Professional Documents

Culture Documents

Vintola V Insular Bank

Uploaded by

Jillian BatacOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vintola V Insular Bank

Uploaded by

Jillian BatacCopyright:

Available Formats

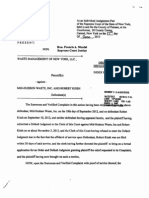

VINTOLA v INSULAR BANK

150 SCRA578

FACTS:

Spouses Vintola (VINTOLAS) applied for and were granted a domestic letter of credit by the

Insular Bank of Asia and America (IBAA). The Letter of Credit authorized the bank to negotiate for their

account drafts drawn by their supplier, one Stalin Tan, on Dax Kin International for the purchase of puka

and olive seashells.

VINTOLAS received from Stalin Tan the puka and olive shells and executed a Trust Receipt

Agreement with IBAA. Under that Agreement, the VINTOLAS agreed to hold the goods in

trust for IBAA as the "latter's property with liberty to sell the same for its account, " and "incase of sale" to

turn over the proceeds.

Having defaulted on their obligation, IBAA demanded payment from the VINTOLAS. The

VINTOLAS, who were unable to dispose of the shells, responded by offering to return thegoods. IBAA

refused to accept the merchandise, and due to the continued refusal of the VINTOLAS to make good their

undertaking, IBAA charged them with Estafa for havingmisappropriated, misapplied and converted for

their own personal use and benefit theaforesaid goods.

The trial court acquitted the VINTOLAS of the offense charged. IBAA commenced a civil action to

recover the value of the goods. The court dismissed the case holding that the complaint was barred by the

judgment of acquittal in the criminal case.

ISSUE:

Whether or not acquittal from criminal offense extinguish civil liability?

HELD:

A letter of credit-trust receipt arrangement is endowed with its own distinctive features and

characteristics. Under that set-up, a bank extends a loan covered by the Letter of Credit, with the trust

receipt as a security for the loan. In other words, the transaction involves a loan feature represented

by the letter of credit, and a security feature which is in the covering trust receipt.

A trust receipt, therefore, is a security agreement, pursuant to which a bank acquires a "security

interest" in the goods. "It secures an indebtedness and there can be no such thing

as security interest that secures no obligation."

IBAA did not become the real owner of the goods. It was merely the holder of a security title

for the advances it had made to the VINTOLAS The goods the VINTOLAS had purchased through IBAA

financing remain their own property and they hold it at their own risk. The trust receipt arrangement

did not convert the IBAA into an investor; the latter remained a lender and creditor.

The foregoing premises considered, it follows that the acquittal of the VINTOLAS in the

Estafa case is no bar to the institution of a civil action for collection. It is inaccurate for the

VINTOLAS to claim that the judgment in the estafa case had declared that the facts from which the civil

action might arise, did not exist, for, it will be recalled that the decision of acquittal expressly declared

that "the remedy of the Bank is civil and not criminal in nature."

The VINTOLAS are liable ex contractu for breach of the Letter of Credit Trust Receipt, whether

they did or they did not "misappropriate, misapply or convert" the merchandise as charged in the criminal

case. Their civil liability does not arise ex delicto, the action for the recovery of which would have been

deemed instituted with the criminal-action (unless waived or reserved) and where acquittal based on a

judicial declaration that the criminal acts charged do not exist would have extinguished the civil action.

Rather, the civil suit instituted by IBAA is based ex contractu and as such is distinct and independent

from any criminal proceedings and may proceed regardless of the result of the latter.

You might also like

- Trust Receipts Secure RTMC's Loan ObligationsDocument1 pageTrust Receipts Secure RTMC's Loan ObligationsGSS100% (1)

- NG V People DigestDocument1 pageNG V People DigestRobynne LopezNo ratings yet

- DBP vs. Guarina Agricultural Ruling on Loan ForeclosureDocument5 pagesDBP vs. Guarina Agricultural Ruling on Loan ForeclosurePatricia Anne SorianoNo ratings yet

- Bank of Commerce Vs Serrano DigestDocument1 pageBank of Commerce Vs Serrano DigestLove Dela CruzNo ratings yet

- RTMC Liable for Loan Payments Despite Warehouse Fire Destroying GoodsDocument1 pageRTMC Liable for Loan Payments Despite Warehouse Fire Destroying GoodsTeff QuibodNo ratings yet

- Land Dispute Between Buyer and Sellers Over Pacto De Retro AgreementsDocument7 pagesLand Dispute Between Buyer and Sellers Over Pacto De Retro AgreementsRen ConchaNo ratings yet

- B11 Allied Banking Corporation V Lim Sio WanDocument3 pagesB11 Allied Banking Corporation V Lim Sio WanJ CaparasNo ratings yet

- PNB v. Noah's Ark Sugar RefineryDocument3 pagesPNB v. Noah's Ark Sugar RefineryBrooke Young100% (2)

- Case Digest NIL - Without Rigor YetDocument3 pagesCase Digest NIL - Without Rigor YetKik EtcNo ratings yet

- 42 Ictsi v. Fgu Insurance Corporation (Lorenzo)Document2 pages42 Ictsi v. Fgu Insurance Corporation (Lorenzo)Mico Lrz100% (1)

- Hur Tin Yang vs. People of the Philippines rulingDocument2 pagesHur Tin Yang vs. People of the Philippines rulingJovanni Christian Duarte PlaterosNo ratings yet

- SPCL Case DigestsDocument191 pagesSPCL Case DigestsPaul Angelo TombocNo ratings yet

- Philippine Banking Corporation Liable for Officer's FraudDocument2 pagesPhilippine Banking Corporation Liable for Officer's FraudmelvieagustinNo ratings yet

- Revisiting Legal and Judicial Ethics, Challenges and PerspectivesDocument10 pagesRevisiting Legal and Judicial Ethics, Challenges and PerspectivesninoNo ratings yet

- 19 Chugani Vs PDICDocument2 pages19 Chugani Vs PDICJoshua Erik MadriaNo ratings yet

- Aguilar v. Lightbringers Credit CooperativeDocument2 pagesAguilar v. Lightbringers Credit Cooperativeat0% (1)

- MWSS V DawayDocument2 pagesMWSS V DawayPerry Rubio100% (1)

- Prudential Bank Vs NLRCDocument1 pagePrudential Bank Vs NLRCReggie Llanto100% (1)

- V. HSBC Vs National Steel Corp.Document1 pageV. HSBC Vs National Steel Corp.Angelica Joyce Belen50% (2)

- Supreme Court upholds high interest rates as unconscionable in loan casesDocument7 pagesSupreme Court upholds high interest rates as unconscionable in loan casesAlman-Najar NamlaNo ratings yet

- Baraoidan Pat-DigestDocument9 pagesBaraoidan Pat-DigestJohn Paul Dumaguin Castro0% (1)

- Insolvency Law - Stay Order - Negros Navigation V CADocument2 pagesInsolvency Law - Stay Order - Negros Navigation V CAKatch Roraldo100% (1)

- Gilat Satellite Networks, Ltd. vs. UCPBDocument4 pagesGilat Satellite Networks, Ltd. vs. UCPBJeffrey MedinaNo ratings yet

- Villanueva v. IpondoDocument1 pageVillanueva v. IpondoMigz Dimayacyac100% (2)

- FEATI Bank V CADocument2 pagesFEATI Bank V CAPerry RubioNo ratings yet

- PHILAMGEN vs SWEET LINES cargo disputeDocument2 pagesPHILAMGEN vs SWEET LINES cargo disputeFelyDiloyNo ratings yet

- POSITOS Vs CHUA (ADR)Document1 pagePOSITOS Vs CHUA (ADR)Joseph AspiNo ratings yet

- Court voids rental rate changes in rehabilitation planDocument2 pagesCourt voids rental rate changes in rehabilitation planRomNo ratings yet

- Equitable Banking Corporation v. Intermediate Appelate Court G.R. No. 74451Document4 pagesEquitable Banking Corporation v. Intermediate Appelate Court G.R. No. 74451Roms RoldanNo ratings yet

- Philippine Savings Bank's registered mortgage has priority over architect's unregistered lienDocument1 pagePhilippine Savings Bank's registered mortgage has priority over architect's unregistered lienkimuchosNo ratings yet

- Carbonell v. Metropolitan Bank ruling on gross negligence and moral damagesDocument2 pagesCarbonell v. Metropolitan Bank ruling on gross negligence and moral damagesbantucin davooNo ratings yet

- Code of Commerce and Ra 8792Document10 pagesCode of Commerce and Ra 8792carlo_tabangcuraNo ratings yet

- Transfield v. Luzon Hydro Corp DIGESTDocument3 pagesTransfield v. Luzon Hydro Corp DIGESTkathrynmaydeveza100% (5)

- Ong V PcibDocument2 pagesOng V PcibKaye100% (1)

- Bank of America Vs CADocument2 pagesBank of America Vs CAVebsie D. Molavin100% (1)

- Land Bank of The Philippines V. Ramon P. Jacinto G.R. No. 154622, 3 August, 2010, THIRD DIVISION, (Villarama, Jr. J.) Doctrine of The CaseDocument8 pagesLand Bank of The Philippines V. Ramon P. Jacinto G.R. No. 154622, 3 August, 2010, THIRD DIVISION, (Villarama, Jr. J.) Doctrine of The CaseKarl CabarlesNo ratings yet

- HSBC liable under LC despite buyer's refusalDocument4 pagesHSBC liable under LC despite buyer's refusalearlanthonyNo ratings yet

- Pando v. Gimenez AntichresisDocument1 pagePando v. Gimenez AntichresisMariel QuinesNo ratings yet

- HSBC V Natl Steel CorpDocument4 pagesHSBC V Natl Steel CorpFrancis Kyle Cagalingan SubidoNo ratings yet

- Santos vs. Pizardo, GR No. 151452Document1 pageSantos vs. Pizardo, GR No. 151452John Roel VillaruzNo ratings yet

- 8 BPI V DE RENYDocument1 page8 BPI V DE RENYErika Mariz CunananNo ratings yet

- Republic of The Philippines, Represented by The Anti-Money Laundering Council v. First Pacific Network Inc. DIGESTDocument2 pagesRepublic of The Philippines, Represented by The Anti-Money Laundering Council v. First Pacific Network Inc. DIGESTroquesa burayNo ratings yet

- Jalbay Vs PNBDocument2 pagesJalbay Vs PNBRam PagongNo ratings yet

- Aclon Vs CADocument1 pageAclon Vs CALorenz LuistroNo ratings yet

- Banco de Oro-Epci, Inc. vs. Japrl Development Corporation, Rapid Forming Corporation and Jose U. Arollado G.R. No. 179901 April 14, 2008 FactsDocument2 pagesBanco de Oro-Epci, Inc. vs. Japrl Development Corporation, Rapid Forming Corporation and Jose U. Arollado G.R. No. 179901 April 14, 2008 FactsAdi LimNo ratings yet

- Bank of America vs. Philippine Racing ClubDocument2 pagesBank of America vs. Philippine Racing ClubJDR JDRNo ratings yet

- San Miguel Brewery v. Law Union Rock Insurance Co. - Mortgagee Insurance DisputeDocument5 pagesSan Miguel Brewery v. Law Union Rock Insurance Co. - Mortgagee Insurance Disputedeuce scriNo ratings yet

- Jaime v. Salvador loan transaction disputeDocument2 pagesJaime v. Salvador loan transaction disputeKaren Ryl Lozada BritoNo ratings yet

- DORIS MARIE S. LOPEZ vs ANICETO G. SALUDO, JRDocument2 pagesDORIS MARIE S. LOPEZ vs ANICETO G. SALUDO, JRUrsula MedinaNo ratings yet

- Boston Bank V Manalo - : Gr. No. 158149Document2 pagesBoston Bank V Manalo - : Gr. No. 158149Anonymous C5NWrY62No ratings yet

- Affidavit of LossDocument1 pageAffidavit of LosslollyNo ratings yet

- Letters of Credit - Digest - Insular Bank of Asia V IacDocument2 pagesLetters of Credit - Digest - Insular Bank of Asia V IacErika Mariz Cunanan100% (1)

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Document4 pagesCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocNo ratings yet

- Isidro V CADocument1 pageIsidro V CAbhieng062002No ratings yet

- Bank Loans Remain Despite Receivables AssignmentDocument4 pagesBank Loans Remain Despite Receivables AssignmentKim Lorenzo CalatravaNo ratings yet

- Calma v. Lahica DigestDocument2 pagesCalma v. Lahica DigestkathrynmaydevezaNo ratings yet

- Legal Rights in Property Transfer DisputeDocument4 pagesLegal Rights in Property Transfer DisputeYPENo ratings yet

- Vintola V Insular Bank of Asia and America 150 Scra 140Document2 pagesVintola V Insular Bank of Asia and America 150 Scra 140MylesNo ratings yet

- Spouses Vintola V Insular Bank of America (IBAA)Document2 pagesSpouses Vintola V Insular Bank of America (IBAA)Candelaria QuezonNo ratings yet

- NEGO Trust Receipts Law: Emergency RecitDocument8 pagesNEGO Trust Receipts Law: Emergency RecityassercarlomanNo ratings yet

- 2015 Download Cover For RegistrationDocument1 page2015 Download Cover For RegistrationRegina MuellerNo ratings yet

- Air Philippines Corporation Vs Pennswell, Inc. 540 Scra 215 (2007)Document3 pagesAir Philippines Corporation Vs Pennswell, Inc. 540 Scra 215 (2007)Jillian BatacNo ratings yet

- Trademark Application in IPO PhilippinesDocument1 pageTrademark Application in IPO PhilippinesJillian BatacNo ratings yet

- 2015 Download Cover For RegistrationDocument1 page2015 Download Cover For RegistrationRegina MuellerNo ratings yet

- Commercial Credit Corporation Cdo Vs CA (1989)Document2 pagesCommercial Credit Corporation Cdo Vs CA (1989)Jillian BatacNo ratings yet

- Heirs of Crisanta Vs CADocument1 pageHeirs of Crisanta Vs CAJillian BatacNo ratings yet

- Gaite Vs Fonacier 2SCRA 830 (1961)Document2 pagesGaite Vs Fonacier 2SCRA 830 (1961)Jillian Batac100% (1)

- Conflict of Laws Bar QuestionsDocument11 pagesConflict of Laws Bar QuestionsJillian Batac100% (3)

- Joint Affidavit LegitimationDocument1 pageJoint Affidavit Legitimationcat_hermosoNo ratings yet

- Manzano Vs CADocument16 pagesManzano Vs CANivla YacadadNo ratings yet

- Mcdonald's Corporation v. Macjoy (2007)Document2 pagesMcdonald's Corporation v. Macjoy (2007)Jillian Batac100% (2)

- Escueta Vs FandalianDocument3 pagesEscueta Vs FandalianJillian BatacNo ratings yet

- CMO-20-2000 of BOCDocument5 pagesCMO-20-2000 of BOCJillian BatacNo ratings yet

- Bir RR 16-2011Document4 pagesBir RR 16-2011ATTY. R.A.L.C.100% (1)

- Kapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas, Inc. vs. Tan, 163 SCRA 371 (1988)Document16 pagesKapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas, Inc. vs. Tan, 163 SCRA 371 (1988)Jillian BatacNo ratings yet

- KHO Vs CADocument1 pageKHO Vs CAJillian BatacNo ratings yet

- Chavez vs. Ongpin, 186 SCRA 331 (1990)Document10 pagesChavez vs. Ongpin, 186 SCRA 331 (1990)Jillian BatacNo ratings yet

- Torts 45 ALR4th 289Document10 pagesTorts 45 ALR4th 289Jillian BatacNo ratings yet

- VAT CasesDocument97 pagesVAT CasesJillian BatacNo ratings yet

- Kapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas, Inc. vs. Tan, 163 SCRA 371 (1988)Document16 pagesKapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas, Inc. vs. Tan, 163 SCRA 371 (1988)Jillian BatacNo ratings yet

- (Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFDocument6 pages(Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFJillian BatacNo ratings yet

- (Associated Bank vs. Pronstroller, 558 SCRA 113 (2008) )Document22 pages(Associated Bank vs. Pronstroller, 558 SCRA 113 (2008) )Jillian BatacNo ratings yet

- Sea Commercial Company, Inc. vs. Court of Appeals, 319 SCRA 210, November 25, 1999Document14 pagesSea Commercial Company, Inc. vs. Court of Appeals, 319 SCRA 210, November 25, 1999KPPNo ratings yet

- (Globe Mackay Cable and Radio Corp. vs. Court of Appeals, 176 SCRA 778 (1989) )Document14 pages(Globe Mackay Cable and Radio Corp. vs. Court of Appeals, 176 SCRA 778 (1989) )Jillian BatacNo ratings yet

- Hung Vs BFI Card Finance CorpDocument7 pagesHung Vs BFI Card Finance CorpJillian BatacNo ratings yet

- China Banking Corporation, Petitioner, Vs CADocument16 pagesChina Banking Corporation, Petitioner, Vs CAJillian BatacNo ratings yet

- Consing JR Vs PeopleDocument7 pagesConsing JR Vs PeopleJillian BatacNo ratings yet

- Loyola Grand Villas v. CADocument10 pagesLoyola Grand Villas v. CAdani_g12No ratings yet

- (Social Security System vs. Davac, Et Al., 17 SCRA 863 (1966) )Document7 pages(Social Security System vs. Davac, Et Al., 17 SCRA 863 (1966) )Jillian BatacNo ratings yet

- Andela Fellows Employment Agreement Jan 2016-5-15Document16 pagesAndela Fellows Employment Agreement Jan 2016-5-15Olalekan Sogunle100% (1)

- Civil Rights Movement in AmericaDocument6 pagesCivil Rights Movement in AmericaDENNIS MOKAYANo ratings yet

- Contract of Service For Sir JerryDocument3 pagesContract of Service For Sir JerryGiles Daya50% (2)

- Revocation of IGPA 3Document7 pagesRevocation of IGPA 3safiuloo7No ratings yet

- Strengthening Charleston Preliminary Report PDFDocument64 pagesStrengthening Charleston Preliminary Report PDFLive 5 NewsNo ratings yet

- CA Reinstates MeTC Ruling in Unlawful Detainer CaseDocument15 pagesCA Reinstates MeTC Ruling in Unlawful Detainer CaseAl SimbajonNo ratings yet

- PFR-CASES OdtDocument50 pagesPFR-CASES OdtJims DadulaNo ratings yet

- "Kulbhushan Jadhav Case": ASE NalysisDocument22 pages"Kulbhushan Jadhav Case": ASE Nalysisharsh sahuNo ratings yet

- PDS Sandrex AlbinoDocument3 pagesPDS Sandrex AlbinoAileen PeñafilNo ratings yet

- FIDIC Harmonized Edition Brief ExplanationDocument2 pagesFIDIC Harmonized Edition Brief ExplanationreezaNo ratings yet

- Order of Dismissal: Metc/Mtcc/Mtc/Mctc Case No. RTC For Court Use OnlyDocument2 pagesOrder of Dismissal: Metc/Mtcc/Mtc/Mctc Case No. RTC For Court Use OnlypolbisenteNo ratings yet

- Admin Toledo Vs CSCDocument11 pagesAdmin Toledo Vs CSCLynne SanchezNo ratings yet

- McAteer v. Riley Et Al (INMATE1) - Document No. 3Document4 pagesMcAteer v. Riley Et Al (INMATE1) - Document No. 3Justia.comNo ratings yet

- Ramaphosa Amends State Capture Inquiry RegulationDocument6 pagesRamaphosa Amends State Capture Inquiry RegulationErin Marisa BatesNo ratings yet

- Supreme Court: Lawphi1.nêtDocument7 pagesSupreme Court: Lawphi1.nêtAnne Sherly OdevilasNo ratings yet

- Affidavit of Discharge and Tender of Payment AcknowledgementDocument5 pagesAffidavit of Discharge and Tender of Payment Acknowledgementsalim bey96% (26)

- 516 Supreme Court Reports Annotated: Mirpuri vs. Court of AppealsDocument39 pages516 Supreme Court Reports Annotated: Mirpuri vs. Court of AppealsVKNo ratings yet

- 09-Bellis v. Bellis G.R. No. L-23678 June 6, 1967Document3 pages09-Bellis v. Bellis G.R. No. L-23678 June 6, 1967kc lovessNo ratings yet

- The Weirdo Book ReportDocument2 pagesThe Weirdo Book ReportJumar Basco100% (1)

- Is 325 2019Document128 pagesIs 325 2019John LiebermanNo ratings yet

- Excess and Umbrella InsuranceDocument3 pagesExcess and Umbrella InsurancemaryamfarqNo ratings yet

- Release waiver internshipDocument2 pagesRelease waiver internshipJOSSA MARIE CUBILLONo ratings yet

- Destination Packages Package Name Class Name: QuestionsDocument6 pagesDestination Packages Package Name Class Name: QuestionsPradeep RajasekeranNo ratings yet

- Licensee'S Reply in Support of Its Motion For Summary JUDGMENT DOCKET NO.: 08-2021-LCB-00997 - Page 1Document19 pagesLicensee'S Reply in Support of Its Motion For Summary JUDGMENT DOCKET NO.: 08-2021-LCB-00997 - Page 1Christopher KingNo ratings yet

- 2009OpinionNo09 17Document4 pages2009OpinionNo09 17Paolo Ervin PerezNo ratings yet

- Robert Kissh Judgement For $37,503Document3 pagesRobert Kissh Judgement For $37,503Hudson Valley Reporter- PutnamNo ratings yet

- MPs' Attendance RecordsDocument3 pagesMPs' Attendance RecordsSamuelNo ratings yet

- Pagcor Vs BirDocument1 pagePagcor Vs BirMarife MinorNo ratings yet

- DC2021-0374 For Web PostingDocument8 pagesDC2021-0374 For Web PostingSbl IrvNo ratings yet

- Marital Rape in IndiaDocument4 pagesMarital Rape in IndiaYuktaNo ratings yet