Professional Documents

Culture Documents

Zxca

Uploaded by

RemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zxca

Uploaded by

RemCopyright:

Available Formats

Under 103(a), as above quoted, the sale of agricultural non-food products in their original state is

exempt from VAT only if the sale is made by the primary producer or owner of the land from which

the same are produced. The sale made by any other person or entity, like a trader or dealer, is not

exempt from the tax. On the other hand, under 103(b) the sale of agricultural food products in their

original state is exempt from VAT at all stages of production or distribution regardless of who the

seller is. Under 103(a), as above quoted, the sale of agricultural non-food products in their original

state is exempt from VAT only if the sale is made by the primary producer or owner of the land from

which the same are produced. The sale made by any other person or entity, like a trader or dealer, is

not exempt from the tax. On the other hand, under 103(b) the sale of agricultural food products in

their original state is exempt from VAT at all stages of production or distribution regardless of who

the seller is. Under 103(a), as above quoted, the sale of agricultural non-food products in their

original state is exempt from VAT only if the sale is made by the primary producer or owner of the

land from which the same are produced. The sale made by any other person or entity, like a trader

or dealer, is not exempt from the tax. On the other hand, under 103(b) the sale of agricultural food

products in their original state is exempt from VAT at all stages of production or distribution

regardless of who the seller is. Under 103(a), as above quoted, the sale of agricultural non-food

products in their original state is exempt from VAT only if the sale is made by the primary producer

or owner of the land from which the same are produced. The sale made by any other person or

entity, like a trader or dealer, is not exempt from the tax. On the other hand, under 103(b) the sale

of agricultural food products in their original state is exempt from VAT at all stages of production or

distribution regardless of who the seller is. Under 103(a), as above quoted, the sale of agricultural

non-food products in their original state is exempt from VAT only if the sale is made by the primary

producer or owner of the land from which the same are produced. The sale made by any other

person or entity, like a trader or dealer, is not exempt from the tax. On the other hand, under 103(b)

the sale of agricultural food products in their original state is exempt from VAT at all stages of

production or distribution regardless of who the seller is. Under 103(a), as above quoted, the sale

of agricultural non-food products in their original state is exempt from VAT only if the sale is made by

the primary producer or owner of the land from which the same are produced. The sale made by any

other person or entity, like a trader or dealer, is not exempt from the tax. On the other hand, under

103(b) the sale of agricultural food products in their original state is exempt from VAT at all stages

of production or distribution regardless of who the seller is.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- SSSForm Funeral ClaimDocument2 pagesSSSForm Funeral ClaimRenmar John Abagat0% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- BBBBDocument1 pageBBBBRemNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Sample Doc Sample Doc Sample Doc Sample Doc Sample Doc Sample Doc SampleDocument1 pageSample Doc Sample Doc Sample Doc Sample Doc Sample Doc Sample Doc SampleRemNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentRemNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- BBBBDocument2 pagesBBBBRemNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- CZXCZXCDocument2 pagesCZXCZXCRemNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentRemNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- AaaaaDocument1 pageAaaaaRemNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- ColoursDocument1 pageColourswezzleNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- New Rich Text DocumentDocument1 pageNew Rich Text DocumentRemNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentRemNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- ColoursDocument1 pageColourswezzleNo ratings yet

- ColoursDocument1 pageColourswezzleNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Mora, Joe Harry D. May 03, 2016 BS Biology IIIDocument9 pagesMora, Joe Harry D. May 03, 2016 BS Biology IIIRemNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 123455Document1 page123455RemNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentRemNo ratings yet

- Boothe Vs Director of Patents 65465Document1 pageBoothe Vs Director of Patents 65465RemNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Asasd 46Document1 pageAsasd 46RemNo ratings yet

- Credit - From RecentDocument5 pagesCredit - From RecentRemNo ratings yet

- Asia Brewery Inc vs. TPMA and Escario Vs NLRCDocument5 pagesAsia Brewery Inc vs. TPMA and Escario Vs NLRCRemNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentRemNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 123455Document4 pages123455RemNo ratings yet

- RR 9-2013 & RR 10-2013Document6 pagesRR 9-2013 & RR 10-2013RemNo ratings yet

- AaaDocument2 pagesAaaRemNo ratings yet

- PPPPPPDocument6 pagesPPPPPPRedge DionisioNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City First DivisionDocument4 pagesRepublic of The Philippines Court of Tax Appeals Quezon City First DivisionRemNo ratings yet

- PPPPPPDocument10 pagesPPPPPPRemNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentRemNo ratings yet

- Understanding Copyright and Related Rights (Intellectual Property)Document26 pagesUnderstanding Copyright and Related Rights (Intellectual Property)Diana Bartolome100% (1)

- Quizzer-Donor's TaxDocument4 pagesQuizzer-Donor's TaxVergel Martinez33% (3)

- Annex F RR 11-2018 (Attachment To 1604CF) Marvel 2022Document3 pagesAnnex F RR 11-2018 (Attachment To 1604CF) Marvel 2022John Paul MariñoNo ratings yet

- 9 - Commissioner vs. PalancaDocument1 page9 - Commissioner vs. Palancacmv mendozaNo ratings yet

- TPA - Report - 27-01-2023Document8 pagesTPA - Report - 27-01-2023Madhav UnnithanNo ratings yet

- Scheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 AmDocument9 pagesScheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 Amsnsoni 89No ratings yet

- MCQ BasicsDocument11 pagesMCQ BasicsBharat ThackerNo ratings yet

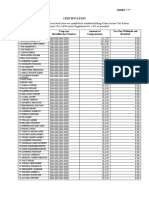

- Annex ' F '' Certification: Taxpayer Identification Number Amount of Compensation Tax Due Withheld and RemittedDocument4 pagesAnnex ' F '' Certification: Taxpayer Identification Number Amount of Compensation Tax Due Withheld and Remittedivs accountingNo ratings yet

- RMC No 28-2018Document1 pageRMC No 28-2018Lom Ow TenesseeNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDeepak SinghNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IIHMR Question PapersDocument1 pageIIHMR Question PapersRishi TripathiNo ratings yet

- 2 - AC Corporation (ACC) v. CIRDocument20 pages2 - AC Corporation (ACC) v. CIRCarlota VillaromanNo ratings yet

- Dilbagh Singh Itr 2022-2023 - UnlockedDocument1 pageDilbagh Singh Itr 2022-2023 - UnlockedmohitNo ratings yet

- Dec 2018Document1 pageDec 2018Bharat YadavNo ratings yet

- Go Go International-3Document2 pagesGo Go International-3sahil.goelNo ratings yet

- Paystub 04.30.2019 PDFDocument1 pagePaystub 04.30.2019 PDFGanesh RautNo ratings yet

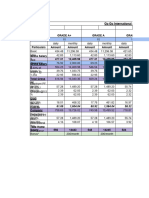

- Athletics Coaches and AD ReductionsDocument2 pagesAthletics Coaches and AD ReductionsMatt BrownNo ratings yet

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- GST APL-01 Powertech Measurment SystemDocument12 pagesGST APL-01 Powertech Measurment SystemUtkarsh KhandelwalNo ratings yet

- Procedure in Computing Vanishing DeductionDocument5 pagesProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- GSTR1 27aaece1594j1ze 122023Document4 pagesGSTR1 27aaece1594j1ze 122023ca.priyanka025No ratings yet

- InvoiceDocument1 pageInvoiceSahil GoyalNo ratings yet

- Taxation - Alan Melville: 28th Edition (Finance Act 2022)Document17 pagesTaxation - Alan Melville: 28th Edition (Finance Act 2022)Carlota CostaNo ratings yet

- Letter of Request - Tax ExemptionDocument1 pageLetter of Request - Tax ExemptionSinchan NurukiNo ratings yet

- The First Step in How To Calculate Long-Term Capital Gains TaxDocument4 pagesThe First Step in How To Calculate Long-Term Capital Gains TaxJyasmine Aura V. AgustinNo ratings yet

- A Report On Impact of Foreign Institutional Investors in Indian Capital MarketDocument87 pagesA Report On Impact of Foreign Institutional Investors in Indian Capital MarketSukruth SNo ratings yet

- Aggressive Tax Planning Article For LHDNDocument3 pagesAggressive Tax Planning Article For LHDNBarjoyai BardaiNo ratings yet

- Tax 1 Course OutlineDocument5 pagesTax 1 Course OutlineChanel GarciaNo ratings yet

- VAT Worked Examples FinalDocument13 pagesVAT Worked Examples Finalironflash18No ratings yet

- Pay Slip Dipankar Mondal 02Document1 pagePay Slip Dipankar Mondal 02Pritam GoswamiNo ratings yet

- RR No. 15-2018 PDFDocument2 pagesRR No. 15-2018 PDFmark linganNo ratings yet

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)