Professional Documents

Culture Documents

Gov. Influence On Exchange Rates

Uploaded by

saminbdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gov. Influence On Exchange Rates

Uploaded by

saminbdCopyright:

Available Formats

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 1

Chapter 6

Government Influence

On Exchange Rates

Chapter 6

Government Influence

On Exchange Rates

Exchange Rate Systems

Exchange rate systems can be classified

according to the degree to which the rates

are controlled by the government.

Exchange rate systems normally fall into one

of the following categories:

fixed

freely floating

managed float

pegged

In a fixed exchange rate system, exchange

rates are either held constant or allowed to

fluctuate only within very narrow bands.

The Bretton Woods era (1944-1971) fixed

each currencys value in terms of gold.

The 1971 Smithsonian Agreement which

followed merely adjusted the exchange rates

and expanded the fluctuation boundaries. The

system was still fixed.

Fixed

Exchange Rate System

Pros: Work becomes easier for the MNCs.

Cons: Governments may revalue their

currencies. In fact, the dollar was devalued

more than once after the U.S. experienced

balance of trade deficits.

Cons: Each country may become more

vulnerable to the economic conditions in

other countries.

Fixed

Exchange Rate System

In a freely floating exchange rate system,

exchange rates are determined solely by

market forces.

Pros: Each country may become more

insulated against the economic problems in

other countries.

Pros: Central bank interventions that may

affect the economy unfavorably are no longer

needed.

Freely Floating

Exchange Rate System

Pros: Governments are not restricted by

exchange rate boundaries when setting new

policies.

Pros: Less capital flow restrictions are

needed, thus enhancing the efficiency of the

financial market.

Freely Floating

Exchange Rate System

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 2

Cons: MNCs may need to devote substantial

resources to managing their exposure to

exchange rate fluctuations.

Cons: The country that initially experienced

economic problems (such as high inflation,

increasing unemployment rate) may have its

problems compounded.

Freely Floating

Exchange Rate System

In a managed (or dirty) float exchange rate

system, exchange rates are allowed to move

freely on a daily basis and no official

boundaries exist. However, governments may

intervene to prevent the rates from moving

too much in a certain direction.

Cons: A government may manipulate its

exchange rates such that its own country

benefits at the expense of others.

Managed Float

Exchange Rate System

In a pegged exchange rate system, the home

currencys value is pegged to a foreign

currency or to some unit of account, and

moves in line with that currency or unit

against other currencies.

The European Economic Communitys snake

arrangement (1972-1979) pegged the

currencies of member countries within

established limits of each other.

Pegged

Exchange Rate System

The European Monetary System which

followed in 1979 held the exchange rates of

member countries together within specified

limits and also pegged them to a European

Currency Unit (ECU) through the exchange

rate mechanism (ERM).

The ERM experienced severe problems in

1992, as economic conditions and goals

varied among member countries.

Pegged

Exchange Rate System

In 1994, Mexicos central bank pegged the

peso to the U.S. dollar, but allowed a band

within which the pesos value could fluctuate

against the dollar.

By the end of the year, there was

substantial downward pressure on the

peso, and the central bank allowed the

peso to float freely. The Mexican peso

crisis had just began ...

Pegged

Exchange Rate System

Currency Boards

A currency board is a system for maintaining

the value of the local currency with respect to

some other specified currency.

For example, Hong Kong has tied the value of

the Hong Kong dollar to the U.S. dollar

(HK$7.8 = $1) since 1983, while Argentina

has tied the value of its peso to the U.S.

dollar (1 peso = $1) since 1991.

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 3

Currency Boards

For a currency board to be successful, it must

have credibility in its promise to maintain the

exchange rate.

It has to intervene to defend its position

against the pressures exerted by economic

conditions, as well as by speculators who are

betting that the board will not be able to

support the specified exchange rate.

Exposure of a Pegged Currency to

Interest Rate Movements

A country that uses a currency board does

not have complete control over its local

interest rates, as the rates must be aligned

with the interest rates of the currency to which

the local currency is tied.

Note that the two interest rates may not be

exactly the same because of different risks.

A currency that is pegged to another currency

will have to move in tandem with that

currency against all other currencies.

So, the value of a pegged currency does not

necessarily reflect the demand and supply

conditions in the foreign exchange market,

and may result in uneven trade or capital

flows.

Exposure of a Pegged Currency to

Exchange Rate Movements

Dollarization

Dollarization refers to the replacement of a

local currency with U.S. dollars.

Dollarization goes beyond a currency board,

as the country no longer has a local currency.

For example, Ecuador implemented

dollarization in 2000.

A Single European Currency

In 1991, the Maastricht treaty called for a

single European currency. On Jan 1, 1999,

the euro was adopted by Austria, Belgium,

Finland, France, Germany, Ireland, Italy,

Luxembourg, Netherlands, Portugal, and

Spain. Greece joined the system in 2001.

By 2002, the national currencies of the 12

participating countries will be withdrawn and

completely replaced with the euro.

Within the euro-zone, cross-border trade and

capital flows will occur without the need to

convert to another currency.

European monetary policy is also

consolidated because of the single money

supply. The Frankfurt-based European

Central Bank (ECB) is responsible for setting

the common monetary policy.

A Single European Currency

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 4

The ECB aims to control inflation in the

participating countries and to stabilize the

euro within reasonable boundaries.

The common monetary policy may eventually

lead to more political harmony.

Note that each participating country may have

to rely on its own fiscal policy (tax and

government expenditure decisions) to help

solve local economic problems.

A Single European Currency

As currency movements among the European

countries will be eliminated, there should be

an increase in all types of business

arrangements, more comparable product

pricing, and more trade flows.

It will also be easier to compare and conduct

valuations of firms across the participating

European countries.

A Single European Currency

Stock and bond prices will also be more

comparable and there should be more cross-

border investing. However, non-European

investors may not achieve as much

diversification as in the past.

Exchange rate risk and foreign exchange

transaction costs within the euro-zone will be

eliminated, while interest rates will have to be

similar.

A Single European Currency

Since its introduction in 1999, the euro has

declined against many currencies.

This weakness was partially attributed to

capital outflows from Europe, which was in

turn partially attributed to a lack of confidence

in the euro.

Some countries had ignored restraint in favor

of resolving domestic problems, resulting in a

lack of solidarity.

A Single European Currency

/

/$

/100

/SwF (Swiss Franc)

s

t

r

e

n

g

t

h

e

n

s

w

e

a

k

e

n

s

Government Intervention

Each country has a government agency

(called the central bank) that may intervene in

the foreign exchange market to control the

value of the countrys currency.

In the United States, the Federal

Reserve System (Fed) is the

central bank.

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 5

Government Intervention

Central banks manage exchange rates

to smooth exchange rate movements,

to establish implicit exchange rate

boundaries, and/or

to respond to temporary disturbances.

Often, intervention is overwhelmed by market

forces. However, currency movements may

be even more volatile in the absence of

intervention.

Direct intervention refers to the exchange of

currencies that the central bank holds as

reserves for other currencies in the foreign

exchange market.

Direct intervention is usually most effective

when there is a coordinated effort among

central banks.

Government Intervention

Government Intervention

Quantity of

S

1

D

1

D

2

Value

of

V

1

V

2

Fed exchanges $ for

to strengthen the

Quantity of

S

2

D

1

Value

of

V

2

V

1

Fed exchanges for $

to weaken the

S

1

When a central bank intervenes in the foreign

exchange market without adjusting for the

change in money supply, it is said to engaged

in nonsterilized intervention.

In a sterilized intervention, Treasury securities

are purchased or sold at the same time to

maintain the money supply.

Government Intervention

Nonsterilized Intervention

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To

Strengthen

the C$:

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To Weaken

the C$:

Sterilized Intervention

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To

Strengthen

the C$:

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To Weaken

the C$:

$

Financial

institutions

that invest

in Treasury

securities

T- securities

Financial

institutions

that invest

in Treasury

securities

$

T- securities

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 6

Some speculators attempt to determine when

the central bank is intervening, and the extent

of the intervention, in order to capitalize on

the anticipated results of the intervention

effort.

Government Intervention

Central banks can also engage in indirect

intervention by influencing the factors that

determine the value of a currency.

For example, the Fed may attempt to

increase interest rates (and hence boost the

dollars value) by reducing the U.S. money

supply.

Note that high interest rates adversely

affects local borrowers.

Government Intervention

Governments may also use foreign exchange

controls (such as restrictions on currency

exchange) as a form of indirect intervention.

Government Intervention Exchange Rate Target Zones

Many economists have criticized the present

exchange rate system because of the wide

swings in the exchange rates of major

currencies.

Some have suggested that target zones be

used, whereby an initial exchange rate will be

established with specific boundaries (that are

wider than the bands used in fixed exchange

rate systems).

Exchange Rate Target Zones

The ideal target zone should allow rates to

adjust to economic factors without causing

wide swings in international trade and fear in

the financial markets.

However, the actual result may be a system

no different from what exists today.

Intervention as a Policy Tool

Like tax laws and money supply, the

exchange rate is a tool which a government

can use to achieve its desired economic

objectives.

A weak home currency can stimulate foreign

demand for products, and hence local jobs.

However, it may also lead to higher inflation.

Madura: International Financial Management Chapter 6

South-Western/Thomson Learning 2003 Page 6 - 7

Intervention as a Policy Tool

A strong currency may cure high inflation,

since the intensified foreign competition

should cause domestic producers to refrain

from increasing prices. However, it may also

lead to higher unemployment.

Impact of Government Actions on Exchange Rates

Government Intervention in

Foreign Exchange Market

Government Monetary

and Fiscal Policies

Relative Interest

Rates

Relative Inflation

Rates

Relative National

Income Levels

International

Capital Flows

Exchange Rates

International

Trade

Tax Laws,

etc.

Quotas,

Tariffs, etc.

Government

Purchases & Sales

of Currencies

Impact of Central Bank Intervention

on an MNCs Value

E (CF

j,t

) = expected cash flows in currency j to be received by

the U.S. parent at the end of period t

E (ER

j,t

) = expected exchange rate at which currency j can be

converted to dollars at the end of period t

k = weighted average cost of capital of the parent

Direct Intervention

Indirect Intervention

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Basel II and BangladeshDocument20 pagesBasel II and Bangladeshসুমন শাহরিয়ারNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- LeasingDocument10 pagesLeasingsaminbdNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Research MethodologyDocument27 pagesResearch MethodologysaminbdNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquesDocument26 pagesThe Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquessaminbdNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Economy StatisticsDocument2 pagesEconomy StatisticssaminbdNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Currency DerivativesDocument7 pagesCurrency DerivativessaminbdNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Itisa Component of - Itisa Deduction of Payment. - Deduction To Be Made - Deduction To Be MadeDocument1 pageItisa Component of - Itisa Deduction of Payment. - Deduction To Be Made - Deduction To Be MadesaminbdNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Monetarism and Money SupplyDocument78 pagesMonetarism and Money SupplysaminbdNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Transmission Mechanisms of Monetary PolicyDocument12 pagesThe Transmission Mechanisms of Monetary PolicyStuff84No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Tax DictionaryDocument49 pagesTax DictionarysaminbdNo ratings yet

- ch01 PenmanDocument27 pagesch01 PenmansaminbdNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- ch02 PenmanDocument31 pagesch02 PenmansaminbdNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Assignment PHLOPHYDocument4 pagesAssignment PHLOPHYAshar AkbarNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- New Financial Products For An Aging PopulationDocument16 pagesNew Financial Products For An Aging PopulationsaminbdNo ratings yet

- Managerial Economics Lecture NotesDocument21 pagesManagerial Economics Lecture NotescprabhakaranNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- SJIBL Internship ReportDocument101 pagesSJIBL Internship ReportsaminbdNo ratings yet

- Internship Report On "Analysis of Credit Department of Dhaka Bank Limited"Document110 pagesInternship Report On "Analysis of Credit Department of Dhaka Bank Limited"Worth FossilNo ratings yet

- Performance Analysis of A Private Commercial Banks in BangladeshDocument34 pagesPerformance Analysis of A Private Commercial Banks in Bangladeshsaminbd100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SJIBL Internship ReportDocument101 pagesSJIBL Internship ReportsaminbdNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Islami Banking in BangladeshDocument7 pagesIslami Banking in BangladeshkmnahidiqbalNo ratings yet

- Internship Report of Sjibl-GbDocument45 pagesInternship Report of Sjibl-GbsaminbdNo ratings yet

- Derivatives As Risk Management Tool For CorporatesDocument86 pagesDerivatives As Risk Management Tool For CorporatesCharu ModiNo ratings yet

- Internship Report Fayal BankDocument25 pagesInternship Report Fayal BankSadiq SagheerNo ratings yet

- Yield To CallDocument16 pagesYield To CallSushma MallapurNo ratings yet

- Mistakes I Made With MoneyDocument28 pagesMistakes I Made With Moneysgdgtf100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Milestones in The History of Indian Stock ExchangesDocument6 pagesMilestones in The History of Indian Stock ExchangesemailkotagiriNo ratings yet

- Jade Group: Company ProfileDocument18 pagesJade Group: Company Profilesajd1No ratings yet

- Corporate Finance and Valuation-DamodaranDocument194 pagesCorporate Finance and Valuation-DamodaranRenz Anthony CañeteNo ratings yet

- Ruminations by Other PeopleDocument31 pagesRuminations by Other PeopledhultstromNo ratings yet

- Convertible Bond - Credit SuisseDocument52 pagesConvertible Bond - Credit Suissenyj martin100% (1)

- Top Down AnalysisDocument1 pageTop Down AnalysisWehan NurNo ratings yet

- Prest On Basics (F&O) - YashodhanDocument13 pagesPrest On Basics (F&O) - YashodhanAkshay SahooNo ratings yet

- 0450/11 Business Studies: Cambridge International ExaminationsDocument12 pages0450/11 Business Studies: Cambridge International ExaminationsRebecca SteatonNo ratings yet

- 610ba5b6e0e61 OLYMPIAD SAMPLE QUESTIONSDocument4 pages610ba5b6e0e61 OLYMPIAD SAMPLE QUESTIONSkaushikshreya1997No ratings yet

- Final HDFC ProjectDocument45 pagesFinal HDFC ProjectAbhishek SainiNo ratings yet

- Managing Transaction Exposure To Currency RiskDocument32 pagesManaging Transaction Exposure To Currency RiskmanishkpratapNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SLIDES Soybean & Corn Subscriber Caliber Video 130819 PDFDocument23 pagesSLIDES Soybean & Corn Subscriber Caliber Video 130819 PDFGARO OHANOGLUNo ratings yet

- Donchian Channel BreakoutDocument11 pagesDonchian Channel BreakoutShahzad Dalal100% (2)

- The Valuation Effects of Bank MergersDocument26 pagesThe Valuation Effects of Bank MergersVictor CebotariNo ratings yet

- Deed of Conditional SaleDocument4 pagesDeed of Conditional Saleheymissruby71% (14)

- Stefanutti Stocks ResponseDocument3 pagesStefanutti Stocks ResponseBranko BrkicNo ratings yet

- Rob Parson at Morgan Stanley 2Document5 pagesRob Parson at Morgan Stanley 2Embuhmas BroNo ratings yet

- Options, Futures and DerivativesDocument50 pagesOptions, Futures and Derivativesshakez777100% (1)

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Sales Quiz For 2nd YearDocument5 pagesSales Quiz For 2nd YearEvita Faith Leong50% (2)

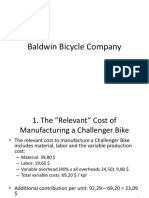

- Baldwin Bicycle Company EngDocument8 pagesBaldwin Bicycle Company EngChayan Kothari IDD,Biochem, IT-BHU, Varanasi (INDIA)No ratings yet

- Investors Preference in Commodities MarketDocument7 pagesInvestors Preference in Commodities MarketMuthu9751No ratings yet

- Differences Between Interest Rate Swaps and Credit Default SwapDocument3 pagesDifferences Between Interest Rate Swaps and Credit Default SwapCT SunilkumarNo ratings yet

- The Global Cost and Availability of CapitalDocument41 pagesThe Global Cost and Availability of CapitalayurishiNo ratings yet

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDocument2 pagesAccount Statement: Date Value Date Description Cheque Deposit Withdrawal Balanceomm123No ratings yet

- What Is An AssetDocument6 pagesWhat Is An AssetrimpyNo ratings yet