Professional Documents

Culture Documents

Service Tax Notification No.10/2014 Dated 11th July, 2014

Uploaded by

stephin k j0 ratings0% found this document useful (0 votes)

47 views2 pagesService Tax Notification No.10/2014 "Seeks to amend the notification No.30/2012-ST dated 20th June,2012, so as to prescribe, the extent of service tax payable by the service provider and the recipient of service, for certain specified services." Dated 11th July, 2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentService Tax Notification No.10/2014 "Seeks to amend the notification No.30/2012-ST dated 20th June,2012, so as to prescribe, the extent of service tax payable by the service provider and the recipient of service, for certain specified services." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

47 views2 pagesService Tax Notification No.10/2014 Dated 11th July, 2014

Uploaded by

stephin k jService Tax Notification No.10/2014 "Seeks to amend the notification No.30/2012-ST dated 20th June,2012, so as to prescribe, the extent of service tax payable by the service provider and the recipient of service, for certain specified services." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

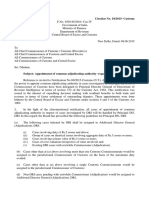

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Notification

No.10/2014-Service Tax

New Delhi, the 11

th

July, 2014

G.S.R...... (E).- In exercise of the powers conferred by sub-section (2) of section 68 of

the Finance Act, 1994 (32 of 1994), the Central Government, hereby makes the following

further amendments in the notification of the Government of India in the Ministry of

Finance (Department of Revenue) No. 30/2012-Service Tax, dated the 20

th

June, 2012,

published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide

number G.S.R. 472 (E), dated the 20

th

June, 2012, namely:-

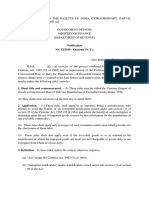

1. In the said notification,

(i) in paragraph I, in clause (A),

(a) after sub-clause (i), the following sub-clause shall be inserted, namely:-

(ia) provided or agreed to be provided by a recovery agent to a banking

company or a financial institution or a non-banking financial company;;

(b) for sub-clause (iva), the following sub-clause shall be substituted, namely :-

(iva) provided or agreed to be provided by a director of a company or a body

corporate to the said company or the body corporate;;

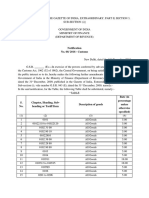

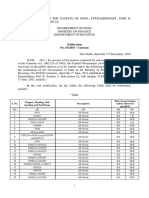

(ii) in paragraph II, in the TABLE,

(a) for all the headings of the columns, the following shall respectively be substituted

namely:-

Sl.No Description of a service Percentage of

service tax payable

by the person

providing service

Percentage of service

tax payable by the

person receiving the

service

(1) (2) (3) (4);

(b) after serial number 1 and the entries relating thereto, the following serial

number and entries shall be inserted, namely:-

1A. in respect of services

provided or agreed to be

provided by a recovery

agent to a banking company

or a financial institution or a

non-banking financial

company

Nil 100%;

(c) against serial number 5A of column (1) , for the entries in column (2), the

following entry shall be substituted namely:-

in respect of services provided or agreed to be provided by a director of a company

or a body corporate to the said company or the body corporate;

(d) in serial number 7, against item (b), in columns (3) and (4), for the existing

entries, the entries 50% and 50% shall respectively be substituted with effect

from the 1

st

day of October, 2014.

2. Save as otherwise provided herein, this notification shall come into force on the 11

th

day of July, 2014.

[F.No. 334 /15/ 2014-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note.- The principal notification was published in the Gazette of India, Extraordinary, by

notification No. 30/2012 - Service Tax, dated the 20

th

June, 2012, vide number G.S.R. 472

(E), dated the 20

th

June, 2012 and last amended by notification No. 45/2012-Service Tax,

dated the 7

th

August, 2012 vide number G.S.R. 621 (E), dated the 7

th

August, 2012

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- People v. HayagDocument2 pagesPeople v. HayagReginaNo ratings yet

- 177 Angeles Vs Sison DigestDocument2 pages177 Angeles Vs Sison DigestJulius Geoffrey TangonanNo ratings yet

- Gift or HibaDocument21 pagesGift or HibaKAYNATALINo ratings yet

- Digests Oblicon ClassDocument31 pagesDigests Oblicon ClassBelzer Resurreccion0% (1)

- Villagracia vs. 5th Shari'a District CourtDocument4 pagesVillagracia vs. 5th Shari'a District Courtana ortizNo ratings yet

- Victory Liner V GammadDocument1 pageVictory Liner V GammadfcnrrsNo ratings yet

- ASME B16.49 Factory Made Wrought Steel Butt Welding Induction Bends For Transportation and Distribution Systems PDFDocument19 pagesASME B16.49 Factory Made Wrought Steel Butt Welding Induction Bends For Transportation and Distribution Systems PDFMuhammadNo ratings yet

- DocxDocument6 pagesDocxJean Monique Oabel-TolentinoNo ratings yet

- REM2 - Cases - Rule 57 - 61 - Provisional RemediesDocument201 pagesREM2 - Cases - Rule 57 - 61 - Provisional RemediesMarife Tubilag ManejaNo ratings yet

- Osmena v. ComelecDocument1 pageOsmena v. ComelecLovely VillanuevaNo ratings yet

- P10 Pesca v. Pesca DigestDocument1 pageP10 Pesca v. Pesca DigestMarissa Mitra LunaNo ratings yet

- 31-CIR v. Batangas Transportation G.R. No. L-9692 January 6, 1958Document6 pages31-CIR v. Batangas Transportation G.R. No. L-9692 January 6, 1958wewNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Document1 pageDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Document3 pagesDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jNo ratings yet

- Constitutional Law Procedure To Amend Constitution of IndiaDocument2 pagesConstitutional Law Procedure To Amend Constitution of IndiaDeepakChoudharyNo ratings yet

- RightsDocument30 pagesRightsCarolyn Elizabeth BarcemoNo ratings yet

- Petitioner vs. vs. Respondents: First DivisionDocument7 pagesPetitioner vs. vs. Respondents: First DivisionkarlshemNo ratings yet

- Decision in Karahalios v. Conservative Party of CanadaDocument56 pagesDecision in Karahalios v. Conservative Party of CanadaAndrew LawtonNo ratings yet

- AbstractDocument2 pagesAbstractMadhav MallyaNo ratings yet

- Banzon vs. CruzDocument65 pagesBanzon vs. Cruzerxha ladoNo ratings yet

- Nierras v. DacuycuyDocument3 pagesNierras v. DacuycuyBeltran KathNo ratings yet

- Haryana Khadi and Village Industries Board Act - Naresh KadianDocument21 pagesHaryana Khadi and Village Industries Board Act - Naresh KadianNaresh KadyanNo ratings yet

- Baldo v. Board of Trustees of The University of Northern Colorado - Document No. 4Document4 pagesBaldo v. Board of Trustees of The University of Northern Colorado - Document No. 4Justia.comNo ratings yet

- Smartdrive Systems v. DrivecamDocument28 pagesSmartdrive Systems v. DrivecamPriorSmartNo ratings yet

- 1.3 - 1.4 Understand Legal and Regulatory Issues That Pertain To Information Security in A GlobalDocument29 pages1.3 - 1.4 Understand Legal and Regulatory Issues That Pertain To Information Security in A GlobalManoj SharmaNo ratings yet

- Reply BriefDocument14 pagesReply BrieftowleroadNo ratings yet

- Civil Application No Nai 32 of 2015 June 12 - 2015 PDFDocument14 pagesCivil Application No Nai 32 of 2015 June 12 - 2015 PDFfelixmuyoveNo ratings yet

- JANUARY 30, 31, FEBRUARY 1 & 2, 2019: Philippine Law SchoolDocument2 pagesJANUARY 30, 31, FEBRUARY 1 & 2, 2019: Philippine Law SchoollawNo ratings yet

- 37.Mcc Industrial Vs SsangyongDocument1 page37.Mcc Industrial Vs SsangyongGlendie LadagNo ratings yet

- Wesleyan University PH v. WUP AssocDocument1 pageWesleyan University PH v. WUP AssocVon Lee De LunaNo ratings yet

- Manila Electric LimDocument2 pagesManila Electric LimPraisah Marjorey Casila-Forrosuelo PicotNo ratings yet

- Soliven v. FastformsDocument3 pagesSoliven v. FastformsTippy Dos SantosNo ratings yet