Professional Documents

Culture Documents

PBC Taxable Fringe Benefit

Uploaded by

Julian A.0 ratings0% found this document useful (0 votes)

15 views4 pagesPBC Taxable Fringe Benefit

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPBC Taxable Fringe Benefit

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesPBC Taxable Fringe Benefit

Uploaded by

Julian A.PBC Taxable Fringe Benefit

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

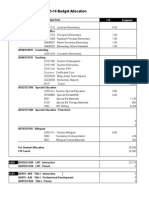

Seattle School District #1

2011 Taxable Car Benefits

PBC

Purpose: To review the District's compliance with federal reporting requirements and its own policies and procedures and follow-up on prior audit recommendation.

Source: Roxanna Melville, Payroll Specialist and Julie Davidson, Payroll Manager

Conclusion:

Based on our follow-up on the prior year issue this matter is partially resolved.

Empl ID First Name Last Name Annual Sal Wk Yr Jan Feb March April May June

Jan/Jun

Days

Total

1/13-6/13

Eric Bergstrom 0.00

1088 Daniel Bryant 170219.68 260 21 19 21 22 22 20 125 375.00

807763 Yvonne Carpenter 48935.56 223 19 17 19 55 165.00

27356 Larry Dorsey 76596.96 260 17 22 20 59 177.00

801917 Michele Drorbaugh 72220.21 260 21 19 21 61 183.00

11486 Evelyn Green 41955.79 203 13 17 21 17 20 11 99 297.00

5709 John Jackson 38157.39 203 18 17 21 17 20 11 104 312.00

19434 Edward Liebl 72298.72 260 16 18 19 16 20 16 105 315.00

14711 Cheryl Martin 72989.15 260 21 19 19 59 177.00

2286 Pegi McEvoy 170445.16 260 21 19 21 22 22 20 125 375.00

4723 Annette Noriega 41645.7 203 15 15 19 17 18 10 94 282.00

Ransom Pittman 0.00

18913 Niel (Wright) Smith 35440.2 203 18 17 21 17 20 11 104 312.00

27510 Michael Tolley 160765.77 260 21 19 21 22 22 20 125 375.00

21086 Michele A White 33677.99 203 18 17 21 14 20 11 101 303.00

Totals 222 213 244 181 206 150 1216 3,648.00

Note 1 We verified this empl commuted with a District for 1st 5 months of 2014.

Note 2 Not eligible for commuter valuation method

Wage Type 5502

Based on our review July - Dec 2013 commuter tracking is incomplete. There are a total of 14 employees using District vehicles for commuting (excluding C.

Martin)

We were unable to determine payroll accounting for imputed wages based on personal use of a district vehicle was complete, accurate, and in accordance with

IRS regulations

Seattle School District #1

2011 Taxable Car Benefits

Empl ID First Name Last Name Annual Sal Wk Yr

July

21

Aug

23

Sept

19

Oct

23

Nov

19

Dec

17

July/Dec

Days

Total

7/13 -12/13

1088 Daniel Bryant 170,219.68 260 17 14 19 23 12 19 104 312.00

807763 Yvonne Carpenter 48,935.56 223 0.00

27356 Larry Dorsey 76,596.96 260 0 0.00

801917 Michele Drorbaugh 72,220.00 260 0.00

11486 Evelyn Green 41,955.79 203 0 0.00

5709 John Jackson 38,157.39 203 0 0 0 0.00

19434 Edward Liebl 72,298.72 260 0 0.00

14711 Cheryl Martin 72,989.15 260 -177.00

2286 Pegi McEvoy 170,445.16 260 15 22 19 23 18 19 116 348.00

4723 Annette Noriega 41,645.70 203 20 21 18 15 74 222.00

18913 Niel (Wright) Smith 35,440.20 203 0 0.00

27510 Michael Tolley 160,765.77 260 15 22 20 23 18 19 117 351.00

21086 Michele A White 33,677.99 203 0 0.00

Ransom Pittman 33,937.59 0.00

Eric Bergstrom 58,072.22 0.00

32 36 38 46 30 38 220 483.00

$1.50/trip

Seattle School District #1

2011 Taxable Car Benefits

To review the District's compliance with federal reporting requirements and its own policies and procedures and follow-up on prior audit recommendation.

See Note 1

See Note 2

These commuter days were reported in error.

1/2-3/30

Dec-March only

Based on our review July - Dec 2013 commuter tracking is incomplete. There are a total of 14 employees using District vehicles for commuting (excluding C.

Martin)

We were unable to determine payroll accounting for imputed wages based on personal use of a district vehicle was complete, accurate, and in accordance with

IRS regulations

Seattle School District #1

2011 Taxable Car Benefits

Note 2

Commutes three months out of year only.

Note 1

Commutes three months out of year only.

Note 1

Note 1

Note 1

Note 2

Note 2

See Note 1

See Note 1

$1.50/trip x 2 trips per day = $3.00 per day

You might also like

- Seattle Schools Staffing Adjustment 10/2015Document2 pagesSeattle Schools Staffing Adjustment 10/2015westello7136No ratings yet

- Wright Ballard ResponseDocument25 pagesWright Ballard ResponseJulian A.No ratings yet

- SPS CDHL Final ReportDocument48 pagesSPS CDHL Final ReportJulian A.No ratings yet

- Proposed Prioritization by Type - 050715 v3Document301 pagesProposed Prioritization by Type - 050715 v3Julian A.No ratings yet

- CSIHS Sped Funds IBDocument5 pagesCSIHS Sped Funds IBJulian A.No ratings yet

- 2015-2016 Service-Based Budgeting Follow-Up ADocument27 pages2015-2016 Service-Based Budgeting Follow-Up AJulian A.No ratings yet

- Seattle Schools Staffing Adjustment Appendix 2015Document6 pagesSeattle Schools Staffing Adjustment Appendix 2015westello7136No ratings yet

- Teacher FTE IA FTEDocument45 pagesTeacher FTE IA FTEJulian A.No ratings yet

- Final ELL Staffing For 10-12-2015 Updated at 2 10pmDocument12 pagesFinal ELL Staffing For 10-12-2015 Updated at 2 10pmJulian A.No ratings yet

- 5 Year Projections 2015 To 2020Document1,132 pages5 Year Projections 2015 To 2020Julian A.No ratings yet

- Master MayShowRate ProjbygradeupdatedwbrentstaticforimportDocument558 pagesMaster MayShowRate ProjbygradeupdatedwbrentstaticforimportJulian A.No ratings yet

- Non Rep Upgrades - 5-14-14 Thru 5-26-15Document12 pagesNon Rep Upgrades - 5-14-14 Thru 5-26-15Julian A.No ratings yet

- Schoolid Equity Factor NBR % of Below Grade Level StudentsDocument5 pagesSchoolid Equity Factor NBR % of Below Grade Level StudentsJulian A.No ratings yet

- 2015-16 WSS School BudgetsDocument667 pages2015-16 WSS School BudgetsJulian A.No ratings yet

- But Were Not ReadyDocument3 pagesBut Were Not ReadyJulian A.No ratings yet

- Oct FTE Adjustment Matrix V3 20141015Document4 pagesOct FTE Adjustment Matrix V3 20141015LynnSPSNo ratings yet

- Seattle Schools Staffing Adjustment 10/2015Document2 pagesSeattle Schools Staffing Adjustment 10/2015westello7136No ratings yet

- Whats ProjectedDocument2 pagesWhats ProjectedJulian A.No ratings yet

- Kroon Decides Whats OkayDocument6 pagesKroon Decides Whats OkayJulian A.No ratings yet

- DRAFT Resolution To Suspend SBAC (Common Core) Testing PETERS & PATU (Seattle)Document4 pagesDRAFT Resolution To Suspend SBAC (Common Core) Testing PETERS & PATU (Seattle)Julian A.No ratings yet

- Who Reqd PRRDocument2 pagesWho Reqd PRRJulian A.No ratings yet

- Brent Kroon Interim Director, Enrollment Planning Seattle Public Schools (206) 252-0747Document2 pagesBrent Kroon Interim Director, Enrollment Planning Seattle Public Schools (206) 252-0747Julian A.No ratings yet

- Seattle SBAC Resolution Board Action Report Doc DRAFT Revision 5.0Document3 pagesSeattle SBAC Resolution Board Action Report Doc DRAFT Revision 5.0Julian A.No ratings yet

- Too Much TrainingDocument7 pagesToo Much TrainingJulian A.No ratings yet

- Sanctioned Students Enrollment ProcessDocument1 pageSanctioned Students Enrollment ProcessJulian A.No ratings yet

- Suspended or Expelled From Another DistrictDocument1 pageSuspended or Expelled From Another DistrictJulian A.No ratings yet

- Not For DistributionDocument3 pagesNot For DistributionJulian A.No ratings yet

- February Enrollment NumbersDocument70 pagesFebruary Enrollment NumbersJulian A.No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MSEA News, Jan-Feb 2014Document20 pagesMSEA News, Jan-Feb 2014Justin HinkleyNo ratings yet

- Introduction To Radar Warning ReceiverDocument23 pagesIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- EP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4Document5 pagesEP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4doyaNo ratings yet

- Strength and Microscale Properties of Bamboo FiberDocument14 pagesStrength and Microscale Properties of Bamboo FiberDm EerzaNo ratings yet

- Triplex (Triple Full Free Panoramic) Mast (5M15D To 5M35D) : Structure and FunctionDocument2 pagesTriplex (Triple Full Free Panoramic) Mast (5M15D To 5M35D) : Structure and FunctionMaz Ariez EkaNo ratings yet

- Oasis 360 Overview 0710Document21 pagesOasis 360 Overview 0710mychar600% (1)

- G JaxDocument4 pagesG Jaxlevin696No ratings yet

- Annotated Portfolio - Wired EyeDocument26 pagesAnnotated Portfolio - Wired Eyeanu1905No ratings yet

- Bode PlotsDocument6 pagesBode PlotshasanozdNo ratings yet

- Elb v2 ApiDocument180 pagesElb v2 ApikhalandharNo ratings yet

- A Case On Product/brand Failure:: Kellogg's in IndiaDocument6 pagesA Case On Product/brand Failure:: Kellogg's in IndiaVicky AkhilNo ratings yet

- Basic Electronic Troubleshooting For Biomedical Technicians 2edDocument239 pagesBasic Electronic Troubleshooting For Biomedical Technicians 2edClovis Justiniano100% (22)

- SyllabusDocument9 pagesSyllabusrr_rroyal550No ratings yet

- Common OPCRF Contents For 2021 2022 FINALE 2Document21 pagesCommon OPCRF Contents For 2021 2022 FINALE 2JENNIFER FONTANILLA100% (30)

- Stainless Steel 1.4404 316lDocument3 pagesStainless Steel 1.4404 316lDilipSinghNo ratings yet

- Mayor Breanna Lungo-Koehn StatementDocument2 pagesMayor Breanna Lungo-Koehn StatementNell CoakleyNo ratings yet

- Divider Block Accessory LTR HowdenDocument4 pagesDivider Block Accessory LTR HowdenjasonNo ratings yet

- Appleyard ResúmenDocument3 pagesAppleyard ResúmenTomás J DCNo ratings yet

- On Applied EthicsDocument34 pagesOn Applied Ethicsamanpatel78667% (3)

- Atom Medical Usa Model 103 Infa Warmer I - 2 PDFDocument7 pagesAtom Medical Usa Model 103 Infa Warmer I - 2 PDFLuqman BhanuNo ratings yet

- Mix Cases UploadDocument4 pagesMix Cases UploadLu CasNo ratings yet

- Relay Interface ModulesDocument2 pagesRelay Interface Modulesmahdi aghamohamadiNo ratings yet

- Business Plan GROUP 10Document35 pagesBusiness Plan GROUP 10Sofia GarciaNo ratings yet

- ARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiDocument5 pagesARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiGAURAV DANGARNo ratings yet

- China Ve01 With Tda93xx An17821 Stv9302a La78040 Ka5q0765-SmDocument40 pagesChina Ve01 With Tda93xx An17821 Stv9302a La78040 Ka5q0765-SmAmadou Fall100% (1)

- Tekla Structures ToturialsDocument35 pagesTekla Structures ToturialsvfmgNo ratings yet

- Sewing Machins Operations ManualDocument243 pagesSewing Machins Operations ManualjemalNo ratings yet

- 1 s2.0 S0304389421026054 MainDocument24 pages1 s2.0 S0304389421026054 MainFarah TalibNo ratings yet

- Certification DSWD Educational AssistanceDocument3 pagesCertification DSWD Educational AssistancePatoc Stand Alone Senior High School (Region VIII - Leyte)No ratings yet

- Eclipsecon MQTT Dashboard SessionDocument82 pagesEclipsecon MQTT Dashboard Sessionoscar.diciomma8446No ratings yet