Professional Documents

Culture Documents

Alibaba Note

Uploaded by

ankit.h.shahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alibaba Note

Uploaded by

ankit.h.shahCopyright:

Available Formats

Alibaba: Setting the table

TaoBao focused more on small and midsized retailers offering new products for sale than to

individuals selling used items.

Alibaba, unlike eBay, does not charge a transaction fee, but instead makes its revenues primarily

from advertising.

In 2010, Alibaba opened a new front in its business with TMall, a site for a selective list of larger

retailers, playing an expanded role in the process for a larger slice of the transaction pie.

retailers pay

a deposit to Alibaba to reimburse buyers who receive counterfeit goods,

a technical service fee to cover the fixed costs of carrying the store and

a sales commission determined by transactions value.

Alibaba also developed Alipay, a third-party online payment platform, akin to Paypal, that has

grown in the last few years to dominate the Chinese online payment market.

Alibaba has been phenomenally successful both in terms of both helping online retailing find its legs

in China and becoming extremely profitable while doing so.

In 2013, the company generated almost $4 billion in operating profit on revenues of approximately $

8 billion and its rapid evolution from small start up to profitable behemoth are traced in the graph

below:

Not only have revenues accelerated over the last three years (the growth story), but the company's

profitability has surged even more. If timing is everything in going public, you can see that Alibaba

has chosen a good time.

Alibaba:

There are four steps to understanding how Alibaba has got to where it is today, where it can expect

to go in the future and the risks along the way.

1. Enter a growth market early and mold it to your strengths: In 1999, when Alibaba was founded,

online retailing in China was in its infancy. While the largest US online players (Amazon, eBay etc.)

either ignored or mishandled the market, Alibaba not only adapted to Chinese conditions but played

a key role in the evolution and growth of the Chinese e-commerce market, as China has become the

second largest online market in the world, as shown in this comparative graph from this McKinsey's

report on the market:

One key difference between the Chinese e-tailing market and US online retail is that the former has

historically been much more dependent on online marketplaces (as opposed to retailer-based online

sites) largely because of Alibaba's influence.

Future: As Chinese consumers get increasingly comfortable buying online, the expectations are that

the Chinese online market will continue to grow at high rates. In its prospectus, Alibaba estimates a

compounded growth rate of 27% a year in Chinese online commerce between 2014 and 2018, and

that number is in line with estimates made by other services. If these forecasts hold up, the online

retail market in China will become the world's largest in the next few years.

Fears: Though there are few who seem to question the China story today, the history of growth in

emerging markets is that there are always unpleasant and unexpected surprises on the pathway to

prosperity. Investing in Alibaba is an investment in continued growth in China, and any economic or

political troubles that operate as speed bumps on that growth will affect Alibaba disproportionately,

since it generates almost all of its profits in China and is dependent on growing consumer spending.

2. Differentiate and dominate: The story of how Alibaba beat eBay and Amazon is grist for strategic

story tellers, but at its core, there are three reasons why Alibaba won (and eBay lost).

The first is economic. By charging no transactions fees initially and depending entirely on modest

advertising charges, Alibaba made itself a bargain to retailers, relative to competitors.

The second is that Alibaba molded its offerings to Chinese culture and consumer behavior. The

Economists characterization of TaoBao as an online bazaar is apt, since the site is colorful, chaotic

and set up for online haggling between buyers and sellers.

Third, the site is also attuned to the fact that the Chinese retail market is splintered, with

thousands of small and mid-sized retailers who lack visibility, credibility and payment processing

skills online and TaoBao offers all of those. The visibility comes from the traffic on the site, the

credibility from Alibabas system of independent verification, paid for by sellers, and payment

processing from Alipay, In 2013, about 75% of all online retail business in China was routed through

one of Alibabas sites. To provide a measure of the sheer volume of transactions on TaoBao and

TMall, it is estimated that $5.75 billion merchandise was sold on Chinese online retail sites just on

"Singles Day" on November 11, 2013, more than two and half times what US online retailers sold on

Cyber Monday, and much of the merchandise was sold on the Alibaba sites. To get a measure of

Alibaba's market share online, take a look at the breakdown of the biggest players in the B2C

(retailers selling to customers), C2C (customers/small retailers selling to other customers), mobile

markets and mobile payments in China:

In every segment, Alibaba is not just the leader but an overwhelming one.

Future: The domination of Alibaba creates a network effect, since retailers have to go where the

customers are now, and as a consequence, they have to be on an Alibaba site to be noticed. That, in

turn, make it easier for Alibaba to attract more customers, as the overall market grows, keeping the

cost of customer acquisition low for the company.

Fears: The dark side of having as large a market share as Alibaba does is that almost all of your

future growth will have to come from the overall market growing. The size of the Chinese market is

also drawing in competitors who are willing to spend significant amounts of money to chip away at

Alibabas market share, with Jingdong (360Buy) and Tencent offering faster delivery and better

after-sale service.

3. Don't be greedy: While most online retail transactions in China go through Alibaba sites, the slice

that Alibaba keeps for itself is very small. In TaoBao, in particular, its revenues are just advertising

charges paid by retailers to list on the site, a very small portion of the total transaction value. In

TMall, Alibaba does get a larger slice of the transaction revenues because it charges a transaction

fee, but it is still only 0.5 and 1.5% of revenues. While this small share may seem like a negative, it

has proved to be one of Alibaba's competitive advantages, since it has made it difficult for

competitors to undercut it and offer better deals to customers and retailers.

Future: The question of how Alibaba's slice of overall transaction revenues will change over time, we

have to make judgments on the relative growth of TMall and TaoBao. If the former grows faster than

the latter, the slice of revenues that Alibaba keeps will increase over time.

Fear: The market, especially in B2C, is getting more competitive, as international players like Amazon

and EBay are coming back to the market, chastened by past failures, but perhaps having learned

from their mistakes and deep pockets.

4. Avoid pretense: Alibaba seems to generate these revenues with little effort (and marketing costs)

and since the company does not aspire to be a technological innovator, its R&D and development

costs are negligible. These factors result in the companys most impressive statistic: in 2013 it had a

pre-tax operating margin of almost 50% and a net profit margin of close to 40%, high even by any

standards.

Future: Alibaba's high margins are a result of the network effect (that we referenced earlier) created

by its immense market share and its limited ambitions (where it has been willing to settle for a small

portion of revenues). While there is nothing to indicate that either will change significantly in the

near future, there are signs that the company is getting more ambitious, planning large investments

in social media companies and logistics infrastructure.

Fear: Alibaba will have to start working harder (and spending more) to get consumers to continue to

use its sites and to keep advertisers on its site. For instance, Alibaba has announced plans to spend

billions in building a logistics network to allow for same-day delivery. These investments, while

necessary to preserve Alibabas success, will reduce both margins in the future and cash flows in the

near term.

Alibaba: What next?

Alibaba is exceptionally profitable and will probably remain so for the near future. To value Alibaba,

consider -

1. Revenue growth: The expected revenue growth at Alibaba will be a composite effect of three of

the four dimensions described in the last section.

Alibaba's revenues will grow at a compounded rate of 27% a year for the next five years, the same

rate as the overall online retail market in China, with losses in market share being offset by a more

diverse business model allowing it to keep a larger slice of transaction revenues. While that is a

steep climb down from last year's growth, note that it is a compounded growth rate and that I am

probably understating revenue growth in the first year or two but overstating it in the fourth and

fifth year. Starting in year 6, that revenue growth will start sliding down towards a mature stage

growth of 2.63%. With my estimates of growth, Alibaba's revenues in 2024 will be approximately

$47.6 billion. To provide perspective, that estimate is 40% lower than Amazon's revenues of $78.1

billion in 2013, about 25% below from Google's revenues of $62.3 billion in 2013 and more than five

times Facebook revenues of $8.9 billion in 2013.

2. Operating margin: The stratospheric margin enjoyed by Alibaba currently (of approximately 50%,

pre-tax) makes it extremely unlikely that the margin will increase over time and more than like that

it will decrease. In fact, while the numbers don't reflect this yet, the news stories about recent

investments that the company has had to make in logistics and technology suggest that it is not a

question of whether the margin will decline over time but by how much. While the margins at

TaoBao will remain high, the competitive nature of the B2C market will put downward pressure on

operating margins at TMall. I will be assuming that the operating margin will decline over time down

to 40% in 2024. To provide perspective again, Facebook reported an operating margin of 35.6% in

2013 and Google's pretax operating margin in 2013 was 23.4%. I would justify Alibaba's higher

operating margin by noting that Alibaba spends far less than either Facebook or Google on R&D or

technology. I also assumed that the tax holidays and credits that have kept Alibaba's effective tax

rate at close to 10% will start to fade over time, and that the tax rate will move towards the Chinese

statutory rate of 25% over time.

3. Investment: If Alibaba plans to ramp up revenues, as I have forecast, it will be called upon to make

investments in logistics, technology or social media companies. While it is difficult to be specific

about what form these investments will take, the company currently generates $1.93 in revenues for

every dollar in capital invested (based on 2013 revenues and capital invested). I assume that for

every $2 in incremental revenues in the future, Alibaba will have to invest a dollar in incremental

capital. That will still make them more efficient than the typical US company in this space, where the

ratio of sales to invested capital is closer to 1.40.

4. Cost of capital: Alibaba's business is a mix of advertising and merchandising (the transaction fees

that it charges in TMall). Using a mix of 70% advertising and 30% online retailing as my mix, I

estimated a cost of capital, in US dollar terms, of 8.84% for the company, at least for the next five

years. As the company matures and growth eases, this cost of capital will decline to 8% by 2024.

5. Cross holdings: Alibaba has made investments in other companies in recent years, primarily

because they offer technologies or products that will help Alibaba in its operations. These

investments are recorded in the balance sheet at $2,093 million and the five biggest are listed

below:

Since two of these companies, Weibo and AutoNavi, are publicly traded, I estimated the market

value of these holdings and replaced the equity value on the balance sheet with the market values

instead. The net effect was small, yielding a corrected value for the cross holdings of $2,087 million.

Finally, the liquidity clause in the Alipay agreement entitles Alibaba to 37.5% of the proceeds from

any liquidity event associated with Alipay (an IPO or a sale), with a cap of $ 6 billion and a floor of $2

billion on Alibaba's share. Alipay's earnings just from Alibaba in 2013 was $305 million and it likely

that it will keep growing over time, suggesting that the value from a liquidity event is likely to yield a

payoff to Alibaba that will be closer to $ 6 billion than $2 billion, in case of a liquidity event. That $6

billion, though, has to be adjusted for the likelihood that the entangled nature of Alipay (with

Alibaba) will make it difficult to sell the company or take it public as well as the time value of money.

Conservatively, I am adding an additional $ 3 billion to Alibaba's value to reflect both of these

factors.

The valuation: The value that I obtain for the equity is approximately $130 billion, before IPO

proceeds are considered, and in excess of $145 billion with the IPO proceeds built in.

The value of the operating assets in Alibaba, based on my assumptions, is $127.48 billion. Adding

cash ($7,876 million), the value of cross holdings in other companies ($2,087 million) and Alipay

($3,000 million), netting out debt ($6,670 million) and the value of equity options granted to

employees ($3,190 million) results in a value for equity of $130.59 billion. Finally, since this is an

initial public offering that will raise money that is going to be kept in the firm (according to the

prospectus), I added an estimated $15 billion (the rumored IPO target) to arrive at an overall equity

value of $145.59 billion. Again, working with the 2368.67 million shares outstanding, including

restricted stock units granted to employees, that works out to a value per share of $61.46/share.

AliBaba Timelines

1999 Alibaba was founded by 18 founders

2000 Raised $25 mm from Softbank, Goldman, Fidelity and other institutions

In 1999, Alibaba raised $5 million from investors including Goldman Sachs and then $20 million from

Japan's Softbank. Plans called for raising more through a stock market offering, but the Internet

bubble burst in 2000 and interest in tech shares evaporated.

October - Launched gold supplier membership to serve china exporters

2001 August

Launched International TrustPass membership to serve exporters outside China

2002 Alibaba becomes profitable

March - Launched China TrustPass membership to serve SMEs engaging in domestic China trade

July - Launched keyword services on our international marketplace

2003 TaoBao is founded in Jack Mas apartment

November - Launched TradeManager instant messaging software to enable users to communicate in

real time

on our marketplaces

2004 AliPay is launched online payment system

2005 Alibaba groups does a strategic partnership with Yahoo. Inc and takes over the operations of

Yahoo! China. Bought stake of $1 bn

March - Launched keyword bidding service on our China marketplace

2006 Alibaba group makes a strategic investment in Koubei.com

2007

January Internet based business software company Alisoft was launched

November Alibaba.com limited lists on the HongKong stock exchange. Alibaba launches AliMama,

an online advertising exchange company

March - Launched branded advertisements on our China marketplace

September - Started distributing Alisoft Export Edition in three major regions Launched premium

placement display on our China marketplace

October - Launched SME loan in collaboration with China Construction Bank and Industrial and

Commercial Bank of China

November - Successfully listed on the Main Board of the Hong Kong Stock Exchange

December - Re-launched our upgraded Alibaba Japan marketplace

opened 15 new sales and customer service offi ces in 15 new cities in China including Hong Kong

Services enhancement

started to offer all our paying members unlimited product listings and increased the number of free

users product listings. Both the level of activity and the satisfaction of our buyers and sellers

showed marked improvement in the first quarter of 2008. To accommodate this new offering, we

unified two Gold Supplier packages originally based on different product listing numbers into one

package priced at RMB50,000. At the same time, launched a special care program for both fi rst-year

Gold Supplier members and China TrustPass members through our sales, customer service and call

center staff. We believe that this offering will help new paying members use our platform better and

improve our customer retention rate

Value added services

For Gold Supplier members, started distributing a web-based business exporter CRM and order

management solution designed by our sister company, Alisoft, through their direct sales force in a

few selected regions

From November 2007, extended keyword bidding from top three ranking positions to top five

ranking positions for China TrustPass members. From the second half of 2007 onwards, China

TrustPass members can also purchase premium placement positions in various product categories.

Both of these initiatives helped increase average member spending.

According to the National Development and Reform Commission, there were over 42 million SMEs

and other private sector companies in China as of October 31, 2006

China marketplace China TrustPass members

International marketplace Gold Supplier Membership packages, Internationa trust pass packages,

Revenue recognition - Membership packages. Our paying members typically enter into one-year or

two-year membership contracts with us. We typically collect the full amount of our fees at the time

we enter into the contract, and we initially record the amounts received as customer advances. After

we enter into a membership contract, we begin producing storefronts for our paying members and

our paying members are required to go through certain third party authentication and verifi cation

procedures. If a paying member does not pass the authentication and verifi cation procedures, we

refund the amount we received under the contract less the authentication and verifi cation fees that

we pay to the third party service provider and other related expenses. After we complete our

production processes and the paying member passes the authentication and verifi cation

procedures, we display the paying members storefront in our marketplaces, and the amounts paid

by the paying member become non-refundable. When we display the paying members storefront in

our marketplaces, amounts previously recorded as customer advances are transferred to deferred

revenue, and the revenue in respect of the membership package is recognized ratably over the term

of the membership contract

As of Dec 2007 had a total employee base of 5,292 employees net increase of 1,270 in the year

Highlights of Full Year 2007

Total revenue increased by 58.6% to RMB2,162.8 million in 2007 from RMB1,363.9 million in 2006.

Gross profit increased by 67.2% to RMB1,882.6 million in 2007 from RMB1,126.2 million in 2006.

Operating profit increased by 199.6% to RMB804.3 million in 2007 from RMB268.5 million in 2006.

Operating profit margin increased to 37.2% in 2007 from 19.7% in 2006.

Net income (Profit attributable to equity owners GAAP) in 2007 increased by 340.0% to RMB967.8

million from RMB219.9 million in 2006.

Earnings per share, basic and diluted ("EPS") for 2007 was 20.41 Hong Kong cents, representing an

increase of 357.6% from 4.46 Hong Kong cents in 2006.

Key Operating Data

Total number of registered users of our combined marketplaces grew by 39.6% to 27.6 million as of

December 31, 2007 from 19.8 million as of December 31, 2006. As of December 31, 2007, we had

4.4 million registered users on our international marketplace and 23.2 million registered users on

our China marketplace.

Total number of storefronts on our marketplaces grew by 42.7% to 3.0 million in 2007 from 2.1

million in 2006. As of December 31, 2007, we had 697,563 storefronts on our international

marketplace and 2,259,283 storefronts on our China marketplace.

The number of paying members of our combined marketplaces grew by 39.5% to over 305,000 as of

December 31, 2007.

2008

April Taobao Mall, a dedicated B2C platform, is introduced to complement Taobaos C2C

marketplace

June Koubei.com is merged with China! Yahoo to form Yahoo! Koubei

September Alimama is integrated with TaoBao. Alibaba group R&D institute is established

Became a constituent stock of Hang Seng Composite Index Series and Hang Seng Freefl oat Index

Series

2009

Feb - Formed a partnership with the Taiwan External Trade Development Council to promote e-

commerce in Taiwan

Mar - Launched Ali-ADvance, a pay-for-performance keyword bidding model, on our China

marketplace

Apr - Launched a domestic wholesale platform on the China marketplace to facilitate small bulk

transactions and forge cross-platform trade relationships among members of Alibaba.com and

Taobao. Launched Japan Link on the Japan marketplace to help Chinese suppliers gain access to

Japanese buyers

May - Formed a strategic partnership with Logo Group, one of the largest software developers and

resellers in Turkey. Hosted the first Alibaba.com- Taobao Net Products Trade Fair in Guangzhou,

China

July Alisoft is merged with Alibaba R&D Institute. Launched the Newpreneur of the Year contest in

the U.S. in partnership with Inc. magazine to encourage entrepreneurship during the recession.

Celebrated our 1 millionth member in India. Launched the Global Gold Supplier membership on our

international marketplace to serve suppliers outside Greater China

August Alisoft business management software division is injected into Alibaba.com. Koubei is

injected into TaoBao as part of the Big TaoBao strategy which positions Taobao as a one stop

provider to promote wider use of ecommerce among customers

Signed multiple agreements with China Construction Bank to expand our loan-assistance program,

Ali-Loan, within Chinas Zhejiang Province and to Shanghai

September Alibaba cloud computing is established in conjunction with Alibaba groups 10

th

anniversary. Completed the acquisition of the business management software division of Alisoft to

further the goal of transforming from Meet at Alibaba to Work at Alibaba

Beta-launched AliExpress, a wholesale platform on our international marketplace designed to

facilitate small bulk transactions online

Oct - Established Ali-Institute as a dedicated division to better cultivate e-commerce talent for

Chinese small businesses

Nov - Hosted the Export to China, Export to the World 2009- 2010 mega sourcing fair in Seoul, Korea

our first offl ine business matching event outside China in partnership with the Korea

International Trade Association

September - Hosted the third Alibaba.com- Taobao Net Products Trade Fair in Chengdu, China

Completed the acquisition of HiChina to enhance our ability to provide additional Internet

infrastructure services to small businesses in China

In 2009, we started to deliver our three acquisition strategies: investment in non-overlapping user or

customer base, investment in proven e-commerce applications and investment in technology.

List of value added services offered

Available Value-Added Services

Ali-Loan

Buyer GPS

Keyword Purchase

Premium Placement

Virtual Showroom

Ali-ADvance NEW

AliExpress NEW

Ali-Institute NEW

Business Management Software (SaaS) NEW

Business Network Service (Renmaitong) NEW

China Wholesale Platform NEW

Japan Link NEW

Mobile China TrustPass NEW

Online Translation NEW

Traffic Analyzer NEW

Winport 2.0 NEW

Key value drivers

o accelerated paying member growth

o increased revenue driven by more paying members and more VAS usage

o expanded economies of scale and margin enhancement

As of Dec 09, had around 11,716 employees

2010

March Alibaba group creates a cross business team consisting of senior managers from Taobao,

Alipay, Alibaba cloud computing and china Yahoo! To execute a full scale roll out of the bIg TaoBao

strategy

November Alibaba group launches TMall.com

2011

January Announces to build a network of warehouses across china and together with its partners,

drive major investment in logistics development in the country

Introduced an upgraded China Gold Supplier membership package (CGS 2011 edition) to replace

the original Gold Supplier Starter Pack

Introduced the Factory Audit service to give Gold Supplier members the option of being inspected

by a third-party company onsite to verify their trading and production capabilities

Launched Fulfillment by AliExpress, a logistics and shipping service provided by a third-party

partner for buyers using AliExpress

Beta-launched Liang Wu Xian (Infinite Quality; previously called Wu Ming Liang Pin or White-Label

Mall) to offer quality wholesale supplier members direct access to the massive consumer base of

Taobao Marketplace

March Alibaba reports $220 mm in profit in 2010 Introduced Ali-ADvance, a pay-for-performance

keyword bidding system, on our international marketplace

Kicked off a one-year program named Emerging Entrepreneur Initiative in California, U.S., through

which we educated more than 800 students in higher education with guidance, skills and

entrepreneurial know-how to start their own businesses and participate successfully in the

knowledge-based, networked economy

Organized an Alibaba.com-Taobao Net Products Trade Fair in Xiamen, China

April - Launched AliExpress Premier Channel to allow U.S. retailers to conveniently source top-quality

authentic Chinese-designed products

May Alibaba obtains key online payment license in China

June Alibaba helps Japanese firms enter the Chinese market through taobao mall,cutting through

red tapes and reducing waiting time by two thirds

Taobao launches one pager women apparel aggregator site

TaoBao splits into 3 separate companies

1. TaoBao marketplace C2C

2. TaoBao Mall B2C

3. eTao a product search engine designed to help consumers find goods and services to help

all e-tailers

Organized our first offline sourcing event in Mumbai, India, to promote products from our Indian

Gold Supplier members

July - Launched Inspection Service, an online solution designed to match small buyers on our

international marketplace with affordable and reliable product inspection services for orders from

anywhere in China

Launched a service to offer AliExpress buyers a cash payment option via Western Union

Organized an Alibaba.com-Taobao Net Products Trade Fair in Guangzhou, China

August - Upgraded Customized Sourcing, a service that allows buyers on our international

marketplace to efficiently identify the right suppliers for their specific requests, providing buyers

with an enhanced channel for sourcing novel, hard-to-find or complex products

Organized our first offline sourcing event in Hong Kong to promote products from our Hong Kong

Gold Supplier members

September - Expanded and enhanced the multi-language websites of our international marketplace

to cover a total of nine non-English foreign languages, providing more buyers with a convenient

channel to navigate our website, look for products and interact with suppliers in their native tongues

Co-hosted, with Alibaba Group, our annual e-commerce summit AliFest in Hangzhou, China, which

comprised the Global Netrepreneur of the Year award ceremony and an Alibaba.com-Taobao Net

Products Trade Fair

October - Introduced Onsite Check, a verification inspection that requires Alibaba.com staff to visit

our Gold Supplier members onsite, as an additional measure to confirm their authenticity

Organized an offline sourcing event in Gurgaon, India, to promote products from our Indian Gold

Supplier members

November - Launched the Assurance Plus program to make the buyer experience on AliExpress safer

and easier, and to raise sellers trustworthiness

December - Introduced the third-party onsite inspection program, Onsite Check, on our China

marketplace to confirm the authenticity of our China TrustPass members

As of Dec 2011, had 12,878 employees

2012 Tmall.com changes its Chinese name to strengthen its positioning as a source of high-quality,

brand-name products. (January)

Alibaba.com delists from the Hong Kong Stock Exchange. (June)

Alibaba Group upgrades its existing subsidiaries operations into one of the seven business groups:

Alibaba International Business Operations, Alibaba Small Business Operations, Taobao Marketplace,

Tmall.com, Juhuasuan, eTao and Alibaba Cloud Computing. (July)

Alibaba Group completes the initial repurchase of shares from Yahoo! and restructured its

relationship with the latter. (September)

Taobao Marketplace and Tmall.com reach a combined GMV of RMB1 trillion for the period January

to November 2012. (November)

2013 Alibaba Cloud Computing merges with HiChina. (January)

Alibaba Group is reorganized into 25 business units to better adapt to Chinas fast-growing e-

commerce environment. (January)

Key points

1. Few Chinese used card payments so they started AliPay

2. Worked with logistics companies to improve reliability

3. Held regular trade shows to persuade merchants to come online

How Alibaba overcame threat from Ebay

1. Launched TaoBao at the same time when Ebay acquired Each net in China for $150m

a. Through this investment Ebay captured around 85% share of the chinese online

market

2. In response, Alibaba invested 1bn yuan in TaoBao

3. Aggressive marketing

4. Free for all business model (free for sellers for the 1

st

3 years)

5. Held regular roadshows/events to onbaord merchants

6. Chinese consumer specific webportal and category classification

7. Has more listings for sales rather than auctions (Ebay had 40% auctions)

8. Targeted Chinese mobile savvy customers by introducing instant messaging + voice mail

services for buyers and sellers

9. High customer satisfaction - According to iResearch, a Beijing-based research firm, the user

satisfaction level was 77 percent for Taobao versus 62 percent for eBay EachNet

10. By March 2006, Taobao had outpaced eBay EachNet and became the leader in Chinas

consumer-to-consumer (C2C) market, with 67 percent market share in terms of users, while

eBay EachNet had only 29 percent market share

11. And in Dec 2006 Ebay changed its strategy and partnered with a wireless value-added

multimedia services company Tom Online

12. Ebay had a team which did not understand the Chinese consumer well they had a

German manager as China operations head and a US CTO (Top management did not

understand the local market well)

Investments

1. Lyft - Lyft is an app that lets its users request friendly, safe, affordable transportation.

$250M / Series D with 5 other investors

Apr 2, 2014 - Series D Details

2. Tango - Tango is a social networking app that allows users to play games, send text

messages, and make

$280M / Series D

Mar 19, 2014 - Series D Details

3. ByeCity

Byecity.com is a service agency, mainly providing O2O (Online to Offline) service of outbound..

$20M / Series B with 1 other investor

Mar 13, 2014 - Series B Details

4. 1stdibs - 1stdibs, an online marketplace, connects dealers to consumers interested in

antiques, design, fine

$15M / Series C

Jan 24, 2014 - Series C Details

5. Quixey - Quixey is an app search engine enabling individuals to find apps that best suit their

need.

$50M / Series C with 6 other investors

Oct 3, 2013 - Series C Details

6. ShopRunner - ShopRunner is a members-only online shopping service that offers consumer-

friendly and free

$75M / Private Equity

Aug 19, 2013 - Private Equity Round Details

7. Sina Weibo - Sina Weibo is a Chinese microblogging platform.

$586M / Private Equity

Apr 29, 2013 - Private Equity Round Details

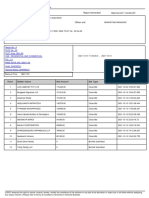

Evolution Financial + Key Operating metrics

Particulars 2004 2005 2006 2007 2008 2009 2010 2011

Revenue

(RMB '000)

4,00,000

7,50,000

13,63,862

21,62,757

30,04,000

38,74,700

55,57,600

64,16,900

Registered

users mm 6 10 19.8 27.6 38 48 62 76

International

marketplace

mm 1 2 3.1 4.4 7.9 11.6 18 25

China

marketplace

mm 5 8 16.7 23.2 30 36 44 51

Storefronts

mm 0.7 1.2 2 3 4.6 6.8 8.5 10

International

marketplace

mm 0.2 0.2 0.5 0.7 0.96 1.4 1.7 2.2

China

marketplace

mm 0.5 1 1.5 2.3 3.6 5.4 6.8 7.8

Paying

members

MM 0.08 0.15 0.2 0.3 0.4 0.6 0.8 0.7

Gold Supplier

members

18,682

27,384

43,028

96,110

1,21,274

99,005

International

TrustPass

members

10,843

12,152

16,136

17,786

10,434

7,558

China

TrustPass

members

1,89,573

2,66,009

3,72,867

5,01,316

6,77,654

6,58,800

TMall

Tmall.com, formerly Taobao Mall, is a Chinese-language website for business-to-consumer (B2C)

online retail, spun off from Taobao, operated in the People's Republic of China by Alibaba Group. It is

a platform for local Chinese and international businesses to sell quality, brand name goods to

consumers in mainland China, Hong Kong, Macau and Taiwan.

Tmall.com was first introduced by Taobao in April 2008 as Taobao Mall, a dedicated B2C platform

within its consumer e-commerce website.

In November 2010, Taobao Mall introduced an independent web domain, tmall.com, to differentiate

listings by its merchants, who are either brand owners or authorized distributors, from Taobaos C2C

merchants.

Meanwhile, it kicked off a US$30 million advertising campaign to raise brand awareness among

consumers. It also announced an enhanced focus on product verticals and improvements in

shopping experience.

In June 2011, Alibaba Group Chairman and CEO Jack Ma announced a major restructuring of Taobao

through an internal email.

It was reorganized into three separate companies.

As a result, Tmall.com became an independent business under Alibaba Group. The other two

businesses that resulted from the reorganization are Taobao Marketplace (a C2C marketplace) and

eTao (a shopping search engine).

The move was said to be necessary for Taobao to meet competitive threats that emerged in the

past two years during which the Internet and e-commerce landscape has changed dramatically.

In October 2011, Tmall.com experienced two successive waves of online rioting since it significantly

increased fees on online vendors. The service fees raised from 6,000 yuan ($940) to 60,000 yuan

($9,400) a year, and a compulsory fixed sum deposit gone from 10,000 yuan ($1,570) to up to

150,000 yuan ($23,500).

According to Tmall.com, the price increase was intended to help weed out merchants that are too

often a source of fakes, shoddy products and poor customer service. Stores that earn top ratings for

service and quality from customers and high sales volumes are entitled to partial or full refunds.

Tmall occupied 51.3% Chinese B2C market share in Q1 2013.

Brands that currently have stores on Tmall.com include P&G, Adidas, UNIQLO, GAP, Nine West,

Reebok, ECCO, Ray-Ban, New Balance, Umbro, Lenovo, Dell, Nokia, Philips, Samsung, Logitech and

Lipton.

Alibaba launched Tmall in 2008 as an alternative to sister shopping site Taobao, where anybody with

a Chinese identification card can peddle wares. Taobao hosts seven million sellers and has been

plagued by counterfeiting, which Alibaba Chairman Jack Ma has called a "cancer."

In order to open a storefront on Tmall, merchants must hold a valid business license, provide

information about the brand and products, and pay a deposit.

Tmall has ballooned in size, with more than 70,000 sellers that control 45% of online business-to-

consumer retail sales in China, according to Euromonitor International.

Over the past three years, the total value of sales through Tmall surged nearly tenfold to 273.7

billion yuan ($44.2 billion), Euromonitor estimates.

For most kinds of products, Tmall takes a cut of between 2% and 5% of each transaction.

Alibaba doesn't disclose the value of sales on Tmall.

Plenty of foreign brands continue to open shops on the site: Tmall hosts more than 2,000 now,

including Nike, Gap and Samsung. Apple Inc., AAPL -0.53% known for its tight control over sales

channels, opened a Tmall storefront in January

One difficulty for many foreign brands on Tmall is that Chinese consumers turn to online sites

which may source from overseas for cheaper goods than they can get in stores at home, where

prices are boosted by import tariffs and fees

While shoppers in the West also expect deals online, Tmall's dominance in China means more

merchants are competing on the same platform to offer the best deal. Tmall partners with

merchants on promotions during the yearin which goods are offered at as much as 60% off the

original pricebut "participation is voluntary by brands,"

Metrics

Tmall.com currently features more than 70,000 international and Chinese brands from more than

50,000 merchants and serves more than 180 million buyers.

Tmall.com ranked number one among all Chinese B2C retail websites for 2010 in terms of

transaction volume, with a gross merchandise volume of RMB30 billion about three times the

amount facilitated by 360buy, its closest competitor.

The site accounts for a 47.6% share of the B2C online retail market in China, followed by 16.2% of

360buy and 4.8% of Joyo Amazon.

According to Alexa, as of October 2013 Tmall.com was the 47th most visited website globally and the

8th most visited site in China.

Features

Alipay, an escrow-based online payment platform owned by Alibaba Group, is the preferred

payment solution for transactions on Tmall.com.

As on Taobao Marketplace, the C2C e-commerce platform under Alibaba Group, buyers and sellers

can communicate prior to the purchase through AliWangWang, its proprietary embedded instant

messaging program. It has become a habit among Chinese online shoppers to chat with the sellers

or their customer service team through AliWangWang to inquire about products, engage in

bargaining, etc. prior to purchase.

Feb 2014 - Data

Chinese e-commerce giant Alibaba Group recently launched Tmall International, a site dedicated for

business entities outside China, where overseas brands and merchants can sell their products

directly to Chinese online shoppers.

The newly launched international platform provides genuine products that are produced or sold in

overseas markets. In addition, the platform offers a direct delivery service. Merchants on the

platform also offer Chinese language customer service through Alibabas instant messaging platform

Alitalk, as well as 72-hour shipping, and product return facilities in mainland China.

More than 140 foreign merchants from the U.S., U.K., Australia, New Zealand, Japan, South Korea,

etc. have settled on the platform, including B2C sites like Bonjour, Strawberrynet, Etmall, Kenko, as

well as premium brands, such as Anna Sui and NYR. To prepare for the launch, Tmall International

has been recruiting international businesses since July last year.

International merchants who want to join the platform have to pay an initial deposit of $25,000 and

a yearly fee based on the types of goods they sell. TMall International will also collect a service fee of

either 5% or 6% per transaction, depending on the product, according the requirements released by

the site.

At the current stage, online shoppers can purchase baby products, healthcare products, beauty

products and apparel on the site.

Tmall International will run independently as a subsidiary of Alibaba, affiliating to the newly

established International B2C Department, which also oversees Alibabas global shopping arm

AliExpress and Taobao Overseas, a unit focused on Southeast Asian market.

Chinese online shoppers demands to purchase cheaper and better products outside China surged in

recent years, mainly focused on the fields of infant formula and maternal products, foreign-branded

cosmetics and luxury goods, among others.

The market size for Chinese online Daigou industry, which means buying via overseas contacts

through Taobao or other professional buyer agencies and websites, surpassed 70 billion yuan

($11.49 billion) in 2013, according to data released by Alibaba.

REACHING CHINA'S CONSUMERS WITH TMALL

TMALL AS A SALES CHANNEL

TMall now has over 70,000 brands in 50,000 stores and is attractive to brands for a variety of

reasons:

By using Taobaos infrastructure and payment system Alipay, users are familiar with all services and

trust the mechanism they have been using over the years.

Unlike Taobao, TMall only accepts verified stores , so theres a guarantee that products sold online

are real, which builds consumers trust and, in turn, conversion rates.

Taobao pushes TMall stores actively over and above other stores, which results in more and higher

converting traffic.

TMall launched a standalone iPhone app at the end of April and it has already received 1855 reviews

with an average rating of 4.5 stars Android and iPad versions are in the works.

The annual Singles Day sale (an event held on 11th November, celebrating people who are still living

the single life) shows just how much TMall has grown in just three years, with sales amounting to

RMB50 million, RMB936 million and RMB3.36 billion in the years 2009, 2010 and 2011 respectively.

TERMS AND FEES

Besides having impressive sales figures, TMall is a straightforward way to reach out to consumers

living far away from those tier one cities where foreign brands usually establish a physical presence

on entering the market. However, setting up a TMall shop without understanding the Chinese

language or having a trusted local partner can be challenging heres a breakdown of the main facts.

TMall has three different store formats:

Flagship Store only brands with a trademark (either or ) can open flagship stores. The owner of

the store must be formal representative of the brand or hold exclusive authorization documents for

setting up a TMall flagship store provided by the formal representative of the brand.

Specialty Store merchants with brand authorization documents giving them distribution rights to

sell products without geographical restrictions in the Greater China region are eligible to open this

store format.

Monopolized Store merchants with two or more brands within one of TMalls product

categories can open this type of store. Only one monopolized store can be held per merchant in

one product category.

Costs depend on the type of shop you opt for, but within this there are other factors which define

the cost structure. In general, TMall costs can be broken down in three categories: deposit, technical

service fee and sales commission.

Deposit this is for reimbursing consumers after a TMall shop has breached the Taobao Mall

Service Agreement and has sold counterfeit products. The deposit can be RMB50,000, RMB100,000

or RMB150,000 based on the chosen store format and the trademark status.

Technical service fee this is an annual fee that varies according to product category and either

amounts to RMB30,000 or RMB60,000. The merchant has the chance to redeem either half or the

full service fee, if they reach TMalls predefined sales targets for the product.

Sales commission for every transaction made, TMall keeps 5% of the sales value as commission.

These key points should provide a good starting point for brands planning to enter the TMall sales

platform. However, the dozens of product categories and sub-categories will require more in-depth

planning to accurately assess the costs. Heres a simple example, as a basic point of reference.

A mens fashion brand aims to open a flagship store on TMall and has the trademark. The set-up

costs are:

Deposit of RMB100,000 for a flagship store with a trademark holder

Technical service fee of RMB60,000 per year- 50% of the fee will be redeemed by reaching

RMB360,000 in sales and 100% after reaching RMB1.2 million in sales

Every transaction is subject to 5% sales commission, automatically deducted by TMall

LONG-TERM PLANNING OVER SHORT-TERM TESTING

TMall has quickly developed to become a sales platform that consumers all over China refer to when

researching and eventually buying branded products online. It provides an additional sales channel

for brands that want to target consumers outside of the cities where they have a physical presence.

With nationwide broadband coverage still developing with room for improvement, TMall should not

be seen as a temporary addition, but rather as a long-term channel that needs a strategic approach

to meet consumer demand and build a successful, long-term brand presence in the Peoples

Republic of China.

AliBaba

TaoBao

Metrics

Taobao Marketplace had more than 5 million registered users as of June 2013 and hosted more than

80 million product listings.

It facilitated approximately RMB 200 billion in gross merchandise volume in 2009. In September

2013, Taobao ranked 12th overall in Alexa's internet rankings.

For the year ending March 31, 2013, the combined gross merchandise volume (GMV) of Taobao and

Tmall.com combined exceeded RMB 1 trillion.

Overview -

Taobao Marketplace (formerly "Taobao") was launched in May 2003 by Alibaba after eBay acquired

Eachnet, Chinas online auction leader at the time, for USD 180 million and became a major player in

the Chinese consumer e-commerce market.

To counter eBays expansion, Taobao offered free listings to sellers and introduced website features

designed to act in local consumers' best interests, such as instant messaging for facilitating buyer-

seller communication and an escrow-based payment tool, Alipay.

As a result, Taobao became mainland China's undisputed market leader within two years.

Its market share surged from 8% to 59% between 2003 and 2005, while eBay China plunged from

79% to 36%. EBay shut down its China site in 2006.

In April 2008, Taobao introduced a newly dedicated B2C platform called Taobao Mall to complement

its C2C marketplace.

Taobao Mall established itself as the destination for quality brand name goods for Chinese

consumers.

Taobao Mall launched an independent web domain, Tmall.com, and enhanced its focus on product

verticals and improvements in shopping experience in November 2010.

It became an independent business in June 2011 and changed its Chinese name to Tian Mao (Tmall)

in January 2012. As of October 2013 it was the eighth most visited web site in China.

In 2008, Taobao fueled the overall growth of the Chinese online shopping industry through

execution of the Big Taobao strategy with the aim of becoming a provider of e-commerce

infrastructure services for all e-commerce market participants.

In October 2010, Taobao beta launched eTao as an independent searching engine for online

shopping, providing product and merchant information from a number of major consumer e-

commerce websites in China.

Online shoppers can use the site to compare prices from different sellers and identify products to

buy. According to the Alibaba Group web site, eTao offers products from Amazon China, Dangdang,

Gome, Yihaodian, Nike China and Vancl, as well as Taobao and Tmall.

In May 2011, Alibaba Group opened a retail store in Beijing under the Taobao Mall brand. The five-

story 25,000sqm Taobao Mall iFengChao Furniture Showroom opened as a complement to their

online stores.

In June 2011, Alibaba Group Executive Chairman and former CEO Jack Ma announced that Taobao

would split into three different companies: Taobao Marketplace (a C2C platform), Tmall.com (a B2C

platform; then called Taobao Mall), and eTao (a search engine for online shopping). The move was

said to be necessary for Taobao to meet competitive threats that emerged in the past two years

during which the Internet and e-commerce landscape has changed dramatically.

From 2012 onward, Taobao began to accept international Visa and MasterCard credit cards; prior,

only domestic banks were supported by AliPay.

On April 29, 2013, Alibaba announced an investment of USD 586 million in Sina Weibo. According to

Reuters, the deal should drive more web traffic to Alibaba's Taobao Marketplace, China's largest e-

commerce website with a consumer focus.

On August 1, 2013, Alibaba launched Weibo for Taobao, which allows users to link Sina Weibo

accounts with Taobao accounts.

With over 800 million items listed on one of the worlds top 10 Alexa ranked websites

Alibaba B2B platform 1688.com achieved daily transaction of 300 million yuan (USD 49.1 million)

after a years transition to online wholesale transaction platform.

1688.com used to be an information platform, now it has been upgraded to a transaction platform

within three years. In 2013, 1688.com integrated 1688 suppliers information in Taobao search,

launched huopin (a wholesale group buy channel), taogongchang (an online manufacturing factories

platform offering suppliers information for Taobao sellers ) and taohuoyuan (an online procurement

platform specified for Taobao sellers). 1688 grew to the top choice of Taobao sellers for

procurement.

In March 2013, 1688 daily transaction was around 30 million yuan (USD 4.91 million). By the end of

2013, it had increased tenfold. With the population of internet, online B2B grew rapidly in 2013. In

the future, the challenge of online B2B lies in replacing the security of offline B2B transactions which

is what Alibaba plans to solve.

You might also like

- Nestle Case 2009Document43 pagesNestle Case 2009Wongsphat AmnuayphanNo ratings yet

- Solution Manual For Microeconomics 4th Edition by BesankoDocument21 pagesSolution Manual For Microeconomics 4th Edition by Besankoa28978213333% (3)

- Group Assignment - Alibaba Case StudyDocument10 pagesGroup Assignment - Alibaba Case StudyKleinNo ratings yet

- Islamic Banking at Allied Islamic BankDocument36 pagesIslamic Banking at Allied Islamic BankArsalan ZuberiNo ratings yet

- Case Study-AmazonDocument6 pagesCase Study-AmazonLutfullahNo ratings yet

- Socio-Cultural and Political-Legal Barriers For Amazon in ChinaDocument5 pagesSocio-Cultural and Political-Legal Barriers For Amazon in Chinaphuc hauNo ratings yet

- KKKDocument4 pagesKKKMax Suyatno SamsirNo ratings yet

- Amazon SWOT Analysis and StrategiesDocument9 pagesAmazon SWOT Analysis and StrategiesUKNo ratings yet

- MTN MobileMoneyDocument22 pagesMTN MobileMoneyAnthony AndersonNo ratings yet

- Comparing Deposit Products to Expand EBL's Customer BaseDocument14 pagesComparing Deposit Products to Expand EBL's Customer BaseGanesh TiwariNo ratings yet

- Internal Audit & E-Commerce Industry Speaker - CA Kartik RadiaDocument23 pagesInternal Audit & E-Commerce Industry Speaker - CA Kartik Radiaafzallodhi736No ratings yet

- T1 Promoters and Pre Incorporation Contract AnswerDocument9 pagesT1 Promoters and Pre Incorporation Contract AnswerEmy TanNo ratings yet

- E Bay Acquisition of Skype: Group 2Document24 pagesE Bay Acquisition of Skype: Group 207anshuman0% (1)

- Strategy - Fromulation - of - Alibaba - T.P. DabareDocument23 pagesStrategy - Fromulation - of - Alibaba - T.P. Dabarepraba DabareNo ratings yet

- Alibaba ReportDocument16 pagesAlibaba ReportSushwet Amatya100% (1)

- Alibaba, A Trailblazing Chinese Internet Giant, Will Soon Go PublicDocument24 pagesAlibaba, A Trailblazing Chinese Internet Giant, Will Soon Go PublicHui XiuNo ratings yet

- Homework 1Document12 pagesHomework 1rabiyamNo ratings yet

- Alibaba Case Study Ecommerece Assignment1Document7 pagesAlibaba Case Study Ecommerece Assignment1abdullah naeemNo ratings yet

- E Business StrategyDocument10 pagesE Business StrategyAnooja Sajeev100% (1)

- Alibaba - Case ReportDocument13 pagesAlibaba - Case ReportHelder JorgeNo ratings yet

- Alibaba Group: China's Amazon Rival and Global E-Commerce LeaderDocument13 pagesAlibaba Group: China's Amazon Rival and Global E-Commerce LeaderHazem Albassam100% (1)

- 8 Alibaba (Final)Document40 pages8 Alibaba (Final)PraNo ratings yet

- Alibaba's Bonds Dilemma PDFDocument19 pagesAlibaba's Bonds Dilemma PDFRahul Kashyap100% (1)

- Alibaba Group Case StudyDocument13 pagesAlibaba Group Case StudyGina MercadoNo ratings yet

- Alibaba Alitrip Innovation & StrategyDocument5 pagesAlibaba Alitrip Innovation & StrategyprogoNo ratings yet

- Alibaba Case StudyDocument17 pagesAlibaba Case StudyDeshna KocharNo ratings yet

- Alibaba Company AnalysisDocument47 pagesAlibaba Company AnalysisAsh100% (1)

- Alibaba Group Social ResponsibilitiesDocument5 pagesAlibaba Group Social ResponsibilitiesС. Бат-ЭрдэнэNo ratings yet

- AlibabaDocument27 pagesAlibabadigvijay gupta100% (2)

- Kshitij Negi Semester 4 (Csit)Document10 pagesKshitij Negi Semester 4 (Csit)Kshitij NegiNo ratings yet

- Alibaba Plan 2022Document33 pagesAlibaba Plan 2022Juan IbáñezNo ratings yet

- 3 AlibabaDocument24 pages3 AlibabaADAM LOW0% (1)

- Ebay and AlibabaDocument49 pagesEbay and AlibabaYeung Yeu Kwen100% (2)

- ALIBABA GroupDocument25 pagesALIBABA GrouptouficNo ratings yet

- Assignment - A Strategic Analysis of Apple CorporationDocument17 pagesAssignment - A Strategic Analysis of Apple CorporationsbhamidNo ratings yet

- Amazon Revenue ModelDocument12 pagesAmazon Revenue ModelAnkitha KuriakoseNo ratings yet

- Alibaba PresentationDocument24 pagesAlibaba PresentationodsoqweqweNo ratings yet

- Presentation of Ebay Company: Realized By: Hana Module: E-CommerceDocument4 pagesPresentation of Ebay Company: Realized By: Hana Module: E-CommerceHana100% (1)

- Irene Torres - Disa Riliana Pakpahan - Shakti Shikhar Mim Ib Fi - Ie Business SchoolDocument17 pagesIrene Torres - Disa Riliana Pakpahan - Shakti Shikhar Mim Ib Fi - Ie Business SchoolShakti ShikharNo ratings yet

- E-Commerce IndustryDocument16 pagesE-Commerce IndustryTUSHARNo ratings yet

- Rise of E-Commerce-The Indian Scenario: The Bhawanipur Education Society CollegeDocument41 pagesRise of E-Commerce-The Indian Scenario: The Bhawanipur Education Society CollegeVishnu sharmaNo ratings yet

- Amazon: HistoryDocument5 pagesAmazon: Historyhadia mushtaqNo ratings yet

- Case Study Analysis-Alibaba Competing in China & Beyond-21!6!10Document61 pagesCase Study Analysis-Alibaba Competing in China & Beyond-21!6!10Gaurav GuptaNo ratings yet

- AlibabaDocument35 pagesAlibabaLucyChanNo ratings yet

- BKash LimitedDocument18 pagesBKash Limitedcrashing nishanNo ratings yet

- Group 3 K Sree Manojna Sejal Malhotra Vishakha Rai Parul TusharDocument22 pagesGroup 3 K Sree Manojna Sejal Malhotra Vishakha Rai Parul TusharVishakha RaiNo ratings yet

- A Report On Logistics & Supply Chain Management of Alibaba GroupDocument34 pagesA Report On Logistics & Supply Chain Management of Alibaba Groupshubham savantNo ratings yet

- Ali PayDocument4 pagesAli PayAhmed GulNo ratings yet

- Thesis On Alibaba GroupDocument16 pagesThesis On Alibaba GroupCheka 110No ratings yet

- AnalysisDocument12 pagesAnalysisWilbert WilbertNo ratings yet

- Amazon's Strategic Marketing PlanDocument8 pagesAmazon's Strategic Marketing PlanmartinNo ratings yet

- INDIAN INSTITUTE OF TECHNOLOGY ROORKEE PRESENTS: AMAZON.COM: A JOURNEY TO SUCCESSDocument43 pagesINDIAN INSTITUTE OF TECHNOLOGY ROORKEE PRESENTS: AMAZON.COM: A JOURNEY TO SUCCESSruby panjiyarNo ratings yet

- Alibaba Group Strategic Management Group AssignmentDocument21 pagesAlibaba Group Strategic Management Group AssignmentAhmed DahiNo ratings yet

- Alibaba Numbers Could Be Fake, Bronte Capital Hedge Fund Manager Says - FortuneDocument18 pagesAlibaba Numbers Could Be Fake, Bronte Capital Hedge Fund Manager Says - Fortunebhaskar.jain20021814No ratings yet

- Amazon in The Global Market.Document12 pagesAmazon in The Global Market.rodolfoNo ratings yet

- Ali Case 1Document6 pagesAli Case 1eric100% (2)

- Challenging Status Quo: Jack Ma's Risk-Taking & Alibaba's SuccessDocument3 pagesChallenging Status Quo: Jack Ma's Risk-Taking & Alibaba's SuccessNur Atikah67% (3)

- Competitors of KarvyDocument23 pagesCompetitors of Karvy123_don100% (2)

- Mis of State Bank of IndiaDocument13 pagesMis of State Bank of IndiaSushil Goyal100% (1)

- A Store Near Me: The online presence that outranks, outshines and outlasts the competition.From EverandA Store Near Me: The online presence that outranks, outshines and outlasts the competition.No ratings yet

- Senikini#06Document24 pagesSenikini#06senikini100% (1)

- Pag Ibig Foreclosed Properties MAY 17Document9 pagesPag Ibig Foreclosed Properties MAY 17ramszlaiNo ratings yet

- Homework 5 - MGMT 335Document1 pageHomework 5 - MGMT 335julettagabrielyanNo ratings yet

- Frank Sciame & Richard AndersonDocument3 pagesFrank Sciame & Richard AndersondfreedlanderNo ratings yet

- Ebay Case StudyDocument8 pagesEbay Case StudyVishal Dixit100% (1)

- CIDCO Auction Report for Plot 26 in Ghanoli SchemeDocument1 pageCIDCO Auction Report for Plot 26 in Ghanoli SchemeVicky GautamNo ratings yet

- Sandvik Online Auction GuideDocument13 pagesSandvik Online Auction GuideRajat AgarwalNo ratings yet

- 1996 1997 Toyota RS3000 Alarm Keyless Entry Remote FOB BAB237131 022 Black Case - EBayDocument3 pages1996 1997 Toyota RS3000 Alarm Keyless Entry Remote FOB BAB237131 022 Black Case - EBayaseppopy0% (1)

- "Civil Works For The Upgrading Section From 7.165 KM To 16.95km of Milloshevë - Mitrovicë M2 Main Road Project, LOT 1" Financing No.: ZKS-0002Document2 pages"Civil Works For The Upgrading Section From 7.165 KM To 16.95km of Milloshevë - Mitrovicë M2 Main Road Project, LOT 1" Financing No.: ZKS-0002GentianNo ratings yet

- Maharashtra State Power Generation Co. Ltd. Tender RFX: 3000035577 Section: Ifb Rev: 00 Invitation For Bids (Ifb)Document17 pagesMaharashtra State Power Generation Co. Ltd. Tender RFX: 3000035577 Section: Ifb Rev: 00 Invitation For Bids (Ifb)Pravin PatilNo ratings yet

- Strategic Management A Case Study On Virtual OrganisationDocument49 pagesStrategic Management A Case Study On Virtual OrganisationAlfiya ShaikhNo ratings yet

- Tamil Nadu Value Added Tax Act, 2006 PDFDocument83 pagesTamil Nadu Value Added Tax Act, 2006 PDFLatest Laws TeamNo ratings yet

- Cbi-Annexure - II & IIIDocument2 pagesCbi-Annexure - II & IIILokesh KonganapalleNo ratings yet

- Public Announcement E-Auction Jan 2021 - MTPCLDocument2 pagesPublic Announcement E-Auction Jan 2021 - MTPCLGopi RkNo ratings yet

- Bid Opening Record (Muchulka)Document2 pagesBid Opening Record (Muchulka)nitish JhaNo ratings yet

- Title: Wong Vs IacDocument2 pagesTitle: Wong Vs IacQuiquiNo ratings yet

- Law Notes: Essentials of a Valid ContractDocument302 pagesLaw Notes: Essentials of a Valid ContractNeha Kalra100% (3)

- viewNitPdf 3919331Document4 pagesviewNitPdf 3919331riya paulNo ratings yet

- Bazerman CarrollDocument48 pagesBazerman CarrollNina KakesNo ratings yet

- 2013 PA Deer Farmers Auction Catalog Eric Pinkston Matt Kirchner Indiana, PADocument88 pages2013 PA Deer Farmers Auction Catalog Eric Pinkston Matt Kirchner Indiana, PAespn1239No ratings yet

- E-Auction Sale Notice For UPLOADINGDocument4 pagesE-Auction Sale Notice For UPLOADINGKiran ShindeNo ratings yet

- 2 G Spectrum ScamDocument23 pages2 G Spectrum Scamsimmishweta100% (1)

- Bidder Application FormDocument3 pagesBidder Application FormAbhishek MNNo ratings yet

- Presentation On Reverse Auctioning in GAILDocument20 pagesPresentation On Reverse Auctioning in GAILArun VermaNo ratings yet

- Business in GhanaDocument4 pagesBusiness in GhanaSamuelNo ratings yet

- Sydney PDFDocument21 pagesSydney PDFJake345678No ratings yet

- FCL 2W Pan India Online Auction EventDocument64 pagesFCL 2W Pan India Online Auction EventAnonymous rtDlncdNo ratings yet