Professional Documents

Culture Documents

Service Tax Notification No.07/2014 Dated 11th July, 2014

Uploaded by

stephin k j0 ratings0% found this document useful (0 votes)

310 views3 pagesService Tax Notification No.07/2014 "Seeks to amend notification No.12/2013-ST dated 1st July, 2013, relating to exemption from service tax to SEZ Units or the Developer." Dated 11th July, 2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentService Tax Notification No.07/2014 "Seeks to amend notification No.12/2013-ST dated 1st July, 2013, relating to exemption from service tax to SEZ Units or the Developer." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

310 views3 pagesService Tax Notification No.07/2014 Dated 11th July, 2014

Uploaded by

stephin k jService Tax Notification No.07/2014 "Seeks to amend notification No.12/2013-ST dated 1st July, 2013, relating to exemption from service tax to SEZ Units or the Developer." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

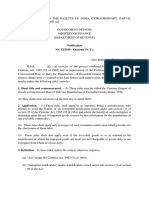

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Notification

No.7/ 2014-Service Tax

New Delhi, the 11

th

July, 2014

G.S.R.(E).In exercise of the powers conferred by sub-section (1) of section 93

of the Finance Act, 1994 (32 of 1994), read with sub-section (3) of section 95 of Finance

(No.2), Act, 2004 (23 of 2004) and sub-section (3) of section 140 of the Finance Act, 2007

(22 of 2007), the Central Government, being satisfied that it is necessary in the public interest

so to do, hereby makes the following further amendments in the notification of the

Government of India in the Ministry of Finance (Department of Revenue) No.12/2013-

Service Tax, dated the 1

st

July,2013, published in the Gazette of India, Extraordinary, Part II,

Section 3, Sub-section (i) vide number G.S.R. 448 (E), dated the 1

st

July, 2013, namely:-

In the said notification,

(i) in paragraph 3, in sub-paragraph (II),

(A) in clause (b), after the words, letter and figure in Form A-2, the words, letter and

figure within fifteen working days from the date of submission of Form A-1 shall be

inserted;

(B) after clause (b), the following clause shall be inserted, namely:-

(ba) the authorisation referred to in clause (b) shall be valid from the date of

verification of Form A-1 by the Specified Officer of the SEZ:

Provided that if the Form A-1 is not submitted by the SEZ Unit or the

Developer to the Assistant Commissioner of Central Excise or Deputy

Commissioner of Central Excise having jurisdiction, as the case may be, within

fifteen days of its verification by the Specified Officer of the SEZ, the

authorisation shall be valid from the date on which it is submitted;;

(C) for clause (c), the following clause shall be substituted, namely:-

(c) the SEZ Unit or the Developer shall provide a copy of the said

authorisation to the provider of specified services, where such provider is the

person liable to pay service tax and on the basis of the said authorisation, the

service provider may provide specified services to the SEZ Unit or the

Developer without payment of service tax:

Provided that pending issuance of said authorisation, the provider of

specified services may, on the basis of Form A-1, provide such specified

services, without payment of service tax, and the SEZ Unit or the Developer

shall provide a copy of authorisation to the service provider immediately on

receipt of such authorisation:

Provided further that if the SEZ Unit or the Developer does not provide

a copy of the said authorisation to the provider of specified services within a

period of three months from the date when such specified services were

deemed to have been provided in terms of the Point of Taxation Rules, 2011,

the service provider shall pay service tax on specified services so provided in

terms of the first proviso.;

(D) in clause (e), the following Explanation shall be inserted, namely:-

Explanation. For the purposes of this notification, a service shall be treated as

used exclusively for the authorised operations if the service is received by the SEZ

Unit or the Developer under an invoice in the name of such Unit or the Developer

and the service is used only for furtherance of authorised operations in the SEZ.;

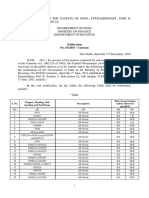

(ii) in Form A-1, in Table II, for sub-heading of column(4), the following shall be substituted,

namely:-

Service Tax Registration No. (Not applicable if specified service is covered under

full reverse charge);

(iii) in Form A-2,-

(a) in item B, in the Table, for sub-heading of column(4), the following sub-heading

shall be substituted, namely:-

Service Tax Registration No. (Not applicable if specified service is covered under

full reverse charge);

(b) after item B, the following item shall be inserted, namely:-

C: The authorisation is valid with effect from .

[refer condition at S.No.3(II)(ba)];

(iv) in Form A-3, in the TABLE, for column heading of column (4), the following column

heading shall be substituted namely:-

Service Tax Registration No. (Not applicable if specified service is covered under

full reverse charge).

.

[F.No. 334/15/ 2014-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note.- The principal notification was published in the Gazette of India, Extraordinary, by

notification No. 12/2013 - Service Tax, dated the 1

st

July, 2013, vide number G.S.R. 448 (E),

dated the 1

st

July, 2013 and last amended by notification No. 15/2013-Service Tax, dated the

21

st

November, 2013 vide number G.S.R. No.744 (E), dated the 21st November, 2013.

You might also like

- Act on Special Measures for the Deregulation of Corporate ActivitiesFrom EverandAct on Special Measures for the Deregulation of Corporate ActivitiesNo ratings yet

- Service Tax Notification No.09/2014 Dated 11th July, 2014Document2 pagesService Tax Notification No.09/2014 Dated 11th July, 2014stephin k jNo ratings yet

- 15 of 2007Document9 pages15 of 2007FelicianFernandopulleNo ratings yet

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- cs24 2013Document3 pagescs24 2013stephin k jNo ratings yet

- HTML File ProcessDocument10 pagesHTML File ProcessSuresh SharmaNo ratings yet

- ct26 2022Document18 pagesct26 2022cadeepaksingh4No ratings yet

- Notification-49 Central TaxDocument5 pagesNotification-49 Central TaxYatrik GandhiNo ratings yet

- Notification No. 52/2011-Service Tax: ProvidedDocument12 pagesNotification No. 52/2011-Service Tax: Providedsatish kumarNo ratings yet

- The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Central Rules, 1980Document29 pagesThe Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Central Rules, 1980Ayesha AlwareNo ratings yet

- Instruction To Fill Form St3Document9 pagesInstruction To Fill Form St3Dhanush GokulNo ratings yet

- GST CT 38 2023Document18 pagesGST CT 38 2023Raju BhaiNo ratings yet

- ST THDocument3 pagesST THDhananjaya MnNo ratings yet

- Form Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Document1 pageForm Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Krishan ChanderNo ratings yet

- Notification No. 35-2021 - Central TaxDocument4 pagesNotification No. 35-2021 - Central TaxSIR GNo ratings yet

- Central VatDocument6 pagesCentral Vatchethan sogiNo ratings yet

- VLK/KKJ.K HKKX (K.M Izkf/Kdkj Ls Izdkf'Kr: JFTLV H Lañ MHÑ, Yñ - (,U) 04@0007@2003-16Document8 pagesVLK/KKJ.K HKKX (K.M Izkf/Kdkj Ls Izdkf'Kr: JFTLV H Lañ MHÑ, Yñ - (,U) 04@0007@2003-16Shrikanth SKNo ratings yet

- 20SEZ Rule Amendment 10Document19 pages20SEZ Rule Amendment 1027-Deekshitha Preeth JayaramNo ratings yet

- NN 14 2022 EnglishDocument13 pagesNN 14 2022 EnglishManish sharmaNo ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- Act 39 of 2021Document9 pagesAct 39 of 2021Kriti KumarNo ratings yet

- Notification 14Document11 pagesNotification 14Amol MoreNo ratings yet

- Paper 8: Indirect Tax Laws Statutory Update For May 2022 ExaminationDocument25 pagesPaper 8: Indirect Tax Laws Statutory Update For May 2022 Examinationparam.ginniNo ratings yet

- Notfctn 40 Central Tax English 2021Document12 pagesNotfctn 40 Central Tax English 2021sridharanNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- VATActNo15 (E) 2008Document12 pagesVATActNo15 (E) 2008jing qiangNo ratings yet

- Section 137 To 146aDocument11 pagesSection 137 To 146aSher DilNo ratings yet

- Relevant Amendments For November 2019 Examination in Paper 6D: Economic LawsDocument28 pagesRelevant Amendments For November 2019 Examination in Paper 6D: Economic LawsJP GuptaNo ratings yet

- S.I. 52 of 2019 Customs and Excise (General) (Amendment) Regulations, 2019Document4 pagesS.I. 52 of 2019 Customs and Excise (General) (Amendment) Regulations, 2019Allan DosantosNo ratings yet

- Act 32 of 2023Document12 pagesAct 32 of 2023Kriti KumarNo ratings yet

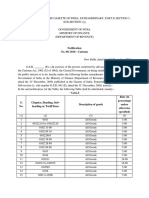

- S. No Sub-Clause of Clause (105) of Section 65 Description of Taxable Service Conditions Perce - NtageDocument3 pagesS. No Sub-Clause of Clause (105) of Section 65 Description of Taxable Service Conditions Perce - NtageAks SomvanshiNo ratings yet

- CA CS CMA Final Statutory Updates For Nov Dec 2020Document43 pagesCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNo ratings yet

- 11-Withholding Rules 2012Document5 pages11-Withholding Rules 2012Imran MemonNo ratings yet

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickNo ratings yet

- The Income Tax Amendment Act 10 2017Document8 pagesThe Income Tax Amendment Act 10 2017Nyeko FrancisNo ratings yet

- Service Tax Exemption in IndiaDocument38 pagesService Tax Exemption in IndiaAnonymous it4wrfEOdNo ratings yet

- GST 31.03.17 Itc Rules PDFDocument9 pagesGST 31.03.17 Itc Rules PDFParthibanNo ratings yet

- Input Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.Document22 pagesInput Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.KaranNo ratings yet

- Amendments in Service TaxDocument15 pagesAmendments in Service TaxShankar NarayananNo ratings yet

- Arunachal Pradesh Goods Tax Rules 2005Document31 pagesArunachal Pradesh Goods Tax Rules 2005Luvjoy ChokerNo ratings yet

- TPT RoadDocument13 pagesTPT RoadLakhan PatidarNo ratings yet

- Act - Skills Development LeviesDocument13 pagesAct - Skills Development LeviesJason Fourie100% (1)

- Amendment To Rules, 2006Document7 pagesAmendment To Rules, 2006Latest Laws TeamNo ratings yet

- Service Tax Procedures: HapterDocument25 pagesService Tax Procedures: HaptertimirkantaNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- GSTNTF55Document7 pagesGSTNTF55JGVNo ratings yet

- Finance Bill 2011Document23 pagesFinance Bill 2011sherafghan_97No ratings yet

- Supp Final Idt07Document73 pagesSupp Final Idt07vadirajtanjoreNo ratings yet

- Service Tax Notification No.11/2014 Dated 11th July, 2014Document2 pagesService Tax Notification No.11/2014 Dated 11th July, 2014stephin k jNo ratings yet

- 11 Rate Notification CGST 6dec2022Document60 pages11 Rate Notification CGST 6dec2022Hemant SinhmarNo ratings yet

- Payment of Service TaxDocument12 pagesPayment of Service TaxPrasanth KumarNo ratings yet

- Act 20 of 2020Document8 pagesAct 20 of 2020Kriti KumarNo ratings yet

- GST Rates On Real Estate Sector Services Wef 01.04.2019 - Taxguru - inDocument30 pagesGST Rates On Real Estate Sector Services Wef 01.04.2019 - Taxguru - inTejas SodhaNo ratings yet

- Section 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDocument3 pagesSection 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDHANNNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Document3 pagesDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jNo ratings yet

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Document1 pageDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- USDC Doc# 45-16 Declaration of Sheila Mojtehedi ISO Request For Entry of DefaultDocument2 pagesUSDC Doc# 45-16 Declaration of Sheila Mojtehedi ISO Request For Entry of DefaultSYCR ServiceNo ratings yet

- 19 Aratea vs. ComelecDocument45 pages19 Aratea vs. ComelecbillietotNo ratings yet

- Labour Co-Operatives in India PDFDocument9 pagesLabour Co-Operatives in India PDFTapesh Awasthi0% (1)

- Affidavit of Self Adjudication With SaleDocument2 pagesAffidavit of Self Adjudication With SaleKatrina Maniquis92% (13)

- SFG Mains 2023 GS2 ScheduleDocument2 pagesSFG Mains 2023 GS2 Schedulegiant affiliateNo ratings yet

- Case Digest CivDocument1 pageCase Digest CivLorenzo TusanezaNo ratings yet

- Singer Workbook NotesDocument3 pagesSinger Workbook NotesDeasiah BlackmanNo ratings yet

- Public Administration System of United Kingdom and Its ReformsDocument8 pagesPublic Administration System of United Kingdom and Its ReformsAarush SinghNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument4 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Halsbury's TRUSTS (VOLUME 48 (2007 REISSUE) )Document705 pagesHalsbury's TRUSTS (VOLUME 48 (2007 REISSUE) )Ian Dsouza100% (2)

- B.shyam Sunder - Harijans and Neo-Buddhist Claim To Scheduled CasteDocument18 pagesB.shyam Sunder - Harijans and Neo-Buddhist Claim To Scheduled CasteMarcus Mcdaniel100% (1)

- Get Clearance Before Exiting SaudiDocument3 pagesGet Clearance Before Exiting SaudiJohn Angelo Biñas JaucianNo ratings yet

- America's 51st State?Document2 pagesAmerica's 51st State?gabrielcharlesytylerNo ratings yet

- Comparative FINAL COACHING - COMPARATIVE MODELS IN POLICINGDocument25 pagesComparative FINAL COACHING - COMPARATIVE MODELS IN POLICINGJoseMelarte GoocoJr.No ratings yet

- UnpublishedDocument19 pagesUnpublishedScribd Government DocsNo ratings yet

- ESPIRITU Vs Municipality of PozzorubioDocument2 pagesESPIRITU Vs Municipality of PozzorubioGean Pearl Pao Icao100% (3)

- GERPH01XDocument2 pagesGERPH01XMarissa VillagraciaNo ratings yet

- Kopirati Do 461 Strane KnjigeDocument592 pagesKopirati Do 461 Strane KnjigeLakić Todor100% (1)

- Manila 1945 KWLDocument3 pagesManila 1945 KWLJairah Faith CammayoNo ratings yet

- The Uniform Adoption ActDocument7 pagesThe Uniform Adoption ActleiliuNo ratings yet

- mg286 AllDocument32 pagesmg286 AllsyedsrahmanNo ratings yet

- Article 21A - Constitutional LawDocument3 pagesArticle 21A - Constitutional LawAamir harunNo ratings yet

- Oribello vs. CADocument2 pagesOribello vs. CAGrace VetusNo ratings yet

- Right To Life: Personal Liberty and More Semester 4 Constitutional Law-IiDocument13 pagesRight To Life: Personal Liberty and More Semester 4 Constitutional Law-IiVíshál RánáNo ratings yet

- SSS SpaDocument2 pagesSSS SpaZina CaidicNo ratings yet

- Diagnostic Exam PPGDocument5 pagesDiagnostic Exam PPGJennifer Mayano100% (1)

- Background and Evolution of Company Law in The SubDocument2 pagesBackground and Evolution of Company Law in The SubAsma Ul HossnaNo ratings yet

- SPL Cases 07.30.19Document96 pagesSPL Cases 07.30.19pipoNo ratings yet

- Memorandum of Law in Support of Defendants' Motion To DismissDocument21 pagesMemorandum of Law in Support of Defendants' Motion To DismissBasseemNo ratings yet

- Trafficking BillDocument41 pagesTrafficking Billbhupendra barhatNo ratings yet