Professional Documents

Culture Documents

Service Tax Circular No.178/4/2014-ST Dated 11th July, 2014

Uploaded by

stephin k j0 ratings0% found this document useful (0 votes)

57 views3 pagesService Tax Circular No.178/4/2014-ST "F.No.334/15/2014-TRU" "Manner of distribution of common input service credit under rule 7(d) of the Cenvat Credit Rules, 2004" Dated 11th July, 2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentService Tax Circular No.178/4/2014-ST "F.No.334/15/2014-TRU" "Manner of distribution of common input service credit under rule 7(d) of the Cenvat Credit Rules, 2004" Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views3 pagesService Tax Circular No.178/4/2014-ST Dated 11th July, 2014

Uploaded by

stephin k jService Tax Circular No.178/4/2014-ST "F.No.334/15/2014-TRU" "Manner of distribution of common input service credit under rule 7(d) of the Cenvat Credit Rules, 2004" Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

1 | P a g e

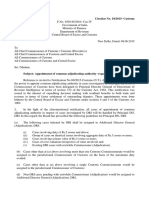

Circular No. 178/4/2014-ST

F.No.334/15/2014-TRU

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise& Customs

Tax Research Unit

North Block, New Delhi

11

th

July, 2014

To,

Chief Commissioners of Central Excise and Service Tax (All),

Director General (Service Tax), Director General (Audit),

Director General (Central Excise Intelligence),

Commissioners of Service Tax (All),

Commissioners of Central Excise and Service Tax (All).

Madam/Sir,

Subject: Manner of distribution of common input service credit

under rule 7(d) of the Cenvat Credit Rules, 2004 -- regarding.

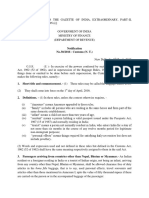

Doubts have been raised regarding the manner and extent of the distribution of

common input service credit in terms of amended rule 7 [especially rule 7(d)] of the

Cenvat Credit Rules, 2004 (CCR). Rule 7 provides for the mechanism of distribution of

common input service credit by the Input Service Distributor to its manufacturing units

or to units providing output services. An amendment was carried out vide Notification

no. 05/2014-CE (N.T.) dated 24

th

February, 2014, amending inter-alia rule 7(d)

providing for distribution of common input service credit among all units in their

turnover ratio of the relevant period. Rule 7(d), after the amendment, reads as under:

credit of service tax attributable to service used by more than one unit shall be distributed pro

rata on the basis of the turnover of such units during the relevant period to the total turnover of

all its units, which are operational in the current year, during the said relevant period

2. These doubts have arisen with respect to the meaning of the words such unit

used in rule 7(d). It has been stated in the representations that due to the use of the term

such unit, the distribution of the credit would be restricted to only those units where

the services are used. It has been interpreted by the trade that in view of the amended

rule 7(d) of the CCR, the credit available for distribution would get reduced by the

proportion of the turnover of those units where the services are not used.

2 | P a g e

3. Rule 7 was amended to simplify the method of distribution. Prior to this

amendment there were a few issues raised by the trade regarding distribution of credit

under rule 7 such as determining the turnover of each unit for each month and

distributing by following the nexus of the input services with the units to which such

services relate. The amendment in the said rule was carried out to address these issues.

The amended rule 7(d) seeks to allow distribution of input service credit to all units in

the ratio of their turnover of the previous year. To make the intent of the amended rule

clear, illustration of the method of distribution to be followed is given below.

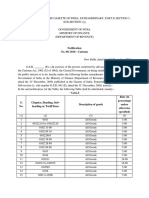

4. An Input Service Distributor (ISD) has a total of 4 units namely A, B, C and

D, which are operational in the current year. The credit of input service pertaining to

more than one unit shall be distributed as follows:

X

Distribution to A =

* Z

Y

X = Turnover of unit A during the relevant period

Y = Total turnover of all its unit i.e. A+B+C+D during the relevant period

Z = Total credit of service tax attributable to services used by more than one unit

Similarly the credit shall be distributed to the other units B, C and D.

Illustration:

An ISD has a common input service credit of Rs. 12000 pertaining to more than one

unit. The ISD has 4 units namely A, B, C and D which are operational in the

current year.

Unit Turnover in the previous year

(in Rs.)

A (Manufacturing excisable goods) 25,00,000

B (Manufacturing excisable and exempted goods) 30,00,000

C (providing exclusively exempted service) 15,00,000

D (providing taxable and exempted service) 30,00,000

Total 1,00,00,000

The common input service relates to units A, B and C, the distribution will be as

under:

(i) Distribution to A = 12000 * 2500000/10000000

3 | P a g e

= 3000

(ii) Distribution to B = 12000 * 3000000/10000000

= 3600

(iii) Distribution to C = 12000 * 1500000/10000000

= 1800

(iv) Distribution to D = 12000 * 3000000/10000000

= 3600

The distribution for the purpose of rule 7(d), will be done in this ratio in all cases,

irrespective of whether such common input services were used in all the units or in

some of the units.

5. Reference may be made to Sh. G. D. Lohani, Director (TRU) in case of any further

doubt. Trade Notice/Public Notice may be issued to the field formations and tax

payers. Please acknowledge receipt of this Circular.

6. Hindi version to follow.

Yours sincerely,

[Dr. Abhishek Chandra Gupta]

Technical Officer, TRU

Tel. no.: 011-23093075

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Customs Circular No.10/2016 Dated 15th March, 2016Document4 pagesCustoms Circular No.10/2016 Dated 15th March, 2016stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Customs Circular No. 13/2014 Dated 18th November, 2014Document3 pagesCustoms Circular No. 13/2014 Dated 18th November, 2014stephin k jNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Customs Circular No. 06/2015 Dated 11th February, 2015Document1 pageCustoms Circular No. 06/2015 Dated 11th February, 2015stephin k jNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Customs Circular No. 16/2015 Dated 19th May, 2015Document6 pagesCustoms Circular No. 16/2015 Dated 19th May, 2015stephin k jNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Customs Non Tariff Notifications No.26/2016 Dated 16th February, 2016Document11 pagesCustoms Non Tariff Notifications No.26/2016 Dated 16th February, 2016stephin k jNo ratings yet

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Customs Circular No. 03/2015 Dated 16th January, 2015Document2 pagesCustoms Circular No. 03/2015 Dated 16th January, 2015stephin k jNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Customs Non Tariff Notifications No.34/2016 Dated 29th February, 2016Document2 pagesCustoms Non Tariff Notifications No.34/2016 Dated 29th February, 2016stephin k jNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Customs Circular No. 10/2014 Dated 17th October, 2014Document3 pagesCustoms Circular No. 10/2014 Dated 17th October, 2014stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Customs Non Tariff Notifications No.31/2016 Dated 1st March, 2016Document2 pagesCustoms Non Tariff Notifications No.31/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.30/2016 Dated 1st March, 2016Document6 pagesCustoms Non Tariff Notifications No.30/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Customs Tariff Notifications No.54/2016 Dated 3rd October, 2016Document6 pagesCustoms Tariff Notifications No.54/2016 Dated 3rd October, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.20/2016 Dated 8th February, 2016Document4 pagesCustoms Non Tariff Notifications No.20/2016 Dated 8th February, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.22/2016 Dated 8th February, 2016Document9 pagesCustoms Non Tariff Notifications No.22/2016 Dated 8th February, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Nitafan V Cir 152 Scra 284Document7 pagesNitafan V Cir 152 Scra 284Anonymous K286lBXothNo ratings yet

- Manila Standard Today - May 19, 2012 IssueDocument12 pagesManila Standard Today - May 19, 2012 IssueManila Standard TodayNo ratings yet

- Baum Et Al v. Maplewood City Library Et Al - Document No. 10Document10 pagesBaum Et Al v. Maplewood City Library Et Al - Document No. 10Justia.comNo ratings yet

- Manuel LDocument3 pagesManuel LKristel GaliciaNo ratings yet

- Law of Public Offices and Public OfficersDocument44 pagesLaw of Public Offices and Public OfficersDensel James Abua Silvania100% (1)

- IBP vs. Zamora Case DigestDocument2 pagesIBP vs. Zamora Case DigestCharles Gerard B. Beluan100% (2)

- Godfrey Phillips V UoIDocument11 pagesGodfrey Phillips V UoIVibha Mohan83% (6)

- Modes of Acquir-WPS OfficeDocument6 pagesModes of Acquir-WPS OfficeManas DasNo ratings yet

- Abdul Salam Federal CT DecisionDocument14 pagesAbdul Salam Federal CT DecisionpolismiliterNo ratings yet

- Solon Seeks Repeal of Anti-Hazing Law Frat Member SurrendersDocument7 pagesSolon Seeks Repeal of Anti-Hazing Law Frat Member SurrenderskqueentanaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Consti CasesDocument221 pagesConsti CasesArlon Bryan DiolesteNo ratings yet

- Law of Delict 3703Document19 pagesLaw of Delict 3703Vertozil BezuidenhoudtNo ratings yet

- Nicolas-Lewis v. COMELECDocument5 pagesNicolas-Lewis v. COMELECBeltran KathNo ratings yet

- ABAKADA Guro Party List V Purisima - DigestDocument1 pageABAKADA Guro Party List V Purisima - DigestRichmark Belgira100% (6)

- G1A. Aldaba Vs ComelecDocument11 pagesG1A. Aldaba Vs ComelecKatNo ratings yet

- Rattan Chand Hira Chand VDocument6 pagesRattan Chand Hira Chand VBishwajeet JhaNo ratings yet

- United States v. Lawrence C. Matthews, 4th Cir. (2000)Document25 pagesUnited States v. Lawrence C. Matthews, 4th Cir. (2000)Scribd Government DocsNo ratings yet

- Entick V CarringtonDocument3 pagesEntick V Carringtonrichardchan001No ratings yet

- Park Village Apartment Tenants Association Et Al v. Mortimer Howard Trust Et Al - Document No. 31Document2 pagesPark Village Apartment Tenants Association Et Al v. Mortimer Howard Trust Et Al - Document No. 31Justia.comNo ratings yet

- Ereno v. Public Service Commission (G.R. No. L-25962)Document3 pagesEreno v. Public Service Commission (G.R. No. L-25962)Rache GutierrezNo ratings yet

- TableinoneDocument1 pageTableinonevexorimNo ratings yet

- Office of The Ombudsman Vs MadriagaDocument2 pagesOffice of The Ombudsman Vs MadriagaKang Minhee100% (2)

- CENTRAL BANK EMPLOYEES ASS'N Vs BSPDocument133 pagesCENTRAL BANK EMPLOYEES ASS'N Vs BSPKristela AdraincemNo ratings yet

- Time at Large Malaysian Construction and Contract LawDocument5 pagesTime at Large Malaysian Construction and Contract LawrahimNo ratings yet

- Wagner V Wallace - Document No. 3Document3 pagesWagner V Wallace - Document No. 3Justia.comNo ratings yet

- Citizenship Law ProjectDocument10 pagesCitizenship Law ProjectaakarshsinghNo ratings yet

- 84th Regular Session - March 12, 2018 - FinalDocument30 pages84th Regular Session - March 12, 2018 - FinalHappy KidNo ratings yet

- UN CRPD - HSLDA Official Issue PaperDocument3 pagesUN CRPD - HSLDA Official Issue Paperkdial40No ratings yet

- David v. Arroyo DigestDocument3 pagesDavid v. Arroyo DigestRochelle Ann Reyes100% (2)

- Retrospective Operations of Statutes in IndiaDocument21 pagesRetrospective Operations of Statutes in IndiaDiksha Goyal100% (16)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)