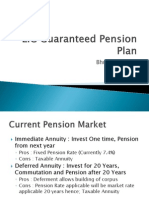

- LIC Guaranteed HNI Pension PlanDocument9 pagesLIC Guaranteed HNI Pension PlanBhushan ShethNo ratings yet

- Seven FridayDocument15 pagesSeven FridayRoshan Acharya0% (1)

- Av1.0Document1 pageAv1.0Muhammad AbuBakarNo ratings yet

- Anarchist's EconomicsDocument11 pagesAnarchist's EconomicsJoseph Winslow100% (4)

- Group 9 Design by Kate Case Analysis PDFDocument7 pagesGroup 9 Design by Kate Case Analysis PDFSIMRANNo ratings yet

- Marketing Plan RubricsDocument1 pageMarketing Plan RubricsDominic Dalton CalingNo ratings yet

- Foreign Trade Policy 2009-2014Document112 pagesForeign Trade Policy 2009-2014shruti_siNo ratings yet

- The Philippine Administrative SystemDocument10 pagesThe Philippine Administrative SystemDan YuNo ratings yet

- Salary Slip FTMO Nov-2021Document1 pageSalary Slip FTMO Nov-2021Ahsan Bin AsimNo ratings yet

- Afiq Razlan Bin Abdul Razad: Trucking/Operation JR - ExecutiveDocument2 pagesAfiq Razlan Bin Abdul Razad: Trucking/Operation JR - ExecutiveDaniel Fauzi AhmadNo ratings yet

- Top 500 Taxpayers in The Philippines 2011Document10 pagesTop 500 Taxpayers in The Philippines 2011Mykiru IsyuseroNo ratings yet

- 35X70 One City-ModelDocument1 page35X70 One City-ModelRD DaskaNo ratings yet

- 12 AdmissionDocument14 pages12 Admissionhussain balochNo ratings yet

- I. Annexure A. Questionnaire: Idbi BankDocument4 pagesI. Annexure A. Questionnaire: Idbi BankRiSHI KeSH GawaINo ratings yet

- Human Capital and Economic Growth - Robert J BarroDocument18 pagesHuman Capital and Economic Growth - Robert J BarroWalter Weber GimenezNo ratings yet

- Macedonian Diplomatic Bulletin No. 51-52Document16 pagesMacedonian Diplomatic Bulletin No. 51-52Republic of Macedonia - Ministry of Foreign AffairsNo ratings yet

- RM CasesDocument17 pagesRM CasesAman Lalit Saini (PGDM 17-19)No ratings yet

- JMR PH 3Document1 pageJMR PH 3kuldeep singh rathoreNo ratings yet

- Review of Literature On Financial Performance Analysis of Sugar Industries in IndiaDocument2 pagesReview of Literature On Financial Performance Analysis of Sugar Industries in IndiaArunkumarNo ratings yet

- Chapter 5 Notes On SalesDocument5 pagesChapter 5 Notes On SalesNikki Estores GonzalesNo ratings yet

- Chapter Twelve QuestionsDocument3 pagesChapter Twelve QuestionsabguyNo ratings yet

- Module 2 - SumsDocument4 pagesModule 2 - SumsShubakar ReddyNo ratings yet

- Land and Property Values in The U.S.: Land Prices For 46 Metro AreasDocument3 pagesLand and Property Values in The U.S.: Land Prices For 46 Metro AreasMirela Andreea GrigorasNo ratings yet

- Qrcar002 en PDFDocument2 pagesQrcar002 en PDFSeba311No ratings yet

- Chapter 2 Activity 2 1Document3 pagesChapter 2 Activity 2 1Wild RiftNo ratings yet

- Brochure MisdevDocument2 pagesBrochure MisdevyakubmindNo ratings yet

- 1930's Technocracy Movement Howard Scott and LaroucheDocument40 pages1930's Technocracy Movement Howard Scott and Larouchejasper_gregoryNo ratings yet