Professional Documents

Culture Documents

Case Studies On Insurance Ombudsman Claims

Uploaded by

MiraRai0 ratings0% found this document useful (0 votes)

242 views5 pagesThis document provides summaries of several insurance claim cases handled by various Insurance Ombudsmen in India. The summaries include details about the claim, the insurer's decision to repudiate or settle the claim, key issues involved, and the Ombudsman's final reasoning and decision in each case. Common reasons for repudiation included violations of policy terms, exclusions of certain losses, disputes over assessed claim amounts, and failures to provide proper documentation. Ombudsmen often upheld insurer decisions but in some cases directed insurers to pay claims if repudiation was deemed unreasonable or documentation requirements were sufficiently met.

Original Description:

its gives case study on insurance ombudsman

Original Title

Case Studies on Insurance Ombudsman Claims

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides summaries of several insurance claim cases handled by various Insurance Ombudsmen in India. The summaries include details about the claim, the insurer's decision to repudiate or settle the claim, key issues involved, and the Ombudsman's final reasoning and decision in each case. Common reasons for repudiation included violations of policy terms, exclusions of certain losses, disputes over assessed claim amounts, and failures to provide proper documentation. Ombudsmen often upheld insurer decisions but in some cases directed insurers to pay claims if repudiation was deemed unreasonable or documentation requirements were sufficiently met.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

242 views5 pagesCase Studies On Insurance Ombudsman Claims

Uploaded by

MiraRaiThis document provides summaries of several insurance claim cases handled by various Insurance Ombudsmen in India. The summaries include details about the claim, the insurer's decision to repudiate or settle the claim, key issues involved, and the Ombudsman's final reasoning and decision in each case. Common reasons for repudiation included violations of policy terms, exclusions of certain losses, disputes over assessed claim amounts, and failures to provide proper documentation. Ombudsmen often upheld insurer decisions but in some cases directed insurers to pay claims if repudiation was deemed unreasonable or documentation requirements were sufficiently met.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

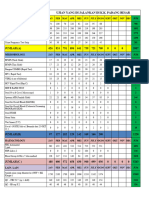

Insurance Ombudsman Claims/Awards:

Case studies on Motor OD

IO centre Facts/Insurance Cos stand

on Repudiation

Issues involved Insurance Ombudsmans Reasoning

/Decision

AHD

11/003/264

A/C :

S Y Patel

Quantum dispute: Motor

OD claim

Surveyor assessed :Net of

salvage/ deductibles 2.15

lacs.

Surveyor assessed Net loss

payable 2.15 lacs., but

Discharge voucher sent for

1.95 lacs

Accident was not in dispute.

No reasons could be adduced why the

amt was reduced. Therefore IO

directed to pay the amt 2.15 lacs with

simple interest

AHD

11/002 /302

A/C :

M P Rawal

Pvt car purchased, RTO

transfer confirmed

Accident took place 20 days

after said transfer

Policy was not transferred

within period of 14 days

IMT-GR 17:

Hence Repudiation

Repudiation Decision upheld , no

relief to complainant

AHD

11/004 /243

A/C :

P GKalantri

Repudiation : in absence of

documents like FIR

confirming accident

Statement of Insured, on

accident relied & survey

conducted

No evidence to deny the date of loss,

as observed from Survey report.

Directed as claim payable

AHD

11/002 /263

A/C :

Yogesh Patel

Quantum dispute: Motor

OD claim : Partial Loss

Repair basic settlement

offered

Assessed loss after

depreciation, fell below

75% of IDV

Not treated as constructive

total loss CTL

Should have assessed without

applying depreciation & treated as

constructive total loss CTL

Repair basic settlement offered

Decision by Insurer upheld

AHD

11/003 /158

A/C :

K A Saha

Repudiation on the ground:

Insured has not taken steps

to safeguard the vehicle

Allegedly Stolen while kept

in a Pay & park plot for 8

days. Delayed FIR

Delayed FIR might have led to

failure of police investigation.

Decision by Insurer upheld

Kochi

IO/KCH/GI/

28/A/C : K

Karunakaran

Repudiation on the ground:

Violation of permit.

Overloading one person

beyond the permit.

Surveyor assessed the loss

about Rs one lac. Accident

caused by a paid driver

whose FIR/ Final report

insisted

No evidence to show that overloading

one person beyond the permit,

contributed to cause of accident .

Surveyors assessed loss payable.

Bhopal/506/

009 A/C

Gurmeet

singh

Quantum dispute: Motor

OD claim : Partial Loss

Settled for 61,000/- in

absence of Bills/cash

memos for the difference.

Surveyor assessed Net loss

payable 72,000/-

Bills/cash memos for the

difference could not be

produced.

Surveyors assessed amount payable

subject production of evidence of

expenses incurred for all such items.

Decision by Insurer upheld

AHD

11/002 /258

A/C :S K

Maru

Repudiation Motor OD

claim: Policy transferred 90

days after tfr of ownership

& 10 days after accident.

Insured under the policy

was seller of the vehicle.

Complainant was alsoseller

of the vehicle

Violation of GR-17 of IMT

Repudiation Decision upheld

AHD

14/003 /007

A/C :S N

Arora

Repudiation : Car fallen into

ditch. Driver escaped unhurt

Curve protected by fencing.

Vehicle toppled without

damage to parapet.

All unusual occurrences

need using due process of

law by calling witnesses.

Forum is neither empowered nor

equipped with the required process.

Complainant advised to take up the

matter with appropriate forum.

AHD

14/002 /339

A/C : V V

Verma

Repudiation :No claim due

to non-compliance of

requirement in the

procedure to produce name

of driver up to satisfaction

Name of driver/ Name of

complainant. Affidavit

sworn. Complainant was

also admitted due to

orthopedic fracture.

Complaint could prove that he was

indeed driving the vehicle, as his

hospitalization papers produced

Directed to pay Surveyors assessed

full claim

AHD

11/002 /360

A/C :R B

Saha

Repudiation :

Agreed to settle on non

standard 75% basis.

Insured vehicle did not have

a valid certificate of

periodic inspection. as per

SG rules mandatory to have

seating ,exceeding 6 persons

In order to avoid harsh consequences

normally Insurers offer non standard

basic settlement of the assessed

amount.

Decision upheld.

AHD

11/003 /304

V K Nanolia

Repudiation Motor OD

claim: Valid /effective DL

not possessed by the driver.

Licensed to drive LMV

Vehicle involved was

Contract carriage Maxi cab

which is a transport vehicle

Adequate precaution was not taken to

engage a driver with Valid /effective

DL. Repudiation Decision upheld.

AHD

11/005 /257

V Prassana

Repudiation Motor OD

claim: Vehicle was stolen.

Claim admitted.

Quantum dispute.

Executed discharge

voucher in full/final

settlement. Cheque payable

subject to letter of

subrogation /undertaking.

Unqualified discharge voucher in

full/final settlement was executed

The case can not be reopened

AHD

11/002 /360

A A Imam

Repudiation Motor OD

claim: Claim settled on total

loss basis. After having

accepted grievances raised

Towing charges negligible.

Separate amount for

accessories claimed

Ceiling specified in the policy. At

this stage separate claim not

permissible.

AHD

11/014 /0081

K S Saha

Motor OD claim: Admitted

for 12281/-as per survey

assessment. Not accepted by

complainant

Engine stopped working

water logged. Major amount

found not admissible, in

view of cause of damage.

Vehicle inspected by expert

technician. Damage attributed to

attempt to run the engine, while in

contact with water.

Decision upheld

AHD

11/004 /111

J V Hirappa

Repudiation Motor OD

claim: Theft of vehicle

while parked in open place

without lock

Violation of condition :

Reasonable care to

safeguard. FIR confirms the

fact, critical document.

Since policy condition :reasonable

safeguard not complied with.

Decision of repudiation upheld

AHD

11/004 /367

T P Patel

Repudiation Motor OD

claim:

Engine being run without

sufficient oil leading to

block.

Surveyor noted that there

was no external damage to

engine, gear box, bumper,

chamber etc. Damage due to

lack of lubrication, beyond

the scope of cover.

Damage due to accident only covered

Established process of claim scrutiny

followed. Another panel surveyor

affirmed the position.

Decision of repudiation upheld.

Insurance Ombudsman Claims/Awards:

Case studies on Misc Policies

IO centre Facts/Insurance Cos stand

on Repudiation

Issues involved Insurance Ombudsmans Reasoning

/Decision

AHD

11/002/0018

Girish

Jethwa

Engg Policy :Repudiation

on the ground of exclusions

in such policy.

Probe is an exchangeable

tool, but not specifically

named to fit the description

in exclusion clause.

Scope of coverage does not

specifically state exclusions

Directed as claim payable, in absence

of clear terms.

Chennai/11/

2/1044

A/C D S

Prabhakar

Householders Policy , with

baggage cover:

Repudiation due to special

exclusion clause.

Scope of cover : Cellphone ,

articles on journey worn or

carried about are excluded

items from baggage

Interpretation : Item does not fall

under category of articles carried in

baggage.

Decision by Insurer upheld

AHD

11/002/002

N K

Ramanathan

Householders Policy

Repudiation due to

exclusion clause.

Washing machine damaged.

Drum jammed. Survey

observed Damage due to

normal wear & tear.

General exception excludes normal

wear & tear.

Decision by Insurer upheld

AHD

11/002/072

V M Patel

Householders Policy

Repudiation due to Scope of

cover / property description

clause.

Damage to swimming pool

due to flood.

Operative clause: Bldg/

Contents of class a

construction

Property described in schedule.

Reference to building is transparent.

Swimming pool is not a part of Bldg

insured.

Decision by Insurer upheld

Insurance Ombudsman Claims/Awards:

Case studies on Fire claims

IO centre Facts/Insurance Cos stand

on Repudiation

Issues involved Insurance Ombudsmans Reasoning

/Decision

BBSR

14/002/0057

Ranjit singh

Quantum dispute: fire at

Godown/shops claim

Surveyor assessed loss

431000 as per a/c books etc

Fire brigade certificate loss

95 000/-

Same amount offered for

settlement

Survey report amount sustainable

Directed claim payable as per

Survey report & not Fire brigade

certificate having no access to a/cs.

HYD

G003/2006/0

7 A/C

K N Rao

Poultry sheds damaged by

cyclone .

Shed damaged beyond

repair claimed fresh thatchs

at roof .

Cause of loss not disputed

Not properly constructed as

per Survey report.

Recommended 20-25% for

repair.

To repair the loss extra material

required more then 50% , practically.

Partly allowed.75% of estimated

amount of claim, fresh thatchs at roof

payable.

Guwhati

14/004/0112

A/C M

Sharma

Quantum dispute: fire at

Shop . Under Insurance.

application of average

clause. Survey report stock

prior to fire, ascertained as

14 lacs but SI was for 8 lacs.

Survey report Rs 66000 /-

without average clause.

Net Loss payable after

application of average

clause & policy excess

deductibles 24,000/-

Ordered for settlement , net loss

payable, as per survey plus lump sum

ex gratia as interest & compensation,

for long delay in settlement.

AHD

11/005/270

U V

Chauhan

Std Fire & Spl perils

policy. House damaged.

Repudiation due to

exclusion clause.

Damage due to heavy rain

Due to water leakage /

seepage by rain water in

first floor & stair room.

Peril causing damage is an excluded

peril, as per coverage.

Decision by Insurer upheld.

Insurance Ombudsman Claims/Awards:

Case studies on Burglary claims

IO centre Facts/Insurance Cos stand

on Repudiation

Issues involved Insurance Ombudsmans Reasoning

/Decision

BBSR11/02/

0056 A/C

T K Mondal

Shop Stock Burglary

Amount claimed as per

stock statement produced

Assessment on the basic of

quantity claimed, but

offered as per Income Tax

documents/ Returns

Order Reasonable : settlement on the

basis of Income Tax documents/

Returns

Chandigarh

25/OIC/11/0

7 J Singh

Shop Stock Burglary

Low boundary wall , no

watch & ward but main

gated locked broken

Violent, visible , forcible

entry pre condition for

admissibility of claim

Loss genuine as per Investigation

Ordered the claim payable

KochiGI/11/

2006-7A/c

Anantharam

an

Shop Stock Burglary

Stock statement/ documents

not produced

Repudiation : Stock records/

documents not produced

Not payable on the basic of

quantity claimed

Cost of stock :difference before &

after the loss, quantified by Surveyor

& CA awarded as payable

Insurance Ombudsman Claims/Awards:

Case studies on PA/JPA claims

IO centre Facts/Insurance Cos stand

on Repudiation

Issues involved Insurance Ombudsmans Reasoning

/Decision

AHD

15/005/170

H C Soni

TTD benefit

Repudiation : Difference in

medical opinion

9 weeks by treating Dr & 6

weeks by referee. Both has

expertise in the field

TTD benefit payable.

Golden mean rule benefit for 6

weeks granted

HYD G-

14/2006-7

G lakshmi

JPA : Deceased brutally

killed by extremists, along

with others suspecting as

police informers.

Police final report issued.

Bodies badly brunt to ashes.

Non settlement in absence

of PMR etc

Insurer did not dispute death &

satisfied on its genuineness.

Directed as claim payable for full SI

along with interest

AHD

11/002/279

B N Babia

TTD benefit settled.

Repudiation of subsequent

PPD claimed.

Policy condition : More then

one sub clause , for same

period is excluded.

Decision by Insurer, to settle on

TTD only upheld.

AHD

11/005/030

K K Bhatia

PA claim

TTD benefit not settled.

Insured injured severally by

vehicular accident

Complainant was treated by

Specialists Recommended at

least 104 weeks TTD/ Very

difficult to access the TTD

Looking into injuries & opinion of

medical referrers benefit awarded for

104 weeks not exceeding the SI.

Case studies on Mediclaims

Insurance Ombudsman Claims/Awards:

IO centre

Facts/Insurance Cos

stand on Repudiation

Issues involved Insurance Ombudsmans

Reasoning /Decision

Chennai

IO/CHN/G-

40/2010-11

S Chandran

Mediclaim :OPD treatment

Repudiation on the ground

of exclusions in such policy

No hospitalization

OPD treatment , not

hospitalized for 24 Hrs

On such condition post-hosp

expenses up to 60 days

payable.

No hospitalization

Policy condition for minimum 24

Hrs as in patient required

Repudiation upheld

Chennai

11/02/1281

M S Velu

Mediclaim : break in policy

for 7 months. Complainant

failed to submit copy of

discharge summary

Any policy commencing

after break in policy,

considered as fresh policy.

Pre existing disease are

exclusions in such policy.

Insurer submitted prior medical

reports advise for further treatment

on the ailment

Repudiation upheld

Chandigarh

101/uii/14/

07 Surinder

Singh

Mediclaim ; Enteric fever,

hospitalized.

Justification sought by TPA

for longer duration

Hospitalized for 11days.

Adm/Discharge summary

clear on the issue.

Harassed on flimsy grounds

A qualified Dr recommend

admission for as specified period.

Period is immaterial & not

questionable.Ordered claim be settled

Chandigarh

81/uii/14/0

7 V K

Nayyer

Mediclaim & OMP for 3

months, for this period

Mediclaim policy not

renewed. Extension for

renewal purpose.

Mediclaim policy not

renewed & subsequently

taken treated as fresh policy.

Both Policy should be taken

from same insurer

Distn between Mediclaim & OMP

unsustainable.

Policy taken from other insurer are

valid for the purpose of continuity

Ordered that claim be settled

Chandigarh

81/uii/14/0

7 Sunita

Rao

Pre-operative x-ray not

submitted. TPA insisted for

Post operative film showing

plating done on the fracture

Treating Dr./Hospital

confirmed mandible

fracture & plating was

done. Holding up the

pending claim unjustified

On the basis of facts &

circumstances, no doubt on the

treatment established it was a case of

fracture as a result of accident

Ordered that claim be settled

Chandigarh

128/nic/14/

07 HC Nair

Insured felt pain in chest

collapsed in office

Hospitalized, for 3 days.

ECG done & advised

admission.

Investigation carried out, no

serious abnormality detected

No positive existence of any

ailment, though initially

appeared to be heart ailment

Repudiated as per policy clause

exclusion 4.10

Investigation shows normal results.

Repudiation upheld.

Chandigarh

119/nic/14/

07 S Mitra

Repudiation as per Panel Dr

opinion , known case of

Atrial Fibrillation &

hypertension. No need for

Hospitalization, no

emergency.

Hospitalized, for I day, as

advised admission, by

treating Dr.

Basic question was

Hospitalization required /not

Hospitalization was not warranted.

As per discharge summary

readjustment , of continuing

mediclaim only & could have

evaluated by ECG only

Complaint dismissed

Chennai

IO/CHN/G-

1058/2006-7

G S Vennkat

raman

Repudiation : Pre existing

disease are exclusions in

policy. Disease/ ailment

which could not develop in

short span of time

Histopathology report

revealed that insured had

papillary carcinoma,

infiltrating perithioridal soft

tissues,

There should be a manifestation by

way of set of symptoms /signs prior

to proposal acceptance.

Insurer failed to establish the same .

Directed to settle the claim.

Chennai

IO/CHN/G-

1037/2006-7

Muralidhar

Mediclaim policy

Repudiation : TPA pointed

that it was for management

of an ailment which was

related to Pre-existing

Patient was Diabetic

Hypertentive for past 20

years. Pre-existing.

Insured met with an

accident & had a blood clot.

Diabetic Hypertention are not the

sole cause of for heart problem ,

controlled by regular medication ..

Heart disease as Proximate cause

could not be conclusively established

exclusions. They may be

one of the contributing

factors among others

Hospitalized, 5 days. They

may be one of contributing

factors among others

by the insurers. Directed to settle the

claim

Hyd G-

030/2006-07

D K Jain

Individual Mediclaim

policy Repudiation :

treatment fall under

exclusion 4(5)

Zyoptix surgery of both the

eyes. Operation was needed

Insureds contention:

No abnormal increase in

refractive error

Insurer obtained an independent

opinion from expert Surgery

undergone falls under

cosmetic/aesthetic treatment. In view

of the evidence Decision upheld.

Kochi

GI/28/206-07

Jayalakhmi

Individual Mediclaim

Repudiation : break for 2

days in renewal. Amt of

renewal premium entrusted

to agent, insured reportedly

unaware of the break

Insurer had not taken a fresh

proposal form

Policy treated a fresh one

Repudiation on Pre-existing

All Insurers have discretion to

condone 7 days delay in renewal.

Insurer should have obtained a fresh

proposal form. Technically break is a

fact , but Insurer is also at lapse.

50% of the claim allowed

Kochi

GI/27/206-07

Anju Manoj

Individual Mediclaim

Repudiation : Treatment for

chicken pox. No facility in

hospital for treatment in

isolation of such patients

Repudiation : domiciliary

treatment, did not satisfy

the requirement laid down

in the policy.

Close examination of record :

Treatment genuine. Dr clarified only

domiciliary treatment possible, for

want of isolation facility in hospital.

IO Directed to honor the claim.

Kochi

GI/24/206-07

V Rajan

Mediclaim policy not

renewed in chain.

Repudiation: Due to break

in renewal & the policy

treated as fresh one.

Thyoriod operation & the

case history cited the

problem as existing for a

period of 3 years.

The records of the case proved that

the disease was pre existing to the

present policy. Insurer justifiable in

repudiation as per policy condition.

Decision upheld, Complaint

dismissed

Kochi

GI/22/206-07

Rashita p

Repudiation. Pre existing

disease. Insurer based their

decision on the opinion of a

panel Dr., that the problem

could have pre existed

for175 days.

Insured contended to be

unaware of the problem as

of Cervical Spondylosis till

the consultation & advise

for hospitalization.

In any case in absence of proper

diagnosis , insured could not be said

to be aware of it .

Directed to settle the claim, subject to

proper verification of bills/

compulsory deductibles

Kochi

GI/21/206-07

K S Pillai

Repudiation. Insurer based

their decision on TPAs

stand that tests conducted

only for diagnosis of

Angioplasty done three

years back.

Angioplasty done three

years back. Admitted again

On evolution of records,

tests were found to be of

continuous treatment of

Angioplasty done earlier.

Contention of Insurer found

erroneous, taking overall view of the

case

Directed to settle the claim, subject to

compulsory deductibles.

Mumbai GI-

036 /2005-06

P Chibbar

Overseas Mediclam

Disclosed diabetics & BP

submitted ECG . Developed

fever, while at Newziland

admitted & claim repudiated

on pre-existing exclusion

Admission note confirmed

that some patient had

Transient ischemic attack.

Some old ischemic changes

consistent with age.

Pre disposing factors are intervened

in a complicated manner & existing

illness played a major part. For a

possible genesis of the disease, which

could be diagonised by test followed

by a package of treatments.

50% of the admissible claim allowed

Insurance Ombudsman Claims/Awards:

Case studies on Group Mediclaims

IO centre

Facts/Insurance Cos

stand on Repudiation

Issues involved Insurance Ombudsmans

Reasoning /Decision

Chandigarh/

GIC/292/NI

A-14/06

Gr Mediclaim :surgery for

Kidny stone removal

Repudiation on the ground

of exclusions :

Pre existing disease

Not only a disease should

be Pre existing, but also

should be in the knowledge

of insured. Clarification by

treating Dr, in discharge

summary past history nil

Imp ingredient of policy condition:

Existence of disease should be in the

knowledge of insured.

Disease not being in the knowledge

of complainant, directed as claim

payable

You might also like

- Vehicle Book3 PDFDocument54 pagesVehicle Book3 PDFAdriya Fellis FurnandaceNo ratings yet

- Vehicle Book4Document100 pagesVehicle Book4suheal007860704No ratings yet

- Rajiv Puri Vs Automobile Kapoor I PVT LTD and Ors RB2017140217153650193COM686934 PDFDocument5 pagesRajiv Puri Vs Automobile Kapoor I PVT LTD and Ors RB2017140217153650193COM686934 PDFSiddharth BhandariNo ratings yet

- G A Sarpong Vrs Silver Star Auto LTD (J4 43 of 2013) 2014 GHASC 121 (15 January 2Document15 pagesG A Sarpong Vrs Silver Star Auto LTD (J4 43 of 2013) 2014 GHASC 121 (15 January 2criskot21No ratings yet

- VSA9079Document3 pagesVSA9079Muhammad Ali BhattiNo ratings yet

- G.R. No. 214122Document6 pagesG.R. No. 214122katNo ratings yet

- Fire Insurance-Case StudyDocument11 pagesFire Insurance-Case StudyMegan White71% (7)

- Objection To Interim Order Approving Customer Agreement Among The Debtors, Their Principal Customers and Jpmorgan Chase Bank, N.A. and Related ReliefDocument30 pagesObjection To Interim Order Approving Customer Agreement Among The Debtors, Their Principal Customers and Jpmorgan Chase Bank, N.A. and Related ReliefChapter 11 DocketsNo ratings yet

- First Appeal ReviewDocument4 pagesFirst Appeal ReviewElla KartheakNo ratings yet

- KD Claim Hander's ManualDocument33 pagesKD Claim Hander's ManualPía NalerioNo ratings yet

- Tata Motors LTD Vs Antonio Paulo Vaz and Ors 18022SC202119022117104010COM384862Document13 pagesTata Motors LTD Vs Antonio Paulo Vaz and Ors 18022SC202119022117104010COM384862giriNo ratings yet

- Vehicle Gen27 PDFDocument46 pagesVehicle Gen27 PDFMOHAN KUMARNo ratings yet

- DORMENYOR v. JOHNSON MOTORS LTD. (1989-90) 2 GLR 145-151Document4 pagesDORMENYOR v. JOHNSON MOTORS LTD. (1989-90) 2 GLR 145-151Hughes100% (4)

- IRDA Lic. No-121271 IIISLA No - L/N/10045 Department - Marine C, Engg., Misc. & MotorDocument6 pagesIRDA Lic. No-121271 IIISLA No - L/N/10045 Department - Marine C, Engg., Misc. & Motorauto scannerNo ratings yet

- Item No. 10 19.02.2023Document2 pagesItem No. 10 19.02.2023isha NagpalNo ratings yet

- National Insurance Co LTD Vs Boghara Polyfab PVT Ls081325COM870551Document20 pagesNational Insurance Co LTD Vs Boghara Polyfab PVT Ls081325COM870551Sidhant WadhawanNo ratings yet

- Claim Intimation ProcessDocument2 pagesClaim Intimation ProcesssksNo ratings yet

- Batliboi Environmental Engineers Limited Vs HindusSC20232209231807572COM682424Document22 pagesBatliboi Environmental Engineers Limited Vs HindusSC20232209231807572COM682424Shreya KumarNo ratings yet

- Virmani RefrigerationDocument3 pagesVirmani RefrigerationGudipi JanardhanNo ratings yet

- Autozentrum vs. Sps. BernardoDocument9 pagesAutozentrum vs. Sps. BernardoGianne Claudette LegaspiNo ratings yet

- 2001 03 23 2001 2 CLJ 609 HJ Ariffin HJ Ismail V Mohamaad Noor Mohammad Ed PDFDocument12 pages2001 03 23 2001 2 CLJ 609 HJ Ariffin HJ Ismail V Mohamaad Noor Mohammad Ed PDFkodi jarvisNo ratings yet

- Claim File ReferralDocument58 pagesClaim File ReferralTsegayeNo ratings yet

- Judgment Karnataka High Court 412085Document16 pagesJudgment Karnataka High Court 412085sarojkumarNo ratings yet

- Arbitration Case StudyDocument28 pagesArbitration Case StudyNilesh GadgeNo ratings yet

- Branch Sum Insured Ajustment MemoDocument1 pageBranch Sum Insured Ajustment MemoTsegayeNo ratings yet

- Review of Valuation Decisions 2019Document22 pagesReview of Valuation Decisions 2019paulartistdingleNo ratings yet

- REPLY in SH. VIJENDER SHOKAND vs. RING ROAD HONDA AND ANR.Document14 pagesREPLY in SH. VIJENDER SHOKAND vs. RING ROAD HONDA AND ANR.Ravi Singh SolankiNo ratings yet

- Management: Claims Manual FOR Gipsa CompaniesDocument28 pagesManagement: Claims Manual FOR Gipsa CompaniesToshang SharmaNo ratings yet

- J 2018 SCC OnLine Del 9096 Anshulasinha Nlujodhpuracin 20211005 181132 1 5Document5 pagesJ 2018 SCC OnLine Del 9096 Anshulasinha Nlujodhpuracin 20211005 181132 1 5Lipika SinglaNo ratings yet

- Autozentrum Alabang, Inc. v. Spouses Bernardo, G.R. No. 214122, June 8, 2016Document14 pagesAutozentrum Alabang, Inc. v. Spouses Bernardo, G.R. No. 214122, June 8, 2016Mak FranciscoNo ratings yet

- Consolidated Construction Consortium Limited Vs SC-2022Document17 pagesConsolidated Construction Consortium Limited Vs SC-2022Samarth AgarwalNo ratings yet

- 202253-2016-Autozentrum Alabang Inc. v. Spouses Bernardo20170704-911-609ony PDFDocument9 pages202253-2016-Autozentrum Alabang Inc. v. Spouses Bernardo20170704-911-609ony PDFJNCNo ratings yet

- ReplevinDocument25 pagesReplevincjoy omaoengNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument8 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCamille CastilloNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument5 pagesBajaj Allianz General Insurance Company LTDRaj GoswamiNo ratings yet

- OgraDocument4 pagesOgraZain ShahabNo ratings yet

- Maverick Motors: Customer Order DescriptionDocument2 pagesMaverick Motors: Customer Order Descriptionanand jeyarajNo ratings yet

- Jimmy Co Vs CaDocument6 pagesJimmy Co Vs CaJoshua L. De JesusNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDAB Block01No ratings yet

- DTI CasesDocument15 pagesDTI CasesKatherine OlidanNo ratings yet

- Company Appeal (AT) (Ins.) No. 1070 of 2022Document15 pagesCompany Appeal (AT) (Ins.) No. 1070 of 2022Surya Veer SinghNo ratings yet

- Union Bank of India Vs Janata Paradise Hotel & Restaurant SolicitorsDocument2 pagesUnion Bank of India Vs Janata Paradise Hotel & Restaurant SolicitorsPriya KantNo ratings yet

- Rs.2,21,153/-. The Said Vehicle Met With An Accident On 11.02.2010 On Account of Rash and NegligentDocument6 pagesRs.2,21,153/-. The Said Vehicle Met With An Accident On 11.02.2010 On Account of Rash and NegligentAnonymous eq1U5a4vCSNo ratings yet

- Dujodwala Products LTD Vs National Insurance Co LtCF202009092016395718COM782781Document6 pagesDujodwala Products LTD Vs National Insurance Co LtCF202009092016395718COM782781NIYATI MOHANTYNo ratings yet

- 2010 - V 15 - Piii PDFDocument169 pages2010 - V 15 - Piii PDFkhushbooNo ratings yet

- KERHCFBDocument30 pagesKERHCFBPratap K.PNo ratings yet

- I. Parties Are Bound by Terms of The Agreement. If Agreement Permits Repossession of Vehicle, The Financier Has A Right of RepossessionDocument63 pagesI. Parties Are Bound by Terms of The Agreement. If Agreement Permits Repossession of Vehicle, The Financier Has A Right of RepossessionkartikNo ratings yet

- Cases 20-23Document27 pagesCases 20-23ALLYN JASPHER BASITNo ratings yet

- Judgment Southern Range Nyanza LTD Vs UNRA & AnotherDocument25 pagesJudgment Southern Range Nyanza LTD Vs UNRA & AnotherNamamm fnfmfdnNo ratings yet

- ASEC Development and Construction Corp. v. Toyota Alabang, Inc., G.R. Nos. 243477-78, (April 27, 2022Document35 pagesASEC Development and Construction Corp. v. Toyota Alabang, Inc., G.R. Nos. 243477-78, (April 27, 2022Gerald MesinaNo ratings yet

- Policy - 2024-04-20T144427.761Document6 pagesPolicy - 2024-04-20T144427.761atulbisht12345No ratings yet

- Written Arguments of SamsungDocument4 pagesWritten Arguments of SamsungElla KartheakNo ratings yet

- SC - Vehicle Overloading No Reason To Deny InsuranceDocument18 pagesSC - Vehicle Overloading No Reason To Deny InsuranceLatest Laws Team100% (1)

- 202253-2016-Autozentrum Alabang Inc. v. Spouses Bernardo20231212-11-294k3vDocument10 pages202253-2016-Autozentrum Alabang Inc. v. Spouses Bernardo20231212-11-294k3vCalista GarciaNo ratings yet

- Layugan vs. IAC G.R. No. 73998 November 14, 1988 Sarmiento, J. Second Division Negligence Res Ipsa Loquitur FactsDocument8 pagesLayugan vs. IAC G.R. No. 73998 November 14, 1988 Sarmiento, J. Second Division Negligence Res Ipsa Loquitur FactsSenri ShimizuNo ratings yet

- Nuclear Power Corp of IndiaDocument9 pagesNuclear Power Corp of IndiaNeha ShanbhagNo ratings yet

- Advent Capital Vs Young - G.R. No. 183018. August 3, 2011Document7 pagesAdvent Capital Vs Young - G.R. No. 183018. August 3, 2011Ebbe DyNo ratings yet

- Resolute Ins. Co. v. Percy Jones, Inc, 198 F.2d 309, 10th Cir. (1952)Document5 pagesResolute Ins. Co. v. Percy Jones, Inc, 198 F.2d 309, 10th Cir. (1952)Scribd Government DocsNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument4 pagesBajaj Allianz General Insurance Company LTDJk DigitNo ratings yet

- The NEC4 Engineering and Construction Contract: A CommentaryFrom EverandThe NEC4 Engineering and Construction Contract: A CommentaryNo ratings yet

- Aviation 1Document10 pagesAviation 1MiraRaiNo ratings yet

- Insurance TerminologyDocument46 pagesInsurance TerminologyMiraRai75% (4)

- THE Consumer Protection ACT, 1986Document16 pagesTHE Consumer Protection ACT, 1986MiraRaiNo ratings yet

- Micro Insurance: Dr. B.R.Roy Manager, Technical Dept, Head OfficeDocument11 pagesMicro Insurance: Dr. B.R.Roy Manager, Technical Dept, Head OfficeMiraRaiNo ratings yet

- Marine Policy in India and TypesDocument16 pagesMarine Policy in India and TypesMiraRaiNo ratings yet

- OmbudsmanDocument14 pagesOmbudsmanMiraRaiNo ratings yet

- Offer Letter From Landlord or LandladyDocument2 pagesOffer Letter From Landlord or LandladyMiraRaiNo ratings yet

- AppealDocument25 pagesAppealMiraRaiNo ratings yet

- 2017b PDFDocument1,241 pages2017b PDFArizaldo Enriquez CastroNo ratings yet

- Tepid Sponge Bath SkillsDocument3 pagesTepid Sponge Bath SkillsDave RondarisNo ratings yet

- An Integrated Socio-Environmental Model of Health and Well-BeingDocument11 pagesAn Integrated Socio-Environmental Model of Health and Well-BeingvictorNo ratings yet

- Long Cases ADocument24 pagesLong Cases Amieraf mesfinNo ratings yet

- Psychopathology Paranoid SchizophreniaDocument2 pagesPsychopathology Paranoid SchizophreniaPrincess Joy T. Catral57% (7)

- Your Doctor Is A Liar! CHOLESTEROL DOES NOT CAUSE HEART DISEASE!Document566 pagesYour Doctor Is A Liar! CHOLESTEROL DOES NOT CAUSE HEART DISEASE!greensmokee276100% (14)

- A Review On Ayurvedic Medicinal Herbs As Remedial Perspective For COVID-19Document21 pagesA Review On Ayurvedic Medicinal Herbs As Remedial Perspective For COVID-19Prabhat KcNo ratings yet

- Milady 9781439059302 ch22Document22 pagesMilady 9781439059302 ch22Mais Omer100% (2)

- Acc ArshaDocument27 pagesAcc ArshaSaurabh Singh RajputNo ratings yet

- MADRSDocument2 pagesMADRSJessica Mae100% (1)

- Jama Mederos 2021 RV 200014 1655494806.72368Document9 pagesJama Mederos 2021 RV 200014 1655494806.72368Soni CollinNo ratings yet

- Acne VulgarisDocument58 pagesAcne VulgarisNargisNo ratings yet

- List of Vendors/Suppliers For Raw Material Related To AYUSH-64Document2 pagesList of Vendors/Suppliers For Raw Material Related To AYUSH-64KumarNo ratings yet

- Reten Bulanan BPKK KKPB 2023Document11 pagesReten Bulanan BPKK KKPB 2023Kanageswaran GaneshNo ratings yet

- Diabetic FootDocument4 pagesDiabetic FootSyurahbil Abdul Halim100% (1)

- Pulmonary Function Test: By: Alfaro, Ruby Jane SDocument13 pagesPulmonary Function Test: By: Alfaro, Ruby Jane SgjevamNo ratings yet

- Critique of CBT 2007 Richard J. Longmore & Michael WorrellDocument15 pagesCritique of CBT 2007 Richard J. Longmore & Michael WorrellCarpenle100% (1)

- Emergency First Aid Made Easy Training PresentationDocument92 pagesEmergency First Aid Made Easy Training PresentationRyan-Jay AbolenciaNo ratings yet

- 11 Postnatal Care of The Mother and NewbornDocument15 pages11 Postnatal Care of The Mother and NewbornArabelle GO100% (1)

- Penilaian LP Dan Resume Kasus GadarDocument6 pagesPenilaian LP Dan Resume Kasus GadarPIPIT PUSPITA PERMANANo ratings yet

- Part One - (Questions 1 - 10) : 1 Test 7Document7 pagesPart One - (Questions 1 - 10) : 1 Test 7SuliemanNo ratings yet

- Examination of The Knee Joint - RP's Ortho NotesDocument3 pagesExamination of The Knee Joint - RP's Ortho NotesSabari NathNo ratings yet

- MOPIA Training Manual Official VersionDocument134 pagesMOPIA Training Manual Official VersionCvijic DejanNo ratings yet

- Bacteria, Virus, Chlamydia, Rickettsia, Mycoplasma, Parasite, Toxin, PoisonsDocument5 pagesBacteria, Virus, Chlamydia, Rickettsia, Mycoplasma, Parasite, Toxin, PoisonsNerdyPotatoNo ratings yet

- Body Fluids and Circulation (1) MMMDocument52 pagesBody Fluids and Circulation (1) MMMRjNo ratings yet

- 3 - Risk assemt.-DB & SMPDocument4 pages3 - Risk assemt.-DB & SMPAraf KalamNo ratings yet

- Bosniak Classification For Complex RenalDocument6 pagesBosniak Classification For Complex RenalraduNo ratings yet

- Pathophysiology-Ng Hirschsprung DiseaseDocument3 pagesPathophysiology-Ng Hirschsprung DiseaseJan Rae Barnatia AtienzaNo ratings yet

- Cervical Polyps - Causes - Symptoms - Management - TeachMeObGynDocument2 pagesCervical Polyps - Causes - Symptoms - Management - TeachMeObGynmohanNo ratings yet

- Vaers Data Use Guide: 1. Important Information About VAERSDocument17 pagesVaers Data Use Guide: 1. Important Information About VAERSMalu HadassaNo ratings yet