Professional Documents

Culture Documents

Financial Analysis Project

Uploaded by

Stanciu NicuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis Project

Uploaded by

Stanciu NicuCopyright:

Available Formats

Academia de Studii Economice,

Bucureti

FINACIAL ANALYSIS

Simex S.A.

STANCIU Nicu, TUHARI Anatolii, UNGUREANU Vlad

Gr. 137, FABIZ Eng.

Abstract

This paper studies the financial position and performance of the Romanian furniture

manufacturing company Simex S.A. for the period of 2010-2012.

Contents

1. Introduction ................................................................................................................................................ 2

2. Key Financials ............................................................................................................................................ 2

3. Financial balance analysis .......................................................................................................................... 3

4. Financial performance analysis .................................................................................................................. 5

5. Cash flow analysis ...................................................................................................................................... 6

6. Ratio analysis .............................................................................................................................................. 7

7. Competitor comparison .............................................................................................................................. 9

8. Conclusion ................................................................................................................................................ 11

1. Introduction

Simex S.A. (referred further as Simex) is a Romanian furniture manufacturing company, located in

imleul Silvaniei, Slaj county. It has been founded as a company in 1984, by a family that had a tradition

of over 50 years in furniture manufacturing. At the beginning of 90s, Simex had become known as an

exclusive manufacturer and exporter of furniture for German market. Soon after, Simex began to expand its

market towards east, entering countries such as Russia, Ukraine, and other former CIS republics. Nowadays,

Simex is a well-known brand in these countries. The company specializes in the production of furniture

made from massive wood, respecting the classical style, putting the importance upon quality and art. In

1998, the company was listed on Bucharest Stock Exchange, foreseeing further development. The year of

2000 was marked by the beginning of the company development, through the acquisition of five furniture

factories, located in Slaj and Satu Mare. In 2004, Simex scored a turnover of 4.5 million EUR, which

represented at that time 80% of Romanian furniture exports on eastern markets. In 2009, Simex had

inaugurated a warehouse (1000 m

2

) and a permanent showroom (200 m

2

) in Moscow. Nowadays, Simex has

over 20 stores, located in Russia, Ukraine, Hungary, Austria and Romania.

2. Key Financials

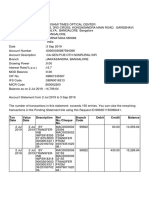

In the tables below, we have extracted main entries from balance sheet and P&L statement that are

going to be used in further analysis.

SIMEX SA RON 1-Jan-11 31-Dec-11 31-Dec-12

NonCurrentAssets 10,044,604 10,476,823 10,204,950

CurrentAssets 11,234,372 12,222,326 15,749,616

Inventory 6,728,973 7,818,054 10,167,995

Receivables 3,991,100 4,336,421 3,940,534

Cash&BankAcc 514,299 67,851 1,641,087

Prepayments 50,000 50,000 50,000

NetCurrAssets/STLiab 4,811,186 5,373,237 5,550,688

TotalAssets 21,328,976 22,749,149 26,004,566

STLiabilities 569,060 960,960 325,682

LongTermLiabilities 6,473,186 6,899,089 10,248,928

TotalLiabilities 7,042,246 7,860,049 10,574,610

SubscribedCapital 4,206,195 4,206,195 4,206,195

ReevaluationReserves 1,018,041 1,018,041 937,209

Reserves 8,061,349 9,097,285 9,777,268

Profit/Loss 1,066,618 602,371 540,856

ProfitDistribution 65,448 34,767 31,547

OwnShare 25 25 25

TotalEquity 14,286,730 14,889,100 15,429,956

AverageNoEmployees

(full time) 279 260 259

3. Financial balance analysis

Net worth = Total assets Total liabilities

1-Jan-11 31-Dec-11 31-Dec-12

1

(m.u)

2

(m.u)

1

(%)

2

(%)

NetWorth 14,286,730 14,889,100 15,429,956 602,370 540,856 4.22 3.63

Called also net assets, represents the amount that remains to the owners discretion. This indicator is

represented in the balance sheet as TotalEquity. In our case we can see that NW indicator had a steady

growth through the period analyzed. During 2011, NW indicator grew by 602,370 RON, which translates

into 4.22%. At the end of 2012, this indicator score a growth of 540,856 RON, or 3.63%. This is a good

financial sign that the company is accumulating wealth.

SIMEX SA

RON 2010 2011 2012

Turnover 16,231,923 15,864,203 15,085,506

OperatingIncome 16,772,784 16,671,945 17,715,735

OtherOpIncome 41,658 76,013 103,271

RawMatExpense 4,875,125 5,016,572 5,320,757

OtherRMExpense 88,421 96,133 102,623

StorageExpense 127,213 135,438 114,305

UtilitiesExpense 482,835 492,345 592,864

SalaryExpense 5,601,128 5,876,863 6,296,034

CommercialDiscount 0 -48,362 -7,963

Deprec&Adjust:

NCAssets 901,675 813,591 873,553

Cassets 36,937 0 -5,808

ExternalServiceExp 2,843,447 3,037,566 3,209,222

OtherTaxExpense 90,483 101,045 90,093

OtherExpense 44,647 16,335 90,934

OperatingExpense 15,091,911 15,537,526 16,676,614

OpResult 1,680,873 1,134,419 1,039,121

FinIncome 320,352 343,390 451,019

FinExpense 692,275 718,300 831,089

InterestExpense 278,898 309,354 267,922

FinResult -371,923 -374,910 -380,070

ProfitTax 242,332 157,138 118,195

NetResult 1,066,618 602,371 540,856

OpVariableCosts 8,461,688 8,794,389 9,430,705

OpFixedCosts 5,691,611 5,977,908 6,386,127

TotDeprec&Adjust 938,612 765,229 859,782

Working capital = (SubscribeCapital+OwnShare+LTLiabilities)-NCAssets

This indicator reflects whether the company manages to cover its long-term financial needs. At the

end of 2011, companys WC decreased by 6,316 RON (-0.99%), and increased by 3,621,712 RON

(+576.26%) at the end of 2012. We can observe that the company had a huge growth of the indicator at the

end of 2012, mainly due to contracting LT liabilities. As a result, the company should not have financing

problems with long-term assets for several years. On the other hand, the sums borrowed seems too large, so

future investments are to be expected in order for the company to justify these debts.

RequiredWC = CurrentAssets-STLiabilities

1-Jan-11 31-Dec-11 31-Dec-12 1(m.u) 2(m.u) 1(%) 2(%)

RWC 10,665,312 11,261,366 15,423,934 596,054 4,162,568 5.59 36.96

This indicator shows how the company manages to cover short-term financial needs, in order to

finance its current activity. The company scored in both years positive results. At the end of 2011, the

indicator shows increase of 5.59%, and an increase of 36.96% at the end of 2012. In addition, this indicator

gives us a hint that the company is solvable on short term, because current assets cover ST liabilities. On the

other hand, we can observe that inventories pile up from year to year, which may indicate a problem with

sales of the production. The company has to work on its inventories turnover rate.

NetTreasury=WC-RWC

1-Jan-11 31-Dec-11 31-Dec-12 1(m.u) 2(m.u) 1(%) 2(%)

NetTreasury -11,300,114 -11,889,852 -19,674,132 -589,738 -7,784,280 -5.22 -65.47

NT indicator shows weather the company manages to keep a financial balance between financing

long term and short-term activity. We observe that the company has higher RequiredWC than available

Working Capital, and probably uses funds to finance short-term activity from funds assigned for long-term

financing. This leads to an unbalanced financial situation and a violation of the basic financial rule, which

states that long-term financial needs should be covered by long-term liabilities, and vice versa. The negative

differences computed above, show that the company has big decreases in cash flow from year to year, hence

liquidity problems.

1-Jan-11 31-Dec-11 31-Dec-12 1(m.u) 2(m.u) 1(%) 2(%)

WorkingCapital 634,802 628,486 4,250,198 -6,316 3,621,712 -0.99 576.26

In conclusion, we observe that the company has an aggressive financing policy, disregarding the

importance of financial balance and prudence. The company has to work on its sales turnover, which can

cover this unbalanced situation.

4. Financial performance analysis

We will analyze further the way the company had reached its net result at the end of each year. This

will give us an insight on sales and costs, hence insights upon

efficiency and profitability.

2010 2011 2012

OperatingIncome -

16,772,784 16,671,945

17,715,735

OpVariableCosts

8,461,688

8,794,389

9,430,705

= VarCostMargin -

8,311,096

7,877,556

8,285,030

OpFixedCosts

5,691,611

5,977,908

6,386,127

= EBITDA -

2,619,485

1,899,648

1,898,903

TotDeprec&Adjust

938,612

765,229

859,782

= OpResult +

1,680,873

1,134,419

1,039,121

FinIncome -

320,352

343,390

451,019

FinExpense

692,275

718,300

831,089

= EBT -

1,308,950

759,509

659,051

ProfitTax

242,332

157,138

118,195

= NetResult

1,066,618

602,371

540,856

We can see an obvious link between rising costs through all three periods, and decreases in profit

levels for all three years. The company should work upon reducing costs, thus increasing efficiency and

profitability. However, it is a good sign that the company continues to score profit.

Self-financing capacity=NetResult+Deprec&Ajust-AssetsDisposalIncome

2010 2011 2012

SFC 1,963,572 1,291,587 1,297,367

The table to the left gives us

insight upon the proportion of each entry

from the OperatingIncome. The variable

costs represent the biggest proportion of

sales, which is 50.45% (2010), 52.75%

(2011), and 53.23% (2012). The other

big part is represented by fixed costs:

33.93% (2012), 35.86% (2011), and

36.05% (2012). Total costs represent

84.38% (2010), 88.61% (2011), and

89.28% (2012). In addition, on average,

financial expenses are almost twice as

bigger as financial income, for all three

years. All these factors have an obvious

influence on net profit, which represents

6.36% (2010), 3.61% (2011), and 3.05%

(2012) from total operating sales.

This indicator shows us the financial potential of the company, and its possibility to self-finance the

development and operating activity, with resources yield by operating activity. In the case of the company

analyzed, this indicator is a positive one, for all three years. On the other hand, even if the company has self-

financing potential, it has to keep the eye on maintaining a positive cash flow. Otherwise, it will be

necessary to contract new ST liabilities to finance current activity. It is important that capacity and liquidity

be proportional, in order for the company to make use of the self-financing capacity.

5. Cash flow analysis

As stated before, it is important for a manufacturing company to keep a positive cash flow, because it

requires continuous input to operate. Therefore, in the next section we will analyze the position of the

company regarding its cash flow.

OperatingCF=SFC-FinIncome-RWC

2011 2012

OpCF 352,143 -3,316,220

The figure above speak for themselves. At the end of 2011, the company closed with a positive

operational cash flow, meaning that it could finance further operating activities with money generated by the

operating activity itself. However, at the end of 2012, has a negative cash flow for operating activities,

meaning that it has to be covered by financial cash flow.

FinancialCF=TotalEquity+LTLiabilities

Financial cash flow is positive, meaning that the company has money to cover the operating one. The

bulk of the financial cash flow is due to long-term liabilities contracted. It is not advisable to use long-term

liabilities for financing operating activities. Financial cash flow should be used for investment purposes.

However, the financial cash flow reported for 2012 can cover the operating one for that same year, giving

the company the ability to continue its operations.

InvestmentCF=TangAssets+FinResult

2011 2012

FinCF 993,506 3,859,148

2011 2012

InvCF 872,029 343,843

CF=OpCF+FinCF+InvCF

2011 2012

CF 2,217,678 886,771

Per total, the company cash flow is a positive one, however a big decrease can be observed at the end

of 2012.

6. Ratio analysis

Turnover ratio

Is a measure of operational efficiency and shows how long does it take a position to make a complete

turnover in the company.

We can observe above the average number of days for a position to make a rotation in the

production cycle of the company. We can observe that inventories and current assets have a very long period

to make a rotation in the cycle, which might be a reason for a decreased efficiency of the company. As it is a

manufacturing company, the company should focus on reducing the stocks and the days needed for them to

make a complete rotation. This will increase the turnover of the company, and as a result, it will become

more profitable and efficient.

Return on Assets

Gives an insight upon how efficient is the management in using available assets to generate returns.

(in days) 2010 2011 2012

NonCurrentAssets 223 238 244

CurrAssets 249 277 376

Inventory 149 177 243

Receivables 89 98 94

Cash&BankAcc 11 2 39

STLiabilities 13 22 8

LTLiabilities 144 157 245

1-Jan-11 31-Dec-11 31-Dec-12

ROA

4.29 3.49

Return on Equity

Shows how profitable is the company, by revealing how much was generated with the money

invested by the owners.

Interest expense/Debt Ratio

Reveals how much interest the company is paying for its debts. It is important to track this indicator,

in order to observe its stability. If the indicator rises, it means that the credits are becoming too expensive. In

the case of this company, the rates are stable and decreasing, which confers a degree of stability to the

business.

Quick and Rapid Ratio

These two represent liquidity ratios, and show if the company can cover short-term liabilities with

the current assets. Quick ratio shows the degree to which available cash can cover ST liabilities. We observe

through the year that the company has enough available monetary assets to cover immediate ST liabilities.

Rapid ratio shows the degree companys current assets less inventories cover ST liabilities. We observe the

negative signs of the ratio, showing that the company does not have enough current assets to cover ST

liabilities. Again, we observe that if we take the inventories out of the equation, the liquidity of the company

drops dramatically. This means that the sale of inventory is of utmost important to the company, in terms of

liquidity and profitability.

Debt Ratio

This is a solvency ratio, which show the companys ability to fulfill its financial obligations. The

first ratio shows that the company is heavy in debt on long term. In addition, this trend is an upward one,

which is a source of risk for the company.

1-Jan-11 31-Dec-11 31-Dec-12

ROE

4.22 3.63

1-Jan-11 31-Dec-11 31-Dec-12

IntExp/Debt 3.96 3.94 2.53

1-Jan-11 31-Dec-11 31-Dec-12

RapidLiqRate -3.37 -2.54 -14.18

QuickRatio 0.90 0.07 5.04

1-Jan-11 31-Dec-11 31-Dec-12

DebtRatio 43.57 43.53 65.05

7. Competitor comparison

We have chosen to compare the companys result to a competitor that has close parameters to our

analyzed company. This competitor is SC Mobil Rdui S.A (referred further as Radauti). It has similar

figures in terms of amounts, and in terms of employees. It means that the size of both companies are similar,

thus comparable.

Radauti key financials

SC MOBILA RADAUTI

SA RON 1-Jan-11 31-Dec-11 31-Dec-12

NonCurrentAssets 11,855,307 12,618,542 12,617,055

Tangible assets 11,628,923 12,381,681 11,826,647

CurrentAssets 4,644,655 5,052,645 4,395,358

Inventory 2,188,892 3,060,800 3,116,960

Receivables 2,374,546 1,899,555 1,196,300

Cash&BankAcc 81,217 92,290 82,098

NetCurrAssets/STLiab 1,500,293 1,250,653 1,436,358

TotalAssets 16,499,962 17,671,187 17,012,413

STLiabilities 3,144,362 3,801,992 2,959,000

LongTermLiabilities 0 0 0

Deferred income 60,067 55,783 51,499

TotalLiabilities 3,204,429 3,857,775 3,010,499

SubscribedCapital 13,437,292 13,437,292 13,437,292

ReevaluationReserves 780,545 780,545 755,615

Reserves 610,020 635,120 645,919

Profit/Loss

Credit Balance 2,023,076 517,879 213,432

ReportedProfit/Loss

Debit Balance 3,452,935 1,532,324 1,039,544

ProfitDistribution 102,465 25,100 10,800

AvgNoEmployess(full

time) 368 345 325

TotalEquity 13,295,533 13,813,412 14,001,914

SC MOBILA RADAUTI SA

RON 2010 2011 2012

Turnover 22,369,096 21,241,712 18,636,356

OperatingIncome 23,137,133 22,675,299 19,257,065

OtherOpIncome 59,250 64,141 58,472

RawMatExpense 8,584,980 8,333,640 7,812,022

OtherRMExpense 42,970 14,168 21,262

StorageExpense 35,104 64,871 64,545

UtilitiesExpense 1,332,938 1,352,779 1,468,365

SalaryExpense 9,356,296 9,450,717 7,860,602

CommercialDiscount 0 0 329,045

Deprec&Adjust:NCAssets 490,844 521,655 661,917

ExternalServiceExp 1,082,958 2,019,300 1,410,810

OtherTaxExpense 130,507 119,690 128,345

Indicators and Ratios

In terms of Net Worth, Radauti has scored 3.90% increase and 1.36%. Simex has scored increases

of 4.22% and 3.63%. It means that Simex built more wealth than Radauti in the same period. In terms of

Working Capital, Radauti has problems covering the needs for long-term activity; mainly because Radauti

does not has any long-term liabilities. In case there will be problems with self-financing capacity or

liquidity, the company will have problems to continue its activity. It is obvious that the financial balance and

rule (e.g. long-term liabilities for financing long-term assets) is violated. In addition, RWC shows that at the

end of 2011 the company had also short term financing problems, which have been solved at the end of

2012. No matter the fact that Radauti does not respect the financial rule, it managed until the end of 2012 to

keep better score regarding the Net Treasury indicator than Simex. It means that Radauti was in a better

financial balance than Simex.

OtherExpense 18,336 90,789 12,961

OperatingExpense 21,074,933 21,910,846 18,986,395

OpResult 2,062,200 764,453 270,670

FinIncome 189,609 184,424 225,450

FinExpense 175,523 334,971 257,912

InterestExpense 23,906 77,781 44,957

FinResult 14,086 -150,547 -32,462

ProfitTax 53,210 96,027 24,776

NetResult 2,023,076 517,879 213,432

OpVariableCosts 11,097,286 11,875,547 10,789,965

OpFixedCosts 9,486,803 9,570,407 7,988,947

TotDeprec&Adjust 490,844 521,655 990,962

1-Jan-11 31-Dec-11 31-Dec-12 1(m.u) 2(m.u) 1(%) 2(%)

NetWorth 13,295,533 13,813,412 14,001,914 517,879 188,502 3.90 1.36

WorkingCapital 1,581,985 818,750 820,237 -763,235 1,487 -48.25 0.18

RWC 1,500,293 1,250,653 1,436,358 -249,640 185,705 -16.64 14.85

NetTreasury -3,082,278 -2,069,403 -2,256,595 -1,012,875 187,192 32.86 -9.05

(in days) 2010 2011 2012

NonCurrentAssets 191 214 244

CurrAssets 75 86 85

Inventory 35 52 60

Receivables 38 32 23

Cash&BankAcc 1 2 2

STLiabilities 51 64 57

In addition, Radauti has better turnover ratios than Simex, meaning that the cycle of converting

assets into profits is faster at Radauti. It means that Radauti is more efficient at selling its production.

Radauti is also better at collecting their receivables than Simex.

1-Jan-11 31-Dec-11 31-Dec-12

ROE

3.47 -4.13

ROA

3.50 -3.30

IntExp/Debt 0.75 2.02 1.49

QuickRatio 0.03 0.02 0.03

DebtRatio 0.00 0.00 0.00

No matter the fact that Radauti is more efficient in terms of turnover ratios, Simex has higher

profits. Even if Radauti makes more in terms of sales, it is not cost efficient. As a result, Simex makes

higher returns on assets and equity than Radauti, and has lower margins of costs upon sales.

8. Conclusion

In conclusion, we can stress the fact that the company per general is doing well, as it is still

producing profit. However, there are certain source of risk, which stem mainly from a high level of

indebtness. On the other hand, the company has many assets available to cover an eventual default. The

company made substantial investments in plants and property, which offer creditors a sense of stability for

their credits. In addition, the company has a lot of unsold inventory, which again fosters the creditors sense

of stability. Another issue to be tackled should be the converting of these inventories into profits, in order to

become more financial independent, and to decrease the Debt/Equity ratio. This is an important thing to do,

as the company has problems with liquidity. Problems with liquidity may translate at some moment in future

in the need to contract a new loan that will be needed in order to continue operations. This cycle of actions

may lead to substantial financial risks for the company. No matter the fact that Radauti has more employees

than Simex, Simex is more efficient in terms of exploiting available assets. The amount of profit is similar,

but ROA and ROE are better for Simex. On the background of these facts, Simex looks a better company

than Radauti, even if both of companies financial position have issues to be aware of in the future.

*Source of financial statements:

Simex SA: http://bvb.ro/Bilanturi/SIMF/SIMF_A_2012.pdf

http://bvb.ro/RapoarteFinanciare/anual11omf.aspx?s=SIMF&y=2011

SC Mobila Radauti SA: http://bvb.ro/Bilanturi/MOBT/MOBT_A_2012.pdf

http://bvb.ro/RapoarteFinanciare/anual11omf.aspx?s=MOBT&y=2011

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SAP FI Certification Actual QuestionDocument4 pagesSAP FI Certification Actual QuestionkhalidmahmoodqumarNo ratings yet

- International Finance ECON 243 - Summer I, 2005 Prof. Steve CunninghamDocument37 pagesInternational Finance ECON 243 - Summer I, 2005 Prof. Steve Cunninghamnitin_usmsNo ratings yet

- CH 1Document52 pagesCH 1Jakaria UzzalNo ratings yet

- Fabm Performance Task PDFDocument5 pagesFabm Performance Task PDFKhiane Audrey GametNo ratings yet

- Final JV Sheet For Accruals Mar 16Document64 pagesFinal JV Sheet For Accruals Mar 16qasmi576No ratings yet

- Annex I - FAPFDocument23 pagesAnnex I - FAPFjaymark canayaNo ratings yet

- 4 AdjustmentDocument19 pages4 AdjustmentMina AmirNo ratings yet

- An Internship Report On Assessment About Online BankingDocument57 pagesAn Internship Report On Assessment About Online BankingNasim Ahmed100% (4)

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- AKM 2E Testbank Chapter 18Document50 pagesAKM 2E Testbank Chapter 18ANNISA AMALIA SALSABIILANo ratings yet

- Investments: Financial Accounting, Seventh EditionDocument39 pagesInvestments: Financial Accounting, Seventh EditionCaroline NguyenNo ratings yet

- Babi Acct Central BankDocument21 pagesBabi Acct Central Bankshiva534No ratings yet

- Tally Project 130721003449 Phpapp01Document61 pagesTally Project 130721003449 Phpapp01Jaspreet SinghNo ratings yet

- 1567496511412VyAvOJ9gFZxAPRBX PDFDocument22 pages1567496511412VyAvOJ9gFZxAPRBX PDFManju Purushothama Manju PurushothamaNo ratings yet

- F3-25 IAS 37 Provisions, Contingent Liabilities and Contingent AssetsDocument12 pagesF3-25 IAS 37 Provisions, Contingent Liabilities and Contingent AssetsZohair HumayunNo ratings yet

- Partnership ReviewerDocument11 pagesPartnership Reviewerbae joohyun0% (1)

- C02 Financial Accounting Fundamentals - Control AccountsDocument7 pagesC02 Financial Accounting Fundamentals - Control AccountsAlfred MakonaNo ratings yet

- Basic Concepts of Guest Accounting - PT 2Document36 pagesBasic Concepts of Guest Accounting - PT 2Leonardo FloresNo ratings yet

- Prime Double EntriesDocument18 pagesPrime Double EntriesfarhanmammadovupsystemsNo ratings yet

- Lesson 1 - Introduction To Computers: OutputDocument41 pagesLesson 1 - Introduction To Computers: OutputRachelle0% (1)

- Chapter 4 Partnership Liquidation 2021 v2.0Document56 pagesChapter 4 Partnership Liquidation 2021 v2.0Aj ZNo ratings yet

- Diquit Acco 05bc Bsba Fundamentals of Acctg RevisedDocument46 pagesDiquit Acco 05bc Bsba Fundamentals of Acctg RevisedJoel TuddaoNo ratings yet

- Philippine Taxation Encyclopedia Third Release 2019 - 01Document173 pagesPhilippine Taxation Encyclopedia Third Release 2019 - 01Patricia Arpilleda100% (1)

- Capitalism and Accounting in The Dutch East-India Company 1602-16Document538 pagesCapitalism and Accounting in The Dutch East-India Company 1602-16Saarvin சர்வின் 李在山 سرفينNo ratings yet

- Audit of PPEDocument1 pageAudit of PPEFroilan Arlando BandulaNo ratings yet

- InventoriesDocument6 pagesInventoriesralphalonzo100% (3)

- SAE SpecsDocument38 pagesSAE Specsbkb45724No ratings yet

- Intermediate Accounting 1 QuestionsDocument3 pagesIntermediate Accounting 1 QuestionsKristel Joyce Laureño100% (2)

- Examiners Report NSSCO 2023Document687 pagesExaminers Report NSSCO 2023jacobinaiipinge050% (2)

- 10 Column Worksheet FormDocument1 page10 Column Worksheet Formcatherinemariposa001No ratings yet