Professional Documents

Culture Documents

Central Excise Tariff Notification No.17/2014 Dated 11th July, 2014

Uploaded by

stephin k jCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Excise Tariff Notification No.17/2014 Dated 11th July, 2014

Uploaded by

stephin k jCopyright:

Available Formats

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION

3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification

No.17/2014 Central Excise

New Delhi, the 11th July, 2014

G.S.R. (E). - In exercise of the powers conferred by sub-section (3) of section 3A of the Central

Excise Act, 1944 (1 of 1944), the Central Government hereby makes the following further

amendments in the notification of the Government of India in the Ministry of Finance (Department

of Revenue) No. 16/2010-Central Excise, dated the 27

th

February, 2010, published in the Gazette of

India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 118 (E), dated the 27

th

February, 2010, namely :-

In the said notification, -

(i) for Table-1, the proviso and Illustrations 1 and 2 thereunder, the following shall be

substituted, namely:-

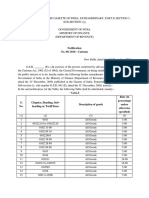

Table-1

Sl.

No.

Retail sale price (per

pouch)

Rate of duty per packing machine per month

(Rupees in lakhs)

Chewing Tobacco (other

than filter khaini)

Unmanufactured

Tobacco

Chewing

tobacco

commonly

known as filter

khaini

Without

lime

tube/lime

pouches

With

lime

tube/lime

pouches

Without

lime

tube/lime

pouches

With

lime

tube/lime

pouches

(1) (2) (3) (4) (5) (6) (7)

1. Up to Re.1.00 15.92 15.12 10.96 10.41 10.94

2.

Exceeding Re. 1.00 but not

exceeding Rs. 1.50

23.88 22.68 16.44 15.62 16.42

3.

Exceeding Rs. 1.50 but not

exceeding Rs. 2.00

28.65 27.06 19.72 18.63 20.79

4.

Exceeding Rs.2.00 but not

exceeding Rs.3.00

42.98 40.59 29.59 27.94 29.63

5.

Exceeding Rs.3.00 but not

exceeding Rs.4.00

53.49 50.30 36.82 34.63 37.53

6.

Exceeding Rs.4.00 but not

exceeding Rs.5.00

66.86 62.88 46.02 43.28 44.57

7.

Exceeding Rs.5.00 but not

exceeding Rs.6.00

80.23 75.46 55.23 51.94 50.81

8.

Exceeding Rs.6.00 but not

exceeding Rs.7.00

127.35 119.39 87.66 82.19 56.32

9.

Exceeding Rs.7.00 but not

exceeding Rs.8.00

127.35 119.39 87.66 82.19 61.14

10.

Exceeding Rs.8.00 but not

exceeding Rs.9.00

127.35 119.39 87.66 82.19 65.35

11.

Exceeding Rs.9.00 but not

exceeding Rs.10.00

127.35 119.39 87.66 82.19 68.98

12.

Exceeding Rs. 10.00 but not

exceeding Rs.15.00

179.57 170.59 123.61 117.43

68.98 + 6.90 x

(P-10)

13.

Exceeding Rs. 15.00 but not

exceeding Rs.20.00

225.05 213.80 154.92 147.18

14.

Exceeding Rs.20.00 but not

exceeding Rs.25.00

264.44 251.22 182.03 172.93

15.

Exceeding Rs. 25.00 but not

exceeding Rs.30.00

298.29 283.37 205.33 195.07

16.

Exceeding Rs.30.00 but not

exceeding Rs.35.00

327.12 310.77 225.18 213.92

17.

Exceeding Rs.35.00 but not

exceeding Rs.40.00

351.42 333.85 241.91 229.81

18.

Exceeding Rs. 40.00 but not

exceeding Rs.45.00

371.63 353.05 255.82 243.03

19.

Exceeding Rs.45.00 but not

exceeding Rs.50.00

388.15 368.74 267.19 253.83

20.

From Rs.50.00 onwards

388.15+ 7.76

x (P-50)

368.74+ 7.37

x (P-50)

267.19+

5.34 x (P-

50)

253.83+

5.08 x (P-

50)

Where P above represents retail sale price of the pouch for which

duty rate is to be determined

Note:- For the purposes of entry in column number (7), against Sl.No.12, the entry in column number

(2) shall be read as Rs. 10.01 and above.

Illustration 1:- The rate of duty per packing machine per month for a chewing tobacco (other than filter

khaini) pouch not containing lime tube and having retail sale price of Rs.55.00 (i.e.

P) shall be = Rs. 388.15 + 7.76*(55-50) lakhs = Rs. 426.95 lakhs.

Illustration 2:- The rate of duty per packing machine per month for a filter khaini pouch having retail

sale price of Rs.15.00 (i.e. P) shall be = Rs. 68.98 + 6.55*(15-10) lakhs = Rs.

101.73 lakhs;

(ii) for Table -2, the following Table shall be substituted, namely:-

Table -2

Sl.

No.

Duty Duty ratio for

unmanufactured

tobacco

Duty ratio for chewing

tobacco

(1) (2) (3) (4)

1 The duty leviable under the Central

Excise Act, 1944

0.9020 0.7903

2 The additional duty of excise leviable

under section 85 of the Finance Act,

2005

0.0689 0.0677

3 National Calamity Contingent Duty

leviable under section 136 of the

Finance Act, 2001

0.0000 0.1129

4 Education Cess leviable under section

91 of the Finance Act, 2004

0.0194 0.0194

5 Secondary and Higher Education Cess

leviable under section 136 of the

Finance Act, 2007

0.0097 0.0097.

[F. No. 334/15/2014-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note: - The principal notification No. 16/2010-Central Excise, dated the 27th February, 2010 was

published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide

number G.S.R. 118 (E), dated the 27th February, 2010 and was last amended vide

notification No.02/2014-Central Excise, dated the 24th January, 2014, published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.57 (E),

dated the 24

th

January, 2014.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Acct 11 Chapter18 SolutionsDocument14 pagesAcct 11 Chapter18 SolutionsRich B EzNo ratings yet

- GASB 34 Governmental Funds vs Government-Wide StatementsDocument22 pagesGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.10/2016 Dated 15th March, 2016Document4 pagesCustoms Circular No.10/2016 Dated 15th March, 2016stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Circular No. 16/2015 Dated 19th May, 2015Document6 pagesCustoms Circular No. 16/2015 Dated 19th May, 2015stephin k jNo ratings yet

- Customs Circular No. 06/2015 Dated 11th February, 2015Document1 pageCustoms Circular No. 06/2015 Dated 11th February, 2015stephin k jNo ratings yet

- Customs Circular No. 03/2015 Dated 16th January, 2015Document2 pagesCustoms Circular No. 03/2015 Dated 16th January, 2015stephin k jNo ratings yet

- Customs Circular No. 13/2014 Dated 18th November, 2014Document3 pagesCustoms Circular No. 13/2014 Dated 18th November, 2014stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 10/2014 Dated 17th October, 2014Document3 pagesCustoms Circular No. 10/2014 Dated 17th October, 2014stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.22/2016 Dated 8th February, 2016Document9 pagesCustoms Non Tariff Notifications No.22/2016 Dated 8th February, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.34/2016 Dated 29th February, 2016Document2 pagesCustoms Non Tariff Notifications No.34/2016 Dated 29th February, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.54/2016 Dated 3rd October, 2016Document6 pagesCustoms Tariff Notifications No.54/2016 Dated 3rd October, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.30/2016 Dated 1st March, 2016Document6 pagesCustoms Non Tariff Notifications No.30/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.26/2016 Dated 16th February, 2016Document11 pagesCustoms Non Tariff Notifications No.26/2016 Dated 16th February, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.20/2016 Dated 8th February, 2016Document4 pagesCustoms Non Tariff Notifications No.20/2016 Dated 8th February, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.31/2016 Dated 1st March, 2016Document2 pagesCustoms Non Tariff Notifications No.31/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Woodford-Public Debt As Private LiquidityDocument8 pagesWoodford-Public Debt As Private LiquidityjohnNo ratings yet

- November 30, 2018 Strathmore TimesDocument20 pagesNovember 30, 2018 Strathmore TimesStrathmore TimesNo ratings yet

- LEITI 2nd Reconciliation ReportDocument112 pagesLEITI 2nd Reconciliation ReportLiberiaEITINo ratings yet

- UMKC Econ431 Fall 2012 SyllabusDocument25 pagesUMKC Econ431 Fall 2012 SyllabusMitch GreenNo ratings yet

- International Finance Theory and Policy v.1.0 - Flatworld Knowledge - AttributedDocument497 pagesInternational Finance Theory and Policy v.1.0 - Flatworld Knowledge - AttributedAlfonso J Sintjago100% (2)

- Duty Free Philippines V BIRDocument2 pagesDuty Free Philippines V BIRTheodore0176No ratings yet

- Budget Balancing Exercise: 1 BackgroundDocument14 pagesBudget Balancing Exercise: 1 Backgroundzagham11No ratings yet

- De Los Santos Danica Jane Laqui de Los Santos, Danica Jane LaquiDocument6 pagesDe Los Santos Danica Jane Laqui de Los Santos, Danica Jane LaquiAllen EndayaNo ratings yet

- Federalism: The Change the Philippines NeedsDocument3 pagesFederalism: The Change the Philippines NeedsWilmarie Hope AlilingNo ratings yet

- Notification No. 33/2012 - Service TaxDocument5 pagesNotification No. 33/2012 - Service TaxMahaveer DhelariyaNo ratings yet

- How You Are Being Economically RapedDocument127 pagesHow You Are Being Economically RapedChris MentizisNo ratings yet

- Greece Government Debt Crisis: Lessons from Greece's Financial CrisisDocument11 pagesGreece Government Debt Crisis: Lessons from Greece's Financial CrisisAzim SengalNo ratings yet

- Everyone Been Tricked Into SlaveryDocument1 pageEveryone Been Tricked Into Slavery9REAL9NEWZ9No ratings yet

- Deficit FinancingDocument18 pagesDeficit Financingshreyamenon95No ratings yet

- Pre-Hispanic to American Coins and BanknotesDocument118 pagesPre-Hispanic to American Coins and BanknotesRishina Cabillo33% (3)

- Juan Luna Subdivision vs. SarmientoDocument5 pagesJuan Luna Subdivision vs. SarmientoMadelle PinedaNo ratings yet

- Young, Tú Te Lo Has BuscadoDocument298 pagesYoung, Tú Te Lo Has BuscadoPaola Nicolasa SchiedaNo ratings yet

- Impacts of budget deficit on macroeconomics in PakistanDocument13 pagesImpacts of budget deficit on macroeconomics in PakistanshaziadurraniNo ratings yet

- Coffee Valorization in BrazilDocument9 pagesCoffee Valorization in BrazilWellington GomesNo ratings yet

- Reserve Bank of India 3Document2 pagesReserve Bank of India 3john_muellorNo ratings yet

- Jefferson vs. HamiltonDocument3 pagesJefferson vs. HamiltonMinaam BaseerNo ratings yet

- Spanish Minister Calls On ECB To Buy Bonds As Crisis Accelerates..... Prays For Bailout After Blowing Too Much Cash To Remain ElectedDocument4 pagesSpanish Minister Calls On ECB To Buy Bonds As Crisis Accelerates..... Prays For Bailout After Blowing Too Much Cash To Remain Electedshawn2207No ratings yet

- PTI White Paper On PML 1st Year PerformanceDocument28 pagesPTI White Paper On PML 1st Year PerformancePTI Official96% (28)

- Caietele de Doleante Ale NobilimiiDocument15 pagesCaietele de Doleante Ale Nobilimiiiancu costiNo ratings yet

- Guide to position classification, compensation and allowances in the Philippine governmentDocument14 pagesGuide to position classification, compensation and allowances in the Philippine governmentedwin6656No ratings yet

- Vat 64Document2 pagesVat 64Tarun AgarwalNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Tender JudDocument44 pagesTender JudAnonymous MKGtsNKRXwNo ratings yet