Professional Documents

Culture Documents

Theory of Accounts With Answers

Uploaded by

Elsa Mendoza100%(4)100% found this document useful (4 votes)

4K views9 pagesNFJPIA Theory of Accounts 2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNFJPIA Theory of Accounts 2013

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(4)100% found this document useful (4 votes)

4K views9 pagesTheory of Accounts With Answers

Uploaded by

Elsa MendozaNFJPIA Theory of Accounts 2013

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

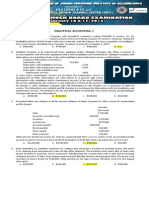

THEORY OF ACCOUNTS

1. Which is(are) correct concerning the FRSC?

I. The FRSC replaces the ASC as the standard setting body in the Philippines

II. The FRSC is composed of 15 members with a Chairman and 14 representatives from various sectors

III. The Chairman and members of FRSC shall have a term of 2 years renewable for another term

IV. Any member of the ASC shall be disqualified from being appointed to the FRSC

a. I and II only b. I, II, and III only c. III and IV only d. I, II, III, and IV

2. Which of the following government agency is represented in FRSC?

a. Bureau of Fisheries b. CHED c. Bureau of Internal Revenue d. Bureau of Customs

3. Under the IFRS Conceptual Framework (2010), which of the following is considered a fundamental characteristic

rather than an enhancing characteristic of financial information?

a. Timeliness b. Verifiability c. Understandability d. Faithful representation

4. Under SEC rules, which of the following entity may qualify as a SME?

a. ASAP Life, a life insurance company

b. ASAP Mart, a supermarket based in Caloocan City

c. ASAP Banking Corporation, a BSP-registered commercial bank

d. ASAP Waters, a water utility company servicing Metro Manila

5. Failure to accrue wages payable to office personnel will

a. Overstate liability b. Overstate loss c. Understate distribution cost d. Understate admin. cost

6. Under PAS 7 (statement of cash flows), which of the following items is not being added to profit under the

indirect method of computing operating cash flows?

a. Bad debt losses b. Depreciation c. Loss on sale of equipment d. Increase in trade receivable

7. Under PAS 33, treasury shares are considered as anti-dilutive because

a. They decrease the basic earnings per share

b. They decrease the diluted earnings per share

c. They decrease the number of common shares outstanding

d. They increase the income available to common shareholders

8. The following statements are based on PFRS for SMEs:

Statement I: Listed companies may not use PFRS for SMEs no matter how small they are.

Statement II: If a publicly accountable entity uses PFRS for SMEs, its financial statements shall not be described

as conforming to the PFRS for SMEs even if law or regulation in its jurisdiction permits or requires PFRS for

SMEs to be used by publicly accountable entities.

Statement III: A subsidiary whose parent uses full PFRS is not prohibited from using this PFRS for SMEs in its own

FS if that subsidiary by itself does not have public accountability.

a. True, true, true b. False, true, true c. False, false, true d. True, false, false

9. What chapter of the Conceptual Framework is still in process?

a. Chapter 1 The Objective of General Purpose Financial Reporting

b. Chapter 2 The Reporting Entity

c. Chapter 3 Qualitative Characteristics of Useful Financial Information

d. Chapter 4 The Framework (1989): The Remaining Text

e. None of the above because all are already published

10. Which of the following does not relate to Verifiability?

a. Quantified information need not be a single point estimate to be verifiable. A range of possible amounts and the

related probabilities can also be verified.

b. Generally, the older the information is the less useful it is. However, some information may continue to be useful

long after the end of a reporting period because, for example, some users may need to identify and assess trends.

c. Direct verification means verifying a representation through direct observation, for example, by counting cash.

d. An example indirect verification is verifying the carrying amount of inventory by checking the inputs and

recalculating the ending inventory using the same cost flow assumption.

11. This assumption was formerly considered as an underlying assumption on the previous Conceptual Framework?

a. Going-Concern Assumption b. Accrual Assumption c. Cost Assumption d. Entity Assumption

12. The amount reported as Cash on a companys balance sheet normally exclude

a. Received Postdated Checks b. Payroll account c. Petty cash d. Undelivered checks

13. If a note receivable is exchanged for a PPE an no interest rate is stated, the note is to be recorded at

a. book value of PPE b. notes face value c. notes maturity value d. fair value of PPE or note

14. If the allowance method of recording uncollectible accounts expense is used, the entries at the time of

collection of an previously written-off account would

a. have no effect on profit or loss of the entity c. have no effect on the contra account of the receivable

b. Increase profit of the entity d. decrease the contra account of the receivable

15. Cash discounts permitted on the purchased direct materials (DM) are theoretically

a. deducted from DM, whether taken or not c. added to other income, whether taken or not

b. deducted from DM, only if taken d. ignored

16. A gain or loss arising on the initial recognition of a biological asset and from a change in the fair value less costs

to sell of a biological asset should be included in

a. in P&L for the period b. revaluation reserve c. capital reserve in equity d. none of the choices

17. Under SEC rules, a company is classified as a Small & Medium Entity (SME) when its total assets are between

a. P3M and P250M b. P3M and P350M c. P5M and P250M d. P5M and P350M

18. Under SEC rules, a company is classified as a Small & Medium Entity (SME) when its total liabilities are

between

a. P3M and P250M b. P3M and P350M c. P5M and P250M d. P5M and P350M

19. Which government body is responsible for the design, preparation and approval of accounting systems of

government agencies?

a. Department of Budget & Management b. COA c. Bureau of Treasury d. Government Agencies

20. The following statements are based on PFRS for SMEs:

Statement I: If an entitys normal operating cycle is not clearly determinable, its duration is assumed to be

twelve (12) months.

Statement II: If an entity is unable to make a reliable estimate of the useful life of an intangible asset, the life

shall be presumed to be twenty (20) years.

Statement III: An entity shall recognize all borrowing costs as an expense in profit or loss in the period in which

they are incurred.

a. True, true, true b. True, false, true c. False, false, false d. True, false, false

21. A cable television company receives deposits from customers, which are refunded when service is terminated.

The average customer stays with the company eight years. How should these deposits be shown on the financial

statements?

a. Operating revenue b. Paid-in capital c. Other revenue d. Liability

22. Given a hyperinflationary economy under PAS 29, which price index is used in (A) measuring inflation and (B)

restating financial statements? Note: General price index (GPI) and Consumer price index (CPI)

a. (A) GPI (B) GPI b. (A) CPI (B) CPI c. (A) CPI (B) GPI d. (A) GPI (B) CPI

23. The basic purpose of derivative financial instruments is to manage some kind of risk such as all of the following,

except

a. Stock price movement b. Currency fluctuations c. Interest rate variations d. Uncollectibility of AR

24. In consignment sales, what is the proper treatment of the consignment-related transportation cost (a) upon

bringing the consigned goods to the consignee and (b) upon return of the consigned goods to the consignor?

a. Inventory then expense

b. Expense then inventory

c. Inventory until sold

d. Expense until sold

25. Which of the following standards shall apply in identifying and recognizing costs of construction (e.g., borrowing

costs specifically financed for the construction)?

I. PAS 11 Construction Contracts

II. PAS 23 Borrowing Costs

a. I only b. II only c. Both I and II d. Neither I nor II

26. Identify if the following statements are true or false regarding disclosures of franchisors:

I. Disclosure of all significant commitments and obligation resulting from franchise agreements, including a

description of services that have not yet been substantially performed, is not required.

II. Initial resolution of uncertainties regarding collectability of franchise fees should be disclosed.

a. True; True b. True; False c. False; True d. False; False

27. PFRS 3 defines non-controlling interest as the equity in a subsidiary not attributable, directly or indirectly, to a

parent. This definition includes not only equity shares in the subsidiary held by other parties, but also other

elements of equity in the subsidiary. Determine how would the following instruments issued by the acquiree

be measured based on the requirements of PFRS 3:

I. Equity component of convertible debt and other compound financial instruments.

II. Preference shares not entitled to a pro rata share of net assets upon liquidation.

a. I - Proportionate share of net assets OR fair value; II - Proportionate share of net assets OR fair value

b. I - Proportionate share of net assets OR fair value; II - Fair value

c. I - Fair value; II - Proportionate share of net assets OR fair value

d. I - Fair value; II - Fair value

28. Which of the following is not among the elements of control based on PFRS 10?

a. investors power over the investee

b. investors exposure, or rights, to variable returns from its involvement with the investee

c. investors ability to participate in the financial and operating policy decisions of an entity

d. investors ability to use its power over the investee to affect the amount of the investor's returns

29. In a business combination achieved in stages, changes in fair value from the last reporting date until the date of

acquisition of the previously held investment classified as FV-OCI is

a. recycled in profit or loss c. recognized as other comprehensive income

b. recycled directly to accumulated profits d. reclassified to share premium

30. PAS 16 Property, Plant and Equipment shall not apply to the following, except

I. The recognition and measurement of exploration and evaluation assets.

II. Property, plant and equipment classified as held for sale.

III. Biological assets related to agricultural activity

IV. Mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative resources.

V. Property, plant and equipment used for the extraction of minerals, oil or natural gas.

a. I and II only b. I, II and IV only c. IV only d. V only e. IV and V only

31. Under the principles of PAS 16 Property, Plant and Equipment, which of the following should be included in

the cost of an item of property, plant and equipment?

I. Initial delivery and handling cost.

II. Cost of training staff on new asset.

III. Apportioned general overhead costs.

IV. Installation and assembly cost.

a. I, II, III and IV c. II and IV only

b. I, II and III only d. I and IV only

32. Allocation of the purchase price in a lump-sum acquisition of different assets may be based on all of the these,

except

a. Book values of the assets to the seller c. Tax assessment values

b. Relative market values d. Appraised values

33. Which statement is(are) correct regarding the scope of PAS 36 Impairment of Assets?

I. PAS 36 applies to some financial assets (i.e., investment in subsidiaries, associates, and joint ventures).

II. PAS 36 does not apply to inventories, assets arising from construction contracts, deferred tax assets, assets arising

from employee benefits, or assets classified as held for sale because existing PFRSs applicable to these assets

contain requirements for recognizing and measuring these assets.

III. PAS 36 applies to investment property that is measured at cost.

a. II only b. I and II only c. II and III only d. I, II, and III

34. Which of the following is incorrect regarding PAS 40 Investment Property?

a. PAS 40 requires all entities to determine the fair value of investment property.

b. An entity is encouraged, but not required, to determine measure the fair value of investment property

on the basis of a valuation by an independent valuer who holds a recognized and relevant professional

qualification and has recent experience in the location and category of the investment property being

valued.

c. With the reference in PFRS 13 Fair Value Measurement, Fair Value is defined as the amount for which

an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction.

d. An investment property shall be derecognized on disposal or when the investment property is

permanently withdrawn from use and no future economic benefits are expected from its disposal.

35. After initial recognition, Investment property are measured using

a. fair value model b. cost model c. either A or B d. Neither A nor B

36. A newly set up dotcom entity has engaged you as its financial advisor. The entity has recently completed one of

its highly publicized research and development projects and seeks your advice on the accuracy of the following

statements made by one of its stakeholders. Which of the following statements is accurate?

a. Costs incurred during the research phase can be capitalized.

b. Costs incurred during the development phase can be capitalized if criteria such as technical feasibility of the

project being established are met.

c. Training costs of technicians used in research can be capitalized.

d. Designing the jigs and tools qualify as research activities.

37. Which of the following note disclosure is not required by PAS 38 Intangible Assets?

a. Useful lives of the intangible assets.

b. Reconciliation of the carrying amount at the beginning and end of the year.

c. Contractual commitments for the acquisition of intangible assets.

d. Fair value of similar intangible assets used by competitors.

38. Are the following statements concerning the measurement of financial instruments after initial recognition true

or false, according to PAS 39 Financial instruments: recognition and measurement & PFRS 9 Financial

Instruments?

I. Under PAS 39, Held-for-trading financial assets are measured at amortized cost.

II. Under PAS 39, Held-to-maturity investments are measured at fair value.

III. Under PFRS 9, If an entity holds an investment to collect contractual cash flows but would sell the

investment in particular circumstances (e.g., entity needs to fund capital expenditures, among others), the

investments should be classified as fair value through profit or loss (FVPL) investment because the business

model test was not satisfied.

IV. Under PFRS 9, there is no recycling between other comprehensive income (OCI) or profit or loss.

a. True, False, True, True b. False, False, True, True c. False, False, False, True d. False, False, False, False

39. In accordance with PFRS 7 Financial instruments: disclosures, which of the following best describes the risk

that an entity will encounter if it has difficulty in meeting obligations associated with its financial liabilities

a. Liquidity risk b. Credit risk c. Financial risk d. Payment risk

40. The following statements are based on PAS 40 (Investment Property):

Statement I: An investment property is a property held to earn rentals or for capital appreciation or both.

Statement II: An investment property shall be measured initially at costs. Transaction costs shall be excluded in

the initial measurement.

Statement III: Under the cost model, a gain or loss arising from a change in the fair value of investment property

shall be recognized in profit or loss for the period in which it arises.

a. True, true, true b. True, false, false c. True, false, true d. True, true, false

41. Which of the following is not an appropriate basis for measuring the historical cost of fixed assets?

a. The purchase price, freight costs, and installation costs of a productive asset should be included in the assets

cost

b. Proceeds obtained in the process of readying land for its intended purpose, such as from the sale of cleared

timber, should be recognized immediately in income

c. The costs of improvement to equipment incurred after its acquisition should be added to the assets cost if

they provide future service potential

d. All costs incurred in the construction of a plant building, from excavation to completion of a plant building,

from excavation to completion, should be considered as part of the assets cost

42. Which of the following is an internal user of a companys financial information?

a. A holder of the companys bonds

b. A holder of the companys stocks

c. A member of the board of directors

d. A member of the family of an incorporator

43. Which of the financial statement should an investor primarily use to assess the amounts, timing, and

uncertainty of investing and financing activities of ABC Company?

a. Statement of comprehensive income

b. Statement of financial position

c. Statement of changes in equity

d. Statement of cash flows

44. Under the National Government Accounting System (NGAS), allotments of the government general

appropriation are recorded in the registries

a. At the beginning of the year

b. At the end of the year

c. Semiannually

d. Quarterly

45. When it is impracticable to determine the effect of an error for all prior periods, the entity

a. Restates comparative information prospectively from the earliest date practicable

b. Restates comparative information prospectively up to the latest date practicable

c. Restates comparative information retrospectively from the earliest date practicable

d. Restates comparative information retrospectively up to the latest date practicable

46. A call option on a common share is more valuable when there is a lower

a. Exercise price on the option

b. Time to maturity on the option

c. Market value of the underlying share

d. Variability of market price on the underlying share

47. A direct labor overtime premium is charged to a specific job when the overtime is caused by

a. Increased overall level of activity

b. Customers requirement for early completion of job

c. Managements failure to include the job in the production schedule

d. Managements requirement that the job be completed before the annual factory vacation closure

48. The physical capital maintenance concept is consistent with

a. Historical cost/nominal peso and historical cost/constant peso

b. Historical cost/nominal peso and current cost/constant peso

c. Current cost/nominal peso and historical cost/constant peso

d. Current cost/nominal peso and current cost/constant peso

49. The amortization of intangible assets over their useful lives is justified by the

a. Economic entity assumption

b. Going concern assumption

c. Monetary unit assumption

d. Historical cost assumption

50. The following statements are based on PFRS for SMEs:

Statement I: If an entity has no items of other comprehensive income, it may present only an Income

Statement.

Statement II: If an entity has no items of other comprehensive income, it may present a Statement of

Comprehensive Income in which the bottom line is profit or loss.

Statement III: If only changes to equity arise from profit or loss, payments of dividends, corrections of prior

period errors, and changes in accounting policy, the entity may present a single Statement of Income and

Retained Earnings in lieu of separate statements of comprehensive income and changes in equity.

a. True, true, true b. True, false, false c. True, false, true d. True, true, false

51. In calculating diluted earnings per share (EPS), which of the following should not be considered?

a. The weighted number of shares outstanding

b. The amount of cash dividends declared on ordinary shares

c. The amount of dividends declared on cumulative preference shares

d. The number of ordinary shares resulting from the assumed conversion of debentures outstanding

52. A bank reconciliation is prepared monthly in order for the enterprise to

a. Arrive at the correct cash balance

b. Unearth any undetected cash fraud

c. Correct bank errors

d. Correct book errors

53. The publisher of a popular magazine offers a special discounted price for a three-year subscription. At the

balance sheet date, the revenue, which has already been collected but pertains to future periods, is best to

referred to as

a. Accrued subscription revenue(an asset account)

b. Unearned subscription revenue (a liability account)

c. Earned subscriptions revenue (a revenue account)

d. Pre-collected subscriptions receivable (a deferred asset account)

54. From the viewpoint of the investor, which of the following securities provides the least risk?

a. Mortgage bond

b. Subordinated debenture

c. Income bond

d. Debentures

55. The measurement basis often used to report a long-term payable requiring a commitment to pay money at a

determinable future date is

a. Current cost

b. General price level

c. Net realizable value

d. Present value of future cash flows

56. The Victoria Company acquired 30,000 4% Government Bonds redeemable in 2013 at the quoted market price

of P200. Victoria has no current intention to sell the Bonds and has a policy to hold them as investments unless

certain corporate criteria are met and the bonds are sold to maintain liquidity. In accordance with PAS 39

Financial instruments: Recognition and Measurement, which one of the following is the most appropriate

classification for Victoria's investment in the Government Bonds?

a. Held for trading b. Available for sale c. Held to maturity investment d. Loans and receivables

57. Under PFRS 9 Financial Instruments, if an entity used its fair value option for equity instruments, which of the

following statements is incorrect?

a. dividends are to be recognized in profit or loss if said dividends are considered return on investment

b. no recycling of fair value changes to profit or loss on impairment, disposal or in any other circumstances

c. impairment testing is required for this equity investment

d. additional disclosures are required for this equity investment

58. Which of the following is incorrect regarding the scope of PFRS 7 Financial Instruments: Disclosures?

a. PFRS 7 applies to recognized and unrecognized financial instruments

b. PFRS 7 applies to contracts to buy or sell a non-financial item that are within the scope of PFRS 9

c. Recognized financial instruments include financial assets and liabilities that are within the scope of PFRS 9

d. Unrecognized financial instruments include some financial instruments that are within the scope of PFRS 9

59. Which step in the accounting cycle is completed later than the others?

a. Posting b. Adjustments c. Journalizing d. Identification and measurement of transactions

60. In reconciling net income on an accrual basis to net cash provided by operating activities. What adjustment is

needed to net income because of (1) an increase during the period in prepaid expenses, and (2) the periodic

depreciation expense of company properties?

a. (1) Add (2) Add b. (1) Add (2) Deduct c. (1) Deduct (2) Add d. (1) Deduct (2) Deduct

61. This accounting objective emphasizes the importance of the Income Statement as it is geared toward proper

income or performance determination of the enterprise.

a. Fund theory b. Entity theory c. Proprietary theory d. Residual equity theory

62. An automobile manufacturer should normally recognize revenue when an

a. Order is received from a dealer

b. Automobile comes off of the assembly line

c. Automobile is shipped to a dealer serving as a sales agent

d. Automobile is shipped to a dealer on a non-consignment basis

63. Jon Co. uses the equity method to account for its investment in Lee Co. stock. How should Jon record a 2% stock

dividend received from Lee?

a. As dividend revenue at Lees carrying value of the stock

b. As dividend revenue at the market value of the stock

c. As a reduction in the total cost of stock investment

d. As a memorandum entry reducing the unit cost of stock investment

64. In accounting for a business combination, which of the following intangibles should not be recognized as an

asset apart from goodwill?

a. Trademarks b. Lease agreements c. Employee quality d. Patents

65. The application of factory overhead costs under job order costing would be reflected in the general ledger as an

increase in

a. Factory overhead control b. Finished goods control c. Work in process control d. Cost of goods sold

66. Which of the following is incorrect regarding the loss of significant influence under the revised PAS 28?

a. An entity loses significant influence over an investee when it loses the power to partake in the financial and

operating policy decisions of that investee

b. The loss of significant influence can occur with or without a change in absolute or relative ownership levels

c. When an associate becomes subject to the control of a government, court, administrator or regulator, significant

influence is unaffected because of the potential rights on the investment in associate

d. Loss of significant influence could occur as a result of a contractual arrangement

67. Which of the following statements is(are) true regarding equity method under the revised PAS 28?

I. Under the equity method, on initial recognition the investment in an associate or a joint venture is recognized at cost.

II. Distributions received from an investee reduce the carrying amount of the investment.

III. Adjustments to the carrying amount may also be necessary for changes in the investor's proportionate interest in the

investee arising from changes in the investee's other comprehensive income (e.g., revaluation surplus).

IV. When potential voting rights exist, an entity's interest in an associate or a joint venture is determined by reflecting the

possible exercise or conversion of potential voting rights.

V. An entity need not apply the equity method to its investment in an associate or a joint venture if the entity is a

subsidiary that is exempt from preparing consolidated financial statements by the scope exception in PFRS 10

Consolidated Financial Statements.

a. I, II, III and V only b. I, II and III only c. I, II, III and V only d. I, II, III, IV and V

68. Which of the following formula is correct?

a. Assets to be realized less liabilities to be liquidated equals net asset at the beginning of the period

b. Assets to be realized less liabilities to be liquidated equals net asset at the end of the period

c. Assets not realized less liabilities not liquidated equals net asset at the beginning of the period

d. Assets not realized less liabilities liquidated equals net asset at the beginning of the period

69. Are the following statements true or false, according to PFRS 11 Joint Arrangement?

Statement I: A joint arrangement is an arrangement of which two or more parties have joint control.

Statement II: A joint arrangement is either a joint operation or a joint venture.

Statement III: A joint control is the contractually agreed sharing of control of an arrangement, which exists only when

decisions about the relevant activities require the majority consent of the parties sharing control.

a. True, true, true b. True, false, false c. True, false, true d. True, true, false

70. Which of the following is the allowed method of accounting for interest in joint venture of a joint venturer under IFRS

11 Joint Arrangement?

a. proportionate consolidation

b. equity method

c. fair value model

d. cost model

71. The following are true about the differences on financial statements prepared for partnerships and those prepared for

corporations, except

a. In the statement of financial position, ownership equity for a partnership will be partners capital balances;

in a corporation, share capital, share premium, and accumulated profits & losses.

b. In lieu of a statement of accumulated profits & losses done for corporations, partnerships present a

statement of partners capital in support of its ownership equity on the statement of financial position.

c. In the statement of partners capital, generally, salaries, interest, & bonuses paid to partners are excluded

from the operating expenses of the partnerships.

d. In the statement of comprehensive income, some partnerships are treating partners remunerations as

operating expenses rather than as distribution of net profits.

72. Which of the following can qualify as an asset of an entity?

a. Freely circulating air in the school campus university

b. An oxygen tank donated to Makati Medical Center

c. Good order by Nolasco Trading from XYZ Corp.

d. The position of a public highway fronting Jollibee in Dagupan City

73. Government assistance includes all of the following, except

a. Free technical advice

b. Provision for Guarantee

c. Government procurement policy that is responsible for a portion of the entitys sales

d. Improved irrigation water system for the benefit of an entire local community

74. Supplemental disclosures required only when the statement of cash flows is prepared using the indirect method

include

a. A schedule reconciling net income with net cash flows from operating activities

b. Amounts paid for interest and taxes

c. Amounts deducted for depreciation and amortization

d. Significant noncash investing and financing activities

75. It is a continuing appropriation for an indefinite period in excess of one fiscal year

a. Annual appropriation b. Continuing appropriation c. Multi-year appropriation d. No-year appropriation

76. For which of the following purposes should an appropriation for possible loss contingencies be established?

a. To match applicable costs with current revenue.

b. To reduce fluctuations in net income in order to lend stability of the entity.

c. To charge operations in periods of rising prices for the losses which may otherwise be absorbed in

periods of falling prices.

d. To inform shareholders that a portion of retained earnings should e set aside from amounts available

for dividends because of such contingencies.

77. The dividends declared account is a nominal account and

a. Carried forward o the next accounting period

b. Closed directly to retained earnings

c. Closed directly to income summary

d. Closed directly to capital

78. Determine the false statement.

a. A material used and made part of the finished good is part of the products prime cost.

b. Labor cost for factory supervisors is part of the products prime and conversion cost.

c. A material used but not part of the finished good is part of the products conversion cost.

d. Plant overhead cost may be applied to products using normal or standard costing system.

79. When the right to receive dividend is forfeited in any one year in which dividend is not declared, the preference

share is said to be

a. Cumulative b. Non-cumulative c. Participating d. Non-participating

80. Which of the following standards may apply in accounting for financial assets and financial liabilities?

III. PAS 39 Financial Instruments: Recognition and Measurement

IV. PFRS 9 Financial Instruments

a. I only b. II only c. Both I and II d. Neither I nor II

------- END OF EXAMINATION --------------

You might also like

- Audit of ReceivablesDocument32 pagesAudit of Receivablesxxxxxxxxx96% (55)

- Audit of Stockholders EquityDocument25 pagesAudit of Stockholders Equityxxxxxxxxx87% (39)

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- At AnswerKeyDocument9 pagesAt AnswerKeyRosalie E. BalhagNo ratings yet

- At AnswerKeyDocument9 pagesAt AnswerKeyRosalie E. BalhagNo ratings yet

- Audit of LiabilitiesDocument33 pagesAudit of Liabilitiesxxxxxxxxx96% (28)

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With Answersaerwinde79% (34)

- Correction of ErrorsDocument37 pagesCorrection of Errorsxxxxxxxxx75% (36)

- Audit of InventoryDocument32 pagesAudit of Inventoryxxxxxxxxx92% (48)

- Accounting for Special Partnership TransactionsDocument15 pagesAccounting for Special Partnership TransactionsJessaNo ratings yet

- Taxation With AnswersDocument8 pagesTaxation With AnswersMarion Tamani Jr.50% (2)

- Taxation With AnswersDocument8 pagesTaxation With AnswersMarion Tamani Jr.50% (2)

- NFJPIA Mockboard 2011 Auditing TheoryDocument6 pagesNFJPIA Mockboard 2011 Auditing TheoryKathleen Ang100% (1)

- Relevant Costing CPARDocument13 pagesRelevant Costing CPARxxxxxxxxx100% (2)

- Cash and Cash Equivalent LatestDocument53 pagesCash and Cash Equivalent LatestxagocipNo ratings yet

- THEORY OF ACCOUNTS EXPLAINEDDocument12 pagesTHEORY OF ACCOUNTS EXPLAINEDChrissa Marie VienteNo ratings yet

- MAS With Answers PDFDocument13 pagesMAS With Answers PDF蔡嘉慧100% (1)

- Accounting for Government Grants, Biological Assets, Investment Property & ProvisionsDocument10 pagesAccounting for Government Grants, Biological Assets, Investment Property & ProvisionsSaeym SegoviaNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- Cost of CapitalDocument10 pagesCost of CapitalCharmaine ChuNo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Joint Arrangement Quizzer 2 AnswerDocument12 pagesJoint Arrangement Quizzer 2 AnswerAndrea ReyesNo ratings yet

- Practical Accounting 2 With AnswersDocument11 pagesPractical Accounting 2 With Answerskidrauhl0767% (6)

- Activity For SMEDocument7 pagesActivity For SMERaymond S. Pacaldo0% (1)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Receivable Financing Notes LoansDocument7 pagesReceivable Financing Notes Loansemman neriNo ratings yet

- Part 1 Advanced Accounting Problems and SolutionsDocument2 pagesPart 1 Advanced Accounting Problems and SolutionsNeil Christian LiwanagNo ratings yet

- Module 1A - PFRS For Small Entities Discussion ProblemsDocument7 pagesModule 1A - PFRS For Small Entities Discussion ProblemsLee SuarezNo ratings yet

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- First Preboard FAR ReviewDocument26 pagesFirst Preboard FAR Reviewlois martinNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- Ch04-Audit Evidence and Audit ProgramsDocument24 pagesCh04-Audit Evidence and Audit ProgramsJames PeraterNo ratings yet

- Cash, Cash Equivalent and Bank ReconDocument7 pagesCash, Cash Equivalent and Bank ReconPrincess ReyesNo ratings yet

- Auditing Theory ReviewerDocument6 pagesAuditing Theory ReviewerHans Even Dela CruzNo ratings yet

- Pre EngagementDocument2 pagesPre EngagementCM LanceNo ratings yet

- Homework on investment property analysisDocument2 pagesHomework on investment property analysisCharles TuazonNo ratings yet

- Lecture Notes On Government GrantsDocument2 pagesLecture Notes On Government Grantsjudel ArielNo ratings yet

- Activity #4 Corporate LiquidationDocument3 pagesActivity #4 Corporate LiquidationddddddaaaaeeeeNo ratings yet

- Far - QuizDocument3 pagesFar - QuizRitchel CasileNo ratings yet

- Investment ReviewerDocument2 pagesInvestment ReviewerLilibeth SolisNo ratings yet

- 1ST Grading ExamDocument12 pages1ST Grading ExamJEFFERSON CUTENo ratings yet

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- Homework On Presentation of Financial Statements (Ias 1)Document4 pagesHomework On Presentation of Financial Statements (Ias 1)Jazehl Joy ValdezNo ratings yet

- PAS 16 Test BankDocument2 pagesPAS 16 Test BankLouiseNo ratings yet

- BPS Quiz Intangibles PRINTDocument3 pagesBPS Quiz Intangibles PRINTSheena CalderonNo ratings yet

- Handout 1 - Nonprofit Organizations - RevisedDocument10 pagesHandout 1 - Nonprofit Organizations - RevisedPaupauNo ratings yet

- Jpia RmycDocument2 pagesJpia RmycFeed Back ParNo ratings yet

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESDocument2 pagesChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosNo ratings yet

- CORPORATE LIQUIDATION STATEMENTDocument73 pagesCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozNo ratings yet

- FAR 02 23 Leases PDFDocument13 pagesFAR 02 23 Leases PDFSherri BonquinNo ratings yet

- Audit of Cash and Cash Equivalents Internal ControlsDocument7 pagesAudit of Cash and Cash Equivalents Internal ControlsRNo ratings yet

- Pas 32 Pfrs 9 Part 2Document8 pagesPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- Financial Inventory TotalDocument6 pagesFinancial Inventory TotalReina EvangelistaNo ratings yet

- 6898 - Equity InvestmentsDocument2 pages6898 - Equity InvestmentsAljur SalamedaNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1Angelo Otañes GasatanNo ratings yet

- Auditing Problem 12-18-21Document23 pagesAuditing Problem 12-18-21Joebelle JamosoNo ratings yet

- Mas Test Bank QuestionDocument3 pagesMas Test Bank QuestionEricka CalaNo ratings yet

- Quiz 1 P2 FinmanDocument3 pagesQuiz 1 P2 FinmanRochelle Joyce CosmeNo ratings yet

- Auditing fraud risk factors and responsibilitiesDocument2 pagesAuditing fraud risk factors and responsibilitiesnhbNo ratings yet

- CHAPTER 2 10 PGDocument10 pagesCHAPTER 2 10 PGgirlyn abadillaNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Inventory and Accounts Payable AdjustmentsDocument3 pagesInventory and Accounts Payable AdjustmentsAngeline DalisayNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Day 1 financial statement reviewDocument12 pagesDay 1 financial statement reviewneo14No ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity SecuritiesNicole Galnayon100% (1)

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Chapter 1: Partnership: Part 1: Theory of AccountsDocument10 pagesChapter 1: Partnership: Part 1: Theory of AccountsKeay Parado0% (1)

- TOA Sample QuestionDocument14 pagesTOA Sample QuestionConstantine MarangaNo ratings yet

- Theory of Accounts With Answers PDFDocument9 pagesTheory of Accounts With Answers PDFRodNo ratings yet

- AcctgDocument14 pagesAcctgLara Lewis AchillesNo ratings yet

- Quiz#1_Cash and Cash EquivalentDocument13 pagesQuiz#1_Cash and Cash EquivalentDewdrop Mae RafananNo ratings yet

- Philippine Financial Reporting Standards for SMEs ReviewDocument12 pagesPhilippine Financial Reporting Standards for SMEs ReviewDennis VelasquezNo ratings yet

- Toa2014 51-100Document9 pagesToa2014 51-100noowrieliinNo ratings yet

- EXERCISES - Chapters 2 and 3: Part I True or FalseDocument4 pagesEXERCISES - Chapters 2 and 3: Part I True or FalseCaroline BagsikNo ratings yet

- Psa 800 PDFDocument20 pagesPsa 800 PDFshambiruarNo ratings yet

- Psa 720Document8 pagesPsa 720shambiruarNo ratings yet

- Psa 710Document18 pagesPsa 710xxxxxxxxxNo ratings yet

- Psa 700 RevDocument86 pagesPsa 700 RevDave RamirezNo ratings yet