Professional Documents

Culture Documents

Taller Carrión Pinzón

Uploaded by

Sergio Saavedra0 ratings0% found this document useful (0 votes)

49 views14 pagesA competitive firm has a cost function C(V): ll2. Suppose that the owner of the firm is risk neutral and is given the following options: option 1: (no price stabilization) the selling price of output is a random variable that equals $1 with probability. And $2 with probability.5.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA competitive firm has a cost function C(V): ll2. Suppose that the owner of the firm is risk neutral and is given the following options: option 1: (no price stabilization) the selling price of output is a random variable that equals $1 with probability. And $2 with probability.5.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views14 pagesTaller Carrión Pinzón

Uploaded by

Sergio SaavedraA competitive firm has a cost function C(V): ll2. Suppose that the owner of the firm is risk neutral and is given the following options: option 1: (no price stabilization) the selling price of output is a random variable that equals $1 with probability. And $2 with probability.5.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

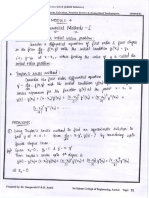

Economi cs l 01A

Problem Set Number 8

DUE: Tuesday November 29 (after Thanksgiving)

L A competitive firm has a cost function C(V):

ll2.

Suppose that the owner of the firm is risk

neutral and is given the following options:

Option 1: (no price stabilization) the selling price of output is a random variable that equals $1

with probability .5 and $2 with probability.5.

Option 2: (price stabilization) the selling price of output is $1.50 for sure.

(a) Suppose that the firm can make its output choice after the price of output is known. Show

that the owner prefers to have an unstabilized price, Explain why,

hint: Show that the firm' s profit function n(p): max

{

p' y

*

C(V)

}

is convex

Explain why this means that the firm likes a variable price,

14

t/

f t il"l"

lp-' t

f

*

f"*l

t*th

'^^"o/

trl

{t^}'

"t

tr"

ll

tt^"

^"*^f

I

&h4,t"{-t

h

t

tl-

b,,ft{J

t""

I

C.Ota&

+I'^^

tt--

n(r)

(ri-)

"i-({.s)

I

I

n ( t )

"f;(a)

,,fi'u-_

Q

{

+r

f1't

h.*t S paslr'(r-;^

I

r l

9'

t

/l \e

=Q

n

(p) =.

fl ' 1"

'

tn.*.cf

f.^'cluu

=7

(tt^. ul.clrd

fh't

('4r

,

uf"

w^*

1({r)

(r' ' u1"' }' d-'

6

op{' o^f

rr^

p4a c,ph' o^

4.

*L--1"S*

+

p4^CP -

*,

(b) Suppose that the firm has to select an output choice before it knows what prices will be.

What is the first-order condition for the optimal choice of y under option I ? Would the owner

prefer option I or option 2 in this case? Why does this differ from your answer in (a)?

L) ow

U-*

$.*

t

.

y,r*l-",*

,',-dtc

o1 tt'o

"

'l

;

e

(g*"tt

zz

W

t

+

(l-il"lDn

th-il"t)

-@"1)=

h,c${"

U

FOc

I

--

U+e.r.

ogtio^

L :

L ! /1l t

e-

r' r

-L r.l

r0

L

bl

tql,

:c

I

'.t = 3-

0L

v

{,-')

=

-o

.L

t.

L

6

@rcl<oL rl"'b

, .

h

T}'

va

L-o1*

I

t^pr^/

Jt's

el^"ot-'7

I

t^-*c.rb*o

L *t

t

arr

l'.Ivflio

'

or- tAjLo*Ae.tiors :'-

rk

r4)

J-

opt

o,.s

^rc

tqftX-

L ,,t-

*f"^fl (

h^*

h

otrr6,' .d-

(l+*

l1*

h

'tA

- P'INL

'A

tL-

it*

+Jr

Ll t \ ' 5

0

3

I

(

t"x*

.|{-

-i/cJ^

b*u' r

a*ct

''t-

(c) Suppose now that the owner is risk averse, with a von Neumann Morgenstern utility function

-T1,.-

u(n):nY, where 0<y<1, and fi

=

profits. Redo part (a). Can you find a value of y such that the

owner prefers a stabilized

Price?

Ohr4!{-

t-

tr"-'*ltt"-A-f

e tl (ri)

r--ov/ , ttFd't-

r og h ot^

ll '

e \ \

(S\

\ r 4

I

b?

tr[e)

oUb'^"\

\ - | , r \ /

T

(

t'

\-l r)

\

----' /

\----

= fitO

.^O

/ a r \ f

(

t -

- L- I L)

:

,

--_--}

=

:it

lr)

i

f T

r

trf+L

LT

\,1\dL

To

Rr

t^^ds-

ogh.o^ L,

r f

eu

[ 5r)

=

LL

t n

(, t D

=

(

s" {

$"/ t )

\,st;&

onr.- J^-

gW

,

t"},t

t

*of,*

t{^^

r

(i)"

+

t,'

t

(fr)'

2

*

)--r ^-

Ea,t

J s' r i or

| |

t' xT

t

e +

4

+T+

L

Q),,

<-2

-L \rtr

L -L r-tr

I /

g

\r?'

$

t

t' L

" \tl

#

l"r +

Lf'

)

e{,

)^eul

s i*f,^UV

I

{t^A-t

&,

I

Cet

1 i , f J- T- l

[ ^^Jr, ; t

; ef

=

(+)'

l t no

:

r{'

l^"

f

f,...

x'T

i"

aP&

tr>(l^

( n

.c- *' T

h @xcr.' *L

y-z

t

l r

*),

r3

tt*)

t

=

dft

{^^l u'

Ly-{

' c!

(h.^".

,"=,

h L*r

q

@

T

-' b

+

J$

o^T ^

+

'

lL

or^^{..

rt^

{{*^ stL, blr<A

a,;r.

(

opNon

D

i

t F

T-L

'

JrL ohl r' +. - h ; d; f f <t cr*' )

tQ-

\rT ,

L

, H-- ov4*r

fW

tL 6a2f.h, 6F"t

iu

,

$,,rcr

Ji- (

P)

th

of^{r.q-hic-

)

Po

Tkr t"lu

K*-

|

dtL

be- cot.ca.*rL

/

Hr---.

(

r^'.t

"-

t" ( -,teD

uY'U

l

r"+

1

4'tr,

L

r"^

p Fo.

fficertaindemandforitsproductisattemptingtoputtogetherawage

package for prospective workers.

In periods of low dernand, the firm

puts its workers on

temporary

layoff and pays them an "unemployment

benefit" $z'

In periods of high demand' each

worker works full time and earns $y.

The probability of low dernand is p' workers evaluate

alternative wage

packages as follows: the utility of income x is U(x)' If a worker is asked to

work, however, his/her net utility is

U(x)

-

b,

where b represents the "cost"

of foregone leisure'

(a) what is the expected utility ofjoining a firm that pays $y for working

(with probability I'p1

and $z during

periods of lay-off

(with probability p))? what is the expected cost to the firm of

offering such a

Package?

;

.

u.\t +

0-r)

fn,r)

-{

(' F

+

(-r)[

L>

Problem Set #8

Continued

(b) Suppose that the firm hires an economist to set up their compensation package. The

economist observes that

jobs

are available elsewhere in the economy that pay

$y*, and have no

risk of layoff. The economist proposes to choose y and z such that the package (y,z) minimizes

the expected cost of compensation, subject to the constraint that workers have the same expected

utility as they can achieve on the alternative (riskless) job. Solve the constrained optimization

problem. What is true about y and z7 How do ttrey vary with the probability of layofl?

F

fea

+

l t-i l T

,t.t.

fl

wt' ) +

(\-r)f

0,.0)-d

a

rQ)

: )

4(l r"rJ*) E-

f

r= F (-

e)tr

-

).f

n

-ta=) *

(t-iltnra)-|-^UI

-fOCs

l

J' ?

rs\") : o

,I

(*-r) u

(l)

-

o

-

f

tl.\t) -t]

{-

U(1

.):o

Ktr

tl

u

1*

(*-r)

|

n,1)

fnl'

hJ'

f

,{,

<

'E

?

a.drtul.1

afOt^r'-pN

On

', So \'t^^-t.

+L^f,

\L

\L-

f

,> CObCzll&

b?

Mfy

i^t'o tt--

to-h^:*J" Uke

b&

lL^ rnl^-fto-)

I

(r-Du

=

tr(,6,

+

u(r)

*-

utl)

.

(-r)l

/ >

W,,*

l't^^*,

- )

\ L\ E) :

t ( ?)

t^^r." ).ot

unr-o\

*

:/

l *

d

t')

--

u' (?)

t

tt)

31

ddetL^^-h"h7

+-p.t l*

I

bolt ndr.

:

-t

Lr-

r

&a

6>o

U0")^hdht

n\

(.) z

o

(a-

"fi {^h

na

"YQ

u7

*;

^o"""?B*)

Cnf.ho^:

'l lt-

frl&tlt!

"l

h^Jx-

o-c-.{b

o-

lovtq

i"+'^,cs

t*

t[d^^t

W

@

u.'

tl)

(

a.'

U'

^A

b

a.t( q/"('

co"^l*-'b)

'

hrllt

' Ls

0y

:)

Y---"

c!fi-

wV

\

-

"tt

ivc<t-+#

c^

tD-6

t-2

n^a

' il [ot-"tt '

(c) Suppose U(x): log(x). How big should be the earnings

premium for accepting a

job with a

probability p of lay-off? How does this vary with b?

Fr

a'3\,2

{l*

,ntl-1

ib

A 4;W

Xln.'\

(to"*'

$lt

I

'*J'aA'c **tr

';-

1-"^

"h\

dp*"-ok;l''L

b7

il

'q)

i , "r

"Ft . t

(-P)

t

r*-

\

\t^-

,*A-

aJ,Le-

,,^t

l'I"l

M?,,c

q-

0

{^'

ir-

bJe-

a{''$\r'u'lt*

t

U*

hrr"

oPt

or

mbs

' ,

0t

' \ so

!-pw

u-

(l)

t.Q)

=

bl n :

i r o

' I

r

\.1--

4A ttn lob

tn

UI

(D

l't^'o'.t"

= u(l )

+

1"ot-

rdi tL

t' n?

=

t ^6

bn

. +

(

-f )

t

+

qx

Wv.

=

(-r)r

f---<----

_

l,pe

I lyf

U- I U

@

e

<:>

So \.t^-

,*MY

7*w-a

0.

3. A consumer with income y faces the risk of a loss L. Suppose the probability of a loss is

P,

and

insurance coverage is available at the rate n>p. Assume the consumer's von-Neumann

Morgenstern utility function is:

u(z)

: -

exp (- Rz)

where R>0.

a) For an arbitrary von-Neumann Morgenstern utility function v, the "coefficient of risk

aversion" at income z is defined as r(z)=-u'rrrlv'(z). Show that for u(z) defined above'

r(z):R.

r,.'

\-)

=.

r'1

\r)

=

T[:s ta

6.

+L

W-

cot^o-t)

co$ue^r

{

abs"L^}-

*

u\[q

rri[ arMio,

i

* ';rtt<f

: n_,

\

%@os

@,

\."' r-

^[t^b

b^ok"-

s* prua,-cr-,heco*o<

"il

4d tL arlt/i.o*

(

t^-a-^'rt

L,0 l{^*

alo*

A

r,ob

Utt

(

-*"r)

d{t u,wt]L

,>

,^\t

=

b) find the optimal amount of coverage for the consumer and show that the uninsured loss. L- C

---@

\ti\AJL

c

is smaller, the bigger is R, and is larger, the larger is n/p

hint: you should be able to show that L

-

C

:

(l/R) log ( n(l

-p)

/ p(l-n)

)

u(c) =

r

\L(.

I

L

-...c.c)+(-r)ul ?

T,o.^'

e'

r' i \'

[t-

nr0

d(.A-t+

(^*))

u' t?

-rf

u

\*)

- -%

(- rD'

" - .

)

Trq"T

-o

r r(*)i

4-lc

(

^ ' f

-

i1--

r-1r

I

{-0

L, t - ?

f

FTr

v?

Yn

>(

>\

- *)

i '

oYL' , db

f

$-' t b

Wr*rt

(r-

ol^'-

t;

trL

";"'*)

9

b^,

wWt

co' L* '

1I-

i-1r

p

^- f

rf

ry

(-rW-NO

{

f-rt.-D

=-

{*(

[.

t' -q)

L

'1i-

ffi

. e

4-1

L(r--. )=

tnv

(ffi)

zL

L

-c t

n*

n(ffi

--

i

*a

(T

*)=

"*

lnf

rfn'

{H

*, H^^

o^rotL

;rL

o'^f4L

W

f

'

L

|

{L

an""'!*-

[-'

hl.i'*aaal

lPYt

*

a,a l*1

,

L-a

l,

>l

V2

>o

aQ

-' )

n

S\t)

t +L

nlr

c-

D

bs(' -n)

o(n

(D

t

=6

a((

'ttJat,')

["^

'

t b6L &sl e.

(*

u(, rI

L-' t )

#

={

0-

0 bfl

(,'()

o

(

nlr)

,t 4

?!

(."

t -y

= -!-

t - y

oFtilpu)

r

- l

- -

rrf

-L

( -

t

L

R. 1r

\-c--,

>Q

r! E-

{{' j r"

,*F--*>

2o

"*

I

rl^,-

ry

t l e

I

pn'ut*.<,r*

' ' nrl.o.I,t

Fo

;.H;',;"u;th)

r t l

ttGTTo

\__P

7O

(*

k, p, t t

=4

\

I r (

, /

-

.\t-

|.o-1n,r il-*

4. An assistant professor at Berkeley is trying to decide how hard to work. If she gets tenure at

her currentjob, her salarywill be y,. Ifshe is denied tenure, she can get ajob at Second Chance

State College for a lower salary yr. The probability of tenure is p(a), where a is the number of

articles published. Her expected utility depends on income y and effort spent on writing: u(y)

-

fia, where u(y) is concave and s

>

0. Note that articles have to written before the tenure

decision.

a) Develop an expression for her e*p"cted uttttrr^

*.ri";;

ll^.o.!

G.

--4

b) Assume p' (a)>0

and p"(a) <

0. Find an expression for a*, tne opiin ar cnorce ora

Show that a rise in the salary y, leads to an increase in the number of articles.

HINT: look at the f.o.c. for a*, and draw a diagam illustrating

the optimum.

e u (o.)

g'

e

(

t' )'

u(?, )

-

u (1")

r(?Dl

-- N*

\'o

t*ghan'7

drh-;i-

b2

I't

oay,^I;ot^

I

l a

IT

(',(t')

T

,^'

(t

)

ir'.[?"I

p'

(r) =

wt l , ) U

(. 1)

tJ'\Yr)

-

2

?

r

dg,

*--

?"*

dr

u' (r)

p"(^)

u-*J

1c

(n ui >o

fo

t o.,

brS

a/rl '

)

\

/ '

u$l

t rl r\ '

l

Lr '

of t '

( " )

3

[")

u*-t

A

n(r)

-ul t)

+

z- o

,!t

^n

flr

t o. *T

(

r\(J)

ll

,

&

't*r

"l

b- *1,.*-l*

t"

(r

o u, ' 1,=lt

I

ntr,)

-

\^ti {

?Y\d*\'

ruf

,lt(

G* z' &

te

[r

' l

a

w(1,)

t

:)

4'

u(l)

-

\I(bt

v

'

rr

oft ("-)

r

t{*

ra'"-

"l

f

(")

ft*"ra-

d+c,t'ts

'

AS

f

(^)

h corco''xr-

VV

a'ot,.*1h'et

: )

A- *t

> d.

li

ie

c) Suppose some people have a high value of s (s:4"), andothers have a low value of a (a:ar).

Berkeley wants to keep the "low oo'professors, because it thinks that they will work harder even

after they get tenure! Show that Berkeley can do this by requiring a minimum number of articles

for tenure,

3LA^tu

A

r d. a o*x) e

s. b.

Pc*) =

r t s

o- > o' -

a-

<

&tx

o-

*fa..+,hi1

qnf:{ih^'^"L

n

*7"- A, E, Low

-

a-

dU-

b- tcr*."c*- o+cL

. &^cL

o\-

b+

-

/- dtt.'

(tpr^-

l.

of

^r.+,h,^n

q1^r^bn^ta,r-

b. wer.L$

v,oaL

"ll

bV

ScJc .

hrc ,t-d-

t"utqt'e-,<-*t7

:

, t

\ )

**. o

t

4, 3

,

' gi ot

(Ll"-

ry

"p$n*A

cLYr't*-

, - l L

bL

* =o

( *^- n o'loL

* lu

Pr

o-MA

n

t

'ro

il-

d

tt nica;go

t-*-

orlcs

b?

n-

=

)

br-t

a

co*^|r"*cJ>

A i,, otgt'alt-)

.5uJv

lt{* L 02 br"lk"

fl

b?

"

tt*,'1^,e-r+d.i?

e)

A b

t^ot

trceJtr- 0"5^li14^-

o

&rn

\.

e-

tl -

tl ,)

-

ut

l *)

t,C,

gtne"t e1^J".b*"l^

coJ.-cb

5. Here are 2 "shoit answer questions" on auctions of the type that are likely to appear on the

final exam, For each question, indicate if the statement is true, false or uncertain, and explain

why, using diagrams, equations, etc'

a. ln a private values English

(ascending bid) auction, each bidder should keep bidding up to his

or her own valuation.

Tl-rte

,

A

^

W't^

(;

tJ'"*

UYd-ea.J(!^,

a^.-c-ln'oz-

I

wt, O1-z- u^<r.L-q.-a-h'ox

N tg,o,rL

-

grl

ur-

dee.^

rA;.Jc

o.^c.'}io- t '

Sto-LoL h'cL

k

b-''t-

b-' &s hwtr

,

"L

n^ rt"s

fl^^.

lr;,^t)

&

ts

+1' *

J^l u' h*

:

^At

V..rt*rrV' Q.^"wtartr

$ryb

l ^r"^

' : ^"^f , ;

, l

f"

" { Qr^-u 6 d-.

Yre^T

?o-n - t1

L<ta

ln^cl strL

a

*tb,

H^^f"

i*-'s

& r./Ylr-^Ja

l .-

Fc.-,l^.*

o,rrrul'oh

I

b, A tract of national

forest is being sold off for logging using an English

auction'

Each logging

contractor

sends a team to evaluate

the forest'

If a team reports an estimate

that the timber is

worth l0 million dollars,

the company's

managers

should bid up to 10 million for the right to log

the land.

l FAtsg.

TLs i :L

gt*^

,{-er^{- ar^cl "i o"--

@

ht* {t

^- trzrf-t.r-<-

(

J U'-

r1\'

*t nzn'}<- '

d+

to H

:

,rr + e

(*L*

e (e)

=9

I

lL la^i' L&r

hi,ll

tt

'tt*^-

g\'dlt',itsI'o*

CDtl^{tt'^

e''-r(.

bq"-t

^r-

It*-

Efut e

dtt

^^,\ C

e")

a'^'d* h''t|

PZ

{t*-

.u^*

"[

. l . , - a

atu4 ,^^tL tt-

ft{or-oL

h^A't

L ( o*

* tu-'

,

^

{L-

g#A

a^-c};*

00

' n - L

l- t{^^

R,A-d\

-

P4^u|*

[4t"t"L h'ol o^c[io--

n[*o

L-

b

" 1" ' vdt JP\ '

I f , - | , . ^. \ dI A- r t r s\ : (

tx Tt*-

{

ft-^-

t^.o.^c

"rfr;w,I*

O

0;7t*

(

/t

n"sls tr^r-t'i7

"(o*+ru-r)=r+t

eQu-)

>rr

t t t d")

: )

+ t^ C*f

..;-.-,lio^

[* 6,:,

xt<-s

AILtpT

\

$o

U tr^rr<rr{

CJ"-rlL'

q/,F.

e[---t-

dou.> l L."r vo.t^-ohots b,0

e(t"-t)

(**V

tt-6

!.uor

$"* c1;rl.:bJc--

d

t

r

$

t (*-')

^..a q

+ S. . '

b1

= \ r ) .

+

gt

{,

( t "- )

,

*&

L

F

t o

H

a ( a" - , )

*

Qor

okr

(

U

"

t tL- r u,*l^; l',

d |lt kL- il'-t

ah'ahr(r

fA*

wL

dioL

i' lt, or^cnk"r-

strl s"-

|

)

You might also like

- Pay Slip Format in Word PDFDocument4 pagesPay Slip Format in Word PDFjoshua galura0% (1)

- Activity Based Costing (ABC) . Feb 2020: Cost Driver AnalysisDocument11 pagesActivity Based Costing (ABC) . Feb 2020: Cost Driver AnalysisMuhammad Noman AnserNo ratings yet

- Please Fill in The Information Below.: University of Guelph Fall Semester 2oio Term Test I MATH 1080 October 15, 2010Document8 pagesPlease Fill in The Information Below.: University of Guelph Fall Semester 2oio Term Test I MATH 1080 October 15, 2010examkillerNo ratings yet

- Seminar Mecanica 1 Specializările LIEMZ + LTDHZDocument21 pagesSeminar Mecanica 1 Specializările LIEMZ + LTDHZcpanaitescuNo ratings yet

- Calculus 3 Practice Test 2Document6 pagesCalculus 3 Practice Test 2kenziej605100% (1)

- Calculus 3 Practice TestDocument6 pagesCalculus 3 Practice Testkenziej605100% (1)

- Subiecte Partial+Repartitii 1Document5 pagesSubiecte Partial+Repartitii 1alinionutNo ratings yet

- Dt=4s-2wWt6:#trtr OrhT-- Wwe*izpfw-ryWWlDocument4 pagesDt=4s-2wWt6:#trtr OrhT-- Wwe*izpfw-ryWWlAleksaTramošljaninNo ratings yet

- E257 Dec2012 AnswersDocument11 pagesE257 Dec2012 AnswersJohnNo ratings yet

- 01 31 14OptimizationWordProbs PDFDocument8 pages01 31 14OptimizationWordProbs PDFElliot SynderNo ratings yet

- CBNST Notes PDFDocument109 pagesCBNST Notes PDFKamlesh GuptaNo ratings yet

- Brigidine 2000 3U Prelim Yearly & SolutionsDocument12 pagesBrigidine 2000 3U Prelim Yearly & SolutionsomhreemaimhreemNo ratings yet

- Advanced Math Exam QuestionsDocument11 pagesAdvanced Math Exam QuestionsNidhish Singh JadaunNo ratings yet

- Klapper SolnsDocument96 pagesKlapper Solnsapi-3770171No ratings yet

- RevisionDocument30 pagesRevisionNadirah Halim100% (1)

- Atividade - OndasDocument4 pagesAtividade - OndasLeonardo MartinsNo ratings yet

- Lecture 4Document6 pagesLecture 4hossienhossieniNo ratings yet

- Numerical Stirling Bessel FormulaDocument4 pagesNumerical Stirling Bessel FormulahossienhossieniNo ratings yet

- MTL107 InterpolationDocument11 pagesMTL107 InterpolationPutriNo ratings yet

- Mte3110 Mei 2010Document21 pagesMte3110 Mei 2010Timothy MaciasNo ratings yet

- Multi: 9: For in ADocument5 pagesMulti: 9: For in Asadek sadekNo ratings yet

- Poisson EquationDocument3 pagesPoisson Equationsalkr30720No ratings yet

- ,R, R.R LR!:, Ic-R, Aq/6, FR!, T (E LDocument4 pages,R, R.R LR!:, Ic-R, Aq/6, FR!, T (E LNor Syahirah MohamadNo ratings yet

- Modern Circuit Analysis TechniquesDocument3 pagesModern Circuit Analysis Techniquesdvaf12No ratings yet

- Home Assignment - 9 ' ': - Assume That The OpDocument20 pagesHome Assignment - 9 ' ': - Assume That The Opegupta1No ratings yet

- Kuching STPM 2012-Mathst Paper 1 (Q&A)Document10 pagesKuching STPM 2012-Mathst Paper 1 (Q&A)SKNo ratings yet

- Minimum Potential EnergyDocument11 pagesMinimum Potential EnergyAhmad SultanNo ratings yet

- Problemas Lupis Capítulo 4Document38 pagesProblemas Lupis Capítulo 4draco21118100% (2)

- TrigeportDocument5 pagesTrigeportapi-232312177No ratings yet

- FizicaDocument86 pagesFizicaPopescu DanielaNo ratings yet

- Partea 1Document20 pagesPartea 1Victor CiobanuNo ratings yet

- MTL107-Error-Lagrange-PolynomialDocument9 pagesMTL107-Error-Lagrange-PolynomialsmoldoggoenthusiastNo ratings yet

- MEC626 Finite Element Final ExamDocument7 pagesMEC626 Finite Element Final ExamgulabNo ratings yet

- CO-5 Eigen Value and Eigen VectorDocument15 pagesCO-5 Eigen Value and Eigen VectorArpit SidaparaNo ratings yet

- Calculus 2+Document192 pagesCalculus 2+Kim JaesungNo ratings yet

- Review Problems For Exam 2 (Not A Sample Test)Document10 pagesReview Problems For Exam 2 (Not A Sample Test)totality9711No ratings yet

- Calculus 3 Practice Test 3Document9 pagesCalculus 3 Practice Test 3kenziej605No ratings yet

- Keywords for a math test documentDocument82 pagesKeywords for a math test documentLackadaisical Lass100% (1)

- Document Analysis of Mathematical ConceptsDocument14 pagesDocument Analysis of Mathematical ConceptsAymen YamoNo ratings yet

- Solving a System of Partial Differential EquationsDocument3 pagesSolving a System of Partial Differential EquationsMunteanu AndreyNo ratings yet

- DM NotesDocument81 pagesDM NotesCharuNo ratings yet

- Green's TheoremDocument5 pagesGreen's TheoremPriyanshu Sekhar pandaNo ratings yet

- Lecture 4Document11 pagesLecture 4tanushka17823No ratings yet

- Winter 2015Document19 pagesWinter 2015Kislay ChoudharyNo ratings yet

- Calculating Solutions to Systems of EquationsDocument17 pagesCalculating Solutions to Systems of Equationsjalrizal7No ratings yet

- Solving Systems of EquationsDocument17 pagesSolving Systems of EquationsLatifah BahanuddinNo ratings yet

- TD1 Genet Pop Correction Exos 1-2-3Document3 pagesTD1 Genet Pop Correction Exos 1-2-3khay.zineb0No ratings yet

- PSM LaboratorDocument23 pagesPSM Laboratorno nameejjNo ratings yet

- 18mat31 Module-4Document48 pages18mat31 Module-4Parthasarathy T100% (1)

- SufficiencyDocument25 pagesSufficiencywhydoiexistt77No ratings yet

- Formule MatematicaDocument9 pagesFormule Matematicapositivity central100% (1)

- 2 Way SlabDocument58 pages2 Way SlabCEG BangladeshNo ratings yet

- HVDC Unit 4Document40 pagesHVDC Unit 4SrinivasNo ratings yet

- J R",8,8) R C'S'C (TRCC'T) JT: Y.,8, L+) KTD'T) JT - 10"' TLT) ! T"T'+) DT JDocument4 pagesJ R",8,8) R C'S'C (TRCC'T) JT: Y.,8, L+) KTD'T) JT - 10"' TLT) ! T"T'+) DT JhossienhossieniNo ratings yet

- Mathematical Modeling of Mechanical SystemsDocument5 pagesMathematical Modeling of Mechanical SystemsNikola BogdanovicNo ratings yet

- ΛΥΣΕΙΣ- ΦΥΛΛΑΔΙΟ 1Document9 pagesΛΥΣΕΙΣ- ΦΥΛΛΑΔΙΟ 1TaysonNo ratings yet

- Differentiation All Pratic Sit WWW - EuelibraryDocument11 pagesDifferentiation All Pratic Sit WWW - EuelibraryShahriar RobbaniNo ratings yet

- Section 7.5Document6 pagesSection 7.5Arwa MNo ratings yet

- Line Integral Over Vector FieldsDocument4 pagesLine Integral Over Vector FieldsRitvi BartiyaNo ratings yet

- 6, "-Iz.T Tu, :: /Yjfr"LDocument13 pages6, "-Iz.T Tu, :: /Yjfr"LAdi NouashcinciNo ratings yet

- 8".r:,7il1) Corres P"N%: - Rhe RL Pton-&aphro", Me (I D Po. Sotuug Tj... :NL - UDocument4 pages8".r:,7il1) Corres P"N%: - Rhe RL Pton-&aphro", Me (I D Po. Sotuug Tj... :NL - UhossienhossieniNo ratings yet

- Solución de La Segunda Práctica de Econometria Ii: Universidad Nacional de Piura Facultad de EconomiaDocument3 pagesSolución de La Segunda Práctica de Econometria Ii: Universidad Nacional de Piura Facultad de EconomiaSergio SaavedraNo ratings yet

- Limited Dependent Variables-DhrymesDocument65 pagesLimited Dependent Variables-DhrymesSergio SaavedraNo ratings yet

- Limited Dependent Variables-DhrymesDocument65 pagesLimited Dependent Variables-DhrymesSergio SaavedraNo ratings yet

- Econometric - Introduction To Econometrics 2nd Ed (1988) - G.S. Maddala - Macmillan Publishing PDFDocument637 pagesEconometric - Introduction To Econometrics 2nd Ed (1988) - G.S. Maddala - Macmillan Publishing PDFFernando Fraga100% (9)

- Barba Vs Liceo de CagaynDocument3 pagesBarba Vs Liceo de CagaynPaula GasparNo ratings yet

- Pregnancy/Parental Leave InformationDocument25 pagesPregnancy/Parental Leave InformationOSSTF District 21No ratings yet

- ILO Handbook - Checklist & GuidanceDocument21 pagesILO Handbook - Checklist & Guidancecepong89No ratings yet

- Activity 1 - Manufacturing Accounting Cycle: Problem 1Document2 pagesActivity 1 - Manufacturing Accounting Cycle: Problem 1AJ OrtegaNo ratings yet

- ECON1B03 Exam 2012fall SolutionDocument8 pagesECON1B03 Exam 2012fall SolutionIshahNo ratings yet

- Motivation Ent DevelpmentDocument4 pagesMotivation Ent DevelpmentMujahadatun_linafsihNo ratings yet

- Labor CasesDocument94 pagesLabor CasesWiam-Oyok B. AmerolNo ratings yet

- 029 Blue Dairy Corporation vs. NLRCDocument2 pages029 Blue Dairy Corporation vs. NLRCNeil BorjaNo ratings yet

- Child Labour......Document14 pagesChild Labour......rajeshkumarlenkaNo ratings yet

- Trade Union Movement in India.Document3 pagesTrade Union Movement in India.IOSRjournalNo ratings yet

- Hitachi Home PoM AssignmentDocument1 pageHitachi Home PoM AssignmentHerendra Singh ChundawatNo ratings yet

- On 30 October The Following Were Among The Balances inDocument2 pagesOn 30 October The Following Were Among The Balances inAmit PandeyNo ratings yet

- When Waiver of Overtime Pay Is AllowedDocument4 pagesWhen Waiver of Overtime Pay Is AllowedjoyNo ratings yet

- Employees' Provident Funds & Misc. Provisions Act. 1952Document21 pagesEmployees' Provident Funds & Misc. Provisions Act. 1952Harshit Kumar SinghNo ratings yet

- A Renaissance For All of Us: Building An Inclusive Prosperity For New HavenDocument41 pagesA Renaissance For All of Us: Building An Inclusive Prosperity For New HavenHelen BennettNo ratings yet

- HRM N LAW International and Pakistan LawsDocument36 pagesHRM N LAW International and Pakistan LawsMuhammad QasimNo ratings yet

- Employee Handbook TemplateDocument17 pagesEmployee Handbook TemplateKing OtneyNo ratings yet

- Eagle Security v. NLRC DigestDocument2 pagesEagle Security v. NLRC Digestada9ablaoNo ratings yet

- 021-JPL Marketing Promotions v. CA, G.R. No. 151966, July 8, 2005Document5 pages021-JPL Marketing Promotions v. CA, G.R. No. 151966, July 8, 2005Jopan SJNo ratings yet

- Immigration NA HandbookDocument18 pagesImmigration NA Handbookdeepanbaalan5112No ratings yet

- Minimum Wages Act Labour-Law-ProjectDocument6 pagesMinimum Wages Act Labour-Law-ProjectAnonymous H1TW3YY51KNo ratings yet

- Ethical and Economic Case For Sweatshop RegulationDocument6 pagesEthical and Economic Case For Sweatshop RegulationHelen BelmontNo ratings yet

- POEA SEC SeafarersDocument39 pagesPOEA SEC SeafarersAdrian de La CuestaNo ratings yet

- Prospects For Increasing Labor Market Flexibility in KoreaDocument6 pagesProspects For Increasing Labor Market Flexibility in KoreaKorea Economic Institute of America (KEI)No ratings yet

- Solidbank V Gamier (Nov 15, 2010)Document13 pagesSolidbank V Gamier (Nov 15, 2010)MelgenNo ratings yet

- Eco 407Document4 pagesEco 407LUnweiNo ratings yet

- Employee Engagement and Recognition Through Gamification (PDFDrive)Document35 pagesEmployee Engagement and Recognition Through Gamification (PDFDrive)Minal KothariNo ratings yet

- Fundamentals of Acc II CH 3 & 4Document13 pagesFundamentals of Acc II CH 3 & 4Sisay Belong To Jesus100% (2)

![Mathematical Tables: Tables of in G [z] for Complex Argument](https://imgv2-2-f.scribdassets.com/img/word_document/282615796/149x198/febb728e8d/1699542561?v=1)