Professional Documents

Culture Documents

DTTL Tax Romaniahighlights 2014

Uploaded by

Mihai Fildan0 ratings0% found this document useful (0 votes)

21 views4 pagesTax consideration

Original Title

Dttl Tax Romaniahighlights 2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax consideration

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views4 pagesDTTL Tax Romaniahighlights 2014

Uploaded by

Mihai FildanTax consideration

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

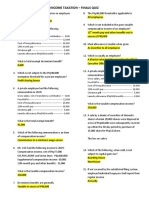

Investment basics:

Currency Romanian New Leu (RON)

Foreign exchange control The national

currency is fully convertible and residents are

allowed to make external payments in foreign

currency (with banks generally requiring

documentation).

Accounting principles/financial

statements Romanian accounting

standards follow the fourth and seventh EU

directives. IFRS also is accepted as a second

set of financial statements, but only for

certain companies. As from 2012, banks,

financial institutions and companies whose

securities are traded on a regulated capital

market must apply IFRS for accounting

purposes.

Principal business entities These are the

joint stock company (SA), general

partnership (SNC), limited partnership,

limited partnership by shares, limited liability

company, branch of a foreign company and

representative office.

Corporate taxation:

Residence A company is resident in

Romania if it is incorporated in accordance

with Romanian legislation or if its place of

effective management is in Romania. The

definition of resident also includes legal

entities headquartered in Romania, but

incorporated under EU rules (e.g. the

Societas Europaea and European

cooperative).

Basis Resident companies are taxed on

their worldwide income; nonresident

companies are taxed only on Romania-

source income. The tax base for computation

of the corporate income tax is the difference

between income from any source (i.e. gross

income) and expenses incurred in generating

the income, from which nontaxable income is

deducted and to which nondeductible

expenses are added. Items similar to income

and expenses also are taken into account.

Taxable income All income generally is

taxable, except for income that is specifically

exempt (such as certain dividends, see below

under Participation exemption).

Taxation of dividends Dividend income

obtained by a Romanian legal entity is

taxable. However, as mentioned above under

Taxable income, dividends can be exempt

from taxation, under certain conditions (see

below under Participation exemption).

Capital gains Gains derived by resident

and nonresident entities on the sale of shares

and real property are included in overall

profits and taxed at the general corporate

rate of 16%. As from 1 January 2014, capital

gains may be exempt from taxation if certain

conditions are satisfied (see below under

Participation exemption).

Losses Losses may be carried forward for

seven years. The carryback of losses is not

permitted.

Rate 16%

Surtax No

Alternative minimum tax A 3% tax is

levied on the income of micro-companies in

certain situations (instead of corporate

income tax).

Foreign tax credit A foreign tax credit is

granted if so provided in a tax treaty between

Romania and the relevant jurisdiction and if

the taxpayer can demonstrate that income

tax was paid abroad. However, the tax credit

cannot exceed the Romanian tax payable on

the income.

Participation exemption As from 1

January 2014, dividends derived by a

resident company from another resident

company, from a company in an EU member

state or a non-EU country that has concluded

a tax treaty with Romania are exempt from

tax if the Romanian recipient company holds

at least 10% of the distributing company's

shares for an uninterrupted period of one

year.

Also as from 1 January 2014, capital gains

from the sale/transfer of shares held in a

Romanian or foreign legal entity located in a

country that has concluded a tax treaty with

Romania are exempt from tax.

Holding company regime There is no

specific holding company regime, but see

under Participation exemption.

Incentives Romanian taxpayers can

benefit from the following incentives for

corporate income tax purposes: (1) an

additional 50% deduction for eligible

expenses arising from R&D activities for

Romanian taxpayers that carry on R&D

activities; and (2) accelerated depreciation of

equipment and devices.

Withholding tax:

Dividends Romania generally levies a 16%

withholding tax on dividends paid to a

company (whether resident or nonresident,

unless the rate is reduced under a tax treaty

or the EU parent-subsidiary directive.

Dividends paid by a Romanian legal entity to

a legal entity resident in another EU/EFTA

member state or to a permanent

establishment of a company from an

EU/EFTA member state situated in another

EU/EFTA member state are subject to a 16%

withholding tax if the dividends do not qualify

for an exemption under the directive (a

minimum 10% holding for an uninterrupted

period of at least two years) or domestic

legislation.

Interest Romania levies a 16% withholding

tax on interest paid to a nonresident

company unless the rate is reduced under a

tax treaty or the EU interest and royalties

directive. The withholding tax on interest paid

to an EU/EFTA resident is reduced to zero

under the directive, provided the

requirements for application of the directive

are met (a minimum 25% holding for an

uninterrupted period of at least two years).

International tax

Romania Highlights 2014

Royalties Romania levies a 16%

withholding tax on royalties paid to a

nonresident company unless the rate is

reduced under a tax treaty or the EU interest

and royalties directive. The withholding tax

on royalty payments made to an EU/EFTA

resident is reduced to zero under the

directive, provided the requirements for

application of the directive are met (minimum

25% holding for an uninterrupted period of at

least two years).

Technical service fees Service fees paid

to a nonresident entity generally are subject

to a 16% withholding tax, unless exempt

under a tax treaty.

Branch remittance tax No

Other A nonresident must provide an

income payer with a tax residence certificate

valid for the year in which the payment is

made in order to obtain benefits under a

Romanian tax treaty or one of the EU

directives.

In determining whether tax treaty benefits are

available, the tax authorities may disregard

any transactions or series of transactions that

are considered artificial or that would not

form part of an entitys regular business. An

artificial transaction is defined as a

transaction or series of transactions that lack

economic substance and that normally would

not be employed in ordinary business

practices, their essential purpose being to

avoid tax or to obtain fiscal advantages that

otherwise would not be granted.

In addition, Romania levies a 50%

withholding tax on payments made to a

jurisdiction that has not concluded an

agreement with Romania for the exchange of

information if the payment is made in relation

to an artificial transaction.

Other taxes on corporations:

Capital duty No

Payroll tax No payroll tax is due by the

employer, but the employer must compute

and withhold tax on salaries on a monthly

basis and remit these taxes to the Romanian

state budget by the 25th day of the month

following the month in which the

salaries/income are paid.

Real property tax Local taxes on buildings

and land apply. For buildings owned by a

company, the building tax rate is set by the

local council and ranges from 0.25% to 1.5%

of the entry value of the building as adjusted

by the value of reconstruction, modernization,

modifications, etc.

Owners of land are subject to land tax at a

fixed amount per square meter, depending

on where the land is located and the area

and/or category of use, in accordance with

the classification made by the local council.

Companies are not subject to land tax on

land where buildings are situated.

A 1.5% tax on special construction applies to

Romanian legal entities, Romanian

permanent establishments (PEs) of foreign

entities, legal entities with their registered

office in Romania, users under finance

leasing contracts and lessors under operating

lease contracts. The tax applies to various

types of construction (e.g. platforms, parking,

etc.), except for buildings that are subject to

building tax.

Social security An employer must make

the following contributions on gross salary: a

social security contribution of 20.8% (for

normal working conditions), capped at five

times the national medium gross salary (i.e.

RON 2,223 for 2013) multiplied by the

number of employees; a health fund

contribution of 5.2%; an unemployment

contribution of 0.5%; the salaries guarantee

fund of 0.25%; work-related accidents and

diseases contribution of 0.15%-0.85%;

disabled persons contribution of 4%,

multiplied by the number of employees and

50% of the national minimum salary; and the

medical leave contribution of 0.85% (applied

to the gross salary fund, capped at 12 times

the national minimum salary (i.e. RON 800

for 2013), multiplied by the number of

employees).

Stamp duty No

Transfer tax No

Other Depending on the nature of the

taxpayer's business, other taxes may apply

(e.g. specific taxes for the energy sector and

the pharmaceutical industry).

Anti-avoidance rules:

Transfer pricing Transfer pricing rules

follow the OECD guidelines. The tax

authorities may adjust intercompany pricing

to reflect the fair market value in appropriate

cases. Documentation should be prepared

and advance transfer pricing agreements are

available.

Thin capitalization Interest expense

related to loans from banking institutions,

finance leasing companies or other legal

persons granting credit in accordance with

the law are fully deductible provided the

loans are incurred to generate taxable

income. The deductibility of interest expense

related to other loans is limited to an interest

rate of 6% for foreign currency-denominated

loans and the interest reference rate set by

the National Bank of Romania for local

currency loans. Interest expense exceeding

these limits is nondeductible and may not be

carried forward.

Further, if the debt-to-equity ratio is higher

than three or the company is in a negative

equity position, the interest expense and

related net losses from foreign exchange

differences are nondeductible. However,

such nondeductible expenses may be carried

forward indefinitely and deducted when the

debt-to equity ratio is less than or equal to

three and the company is in a positive equity

position.

Controlled foreign companies No

Other The tax authorities may disregard a

transaction or reclassify the nature of a

transaction to reflect economic substance if

the transaction is viewed as artificial or would

not form part of an entitys regular business

(for the definition of artificial transaction, see

Other, above).

Disclosure requirements No

Administration and compliance:

Tax year Calendar year, although, as from

2014, taxpayers also can opt for a fiscal year

corresponding to a financial accounting year.

Consolidated returns Consolidated

returns are not permitted; each company

must file a separate return.

Nonresident legal entities that carry out

activities in Romania through multiple PEs

must designate a PE to fulfill the corporate

income tax obligations (i.e. prepare a single

set of returns consolidating income and

expense items at the level of all Romanian

PEs of the nonresident).

Filing requirements Corporate income tax

compliance is carried out on a quarterly

basis, followed by the final year-end

computation, declaration and payment of tax.

Corporate income tax is computed and paid

on a quarterly basis based on actual figures.

Quarterly return and payments are due by

the 25th of the month following the reporting

quarter (applicable for the first three

quarters). At year-end, the annual corporate

income tax must be computed, declared in

the annual tax return and paid by 25 March of

the year following the tax year.

Certain taxpayers can opt to declare and pay

annual corporate income tax by making

advance payments on a quarterly basis (i.e.

four equal installments based on the income

of the previous year as adjusted for inflation).

At year-end, the taxpayer computes the

annual corporate income tax liability based

on actual figures and pays any difference.

The election to use this system must be

made at the beginning of the fiscal year, and

once the election is made, it must be

maintained for at least two consecutive

years.

Penalties Late payment of tax is subject to

interest at a rate of 0.04% per day of delay,

with additional late payment penalty of 0.02%

per day of delay.

Rulings Advance pricing agreements and

individual fiscal solutions are available.

Personal taxation:

Basis Resident individuals are taxed on

their worldwide income; nonresidents are

taxed only on Romania-source income.

Residence An individual is resident in

Romania if he/she satisfies at least one of the

following conditions: the individual has

his/her domicile in Romania; the individual's

center of vital interests is in Romania; he/she

is present in Romania for a period or periods

that exceed in the aggregate 183 days during

any consecutive 12-month period ending in

the calendar year in question; or the

individual is a Romanian citizen who is

serving abroad as an official or employee of

Romania in a foreign state. A foreign

individual will become liable to tax on

worldwide income if certain conditions are

satisfied.

Filing status Each taxpayer must file a tax

return; joint filing is not permitted.

Taxable income All salaries and related

income are subject to tax. The taxable

income of employees under an employment

contract is determined as the difference

between gross income from salaries and

allowable personal deductions, union dues

paid, mandatory social contribution charges

and private social security contributions

capped at EUR 400 per year.

Capital gains Capital gains generally are

taxed at a rate of 16%. Income from the sale

of real property is taxed at a rate between 1%

and 3%.

Deductions and allowances There are

certain allowances for children and personal

deductions for taxable persons having

dependents.

Rates 16%

Other taxes on individuals:

Capital duty No

Stamp duty No

Capital acquisitions tax No

Real property tax Real property tax is

levied as a fixed fee (established by location

and other factors) per square meter of land

and buildings.

Inheritance/estate tax No, if the

succession is made during the first two years.

Otherwise, a 1% tax on the value of the

property is levied.

Net wealth/net worth tax No

Social security Employee contributions

include the contribution for social security at

10.5% (this contribution includes the 3% to

be paid for the private pension scheme) and

capped at five times the national medium

gross salary, health at 5.5% and

unemployment at 0.5%.

Administration and compliance:

Tax year Calendar year

Filing and payment Personal income tax

returns and payment are due by 25 May of

the year following the year in which the

income is realized.

Returns relating to salary-type income

earned from a Romanian employer are due

by the 25th of each month for salary derived

in the previous month; the employer must

remit the tax to the authorities.

Returns related to salary-type income earned

from abroad for activities performed in

Romania are due by the 25th of each month

for salary derived in the previous month; the

individual must remit the tax to the

authorities.

Penalties Late payment of tax is subject to

interest at a rate of 0.04% per day of delay,

with additional late payment penalty of 0.02%

per day of delay.

Value added tax:

Taxable transactions VAT is levied on the

supply of goods and services.

Rates The standard rate of VAT is 24%,

with two reduced rates of 9% and 5%.

Exports and intra-Community supplies of

goods are exempt. Also exempt are social,

medical, educational, financial and banking

services and certain real estate transactions.

Registration Registration is required for

persons carrying out taxable operations.

Taxable persons with annual turnover of less

than EUR 65,000 may be eligible for a

special VAT-exempt regime.

Filing and payment VAT returns must be

submitted on a monthly basis. Quarterly

payments and filing are available for taxable

persons with an annual turnover of less than

EUR 100,000. However, if a taxable person

performs at least one intra-Community

acquisition of goods, VAT returns must be

submitted monthly.

A VAT cash accounting system applies,

under which local suppliers, established in

Romania, with an annual turnover below

EUR 500,000 are required to collect VAT

only when their invoices have been paid, but

no later than 90 days from the date of

issuance.

A consolidated VAT return is submitted by

the members of a VAT group (i.e. companies

administrated by the same tax authority).

Source of tax law: Romanian Fiscal

Code (and Methodological Norms),

Romanian Fiscal Procedure Code (and

Methodological Norms).

Tax treaties: Romania has concluded tax

treaties with approximately 80 countries.

Tax authorities: National Agency for

Fiscal Administration.

International organizations: EU,

Council of Europe, NATO, WTO, Black Sea

Economic Cooperation

Deloitte contact

Dan Badin

E-mail: dbadin@deloitteCE.com

Pieter Wessel

E-mail: pwessel@deloitteCE.com

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and

its network of member firms, each of which is a legally separate and independent entity. Please see

www.deloitte.com/about for a detailed description of the legal structure of Deloitte Touche Tohmatsu Limited and its

member firms.

Deloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple

industries. With a globally connected network of member firms in more than 150 countries and territories, Deloitte

brings world-class capabilities and high-quality service to clients, delivering the insights they need to address their

most complex business challenges. Deloittes more than 200,000 professionals are committed to becoming the

standard of excellence.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member

firms, or their related entities (collectively, the Deloitte network) is, by means of this communication, rendering

professional advice or services. No entity in the Deloitte network shall be responsible for any loss whatsoever

sustained by any person who relies on this communication.

2014. For information, contact Deloitte Touche Tohmatsu Limited.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- XML PublisherDocument268 pagesXML PublishertechmandavaappsNo ratings yet

- Approval Rule Setup Joblevel Based On Invoice ValueDocument5 pagesApproval Rule Setup Joblevel Based On Invoice ValueMihai FildanNo ratings yet

- Ey Worldwide R and D Incentives Guide 2022Document498 pagesEy Worldwide R and D Incentives Guide 2022Olena SamsonnykovaNo ratings yet

- Digest (1986 To 2016)Document151 pagesDigest (1986 To 2016)Jerwin DaveNo ratings yet

- CIR vs. ESTATE OF BENIGNO TODADocument2 pagesCIR vs. ESTATE OF BENIGNO TODAAngela Mericci G. Mejia100% (1)

- MF SlaDocument33 pagesMF SlaMihai Fildan100% (1)

- CIR-v-American-Airlines-180-SCRA-274Document6 pagesCIR-v-American-Airlines-180-SCRA-274Darrel John Sombilon100% (1)

- Standard Chart of AccountsDocument4 pagesStandard Chart of AccountsMihai FildanNo ratings yet

- Oracle Erp Cloud Period Close WhitepaperDocument92 pagesOracle Erp Cloud Period Close WhitepaperskshivaNo ratings yet

- TaxDocument26 pagesTaxParticia CorveraNo ratings yet

- Income Taxation - Finals QuizzesDocument12 pagesIncome Taxation - Finals QuizzesJalyn Jalando-onNo ratings yet

- FM - SLA - Description CustomizationDocument3 pagesFM - SLA - Description CustomizationMihai FildanNo ratings yet

- MF BC - CloseBudgetDefineNewBudgetDocument5 pagesMF BC - CloseBudgetDefineNewBudgetMihai FildanNo ratings yet

- PO Implementation: Conception DocumentDocument47 pagesPO Implementation: Conception DocumentMihai FildanNo ratings yet

- Makita Ls 1040Document88 pagesMakita Ls 1040Mihai FildanNo ratings yet

- Using Custom Source in SLADocument10 pagesUsing Custom Source in SLAMihai FildanNo ratings yet

- Allocations Recurring Journals Oracle Erp Financials CloudDocument41 pagesAllocations Recurring Journals Oracle Erp Financials CloudMihai FildanNo ratings yet

- Template Builder For Word TutorialDocument11 pagesTemplate Builder For Word TutorialPranoy Kakubal0% (1)

- Cristian Frasinaru-Curs Practic de JavaDocument462 pagesCristian Frasinaru-Curs Practic de Javaanon-331879100% (14)

- Budgets and PSBDocument34 pagesBudgets and PSBMihai FildanNo ratings yet

- Call D2K Form From OAF PageDocument5 pagesCall D2K Form From OAF PageMihai FildanNo ratings yet

- Fixed Assets SIGDocument24 pagesFixed Assets SIGMihai FildanNo ratings yet

- Call Concurrent Program From OA FrameworkDocument1 pageCall Concurrent Program From OA FrameworkMihai FildanNo ratings yet

- Call Concurrent Program From OA FrameworkDocument1 pageCall Concurrent Program From OA FrameworkMihai FildanNo ratings yet

- ADF TutorialDocument170 pagesADF TutorialCarlos Meneses HernandezNo ratings yet

- Purchase Order Search Page CreationDocument74 pagesPurchase Order Search Page CreationMihai FildanNo ratings yet

- OAF MaterialDocument45 pagesOAF Materialpmarreddy100% (3)

- Oracle R12 Fixed Assets Changes From 11iDocument29 pagesOracle R12 Fixed Assets Changes From 11isanjayapps100% (1)

- Oracle Applications - Concepts R12Document204 pagesOracle Applications - Concepts R12Ramesh GarikapatiNo ratings yet

- OA Framework Tutorial Deployment in APPS EnvironmentDocument14 pagesOA Framework Tutorial Deployment in APPS Environmentvjain_66No ratings yet

- Upgrade R1211 R1212Document12 pagesUpgrade R1211 R1212triton77No ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Small and Medium Enterprises: BE - Mech - EDP SMSMPITR, AklujDocument36 pagesSmall and Medium Enterprises: BE - Mech - EDP SMSMPITR, AklujAjij MujawarNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3Document2 pages2551Q Jan 2018 ENCS Final Rev 3MIS MijerssNo ratings yet

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- SIP Project FinalDocument45 pagesSIP Project FinalHrishikesh BadeNo ratings yet

- PKF Kenya Quick Tax Guide 2016Document10 pagesPKF Kenya Quick Tax Guide 2016KalGeorgeNo ratings yet

- BIR Form No. 1700Document2 pagesBIR Form No. 1700mijareschabelita2No ratings yet

- MCQ in Taxation-Part 1Document31 pagesMCQ in Taxation-Part 1Tahani Awar GurarNo ratings yet

- Income Tax Due and PayableDocument2 pagesIncome Tax Due and PayableJpoy RiveraNo ratings yet

- Income Tax Fundamentals 2019 37th Edition Whittenburg Test BankDocument11 pagesIncome Tax Fundamentals 2019 37th Edition Whittenburg Test BankLindaBrownoaeg100% (60)

- Chamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlDocument20 pagesChamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlMark Gabriel B. MarangaNo ratings yet

- A Comparative Study On Individual Tax Payers Preference Between Old Vs New Tax RegimeDocument14 pagesA Comparative Study On Individual Tax Payers Preference Between Old Vs New Tax RegimeJ.P. Venu GopalNo ratings yet

- IndividualsDocument63 pagesIndividualsWilliam HarrisNo ratings yet

- Income Tax - How Do I Know What Needs To Be Done?Document30 pagesIncome Tax - How Do I Know What Needs To Be Done?Emran AkbarNo ratings yet

- Naaannnsssiii IiiibbbbDocument3 pagesNaaannnsssiii IiiibbbbMahalakshmi RavikumarNo ratings yet

- Rate Is 20-35%.: Dela Cruz - Pastrana Taxation Law Review - Atty. Lumbera - FinalsDocument16 pagesRate Is 20-35%.: Dela Cruz - Pastrana Taxation Law Review - Atty. Lumbera - FinalsSharmane PastranaNo ratings yet

- Cha 4 Schadul A Income From EmploymentDocument88 pagesCha 4 Schadul A Income From EmploymentLakachew GetasewNo ratings yet

- Revenue MobilizationDocument43 pagesRevenue MobilizationAllan KamwanaNo ratings yet

- M. Patanjali Sastri, C.J., M.C. Mahajan, B.K. Mukherjea, Sudhi Ranjan Das and N. Chandrasekhara Aiyar, JJDocument19 pagesM. Patanjali Sastri, C.J., M.C. Mahajan, B.K. Mukherjea, Sudhi Ranjan Das and N. Chandrasekhara Aiyar, JJbijahariniNo ratings yet

- Tax Planning - Intro NotesDocument7 pagesTax Planning - Intro NotesBest How To StudioNo ratings yet

- Kuenzle & Streiff, Inc., Petitioner, V. The Commissioner of Internal Revenue, Respondent. (G.R. No. L-18840. May 29, 1969.)Document7 pagesKuenzle & Streiff, Inc., Petitioner, V. The Commissioner of Internal Revenue, Respondent. (G.R. No. L-18840. May 29, 1969.)Samantha BaricauaNo ratings yet

- Atlas Copco (India) Limited: NoticeDocument12 pagesAtlas Copco (India) Limited: NoticedivyaniNo ratings yet

- 55fi30fi307777777getahun Hordofa Research Paper Ms Post Accounting and Finance2888erreech222Document101 pages55fi30fi307777777getahun Hordofa Research Paper Ms Post Accounting and Finance2888erreech222Diriba K LetaNo ratings yet

- PAYE BookletDocument19 pagesPAYE BookletNirvana230100% (3)