Professional Documents

Culture Documents

Finance (No. 2) Bill 2014: Amendments in Real Estate (Part II)

Uploaded by

123aricaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance (No. 2) Bill 2014: Amendments in Real Estate (Part II)

Uploaded by

123aricaCopyright:

Available Formats

Finance (No.

2) Bill 2014:

Amendments In Real Estate

(Part Ii)

The Finance (2) Bill 2014 contains may of

amendments to the Income-tax Act, 1961 specially

with reference to the Real Estate Sector. The

Finance inister has proposed h!ndred new cities

and !r"an de#elopment thro!$h the concept of

%!"lic %ri#ate %artnership. &t is e'pected that this

type of anno!ncement "y the Finance inister will

ma(e a "i$ t!rnaro!nd for the Real Estate Sector

and one can e'pect to see "i$ de#elopment of the

Real Estate Sector all aro!nd in whole of &ndia. The

followin$ are the main amendments relatin$ to real

estate sector )*

Mode of tain!" acce#tin! or re#a$ment of certain %oan and &e#osit

Presently the Income-tax Act provides in section 269SS and section 269P that no

person shall pay or accept from another person any loan or deposit otherwise by

account payee cheque or account payee bank draft !imilarly" it is also provided

that no person shall repay any loan or deposit made with it otherwise than by an

account payee cheque or account payee bank draft drawn in the name of the

person who has made the loan or deposit #his restriction is applicable in payment

exceedin$ %s 2&"&&& or more #he bud$et has amended sli$ht provisions relatin$ to

the above effect and provides that apart from cheque or account payee bank draft

drawn in the name of the person who made the loan or deposit the use of electronic

clearin$ system throu$h a bank account shall also be accepted as a valid activity for

acceptin$ or repayin$ loan and deposit 'ence" use of electronic clearin$ system

throu$h a bank will not result into violation of the above mentioned both sections of

the Income-tax Act (96(

Estimation of t'e (al)e of t'e Assets *$ (al)ation +fficer

)rom (st *ctober 2&(+ the existin$ provisions as contained in section 142A are

proposed to be substituted by a new provision and these provisions relate to the

estimation of the value of the assets by the ,aluation *fficer -nder the existin$

under the existin$ provisions contained in section 142A" the Assessin$ *fficer

may" for the purpose of makin$ an assessment or reassessment" require the

,aluation *fficer to make an estimate of the value of any investment" any bullion"

.ewellery or fair market value of any property *n receipt of the report of the

,aluation *fficer" the Assessin$ *fficer may after $ivin$ the assessee an

opportunity of bein$ heard take into account such report for the purposes of

assessment or reassessment !ection (+2A does not envisa$e re.ection of books of

account as a pre-condition for reference to the ,aluation *fficer for estimation of

the value of any investment or property )urther" section 142A does not provide for

any time limit for furnishin$ of the report by the ,aluation *fficer

Accordin$ly" it is proposed to substitute the said section (+2A so as to provide that

the Assessin$ *fficer may" for the purposes of assessment or reassessment" require

the assistance of a ,aluation *fficer to estimate the value" includin$ fair market

value" of any asset" property or investment and submit the report to him #he

Assessin$ *fficer may make a reference whether or not he is satisfied about the

correctness or completeness of the accounts of the assessee

#he ,aluation *fficer" shall" for the purpose of estimatin$ the value of the asset"

property or investment" have all the powers of section /0A of the Wealth-tax Act"

(912 #he ,aluation *fficer is required to estimate the value of the asset" property

or investment after takin$ into account the evidence produced by the assessee and

any other evidence in his possession $athered" after $ivin$ an opportunity of bein$

heard to the assessee If the assessee does not co-operate or comply with the

directions of the ,aluation *fficer he may" estimate the value of the asset" property

or investment to the best of his .ud$ment

It is also proposed to provide that the ,aluation *fficer shall send a copy of his

estimate to the Assessin$ *fficer and the assessee within a period of six months

from the end of the month in which the reference is made #he Assessin$ *fficer on

receipt of the report from the ,aluation *fficer may" after $ivin$ the assessee an

opportunity of bein$ heard" take into account such report in makin$ the assessment

or reassessment It is also proposed to amend sections (1/ and (1/3 of the Act so

as to provide that the time period be$innin$ with the date on which the reference is

made to the ,aluation *fficer and endin$ with the date on which his report is

received by the Assessin$ *fficer shall be excluded from the time limit provided

under the aforesaid section for completion of assessment or reassessment

&isallo,ance of E-#endit)re d)e to non.ded)ction of /&0

#he existin$ provisions of section 40(a)(i) of the Act provide that certain payments

such as interest" royalty and fee for technical services made to a non-resident shall

not be allowed as deduction for computin$ business income if tax on such payments

was not deducted" or after deduction" was not paid within the time prescribed under

section 200(1) of the Act

#he Act contains similar provisions for disallowance of business expenditure in

respect of certain payments made to the residents -nder section 40(a)(ia) of the

Act" in case of payments made to resident" the deductor is allowed to claim

deduction for payments as expenditure in the previous year of payment" if tax is

deducted durin$ the previous year and the same is paid on or before the due date

specified for filin$ of return of income under section 112(1) of the Act 'owever" in

case of disallowance for non-payment of tax from payments made to non-residents"

this extended time limit of payment up to the date of filin$ of return of income

under section (/94(5 is not available

In order to provide similar extended time limit for payment of tax deducted from

payments made to non-residents" it is proposed that the deductor shall be allowed

to claim deduction for payments made to non-residents in the previous year of

payment" if tax is deducted durin$ the previous year and the same is paid on or

before the due date specified for filin$ of return under section (/94(5 of the Act

As mentioned above" in case of non-deduction or non-payment of tax deducted at

source 4#6!5 from certain payments made to residents" the entire amount of

expenditure on which tax was deductible is disallowed under section +&4a54ia5 for

the purposes of computin$ income under the head 7Profits and $ains of business or

profession8 #he disallowance of whole of the amount of expenditure results into

undue hardship In order to reduce the hardship" it is proposed that in case of

non-deduction or non-payment of #6! on payments made to residents as specified

in section 40(a)(ia) of the Act" the disallowance shall be restricted to /&9 of the

amount of expenditure claimed

)urther" existin$ provisions of section +&4a54ia5 of the Act provides that certain

payments such as interest" commission" brokera$e" rent" royalty fee for technical

services and contract payment made to a resident shall not be allowed as deduction

for computin$ business income if tax on such payments was not deducted" or after

deduction" was not paid within the time specified under the said section :hapter

;,II-3 of the Act mandates deduction of tax from certain other payments such as

salary" directors fee" which are currently not specified under section +&4a54ia5 of the

Act #he payments on which tax is deductible under :hapter ;,II-3 but not specified

under section +&4a54ia5 of the Act may also be claimed as expenditure for the

purposes of computation of income under the head 7Profits and $ains from business

or profession8

!ection +&4a54ia5 has proved to be an effective tool for ensurin$ compliance of #6!

provisions by the payers #herefore" in order to improve the #6! compliance in

respect of payments to residents which are currently not specified in section +&4a5

4ia5"

it is proposed that the disallowance under section +&4a54ia5 of the Act shall extend

to all expenditure on which tax is deductible under :hapter ;,II-3 of the Act

3a#ital4 5ain arisin! from transfer of an asset *$ ,a$ of com#)lsor$

ac6)isition

#he existin$ provisions contained in section +1 provide for char$in$ of any profits or

$ains arisin$ from transfer of a capital asset !ub-section 415 of the said section

provides for dealin$ with capital $ains arisin$ from transfer by way of compulsory

acquisition where the compensation is enhanced or further enhanced by the court"

#ribunal or any other authority :lause 4b5 of the said sub-section provides that

where the amount of compensation is enhanced or further enhanced by the court it

shall

be deemed to be the income char$eable of the previous year in which such amount

is received by the assessee

#here is uncertainty about the year in which the amount of compensation received

in pursuance of an interim order of the court is to be char$ed to tax" due to court

orders

Accordin$ly" it is proposed to provide that the amount of compensation received in

pursuance of an interim order of the court" #ribunal or other authority shall be

deemed to be income char$eable under the head <:apital $ains= in the previous

year in which the final order of such court" #ribunal or other authority is made

Ne, 3once#t of 3ost Inflation Inde-

#he existin$ provisions contained in section +0 prescribe the mode of computation

of income char$eable under the head 7:apital $ains8 :lause 4v5 of the >xplanation

to the said section defines the term 73ost Inflation Inde-8 4:II5 which in relation

to a previous year means such index as may be notified by the ?overnment havin$

re$ard to seventy-five percent of avera$e rise in the 3ons)mer Price Inde- (3PI)

for )r*an non.man)al em#lo$ees 4-@A>5 for the immediately precedin$

previous year to such previous year

#he release of :PI for -@A> has been discontinued Accordin$ly" it is proposed to

amend the said clause 4v5 of the >xplanation to section +0 to provide that 7:ost

Inflation Index8 in relation to a previous year means such index as may be notified

by the :entral ?overnment havin$ re$ard to seventy-five percent of avera$e rise in

the :onsumer Price Index 4-rban5 for the immediately precedin$ previous year to

such previous year

Po,er to call for information *$ #rescri*ed Income.ta- A)t'orit$

A new section (+/: has been proposed in the )inance 3ill which mentions that the

prescribed Income.ta- A)t'orit$ may for the purposes of verification of

information in its possession relatin$ to any person" issue a notice to such person

requirin$ him" on or before a date to be specified therein" to furnish information or

documents verified in the manner specified therein" which may be useful for" or

relevant to" any inquiry or proceedin$ under this Act

0o)rceB :ommon)loorcom

)or Catest -pdates on %eal >state -pdates" Property @ews and :ities

Infrastructure 6evelopments ,isitB httpBDDwwwcommonfloorcomD$uide

:opyri$ht E 2&&2-(+ :ommon)loorcom All ri$hts reserved

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- PAS 26 Accounting and Reporting by Retirement Benefit PlansDocument25 pagesPAS 26 Accounting and Reporting by Retirement Benefit Plansrena chavezNo ratings yet

- Birch Paper Company FinalllllDocument11 pagesBirch Paper Company FinalllllMadhuri Sangare100% (1)

- City of Calgary Proposed Service Plans and Budgets For 2019-2022Document668 pagesCity of Calgary Proposed Service Plans and Budgets For 2019-2022CTV CalgaryNo ratings yet

- Financial Management in Hospitality Hotel Industries Like TAJ LeelaDocument56 pagesFinancial Management in Hospitality Hotel Industries Like TAJ Leelajames_j09No ratings yet

- 3b. (NEW) Financing Enterprises 200910 TEXTBOOK 2nd Edn NewDocument355 pages3b. (NEW) Financing Enterprises 200910 TEXTBOOK 2nd Edn NewTrần Linh100% (2)

- The Karnataka Rent Control Act 2001 - An AnalysisDocument4 pagesThe Karnataka Rent Control Act 2001 - An Analysis123aricaNo ratings yet

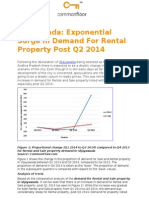

- Vijayawada: Exponential Surge in Demand For Rental Property Post Q2 2014Document3 pagesVijayawada: Exponential Surge in Demand For Rental Property Post Q2 2014123aricaNo ratings yet

- Ajmer Plays It Smart'Document2 pagesAjmer Plays It Smart'123aricaNo ratings yet

- Chennai: Major Real Estate Deals of 2014Document2 pagesChennai: Major Real Estate Deals of 2014123aricaNo ratings yet

- Planning To Purchase An Apartment in Guntur Go For It NowDocument2 pagesPlanning To Purchase An Apartment in Guntur Go For It Now123aricaNo ratings yet

- Things You Need To Know About Home Loan Approval-In-PrincipleDocument2 pagesThings You Need To Know About Home Loan Approval-In-Principle123aricaNo ratings yet

- MMR: 15 Major Realty Deals in 2014Document3 pagesMMR: 15 Major Realty Deals in 2014123aricaNo ratings yet

- Bijli Ghar To Electrify Villages in Remote AreasDocument2 pagesBijli Ghar To Electrify Villages in Remote Areas123aricaNo ratings yet

- Demand Higher For 2 BHK Apartments in Viman Nagar, PuneDocument2 pagesDemand Higher For 2 BHK Apartments in Viman Nagar, Pune123aricaNo ratings yet

- Current Residential Real Estate Trend in NCRDocument3 pagesCurrent Residential Real Estate Trend in NCR123aricaNo ratings yet

- Sri City in Andhra Realty Impact in Surrounding AreasDocument3 pagesSri City in Andhra Realty Impact in Surrounding Areas123aricaNo ratings yet

- Varanasi: The New Hotspot On India's Realty MapDocument2 pagesVaranasi: The New Hotspot On India's Realty Map123aricaNo ratings yet

- Delhi: Consider CR Park For Rental AccommodationDocument2 pagesDelhi: Consider CR Park For Rental Accommodation123aricaNo ratings yet

- Mehrauli: Thriving On Connectivity & Proximity To Delhi Univ.Document2 pagesMehrauli: Thriving On Connectivity & Proximity To Delhi Univ.123aricaNo ratings yet

- All You Need To Know About Guwahati Metro!Document2 pagesAll You Need To Know About Guwahati Metro!123aricaNo ratings yet

- Budget 2014: Tumkur Gets Smart City' TagDocument2 pagesBudget 2014: Tumkur Gets Smart City' Tag123aricaNo ratings yet

- SEBI Has Finalised The Draft Norms of InvITsDocument2 pagesSEBI Has Finalised The Draft Norms of InvITs123aricaNo ratings yet

- Smart Cities - A Futuristic Vision of Urbanisation in IndiaDocument2 pagesSmart Cities - A Futuristic Vision of Urbanisation in India123aricaNo ratings yet

- Single-Window Clearance in Telangana May Boost RealtyDocument2 pagesSingle-Window Clearance in Telangana May Boost Realty123aricaNo ratings yet

- Budget 2014: New FDI Norms To Attract Foreign InvestorsDocument2 pagesBudget 2014: New FDI Norms To Attract Foreign Investors123aricaNo ratings yet

- How Will The Budget Shape Up The SectorDocument2 pagesHow Will The Budget Shape Up The Sector123aricaNo ratings yet

- Budget 2014: PPP Model in InfrastructureDocument3 pagesBudget 2014: PPP Model in Infrastructure123aricaNo ratings yet

- Railway Budget 2014: Railway Minister Announces Diamond QuadrilateralDocument2 pagesRailway Budget 2014: Railway Minister Announces Diamond Quadrilateral123aricaNo ratings yet

- Housing For All by 2022Document2 pagesHousing For All by 2022123aricaNo ratings yet

- MCD Delhi Property Tax Guide: Pay Your Property Tax OnlineDocument3 pagesMCD Delhi Property Tax Guide: Pay Your Property Tax Online123arica100% (1)

- Saving Income Tax During Financial Year 2014-2015 On Property Gains Through Cost Inflation IndexDocument4 pagesSaving Income Tax During Financial Year 2014-2015 On Property Gains Through Cost Inflation Index123aricaNo ratings yet

- Eco-Friendly Homes Gaining Prominence in IndiaDocument2 pagesEco-Friendly Homes Gaining Prominence in India123aricaNo ratings yet

- Reduce Interest Rate On Home Loan: CommonFloor PollDocument3 pagesReduce Interest Rate On Home Loan: CommonFloor Poll123aricaNo ratings yet

- Noida: NGT's Order Delay Construction and Possession of FlatsDocument2 pagesNoida: NGT's Order Delay Construction and Possession of Flats123aricaNo ratings yet

- Richard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Document87 pagesRichard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Maverick MinitriesNo ratings yet

- Accepted Version of RevisionDocument40 pagesAccepted Version of RevisionMunir HussainNo ratings yet

- How To Account For Spare Parts Under IFRS - IFRSbox - Making IFRS EasyDocument20 pagesHow To Account For Spare Parts Under IFRS - IFRSbox - Making IFRS EasyLinkon PeterNo ratings yet

- CH 05Document46 pagesCH 05Waseem Ahmad QurashiNo ratings yet

- Reviewer MathDocument261 pagesReviewer MathMac Jayson DiazNo ratings yet

- QUEST BOOK ICSE 10 MathsDocument36 pagesQUEST BOOK ICSE 10 MathsBidisha DeyNo ratings yet

- Ethiopia, 6.625% 11dec2024, USDDocument1 pageEthiopia, 6.625% 11dec2024, USDLloyd Ki'sNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)sajid bhattiNo ratings yet

- Rural EntrepreneurshipDocument25 pagesRural Entrepreneurshipchirag gavadiya50% (4)

- On Blue Green Book - DredgingDocument19 pagesOn Blue Green Book - DredgingSandeep RaoNo ratings yet

- FEU List of Top 100 Stockholders As of 31 March 2020-MergedDocument8 pagesFEU List of Top 100 Stockholders As of 31 March 2020-MergedJohn M. RoyNo ratings yet

- List of Documents For TrustDocument4 pagesList of Documents For TrustSunil SoniNo ratings yet

- ReviewerDocument8 pagesReviewerjescy pauloNo ratings yet

- Sebi Rta Circular - 20.04.2018Document10 pagesSebi Rta Circular - 20.04.2018Arun Kumar SharmaNo ratings yet

- ReportDocument1 pageReportarun_algoNo ratings yet

- Starbucks Memo Draft 1Document2 pagesStarbucks Memo Draft 1uygh gNo ratings yet

- Mensah EvansDocument85 pagesMensah EvansHadyan WidyadhanaNo ratings yet

- Marketing Plan TemplateDocument3 pagesMarketing Plan TemplateLawrence Qholloi StrydomNo ratings yet

- Principles of AccountingDocument28 pagesPrinciples of Accountingعادل اعظمNo ratings yet

- National Income: Click To Edit Master Subtitle StyleDocument26 pagesNational Income: Click To Edit Master Subtitle StyleashpakkhatikNo ratings yet

- IFM AssignmentDocument27 pagesIFM AssignmentImranNo ratings yet

- Ft232062 - Sec 2 - Rohit Gupta - SHG Business PlanDocument8 pagesFt232062 - Sec 2 - Rohit Gupta - SHG Business PlanKanika SubbaNo ratings yet

- Auditing Theory Questions Chapter 1Document7 pagesAuditing Theory Questions Chapter 1Ganessa RolandNo ratings yet

- Al Arafa Isalmi Bank Internship ReportDocument42 pagesAl Arafa Isalmi Bank Internship ReportarifulseuNo ratings yet

- Kotak Life Insurance Launches e Insurance Nov 10 2010Document2 pagesKotak Life Insurance Launches e Insurance Nov 10 2010Prakash KrishnamoorthyNo ratings yet