Professional Documents

Culture Documents

PWC - Indian Social Security For Cross Border Assignments October 2011-130112

Uploaded by

Swapnil Parikh0 ratings0% found this document useful (0 votes)

28 views19 pagesIndian Social Security for Cross Border Assignments October 2011-130112

Original Title

PwC - Indian Social Security for Cross Border Assignments October 2011-130112

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIndian Social Security for Cross Border Assignments October 2011-130112

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views19 pagesPWC - Indian Social Security For Cross Border Assignments October 2011-130112

Uploaded by

Swapnil ParikhIndian Social Security for Cross Border Assignments October 2011-130112

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

Indian social security

For cross-border assignments

www.pwc.com/india

October 2011

Foreword

Foreign assignments are often challenging because they involve not only entering into a

new tax system but also negotiating the social security structure in the country in question.

Every country has its own set of social security regulations for employees working within its

territory. India introduced compulsory social security regulations for cross border workers

for the frst time in October 2008. These regulations are still evolving and the authorities

have issued several clarifcations since their introduction. This guide is designed to help

employers and cross border workers understand:

the social security system in India and its various compliance requirements;

the benefts available under social security agreements; and

other matters which need to be kept in view.

This booklet contains details of the social security law and practice in India currently

applicable to cross border workers, compiled by a team of specialists within the

PricewaterhouseCoopers, International Assignment Services (IAS) practice. We invite

you to contact us for further details. Our specialists will be pleased to provide advice and

assistance tailored to your specifc requirements.

Addresses of PricewaterhouseCoopers offces in India are provided in Appendix D of this

publication.

Kaushik Mukerjee

Leader

International Assignment Services

PwC India

Kuldip Kumar

Executive Director

PwC India

Contents

Section 1: The Indian social security system for cross border workers 4

Section 2: Benefts of social security agreements 7

Section 3: Compliance requirements 9

Section 4: Other matters 11

Appendix A: Social security agreements 13

Appendix B: Non compliance penalties 14

Appendix C: Important contact details and useful web links 15

Appendix D: Contacts 16

4 PwC

Section 1

The Indian social security system for cross border workers

Introduction

The Indian social security

system provides retirement and

insurance benefts to employees

working in factories or other

establishments covered by the

system, in India. The system

is governed by the Employees

Provident Fund and Miscellaneous

Provisions Act 1952 (PF Act) and

the schemes made there under,

namely, the Employees Provident

Fund Scheme (EPF) and the

Employees Pension Scheme

(EPS). The Employees Provident

Fund Organisation (EPFO), a

statutory body established by the

government of India, administers

the social security regulations in

India.

Scope

Every establishment in India,

employing 20 or more persons

is required to register with the

social security authorities unless

they are an exempt establishment.

An establishment employing less

than 20 persons can voluntarily

opt to register with the authorities

for the welfare of its employees.

Upon voluntarily registration, the

provisions of the Indian social

security regulations apply in

exactly the same way as if such

registration were mandatory.

In October 2008, the government

of India made the social security

scheme mandatory for cross

border workers by introducing

a new category of employee,

international worker, within the

ambit of the EPF and EPS. Prior

to this amendment, such workers

used to qualify for exclusion from

the provisions of the Indian social

security regulations and were

not subject to the Indian social

security system.

International worker

A foreign national qualifes as

an international worker, if

he/she is coming to work for

an establishment in India to

which the Indian social security

regulations apply.

Similarly, an Indian national

qualifes as an international

worker, if he/she has worked or

is going to work in a country with

which India has entered into a

social security agreement (SSA)

and is eligible to avail him /herself

of the benefts under the social

security programme of the host

country, according to the terms of

the relevant SSA.

Exemption

An international worker is

exempted from Indian social

security regulations where he

or she:

(a) is from a country with which

India has a reciprocal SSA;

and

(b) is contributing to his/her

home countrys social

security, either as a citizen or

resident; and

(c) he or she enjoys the status

of detached worker for the

period, and according to

the terms, specifed in the

relevant SSA.

Contributions

An international worker is required

to contribute 12% of his/her salary

to the social security system. The

term salary is broad and covers

basic wages (all emoluments paid

or payable in cash while on duty

or on leave/holiday), dearness

allowance, retaining allowance

and cash value of any food

concessions. However, house rent

allowance, overtime allowance,

bonus, commission or any other

similar allowance or presents are

excluded from the salary fgure

used to calculate contributions.

Employers are required to deduct

the social security contribution

from the employees monthly pay

and, after making a matching

contribution of 12%, to deposit the

sum with the Indian social security

authorities/ fund by the 20th day

of the following month. A fve day

grace period is included within

this time limit.

Contributions are payable on the

full salary where an international

worker is on a split payroll. For

converting foreign salary fgures

into the equivalent INR, the month

end telegraphic transfer buying

exchange rate, as published by the

State Bank of India, is to be used.

Indian social security 5

6 PwC

Employers contributions to Indian

social security are not taxable

in the hands of international

workers. In relation to their own

contributions, international

workers can claim a deduction of

up to INR 100,000

per annum from their taxable

income in India.

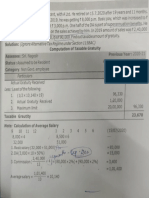

Allocation of contributions

From the employers 12%

contribution, an amount equal to

8.33% of the salary is allocated to

the international workers pension

fund and the remaining amount is

allocated to the provident fund.

The employees entire contribution

of 12% is allocated to the

provident fund.

The accumulated balance in the

provident fund earns interest at a

specifed rate, which is announced

by the government from time to

time. The government announced

a 9.5% rate of interest for the year

2010-11.

Interest that accrues on

accumulated contributions

(employers as well as employees)

is exempt from tax.

Withdrawal benefts

The EPF and the EPS provide

detailed rules for withdrawal

benefts.

Provident fund

An international worker can

withdraw their accumulated

balance in the provident fund in

the following circumstances:

Retirement from service in

the establishment or after

attaining 58 years of age,

whichever is later.

Retirement on account

of permanent and total

incapacity to work due to

bodily or mental infrmity

as certifed by a prescribed

medical offcer/registered

practitioner,

When suffering from certain

diseases detailed in the terms

of the scheme,

According to the provisions

specifed in the relevant

SSA which covers the

international worker.

In cases where the international

worker is from an SSA country,

withdrawal from the provident

fund must be carried out according

to the terms of the relevant SSA.

In all other cases, the amount

withdrawn will be credited to the

international workers Indian bank

account. Amendments have been

made in the Indian regulatory

framework to permit international

workers to open Indian bank

accounts in order to realise

provident fund money.

Any lump sum withdrawn by

international workers from

their provident fund account

on retirement or otherwise,

after completing fve years of

continuous service in a covered

establishment in India or under

other specifed circumstances, is

exempt from tax.

In all other cases, the employers

contribution and interest earned

on that contribution (both on

the employer and employees

share) is taxable in the year of

withdrawal. Furthermore, where

an international worker availed

of any deduction for his/her own

contribution during the past years,

such deduction shall be taxable in

the year in which it is withdrawn.

Pension fund

Accumulated sums in the pension

fund are used to pay a pension to

employees upon retirement or in

certain circumstances as specifed

in the EPS. International workers

are not permitted to withdraw

from the pension fund unless they

have rendered eligible service for

a period of ten years. However,

where international workers are

covered under an SSA, withdrawal

is possible earlier.

The monthly pension received

from the pension fund on

retirement is taxable as

employment income. However,

commutation of pension payments

are exempt from tax, subject to the

following conditions:

In cases of a receipt of

gratuity, the commuted value

of one third of the pension is

exempt from tax.

In other cases, the commuted

value of one half of the

pension is exempt from tax.

7 PwC

Section 2

Benefts of social security agreements

SSAs are bilateral agreements

between India and other countries

designed to protect the interests

of cross border workers. They

provide for avoidance of no

coverage or double coverage

and equality of treatment of the

workers of both countries. A

SSA generally provides for the

following:

(a) Detachment: Applies to

employees posted to the

other country provided

they comply with the social

security requirements of their

home country.

(b) Exportability of pension:

Provision for payment of

pension benefts directly

without any reduction to the

benefciary choosing to reside

in his/ her home country or

any other country.

(c) Totalisation of benefts: The

period of service rendered in

a foreign country is counted

when determining eligibility

for benefts. Benefts are

linked to the length of service,

on a pro rata basis.

India has entered into SSAs with

11 countries, as listed in Appendix

A. The government of India is

currently negotiating SSAs with

a number of other countries,

including Sweden, the USA,

Canada, Australia, and Japan.

As at the current date, only

the agreements with Belgium,

Germany, Switzerland,

Luxembourg and France are

operational. The other agreements

have not yet come into force.

Certifcates of coverage

(Detachment)

A certifcate of coverage (COC),

otherwise known as a detachment

certifcate must be obtained by

an international worker to avoid

double coverage. A COC will

be issued by the workers home

countrys social security authority

in accordance with the provisions

of the relevant SSA. The COC

serves as a proof of detachment

on the basis of which exemption

from social security contributions

or social security taxes in the

host country are available for

the period of detachment. For

example, a German national

can apply for a COC from the

German social security authorities

before being deputed to India to

work with an establishment to

which the Indian social security

regulations apply. This will exempt

him/her from contributing to

Indian social security for the

period stated in the COC.

Period covered by COC

The period covered by the COC

depends on the period of the

international workers assignment

to the other country. The

maximum duration for which the

COC can be issued depends on the

terms provided in the SSA with

the international workers home

country. For instance, in the case

of the India Germany SSA, the

maximum duration for which the

COC can be issued is 48 months.

Indian social security 8

9 PwC

Section 3

Compliance requirements

Employers obligations

Employers are under a legal

obligation to deduct the

contributions and remit them

with the Indian social security

authorities within the specifed

time frame, as explained in the

previous section.

Employers are required to fle a

Form (IW-1) to report details of

their international workers on a

monthly basis. A Nil return must

be fled in cases where there is

no movement of international

workers. Employers are also

required to fle monthly return

(12A) and annual return (Form

6A and 3A) within the prescribed

time frame.

Interest for non payment/

short payment

Where any employer fails to remit

a contribution or makes short

remittance of any contribution

to the Indian social security

authorities/ fund, interest at the

rate of 12% per annum is payable

from the date on which the

amount became due till the date of

actual payment.

Non compliance penalties

Levy of damages

Where any employer makes

a default in their payment of

contributions to the fund, a default

in their transfer of accumulations,

or a default in their payment of

applicable charges, the Central

Provident Fund Commissioner

may recover from the employer, by

way of penalty, damages at the

rates given in Appendix B.

Other consequences

In addition to the levy of damages

detailed above, the employer

and/or any other person may be

penalised/ prosecuted where that

employer and/or person commits

any of the offences summarised

in Appendix B. An opportunity

of being heard is provided before

any penalty is imposed and/or

prosecution is initiated by the

authorities.

Indian social security 10

11 PwC

Section 4

Other matters

Equalisation policies

The social security regulations are

designed to protect the welfare

of employees. Under the Indian

social security regulations it is

illegal to enter into an agreement

with employees to reduce their

salaries in order to provide

social security benefts and/or

otherwise to recover/claim the

social security benefts from

employees. Employers need to be

careful particularly where foreign

nationals are covered under the

equalisation policies and may

require to defne the process

appropriately to avoid any legal

violation in India.

Tax and other considerations

Obtaining a COC may help

to optimise social security

contributions, but it may also have

tax ramifcations in India. The

presence of foreign nationals as

employees of a foreign company

may result in a permanent

establishment risk for the foreign

company. Assignments needs to

be structured and documented

appropriately to keep in view

social security, income tax, and

regulatory considerations, in order

to be compliant with Indian law.

Appendix A

Social security agreements

Sl. No. Name of countries Status

1 Belgium Operational from 1 September 2009

2 Germany Operational from 1 October 2009

3 Switzerland Operational from 29 January 2011

4 Luxembourg Operational from 1 June 2011

5 France Operational from 1 July 2011

6 Netherlands Signed on 22 October 2009. Not yet operational.

7 Denmark Signed on 17 February 2010. Not yet operational.

8 Hungary Signed on 3 February 2010. Not yet operational.

9 The Czech Republic Signed on 8 June 2010. Not yet operational.

10 Korea Signed on 19 October 2010. Not yet operational.

11 Norway Signed on 29 October 2010. Not yet operational.

Indian social security 13

Appendix B

Non compliance penalties

Period of default Rate of damage *

(% of arrears per annum)

Less than two months 5%

Two months and above but less than four months 10%

Four months and above but less than six months 15%

Six months and above 25%

* The damages shall be calculated to the nearest rupee and are levied simultaneously along with interest for

non payment or short payment of contributions as explained above.

Rates of damages

Nature of offence Person

liable

Consequences

Default in relation to the payment of contributions (or

administration charges or inspection charges) towards

the provident fund according to the provisions of the

PF Act.

Employer Where the default is in relation to payment of the

employees contribution which has already been

deducted by the employer from the employees

wages. Imprisonment for a minimum term of

one year (which may be extended to three years)

together with a fne of INR 10,000.

For all other cases Imprisonment for a minimum

term of six months (which may be extended to

three years) together with a fne of INR 5,000.

Default in relation to the payment of contributions

(or inspection charges) towards the Deposit linked

Insurance scheme.

Employer Imprisonment for a term not less than six months

which may be extended to one year and a fne of

up to INR 5,000.

Making a false statement or misrepresentation to avoid

any payment towards the provident fund, pension fund

or deposit linked insurance fund.

Any person Imprisonment up to one year or fne of INR 5,000

or both.

Contravention/default in complying with any of the

provisions.

Any person Imprisonment for up to one year or fne of up to INR

4,000 or both.

Contravention/default in complying with any

provision of the PF Act where no other penalty is

provided elsewhere in relation to that non compliance.

Any person Imprisonment for a term not less than one month

which may be extended up to six months and a fne

of up to INR 5,000.

Penalties and prosecution

Appendix C

Important contact details and useful web links

Head offce

Bhavishya Nidhi Bhawan,

14, Bhikaiji Cama Place,

New Delhi 110 066

Central Provident Fund Commissioner

Phone: 011 26172671

Email: cpfc@epfndia.gov.in

Regional Provident Fund Commissioner

(International Workers Unit)

Phone: 011 26172668

Email: rc.iwcell@epfndia.gov.in

Useful links

Employees Provident Fund Organisation (EPFO)

www.epfndia.com

Ministry of Labour, Government of India

www.labour.nic.in

Ministry of Overseas Indian Affairs, Government of India

www.moia.gov.in

Frequently Asked Questions (FAQ)

http://www.epfndia.com/faq_IntWorker.pdf

15 PwC

Bangalore

Millenia, Tower D, 6th Floor

1&2 Murphy Road

Ulsoor, Bangalore 560 008

Tel : +91 80 4079 6002

Fax : +91 80 4079 6222

Contact Person: Kaushik Mukerjee

Email: kaushik.mukerjee@in.pwc.com

Delhi NCR

Building No. 10, Tower C

17th & 18th Floor, DLF Cyber City,

Gurgaon, Haryana 122002

Tel: +91 124 330 6000

Fax: +91 124 330 6999

Contact Person: Kuldip Kumar

Email: kuldip.kumar@in.pwc.com

Mumbai

PwC House, Plot 18/A

Guru Nanak Road (Station Road),

Bandra (West)

Mumbai 400 050

Tel: +91 22 66891000

Fax: +91 22 66891888

Contact Person: Nikhil Bhatia

Email: nikhil.bhatia@in.pwc.com

Ahmedabad

President Plaza, Ist Floor

Opposite Muktidham Derasar

S.G. Highway, Thaltej

Ahmedabad 380 054

Tel: +91 79 30917000

Fax: +91 79 29090007

Contact Person: Mayur Desai

Email: mayur.desai@in.pwc.com

Kolkata

Plot No. Y 14, Sector V,

Salt Lake Electronics Complex,

Bidhan Nagar, Kolkata 700 091

Tel: +91 33 2357 9100/2357 3384

Fax: +91 33 2357 3394

Contact Person: Somnath Ballav

Email: somnath.ballav@in.pwc.com

Hyderabad

# 8 2 293/82/A/1131A

Road No. 36

Jubilee Hills, Hyderabad 500034

Tel: +91 40 66246600

Fax: +91 040 66246400

Contact Person: R. D. Hingwala

Email: r.d.hingwala@in.pwc.com

Chennai

32, Khader Nawaz Khan Road

Nungambakkam,

Chennai 600 006

Tel: +91 44 4228 5000

Fax: +91 44 4228 5100

Contact Person: K Venkatachalam

Email: k.venkatachalam@in.pwc.com

Pune

GF 02, Tower C

Panchshil Tech Park

Don Bosco Road, Yerwada

Pune 411 006

Tel: +91 20 4100 4444

Fax: +91 20 4100 4599

Contact Person: Sandip Mukherjee

Email: sandip.mukherjee@in.pwc.com

Appendix D

Contacts

Indian social security 16

PwC frms help organisations and

individuals create the value theyre

looking for. Were a network

of frms in 158 countries with

close to 169,000 people who are

committed to delivering quality

in assurance, tax and advisory

services. Tell us what matters to

you and fnd out more by visiting

us at www.pwc.com.

In India, PwC (www.pwc.com/

India) offers a comprehensive

portfolio of Advisory and Tax &

Regulatory services; each, in turn,

presents a basket of fnely defned

deliverables. Network frms of

PwC in India also provide services

in Assurance as per the relevant

rules and regulations in India.

Providing organisations with

the advice they need, wherever

they may be located, our

highly qualifed, experienced

professionals, who have sound

knowledge of the Indian

business environment, listen to

different points of view to help

organisations solve their business

issues and identify and maximise

the opportunities they seek. Our

industry specialisation allows us to

help co-create solutions with our

clients for their sector of interest.

We are located in these cities:

Ahmedabad, Bangalore,

Bhubaneshwar, Chennai, Delhi

NCR, Hyderabad, Kolkata,

Mumbai and Pune.

About PwC

18 PwC

Kuldip Kumar

Executive Director

kuldip.kumar@in.pwc.com

Phone: +91 (124) 3306516

Sundeep Agarwal

Associate Director

sundeep.agarwal@in.pwc.com

Phone: +91 (22) 66891330

Vikas Kumar

Manager

kumar.vikas@in.pwc.com

Phone: +91 (124) 3306794

Contributors:

www.pwc.com/india

This publication does not constitute professional advice. The information in this publication has been obtained or derived from sources

believed by PricewaterhouseCoopers Private Limited (PwCPL) to be reliable but PwCPL does not represent that this information is

accurate or complete. Any opinions or estimates contained in this publication represent the judgment of PwCPL at this time and are

subject to change without notice. Readers of this publication are advised to seek their own professional advice before taking any course

of action or decision, for which they are entirely responsible, based on the contents of this publication. PwCPL neither accepts or

assumes any responsibility or liability to any reader of this publication in respect of the information contained within it or for any decisions

readers may take or decide not to or fail to take.

2011 PricewaterhouseCoopers Private Limited. All rights reserved. In this document, PwC refers to PricewaterhouseCoopers Private

Limited (a limited liability company in India), which is a member rm of PricewaterhouseCoopers International Limited (PwCIL), each

member rm of which is a separate legal entity.

NJ 238 October 2011 Social Security.indd

Designed by: PwC Brand and Communications, India

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- I Barnes - MIRF-withdrawalretreanchmentretDocument8 pagesI Barnes - MIRF-withdrawalretreanchmentretridbastraNo ratings yet

- Transforming Rural India through Financial InclusionDocument2 pagesTransforming Rural India through Financial Inclusionjohnyy2kNo ratings yet

- Jain University CMS B School Business Taxation Module OverviewDocument7 pagesJain University CMS B School Business Taxation Module OverviewPrajwal kumarNo ratings yet

- Ekedahl Inc Has Sponsored A Non Contributory Defined Benefit Pension Plan PDFDocument2 pagesEkedahl Inc Has Sponsored A Non Contributory Defined Benefit Pension Plan PDFTaimur TechnologistNo ratings yet

- Biodata Page2Document1 pageBiodata Page2cm_krish6478No ratings yet

- Estimated Tax for IndividualsDocument12 pagesEstimated Tax for IndividualsJob SchwartzNo ratings yet

- Lopez v Constantino Life Pension Building DestructionDocument2 pagesLopez v Constantino Life Pension Building DestructionMik ZeidNo ratings yet

- Act 195 Wages Councils Act 1947Document32 pagesAct 195 Wages Councils Act 1947Adam Haida & CoNo ratings yet

- RotherhamBoroughProfile2008 9Document16 pagesRotherhamBoroughProfile2008 9Paul BevanNo ratings yet

- The Three Economic QuestionsDocument15 pagesThe Three Economic QuestionsJasMisionMXPachucaNo ratings yet

- Benefits. by of Sales: 2020. SuperannuationDocument1 pageBenefits. by of Sales: 2020. SuperannuationArya RoshanNo ratings yet

- Introduction:-: WorksheetDocument24 pagesIntroduction:-: WorksheetbharatNo ratings yet

- Hypothesis Testing of Two MeansDocument2 pagesHypothesis Testing of Two MeansMirza Naveed BaigNo ratings yet

- Retirement Case StudyDocument27 pagesRetirement Case StudyAllieMikelleNo ratings yet

- Guidelines For Investment Proof Submission 2018-19Document7 pagesGuidelines For Investment Proof Submission 2018-19AsifNo ratings yet

- TAX 1 Mini Digest Part 2Document6 pagesTAX 1 Mini Digest Part 2Lilu BalgosNo ratings yet

- South African Tax Thesis TopicsDocument6 pagesSouth African Tax Thesis Topicsdnr68wp2100% (2)

- Unit Trust of Tanzania: Application FormDocument4 pagesUnit Trust of Tanzania: Application FormadolfNo ratings yet

- Legion 2017-05-06Document100 pagesLegion 2017-05-06Adrian Cin100% (1)

- Income Tax Form 12BB TitleDocument1 pageIncome Tax Form 12BB TitleMaheshNo ratings yet

- GSIS BenefitsDocument21 pagesGSIS BenefitsKeplot LirpaNo ratings yet

- 10 Perez vs. Comparts IndustriesDocument1 page10 Perez vs. Comparts Industriesmei atienzaNo ratings yet

- Rural bank retirement caseDocument6 pagesRural bank retirement caseRon AceroNo ratings yet

- 03 Icai Case Study QuestionDocument7 pages03 Icai Case Study QuestionFAMLITNo ratings yet

- Salary SlipDocument3 pagesSalary Slipmohd aslamNo ratings yet

- Tax & Wealth Advisory Firm GuideDocument27 pagesTax & Wealth Advisory Firm GuideSumit BawejaNo ratings yet

- Instructions Ver 6.0 - Final PDFDocument57 pagesInstructions Ver 6.0 - Final PDFanon_20637111No ratings yet

- Direct Tax Code DTC Summary - Highlights - Income TaxDocument12 pagesDirect Tax Code DTC Summary - Highlights - Income TaxDeepak_Bansal_9766No ratings yet

- Poverty Social Exclusion and Disadvantage PDFDocument63 pagesPoverty Social Exclusion and Disadvantage PDFnevanaaaNo ratings yet

- Medical Facility: Section 19 (Copies of Csir Orders/Circulars) 1Document7 pagesMedical Facility: Section 19 (Copies of Csir Orders/Circulars) 1hariom guptaNo ratings yet