Professional Documents

Culture Documents

Persons Cases 11-20

Uploaded by

Angie DouglasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Persons Cases 11-20

Uploaded by

Angie DouglasCopyright:

Available Formats

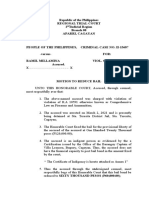

Republic of the Philippines

SUPREME COURT

Manila

EN BANC

G.R. No. L-14683 May 30, 1961

JOAQUIN QUIMSING, petitioner-appellant,

vs.

CAPT. ALFREDO LACHICA, Officer-in-Charge of the PC Controlled-Police Dept., Iloilo City; LT.

NARCISO ALIO, JR., Actg. Chief of Police of the City of Iloilo; and MAJ. CESAR LUCERO, PC

Provincial Commander of the Province of Iloilo, respondents-appellees.

Ramon A. Gonzales for petitioner-appellant.

The City Fiscal of Iloilo City for respondents-appellees.

CONCEPCION, J .:

Appeal from a decision of the Court of First Instance of Iloilo dismissing the petition in this case, as well as the

counterclaim of respondents herein, without costs.

Petitioner Joaquin Quimsing is the owner and manager of a duly licensed cockpit, located in the District of

Molo, City of Iloilo. On February 13, 1958, the cockpit was raided by members of the city police force and the

Constabulary under the command of Capt. Alfredo Lachica and Lt. Narciso Alio Jr., upon the ground that it

was being illegally operated on that day, which was Thursday, not a legal holiday. Quimsing claimed that the

cockpit was authorized to operate on Thursday by an ordinance of the City Council of Iloilo, approved on

October 31, 1956. This notwithstanding, Capt. Lachica allegedly threatened to raid the cockpit should

cockfighting be held therein, thereafter, on Thursdays. Moreover, Quimsing and nine (9) other persons were

arrested and then charged in the Municipal Court of Iloilo with a violation of Article 199 of the Revised Penal

Code, in relation to sections 2285 and 2286 of the Revised Administrative Code.

Quimsing, in turn, commenced the present action, in the Court of First Instance of Iloilo, against Major Cesar

Lucero, as the then provincial commander of the Constabulary, and Capt. Alfredo Lachica and Lt. Narciso

Alio, Jr., as incumbent PC officer in charge and acting chief of police, respectively, of the Iloilo City Police. In

his petition, Quimsing set up two (2) causes of action: one for the recovery from respondents, in their private

capacity, of compensatory damages, as well as moral and exemplary damages allegedly sustained in

consequence of the raid and arrest effected on February 13, 1958, upon the ground that the same were made

illegally and in bad faith, because cockfighting on Thursdays was, it is claimed, authorized by Ordinances Nos.

5 and 58 of the City of Iloilo, in relation to Republic Act No. 938, and because Quimsing was at odds with the

city mayor of Iloilo; and another for a writ of preliminary injunction, and, after trial, a permanent injunction,

restraining respondents, in their official, capacity, and/or their agents, from stopping the operation of said

cockpit on Thursdays and making any arrest in connection therewith.

In their answer, respondents alleged that the raid and arrest aforementioned were made in good faith, without

malice and in the faithful discharge of their official duties as law enforcing agents, and that, pursuant to the

aforementioned provisions of the Revised Penal Code and the Revised Administrative Code, petitioner cannot

legally hold cockfighting on Thursdays, despite said ordinances of the City of Iloilo. Respondents, likewise, set

up a P150,000 counterclaim for moral and exemplary damages.

After due hearing, the Court of First Instance of Iloilo rendered judgment dismissing the petition, as well as

respondents' counterclaim. Hence this appeal by petitioner herein, who maintains that:

1. The lower court erred in not disqualifying the city fiscal from representing the respondents-appellees

in the first cause of action of the petition where they are sued in their personal capacity;

2. The lower court erred in not disqualifying the city fiscal from asking the invalidity of an ordinance of

the City of Iloilo;

3. The lower court erred in declaring Ordinance No. 51 series of 1954, as amended by Ordinance No.

58, series of 1956, of the City of Iloilo as illegal;

4. The lower court erred in not awarding damages to the petitioner.

The first three assignments of error are related to petitioner's second cause of action, whereas the fourth

assignment of error refers to the first cause of action. Hence, we will begin by considering the last assignment

of error.

At the outset, we note that the bad faith imputed to respondents herein has not been duly established. In fact,

there is no evidence that Major Lucero had previous knowledge of the raid and arrest that his co-respondents

intended to make. What is more, petitioner would appear to have included him as respondent merely upon the

theory of command responsibility, as provincial commander of the constabulary in the province and city of

Iloilo. However, there is neither allegation nor proof that he had been in any way guilty of fault or negligence in

connection with said raid and arrest.

As regards Capt. Lachica and Lt. Alio Jr., the records indicate that they were unaware of the city ordinances

relieved upon by petitioner herein. Indeed, they appeared to have been surprised when petitioner invoked said

ordinances. Moreover, there is every reason to believe that they were earnestly of the opinion, as His Honor

the Trial judge was, that cockfighting on Thursdays is, despite the aforementioned ordinances, illegal under

Article 199 of the Revised Penal Code, in relation to sections 2285 and 2286 of the Revised Administrative

Code. Although petitioner maintains that such opinion is erroneous, the facts of record sufficiently warrant the

conclusion that Capt. Lachica and Lt. Alio Jr. had acted in good faith and under the firm conviction that they

were faithfully discharging their duty as law enforcing agents.

In the light of the foregoing and of the other circumstances surrounding the case, and inasmuch as the

assessment of moral and exemplary damages "is left to the discretion of the court, according to the

circumstances of each case" (Art. 2216, Civil Code of the Philippines), it is our considered view that

respondents herein should not be held liable for said damages. Neither should they be sentenced to pay

compensatory damages, the same not having been proven satisfactorily. Hence, the fourth assignment of error

is untenable.

The first assignment of error is based upon section 64 of the Charter of the City of Iloilo (Commonwealth Act

No. 158), pursuant to which the City Fiscal thereof "shall represent the city in all civil cases wherein the city or

any officers thereof in his official capacity is a party." Although this section imposes upon the city fiscal

the duty to appear in the eases specified, it does not prohibit him from representing city officers sued as private

individualson account of acts performed by them in their official capacity, specially when, as in the case at bar,

they claim to have acted in good faith and in accordance with a legal provision, which they earnestly believed,

as the lower court believed, should be construed in the manner set forth in their answer. Again, under

petitioner's second cause of action, respondents are sued in their official capacity. This fact and the

circumstances under which respondents performed the acts involved in the first cause of action sufficiently

justified the appearance of the City Fiscal of Iloilo on their behalf.

We need not pass upon the merits of the second assignment of error, the same not being essential to the

determination of this case, for, regardless of whether or not it is proper for the City Fiscal of Iloilo, as such, to

assail the validity of an ordinance thereof, it cannot be denied that respondents herein may do so in their

defense.

Referring now to the third assignment of error, Article 199 of the Revised Penal Code provides:

The penalty of arresto menor or a fine not exceeding 200 pesos, or both, in the discretion of the court,

shall be imposed upon:

1. Any person who directly or indirectly participates in cockfights, by betting money or other valuable

things, or who organizes cockfights at which bets are made, on a day other than those permitted by

law.

2. Any person who directly or indirectly participates in cockfights, by betting money or other valuable

things, or organizes such cockfights at a place other than a licensed cockpit.

Respondents maintain that this legal provision should construed be in relation to sections 2285 and 2286 of the

Revised Administrative Code, reading:

SEC. 2285. Restriction upon cockfighting. Cockfighting shall take place only in licensed cockpits

and, except as provided n the next succeeding section hereof, only upon legal holidays and for a period

of not exceeding three days during the celebration of the local fiesta. No card game or games of

chance of any kind shall be permitted on the premises of the cockpit.

SEC. 2286. Cockfighting at fairs and carnivals. In provinces where the provincial board resolves that

a fair or exposition of agricultural and industrial products of the province, carnival, or any other act

which may redound to the promotion of the general interests thereof, shall be held on a suitable date or

dates, the council of the municipality in which such fair, exposition or carnival is held may, by resolution

of a majority of the council, authorize the cockfighting permitted at a local fiesta to take place for not to

exceed three days during said exposition fair, or carnival, if these fall on a date other than that of the

local fiesta. Where this action is taken, cockfighting shall not be permitted during the local fiesta unless

a legal holiday occurs at such period in which case cockfighting may be permitted upon the holiday.

Petitioner assails, however, the applicability of these two (2) provisions to the case at bar, upon the ground that

said provisions form part of Chapter 57 of the Revised Administrative Code which chapter is entitled

"Municipal Law" governing regular municipalities, not chartered cities, like the City of Iloilo, for, "except as

otherwise specially provided", the term "municipality", as used in that Code and in said section 2286, "does not

include chartered city, municipal district or other political division" (Section 2, Revised Administrative Code).

Petitioner's contention is well-taken but it does not follow therefrom that he was entitled to hold cockfightings

on Thursdays.

Pursuant to section 21 of Commonwealth Act No. 158, otherwise known as the Charter of the City of Iloilo:

Except as otherwise provided by law, the Municipal Board shall have the following legislative powers . .

. to tax, fix the license fee for, and regulate, among others, theatrical performances . . . and places of

amusements (par. j) . . . .

Moreover, under section 1 of Republic Act No. 938, as amended by Republic Act No. 1224:

The municipal or city board or council of each chartered city and the municipal council of each

municipality and municipal district shall have the power to regulate or prohibit by ordinance the

establishment, maintenance and operation of nightclubs, cabarets, dancing schools, pavilions, cockpits,

bars, saloons, bowling alleys, billiard pools, and other similar places of amusements within its territorial

jurisdiction:Provided, however, That no such places of amusement mentioned herein shall be

established, maintained and/or operated within a radius of two hundred lineal meters in the case of

night clubs, cabarets, pavilions, or other similar places, and fifty lineal meters in the case of dancing

schools, bars, saloons, billiard pools, bowling alleys, or other similar places, except cockpits, the

distance of which shall be left to the discretion of the municipal or city board or council, from any public

building, schools, hospitals and churches: Provided, further, That no municipal or city ordinance fixing

distances at which such places of amusement may be established or operated shall apply to those

already licensed and operating at the time of the enactment of such municipal or city ordinance, nor will

the subsequent opening of any public building or other premises from which distances shall be

measured prejudice any place of amusement already then licensed and operating, but any such place

of amusement established within fifty lineal meters from any school, hospital or church shall be so

constructed that the noise coming therefrom shall not disturb those in the school, hospital or church,

and, if such noise causes such disturbance then such place of amusement shall not operate during

school hours when near a school, or at night when near a hospital, or when there are religious services

when near a church: Provided, furthermore, That no minor shall be admitted in any bar, saloon,

cabaret, or night club employing hostesses: And provided, finally, That this Act shall not apply to

establishments operating by virtue of Commonwealth Act Numbered Four hundred eighty-five nor to

any establishment already in operation when Republic Act Numbered Nine hundred seventy-nine took

effect.

The question for determination is whether the power of the Municipal Board of Iloilo, under section 21 of its

charter to "regulate . . . places of amusement", as broadened by Republic Act No. 938, as amended, to include

"the power to regulate . . . by ordinance the establishment, maintenance, and operation of . . . cockpits," carries

with it the authority to fix the dates on which "cockfighting" may be held. In this connection, it should be noted

that said Republic Act No. 938, as amended, applies, not only to "the municipal or city board or council of each

chartered city", but, also, to "the municipal council of each municipality or municipal district." Consequently, an

affirmative answer to the question adverted to above would necessarily imply, not merely an amendment of

sections 2285 and 2286 of the Revised Administrative Code, but, even, a virtual repeal thereof, for then local

boards or councils could authorize the holding of cockfighting, not only on legal holidays, but on any day and

as often as said boards or councils may deem fit to permit, whether it be during a fair, carnival, or exposition of

agricultural and industrial products of the province, or not. Thus, the issue boils down to whether Republic Act

No. 938, as amended, gives local governments a blanket authority to permit cockfighting at any time and for as

long as said governments may wish it.

Upon mature deliberation, we hold that the answer must be in the negative. To begin with, repeals and even

amendments by implication are not favored, whereas an affirmative answer would entail a vital amendment,

amounting, for all practical purposes, to a repeal, of sections 2285 and 2286 of the Revised Administrative

Code. Secondly, grants of power to local governments are to be construed strictly, and doubts in the

interpretation thereof should be resolved in favor of the national government and against the political

subdivisions concerned. Thirdly, it is a matter of common knowledge that cockfighting is one of the most

widespread vices of our population, and that the government has always shown a grave concern over the need

of effectively curbing its evil effects. The theory of petitioner herein presupposes that the Republic of the

Philippines has completely reversed its position and chosen, instead, to place the matter entirely at the

discretion of local governments. We should not, and can not adopt, such premise except upon a clear and

unequivocal expression of the will of Congress, which, insofar as said premise is concerned, is not manifest

from the language used in Republic Act No. 938, as amended.

Lastly, "cockpits" and "cockfighting" are regulated separately by our laws. Thus, section 2243 (i) of the Revised

Administrative Code empowers municipal councils "to regulate cockpits". Yet, the authority of said council over

"cockfighting" is found in sections 2285 and 2286 of said Code, not in said section 2243 (i). Similarly, Article

199 of the Revised Penal Code punishes, not illegal "cockpits", but "illegal cockfighting". What is more,

participation in cockfights "on a day other than those permitted by law", in dealt with in said article separately

from participation in cockfights "at a place other than a licensed cockpit." .

So, too, the authority of local governments, under Republic Act No. 938, as amended, to "regulate . . . the

establishment, maintenance and operation of . . . cockpits", does not necessarily connote the power to regulate

"cockfighting", except insofar as the same must take place in a duly licensed "cockpit". Again, the first and

second proviso in section 1 of said Act, regulating the distance of cockpits and places of amusement therein

mentioned from "any public building, schools, hospitals and churches" and the third proviso of the same

section, prohibiting the admission of minors to some of those places of amusement, suggest that the authority

conferred in said provision may include the power to determine the location of cockpits, the type or nature of

construction used therefor, the conditions to persons therein, the number of cockpits that may be established in

each municipality and/or by each operator, the minimum age of the individuals who may be admitted therein,

and other matters of similar nature as distinguished from the days on which cockfighting shall be held and

the frequency thereof.

In short, we are of the opinion that the city ordinances relied upon by petitioner herein, authorizing cockfighting

on Thursdays, are invalid.

WHEREFORE, the decision appealed from is hereby affirmed, without special pronouncement as to costs. It is

so ordered.

Republic of the Philippines

SUPREME COURT

Manila

EN BANC

G.R. No. L-24022 March 3, 1965

ILOILO PALAY AND CORN PLANTERS ASSOCIATION, INC., ET AL., petitioners,

vs.

HON. JOSE, Y. FELICIANO, ET AL., respondents.

Jose C. Zulueta and Ramon A. Gonzales for petitioners.

Office of the Solicitor General for respondents.

BAUTISTA ANGELO, J .:

On December 26, 1964, Jose Y. Feliciano, Chairman and General Manager of the Rice and Corn

Administration, wrote the President of the Philippines urging the immediate importation of 595,400 metric tons

of rice, thru a government agency which the President may designate, pursuant to the recommendation of the

National Economic Council as embodied in its Resolution No. 70, series of 1964.

On December 27, 1964, the President submitted said letter to his cabinet for consideration and on December

28, 1964, the cabinet approved the needed importation. On January 4, 1965, the President designated the

Rice and Corn Administration as the government agency authorized to undertake the importation pursuant to

which Chairman Jose Y. Feliciano announced an invitation to bid for said importation and set the bidding for

February 1, 1965.

Considering that said importation is contrary to Republic Act 3452 which prohibits the government from

importing rice and that there is no law appropriating funds to finance the same, the Iloilo Palay and Corn

Planters Association, Inc., together with Ramon A. Gonzales, in his capacity as taxpayer, filed the instant

petition before this Court seeking to restrain Jose Y. Feliciano, in his capacity as Chairman and General

Manager of the Rice and Corn Administration, from conducting the bid scheduled on the date abovementioned,

and from doing any other act that may result in the contemplated importation until further orders of this Court.

For reasons that do not clearly appear, the Secretary of Foreign Affairs and the Auditor General were made co-

respondents.

Pending decision on the merits, petitioners prayed for the issuance of a writ of preliminary injunction, which, in

due course, this Court granted upon petitioners' filing a bond in the amount of P50,000.00. This bond having

been filed, the writ was issued on February 10, 1965.

Respondents, in their answer do not dispute the essential allegations of the petition though they adduced

reasons which justify the importation sought to be made. They anchor the validity of the importation on the

provisions of Republic Act 2207 which, in their opinion, still stand.

It is petitioners' contention that the importation in question being undertaken by the government even if there is

a certification by the National Economic Council that there is a shortage in the local supply of rice of such

gravity as to constitute a national emergency, is illegal because the same is prohibited by Republic Act 3452

which, in its Section 10, provides that the importation of rice and corn is only left to private parties upon

payment of the corresponding taxes. They claim that the Rice and Corn Administration, or any other

government agency, is prohibited from doing so.

It is true that the section above adverted to leaves the importation of rice and corn exclusively to private parties

thereby prohibiting from doing so the Rice and Corn Administration or any other government agency, but from

this it does not follow that at present there is no law which permits the government to undertake the importation

of rice into the Philippines. And this we say because, in our opinion, the provision of Republic Act 2207 on the

matter still stands. We refer to Section 2 of said Act wherein, among other things, it provides that should there

be an existing or imminent shortage in the local supply of rice of such gravity as to constitute a national

emergency, and this is certified by the National Economic Council, the President of the Philippines may

authorize such importation thru any government agency that he may designate. Here there is no dispute that

the National Economic Council has certified that there is such shortage present which, because of its gravity,

constitutes a national emergency, and acting in pursuance thereof the President lost no time in authorizing,

after consulting his cabinet, the General Manager of the Rice and Corn Administration to immediately

undertake the needed importation in order to stave off the impending emergency. We find, therefore, no

plausible reason why the disputed importation should be prevented as petitioners now desire.

The contention that Republic Act 2207 has already been repealed by Republic Act 3452 is untenable in the

light of the divergent provisions obtaining in said two laws. Admittedly, Section 16 of Republic Act 3452

contains a repealing clause which provides: "All laws or parts thereof inconsistent with the provisions of this

Act are hereby repealed or modified accordingly." The question may now be asked: what is the nature of this

repealing clause ? It is certainly not an express repealing clause because it fails to identify or designate the Act

or Acts that are intended to be repealed [ Sutherland, Statutory Construction, (1943) Vol. 1, p. 467]. Rather, it

is a clause which predicates the intended repeal upon the condition that a substantial conflict must be found in

existing and prior Acts. Such being the case, the presumption against implied repeals and the rule against

strict construction regarding implied repeals apply ex proprio vigore. Indeed, the legislature is presumed to

know the existing laws so that, if a repeal is intended, the proper step is to so express it [Continental Insurance

Co. v. Simpson, 8 F (2d) 439; Weber v. Bailey, 151 Ore. 2188, 51 P (2d) 832; State v. Jackson, 120 W. Va.

521, 199 S.E. 876]. The failure to add a specific repealing clause indicates that the intent was not to repeal any

existing law (Crawford, Construction of Statute, 1940 ed., p. 631), unless an irreconcilable inconsistency and

repugnancy exist in the terms of the new and old laws. Here there is no such inconsistency.

To begin with, the two laws, although with a common objective, refer to different methods applicable to

different circumstances. Thus, the total banning of importation under normal conditions as provided for in

Republic Act 2207 is one step to achieve the rice and corn sufficiency program of the Administration. The

philosophy behind the banning is that any importation of rice during a period of sufficiency or even of a minor

shortage will unduly compete with the local producers and depress the local price which may discourage them

from raising said crop. On the other hand, a price support program and a partial ban of rice importation as

embodied in Republic Act 3452 is another step adopted to attend the sufficiency program. While the two laws

are geared towards the same ultimate objective, their methods of approach are different; one is by a total ban

of rice importation and the other by a partial ban, the same being applicable only to the government during

normal period.

There is another area where the two laws find a common point of reconciliation: the normalcy of the time

underlying both laws. Thus, with respect to the matter of importation Republic Act 2207 covers three different

situations: (1) when the local produce of rice is sufficient to supply local consumption; (2) when the local

produce falls short of the supply but the shortage is not enough to constitute a national emergency; and (3)

when the shortage, on the local supply of rice is of such gravity as to constitute a national emergency. Under

the first two situations, no importation is allowed whether by the government or by the private sector. However,

in the case of the third situation, the law authorizes importation, by the government.

Republic Act 3452, on the other hand, deals only with situations 1 and 2, but not with. Nowhere in said law can

we discern that it covers importation where the shortage in the local supply is of such gravity as to constitute a

national emergency. In short, Republic Act 3452 only authorizes importation during normal times, but when

there is a shortage in the local supply of such gravity as to constitute a national emergency, we have to turn to

Republic Act 2207. These two laws therefore, are not inconsistent and so implied repeal does not ensue.

Our view that Republic Act 3452 merely contemplates importation during normal times is bolstered by a

consideration of the discussion that took place in Congress of House Bill No. 11511 which was presented in

answer to the request of the Chief Executive that he be given a standby power to import rice in the Philippines.

On this matter, we quote the following views of Senators Padilla and Almendras:

SENATOR PADILLA: But under Republic Act No. 3452 them is a proviso in Sec. 10 thereof "that the

Rice and Corn Administration or any government agency is hereby prohibited from importing rice and

corn."

SENATOR ALMENDRAS: That is under normal conditions.

SENATOR PADILLA: "Provided further", it says, "that the importation of rice, and corn is left to private

parties upon payment of the corresponding tax." So therefore, the position of the Committee as

expressed by the distinguished sponsor, is that Sec. 10 of Republic Act No. 3452 is applicable under

normal conditions.

SENATOR ALMENDRAS: "Yes". (Senate Debate, June 16, 1964).

Much stress is laid on the content of Section 12 of Republic Act 3452 which gives to the President authority to

declare a rice and corn emergency any time he deems necessary in the public interest and, during the

emergency, to conduct raids, seizure and confiscation of rice and corn hoarded in any private warehouse or

bodega subject to constitutional limitations, to support the claim that said Act also bans importation on the part

of the government even in case of an emergency. The contention is predicated on a misinterpretation of the

import and meaning of said provision. Note that the section refers to an emergency where there is an artificial

shortage because of the apparent hoarding undertaken by certain unscrupulous dealers or businessmen, and

not to an actual serious shortage of the commodity because, if the latter exists, there is really nothing to raid,

seize or confiscate, because the situation creates a real national emergency. Congress by no means could

have intended under such a situation to deprive the government of its right to import to stave off hunger and

starvation. Congress knows that such remedy is worthless as there is no rice to be found in the Philippines.

Seizure of rice is only of value in fighting hoarding and profiteering, but such remedy cannot produce the rice

needed to solve the emergency. If there is really insufficient rice stocked in the private warehouses and

bodegas such confiscatory step cannot remedy an actual emergency, in which case we have to turn to

Republic Act 2207.

The two laws can therefore be construed as harmonious parts of the legislative expression of its policy to

promote a rice and corn program. And if this can be done, as we have shown, it is the duty of this Court to

adopt such interpretation that would give effect to both laws. Conversely, in order to effect a repeal by

implication, the litter statute must be irreconcilably inconsistent and repugnant to the prior existing law [United

States v. Greathouse,. 166 U.S. 601, 41 L. Ed., 1130; In re Phoenix Hotel Co., 13 F. Supp. 229; Hammond v.

McDonald, 32 Cal. App. 187, 89 P (2d) 407; Sutherland, Statutory Construction, supra, p. 462]. The old and

the new laws must be absolutely incompatible (Compaia General de Tabacos v. Collector of Customs, 46

Phil. 8). A mere difference in the terms and provisions of the statutes is not sufficient to create a repugnancy

between them. There must be such a positive repugnancy between the provisions of the old and the new

statutes that they cannot be made to reconcile and stand together (Crawford, Construction of Statute, supra, p.

631). The clearest case possible must first be made before the inference of implied repeal may be drawn

[Nagano v. McGrath, 187 F (2d) 759]. Inconsistency is never presumed.

Republic Act 3848 entitled "An Act Providing for the Importation of Rice During the Calendar Year Nineteen

Hundred Sixty-Four in the Event of Shortage in Local Supply" cannot be given any nullifying value, as it is

pretended, simply because Section 6 thereof provides that "except as provided in this Act, no other agency or

instrumentality of the Government shall be allowed to purchase rice from abroad." The reason is that it is a

mere temporary law effective only for a specific year. As its title reads, it is merely an authority to import

rice during the year 1964. The same, therefore, is now functus officio at least on the matter of importation.

Neither can petitioners successfully pretend that as Section 4 thereof provides that pending prosecutions for

any violation of Republic Acts 2207 and 3452 shall in no way be affected by said Act 3848 the implication is

that the aforesaid Acts have already been repealed. That provision is merely a safeguard placed therein in

order that the prosecutions already undertaken may not be defeated with the enactment of Republic Act 3848

because the latter provides for penal provisions which call for lesser penalty. The intention is to except them

from the rule that penal statutes can be given retroactive effect if favorable to the accused.

To further bolster our view that Republic Act 2207 has not been impliedly repealed by Republic Act 3452, we

wish to briefly quote hereunder the views expressed by some senators during the discussion of House Bill

11511 already mentioned above. It should be here repeated that said bill was presented to accede to the

request of the President for a stand-by power to import in case of emergency in view of the uncertainty of the

law, but that during the discussion thereof it was strongly asserted and apparently upheld that such request for

authority was not necessary because Republic Act 2207 was still in force. It is probably for this reason that said

bill, after having been approved by the Senate, was killed in the conference committee that considered it.

These views, while not binding, are of persuasive authority and throw light on the issue relative to the effectivity

of Republic Act 2207.

SENATOR LIWAG: ... Now Mr. Chairman, is it the sense of the Committee that in the case of

emergency, in case of an impending shortage, we can import rice under the provisions of R.A. No.

2207?

SENATOR ALMENDRAS: Yes, that is what we mean, your Honor, in this paragraph (c), Section 2,

page 2, that when we say "under the provisions of existing law," we are referring to R.A. No. 2207.

x x x x x x x x x

SENATOR PADILLA: I notice, Mr. Senator, that Section 2 paragraph (c) of the amendment by

substitution reads:

Importation of rice and/or corn should be resorted to only in cases of extreme and under the provisions

of existing law.

I suppose that the existing laws referred to are Republic Act No. 2207 and Republic Act No. 3452. Does

this section in the proposed bill by substitution recognize the continued existence of the pertinent

provisions of Republic Act No. 2207 and Republic Act No. 3452 on rice importation ?

SENATOR ALMENDRAS: Yes, that is the reason, Your Honor, why we struck out the stand-by power

on the part of the President to import rice.

x x x x x x x x x

SENATOR ALMENDRAS: The position of your Committee, Your Honor, because of the existing law

that is, Republic Act No. 3452 and Republic Act No. 2207 that is the reason your Committee

eliminated that stand-by power of the President to import rice. Because you know, Your Honor, what is

the use of that stand-by power, inasmuch as under Republic Act No. 3452 and Republic Act No. 2207

the President can designate any government agency to import rice?

SENATOR PADILLA: Well, it is good to make that clear because in the decision of the Supreme Court,

as I said, there was no clear-cut holding as to the possible co-existence or implied repeal between

these two Acts.

SENATOR ALMENDRAS: Yes, Your Honor, but the gentleman from Nueva Ecija, Senator Liwag,

informed me that Republic Act No. 2207 has never been repealed.

SENATOR PADILLA: Well, I also concur with that view, but we want to make that clear ... .

SENATOR PADILLA: "Provided, further," it says, "That the importation of rice and corn is left to private

parties upon payment of the corresponding taxes." So, therefore, the position of the Committee, as

expressed by the distinguished sponsor is that Sec. 10 of Republic Act No. 3452 is applicable under

normal conditions.

SENATOR ALMENDRAS: Yes.

SENATOR PADILLA: So, both provisions of law are in existence.

SENATOR ALMENDRAS: Yes.

SENATOR PADILLA: One is not repealed by the other.

x x x x x x x x x

SENATOR TOLENTINO: Mr. President, there are two views already expressed on whether Republic

Act No. 2207 has been repealed by Republic Act No. 3452. One view sustains the theory that there has

been a repeal of Republic Act No. 2207 by Republic Act No. 3452 insofar as rice importation is

concerned. The other view is that there is no repeal. The Supreme Court does not state clearly which

side prevails. I take the view that the two laws can be reconciled ... .

Now, Mr. President, reading those two provisions together, I maintain that they are not totally repugnant

to each other, that it is possible for them to stand together except on certain points: First, is importation

in case of a national emergency certified by the National Economic Council permissible? By reading the

two provisos together I would say yes because there is nothing in the proviso contained in Republic Act

No. 3452 which would be inconsistent with importation during a shortage amounting to a national

emergency.

Another circumstance that strengthens our view is that when said House Bill No. 11511 was finally approved

by the Senate, it carried a clause which expressly repeals, among others, Republic Act No. 2207 (Section 14),

but which bill, as already said, was later killed in the conference committee. This attitude clearly reveals that

Congress preferred to fall back on Republic Act 2207 with regard to future importations.

Anent the point raised relative to the lack of necessary appropriation to finance the importation in question,

suffice it to state that under Republic Act 663 the National Rice and Corn Corporation is authorized to borrow,

raise and secure the money that may be necessary to carry out its objectives. We refer to Section 3 (e) of said

Act which empowers said corporation to secure money and to encumber any property it has as a guaranty, and

Republic Act No. 3452, which creates the Rice and Corn Administration, transferred its functions and powers to

the latter, including the power to borrow money under Section 3(e). This provision gives the RCA enough

power with which to finance the importation in question.

WHEREFORE, petition is dismissed. The writ of preliminary injunction issued by this Court is hereby dissolved.

Costs against petitioners.

Paredes, Regala, Makalintal, Bengzon, J.P., and Zaldivar, JJ., concur.

Republic of the Philippines

SUPREME COURT

Manila

EN BANC

G.R. No. L-28089 October 25, 1967

BARA LIDASAN, petitioner,

vs.

COMMISSION ON ELECTIONS, respondent.

Suntay for petitioner.

Barrios and Fule for respondent.

SANCHEZ, J .:

The question initially presented to the Commission on Elections,

1

is this: Is Republic Act 4790, which is entitled

"An Act Creating the Municipality of Dianaton in the Province of Lanao del Sur", but which includes barrios

located in another province Cotabato to be spared from attack planted upon the constitutional mandate

that "No bill which may be enacted into law shall embrace more than one subject which shall be expressed in

the title of the bill"? Comelec's answer is in the affirmative. Offshoot is the present original petition

for certiorari and prohibition.

On June 18, 1966, the Chief Executive signed into law House Bill 1247, known as Republic Act 4790, now in

dispute. The body of the statute, reproduced in haec verba, reads:

Sec. 1. Barrios Togaig, Madalum, Bayanga, Langkong, Sarakan, Kat-bo, Digakapan, Magabo,

Tabangao, Tiongko, Colodan, Kabamakawan, Kapatagan, Bongabong, Aipang, Dagowan, Bakikis,

Bungabung, Losain, Matimos and Magolatung, in the Municipalities of Butig and Balabagan, Province

of Lanao del Sur, are separated from said municipalities and constituted into a distinct and independent

municipality of the same province to be known as the Municipality of Dianaton, Province of Lanao del

Sur. The seat of government of the municipality shall be in Togaig.

Sec. 2. The first mayor, vice-mayor and councilors of the new municipality shall be elected in the

nineteen hundred sixty-seven general elections for local officials.

Sec. 3. This Act shall take effect upon its approval.

It came to light later that barrios Togaig and Madalum just mentioned are within the municipality

of Buldon,Province of Cotabato, and that Bayanga, Langkong, Sarakan, Kat-bo, Digakapan, Magabo,

Tabangao, Tiongko, Colodan and Kabamakawan are parts and parcel of another municipality, the municipality

of Parang, also in theProvince of Cotabato and not of Lanao del Sur.

Prompted by the coming elections, Comelec adopted its resolution of August 15, 1967, the pertinent portions of

which are:

For purposes of establishment of precincts, registration of voters and for other election purposes, the

Commission RESOLVED that pursuant to RA 4790, the new municipality of Dianaton, Lanao del Sur

shall comprise the barrios of Kapatagan, Bongabong, Aipang, Dagowan, Bakikis, Bungabung, Losain,

Matimos, and Magolatung situated in the municipality of Balabagan, Lanao del Sur, the barrios of

Togaig and Madalum situated in the municipality of Buldon, Cotabato, the barrios of Bayanga,

Langkong, Sarakan, Kat-bo, Digakapan, Magabo, Tabangao, Tiongko, Colodan and Kabamakawan

situated in the municipality of Parang, also of Cotabato.

Doubtless, as the statute stands, twelve barrios in two municipalities in the province of Cotabato are

transferred to the province of Lanao del Sur. This brought about a change in the boundaries of the two

provinces.

Apprised of this development, on September 7, 1967, the Office of the President, through the Assistant

Executive Secretary, recommended to Comelec that the operation of the statute be suspended until "clarified

by correcting legislation."

Comelec, by resolution of September 20, 1967, stood by its own interpretation, declared that the statute

"should be implemented unless declared unconstitutional by the Supreme Court."

This triggered the present original action for certiorari and prohibition by Bara Lidasan, a resident and taxpayer

of the detached portion of Parang, Cotabato, and a qualified voter for the 1967 elections. He prays that

Republic Act 4790 be declared unconstitutional; and that Comelec's resolutions of August 15, 1967 and

September 20, 1967 implementing the same for electoral purposes, be nullified.

1. Petitioner relies upon the constitutional requirement aforestated, that "[n]o bill which may be enacted into

law shall embrace more than one subject which shall be expressed in the title of the bill."

2

It may be well to state, right at the outset, that the constitutional provision contains dual limitations upon

legislative power. First. Congress is to refrain from conglomeration, under one statute, of heterogeneous

subjects. Second. The title of the bill is to be couched in a language sufficient to notify the legislators and the

public and those concerned of the import of the single subject thereof.

Of relevance here is the second directive. The subject of the statute must be "expressed in the title" of the bill.

This constitutional requirement "breathes the spirit of command."

3

Compliance is imperative, given the fact that

the Constitution does not exact of Congress the obligation to read during its deliberations the entire text of the

bill. In fact, in the case of House Bill 1247, which became Republic Act 4790, only its title was read from its

introduction to its final approval in the House of Representatives

4

where the bill, being of local application,

originated.

5

Of course, the Constitution does not require Congress to employ in the title of an enactment, language of such

precision as to mirror, fully index or catalogue all the contents and the minute details therein. It suffices if the

title should serve the purpose of the constitutional demand that it inform the legislators, the persons interested

in the subject of the bill, and the public, of the nature, scope and consequences of the proposed law and its

operation. And this, to lead them to inquire into the body of the bill, study and discuss the same, take

appropriate action thereon, and, thus, prevent surprise or fraud upon the legislators.

6

In our task of ascertaining whether or not the title of a statute conforms with the constitutional requirement, the

following, we believe, may be taken as guidelines:

The test of the sufficiency of a title is whether or not it is misleading; and, which technical accuracy is

not essential, and the subject need not be stated in express terms where it is clearly inferable from the

details set forth, a title which is so uncertain that the average person reading it would not be informed of

the purpose of the enactment or put on inquiry as to its contents, or which is misleading, either in

referring to or indicating one subject where another or different one is really embraced in the act, or in

omitting any expression or indication of the real subject or scope of the act, is bad.

xxx xxx xxx

In determining sufficiency of particular title its substance rather than its form should be considered, and

the purpose of the constitutional requirement, of giving notice to all persons interested, should be kept

in mind by the court.

7

With the foregoing principles at hand, we take a hard look at the disputed statute. The title "An Act Creating

the Municipality of Dianaton, in the Province of Lanao del Sur"

8

projects the impression that solely the

province of Lanao del Sur is affected by the creation of Dianaton. Not the slightest intimation is there that

communities in the adjacent province of Cotabato are incorporated in this new Lanao del Sur town. The phrase

"in the Province of Lanao del Sur," read without subtlety or contortion, makes the title misleading, deceptive.

For, the known fact is that the legislation has a two-pronged purpose combined in one statute: (1) it creates the

municipality of Dianaton purportedly from twenty-one barrios in the towns of Butig and Balabagan, both in the

province of Lanao del Sur; and (2) it also dismembers two municipalities in Cotabato, a province different from

Lanao del Sur.

The baneful effect of the defective title here presented is not so difficult to perceive. Such title did not inform

the members of Congress as to the full impact of the law; it did not apprise the people in the towns of Buldon

and Parang in Cotabato and in the province of Cotabato itself that part of their territory is being taken away

from their towns and province and added to the adjacent Province of Lanao del Sur; it kept the public in the

dark as to what towns and provinces were actually affected by the bill. These are the pressures which heavily

weigh against the constitutionality of Republic Act 4790.

Respondent's stance is that the change in boundaries of the two provinces resulting in "the substantial

diminution of territorial limits" of Cotabato province is "merely the incidental legal results of the definition of the

boundary" of the municipality of Dianaton and that, therefore, reference to the fact that portions in Cotabato are

taken away "need not be expressed in the title of the law." This posture we must say but emphasizes the

error of constitutional dimensions in writing down the title of the bill. Transfer of a sizeable portion of territory

from one province to another of necessity involves reduction of area, population and income of the first and the

corresponding increase of those of the other. This is as important as the creation of a municipality. And yet, the

title did not reflect this fact.

Respondent asks us to read Felwa vs. Salas, L-16511, October 29, 1966, as controlling here. The Felwa case

is not in focus. For there, the title of the Act (Republic Act 4695) reads: "An Act Creating the Provinces of

Benguet, Mountain Province, Ifugao, and Kalinga-Apayao." That title was assailed as unconstitutional upon the

averment that the provisions of the law (Section, 8 thereof) in reference to the elective officials of the provinces

thus created, were not set forth in the title of the bill. We there ruled that this pretense is devoid of merit "for,

surely, an Act creating said provinces must be expected to provide for the officers who shall run the affairs

thereof" which is "manifestly germane to the subject" of the legislation, as set forth in its title. The statute

now before us stands altogether on a different footing. The lumping together of barrios in adjacent but separate

provinces under one statute is neither a natural nor logical consequence of the creation of the new municipality

of Dianaton. A change of boundaries of the two provinces may be made without necessarily creating a new

municipality and vice versa.

As we canvass the authorities on this point, our attention is drawn to Hume vs. Village of Fruitport, 219 NW

648, 649. There, the statute in controversy bears the title "An Act to Incorporate the Village of Fruitport, in the

County of Muskegon." The statute, however, in its section 1 reads: "The people of the state of Michigan enact,

that the following described territory in the counties of Muskegon and Ottawa Michigan, to wit: . . . be, and the

same is hereby constituted a village corporate, by the name of the Village of Fruitport." This statute was

challenged as void by plaintiff, a resident of Ottawa county, in an action to restraint the Village from exercising

jurisdiction and control, including taxing his lands. Plaintiff based his claim on Section 20, Article IV of the

Michigan State Constitution, which reads: "No law shall embrace more than one object, which shall be

expressed in its title." The Circuit Court decree voided the statute and defendant appealed. The Supreme

Court of Michigan voted to uphold the decree of nullity. The following, said in Hume, may well apply to this

case:

It may be that words, "An act to incorporate the village of Fruitport," would have been a sufficient title,

and that the words, "in the county of Muskegon" were unnecessary; but we do not agree with appellant

that the words last quoted may, for that reason, be disregarded as surplusage.

. . . Under the guise of discarding surplusage, a court cannot reject a part of the title of an act for the

purpose of saving the act. Schmalz vs. Woody, 56 N.J. Eq. 649, 39 A. 539.

A purpose of the provision of the Constitution is to "challenge the attention of those affected by the act

to its provisions." Savings Bank vs. State of Michigan, 228 Mich. 316, 200 NW 262.

The title here is restrictive. It restricts the operation of the act of Muskegon county. The act goes

beyond the restriction. As was said in Schmalz vs. Wooly, supra: "The title is erroneous in the worst

degree, for it is misleading."

9

Similar statutes aimed at changing boundaries of political subdivisions, which legislative purpose is not

expressed in the title, were likewise declared unconstitutional."

10

We rule that Republic Act 4790 is null and void.

2. Suggestion was made that Republic Act 4790 may still be salvaged with reference to the nine barrios in the

municipalities of Butig and Balabagan in Lanao del Sur, with the mere nullification of the portion thereof which

took away the twelve barrios in the municipalities of Buldon and Parang in the other province of Cotabato. The

reasoning advocated is that the limited title of the Act still covers those barrios actually in the province of Lanao

del Sur.

We are not unmindful of the rule, buttressed on reason and of long standing, that where a portion of a statute is

rendered unconstitutional and the remainder valid, the parts will be separated, and the constitutional portion

upheld. Black, however, gives the exception to this rule, thus:

. . . But when the parts of the statute are so mutually dependent and connected, as conditions,

considerations, inducements, or compensations for each other, as to warrant a belief that the

legislature intended them as a whole, and that if all could not be carried into effect, the legislature would

not pass the residue independently, then, if some parts are unconstitutional, all the provisions which are

thus dependent, conditional, or connected, must fall with them,

11

In substantially similar language, the same exception is recognized in the jurisprudence of this Court, thus:

The general rule is that where part of a statute is void, as repugnant to the Organic Law, while another

part is valid, the valid portion if separable from the invalid, may stand and be enforced. But in order to

do this, the valid portion must be so far independent of the invalid portion that it is fair to presume that

the Legislature would have enacted it by itself if they had supposed that they could not constitutionally

enact the other. . . Enough must remain to make a complete, intelligible, and valid statute, which carries

out the legislative intent. . . . The language used in the invalid part of the statute can have no legal force

or efficacy for any purpose whatever, and what remains must express the legislative will independently

of the void part, since the court has no power to legislate, . . . .

12

Could we indulge in the assumption that Congress still intended, by the Act, to create the restricted area

of nine barrios in the towns of Butig and Balabagan in Lanao del Sur into the town of Dianaton, if the twelve

barrios in the towns of Buldon and Parang, Cotabato were to be excluded therefrom? The answer must be in

the negative.

Municipal corporations perform twin functions. Firstly. They serve as an instrumentality of the State in carrying

out the functions of government. Secondly. They act as an agency of the community in the administration of

local affairs. It is in the latter character that they are a separate entity acting for their own purposes and not a

subdivision of the State.

13

Consequently, several factors come to the fore in the consideration of whether a group of barrios is capable of

maintaining itself as an independent municipality. Amongst these are population, territory, and income. It was

apparently these same factors which induced the writing out of House Bill 1247 creating the town of Dianaton.

Speaking of the original twenty-one barrios which comprise the new municipality, the explanatory note to

House Bill 1247, now Republic Act 4790, reads:

The territory is now a progressive community; the aggregate population is large; and the collective

income is sufficient to maintain an independent municipality.

This bill, if enacted into law, will enable the inhabitants concerned to govern themselves and enjoy the

blessings of municipal autonomy.

When the foregoing bill was presented in Congress, unquestionably, the totality of the twenty-one barrios

not nine barrios was in the mind of the proponent thereof. That this is so, is plainly evident by the fact that

the bill itself, thereafter enacted into law, states that the seat of the government is in Togaig, which is a barrio

in the municipality of Buldon in Cotabato. And then the reduced area poses a number of questions, thus: Could

the observations as to progressive community, large aggregate population, collective income sufficient to

maintain an independent municipality, still apply to a motley group of only nine barrios out of the twenty-one? Is

it fair to assume that the inhabitants of the said remaining barrios would have agreed that they be formed into a

municipality, what with the consequent duties and liabilities of an independent municipal corporation? Could

they stand on their own feet with the income to be derived in their community? How about the peace and order,

sanitation, and other corporate obligations? This Court may not supply the answer to any of these disturbing

questions. And yet, to remain deaf to these problems, or to answer them in the negative and still cling to the

rule on separability, we are afraid, is to impute to Congress an undeclared will. With the known premise that

Dianaton was created upon the basic considerations of progressive community, large aggregate population

and sufficient income, we may not now say that Congress intended to create Dianaton with only nine of the

original twenty-one barrios, with a seat of government still left to be conjectured. For, this unduly stretches

judicial interpretation of congressional intent beyond credibility point. To do so, indeed, is to pass the line which

circumscribes the judiciary and tread on legislative premises. Paying due respect to the traditional separation

of powers, we may not now melt and recast Republic Act 4790 to read a Dianaton town of nine instead of the

originally intended twenty-one barrios. Really, if these nine barrios are to constitute a town at all, it is the

function of Congress, not of this Court, to spell out that congressional will.

Republic Act 4790 is thus indivisible, and it is accordingly null and void in its totality.

14

3. There remains for consideration the issue raised by respondent, namely, that petitioner has no substantial

legal interest adversely affected by the implementation of Republic Act 4790. Stated differently, respondent's

pose is that petitioner is not the real party in interest.

Here the validity of a statute is challenged on the ground that it violates the constitutional requirement that the

subject of the bill be expressed in its title. Capacity to sue, therefore, hinges on whether petitioner's substantial

rights or interests are impaired by lack of notification in the title that the barrio in Parang, Cotabato, where he is

residing has been transferred to a different provincial hegemony.

The right of every citizen, taxpayer and voter of a community affected by legislation creating a town to

ascertain that the law so created is not dismembering his place of residence "in accordance with the

Constitution" is recognized in this jurisdiction.

15

Petitioner is a qualified voter. He expects to vote in the 1967 elections. His right to vote in his own barrio before

it was annexed to a new town is affected. He may not want, as is the case here, to vote in a town different from

his actual residence. He may not desire to be considered a part of hitherto different communities which are

fanned into the new town; he may prefer to remain in the place where he is and as it was constituted, and

continue to enjoy the rights and benefits he acquired therein. He may not even know the candidates of the new

town; he may express a lack of desire to vote for anyone of them; he may feel that his vote should be cast for

the officials in the town before dismemberment. Since by constitutional direction the purpose of a bill must be

shown in its title for the benefit, amongst others, of the community affected thereby,

16

it stands to reason to say

that when the constitutional right to vote on the part of any citizen of that community is affected, he may

become a suitor to challenge the constitutionality of the Act as passed by Congress.

For the reasons given, we vote to declare Republic Act 4790 null and void, and to prohibit respondent

Commission from implementing the same for electoral purposes.

No costs allowed. So ordered.

Concepcion, C.J., Reyes, J.B.L., Dizon, Makalintal, Bengzon, J.P., Zaldivar, Castro and Angeles, JJ., concur.

Republic of the Philippines

SUPREME COURT

Manila

EN BANC

G.R. No. L-16704 March 17, 1962

VICTORIAS MILLING COMPANY, INC., petitioner-appellant,

vs.

SOCIAL SECURITY COMMISSION, respondent-appellee.

Ross, Selph and Carrascoso for petitioner-appellant.

Office of the Solicitor General and Ernesto T. Duran for respondent-appellee.

BARRERA, J .:

On October 15, 1958, the Social Security Commission issued its Circular No. 22 of the following tenor: .

Effective November 1, 1958, all Employers in computing the premiums due the System, will take into

consideration and include in the Employee's remuneration all bonuses and overtime pay, as well as the

cash value of other media of remuneration. All these will comprise the Employee's remuneration or

earnings, upon which the 3-1/2% and 2-1/2% contributions will be based, up to a maximum of P500 for

any one month.

Upon receipt of a copy thereof, petitioner Victorias Milling Company, Inc., through counsel, wrote the Social

Security Commission in effect protesting against the circular as contradictory to a previous Circular No. 7,

dated October 7, 1957 expressly excluding overtime pay and bonus in the computation of the employers' and

employees' respective monthly premium contributions, and submitting, "In order to assist your System in

arriving at a proper interpretation of the term 'compensation' for the purposes of" such computation, their

observations on Republic Act 1161 and its amendment and on the general interpretation of the words

"compensation", "remuneration" and "wages". Counsel further questioned the validity of the circular for lack of

authority on the part of the Social Security Commission to promulgate it without the approval of the President

and for lack of publication in the Official Gazette.

Overruling these objections, the Social Security Commission ruled that Circular No. 22 is not a rule or

regulation that needed the approval of the President and publication in the Official Gazette to be effective, but

a mere administrative interpretation of the statute, a mere statement of general policy or opinion as to how the

law should be construed.

Not satisfied with this ruling, petitioner comes to this Court on appeal.

The single issue involved in this appeal is whether or not Circular No. 22 is a rule or regulation, as

contemplated in Section 4(a) of Republic Act 1161 empowering the Social Security Commission "to adopt,

amend and repeal subject to the approval of the President such rules and regulations as may be necessary to

carry out the provisions and purposes of this Act."

There can be no doubt that there is a distinction between an administrative rule or regulation and an

administrative interpretation of a law whose enforcement is entrusted to an administrative body. When an

administrative agency promulgates rules and regulations, it "makes" a new law with the force and effect of a

valid law, while when it renders an opinion or gives a statement of policy, it merely interprets a pre-existing law

(Parker, Administrative Law, p. 197; Davis, Administrative Law, p. 194). Rules and regulations when

promulgated in pursuance of the procedure or authority conferred upon the administrative agency by law,

partake of the nature of a statute, and compliance therewith may be enforced by a penal sanction provided in

the law. This is so because statutes are usually couched in general terms, after expressing the policy,

purposes, objectives, remedies and sanctions intended by the legislature. The details and the manner of

carrying out the law are often times left to the administrative agency entrusted with its enforcement. In this

sense, it has been said that rules and regulations are the product of a delegated power to create new or

additional legal provisions that have the effect of law. (Davis, op. cit., p. 194.) .

A rule is binding on the courts so long as the procedure fixed for its promulgation is followed and its scope is

within the statutory authority granted by the legislature, even if the courts are not in agreement with the policy

stated therein or its innate wisdom (Davis, op. cit., 195-197). On the other hand, administrative interpretation of

the law is at best merely advisory, for it is the courts that finally determine what the law means.

Circular No. 22 in question was issued by the Social Security Commission, in view of the amendment of the

provisions of the Social Security Law defining the term "compensation" contained in Section 8 (f) of Republic

Act No. 1161 which, before its amendment, reads as follows: .

(f) Compensation All remuneration for employment include the cash value of any remuneration paid

in any medium other than cash except (1) that part of the remuneration in excess of P500 received

during the month; (2) bonuses, allowances or overtime pay; and (3) dismissal and all other payments

which the employer may make, although not legally required to do so.

Republic Act No. 1792 changed the definition of "compensation" to:

(f) Compensation All remuneration for employment include the cash value of any remuneration paid

in any medium other than cash except that part of the remuneration in excess of P500.00 received

during the month.

It will thus be seen that whereas prior to the amendment, bonuses, allowances, and overtime pay given in

addition to the regular or base pay were expressly excluded, or exempted from the definition of the term

"compensation", such exemption or exclusion was deleted by the amendatory law. It thus became necessary

for the Social Security Commission to interpret the effect of such deletion or elimination. Circular No. 22 was,

therefore, issued to apprise those concerned of the interpretation or understanding of the Commission, of the

law as amended, which it was its duty to enforce. It did not add any duty or detail that was not already in the

law as amended. It merely stated and circularized the opinion of the Commission as to how the law should be

construed. 1wph1.t

The case of People v. Jolliffe (G.R. No. L-9553, promulgated on May 30, 1959) cited by appellant, does not

support its contention that the circular in question is a rule or regulation. What was there said was merely that a

regulation may be incorporated in the form of a circular. Such statement simply meant that the substance and

not the form of a regulation is decisive in determining its nature. It does not lay down a general proposition of

law that any circular, regardless of its substance and even if it is only interpretative, constitutes a rule or

regulation which must be published in the Official Gazette before it could take effect.

The case of People v. Que Po Lay (50 O.G. 2850) also cited by appellant is not applicable to the present case,

because the penalty that may be incurred by employers and employees if they refuse to pay the corresponding

premiums on bonus, overtime pay, etc. which the employer pays to his employees, is not by reason of non-

compliance with Circular No. 22, but for violation of the specific legal provisions contained in Section 27(c) and

(f) of Republic Act No. 1161.

We find, therefore, that Circular No. 22 purports merely to advise employers-members of the System of what,

in the light of the amendment of the law, they should include in determining the monthly compensation of their

employees upon which the social security contributions should be based, and that such circular did not require

presidential approval and publication in the Official Gazette for its effectivity.

It hardly need be said that the Commission's interpretation of the amendment embodied in its Circular No. 22,

is correct. The express elimination among the exemptions excluded in the old law, of all bonuses, allowances

and overtime pay in the determination of the "compensation" paid to employees makes it imperative that such

bonuses and overtime pay must now be included in the employee's remuneration in pursuance of the

amendatory law. It is true that in previous cases, this Court has held that bonus is not demandable because it

is not part of the wage, salary, or compensation of the employee. But the question in the instant case is not

whether bonus is demandable or not as part of compensation, but whether, after the employer does, in fact,

give or pay bonus to his employees, such bonuses shall be considered compensation under the Social

Security Act after they have been received by the employees. While it is true that terms or words are to be

interpreted in accordance with their well-accepted meaning in law, nevertheless, when such term or word is

specifically defined in a particular law, such interpretation must be adopted in enforcing that particular law, for it

can not be gainsaid that a particular phrase or term may have one meaning for one purpose and another

meaning for some other purpose. Such is the case that is now before us. Republic Act 1161 specifically

defined what "compensation" should mean "For the purposes of this Act". Republic Act 1792 amended such

definition by deleting same exemptions authorized in the original Act. By virtue of this express substantial

change in the phraseology of the law, whatever prior executive or judicial construction may have been given to

the phrase in question should give way to the clear mandate of the new law.

IN VIEW OF THE FOREGOING, the Resolution appealed from is hereby affirmed, with costs against appellant.

So ordered.

Republic of the Philippines

SUPREME COURT

Manila

EN BANC

DECISION

June 30, 1970

G.R. No. L-25619

DOMINGO B. TEOXON, petitioner-appellant,

vs.

MEMBERS OF THE BOARD OF ADMINISTRATORS, PHILIPPINE VETERANS ADMINISTRATION,

respondents-appellees.

Ulpiano S. Masallo for petitioner-appellant. Office of the Solicitor General Antonio P. Barredo, Assistant Solicitor

General Isidro C. Borromeo and Perfecto O. Fernandez for respondents-appellees.

Fernando, J .:

The pivotal question raised by petitioner, a veteran who suffered from permanent physical disability, in this appeal from a

lower court decision dismissing his suit formandamus, is its failure to accord primacy to statutory provisions fixing the

amount of pension to which he was entitled. 1 Instead, it sustained the plea of respondent officials, members of the board

of Administrators of the Philippine Veterans Administration, relying on the administrative rules issued by them

presumably in pursuance of their duty to enforce the Veterans' Bill of Rights. We have to resolve, then, whether or not

there has been a failure to apply the doctrine to which this Court has been committed that if it can be shown that there is

repugnancy between the statute and the rules issued in pursuance thereof, the former prevails. Unfortunately, as will be

hereafter shown, the lower court did not see it that way. It found nothing objectionable in respondents following a

contrary norm and thus disregarding petitioner's legal right for which mandamus is the proper remedy. We cannot lend our

approval then to such conclusion especially so in the light of our decision barely two months ago, Begosa v. Chairman,

Philippine Veterans Administration, 2 where we categorically held that a veteran suffering from permanent disability is

not to be denied what has been granted him specifically by legislative enactment, which certainly is superior to any

regulation that may be promulgated by the Philippine Veterans Administration, presumably in the implementation thereof.

We reverse.

Petitioner, on April 23, 1965, filed his suit for mandamusbefore the Court of First Instance of Manila alleging that he filed

his claim for disability pension under the Veterans' Bill of Rights, Republic Act No. 65, for having been permanently

incapacitated from work and that he was first awarded only P25.00 monthly, thereafter increased to P50.00 a month

contrary to the terms of the basic law as thereafter amended. 3 His claim, therefore, was for a pension effective May 10,

1955 at the rate of P50.00 a month up to June 21, 1957 and at the rate of P100.00 a month, plus P10.00 a month, for each

of his unmarried minor children below 18 years of age from June 22, 1957 up to June 30, 1963; and the difference of

P50.00 a month, plus P10.00 a month for each of his four unmarried minor children below 18 years of age from July 1,

1963. He would likewise seek for the payment of moral and exemplary damages as well as attorney's fees. 4 The answer

for respondents filed on May 25, 1965, while admitting, with qualification, the facts as alleged in the petition, would rely

primarily in its special and affirmative defenses, on petitioner not having exhausted its administrative remedies and his

suit being in effect one against the government, which cannot prosper without its consent. 5 In the stipulation of facts

dated Oct. 13, 1965, it was expressly agreed: "That the petitioner sustained physical injuries in line of duty as a former

member of a recognized guerilla organization which participated actively in the resistance movement against the enemy,

and as a result of which petitioner suffered a permanent, physical disability." 6 Mention was likewise made in the

aforesaid stipulation of facts that while petitioner would rely on what is set forth in the Veterans' Bill of Rights, as

amended, respondents in turn would limit the amount of pension received by him in accordance with the rules and

regulations promulgated by them.

In the decision now on appeal, promulgated on Dec. 4, 1965, the lower court, in dismissing the petition, expressed its

conformity with the contention of respondents. Thus: "Upon examination of the issues involved in this case, the Court

believes that a case for mandamus will not lie. The respondent Board has authority under the Pension law to process

applications for pension, using as guide the rules and regulations that it adopted under the law and their decisions, unless

shown clearly to be in error or against the law or against the general policy of the Board, should be maintained." 7 The

lower court went even further in its recognition of the binding force to be given the administrative rules and regulations

promulgated by respondents. Thus: "As mentioned above, under the provisions of the Veterans Law as subsequently

amended, the Board is authorized to promulgate regulations to carry into effect the provisions of the law. In accordance

with said law, the Board has promulgated rules and regulations which are considered in the approval of the claims for

pension. The court sees no reason why the case of petitioner should be considered as an exception. There is no question

that his disability is not complete, and, therefore, he cannot be entitled to complete disability allowance. That the decision

of the Board is based on its regulations is also, according to the Court, justified because that is how the Board functions."

8

Hence, this appeal, which, as noted at the outset, calls for an affirmative response. Petitioner's contention that his right as

conferred by law takes precedence to what the administrative rules and regulations of respondents provide is indisputable.

So our decisions have indicated with unfailing uniformity.

1. The recognition of the power of administrative officials to promulgate rules in the implementation of the statute,

necessarily limited to what is provided for in the legislative enactment, may be found in the early case of United States v.

Barrias 9 decided in 1908. Then came, in a 1914 decision, United States v. Tupasi Molina, 10 a delineation of the scope of

such competence. Thus: "Of course the regulations adopted under legislative authority by a particular department must be

in harmony with the provisions of the law, and for the sole purpose of carrying into effect its general provisions. By such

regulations, of course, the law itself can not be extended. So long, however, as the regulations relate solely to carrying into

effect the provisions of the law, they are valid." In 1936, in People v. Santos, 11 this Court expressed its disapproval of an

administrative order that would amount to an excess of the regulatory power vested in an administrative official. We

reaffirmed such a doctrine in a 1951 decision, where we again made clear that where an administrative order betrays

inconsistency or repugnancy to the provisions of the Act, "the mandate of the Act must prevail and must be followed." 12

Justice Barrera, speaking for the Court in Victorias Milling Company, Inc. v. Social Security Commission, 13 citing

Parker, 14 as well as Davis 15 did tersely sum up the matter thus: "A rule is binding on the courts so long as the procedure

fixed for its promulgation is followed and its scope is within the statutory granted by the legislature, even if the courts are

not in agreement with the policy stated therein or its innate wisdom .... On the other hand, administrative interpretation of

the law is at best merely advisory, for it is the courts that finally determine what the law means."

It cannot be otherwise as the Constitution limits the authority of the President, in whom all executive power resides, to

take care that the laws be faithfully executed. 16 No lesser administrative executive office or agency then can, contrary to