Professional Documents

Culture Documents

Mrunal (Economic Survey Ch6) Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

Uploaded by

Anil CletusOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mrunal (Economic Survey Ch6) Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

Uploaded by

Anil CletusCopyright:

Available Formats

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 1/14

[Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency

Exchange, NEER, REER

1. What is Balance of Payment?

2. Why BoP = 0 in theory?

3. Convertibility

4. Rupee-Dollar Exchange rate

5. Building up Foreign Exchange Reserves

6. FOREIGN EXCHANGE RESERVES

7. FOREX Reserve: India vs other

8. Why volatility in rupee?

9. How did rupee recover?

10. Exchange Rate of Other Emerging Economies

11. NEER and REER

12. Why is REER important?

13. External Debt

14. FDI Restrictiveness Index (FRI)

15. FDI: defense offset

16. CHALLENGES AND OUTLOOK

17. Mock Question

What is Balance of Payment?

If you want to see a companys incoming and outgoing cash, youve to check

its account book.

Similarly Balance of Payment (BoP) is the summary / account sheet that

shows the cash flow between India and rest of the world.

BoP is made up of two parts: Current account and capital account. (As per

IMF definition, three parts: Current Account + Capital account+ financial

account).

Without getting into technical details, just a brief over view:

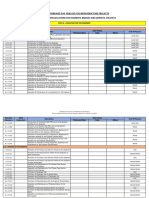

Balance of Payment

Current Account

Capital (and

financial) Account

1. Import, Export (always negative, because

we export less and import more oil n gold,

hence weve trade deficit.)

2. Income from abroad (interest, dividends

paid on Indian investors FDI, FII in USA

1. Foreign investment in

India (FDI, FII, ADR,

direct purchase of land,

assets).

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 2/14

etc.)

3. Transfer (gift, remittances from NRI to

their families etc. always positive for India

because of large Diaspora abroad.)

2. External commercial

borrowing, external

assistance etc.

Note: current account can be calculated using Visible and invisibles, that

was explained in old article on current account deficit click me.

Since we want to track the flow of cash, so, whenever American invest in India

(via FDI, FII, ADR etc) we add it as (+), and

when Indians invest in USA (via FDI, FII, IDR etc.) we add it as (-) and then get

the final figure for Foreign investment.

Same goes for everything in balance of payment (remittances, External

commercial borrowing whatever.)

In short, BoP= we are tracking the incoming and outgoing money.

For India, current account has been in deficit (negative number) and capital

account has been in surplus (positive number).

The BoP accounting system is similar to double entry book-keeping.

Therefore theoretically, balance in current account and balance in capital

account should be same (ignoring the +/- signs).

In other words, if there is deficit in current account, there has to be equal

surplus in capital account. Why?

Why BoP = 0 in theory?

Assume there are only two countries India (rupees) and USA (dollars). And

there are no forex agents or middlemen, taxation, regulation, cricketers,

politicians, saah-bahu serials nothing

Now Indian importer buys Apple6 phones worth 10 billion US$ from

American exporter. Since there is no forex agent, the Indian importer will pay

500 billion Indian rupees to that American exporter. (assuming 1$=50 Rs.)

Means that much Rupee currency is gone from Indian system via current

account.

But that American exporter has no use of Indian rupees! He lives in USA, he

cannot even buy a burger from local McDonalds shop using Indian rupees. So

what can he do?

1. He can import something else from India (e.g. raw material, steel and

plastic for further production of Apple6) = our rupee currency comes

back to India via current account.

2. He can invest that Indian currency to setup some factory or joint

venture in India (=our rupee currency comes back to India via capital

account)

3. He can buy some shares or bonds in India. Again our rupee currency

comes back.

4. He can find a 2

nd

American who wants to import something from India /

wants to invest in India. Apple6 guy can sell his rupee currency to that

third American fellow @Rs.50=1$ or Rs.49=1$ or Rs.99=1$

(depending on the desperation of that 2

nd

American fellow).

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 3/14

In short, if rupee goes out, it has to come back. (same for dollar, from

American point of view).

Therefore, current account + capital account = ZERO (balance of Payment),

atleast in theory.

But in reality, RBI or tax authorities never have complete details of all

financial transactions and currency exchange rates keep fluctuating. Hence

there will be statistical discrepancies, errors and omissions and. So, BoP is

expressed as:

Current Account + Capital account + Net errors and omissions = 0 (Balance of

Payment).

In IMF definition, we can express this as

Current Account + Capital account + Financial account + balancing item = 0

Ok then does it mean a country can never have surplus (or deficit) in Balance

of payment?

Well, a country can have TEMPORARY surplus or deficit in BoP. Because,

BoP is calculated on quarterly and yearly basis. There is a good chance, that

American Apple6 exporter may not invest back all those 500 billion Indian

rupees in India within that time-frame.

Secondly, Indian Government may put some FDI/FII restrictions so Apple6

exporter (or that third American guy) cannot re-invest in India even if he wants

to.

But in the long run, system will balance itself. for example

Apple exporter will find some fourth American importer and convince

him to pay Indian exporter in rupee currency and thus apple guy will get

rid of his 500 billion Rupees by exchanging it with that American

importers dollar

Or the apple exporter will find some NRI living in USA. This NRI wants

to send money (dollar earned by working in USA) to his family back in

India, (preferably in Indian currency ) so this NRI will be willing to

exchange his dollar savings with that Apple exporters rupees.

There are many other possibilities and combinations but the point is,

in BoP, whatever currency goes out of the country, will come back to

the country.

Convertibility

Suppose you want to import a dell computer from USA. And American

exporter accepts only payments dollars.

If you can easily convert your rupee into dollars, that means Rupee is fully

convertible. And rupee is fully convertible as far as Current account

transactions are concerned (e.g. import, export, interest, dividends).

But rupee is partially convertible for capital account transection. (In crude

terms it means, if an Indian wants to buy assets abroad or invest via FDI/FII

OR borrow via External commericial borrowing (ECB) he cannot do it beyond

the limits prescribed by RBI. (And vice versa e.g. American wants to convert

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 4/14

his dollars to rupees to invest in India, then also RBIs limits have to be

followed).

RBI gets power to do ^this, via FERA and FEMA Acts.

1973: Foreign Exchange Regulations Act, 1973 (FERA).

1997: Tarapore Committee (of RBI), had recommended that India should have

full capital account convertibility. (Meaning anyone should be allowed to

freely move from local currency into foreign currency and back, without any

restrictions by Government or RBI.)

2002: Government replaced FERA with Foreign Exchange Management Act

(FEMA). Although full capital account convertibility is yet not given.

Full capital account convertibility has both pros and cons. But thatd require

another article. Lets get back to the topic, we are seeing the 6

th

chapter of

Economic Survey: Balance of Payment, exchange rates etc.

Rupee-Dollar Exchange rate

How does Fixed Exchange Rate system work? and how does market based

exchange rate system work? = explained in the Bretton woods article. Click

me

Anyways, lets construct a bogus technically incorrect model to understand

the market based exchange rate system, once again:

Assume following things

There are only two countries in the world India and America.

India has rupee currency. Indian farmers dont grow Onions.

America doesnt have any currency, they trade using onions. The rate

being 1kg onion=Rs.50

First situation: American investor thinks that Indian economy is rising. If we

invest in India (FDI/FII), well make good profit. So theyre more eager to

convert their onions to Indian rupee currency. So theyd even agree to sell 1kg

onions =Rs.45. (and then buy Indian shares/bonds worth Rs.45)

Result =Rupee strengthened against onion (dollar).

During this time, RBI governor also buys 300 billion kilo onions from the

forex and stores these onions in his refrigerator. (Why? Because onions are

selling cheap! And why onions are selling cheap? Because there is surge in

capital investment in India by American investors.)

Ok everything is going nice and smooth. Now add third country to our bogus

model: UAE.

Second situation: UAE has increased crude oil prices, and they dont accept

rupee currency. They also want payment in onions.

1 barrel of crude oil costs 132kg of Onions.

India is eager/desperate for oil, because if we dont have crude oil, we cant

get petrol, diesel= whole economy will collapse.

So India would agree to buy 1kg onion even for Rs.55 (from American or

forex agent or whoever is willing to sell his onions). Then India can give that

onions to some Sheikh of UAE and import crude oil.

Third situation: The Sheikh of UAE gets even greedier, he demands 200kg

onions for 1 barrel of crude oil. Now 1kg onion sells for Rs.59, Because

those with onion surplus (vendors) know that India likes it or not, itll have to

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 5/14

buy onions to pay for the crude oil!

Thus, Rupee has weakened against onion (Dollar.)

If such situation continues, then there will be huge inflation in India (because

crude oil expensive=petrol/diesel expensive = transport expensive=

milk/vegetables and everything else transported using petrol/diesel becomes

expensive.)

Now RBI governor decides to become the hero and save the fall of rupee

against onion. So, He loads a few tonnes of onions in his truck and drive it to

the forex market.

Result: onion supply has increased, price should go down.

Now onions get little cheaper: 1kg onion =53 Rs.

Thus RBIs intervention in the forex market has led to recovery of rupee.

Ok so what do we get from this story?

1. RBIs intervention to buy Foreign exchange during surge in capital

investment= leads to build-up of (foreign exchange) reserves, which provides

self-insurance against external vulnerability of rupee.

2. When RBI sells its foreign exchange reserves, it stems (halts) the fall of

rupee.

3. Higher foreign exchange reserve levels restore investor confidence and may

lead to an increase in foreign direct and indirect investment flows= boost in

growth and helps bridge the current account deficit.

Building up Foreign Exchange Reserves

Prior to 1991, India followed License-quota-inspector (and suitcase) raj and

import substitution strategy. (Beautifully explained class 11 NCERT

textbook.)

During that era, foreign companies couldnt invest in India.

Imported products such as radio / camera/ wristwatches attracted heavy

custom duty. (And that led to rise of smugglers and mafias, and the Bollywood

movies that romanticized their criminal lives.)

On the other hand, thanks to the license-quota-inspector (and suitcase) raj, the

private Indian companies werent big or efficient enough to compete in

international market so export was also low.

Result: during that time incoming money (via export, investment) was very

low. Hence RBI couldnt build up huge forex reserve. (when onion supply is

low, its prices will be high)

Ultimately in 1991, the Forex reverses of India were about to exhaust.

Finally India had to pledge its gold to IMF and get loans.

Then India had to open up its economy for private and foreign sector

investment. Remove the license-quota-inspector raj etc. to boost the

incoming flow of dollars and other foreign currencies..all those LPG

reforms. (Although suitcase raj still continues, because the Mohans in the

system are blinded by totally awesome people like A.Raja.)

fast-forward: now weve a trillion dollar economy, our software and

automobile companies are globally recognized blah blah blah.

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 6/14

But the lesson learnt: RBI should have good foreign exchange reserve.

Hence post LPG reforms, RBI has been buying dollars, pound yen etc. from

the currency market, whenever FII/FDI inflow is high. Because during such

situation, the foreign investors are more eager to get their dollars converted

to rupee currency hence rupee is trading at higher rate e.g. 1$=Rs.49

But after global financial crisis, RBI has stopped building forex reserves

actively.

Nowadays RBI intervenes in the forex market, only to stop the excess

volatility (fluctuation) in rupee exchange rate.

However, there was a sharp decline in rupee in 2011-12. Then RBI had to sell

foreign exchange worth 20 billion dollars. (so demand of foreign currency

would decrease and rupee would stop).

Similarly in 2012 also RBI had to sell its foreign exchange reserve worth 3

billion dollars to prevent the fall of rupee. (in June 2012, Rupee had became

very weak: 1$=around 57 Rupees. Thanks to RBI and Governments

interventions, it came back to the normal 53-54 level at the end of 2012.)

FOREIGN EXCHANGE RESERVES

Indias foreign exchange reserves is made up of

1. Foreign currency assets (FCA) (US dollar, euro, pound sterling, Canadian

dollar, Australian dollar and Japanese yen etc.)

2. gold,

3. special drawing rights (SDRs) of IMF

4. Reserve tranche position (RTP) in the International Monetary Fund (IMF)

The level of forex reserve is expressed in US dollars. Hence Indias forex reserve

declines when US dollar appreciates against major international currencies and vice

versa.

RBI gains Foreign exchange reserves by

buying foreign currency (via intervention in the foreign exchange market

Funding from the International Bank for Reconstruction and Development

(IBRD), Asian Development Bank (ADB), International Development

Association (IDA) etc.

aid receipts,

interest receipts

FOREX Reserve: India vs other

Country wide- China has the largest forex reserve (3300+ billion USD). India

is 8

th

position (close to 300 Billion USD).

Countries with largest Forex reserves

1. China

2. Japan

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 7/14

3. Russia

4. Switzerland

5. Brazil

6. South Korea

7. Hong Kong

8. India

Why volatility in rupee?

Volatility = Variation in something over the given time.

if today SENSEX is 12000 points, tomorrow it goes up by 200 points and day

after it goes down by 300 points etc..they we say market is volatile.

If morning shifts SSC paper is too easy but evening shifts SSC paper is too

damn difficult then we can say SSC paper is volatile.

Similarly, if there is too much fluctuation in Dollar to rupee exchange rate,

we say rupee is volatile.

In 2012, the rupee has experienced unusually high volatility. Why?

#1: import-export

Demand for Indian goods and services has declined due to Euro-zone crisis +

America hasnt fully recovered.

On the other hand, cost of import= very high due to oil and heavy gold import

(due to high inflation).

Similarly high inflation = raw material / services become costly for the

export. If he raises the prices, then his export product becomes less

competitive than Cheap China made stuff.

#2: FII

In the total foreign investment in India, majority comes from FII (and not

from FDI).

FII money is hot, it leaves quickly whenever FII investors feels that Indias

market is not giving good returns and or some other xyz countrys market is

giving better returns.

There are week-to-week variation in such FII inflows and outflows. Hence it

leads to changes in rupee-dollar exchange rate.

#3: Dollar is strengthened

US treasury bonds are consider the safest investment. During the peak of

Eurozone, Greece crisis, the big investors started pulling out money from

Europe and investing it in US treasury bonds. = demand of dollar increased.

So other currencies would automatically weaken against dollar.

#4: policy paralysis

For past few years, Indian Government was lazy regarding environmental

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 8/14

project clearances, land acquisition, FDI in retail, pension, insurance etc. that

has led to foreign investors losing faith in Indian economy= slowdown in FII

inflows. (besides Government did not allow more FDI in pension / insurance /

retail etc. so FDI inflow did not increase either).

#5: Risk On / Risk off

From the earlier article on debt vs equity, Government bonds = safer than

equities (shares). But when an investment is safe= it doesnt offer good

returns.

When foreign investors feel confident, they display risk on behavior =they

invest more in equities, particularly in developing countries. (which are risky

but offer more profit).

But when foreign investors are not feeling confident, they display risk off

behavior, = they usually fall back to investing in US treasury bonds or gold.

In India, majority of foreign investment comes from FII (and not FDI)

and FII investors are more prone to displaying this risk-on/risk-off behavior.

They plug in their money quickly, they pull out their money quickly. Thus,

Indian rupees exchange rate becomes volatile against Dollar.

Therefore, Indian Government needs to inspire and sustain the confidence of

foreign investors, to prevent the fall of rupee. RBI intervention in forex

market, cannot help beyond a level.

How did rupee recover?

Rupee is weakening against dollar, it means demand of rupee is less than the demand

for dollars. So how did RBI and Government fix it?

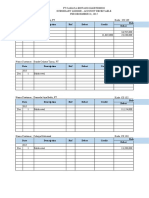

RBI Govt.

During 2012, RBI sold around 3 billion dollars

from its forex reserves.

Oct-12, Rupee recovers, 1$=around 51 rupees.

RBI allowed Indian banks to give more interest

on Foreign Currency Non-Resident (FCNR)

bank accounts. (thus attracting more NRIs to

save their dollars in Indian banks).

Govt. allowed FIIs

to invest more

money in govt.and

corporate bonds.

Govt. eased the FDI

policy for pension,

insurance, aviation,

multi-brand retail

etc.

Govt. offered

subsidies and tax

benefits to

exporters.

Exchange Rate of Other Emerging Economies

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 9/14

In 2012, Rupee wasnot the only currency that weakened against dollar.

The currencies of other emerging economies, such as Brazilian real,

Argentina peso, Russian rouble, and South Africas rand also depreciated

against the US dollar.

It means dollars demand has increased. In the wake of sovereign debt crisis in

the euro zone and due to uncertain global economic environment, more and

more investors are preferring to buy US treasury bonds and other securities in

USA.

NEER and REER

We keep reading bad headlines that rupee weakened against dollarrupee all

time low against dollarand so on.

Does it mean, Indian rupee is a really bogus weak and fragile currency? Nope.

Because we dont trade only with USA.

We dont trade only in terms of Rupee to Dollar exchange.

We also trade with many other countries in many other forms of currency.

Therefore, if we want to objectively measure Rupees volatility, weve to

compare its price fluctuations with multiple currencies (Euro, Yen, Pound

etc.) and not just against single Dollar currency.

Secondly: 1$=Rs.50 or 1$=Rs.40 that alone doesnt decide the demand of

goods and services between India and America. This demand also depends on

the inflation (both in India and in USA.)

NEER and REER index (calculated by RBI), help us here get a clear picture

here.

First youve to calculate NEER. Then using NEERs, you calculate REER.

NEER REER

Nominal Effective Exchange Rate

Real Effective Exchange Rate

(REER)

The weighted average of bilateral nominal

exchange rates of the home currency in

terms of foreign currencies.

weighted average of

nominal exchange

rates, adjusted for

inflation.

Why is REER important?

REER captures inflation differentials between India and its major trading

partners.

REER reflects the degree of external competitiveness of Indian products

REER captures movements in cross-currency exchange rates.

RBI calculates two REER indices:

REER-6 REER-36

Here Indian rupee is measured against 6 big

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 10/14

currencies viz.

1. Dollar

2. Hong Kong dollar

3. Euro

4. Pound sterling

5. Japanese Yen

6. Chinese Renminbi

As the name suggest, 36

currencies.

Now Indian rupees vs. other currencies (Dec. 2012 data)

Just for reference:

1 unit of foreign currency Worth Rs.

Indonesian Rupiah 0.006

S.Korean Won 0.05

Pakistan Rupee 0.56

Yen 0.65

Thailand Baht 1.78

Mexican Peso 4.25

Chinese Renminbi 8

Brazilian Real 26

Turkish LIRA 30

US Dollar 54

Canadian Dollar 55

Euro 71

SDR of IMF 84

Pound 88

External Debt

World Bank has released International Debt Statistics, 2013

It contains the debt numbers for the year 2011.

According to those statistics, in 2011 India was in fourth position in terms of

absolute external debt stock after China, the Russian Federation and Brazil.

At the end of March 2012, Indias external debt stock = 345 billion (near to

17 lakh crore rupees.)

Indias external debt is high because of

Higher NRI deposits (since NRIs are not getting much return on their dollar

savings in American banks, they prefer to invest it in India).

External Commercial borrowings (by Indian corporates)

Corporate borrowers in India and other emerging economies are keen to

borrow in foreign currency (dollar and Euro). Because in US/EU right now the

market is down, not many loan domestic taker businessmen, hence their

banks/ investors dont mind giving loans to foreigners (that is Indian / other

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 11/14

Asian businessmen) at very low interest rate and longer EMIs.

But such borrowings however, are not always helpful, especially in times of

high currency volatility. For example, if Indian businessman had borrowed

loans from USA when 1$=49 rupees but after some years, if 1$=57 rupee,

then hell have to repay more. This will badly affect not just him but to Indias

BoP as well.

FDI Restrictiveness Index (FRI)

Prepared by OECD.

A score of 1 indicates a closed economy and 0 indicates openness.

China is ranked #1 (=it is the most restrictive country)

India is ranked fourth

Foreign Direct Investment (FDI) is preferred to the foreign portfolio

investments primarily because FDI is expected to bring modern technology,

managerial practices and is long term in nature investment.

The Government has liberalized FDI norms overtime. As a result, only a

handful of sensitive sectors now fall in the prohibited zone and FDI is allowed

fully or partially in the rest of the sectors.

FDI: defense offset

At present, 26% FDI is allowed in Indian defense sector. It also requires

FIPB approval

licensing under Industries (Development & Regulation) Act, 1951

has to follow guidelines on FDI in production of arms & ammunition.

India needs to open up the defense production sector to get access and ensure

transfer of technology.

The existing FDI policy for defence sector provides for offsets policy.

(meaning the foreign company has to buy or outsource some of its work to

local /domestic players. E.g. FDI in multibrand retail, mandates that foreign

company must buy 30 percent of the from small-scale industries.)

Such offset policy soften the balance of payments impact and/or develop local

technical capability.

Recently Government revised the offsets policy for defense sector.

But still, it has shown no visible direct or indirect benefits h on the domestic

Indian defence industry.

CHALLENGES AND OUTLOOK

while capital inflows in India, were sufficient to finance the CAD safely.

But majority of the capital flows are via FII (hence volatile)= this has led to

financial fragility and is reflected in rupee exchange rate volatility.

We cannot significantly increase our exports in the short run because they are

dependent upon the recovery and growth of partner countries (US, EU). And

this may take time.

Therefore our main focus has to be on curbing imports, mainly by making oil

prices more market determined (=expensive), and curbing imports of gold.

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 12/14

We should put greater emphasis on FDI including opening up sectors further.

Finally, external commercial borrowing needs to be monitored carefully.

Misc. facts

Three top countries from where FDI comes to India: Mauritius, Singapore and

UK

Global Economic Prospects= this report is published by world bank.

Mock Question

1. Which of the following, is not a part of Capital account

a. FDI

b. FII

c. Remittances

d. External commercial borrowing

2. Which of the following is not a part of Current account?

a. Import

b. Export

c. External commercial borrowing

d. Interest, dividends paid on FII

3. India has deficit in

a. Current account

b. Capital account

c. Both

d. None

4. India has surplus in

a. Current account

b. Capital account

c. Both

d. None

5. Indias official forex reserve doesnt include

a. Foreign currency assets (FCA) (US dollar, euro, pound sterling,

Canadian dollar, Australian dollar and Japanese yen etc.)

b. Gold

c. Silver

d. Special drawing rights (SDRs)

6. How can RBI build its foreign exchange reserve?

a. By Buying foreign currency

b. via funding from World Bank, ADB etc.

c. Both

d. None

7. Which of the following country has second largest forex reserves in the

world?

a. India

b. France

c. Japan

d. USA

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 13/14

8. Among the countries with largest forex reserves, India ranks

a. second

b. third

c. fifth

d. eighth

9. Rupee will strengthen against dollar when

a. Government eases FDI policy

b. Government raises the ceiling on FII investment

c. Both

d. None

10. Correct statement

a. NEER is calculated by RBI

b. REER is calculated by Finance ministry

c. both

d. none

11. REER captures

a. difference in inflation between India and its trading partners

b. external competitiveness of Indian products

c. Both

d. none

12. Which of the following currency is not part of REER-6 calculation?

a. Hong Kong Dollar

b. Japanese Yen

c. Pound Sterling

d. Canadian Dollar

13. Incorrect Match

a. S.Korea: won

b. Mexico: Peso

c. Argentina: Peso

d. S.Africa: Baht

14. Which of the following is not released by World Bank?

a. International Debt Statistics, 2013

b. FDI Restrictiveness Index

c. Global Economic Prospects

d. All of Above

15. FDI Restrictiveness Index is released by

a. IMF

b. ADB

c. OECD

d. World Bank

16. Majority of FDI to India, comes from

a. Mauritius

b. Germany

c. USA

d. None of above

URL to article: http://mrunal.org/2013/04/economic-survey-ch6-balance-of-

6/24/13 Mrunal [Economic Survey Ch6] Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER Print

mrunal.org/2013/04/economic-survey-ch6-balance-of-payments-forex-reserves-currency-exchange-neer-reer.html/print/ 14/14

payments-forex-reserves-currency-exchange-neer-reer.html

Posted By Mrunal On 23/04/2013 @ 23:48 In the category Economy

You might also like

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Document103 pages2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- Devaluation of RupeeDocument24 pagesDevaluation of Rupeesweetjiya2010No ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Aml Az Compliance TemplateDocument35 pagesAml Az Compliance TemplateAnonymous CZV5W00No ratings yet

- Know The Difference Between NRE and NRO Account: Download The FREE Android App!Document3 pagesKnow The Difference Between NRE and NRO Account: Download The FREE Android App!Ajit KumarNo ratings yet

- Capital Account ConvertabilityDocument3 pagesCapital Account Convertabilitydisha_11_89No ratings yet

- 5 MacroeconomicsDocument22 pages5 MacroeconomicsSai harshaNo ratings yet

- Economy 4 NewbiesDocument441 pagesEconomy 4 NewbiesSahil KapoorNo ratings yet

- Indian Forex ReservesDocument3 pagesIndian Forex Reserves00758ganeshNo ratings yet

- What Is Current and Capital Account?: (Basic Stuff From Ex Am Point of View) Mrunal PatelDocument6 pagesWhat Is Current and Capital Account?: (Basic Stuff From Ex Am Point of View) Mrunal PateldhiwaNo ratings yet

- Mrunal (Economy) Participatory Notes (P-Notes), Hedge Funds, New Limits On FII, FPI, REFI Explained MrunalDocument8 pagesMrunal (Economy) Participatory Notes (P-Notes), Hedge Funds, New Limits On FII, FPI, REFI Explained Mrunalmerc7inNo ratings yet

- Basic Concepts of Economics in Simple LanguageDocument5 pagesBasic Concepts of Economics in Simple LanguageckmNo ratings yet

- Will Fiis Continue To Bet On India?: Essay-Role of Fdi & Fii in Indian EconomyDocument8 pagesWill Fiis Continue To Bet On India?: Essay-Role of Fdi & Fii in Indian EconomyZekria Noori AfghanNo ratings yet

- Indian Depository RecieptDocument24 pagesIndian Depository Recieptadilfahim_siddiqi100% (1)

- Uestion Paper IftDocument48 pagesUestion Paper IftArchitAgrawalNo ratings yet

- Meaning of Convertibility of Rupee by YashuDocument4 pagesMeaning of Convertibility of Rupee by YashuVishal ModiNo ratings yet

- Shikhar Sharma Theswedishinvestor Iag1-HmmDocument5 pagesShikhar Sharma Theswedishinvestor Iag1-HmmresourcesficNo ratings yet

- Balance of PaymentsDocument54 pagesBalance of PaymentsParag GautamNo ratings yet

- Analysis On Balance of Payments in India For Last 5 YearsDocument15 pagesAnalysis On Balance of Payments in India For Last 5 YearsRoopavathy Mani100% (2)

- Exchange Rate System in IndiaDocument9 pagesExchange Rate System in IndiaRishi Palai100% (1)

- BAJPAIYEE ASSIGNMNET Top 4 International Capital Market InstrumentsDocument21 pagesBAJPAIYEE ASSIGNMNET Top 4 International Capital Market InstrumentsRajat VermaNo ratings yet

- Global Marketplace: Contradictions Galore & Policy JittersDocument5 pagesGlobal Marketplace: Contradictions Galore & Policy JittersAmit BhushanNo ratings yet

- Capital Edge Volume2Document12 pagesCapital Edge Volume2priye250No ratings yet

- External Sector: Balance of Payments (BOP)Document39 pagesExternal Sector: Balance of Payments (BOP)Gaurav KhemkaNo ratings yet

- Two-Point Arbitrage: ProfitDocument6 pagesTwo-Point Arbitrage: ProfitLeo the BulldogNo ratings yet

- PPP, Transfer PaymntsDocument5 pagesPPP, Transfer PaymntsShilpi JainNo ratings yet

- Why Not 1 Us Dollar 1 Rupee - S.NagarjunaDocument14 pagesWhy Not 1 Us Dollar 1 Rupee - S.NagarjunaINNOVATION EraNo ratings yet

- BoP and ForexDocument33 pagesBoP and ForexNeha RathoreNo ratings yet

- Model Question PaperDocument10 pagesModel Question PaperRajesh DmNo ratings yet

- UNIVERSITY of MUMBAI - Eco Foreign Excahge RiskDocument25 pagesUNIVERSITY of MUMBAI - Eco Foreign Excahge RiskTAJ26No ratings yet

- Reliance Capital LimitedDocument13 pagesReliance Capital LimitedavaniagravatNo ratings yet

- The Tandav of Forex Flows & Its Governance in IndiaDocument6 pagesThe Tandav of Forex Flows & Its Governance in IndiaAmit BhushanNo ratings yet

- Finance DailyDocument3 pagesFinance DailyRatanNo ratings yet

- 3.4 Reserve Bank of India (RBI) Establishment: Main Functions 1. Monetary AuthorityDocument8 pages3.4 Reserve Bank of India (RBI) Establishment: Main Functions 1. Monetary AuthorityrohitkordeNo ratings yet

- Posted Online: Thursday, March 23, 2006 at 0000 Hrs IST: Print StoryDocument2 pagesPosted Online: Thursday, March 23, 2006 at 0000 Hrs IST: Print StoryAmol MahajanNo ratings yet

- 1.years Known As & Rank of India in 2013:: SNAP - IIFT - CMAT Specific G.K. ContentDocument15 pages1.years Known As & Rank of India in 2013:: SNAP - IIFT - CMAT Specific G.K. ContentTejashwi KumarNo ratings yet

- T R A D I N G M A N T R ADocument11 pagesT R A D I N G M A N T R AAnkit VyasNo ratings yet

- Wealth Management For NRIsDocument4 pagesWealth Management For NRIsVishal SoniNo ratings yet

- Know The Difference Between NRE and NRO AccountDocument5 pagesKnow The Difference Between NRE and NRO AccountSanjeet MohantyNo ratings yet

- University Department of Management Sciences, Pune: F F T FDocument15 pagesUniversity Department of Management Sciences, Pune: F F T FArham Ali ZaidiNo ratings yet

- Who's Afraid of A Big Current Account DeficitDocument15 pagesWho's Afraid of A Big Current Account DeficitsilberksouzaNo ratings yet

- Are You InvestingDocument10 pagesAre You InvestingShailesh BansalNo ratings yet

- Impact On Indian Economy: Why Is The Indian Rupee Depreciating?Document9 pagesImpact On Indian Economy: Why Is The Indian Rupee Depreciating?Amar ItagiNo ratings yet

- What Is FII?: AdvantagesDocument10 pagesWhat Is FII?: AdvantagesNikkNo ratings yet

- GD TopicDocument5 pagesGD Topicmahaseth2008No ratings yet

- RupeeDocument5 pagesRupeeGarveet ModiNo ratings yet

- NRE and NRO AccountDocument4 pagesNRE and NRO AccountayaznptiNo ratings yet

- NRI TaxationDocument9 pagesNRI TaxationTekumani Naveen KumarNo ratings yet

- ForeignDocument70 pagesForeignadsfdgfhgjhkNo ratings yet

- Why The Study of BOP Is Important For Finance Manager/Professional?Document32 pagesWhy The Study of BOP Is Important For Finance Manager/Professional?Afaq SanaNo ratings yet

- FCNR Swap Deal: What It Means For NrisDocument5 pagesFCNR Swap Deal: What It Means For NrisPrateek MohapatraNo ratings yet

- Fiis and Their Influence On Indian Capital MarketsDocument8 pagesFiis and Their Influence On Indian Capital MarketsRohit GuptaNo ratings yet

- Forex Risk and Hedging - Arun TrikhaDocument28 pagesForex Risk and Hedging - Arun TrikhaArun Trikha100% (1)

- Indian Rupee Vs US Dollar Exchange RatesDocument3 pagesIndian Rupee Vs US Dollar Exchange RatesGanaie AhmadNo ratings yet

- Balance of Payment 20 PDFDocument79 pagesBalance of Payment 20 PDFRiyaNo ratings yet

- Foreign Exchange RegulationsDocument58 pagesForeign Exchange RegulationsSanket SinghNo ratings yet

- Exchange RateDocument6 pagesExchange RateChirag HablaniNo ratings yet

- Https:/dpiit - Gov.in/sites/default/files/ready Reckoner For NRI - Final - 2Document27 pagesHttps:/dpiit - Gov.in/sites/default/files/ready Reckoner For NRI - Final - 2Madhav ZoadNo ratings yet

- Modified Final Version 5.6.08Document13 pagesModified Final Version 5.6.08Subhadip NandyNo ratings yet

- Indian Stock MarketsDocument25 pagesIndian Stock MarketsNidhi GuptaNo ratings yet

- Sensex Will Gain Over 30% in Three Years: Sunil Singhania, Reliance Mutual FundDocument5 pagesSensex Will Gain Over 30% in Three Years: Sunil Singhania, Reliance Mutual FundGurdeep Singh ChhabraNo ratings yet

- Mrunal (Economy Q) Micro Finance and Its Problems PrintDocument2 pagesMrunal (Economy Q) Micro Finance and Its Problems PrintAnil CletusNo ratings yet

- Mrunal (Economy) Rupee Downfall - RBI Directive To Oil Cos - Buy 50% Dollars From SBIs PrintDocument2 pagesMrunal (Economy) Rupee Downfall - RBI Directive To Oil Cos - Buy 50% Dollars From SBIs PrintAnil CletusNo ratings yet

- Mrunal (Economic Survey Ch1) Introduction, GDP FC MC Relation (Part 1 of 3) PrintDocument5 pagesMrunal (Economic Survey Ch1) Introduction, GDP FC MC Relation (Part 1 of 3) PrintAnil CletusNo ratings yet

- Mrunal (Economic Survey Ch3) Fiscal Marksmanship, Tax Buoyancy, 14th Finance Commission PrintDocument8 pagesMrunal (Economic Survey Ch3) Fiscal Marksmanship, Tax Buoyancy, 14th Finance Commission PrintAnil CletusNo ratings yet

- Mrunal (Economy) Teaser Home Loans - Meaning, Implications PrintDocument2 pagesMrunal (Economy) Teaser Home Loans - Meaning, Implications PrintAnil CletusNo ratings yet

- Mrunal (Economic Survey Ch1) Investment, Savings, Gold Rush, Inflation Indexed Bonds (Part 2 of 3) PrintDocument6 pagesMrunal (Economic Survey Ch1) Investment, Savings, Gold Rush, Inflation Indexed Bonds (Part 2 of 3) PrintAnil CletusNo ratings yet

- Mrunal (Economy) Urban Financial Inclusion - New Directive of The Government To Cut Subsidy Leakage PrintDocument2 pagesMrunal (Economy) Urban Financial Inclusion - New Directive of The Government To Cut Subsidy Leakage PrintAnil CletusNo ratings yet

- Mrunal (Economy 4 Newbie) Petrol-Diesel-LPG Subsidy - The Parikh Solution PrintDocument6 pagesMrunal (Economy 4 Newbie) Petrol-Diesel-LPG Subsidy - The Parikh Solution PrintJitendra RaghuwanshiNo ratings yet

- Mrunal (Economy 4 Newbie) Money Market, Repo Rate & Call Money PrintDocument6 pagesMrunal (Economy 4 Newbie) Money Market, Repo Rate & Call Money PrintAnil CletusNo ratings yet

- Mrunal (Economy) Why Do We Need Budget - PrintDocument2 pagesMrunal (Economy) Why Do We Need Budget - PrintAnil CletusNo ratings yet

- Mrunal (Economy 4 Newbie) Infrastructure - Roads, Railways, Seaports Etc PrintDocument9 pagesMrunal (Economy 4 Newbie) Infrastructure - Roads, Railways, Seaports Etc PrintAnil CletusNo ratings yet

- Mrunal (Economy Q) Micro Finance and Its Problems PrintDocument2 pagesMrunal (Economy Q) Micro Finance and Its Problems PrintAnil CletusNo ratings yet

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastNo ratings yet

- Organic Farming in The Philippines: and How It Affects Philippine AgricultureDocument6 pagesOrganic Farming in The Philippines: and How It Affects Philippine AgricultureSarahNo ratings yet

- Intellectual Property RightsDocument2 pagesIntellectual Property RightsPuralika MohantyNo ratings yet

- Pandit Automotive Pvt. Ltd.Document6 pagesPandit Automotive Pvt. Ltd.JudicialNo ratings yet

- PaySlip 05 201911 5552Document1 pagePaySlip 05 201911 5552KumarNo ratings yet

- Ekspedisi Central - Google SearchDocument1 pageEkspedisi Central - Google SearchSketch DevNo ratings yet

- GL July KoreksiDocument115 pagesGL July KoreksihartiniNo ratings yet

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFDocument7 pages002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezNo ratings yet

- Fabozzi Ch13 BMAS 7thedDocument36 pagesFabozzi Ch13 BMAS 7thedAvinash KumarNo ratings yet

- Malta in A NutshellDocument4 pagesMalta in A NutshellsjplepNo ratings yet

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNo ratings yet

- TCW Act #4 EdoraDocument5 pagesTCW Act #4 EdoraMon RamNo ratings yet

- Literature ReviewDocument14 pagesLiterature ReviewNamdev Upadhyay100% (1)

- Rental AgreementDocument1 pageRental AgreementrampartnersbusinessllcNo ratings yet

- Top Form 10 KM 2014 ResultsDocument60 pagesTop Form 10 KM 2014 ResultsabstickleNo ratings yet

- Indian Contract ActDocument8 pagesIndian Contract ActManish SinghNo ratings yet

- Calander of Events 18 3 2020-21Document67 pagesCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiNo ratings yet

- Bill CertificateDocument3 pagesBill CertificateRohith ReddyNo ratings yet

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Document42 pagesReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruNo ratings yet

- BAIN REPORT Global Private Equity Report 2017Document76 pagesBAIN REPORT Global Private Equity Report 2017baashii4No ratings yet

- 4 P'sDocument49 pages4 P'sankitpnani50% (2)

- Latihan Soal PT CahayaDocument20 pagesLatihan Soal PT CahayaAisyah Sakinah PutriNo ratings yet

- P1 Ii2005Document3 pagesP1 Ii2005Boris YanguezNo ratings yet

- Contract Costing 07Document16 pagesContract Costing 07Kamal BhanushaliNo ratings yet

- Coconut Oil Refiners Association, Inc. vs. TorresDocument38 pagesCoconut Oil Refiners Association, Inc. vs. TorresPia SottoNo ratings yet

- Agony of ReformDocument3 pagesAgony of ReformHarmon SolanteNo ratings yet

- Business Economics - Question BankDocument4 pagesBusiness Economics - Question BankKinnari SinghNo ratings yet

- Smart Home Lista de ProduseDocument292 pagesSmart Home Lista de ProduseNicolae Chiriac0% (1)