Professional Documents

Culture Documents

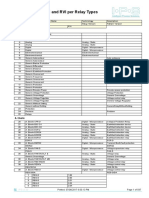

Comparison Chart

Uploaded by

balleh100%(1)100% found this document useful (1 vote)

223 views1 pageBusiness Association comparison chart of different business entities

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBusiness Association comparison chart of different business entities

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

223 views1 pageComparison Chart

Uploaded by

ballehBusiness Association comparison chart of different business entities

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Sole Trader Partnership Joint Venture Trust Inc Associa. Uninc.

Association Company Franchise

legal

entity

No No If Company = yes No; unless statutory trust

(dependent on statute)

Yes, s21 Inc.

Ass. Act

No; (k) made only w/ trustee/privy

of (k) Freeman v McManus

Yes Salomon Case (at reg.) s124: can enter into (K) as

artificial legal person

Not business entity;

franchise can be sued

Type of

liability

Unlimited 3. Unlimited ss8-15 PA; 1. Limited:

Individually

liability

2. Limited for trustee following

instructions human mistakes

ok

1. Limited

only as far as

company: s27

liability of

members; s70

public liability

2. UA cant sue/be sued/own prop;

committee personal liab. (mayb

indemnity) Bradley Egg unless

long-term (k) Carlton Cricket;

internal liability if legal

ramifications/ external defamation

Plenty; members sign = liab FvM

1. Limited unless wrong-doing 119 CA; liable to 3

rd

party

(stat. assumption of Agent) s129 CA; shareholders

(limited amt unpaid on shares) s516 CA

3. Exposure to liability;

increase risk w/ increase

branches (risk w/ each

franchisor: free-riding);

liability to reputation/quality

Trans.

of inter.

difficult as

linked to indiv.

expertise

2. Cant sell share without

consent of other Ps; can sell

right to share

1. Easily

assignable (no

consent needed)

2. Trustee changed by

Appointer/principle

-- 7. Watson v Johnson: interest of

members exists only for duration

of membership; not transmissible

2. Transferability of shares (sold) Yes (sold)

Perpt

succes

Yes asset

goes to

deceaseds

estate; often

dies w/ ST

3. Death of partner terminates

partnership; goes to surviving

partner (as w/in (K)); holding

out s17; Retiring s39(1);

incoming s20(1)

2. Individual

interests go to

estate (?)

1. Death in unit trust goes to

estate

- ease of succession/estate

planning (units go to estate)

1. Family N/A 1. Automatic to family N/A

Finance Limited from

ST/loan; no

floating

charge; no

public funds

1. Limited agreement of all

partners

2. Individual Cox

v Coulson

3. Benefits (profits) go to

beneficiary; payment made to

trustee; reimbursement of

reasonable expenses for

trustee by beneficiary s72 TA

Separate

accounts; no

pecuniary

profits

1. No profit (pecuniary profits)

Adamsons Case: profit-activities

ok at market price; inexpensive

startup; gen admin fee Watson v

Johnson (buys u nothing)

4. Ongoing costs (investors; bank loans; assets); costly to

establish

Cost effective; fees payable:

initial establishment; onging

(licence, royalties); training;

supply material via For;

marketing

Size

period

Form/

formaliti

es

1 owner; can

employ others.

Duration

limited to

owner

No formalities

to estate

1. Start up easy/Cheap

Limited by s115 Corps Act

(matter of form not

substance) by s5(1) PA; no

formalities

1. Start up easy

on agreement

Unlimited. Based

on Contractual

agreement

Keith v Mansell;

Khan v Miah

Cheap to form

(equal to Part.)

4. Start up: complex for small

SMEs; expensive to

establish/maintain; Appointer

(settlor) Trustee (LT)

beneficiary (ET); by instrument

oral/written; difficult to re-write

deeds

3. Name;

consti/ rules;

lodge w/

ASIC; appoint

secretary; reg.

address; keep

to-date; ann.

general

meeting/

financial return

2. No formalities; just meet

Anderson: not-for-profit Burrell

characterises: members; social

(k) not binding Cameron v

Hogan mutual understanding;

structure; free to join/leave;

continue exist independent of

change in composition;

historical moment of formation

5.Formation registration ASIC; costly individually; duration

based on comp.

Easily expandable; rapid

market penetration;

Initial ground

work/investment intensive;

expensive start-up cl 4

(exclude D) + initial obli

FCCB cl10, 11; (K) inflexible

External

discl

None 2. Limited partnership must

be registered s56(b)

1. None 2. To beneficiary 3. ASIC 1. None; issue with privacy b/c ppl

come and go at will

3. AISC if not listed; ASX if listed; or both; s129; ch 6:

disclosure to shareholders (everything) *esp fundraise

FCCB cl 6, 6B disclosure

doc; regulated by ACCC

Tax Personal tax

rate

1. Benefit Pass through 3. Individual 2. Pass through; tax

concession (tax free

thresholds) - maybe disadvan.

-- -- 1. Benefit fix 30% Maybe

Manage

+

control

Absolute 4. Within partnership s27;

equal say but subject to

agreement

2. Individual 3. By trustee; disclosed to

Beneficiary BAD

3. Committee

must comply

w/ duties

2. Committee members 1. Limited sole director; consti s126 CA; more votes per

share; majority share holder; corporate veil (Salomon);

Promoter (personal liable; info)

Limited depending on

franchise rules/regulations:

balance need for centralised

control against benefits of

individual management by

Fee

Reg

body

N/A Partnership Act QLD N/A Trusts Act QLD Associations

Incorporation

s Act QLD

N/A Corporations Act Cth Franchising Code of

Conduct code not Act;

read like statute (July 1/10)

Termina

t

Individual 2. Expiration s35(1)(a);

undertakings done s35(1)(b);

notice s35(1)(c); operation of

law 36; illegality s37; Court

s38

1. Individual

decision

5. By beneficiary in accordance

to terms; difficult before

matures

-- 1. Easy (at will of members) 4. S491 dereg. With ASIC but costly Uncertainties: termin.,

renewal, sale; Breach by

Fee cl21; no breach cl22;

exit clause in (K); special

circumstances cl23

Buz

prop.

Individual 2. 23 original 24 acquired

later 6(1)(a) P property: JT;

Exception Kelly v Kelly (not

intended as part of P)

1. Individual: TIC 3. No one owns: LT = Trustee;

ET = beneficiary

-- 3. Only on trust; UA cant own 2. Owned by corporation; Macaura: shareholders own no

prop of company

Intellectual prop (trademark,

logo, etc.)= w/ goodwill s9

CA + FCCB cl4

Rem. indemnity insurance (law

firm); term of (k)

(K); none Indemnity; Part 6 TA; (K); dont

act outside duties Wyman

Cameron v Hogan: internal rules;

not bound (legally social (k));

External Plenty

Promoters: pre-reg (K): Rescission (untrue discl doc

ss728,729), damages, recovery, construc trust, recovery

by liquidators ss567,588FH ; external indemnity, internal

not s132 Post-reg: ratify pre-reg(K); sue promoters;

novation (execute (K) on similar terms); shelf-comp

-- insurance??

You might also like

- Professional Resp ExamDocument5 pagesProfessional Resp ExamMaybach Murtaza100% (1)

- Backup of Obligations Finals Outline-RHILL (2012)Document53 pagesBackup of Obligations Finals Outline-RHILL (2012)roneekahNo ratings yet

- Conlaw Shortol ChillDocument2 pagesConlaw Shortol ChillBaber RahimNo ratings yet

- Charging Documents Aryeh CohenDocument5 pagesCharging Documents Aryeh CohenTC JewfolkNo ratings yet

- Civil Procedure OutlineDocument18 pagesCivil Procedure OutlineGevork JabakchurianNo ratings yet

- Issues As You Assist Client in Negotiation and DocumentingDocument35 pagesIssues As You Assist Client in Negotiation and DocumentingJen Holder WesselNo ratings yet

- Motion For Temporary Injunction 06fdf892 7521 46dc A7e1 E5f41ba1465eDocument19 pagesMotion For Temporary Injunction 06fdf892 7521 46dc A7e1 E5f41ba1465esmallcapsmarketNo ratings yet

- Babich CivPro Fall 2017Document30 pagesBabich CivPro Fall 2017Jelani WatsonNo ratings yet

- Attorney's Duty Model Rules SummaryDocument11 pagesAttorney's Duty Model Rules SummaryRonnie Barcena Jr.No ratings yet

- Short Outline ContractsDocument4 pagesShort Outline ContractsslavichorseNo ratings yet

- Flowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptDocument2 pagesFlowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptAudrey LimNo ratings yet

- Can the Supreme Court hear challenges to impeachment proceedingsDocument6 pagesCan the Supreme Court hear challenges to impeachment proceedingsSpencer BrooksNo ratings yet

- January 10, 2000, Monday INTRODUCTION (Read Pp. 1-48)Document38 pagesJanuary 10, 2000, Monday INTRODUCTION (Read Pp. 1-48)ahmer2No ratings yet

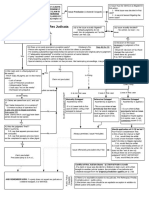

- Eerie Flow ChartDocument1 pageEerie Flow ChartMissPardisNo ratings yet

- Constituional LawDocument8 pagesConstituional LawQuiana MontgomeryNo ratings yet

- Affidavit of CostsDocument2 pagesAffidavit of CostsFloridaLegalBlogNo ratings yet

- How To Prepare A Supreme Court Appeal BriefDocument52 pagesHow To Prepare A Supreme Court Appeal BriefJoshua J. IsraelNo ratings yet

- Professional Responsibility: Outline: Disclaimer: These Notes and Outlines Are Provided AsDocument16 pagesProfessional Responsibility: Outline: Disclaimer: These Notes and Outlines Are Provided Asdoesntmatter555No ratings yet

- Business Associations Berdejo Fall 2020 MC4xNzI3NTkwMADocument105 pagesBusiness Associations Berdejo Fall 2020 MC4xNzI3NTkwMARhyzan CroomesNo ratings yet

- Admin OutlineDocument5 pagesAdmin OutlineflipscbNo ratings yet

- Contracts Bender4Document93 pagesContracts Bender4Laura CNo ratings yet

- Dministrative AW Utline: I. D A SDocument45 pagesDministrative AW Utline: I. D A Snak75No ratings yet

- Contracts I - Swain - Fall 2010 - 3Document55 pagesContracts I - Swain - Fall 2010 - 3champion_egy325No ratings yet

- 213con Law QuizletDocument26 pages213con Law QuizletMissy MeyerNo ratings yet

- Res JudicataDocument1 pageRes JudicataTed FlannetyNo ratings yet

- Outline of A Moot Court ArgumentDocument2 pagesOutline of A Moot Court ArgumentMd AbdulNo ratings yet

- V. Strict LiabilityDocument3 pagesV. Strict LiabilityVeronica MejiaNo ratings yet

- Fall 2016 Exam With Better Scoring Student AnswersDocument46 pagesFall 2016 Exam With Better Scoring Student AnswersACDCNo ratings yet

- PR Muth Spring 2018Document54 pagesPR Muth Spring 2018Ana FosterNo ratings yet

- Land Use ControlsDocument17 pagesLand Use ControlsHaifaNo ratings yet

- Short Draft 2Document12 pagesShort Draft 2Rishabh AgnyNo ratings yet

- Civil Procedure OutlineDocument18 pagesCivil Procedure OutlineLanieNo ratings yet

- La Salle National Bank V VegaDocument1 pageLa Salle National Bank V VegacrlstinaaaNo ratings yet

- Davis EvidenceDocument101 pagesDavis EvidenceKaren DulaNo ratings yet

- Prof Resp OutlineDocument77 pagesProf Resp OutlineChirag Patel100% (1)

- Agency & Partnership LiabilitiesDocument147 pagesAgency & Partnership LiabilitiesAndrew FergusonNo ratings yet

- Memo On CoA FAA InvestigationDocument7 pagesMemo On CoA FAA InvestigationCause of ActionNo ratings yet

- Assignment #3 68-77 Assignment #5 106-115 Assignment #6 119-128Document16 pagesAssignment #3 68-77 Assignment #5 106-115 Assignment #6 119-128Marco FortadesNo ratings yet

- Property 2nd Semester AttackDocument5 pagesProperty 2nd Semester Attackdsweetwood0% (1)

- Civil Procedure Outline - 1LDocument4 pagesCivil Procedure Outline - 1LEben TessariNo ratings yet

- Ip OutlineDocument9 pagesIp Outlinejp71422No ratings yet

- I. The Supreme Court Rises: (Conservative)Document8 pagesI. The Supreme Court Rises: (Conservative)izdr1No ratings yet

- Agency OutlineDocument41 pagesAgency OutlineNana Mireku-BoatengNo ratings yet

- NY Mini ReviewDocument32 pagesNY Mini Reviewlaurabayne17501No ratings yet

- Babri EthicsDocument24 pagesBabri EthicsuduhdhehNo ratings yet

- Civil-Procedure Outline Greiner BlueberryDocument55 pagesCivil-Procedure Outline Greiner BlueberryIsaac GelbfishNo ratings yet

- Outline - Agency & PartnershipDocument19 pagesOutline - Agency & PartnershipSaulNo ratings yet

- Partnership Agreement ElementsDocument11 pagesPartnership Agreement ElementsPuneet SinghNo ratings yet

- NABET-CWA Local 31 ULP Position Statement (Signed)Document13 pagesNABET-CWA Local 31 ULP Position Statement (Signed)David LublinNo ratings yet

- CDocument11 pagesCAlexNo ratings yet

- Torts Outline Mortazavi 2013Document19 pagesTorts Outline Mortazavi 2013deenydoll4125No ratings yet

- Corps Final Outline WordDocument30 pagesCorps Final Outline Wordrmexico316No ratings yet

- Strict Liability: Products Liability EssentialsDocument22 pagesStrict Liability: Products Liability EssentialsmattNo ratings yet

- Final Property Outline KacieDocument86 pagesFinal Property Outline KacieNicole AmaranteNo ratings yet

- Outline Laura Civil Procedure.Document97 pagesOutline Laura Civil Procedure.Mike Binka KusiNo ratings yet

- Authority: Actual Apparent Inherent Ratification EstoppelDocument6 pagesAuthority: Actual Apparent Inherent Ratification EstoppelBrick295No ratings yet

- Evidentiary rules for admissibilityDocument2 pagesEvidentiary rules for admissibilityJennilyn NevinsNo ratings yet

- Classification of Remedies (Outline)Document4 pagesClassification of Remedies (Outline)Ronnie Barcena Jr.No ratings yet

- Reo RFBTDocument14 pagesReo RFBTKawaii SevennNo ratings yet

- 26 - Submission of Calibration Certificate of Relative Testing EquipmentsDocument18 pages26 - Submission of Calibration Certificate of Relative Testing EquipmentsUgrasen ChaudharyNo ratings yet

- Regulating Admin AccountsDocument5 pagesRegulating Admin Accountsami pritNo ratings yet

- Simultaneous Translation Booth SystemsDocument13 pagesSimultaneous Translation Booth SystemsJuan Ignacio Estay CarvajalNo ratings yet

- ECC Chemical Process Pumps GuideDocument84 pagesECC Chemical Process Pumps GuideIwan KurniawanNo ratings yet

- ArimaDocument65 pagesArimarkarthik403No ratings yet

- NSW Building Industry Security of Payment ActDocument31 pagesNSW Building Industry Security of Payment ActJason ShermanNo ratings yet

- Rig 2017Document34 pagesRig 2017ralphNo ratings yet

- Contribution Collection List: Quarter EndingDocument2 pagesContribution Collection List: Quarter EndingBevs Al-OroNo ratings yet

- Latest JIG Standards issues releasedDocument2 pagesLatest JIG Standards issues releasedPETENo ratings yet

- Call Sheet: Production Title Production Group Date Producer and DirectorDocument12 pagesCall Sheet: Production Title Production Group Date Producer and Directorapi-443161282No ratings yet

- Piksi Schematics v2.3.1Document7 pagesPiksi Schematics v2.3.1Danut StanciuNo ratings yet

- VRF Plus 2011 CatalogDocument32 pagesVRF Plus 2011 CatalogJorge DovaleNo ratings yet

- SteganographyDocument32 pagesSteganographysubashreeNo ratings yet

- Total Preventative Maintenance Program InitiationDocument20 pagesTotal Preventative Maintenance Program InitiationAji Beni LastomoNo ratings yet

- C2022 04Document72 pagesC2022 04Leo2pbNo ratings yet

- En PLC InterfaceDocument2 pagesEn PLC InterfaceBsd FareedNo ratings yet

- Direct Cuspal Coverage Posterior Resin Composite RestorationsDocument8 pagesDirect Cuspal Coverage Posterior Resin Composite Restorationsdentace1No ratings yet

- R 245Document2 pagesR 245Ravi RanjanNo ratings yet

- AWS CWI Training Program PDFDocument22 pagesAWS CWI Training Program PDFDjamelNo ratings yet

- OpenStack Installation Guide For (RHEL, CentOS, Fedora)Document140 pagesOpenStack Installation Guide For (RHEL, CentOS, Fedora)kinamedebo100% (1)

- Configuracion y O&M BTS NokiaDocument43 pagesConfiguracion y O&M BTS Nokiajcardenas55No ratings yet

- Micropipettes SOPDocument1 pageMicropipettes SOPNishchaya SinghNo ratings yet

- Tugas Contoh 3 Jurnal Nasional - Muhammad Habib - 217312040005Document73 pagesTugas Contoh 3 Jurnal Nasional - Muhammad Habib - 217312040005abibardaya desain3No ratings yet

- Unit 2 - Professional Ethics & Code of ConductDocument97 pagesUnit 2 - Professional Ethics & Code of ConductPradiba Raajkumaar25% (4)

- US V RuizDocument2 pagesUS V RuizCristelle Elaine ColleraNo ratings yet

- Dow Corning Success in ChinaDocument24 pagesDow Corning Success in ChinaAnonymous lSeU8v2vQJ100% (1)

- Buddha LeaderDocument1 pageBuddha LeadersandeepbelovedNo ratings yet

- IPS-ENERGY - Available Relay ModelsDocument597 pagesIPS-ENERGY - Available Relay Modelsbrahim100% (2)

- Cash Reserve Ratio: Economics Project by Ayush Dadawala and Suradnya PatilDocument14 pagesCash Reserve Ratio: Economics Project by Ayush Dadawala and Suradnya PatilSuradnya PatilNo ratings yet

- NBFC Playbook: Understanding Non-Banking Financial CompaniesDocument13 pagesNBFC Playbook: Understanding Non-Banking Financial CompaniesAkshay TyagiNo ratings yet