Professional Documents

Culture Documents

43 ST Gta

Uploaded by

Pradeep KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

43 ST Gta

Uploaded by

Pradeep KumarCopyright:

Available Formats

Service of Transport of Goods by Road

As per section 66(105)(zzp) of Finance Act, 1994, any service provided to a customer, by a

goods transport agency, in relation to transport of goods by road in a goods carriage is a taxable service.

Can you tell me background of the service tax on goods transport by road ?

Service tax was earlier imposed on goods transport operators (GTO) but was discontinued with

effect from 2-6-!!"#

Subse$uentl%& the services provided b% goods transport agenc% (and not the owner of truc' or

truc' operators) were made taxable vide (inance ()o# 2) *ct& 2++,& w#e#f# +-!-2++,# -owever&

these were 'ept in abe%ance as per .((/0) circular )o# 122"22++,-T03 dated +-!-2++,#

Subse$uentl%& the service tax on goods transport b% road is being made effective from --2++4#

Can you tell me the mode of imposing and recovering service tax on goods transport

agency?

All sort of services of goods transport by road are not liable to service tax. The tax is onl% on

services provided b% Goods Transport *genc% (GT*) (termed as 5transport boo'ing agents6 b%

(inance .inister in his budget speech on "-7-2++,)# Onl% GT* which is a 5commercial concern6

and which issues a consignment note is liable to service tax#

)ote that in !!7-!"& the service tax was pa%able on services of 5Goods Transport Operator6&

while now it is pa%able b% 5Goods Transport *genc%6# The difference is highl% significant to

understand the coverage of service tax#

The basic scheme is that the goods transport agenc% (GT*) will be preparing the consignment

note and invoice containing details as re$uired# Service tax pa%able will also be shown on the

invoice2bill2challan prepared b% goods transport agenc%# -owever& pa%ment of service tax will be

made b% the consignor or consignee who is actuall% pa%ing the freight& if the consignor2consignee

pa%ing freight is a compan%& bod% corporate& cooperative societ%& registered societ%& factor%&

partnership or dealer registered under 8entral 9xcise#

9ven in other cases& i#e# where freight is paid b% individual& -3( or unregistered partnership firm&

the service tax is pa%able b% individual2-3(2unregistered partnership firm& if the

consignor2consignee is factor%& bod% corporate& societ% etc# :This may not be the intention, but

this is as per clear provisions of rule 2(1)(d)(v) of Service Tax ules;#

9xemption has been given to small consignments where freight is upto 0s 74+ per consignee per

carriage or 0s &4++ per goods carriage# Similarl%& transport of fruits& vegetables& eggs or mil' b%

road has been full% exempted from service tax#

Though general rate of service tax is +< plus 2< education cess& actual service tax pa%able is

24< of normal service tax& i#e# 2#4< plus 2< education cess (total 2#44<) of gross amount

charged from customer for providing taxable service#

Is there service tax on all services of goods transport by road ?

There is no general service tax on all goods transport. Service tax is payable only when service is provided

by goods transport agency, as defined in the Act.

Finance inister Shri ! "hidambaram, in his budget speech on #$%$&''( )para *(+ of speech,, had stated

as follows, -# services have been brought under the net so far. . propose to add some more this year. These

are business exhibition services, airport services, services provided by transport booking agents, transport

of goods by air, survey and exploration services, opinion poll services, $ $ $ $ $. I may clarify that there is

no intention to levy service tax on truck owners or truck operators.

Thus, intention of /overnment is to tax only services provided by transport boo0ing agents. This aspect

should be 0ept in mind while interpreting various provisions in the Act and 1ules.

Goods Transport Agency (GTA

What is the meaning of goods transport agency ?

As per section 2-)-'3,, goods transport agency means any commercial concern which provides service in

relation to transport of goods by road and issues consignment note, by whatever name called.

Thus, essential re4uirement are 5 )a, Service must be in relation to transport of goods by road and )b,

Service should be provided by commercial concern and )c, The service provider must have issued

consignment note by whatever name called.

An individual truck owner has direct contract with Consignor consignee! "e himself receives freight

from consignorconsignee! Is #ervice $ax is payable ?

As per section 2-)-'3,, goods transport agency means any commercial concern which provides service in

relation to transport of goods by road and issues consignment note, by whatever name called.

.f driver of goods carriage is self employed )i.e. ta0en vehicle on rent, or he is himself owner of vehicle, he

is not a 6commercial concern6 and hence would not come under that definition, even if he issues a

consignment note )usually, he will not issue a consignment note,.

The word 5commercial concern6 is not defined in the *ct# *s discussed earlier& individual providing

services will not be a 5commercial concern6& if he is self emplo%ed& even if he purchases a vehicle

for providing service# The reason is that his primar% motive is to earn livelihood and not earn

profit#

This vie! is also supported by statement of "inance #inister made in his budget speech on $%&%

2''(.

)o!ever, a proprietary firm doing business on commercial basis !ill be a *commercial concern+.

Would services of %overnment or non&profit organisations be taxable ?

Service of goods transport provided b% Government& charitable institution or an% other non-profit

organisation will not be taxable& as it is not a 5commercial concern6#

I have given my truck on hire to a company. Am I liable to pay service tax ?

In some cases, the truck owners give their vehice to some companies for

transporting the goo!s" #he charge for vehice ma$ %e on kiometer %asis or month$

%asis or num%er of trips %asis" In such cases, issue of an$ consignment note is not

necessar$" In fact, the service is in nature of hire an! not service of &goo!s transport'"

(onse)uent$, person giving vehice on hire !oes not come within !e*nition of &goo!s

transport agenc$' an! their services are not ta+a%e"

#his view is aso supporte! %$ %u!get speech of Finance ,inister ma!e on -./.0004"

If a booking agent say 'r! A having no truck of his own( hires a truck from another trucker and then

sends the truck on his )i!e! of 'r! A himself* consignment note to say +ombay and charges ,s! -.(///

0 1!..2 service tax! +ut he pays only ,s! -/(/// to the person who really owns the truck( now is the

person who gets ,s! -/(/// and is the real owner of the truck liable for service tax!

The person who owns truc0 is not re4uired to pay service tax, as he has not issued consignment note.

We transport goods only for companies and hence there will be no liability of service tax on us! Is it

necessary for us to register under service tax ?

As per section 2+, only person liable to pay service tax is re4uired to be registered. .t is true that as per rule

(A)*,)i,, a service provider issuing invoice has to indicate his registration number in his invoice. 7owever,

in case of conflict between section and rule, obviously section will prevail. oreover, as per para -.* of

F)81, letter 9o. :(*;*#;&''($T1<)!t, dated *%$*&$&''(, goods transport agencies which are not liable

to pay service tax are not re4uired to be registered under service tax rules.

7ence, applying rule of harmonious construction, in the opinion of author, the service provider need not

indicate service tax registration number in his invoice. 7e may indicate Service Tax 1egistration 9umber

5 9ot Applicable. .f one wants to be on safe side, he may register and file 9il returns, though not legally

re4uired =It would be better if department issues clarification on this aspect>.

A %$A can avail either of the 1 benefits given to him i!e! )a* "e can en3oy abatement of 4.2 on value

of service 5 pay tax on only 1.2 of the value of service )b* he can claim the benefit of Cenvat Credit

on duties paid on inputs 5 capital goods! In both the cases mentioned above( he is not barred from

taking credit for service tax paid by him on value of input services availed by him for the purpose of

rendering the taxable service! 'y 6uery is how this choice of )a* or )b* i!e! whether to avail 4.2

abatement or Cenvat Credit is to be exercised? on yearly( 6uarterly( monthly basis or is it a one time

choice?

There is no specific provision, but normally, a choice cannot be changed during a financial year. 7owever,

in the case of /TA, only a person who is out of his mind will avail "envat on inputs and capital goods and

show full service tax in his invoice. 1est will not avail "envat on inputs and capital goods and will show

&-? tax in their invoice. !erson who is showing full i.e. *'.&? service tax in his invoice will soon go out

of business and hence any further 4uestion will not arise.

Whether a person doing only business on commission 5 arranging for business to others for small

amount of commission under $ransport #ector will be covered under +usiness Auxiliary #ervices?

@es, he may get covered under business auxiliary service as commission agent.

I am a %$A rendering exclusive service only to a few corporate clients( on contract basis( for which I

am paid my charges on weekly basis! In the new regime w!e!f! from -&-&1//.( in such a case( if my bill

is say ,s! --(/1/& inclusive of service tax( the client will pay me only ,s! -/(///& 5 will pay ,s!

-(/1/& service tax directly to the department on his own! "owever I will have to file all the necessary

returns with the #ervice $ax 7ept regularly( In such a case( what will be the proofs of payment that I

will be re6uired to attach 5 how they are to be obtained from my corporate clients who are the

consignors?

.f you are not liable to pay service tax, you need not register. .n your invoice, you can show, Service Tax

1egistration 9umber 5 9ot Applicable. .f you want to be on safe side, you may register and file 9il

returns, though not legally re4uired.

@ou have no liability to prove payment of service tax by your clients.

Is a contractor carrying garbage for municipal corporation liable for service tax ?

9o, for two reasons 5 )a, /arbage is not goods as it is not mar0etable commodity and )b, he does not

issue consignment note.

Goods Carriage

What is meant by goods carriage ?

As per section 65(50A) of the Finance Act, 5Goods carriage6 has the meaning assigned to it

section 2(,) of the .otor =ehicles *ct& !""# As per section 0(14) of the ,otor 1ehices

Act, 19--, goo!s carriage means an$ motor vehice constructe! or a!apte! for use

soe$ for the carriage of goo!s or an$ motor vehice not so constructe! or a!apte!

when use! for carriage of goo!s"

As per section 0(0-) of ,otor 1ehices Act, 19--, otor vehicle or vehicle means any

mechanically propelled vehicle adopted for use upon roads whether the power of propulsion is transmitted

thereto from external or internal source and includes a chassis to which a body has not been attached and a

trailerA but does not include a vehicle running upon fixed rails or vehicle of a special type adapted for use

only in a factory or any other enclosed premises or a vehicle having less than four wheels fitted with engine

capacity of not exceeding &- )Twenty$five, cubic centimeters.

#hus, goo!s carriage wi cover an$ motor vehice constructe! or a!apte! for use

soe$ for carriage of goo!s as well as other motor vehicles when used for

carriage of goods" #he wor!s &,otor 1ehice' wi cover a the mechanica$

propee! vehices ike trucks, ight carriage vehices, traiers, cars, etc"

Many passenger buses also carry goods. Will they come under defnition of

goods carriage ?

2assenger %uses (pu%ic transport or private$ owne!) can come un!er !e*nition of

&goo!s carriage', since the wor!s use! are 3 &an$ motor vehice not so constructe! or

a!apte!, when use! for carriage of goo!s'" 4f course, if their charges are ess than

5s /50 per consignee or tota 5s 1,500, the$ wi %e e+empt from service ta+" #he$

wi aso %e e+empt if the$ !o not issue &consignment note'"

!an ricksha" or tempo or taxi driven by o"ner or self employed person be

a goods carriage ?

5ickshaw, ta+i or tempo can come un!er !e*nition of &goo!s carriage', if the$ carr$

goo!s" 6owever, if such rickshaw, tempo or ta+i is owner !riven or run %$ sef

empo$e! person, it is not a &commercia concern'" It wi %e out of !e*nition of

&7oo!s #ransport Agenc$'" ,oreover, the$ !o not issue consignment note"

7ence their services will not be taxable even if the charges are higher than 1s %-';*,-''.

#his view is aso supporte! %$ %u!get speech of Finance ,inister ma!e on -./.0004"

Consignment !ote and "nvoice

Is issue of consignment note compulsory for all goods transporters?

No. As per section 2-)-'3,, goods transport agency means any commercial concern which provides

service in relation to transport of goods by road and issues consignment note, by whatever name called.

Thus, as per section 2-)-'3,, service provider which is a commercial concern and issues consignment note

is covered. .n other words, issue of consignment note is optional, it is not compulsory.

Finance Minister, in his speech, has also clarified that the service tax is on transport booking agents and

not on truck owners or truck operators.

As per rule (3 of Service Tax 1ules, issue of consignment note is compulsory only for goods transport

agency.

.f a goods transporter does not issue consignment note, he is not goods transport agency at all u;s

2-)-'3,, even if he is a commercial concern. 7ence rule (3 does not apply to him. Similarly, if a

transporter of goods is not a commercial concern, he is not re4uired to issue a consignment note.

Assuming that there is some conflict between section and rule, obviously, section will prevail over rule.

Bhat is clearly permitted in a section cannot be restricted by rule ma0ing authority.

A rule cannot restrict scope of an Act. 1ule cannot impose a condition, which is not there in Act.

What is meaning of consignment note ?

As per explanation to rule (3 of Service Tax 1ules, for purpose of rules (A and (3, Cconsignment noteD

means a document, issued by a goods transport agency against the receipt of goods for the purpose of

transport of goods by road in a goods carriage. .t should be serially numbered, and should contain

following details 5

)ame of the consignor and consignee

0egistration number of the goods carriage in which the goods are transported

/etails of the goods transported

/etails of the place of origin and destination

>erson liable for pa%ing service tax whether consignor& consignee or the goods transport

agenc%#

The definition itself ma0es it clear that it is for purpose of rules (A and (3. This definition cannot be

straight away used to interpret the word consignment note in section 2-)-'3,, but guidance can be ta0en

from this definition. This means that even if some of the details as prescribed above are missing, it can still

be a "onsignment 9ote for purpose of section 2-)-'3,, if it is understood as a consignment note in trade

parlance.

(489I78,:8# 84#: I9 ;4(<,:8# 4F #I#=: . #he wor! &consignment note' has a

speci*c meaning in the tra!e" 8orma$, it contains, among other things 3 (a) name of

consignor an! consignee (%) !etais of goo!s transporte! (c) !etais of pace of origin

an! !estination (!) Freight pai!>pa$a%e (e) 8ame an! a!!ress of goo!s transport

agenc$"

?hen a person !eposits the goo!s with an$ transporter for the purpose of transport

to a given !estination, the transporter issues a orr$ receipt (=5) or consignment note

to the person !epositing the goo!s" #he origina =5>consignment note is sent %$ the

person %ooking the goo!s to the consignee either !irect$ or through %ank" #he

consignee can coect the goo!s from the transporter %$ presenting the

=5>consignment note"

As per tra!e parance, the &orr$ receipt' or &consignment note' is a &!ocument of tite'

an! ownership of goo!s passes %$ !eiver$ of the =5>consignment note"

E1E .SS<.9/ "AS7 1E"E.!T F1 A"G9FBHE8/.9/ 1E"E.!T FF /FF8S .S 9FT A

"F9S./9E9T 9FTE $ .f the transporter issues a "ash 1eceipt or 1eceipt of "he4ue, it is not taxable,

as receipt of cash or che4ue is not a consignment note. .t is not a 8ocument of Title. .f goods are given

to a transporter and he ac0nowledges receipt of goods by signing your 8elivery "hallan and 0eeps another

copy with himself for transport, it is not a 8ocument of Title, as consignee cannot get delivery of goods

on production of such 8elivery "hallan. .n such case, service tax cannot be imposed.

Is it necessary for a small tempo owner to issue consignment note ?

#he unorgani@e! transporters ike sma &tempo owners' or &truck owners' who carr$

the goo!s for transporting them at short !istances from one pace to another as per

instructions of person !eivering the goo!s to them" #he$ usua$ !o not an! nee! not

issue consignment note an! hence !o not come within !e*nition of &goo!s transport

agenc$'" ,oreover, the$ are not a &commercia concern'"

(onse)uent$, the$ !o not come within !e*nition of &goo!s transport agenc$' an!

their services are not ta+a%e"

!an you tell me "hen issue of consignment note is not necessary ?

As e+paine! a%ove, issue of consignment note is necessar$ on$ in case of &7oo!s

#ransport Agenc$' an! not in case of a goo!s transport %$ roa!" If goo!s transporter

is not 7#A, he is not re)uire! to issue consignment note"

!E1SF9 B7F .S 9FT /TA 9FT 1EI<.1E8 TF .SS<E "F9S./9E9T 9FTE $ As per rule (3 of

Service Tax 1ules )introduced w.e.f. *$*$&''-,, any goods transport agency which provides service in

relation to transport of goods by road in a goods carriage must issue a consignment note. This provision

applies only to /TA and not to others. A person who is not a /oods Transport Agency as defined in the

Act is not re4uired to issue consignment note.

B7E9 .SS<E FF "F9S./9E9T 9FTE 3@ /TA .S 9FT 1EI<.1E8 $ Even in case of /TA, issue

of consignment note is not necessary when the service is exempt under a notification issued under section

+: of Finance Act )exemptions discussed later,.

?hat are re$uirements of invoice to be issued b% GT* @

*s per rule ,*() of Service Tax 0ules& the invoice2challan21ill should be signed b% authorised

person of provider of input services# The invoice21ill2challan should be seriall% numbered# At

should contain following details B

*. )ame& address and registration number of person providing taxable service

&. )ame and address of person receiving taxable service

:. /escription& classification and value of taxable service provided or to be provided and

(. Service tax pa%able on the taxable service

,ven if -nvoice./hallan.0ill does not contain serial number, /envat credit cannot be denied, in

vie! of rule 1(2) of /envat /redit ules.

The rule does not ma'e mention of date& but actuall%& date should be mentioned#

.n addition, as per second proviso to rule (A)*,, gross weight of consignment, consignment note number

and date should be indicated in addition to aforesaid details.

Education cess payable should be shown separately in invoicechallan.

We have Annual contract with transporter for taking goods from one factory to another! Can he

make a monthly invoice ?

@es, there seems to be no obJection for this purpose. .n fact, as discussed earlier, he may not come under

definition of goods transport agency and service tax may not be payable at all, if he does not issue

consignment note.

$he goods transport agency is not liable to pay service tax! Is he still liable to show service tax

separately in his invoice ?

@es, that is what law says. 7e should show service tax and education cess separately in his invoice, but

should not charge it to customer. "onsignor;consignee paying freight should pay him net amount )i.e.

excluding service tax and education cess, and pay service tax directly.

Can a %$A issue combined consignment note cum invoice ?

There is no specific provision, but there seems to be no obJection to do so, as the words used in section

2-)-'b, are consignment note by whatever name called. Second proviso to rule (A)*, also uses the words

invoice, bill or challan on any document by whatever name called.

The document should ma0e it clear that it is invoice cum consignment note. 1e4uirements of both

documents as prescribed should be fulfilled.

#erson liable to pay service tax

As per rule &)*,)d,)v, of Service Tax 1ules, "onsignor or consignee who is

paying freight will be liable to pay service tax, if consignor or consignee is any

one of the following 5

any factory registered under or governed by the Factories Act, *+(# )2: of *+(#,

any company established by or under the "ompanies Act, *+-2 )* of *+-2,

any corporation established by or under any law

any society registered under the Societies 1egistration Act, *#2' )&* of *#2', or under any

law corresponding to that Act in force in any part of .ndia

any co$operative society established by or under any law

any dealer of excisable goods, who is registered under the "entral Excise Act, *+(( )* of

*+((, or the rules made thereunder

any body corporate established, or a partnership firm registered, by or under any law

.n brief, if the goods are boo0ed on freight to pay basis, the consignee will be liable if he falls under any

one of aforesaid categories. .f goods are boo0ed freight paid basis, consignor will be liable, if he falls

under one of aforesaid categories.

As consignor2consignee liable to pa% service tax re$uired to be registered under service tax @

8onsignor or consignee who is liable to pa% service tax should be registered under Service tax#

A am consignor# A am an individual2 -3(2unregistered firm consignor pa%ing freight charges& but

m% consignee is compan%2societ%2factor%# ?ho is liable to pa% service tax @

.n such cases, the consignor who is individual;7<F;unregistered firm is liable to pay service tax. This is

also the case where consignee is individual;7<F;unregistered partnership firm and freight is to be paid by

him. .n such case, consignee will be liable =This may not be the intention, but that is the clear wording of

rule &)*,)d,)v,>.

$hen the goods transport agency %ill be liable to pay service tax ?

Af either the consignor or consignee is factor%& compan%& societ%& registered partnership firm etc#&

the goods transport agenc% is not liable at all& even if freight is to be paid b%

individual2-3(2unregistered partnership firm#

The goods transport agenc% will be liable onl% in cases where both consignor and consignee are

individual2-3(2unregistered partnership firm and when individual consignment freight exceeds 0s

74+24++ as applicable#

-e will also not be liable when he carries mil'& egg& fruits or vegetables& as transport of these

goods is completel% exempt from service tax#

.f taxable turnover of /oods Transport Agency is less than 1s four la0hs per annum, he is exempt from

service tax under notification 9o. 9otification 9o. 2;&''-$ST dated *$:$&''-. This would be so even

if his total turnover is in crores. 7owever, this exemption is not available to service receiver, when

service tax is payable by the service receiver.

'y transporter has not shown any service in his invoice! Am I liable to pay service tax ?

Strictly legally- No. The reason is that service tax is payable only when service is provided by /oods

Transport Agency and not on each and every goods transport. 7e should be a commercial concern and

should issue a consignment note. oreover, the service is taxable only when provided by road in goods

carriage.

@ou have no powers or liability to investigate whether the provider of service is commercial concern or

not. @ou even do not )legally, 0now whether he has provided service by goods carriage. .t is also not

0nown whether or not he has availed "envat credit on inputs and capital goods. All these facts are only

0nown to him.

@our legal liability commences only when he shows service tax separately in his invoice as re4uired under

rule (A and issues consignment note as re4uired under rule (3. .f this is missing, your liability cannot

commence.

.n short, assessment of service tax is liability of goods transport agency. @our legal liability is only when he

issues consignment note and invoice as re4uired under rules. 9ote that there is no provision similar to T8S,

under Service Tax.

Ff course, as a precaution, it is always advisable to get confirmation from him, and if re4uired, advise him

suitably the correct legal position, particularly in cases when he issues a consignment note.

.f he is issuing consignment note, it is advisable to pay service tax K &.--? by T1$2 challan and avail

"envat credit.

'y transporter has simply shown( #ervice tax extra( payable by person paying freight! Am I liable

to pay service tax?

The invoice is not correct. Though liability for payment is yours, the transporter should show service tax

payable in his invoice. Ftherwise, how you will 0now whether service tax payable is &.--? or *'.&?L The

concessional rate of service tax is payable only when the /oods Transport Agency fulfils re4uired

conditions. .f service tax is not shown, you cannot 0now whether or not the /TA is fulfilling those

conditions.

.t is advisable to discuss with him and explain him the legal position. .f nothing wor0s, it is advisable to

pay service tax K &.--? and avail "envat credit on basis of T1$2 challan.

We have entered into agreement with transporter that he will be liable to pay service tax! In such

case( is it necessary for us to register under service tax ?

A statutory liability cannot be shifted to another by mutual private agreement. Bhatever your agreement

with transport agency, you will be liable to pay service tax, file returns etc. @our mutual private agreement

has no validity in law.

If a company is paying freight charges to various transporters whether company is liable to deduct

the service tax from the bill of transporters and pay the same to the service tax department ? If yes(

then the company will have to get itself registered with the service tax department!

"ompany has to register if it is liable to pay service tax on goods transport. 7owever, there is no liability to

6deduct6 service tax from bill of goods transporter. Hegally, the goods transport agency should show it

separately in invoice. @our liability is only to pay service tax as shown by him in his invoice. .f he does not

charge any service tax, there is no legal liability, as you do not 0now whether he is goods transport agency

or not. This will be particularly so if he has not issued consignment note.

What precautions a consignorconsignee should take ?

7e should ta0e following precautions 5

*. 7e should maintain separate account of transport charges in respect of services of /TA and others.

Ftherwise, he may face problems during EA$&''' audit.

&. Though not legally re4uired, he should en4uire whether person providing goods transport service

is /oods Transport Agency or not and get suitable certificate.

:. 7e should register under service tax, pay service tax by T1$2 challan )and not through "envat

credit,. 7e will have to file half yearly return, as re4uired under Service Tax 1ules.

(. "envat credit can be ta0en on basis of invoice of /TA and not on basis of T1$2 challan.

Recovery of service tax from customer

We are sellers! 8ur sales are ex&works basis! "owever( we pay freight on behalf of buyer and recover

the freight from the buyer in invoicedebit note! Who will be liable to pay service tax ?

As per rule &)*,)d,)v,, any person who pays or is liable to pay freight either himself or through his agent is

liable to pay service tax. .n this case, since you are paying the freight, you will get covered under the words

who pays. @ou will be liable to pay service tax. @ou may recover the net amount from the seller, but that

is a separate transaction.

.f invoice is in your name, @ou will be able to avail "envat credit as the payment is for activity relating to

business.

@ou will not be liable to pay service tax only when you establish that you are paying freight as agent of

other. There should be proper agreement with !rincipal to ma0e it clear that you are paying freight on

behalf of other and you are his agent for payment of freight. Agreement should ma0e it clear that service

tax liability will be of !rincipal. The consignment note;invoice issued by /TA should be preferably in

name of !rincipal.

.n such case, the agent can pay freight and recover entire amount from !rincipal including service tax.

7owever, he should not charge service tax separately in his debit note. The Agent cannot avail "envat

credit when he is paying freight only as an agent. .t is advisable if the "onsignment 9ote indicates name of

!rincipal as the person who is liable to pay freight.

In above case( can I recover the amount from buyer showing it separately as service tax( so that he

can avail Cenvat credit ?

.f you pay freight, you cannot recover any amount representing service tax. .f you do so, department may

ta0e a view that you are liable to pay it to /overnment again, as per section **8 of "entral Excise Act,

which has been made applicable to service tax also =!f course, the issue is arguable, but risk is not worth

taking>.

The main issue is that if you recover an amount representing service tax, the same amount will be shown

as service tax in invoice of /TA as well as your invoice. Theoretically, it is possible that two persons may

avail "envat credit of same service tax, which will be highly improper.

Even if you have agreement with customer that he has agreed to bear service tax, a private agreement

cannot override a statutory provision.

/epartment vide para 4#7 of its circular )o# C,2"22++,-ST dated 7-2-2++, has clarified as

follows& 5Af service tax due on transportation of a consignment has been paid or is pa%able b% a

person liable to pa% service tax& service tax should not be charged for the same amount from an%

other person& to avoid double taxation6#

This also supports the view that %ou cannot recover an% amount from %our customer showing it

as service tax#

In aforesaid case( if the service tax cannot be passed on to the customers( whether the supplier

himself can avail the credit immediately on payment of service tax? If so( what is the document

based on which such credit can be availed by the supplier?

Supplier who has paid service tax can avail "envat credit on basis of invoice of /TA issued by him under

rule (A)*,. .f the supplier intends to avail "envat credit, it would be advisable to recover only net amount

from the buyer. In any case, such amount should not be recovered showing it as "service tax#.

.f he recovers gross amount from customer )i.e. inclusive of service tax,, in addition to problems under

service tax, he may face problem of valuation in section ( of "entral Excise. As per valuation rule -, only

actual cost of transportation is allowable as deduction. A view is possible that service tax charged is not

actual cost of transportation, particularly if he has availed "envat "redit of such service tax.

We are purchasers! 8ur purchase is on 9!8!,! basis! 9or convenience( we pay on behalf of supplier

and debit his account! In such case( who will be liable to pay service tax ?

As per rule &)*,)d,)v,, any person who pays or is liable to pay freight either himself or through his agent is

liable to pay service tax. .n this case, since you are paying the freight, you will get covered under the words

who pays. @ou will be liable to pay service tax. Then you may recover the amount from the seller, but that

is a separate transaction.

@ou cannot recover the amount showing it as service tax. Ftherwise, you will have to pay it again to

/overnment. As explained above, if you intend to avail "envat, it is advisable that you should recover only

net amount from your customer.

.f invoice and consignment note of /TA is in name to supplier, you can ta0e a stand that you are paying as

his agent. .n that case, the supplier will be liable for payment of service tax. 7owever, there should be clear

agreement on this behalf, as discussed above.

&uantum of service tax payable

9ormally, service tax is payable K *'? plus &? education cess on service tax i.e. total *'.&?. 7owever,

there is partial exemption and as per exemption notification 9o. :&;&''($ST dated :$*&$&''(, actually

service tax is payable on &-? of gross amount charged from customer by goods transport agency. Thus,

service tax payable will be &.-? of gross amount charged plus &? education cess i.e. total &.--?.

.t is necessary to show education cess separately in invoice;challan. .n the T1$2 challan also, the education

cess is re4uired to be shown separately under different account head.

Tax D 24< is pa%able onl% if (a) the credit of dut% paid on inputs or capital goods used for

providing the taxable service has not been ta'en under the provisions of the 8envat 8redit 0ules&

2++,E or (ii) the goods transport agenc% has not availed the benefit under the notification )o#

222++C-ST dated the 2+th Fune& 2++C :*s per this exemption notification& if the service provider

supplies certain goods while providing service& he is not re$uired to pa% service tax on the value

of goods supplied;# At is apparent that these conditions for exemption are re$uired to be fulfilled b%

goods transport agenc% and if he fulfils those conditions& the consignor2consignee pa%ing service

tax will also be eligible for this concession#

'o% consignor(consignee paying service tax %ould kno% %hether the GTA fulfils these

conditions ?

Af the goods transport agenc% charges onl% 24< service tax in his invoice2challan& it can be ta'en

as his declaration that he is fulfilling the conditions of exemption# *ssessment of tax is his

responsibilit%# -owever& wherever possible& it ma% be advisable to get a certificate from him

annuall% that he is fulfilling the conditions of exemption& to avoid possible disputes#

The GTA has paid octroi) entry tax etc* on my behalf* "s service tax payable on such

amounts also ?

2o# *s per section 67 of (inance *ct& !!,& the service tax is pa%able on gross amount charged

b% service provider for taxable service rendered# Thus& tax is onl% on amount charged for taxable

service and not for other services#

Af the goods transport agenc% pa%s some amount 5on behalf6 of customer& that amount is not part

of service provided b% him for transport of goods# An short& service tax is pa%able on value of

services rendered for transport of goods# Thus& no tax will be pa%able on expenses incurred on

behalf of customer and got reimbursed from customer# This was made clear in respect of some

other services earlier& and the same principle will appl% here also#

"s the tax payable on demurrage charges collected by GTA ?

/emurrage charges are levied when goods are not cleared within stipulated period# These are

penal in nature# The charge is not for providing transport service& which alone is taxable#

.oreover& these are never shown on the 8onsignment )ote2Anvoice of GT*# These cannot be

included for purpose of service tax on service of GT*#

:otification :o! ;11//<&#$ exempts service provided in relation to transportation of goods upto

4.2 of total charges! Is this exemption available only if the transporter opts to pay the service tax( or

it is available even if the consignerConsignee pays the service tax ?

The condition for exemption is to be fulfilled by /TA and not by consignor;consignee. .n his .nvoice, he is

re4uired to show service tax separately. .f he shows &.--?, the liability of consignor;consignee is only

&.--?. Assessment of tax and showing it in invoice is responsibility of /TA, only payment is responsibility

of consignor;consignee.

+xemption from service tax

.n following cases, service tax is exempt.5

)a, Transport of fruits, vegetables, eggs or mil0 by road )as exempt under notification ::;&''($ST dated

:$*&$&''(, or

)b, /ross Amount charged on consignments transported in a goods carriage does not exceed 1s *,-'' )as

exempt under clause )i, of notification 9o. :(;&''($ST dated :$*&$&''(, =This is total of all consignments

carried in a goods carriage at one time> or

)c, /ross Amount charged on individual consignment transported in a goods carriage does not exceed 1s

%-' )as exempt under clause )ii, of notification 9o. :(;&''($ST dated :$*&$&''(,. $ $ An individual

consignment means all goods transported by a goods transport agency by road in a goods carriage for a

consignee. =The intention is that the transporting agency should not split the consignment, so that transport

charges of individual consignment remain below 1s %-'>.

The intention seems to be to exempt transporters carrying small consignments at short destinations.

.nterestingly, there is no exemption for transport of food grains, cotton, sugarcane, oil seeds or other

agricultural produce.

The word used are or. 7ence, service tax is exempt if either condition of clause )b, or condition of clause

)c, are satisfied.

I would re6uest you to kindly throw some light as to the limits of ,s 4./ & and ,s -(.// & as specified

in the notification :o! ;<1//<&#$ dated ;&-1&1//<! When would the limit of 4./ and when the limit

of ,s -(.// has to be taken into consideration ?

The limit of 1s %-' is 0ept so that a consignment is not split, e.g. if total bill is 1s &,*'', goods transport

agency may split one consignment into three consignments. 7e will ma0e three invoices of 1s %'' each

and then avoid service tax. 7ence, individual consignment has been defined as all goods transported in a

goods carriage for a consignee.

Himit of 1s *,-'' applies in case of full load i.e. there may be more than one consignments to more than

one consignees, but total freight for all consignments together should not exceed 1s *,-''.

Exemption is available if any one of the conditions is satisfied.

. agree that some confusion is li0ely. .t is also not clear how department is going to chec0 such 3illing.

We are availing services of %$A! 8ur annual billing will be certainly less than ,s four lakhs per

annum! Are we exempt from payment of service tax?

. am sorry to say that the general exemption available to small service providers under 9otification 9o.

2;&''-$ST dated *$:$&''- is not applicable in cases where the service receiver is liable to pay service tax

as per provisions of section 2#)&, read with rule &)*, of Service tax 1ules. $hus, the exemption is not

applicable to receiver of services of goods $ransport %gency. 7owever, the exemption is available to

/oods Transport Agency.

8ne of my assessee is a partnership firm! $hey are in the wholesale business of kerosene! 7aily they

receive tankers of kerosene from the company and then sale it! 9or the tankers they have to pay the

freight of ,s! =./& per tanker! 7aily the company receives around -/ tankers! Can the company take

the exemption of ,s -(.//& and therefore not liable for service $ax ? $he whole tanker belongs to the

assessee!

. thin0 what you mean by 6whole tan0er belongs to assessee6 is that the 0erosene in tan0er belongs to

assessee and not the tan0er. .f so, . agree that exemption will be available if whole consignment freight is

less than 1s *,-''.

Cenvat Credit of Service Tax

Can the person paying service tax avail Cenvat credit of service tax paid by him ?

"onsignor;consignee will be eligible if the service falls under the definition of input service as defined in

rule &)l, of "envat "redit 1ules, &''(. The invoice, bill or challan issued by goods transport agency will be

a valid document to avail "envat credit.

Can I avail Cenvat credit on basis of $,&> challan by which I have paid service tax ?

Since *2$2$&''-, T1$2 challan has been made an eligible document to avail "envat credit.

Can we avail credit of service tax on transport charges paid by us ?

The service tax paid by you on good transport is obviously used in activities relating to business and hence,

you can avail "envat credit on basis of invoice of /TA.

$he definition of input service as per rule 1)l* of Cenvat Credit ,ules uses the words outward

transportation upto place of removal! "owever( we incur expenses on outward freight from

factorydepot also! Can we avail Cenvat of service tax paid on such freight ?

The words used in the definition of input service in rule &)l, are activities relating to business, such as.

Such as means all the examples given in the definition are only illustrative. They do not limit the

definition. <se of words upto place of removal does not mean that other transport charges are not

allowable. %ny service relating to your business will be "input service# and will be eligible. Thus, outward

freight even after place of removal will be eligible, as long as it is in relation to your business.

Who can avail credit of #ervice $ax paid by us on freight on finished excisable goods dispatched to

our depots stockyards? Is it the parent factory )Consignor* or the depotsstockyards )Consignee*?

What is the document on which such credit can be availed?

.f freight is paid in factory, consignor i.e. factory can avail "envat credit. .f depot has paid service tax, it

will have to register as 6.nput Service 8istributor6 and then raise monthly invoice;challan on factory.

Factory can avail "envat credit on basis of such invoice;challan. The depot will also have to register under

Service Tax for purpose of payment of service tax.

Factory may apply to "ommissioner for permission for central registration and payment of service tax

under rule ():A, of Service Tax 1ules. .f such permission is obtained, the depot need not register under

service tax provisions and need not pay service tax.

Whether service tax paid by the supplier on finished goods dispatched to their customers can be

passed on to their customers? i!e! whether the service tax on %oods $ransport Agency paid by the

supplier can be collected from the customers separately? Is such collection permissible under #ervice

$ax Act,ules? Whether the element of #ervice $ax and @ducational Cess can be indicated

separately in the ,ule -- Invoice )prescribed under Central @xcise ,ules* for collection from

customers?

There is no such provision. @ou cannot recover any amount representing service tax from your customer.

This cannot be done as you are not /oods Transport Agency. 7owever, "envat credit of service tax paid

can be availed by you.

I have paid freight on behalf of my customer! Can I endorse the invoice of %$A( to enable my

customer to take Cenvat credit ?

There is no such provision in law, though there is no specific prohibition. 9ote that as per rule +)&, of

"envat "redit 1ules, credit cannot be denied even if name of user is not shown in the .nvoice.

.f you are ris0 ta0ing and fighting type, you can legally do it. 7owever, considering the way adJudication

and appeal mechanism wor0s in excise department, final success cannot be assured.

7ence, to avoid complications, it is advisable that you avail "envat credit yourself.

#ayment of Service Tax

Can we pay the service tax on goods transport through Cenvat credit available with us ?

This is slightly ris0y. .f you are not providing any service and not manufacturer, you can as well utilise

your "envat credit )of telephone, courier etc., for payment of service tax on /TA )possibly restriction of

&'? of tax payable on output services may apply,. .f you are manufacturer or service provider, it is safer

and better to pay service tax through T1$2 challan. @ou can avail its envat credit, since it is your 6input

service6.

When the liability to pay service tax arises ?

Hiability to pay service tax arises when you ma0e payment of freight to /oods transport Agency. This is on

the principle that as per rule 2)*,, service tax is payable on value received.

We have few branch offices in India and they are not registered with Central @xcise! $he branch

offices are meant for performing coordination work for factories situated in a far off place! $hese

branch offices make payment of freight charges for movement of our raw materials from Aort to

factory! In this regard( the following points need clarificationB )a* Whether the +ranch 8ffice is

re6uired to take registration for payment of #ervice )b* Centralised payment of #ervice $ax can be

made at the factory in respect of freight payment made by the branch office? )c* In case( such

Centralised payment of #ervice $ax at factory is not possible( whether the #ervice $ax so paid by the

branches can be distributed by the +ranch 8ffices to the factory?

The branch office is re4uired to be registered if the freight is paid by branch. .f service tax is paid by

branches, same can be transferred to main factory by issuing .nvoice;"hallan as .nput Service 8istributor.

"entralised payment of service tax will be permissible only if you apply and get specific permission from

"ommissioner under rule ():A,. .f such permission is obtained, the branch office need not pay service tax

and need not register under service tax provisions.

.f payment of freight itself is done directly from factory;head office, then service tax can be paid by

factory;head office.

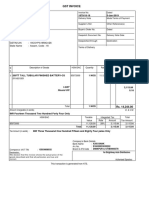

Sample Consignment !ote

"onsidering re4uirements of Service Tax 1ules, a sample "onsignment 9ote is given below. The form

given above may be changed to suit individual re4uirements of /oods Transport Agency.

,-. Goods Carriers

22,4& Gamla .ar'et& )ew /elhi B + ++2

Tel B (+) 24!!,+

Service Tax 0egn )o# *H.>I2"GST++

8onsignment

)ote cum Anvoice

)o#

/ate

)ame and *ddress of 8onsignor -

)ame and *ddress of 8onsignee -

/eliver% of Goods at -

8ontents as declared b%

consignor

)umber of

>ac'ages

and mar's ?eight Ggs

/etails of

8harges

*mount

0s

*ctual 8harged (reight

Jabour

8harges

(reight B

To pa% b%

consignee2

To pa% b% consignor2

>aid b% consignor

Stationer%

8harges

8onsignor6s 8hallan )o#

and date

=alue as

declared b%

consignor(0s)

.iscellaneous

Total

/etails of Service Tax

Service tax 3ayable by 4

8onsignor2 8onsignee2 Goods Transport *genc% (GT*)

Service Tax

9ducation

8ess

0emar's - Total

Goods are carried at owner6s ris'& unless specified

otherwise# SubKect to /elhi Kurisdiction# Other

conditions as overleaf#

(or HLI Goods 8arrier

)ote B The 8onsignment )ote cum Anvoice should be in triplicate# Original B for 8onsignee (for

deliver%)# /uplicate B 8onsignor 8op%# Triplicate B Office 8op%# 9ach cop% should be mar'ed

suitabl%#

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Tax Invoice: Gati Kintetsu Express Private LimitedDocument1 pageTax Invoice: Gati Kintetsu Express Private Limitedsibesh nandiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Print Money ReceiptDocument1 pagePrint Money ReceiptBorshon Bayzid100% (5)

- Acct11 1hwDocument3 pagesAcct11 1hwRonald James Siruno MonisNo ratings yet

- Student Instructions and Worksheets 1Document13 pagesStudent Instructions and Worksheets 1api-4583202030% (1)

- Procurement ProgressDocument1 pageProcurement ProgressPradeep KumarNo ratings yet

- Finished Steel Products Imports - Nov14Document3 pagesFinished Steel Products Imports - Nov14Pradeep KumarNo ratings yet

- NEC Contract For ECC Option ADocument1 pageNEC Contract For ECC Option APradeep KumarNo ratings yet

- Plus TwoDocument1 pagePlus TwoPradeep KumarNo ratings yet

- Start Up Costs CalculatorDocument5 pagesStart Up Costs CalculatorMainul HossainNo ratings yet

- Finished Steel Apparent Consumption - Nov14Document3 pagesFinished Steel Apparent Consumption - Nov14Pradeep KumarNo ratings yet

- Toyota 0.128 General Motors 0.089 Daimler 0.081 Ford 0.078 Others 0.624Document2 pagesToyota 0.128 General Motors 0.089 Daimler 0.081 Ford 0.078 Others 0.624Pradeep KumarNo ratings yet

- Smart City Corporate Price ListDocument2 pagesSmart City Corporate Price ListPradeep KumarNo ratings yet

- Ports in WorldDocument4 pagesPorts in Worldra_mechNo ratings yet

- Ports in WorldDocument4 pagesPorts in Worldra_mechNo ratings yet

- Ports in WorldDocument4 pagesPorts in Worldra_mechNo ratings yet

- Bangalore Urban AgglomerationDocument4 pagesBangalore Urban AgglomerationPradeep KumarNo ratings yet

- Alp Ha 0.6 8 RSFE - Running Sum of Forecast ErrorsDocument3 pagesAlp Ha 0.6 8 RSFE - Running Sum of Forecast ErrorsPradeep KumarNo ratings yet

- Man Power - TenderDocument3 pagesMan Power - TenderPradeep KumarNo ratings yet

- 9 Form HDocument2 pages9 Form HBhaskara RaoNo ratings yet

- Incoterms ChartDocument2 pagesIncoterms ChartPradeep KumarNo ratings yet

- Alpha 0.68 RSFE - Running Sum of Forecast ErrorsDocument3 pagesAlpha 0.68 RSFE - Running Sum of Forecast ErrorsPradeep KumarNo ratings yet

- Alpha 0.68 RSFE - Running Sum of Forecast ErrorsDocument3 pagesAlpha 0.68 RSFE - Running Sum of Forecast ErrorsPradeep KumarNo ratings yet

- Conf Ident IAL: Averages, AlligationDocument2 pagesConf Ident IAL: Averages, AlligationPradeep KumarNo ratings yet

- Form D AbolishedDocument1 pageForm D AbolishedPradeep KumarNo ratings yet

- Subject: - Purchasing of Fire &safety ItemsDocument2 pagesSubject: - Purchasing of Fire &safety ItemsPradeep KumarNo ratings yet

- Custom Duty Calculator - Last YearDocument5 pagesCustom Duty Calculator - Last YearPradeep KumarNo ratings yet

- Custom Duty Calculator - Last YearDocument5 pagesCustom Duty Calculator - Last YearPradeep KumarNo ratings yet

- Swot AnalysisDocument1 pageSwot AnalysisPradeep KumarNo ratings yet

- Custom Duty Calculator - LatestDocument3 pagesCustom Duty Calculator - LatestPradeep KumarNo ratings yet

- Tool Box TalkDocument2 pagesTool Box TalkPradeep KumarNo ratings yet

- How To Conduct Industry AnalysisDocument4 pagesHow To Conduct Industry AnalysisvinaytyNo ratings yet

- Industry AnalysisDocument4 pagesIndustry AnalysisPradeep KumarNo ratings yet

- Sl. No Description Duty % Amount Total DutyDocument2 pagesSl. No Description Duty % Amount Total DutyPradeep KumarNo ratings yet

- Tender For Car DisposalDocument3 pagesTender For Car DisposalPradeep KumarNo ratings yet

- Indicative Taxnet Profile: Personal InformationDocument4 pagesIndicative Taxnet Profile: Personal InformationAbdul WadoodNo ratings yet

- SG Arrival Card - 11sep23Document2 pagesSG Arrival Card - 11sep23maximus_2000No ratings yet

- FullStmt 1678965714873 4220102828520 Arsala04Document43 pagesFullStmt 1678965714873 4220102828520 Arsala04Arsala QasimNo ratings yet

- ThirdPartyRetrieveDocument - Asp 5Document4 pagesThirdPartyRetrieveDocument - Asp 5Elizabeth HilsonNo ratings yet

- COLLECTOR of Internal Revenue vs. Pedro BAUTISTA and David TanDocument1 pageCOLLECTOR of Internal Revenue vs. Pedro BAUTISTA and David TanPouǝllǝ ɐlʎssɐNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Form 510Document6 pagesForm 510Cor LeonisNo ratings yet

- Megahertz Internet Network Pvt. LTD.: Retail InvoiceDocument1 pageMegahertz Internet Network Pvt. LTD.: Retail InvoiceAyush ThapliyalNo ratings yet

- INVOICE Jco PassDocument3 pagesINVOICE Jco PasseldaNo ratings yet

- Jio Fiber InvoiceDocument10 pagesJio Fiber InvoicePiyush Kumar PandeyNo ratings yet

- Tax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalDocument1 pageTax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalSiwam ChoudharyNo ratings yet

- Taxation Bar Examination 2013 Q&ADocument11 pagesTaxation Bar Examination 2013 Q&ADianne Esidera RosalesNo ratings yet

- MyobDocument1 pageMyobAgnes WeaNo ratings yet

- GST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Document1 pageGST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Yogesh GuptaNo ratings yet

- Position PaperDocument1 pagePosition PaperAlvy Faith Pel-eyNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 09314, 10-Sep-2021, 2S, LKO - UJNDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 09314, 10-Sep-2021, 2S, LKO - UJNSumitNo ratings yet

- Compost 58000002480Document13 pagesCompost 58000002480prasadNo ratings yet

- Safe Deposit LockerDocument3 pagesSafe Deposit LockerPaul BlessonNo ratings yet

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Document16 pagesGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanNo ratings yet

- Settlement Payment in Lazada: 1.1 CompanyDocument15 pagesSettlement Payment in Lazada: 1.1 CompanyMinhHuy LêNo ratings yet

- 23 UgsthbDocument84 pages23 UgsthbChawla DimpleNo ratings yet

- 2012 Banking Services RFP - Exhibit Items - Supplement To Exhibit SAP PDFDocument155 pages2012 Banking Services RFP - Exhibit Items - Supplement To Exhibit SAP PDFRajendra PilludaNo ratings yet

- Ministry of Corporate Affairs: Only For Pay Later Payment. Not For Payment at Branch Counter E-Challan For Paying LaterDocument2 pagesMinistry of Corporate Affairs: Only For Pay Later Payment. Not For Payment at Branch Counter E-Challan For Paying LaterPrakashNo ratings yet

- FlexiDocument4 pagesFlexiManish Mani100% (1)

- Laporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFDocument3 pagesLaporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFAlfiIchaNo ratings yet

- Nothing Phone (1) (Black, 128 GB) : Grand Total 27009.00Document1 pageNothing Phone (1) (Black, 128 GB) : Grand Total 27009.00Rehan KahnNo ratings yet