Professional Documents

Culture Documents

Trader Manual

Uploaded by

Ts'epo Mochekele0 ratings0% found this document useful (0 votes)

4K views121 pagesManual

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentManual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4K views121 pagesTrader Manual

Uploaded by

Ts'epo MochekeleManual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 121

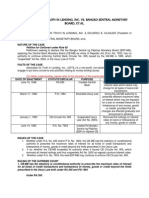

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

1

Zimbabwe Revenue Authority

ASYCUDA++ Trade Manual

Introduction

Goods that are imported into or exported from Zimbabwe must be declared to

Customs.

With the exception of some goods carried as passenger's baggage, goods of a value

not exceeding a prescribed amount and certain other categories of private or

diplomatic importations the standard form of declaration is made on Form 21-

Zimbabwe Revenue Authority Bill of Entry. The legal provisions enacting

the use of this form are contained in Part 2 and First Schedule, Part II of the Customs

and Excise (General) Regulations, 2001.

The new ASYCUDA

++

system has been introduced in Zimbabwe with the objective

of streamlining the operation of Customs entry processing. This should result both in

more efficient revenue collection and a reduced administrative burden on the trading

community. Streamlined processing of entries should also result in reduced clearance

times.

At all our computerised ports, the full advanced computer system is already running.

Arrangements will be made to notify traders within a locality when computerisation is

implemented our non computerised ports.

The Asycuda ++ features that you will observe can be summarised as follows:

The introduction of Direct Trader Input which will give the trade more control

over this important area resulting in a reduction in clearance times due to the

elimination of validation failures and resultant forms C30 resolution. Traders

using remote DTI will be able to obtain information directly from the customs

computer relating to their business with customs.

A simplified Form 21 is printed in black and white resulting in substantial cost

savings.

The need to have staff attending all day at the customs office will be removed.

Presentation of payment with the entry submission will avoid the need to wait for

assessment notices and lengthy queues at the cashiers.

The use of the new Customs Release Order will provide extra security to both

customs and the trade. This computer-generated document will be the evidence

that goods have been cleared from customs control.

In introducing these changes zimra has the interests of legitimate traders in mind at

all times.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

2

Officers have been trained on the new procedures prior to their introduction .The

asycuda system will have long-term benefits to all stakeholders.

1.0 Direct Trader Input (DTI).

1.1 What is DTI?

Direct Trader Input is the term used in situations where the Agent or importer is

responsible for the input of the Customs entry to the customs system. This may be by

connection to the Customs system directly or by use of an electronic message. The

use of DTI is widespread in the Customs world. It is the normal mechanism by which

most entries are received in all developed countries. It removes from Customs what is

basically a clerical task and places the responsibility where it properly belongs, with

the trade. It is a perfect example of a trade facilitation measure that benefits both

Zimra and the trade.

1.2 Benefits

The reasons that DTI has been so widely introduced are two fold.

First from the Zimbabwe Revenue Authoritys (ZIMRA) perspective, it results

in the reduction of the cost to ZIMRA sections of processing entries. This cost

saving is not only in respect of the direct staff costs for data input personnel

and the associated management costs but also the reduced requirement for

computer hardware, consumables and office space.

Further savings are made by the removal of the need to deal with data

correction actions on entries that fail data capture controls. These savings

enable targeted improvements in other more important areas of interest to

ZIMRA. The result of these increased resources in these key areas inevitably

results in an increased detection rate for irregularities.

From the trade perspective, the ability of the trader to ensure that his entry has

been accepted and validated by ZIMRA should mean a reduction in clearance

times and the elimination of the administration of validity error resolution with

ZIMRA. They have control of an area where delays can otherwise occur. It also

enables them to have up to date information on their entries and accounts on line.

Since information will be on line, there will not be any F45s arising from wrong

rates of duty and exchange rates.

1.3 DTI in ASYCUDA

++

ASYCUDA++ is designed specifically with DTI at its core. Security is controlled

completely by the system. The traders do not have direct access to the ZIMRA

system.

They communicate through a specifically designed program, MODBRK, by the use

of electronic messages.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

3

These messages are pre-programmed and so cannot be altered by the trader in

anyway. This means in simple terms that only messages requesting acceptance of

entries or requests for list of entries or account balances will be accepted and actioned

by the system. No other requests will be accepted by the ZIMRA system. The

messages are encrypted and so cannot be intercepted by a third party. The system

recognises the individual agent or importer by his name and password. The system

limits an individual agent or importer to submitting only their own entries and also to

obtaining information regarding their own business with ZIMRA. This ensures

commercial confidentiality.

1.4 DTI options

There are two options available under ASYCUDA

++

for using DTI in Zimbabwe.

Both methods can be used.

1.4.1 Remote DTI

Under this method the approved DTI declarant, using information provided by the

importer or exporter prepares the customs declaration at their own premises using a

PC. This may be stand alone or part of an in-house network, with a communication

link to the ASYCUDA Customs Server. In this context the declarants PC is known as

a client machine and receives messages from and transmits messages to the

ASYCUDA Customs Server.

The declaration information is input by the declarant and is subjected to interactive

validation checks. When the full declaration information has been input a facility

exists for it to be checked against control data previously downloaded to the client

machine from the customs server.

Any errors detected during the input phase or the local check must be rectified before

the next stage is initiated. In the event that any of the errors identified by the checking

process cannot be immediately rectified the declaration data may be stored locally on

the client machine or on the Customs server under a unique identity for retrieval at a

later time.

If the local check is completed without errors the declaration data is then passed to the

customs server with a request for registration.

The declaration input data is then automatically checked against control data held in

the customs server and if satisfactory will be allocated a Registration number.

The Registration response from the customs server will also provide the printout of

the Form 21.

The computer generated Form 21 is to be signed by the declarant and, together with

the necessary supporting documents, delivered without delay to the appropriate

customs office.

Dependent on the nature of the telecommunications infrastructure available, DTI

declarants may be able to log-in to any customs server irrespective of their geographic

location but the Form 21, and the payment of any revenue due, must be presented to

the customs office identified on the Form 21.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

4

1.4.2 Bureau Input

The procedure for the Input of declaration data using the Bureau facility is very

similar to that described above. A special area for the Bureau is defined in the public

area at the individual ZIMRA offices. Within the Bureau Office ASYCUDA client

computers with an associated printer are located.

This equipment will be supplied and manned by the Bureau Operator. Declaration

data may be input via the keyboard or from diskettes. In either case the computer

generated Form 21 must be signed by the declarant and, with the appropriate

supporting documentation, delivered immediately to the ZIMRA Entry Reception

Office/ Cash Office.

This option allows smaller declarants who do not have their own computers to use

DTI. The bureau is connected directly to the Customs network.

2.0 The F21 Declaration Form

The new Form 21 is specifically designed to facilitate input of the information it

contains to the Asycuda computer system. Although much of the information is now

required in coded form the design also caters for the use of the form in a solely

manual environment.

The lodgement at a ZIMRA Office of a declaration signed by the declarant or his/her

representative shall indicate that the person concerned is declaring the goods in

question for the Customs Procedure applied for and, without prejudice to the possible

application of any penal provisions, shall be equivalent to the engagement of

responsibility in respect of:

-the accuracy of the information given in the declaration,

-the authenticity of the documents attached, and

-the observance of the obligations inherent in the entry of the goods in

question under the Customs Regime / Procedure concerned.

The form contains, inter-alia, a brief pre-printed declaration as to the accuracy of the

information it contains. For computerised ports, a computer-generated printout is the

legal document. The action of signing the document, writing your national

identification number and presenting it to ZIMRA indicates full acceptance of all

responsibilities.

Manual Environment

The form may be completed in manuscript using block capitals in blue or black ink or

ballpoint pen but must be legible and indelible. The form may also be completed by

typewriter or computer printer. There must be no erasures or overwriting on the

forms. Any alterations should be made by crossing out the incorrect detail and

inserting those required at the side or above the original.

Any alterations made this way must be initialled. An authorised registered agent

before presentation to ZIMRA must sign the form.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

5

In instances where the form is considered illegible ZIMRA may require a fresh

declaration to be completed.

Computerised Environment

The declaration information is input by the declarant using DTI and is subjected to

interactive validation checks. When the full declaration information has been input

and there are no validation errors (C30 errors), the entry is registered by the Customs

Server.

A computer-generated printout is produced and it is the legal document, which must

be signed, dated and the necessary supporting documents attached for delivery to

ZIMRA without delay.

The fields in a computer-generated printout are exactly the same as those on the new

F21.

Code 777 will automatically appear on the duty rate column if ever there is a

combination duty rate eg. 60% + $100.00/kg or if the duty rate is not ad valorem

eg.$650/kg.

The basic F21 contains three distinct sections, viz:

- heading information which is common to the entire consignment and is

identifiable by a sequential number identifier within each box from 1 to30,

- one set of item information which provides details pertaining to a

particular commodity or procedure code. Each box containing item

information is identified from box '31' to '46'.

Individual item information elements are identifiable by a combination of

the item consecutive number and the item numeric identifier, eg l:37

represents item number 1 box '37', (the commodity code box in item 1);

similarly, 5:36 represents item number 5 box '36', (the preference code

box in item 5), etc. and lastly

- the summary total of duties and taxes for item 1 and declaration area

identifiable by a numeric identifier between 47 and 51.

The basic form provides for goods of one tariff description or customs procedure to be

declared.

A continuation sheet (Form No. F21 continuation page) must be used where the

number of tariff descriptions or acceptable procedure codes exceeds one. This form

provides for a further three sets of tariff descriptions or procedure codes to be

declared but the maximum number of items to any one declaration is 999.

Item information boxes on the continuation forms bear the same identification system

as used on the basic form.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

6

2.1 Private prints of the new form

The Commissioner General may authorise the private printing of the new form.

Private prints of the form must correspond precisely as to size, layout and all

particulars thereon with the officially printed copies. Further information on this

aspect is available from:

The Commissioner General

Box 4360

Harare.

Tel: 263 4 752731/790811

Fax: 263 4 773161

E-mail: Helpdesk@zimra.co.zw

ZIMRA reserve the right to reject at presentation any forms, which do not comply

with these requirements.

2.2 Documents to accompany declarations, assembly of the declaration set:

2.2.1 Supporting documents

ZIMRA will retain a full set of the commercial documents normally accompanying a

declaration; these documents include commercial invoices, transport documents such

as AWBs, rail advice notes and Bills of Lading, documents supporting a claim to

preferential or reduced rates of duty and / or worksheets. Importers, exporters or

declarants who wish to retain a set of similar documents for their own or other

organisations use must ensure that a duplicate set is available at the time of first

presentation of the declaration and these will be returned when ZIMRA processing of

the declaration has been completed.

The number of copies of the declaration form to be submitted to ZIMRA varies as to

the customs procedure(s) being used and whether or not the document will be

processed using the computerised system.

2.3 Amendments to declaration information

A form 45 is used to advise declarants of errors on entries. This form (Form 45) "Bill

of Entry Query Notification / Request to Amend" comprises four parts. Parts A and D

are for official use only, Parts B and C are for completion by declarants as necessary.

The form (Part A) is prepared in duplicate by ZIMRA when an error is detected on

an entry .The original copy is forwarded to the declarant and is to be completed at

Part B as appropriate and then returned to ZIMRA at the place where the entry was

first presented. Dependant upon the scope and/or magnitude of the error ZIMRA

may require the preparation and lodgement of a "substitute entry" to replace the

original. ZIMRA may also require an explanation as to the reason for any error in

which case the requirement will be stated in Part B. In such instances Part C on the

reverse of the form must be completed with the declarant's explanation for the error.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

7

ZIMRA may also call for payment of a deposit pending fulfilment of Section 44 of

the Customs and Excise Act.

Any additional supporting documents requested by ZIMRA must accompany the

original copy of the query advice upon its return to zimra.

The declaration contained in Part B of the form must be signed by the person

responding to the customs query and must be the importer/exporter or his/her duly

appointed agent. In signing this declaration the same conditions and responsibilities

pertaining to the signing of the declaration on the relevant Form 21 apply.

3.0 Customs Assigned Numbers (CAN's)

All commercial importers, exporters and their appointed agents must be in possession

of a Customs Assigned Number at the time of making a declaration to ZIMRA. The

CAN is the means by which the ZIMRA computer system recognises traders

registered with ZIMRA.

Arrangements exist whereby any importer, exporter or agent who is not already in

possession of CAN may apply for registration. Application forms are available at all

offices or alternatively will be forwarded upon request made to:

I.T. Section.

Zimbabwe Revenue Authority

2

nd

Floor, South, West Wing,

Kurima House.

89 Nelson Mandela Avenue,

Box 4360

Harare.

Telephone: 263 4 728355

Fax: 263 4 793450

E-mail: Helpdesk@zimra.co.zw

Once a CAN has been issued any changes concerning company name, status, address

or phone details must be advised to the Computer Office at the address given above.

Completion of the CAN number box is mandatory on all declaration types.

4.0 Customs Procedure Codes (CPCs)

New CPCs are now in place to bring Zimbabwe into line with international

standards. They have been integrated into ASYCUDA ++.

4.1 Structure

The procedure codes are based on a 4 digit code that can define any of the normal

customs procedures that apply anywhere in the world. An extra 3 digits are available

for special rebates etc. that only apply in Zimbabwe.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

8

4.2 Extended Procedures

The first group of 4 numbers is called the Extended Procedure. A list of these codes

is attached. The Extended procedure is made up of 2 parts. The Requested Procedure

and the Previous Procedure.

The Requested Procedure, which comprises the first 2 numbers of the 4 digit

extended procedure, represents the customs procedure that is being asked for.

The Previous Procedure, which comprises the 3rd and 4th number of the 4 digits

extended procedure, represents any previous customs procedure that the goods

concerned have been entered under.

For example, when goods are entered for import into ZIMRA warehouse they would

be entered under extended procedure 7100.

Requested Procedure 71 Warehousing

Previous Procedure 00 No previous procedure

When those same goods are removed to home use they would use the extended

procedure 4071.

Requested Procedure 40 Home use

Previous Procedure 71 Previously in warehouse

4.3 Additional Codes

The special national rebates etc. are handled by the next set of 3 numbers. These

additional codes follow as near as possible the old CPCs. The opportunity has been

taken to simplify and rationalise the existing codes. A list of the new additional

codes is attached. It can be seen that they are almost identical to the old CPCs. Their

use is simple. If goods were entered for home use by the government they would use

the full CPC 4000 403. If goods were re-imported after previous temporary

exportation for repair under guarantee they would use the full CPC 6021 602.

4.4 Model (Type) of Declaration

Different boxes have to be completed on the different types of entry to provide the

required information. When inputting an entry into ASYCUDA++ then the type of

entry must be specified. The Model of Declaration is simply the type of entry.

Entry types are made up of a prefix, which tells whether it is an import, export or

excise entry followed by the first number of the extended procedure. For example a

home use entry would be input on an IM 4 Model of Declaration.

Each individual entry may have many lines or items each with different CPCs. All

the individual CPCs must however start with the same number. It is possible for

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

9

example to use CPCs 4000 401 and 4000 402 on the same IM4 entry but not 4000

401 and 7100 000 as the first numbers in the CPCs are not the same.

Type or Model of Declaration

EX 1 Exportation

EX 2 Temporary Export

EX 3 Re-export

EXC 2 Excise

IM 4 Entry for home use

IM 5 Temporary Importation

IM 6 Re-importation

IM 7 Entry for warehousing

IM 8 R.I.B / R.I.T

IM 9 Private Importations

5.0 Payment of customs duties and other charges

5.1 Pre-payment accounting

The prepayment facility is going to be used in both computerised and manual

environments. This is a situation whereby declarants will pay first the exact amount of

duties and taxes that are reflected on the F21 on presentation of their entries to

ZIMRA for processing.

5.2 Prepayment Account Numbers

Each declarant / importer or exporter is given an account number which is his

Customs Assigned Number (CAN). Although the CAN is national, the Prepayment

Account Number is managed per office of clearance. The account number is written

in box 48 of the F21.

Entries which are submitted to Customs without being paid for will not be processed.

Customs accept no responsibility for delays in clearance arising from an insufficient

balance existing in the account. No entries will be cleared until the account is restored

to a credit balance.

A statement of the account is produced by the computer (when required) detailing

entries cleared against the account number, any credit amounts paid in during the

period since production of the previous account statement and the account balance.

On assessment, money in the prepayment account is automatically transferred into the

ZIMRA Revenue Account. Assessment notices are not going to be generated.

If the amount transferred into revenue is less than the amount paid in the prepayment

account, a credit balance will remain in the account. Such monies can be used for

future importations.

When the declarant / importer requires a refund, a Form 46 must be prepared to

reclaim the overpaid amount. The Form 46 must be completed in triplicate and must

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

10

be supported by suitable evidence to substantiate the claim including copies of the

original computer produced Registration Advice, Payment Receipt and a Customs

Release Order.

5.3 Entry Reception/ Cash Office- This function is the first point at which ZIMRA

receive the entry from the agent. Entries will be received at Entry Reception having

been registered (that is, in a computerised environment.) In a manual environment, the

cashier issues an entry identification number.

Upon first presentation all entries are subjected to the following checks, which are

aimed at ensuring that:

a) the entry is proper to the location at which it is presented and,

b) the form is legible and complies with the requirements for a computer

generated Form 21,

c) it has been properly completed, e.g. signed and dated.

d) the basic supporting documents are attached and

e) the correct payment is attached.

The face vet checks will be applied and any errors should be referred to the agent and

the documents rejected.

Receipt of the entry at the Entry Reception marks the official receipt of the entry into

customs control. Once received at the Cash Office the entry should remain always

within customs control and is never subsequently returned to the agent.

The payment will be recorded in ASYCUDA against the prepayment account

declared on the form 21.

Payment may be effected by the following methods:

-cash,

-bank cheque, or

-other cheques guaranteed by a special bank guarantee held by the

Controller/Co-ordinator at the port of presentation of the entry.

Payment MUST be made on presentation of the entry to ZIMRA. If payment is not

received within the due time ZIMRA reserve the right to cancel the entry and require

presentation of a new entry.

5.4 Private Importations

For all private importations, the Declaration Cash system is used. This facility is

whereby an assessment is done first and an assessment notice/ payment advice is

generated for payment to be done at the cash office.

Before the F49 declaration his registered and assessed, the importer should be advised

of the amount payable and must have ready cash on himself.

For companies importing goods of a negligible value,(that does not require a Bill of

Entry) they are to clear on F49 but can use the prepayment facility.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

11

6.0 Customs Release Order

6.1 Computerised environment

The Customs Release Order is going to be the authority to release goods from ZIMRA

control. It is a security document printed on security paper (with a customs logo as a

watermark) on size A5.The Customs Release Order is also called form 21A (F21A).

It is a continuation of the bill of entry F21.

A Customs Release Order is only issued when an entry has been processed through

customs and all duties and taxes paid. It is issued in duplicate, the first copy is

attached to the declarants set of documents and the second copy onto the ZIMRA set.

If there is no credit balance in the prepayment account, an entry cannot be assessed

and a release order cannot be generated.

After an entry has passed through ZIMRA, the declarant / importer or exporter must

make sure that he gets a Customs Release Order attached to his set of documents

which he collects from ZIMRA.

**NB. At all ports of exit, a release order must be attached to the documents for

acquittal otherwise delays will be experienced at ports of exits where Zimbabwe

Revenue Officers want to verify whether such documents have passed through

the office of clearance.

This measure has been put in place since the declaration input of entries into the

customs computers is now controlled by the trade using DTI.

6.2 Manual Environment

A manually completed Customs Release Order is going to be issued for every entry

that has been processed. It is going to be issued in triplicate and distributed in the

same manner as in a computerised environment. The third copy (fast copy) is for audit

purposes.

7.0 Clearance of Household effects

In order to reduce the burden of completing multi-item entries for consignments of

household effects, special arrangements apply in relation to the entry of such goods

which are for export (Type/Model of declaration EXI), for removal under bond or in

transit through Zimbabwe. (Type/Model of declaration IM8)

Provided always that the consignment comprises only bona-: fide household effects a

single item entry will be accepted covering all the goods in the consignment.

The Commodity Code to be used in such circumstances must be that which attracts

the highest rate of duty in relation to the goods within the consignment.

The information in (Description of goods) must state the nature of the goods

to that Commodity Code and additionally, generally describe the remainder of the

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

12

goods as "bona-: fide household effects".

In instances where this arrangement may cause abnormal distortion to trade statistics

ZIMRA reserve the right to determine a more representative Commodity Code and

require amendment of the entry as necessary.

8.0 Non-availability of the computerised system

Due to unforeseen occurrences it is possible that occasions will arise where the

computer system is unavailable; such periods of non-availability are likely to be

extremely rare and of relatively short duration.

The procedures to be adopted during periods of non-availability of the computer

system are known as 'Fallback' and cover two situations. 'Short Term Fallback' (STF)

is the name given to the procedures adopted where the anticipated period of non-

availability is not likely to exceed 24 hours. On other occasions the system adopted is

known as 'Long Term Fallback' (LTF).

9.0 The Manual Procedure System

9.1 Declarant

The declarant manually prepares the Bill of Entry in the prescribed form. The number

of copies needed is spelt out in CPCs descriptive notes. (Section 12.0) All supporting

documents are to be attached on the F21 before submission to ZIMRA for processing.

Prepayment remains mandatory in all manual environments and payment must be

done on presentation of the Bill of Entry.

9.2 Entry Reception/Cash Office

The declarant will submit to the officer a signed entry, together with all supporting

documents and the exact amount of money. He/she will get a receipt for the amount

paid.

9.3 Entry Processing

If the Entry is correct, a manual Customs Release Order is issued and can be collected

from the delivery office.

If a declaration has an error a F45 detailing the nature of the error will be issued and

this can also be collected from the delivery office.

All queries should be channelled to the Queries Section and not to individual officers.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

13

10.0 Detailed guidance on completion of Form 21 Boxes

Box Description Action Use

Clearance Office

Manifest Number

Registration

number and date

Mandatory Enter the name and code for the Customs Office where the

entry is to be lodged for processing.

e.g. Beitbridge ZWBB

Leave blank

For official use only

1

Declaration Type

Mandatory

The Type or model of declaration is identified in this box,

which is in two parts. The first part tells the type of

declaration

Model Description

EX Export entry

EXC Excise entry

IM Import entry

The second part is the General procedure code which is the

first digit of the CPC

( See Section 4.4 of this manual for details)

2

Exporter

/Consignor

Mandatory

IM

For import declarations enter full name and address of the

exporter (Supplier) of the goods to Zimbabwe. This is

usually the name of the person or organisation from which

the Zimbabwean importer purchased the goods.

EX

For export declarations, the full name and address and the

Customs Assigned Number (CAN) must be entered. This is

usually the person or organisation that is exporting the

goods from Zimbabwe.

3

Forms

Mandatory

Total number of pages in this declaration, including the

front page and any insertions of page two, three, etc. If

there is only one page it should be 1/1 and if there are two

pages it should be 1/2 and 2/2 etc.

4

Prohibited

Not used

5

No. Items

Mandatory

Total number of items (lines) declared.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

14

6 No. Packages

Mandatory Enter the total number of packages in the Declaration.

For bulk goods, this box must be filled with the number

1.

7

Declarant s

Reference

Number

Mandatory

Enter your own reference number for the declaration.

(Maximum 13 characters) (both alpha and numeric)

*The reference number must not be repeated within a

calendar year.

8

Importer/

Consignee

Mandatory

IM

For imports enter the full name, address and Customs

Assigned Number of the importer.

Where the importer is claiming Import Tax relief, enter the

Registered Operators number in the appropriate box.

For Transits it is the bondholder.

EX

For export declarations the consignee name and address

must be entered. This is usually the name of the person or

organisation to which the goods are consigned outside

Zimbabwe.

9

Prohibited

Not used

10

Country of First

Destination / Last

consignment

Mandatory

IM and EX

Enter the code for the country where the goods are first

destined or last consigned (i.e. transit country)

11

Country of

Supply

Mandatory

Prohibited

IM

Enter the code for the country from which the goods were

supplied. This is the code for the country where the goods

were loaded for export to Zimbabwe, excluding transit

countries.

EX

12

Value details

Prohibited

Not used

13

Accounting Fee

Details

Optional

Only used when an entry is paying Accounting Fees

arising from a F45.

Enter a three alpha character code: ACC

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

15

14

Declarant / Agent

Mandatory

If the Entry is being completed by:

i) An authorised Agent on behalf of the Importer /

Exporter, Enter the Customs Assigned Number and name

and address of the agent.

ii) Importer/Exporter - Enter Self (CAN is 509999)

15

Country of Export

Mandatory

IM

Enter the code for the country from which the goods were

exported

EX

Enter the code for the country to where the goods are

destined.(See appendix 11 for country codes)

16

Prohibited

Not used

17

Country of

Destination

Prohibited

Mandatory

IM

EX

Enter the code for the country to which the particular

goods declared are to be finally exported.

18

Flight Details /

Vehicle

Registration /

Train number

Mandatory

Optional

IM

Enter the transport that brings the goods into the country:

i) Air enter flight number

ii) Road- enter vehicle registration number

iii) Rail enter train number

In addition, enter detention details, e.g. Road Report, Rail

Advice Note and Detention Number(s).

In the second box enter a country code that shows the

nationality (country of ownership or nationality) of the

transport.

EX

19

Container Flag

Mandatory

Enter 0 if not containerised and 1 if containerised.

20

Delivery terms

Mandatory

Enter a code describing the terms of delivery specified in

the sale contract between the buyer and the seller of the

declared goods. The code is the international standard

incoterms code, promoted by the International Chamber of

Commerce. Delivery terms format is of three characters,

e.g. CIF, FOB etc.

Also, enter the place referred to by the incoterm. e.g. CIF

Bulawayo.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

16

21 Prohibited

Not used

22

Currency Code

and

Total Invoice

Value

Mandatory

IM

Total amount invoiced and currency code of particular

goods declared. The first block states the currency code,

(e.g. USD, ZAR etc) whereas for the second block

represents the invoice amount.

EX

Total amount and currency code of particular goods

declared to be in Zimbabwean dollars as per CD1 form

rates. (See Appendix 11 for currency codes)

23

Exchange Rate

Mandatory

Enter the current Customs rate of exchange of the declared

currency in box 22.

24

Freight 1/

Insurance /

Freight 2 /

Other Charges /

Deductions

Optional

Optional

Optional

Optional

Optional

These boxes are used in the Valuation note segment of the

entry to calculate the Defined Value. Freight charges can

be split in cases where freight charges are invoiced in more

than one currency. Rates of exchange to be shown on

worksheet.

Deductions: Enter amount of discount on whole invoice

not already apportioned to individual items of the invoice.

25

Mode of transport

Mandatory

Enter the code of the means of arrival into, or departure

from the country. (See Appendix 2 for mode of transport

codes)

26 Prohibited Not used

27 Prohibited Not used

28

Exchange Control

Declaration /

E.I.S. ref.

Prohibited

Optional

IM

EX Enter the identifying particulars of any supporting

Form CD1 and/or Export Incentive Scheme Claim Form.

29

Frontier Office

Code

Mandatory

IM Enter the code of the customs office where the goods

first entered Zimbabwe.

EX - Enter the code of the customs office where the goods

will finally leave Zimbabwe.

RITs-Enter Port of final exit of the goods. (same as

exports)

RIBs-Enter port of final clearance of the goods.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

17

30

31

Location of goods

Packages &

Description of

Goods.

Marks and

Numbers

Number and Type

of Packages

Container

Numbers

Description of

Goods

Mandatory

Mandatory

Mandatory

Optional

Mandatory

IM

Enter the code of the place where the goods are located

EX

Enter the code of the place where the goods are located

prior to their being loaded for exportation and where they

are available for examination by Customs if so required.

Enter the shipping marks and numbers for this item.

Enter number and code for the type of packages

Enter Container Numbers as appropriate

Enter here the actual description of the goods. The descrip-

tion must be the normal trade description expressed in

sufficiently precise terms to enable immediate and unam-

biguous identification and classification (this does not

mean repetition of the description found in the Tariff

Handbook alongside the relevant Commodity Code).

Where the Commodity Code to be used depends on size,

weight or other physical criteria, the description should

include that information. In the case of chemicals classified

in Chapters 28 and 29 of the Tariff the full chemical name

in accordance with the Chemicals Nomenclature Handbook

must be used.

32

Item Number

Mandatory

Sequential number of the Item.

33

Commodity Code

Mandatory

Enter the full 8-digit commodity code relevant to the

description and classification of the goods as set out in the

Tariff Handbook.

34

Country of origin

Mandatory

Enter the country of origin code of goods in this item.

(See Appendix 11 for country codes)

35

Gross Weight

Mandatory

Enter the gross weight of the goods declared to the nearest

whole number.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

18

36 Preference Optional Enter a preference code, where applicable, to claim a

reduced rate of import duty allowable when the goods

conform to a description with a regional trade agreement,

for preference on certain kinds of goods.

(See Appendix 5 for preference codes)

37

CPC

Mandatory

Enter Customs Procedures Code applicable

(See Appendix 10 and Section 12 for CPCs).

38

Net Weight

Mandatory

Enter the net weight of the goods declared rounded to the

nearest whole number.

39

Prohibited

Not used

40

Preceding

Document

Reference

Optional

Enter details of any preceding document being acquitted.

E.g. RIB, Warehouse Entry, Report Order, etc.

41

Supplementary

Units

Mandatory

Prohibited

When a quantity other than net weight is required as per

the Tariff Handbook, enter the unit. Up to 2 Supplementary

Units may be specified against individual commodity

codes.

If no units are specified in the Tariff Handbook.

42

Item Invoice

Value

Mandatory

Enter the Item Invoice Value in the currency declared in

Box 22.

43

Valuation Method

(VM)

Mandatory

Enter the code appropriate to the valuation method used to

arrive at the value for customs purposes and, where

applicable and appropriate, the reference number of any

Valuation Ruling issued by the Commissioner General.

(See Appendix 6 for Valuation Codes)

44

Additional

Information

Optional

Enter the Licence/Permit/Certificate reference number

required as per applicable controls.

Indicate Quantity/ Value to be marked off.

45

Prohibited

Not used

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

19

46 Defined Value Mandatory Enter the value of the goods for Customs duty purposes in

Zimbabwe Dollars.

47

Duties and Taxes

Mandatory

Enter the Tax Base, Rate, Amount, Mode of Payment code

and Total for all appropriate duties and taxes applicable to

the item.(See Appendix 8 for details)

48

Account Code

Mandatory

Enter the importers or agents prepayment account.

number.

49

Warehouse code

and Address /

Removal

destination

Optional

To be used in future when goods are to be placed into or

removed from a bonded warehouse; enter the code number,

name and address of the warehouse.

In the interim leave blank

Total Duties and

Taxes

Mandatory Enter the total amount of Duties and Taxes for the whole

Entry. If none enter NIL.

Clearance Fee Mandatory Enter the Fees applicable to the Entry. If none enter NIL

Other Optional Enter any other payable charges e.g. fines.

Total payable Mandatory Enter the total payable for the whole entry. If none enter

NIL

50 Declaration Mandatory Enter the name of the person making this declaration, the

name of the respective firm or company and the capacity in

which the declaration is being provided

The declaration must be signed by the importer/exporter,

or by an employee who has been duly authorised in the

case of a firm or company, or by an authorised agent. The

authorised signatory must enter his/her National I.D. No.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

20

11.0

Appendix 1

Customs Office Codes

(Boxes 1 and 29 on the bill of entry)

ZWAGS Air Ground Services (Harare Airport)

ZWBA Bulawayo Airport

ZWBB Beitbridge Custom House

ZWBR Buffalo Range (Frontier Office only)

ZWBW Bulawayo Custom House (Clearance Office only)

ZWCZ Chiredzi Customs House

ZWCH Chirundu Custom House

ZWFB Forbes Border Post

ZWGW Gweru Custom House (Clearance office only)-

ZWHA Harare Airport

ZWHQ Zimbabwe Revenue Authority Headquarters (code allocated for

administrative purposes only, not a valid code for use on Bills of

Entry).

ZWHR Harare Custom House

ZWKB Kariba Border Post

ZWKW Kwekwe Custom House

ZWKN Kanyemba Border Post

ZWKZ Kazungula Border Post

ZWMG Maitengwe Border Post

ZWMK Mukumbura Border Post

ZWMN Masvingo Custom House (Clearance office only)

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

21

ZWMP Mphoengs Border Post

ZWMS Mount Selinda Border Post

ZWMT Mutare Custom House

ZWNY Nyamapanda Border Post

ZWPT Plumtree Custom House

ZWSN Sango Border Post

ZWVF Victoria Falls Custom House

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

22

Appendix 1.a

Frontier Office Codes for Excise Procedures

Note: The following codes are for use ONLY in conjunction with Excise Procedure

Code (IM2). They are ONLY to be shown as Frontier Office Codes (Box 29 on the

Bill of Entry as directed in the notes to the relevant Customs Procedure Code.

Declarants must identify from the list the appropriate code for the office where the

declaration is due to be presented for clearance.

BWEX Bulawayo Excise

CHEX Chirundu Excise

CZEX Chiredzi Excise

GWEX Gweru Excise

HREX Harare Excise

KWEX Kwekwe Excise

MSEX Masvingo Excise

MTEX Mutare Excise

VFEX Victoria Falls Excise

.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

23

Appendix 2

Mode of Transport Codes

(Box 25 on entry)

20 Rail transport

30 Road transport

40 Air transport

50 Postal

61 Multimodal transport -Sea, Rail

62 Multimodal transport -Sea, Road

69 Multimodal transport -not elsewhere specified

70 Pipeline

75 Electric power line

90 Mode unknown

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

24

Appendix 3

Location Codes

(Box 30 on entry)

Location Code

Railways Goods Shed LOC 01

Private Railway Siding LOC 02

Importers Premises LOC 03

Exporters Premises LOC 04

Air Cargo Shed LOC 05

Bonded Warehouse LOC 06

Customs Area/Yard LOC 07

State Warehouse LOC 08

Container Depot LOC 09

Transporters Depot/ Premises, n.e.s.* LOC 10

Agents / Declarants Premises LOC 11

Postal Assessing Office LOC 12

Transit Shed, n.e.s.* LOC 13

Manufacturers Premises LOC 14

Other Location, n.e.s.* LOC 15

*n.e.s.= not elsewhere specified in the list

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

25

Appendix 4

Package Codes

( on entry)

Package type Code

Bulk, Solid particles 01

Bulk, Gaseous 02

Bulk, Liquid 03

Unpacked 04

Cylinder 05

Carton / Boxes 06

Drums 07

Pallets 08

Bags / Sacks 09

Rolls / Reels 10

Units 11

Sheets 12

Bundles 13

Bulk, Solid 14

Part of a package 15

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

26

Appendix 5

Preference Codes

(Box 36 on entry)

RSA South Africa Trade Agreement.

TAG Trade Agreement Group

Countries- BW

NA

MW

CSA Comesa Trade Agreement

Schedule A member states (Duty Free)

Djibouti

Egypt

Madagascar

Malawi

Mauritius

Sudan

Zambia

Schedule B member states (60% reduction)

Burundi

Rwanda

Schedule C member states (80% reduction)

Comoros

Democratic Republic of Congo

Eritrea

Namibia

Swaziland

Uganda

SDC SADC Trade Agreement

Member States (Enjoying Preferential Rates)

South Africa

Mauritius

Namibia

Botswana

Zambia

Zimbabwe

Lesotho

Swaziland

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

27

Appendix 6

Valuation Method Codes

(Box 43 on entry)

Method of Valuation Code

Transaction Value: Primary Method 1

Transaction Value of Identical Goods: 1

st

Alternative 2

Transaction Value of Similar Goods: 2

nd

Alternative 3

The Deductive Value: 3

rd

Alternative 4

The Computed Value: 4th Alternative 5

Fallback: Final Alternative 6

Commissioner Generals Value Ruling 7*

*This code is only applicable where the Commissioner General has issued a Value

Ruling a copy of which must be attached to the Bill of entry presented to ZIMRA.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

28

Appendix 7

Attached Document Codes

(Box 44 on entry)

100 Government Duty Free certificate.

101 Secretary for Education certificate.

200 End user certificate.

300 Manufacturers certificate.

301 Secretary for Finance certificate.

302 Agricultural permit.

303 Secretary for Mines permit.

304 Firearms Permit

305 Industry & Commerce certificate.

307 Secretary for Health certificate.

308 Drugs Control Council licence/certificate

312 Director of National Parks permit

313 CITES certificate

314 Secretary for Local Government, Rural and Urban Development certificate

315 Certificate issued by the Commissioner General

317 Declaration by the Export Processing Zone Executive Officer

318 Rebate letter from Commissioner General

400 Inward Processing Relief declaration.

500 Aircraft Assemblers Declaration

502 Declaration by the Responsible Officer for Rebates.

510 Declaration by the former President.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

29

Appendix 8

Duty Tax Types

(Box 47 of the Bill of Entry)

(A) Tax Codes

01 Customs duty prime

02 Value Added Tax (VAT)

03 Surtax

(B) Tax Base

*This is the (VDP) Value for Duty Purposes (as in box 46) in relation to:

01 Customs Duty and

03 Surtax

*It is also the (VTP) Value for Tax Purposes in relation to:

02 VAT

(C) Rate

*To be displayed will be the ad valorem rate of duty or Value Added Tax

*In cases where there is a combination rate in the Customs Duty column eg

60% + $100.00/kg enter code 777

(D) Amount

Enter the amount of duty to be paid to two decimal places

(E) M.P (Method of Payment)

Enter code 1 if duty is to be collected

Enter code 0 if no duty is to be collected

In a computerised environment box 47 will be electronically completed by the

Computer system but it is advisable to complete it and double-check it against a

computer-generated printout.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

30

Appendix 9

Extended Procedures

(Box 37 on entry)

1000 Direct permanent export

1040 Direct permanent export after entry for home use

1052 Direct permanent export after temporary importation for inward processing

1071 Direct permanent export for excisable goods ex- warehouse.

2000 Entry for Excisable goods

2100 Temporary exports for outward processing

2171 Temporary exports for outward processing of goods ex-warehouse

2200 Temporary exports for return in an unaltered state

2271 Temporary exports for return in an unaltered state of goods ex-warehouse

3040 Re-export after entry for home use

3051 Re-export after temporary import

3052 Re-export after customs inward processing procedure

3071 Re-export after warehousing

4000 Entry for home use (general)

4051 Entry for home use after temporary import and return in an unaltered state

4052 Entry for home use after temporary import for inward processing

4071 Entry for home use ex-warehouse

4080 Entry for consumption ex-Removal in Bond

4081 Entry for consumption ex-Removal in Transit

5100 Temporary import for return in unaltered state

5200 Temporary import for customs inward processing procedure

5271 Temporary import for customs inward processing procedure ex - warehouse

5280 Entry for inward processing ex-Removal in Bond

6010 Re-importation after outright exportation

6021 Re-import after temporary export for outward processing procedure

6022 Re-import after temporary export for return of goods in an unaltered state

7100 Direct entry for customs warehousing procedure

7171 Re-warehousing of goods at the same or another port

7180 Entry for customs warehousing procedure after removal in bond

7181 Entry for customs warehousing procedure after removal in transit

8000 Removal of goods in bond

8071 Removal of goods in bond ex-warehouse

8100 Removal in transit

8180 Removal of goods in transit ex-RIB

9000 Private Importations

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

31

Appendix 10

Additional Codes

(Box 37 on entry)

000

General entry

Authorised with

Extended Procedures

All

105 Exportation of goods by the Government of Zimbabwe 1000, 1040, 1052, 1071,

2100, 2171, 2200, 2271,

3040, 3051, 3052, 3071

120 Exportation of goods - Industrial drawback is claimed

1040

125 Exportation of compensating products manufactured

under IPR combined with materials on which industrial

drawback will be claimed.

1040

170

Exportation of compensating products manufactured

under I.P.R

1052

175 Exportation of goods ex Export Processing Zone 1052

180

Export of excisable goods

1000

201

Entry of opaque beer produced by Local Authorities

2000

301 Re-export after entry for home use where same state

drawback of duty will be claimed

3040

320

Re-exportation of goods where Industrial drawback of

duty is claimed.

3052

401 Goods for resale - Direct home use

4000, 4051,4052, 4071,

4080, 4081

402 Goods for use in manufacture - Direct home use

4000, 4051, 4052, 4071,

4080, 4081

403 Goods for use by the Government

4000, 4051, 4052, 4071,

4080, 4081

404 Goods for use by foreign embassies, High Commissions

and other diplomatic missions

4000, 4051, 4052, 4071,

4080, 4081

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

32

405 Donated hospital requisites including motor vehicles

4000, 4051, 4052, 4071,

4080, 4081,

406 Donated school requisites including motor vehicles

4000, 4051, 4052, 4071,

4080, 4081

407 Component parts and materials for use in the

manufacture of aircraft - conditional entry Commissioner

requirements

4000, 4051, 4052, 4071,

4080, 4081

410 Goods for occupational therapy or training of the blind

4000, 4051, 4052, 4071,

4080,4081

411 Importation of goods by registered miners

4000, 4051, 4052, 4071,

4080, 4081

412 Importation of specified goods for the mining industry

and goods for the prospecting and search for mineral

deposits

4000, 4051, 4052, 4071,

4080, 4081

413 Importation of specified goods for the mining industry

which are for specific use by registered miners

4000, 4051, 4052, 4071 ,

4080,4081

414 Importation of goods of a capital nature for use in the

prospecting and search for mineral deposits

4000, 4051, 4052, 4071,

4080, 4081

415 i) Importation of goods for use in petroleum

exploration or production

ii) Importation of goods pursuant to a special mining

lease.

4000, 4051, 4052, 4071,

4080, 4081

416 Component parts and materials for use in the

manufacture of electrical goods - conditional entry

Commissioner requirements

4000, 4051, 4052, 4071,

4080,4081

417 Importation of goods by farmers and agricultural

co-operatives

4000, 4051, 4052, 4071,

4080, 4081

418 Importation of kerosene for use as fuel in jet aircraft and

importation of fuel, lubricants, and consumable supplies

for certain aircraft

4000, 4051, 4052, 4071,

4080, 4081

420 Importation of aircraft stores and equipment for aircraft

engaged in international air navigation, etc.

4000, 4051, 4052, 4071,

4080, 4081

421 Importation of spare parts for repair or servicing of

foreign owned aircraft

4000, 4051, 4052, 4071,

4080, 4081

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

33

422 Importation of goods for free distribution by International

Organisations

4000, 4051, 4052, 4071,

4080, 4081

423 Importation of goods by a foreign organisation under an

aid or technical co-operation agreement

4000, 4051, 4052, 4071,

4080, 4081

424 Importation of goods by road safety associations or

organisations

4000, 4051, 4052, 4071,

4080,4081

425 Importation of goods by religious, charitable or welfare

organisations in Zimbabwe

4000, 4051, 4052, 4071,

4080, 4081

426 Automatic motor vehicles of 8703 and/or with special

controls for use by a disabled person, and any other

goods for use by a blind or disabled person under

authority of a certificate issued by the Commissioner.

4000, 4051, 4052, 4071,

4080, 4081

427 Importation of goods for religious purposes

4000, 4051, 4052, 4071,

4080, 4081

428 Importation of cups, medals and other trophies awarded

outside Zimbabwe

4000, 4051, 4052, 4071,

4080, 4081

429 Importation of goods for incorporation in the

construction of an approved project

4000, 4051, 4052, 4071,

4080,4081

430 Importation of goods for public museums

4000, 4051, 4052, 4071,

4080, 4081

431 Importation of goods for preparation and packing of

fresh fruit for export

4000, 4051, 4052, 4071,

4080, 4081

432 Importation of samples for destructive testing

4000, 4051, 4052, 4071,

4080, 4081

433 Importation of goods imported by blood transfusion

service organisations

4000, 4051, 4052, 4071,

4080, 4081

434 Importation of seeds of all kinds in bulk for planting

4000, 4051, 4052, 4071,

4080, 4081

435 Importation of substances prepared for medical or

veterinary research

4000, 4051, 4052, 4071,

4080, 4081

436 Importation of diamond drilling tools placed between a

machine and the hole being drilled

4000, 4051, 4052, 4071,

4080, 4081

437 Importation of containers e.g carboys, cylinders, etc.

used on a returnable basis

4000, 4051, 4052, 4071,

4080, 4081

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

34

438

Importation of capital equipment for use in export

processing zones

4000, 4051, 4071, 4080,

4081

439

Importation of capital equipment for use in export

processing zones

4000, 4051, 4071, 4080,

4081

440 Importation of specified goods for the manufacture of

tyres under rebate.

4000, 4051, 4071, 4080,

4081

441

Importation of wines and /or spirits under rebate 4000, 4051, 4052, 4071,

4080, 4081

443 Importation of bicycle kits for use in the assembly of

bicycles.

4000, 4051, 4052, 4071,

4080, 4081

444 Importation of donated goods by Local Authorities

4000, 4051, 4052, 4071,

4080, 4081

445 Importation of certain goods by a former President 4000, 4051, 4052, 4071,

4080, 4081

446 Importation of goods for use by the President of

Zimbabwe and/or his spouse

4000, 4051, 4052, 4071,

4080, 4081

447 Importation of motor vehicle component parts by a

registered assembler

4000, 4051, 4052, 4071,

4080, 4081

449 Importations of goods for specific mine development

operations

4000, 4051, 4052, 4071,

4080, 4081

450

Reserve Bank relief on capital goods and spares 4000, 4051, 4052, 4071,

4080, 4081

452

Reserve Bank relief on raw materials for manufacture 4000, 4051, 4052, 4071,

4080, 4081

453

Rebate of Duty on parts and accessories for public

transport vehicles

4000, 4051, 4052, 4071,

4080, 4081

454

Rebate of Duty on parts of certain railway locomotives of

NRZ

4000, 4051, 4052, 4071,

4080, 4081

455

Rebate of Duty on parts of certain railway locomotives of

other operators

4000, 4051, 4052, 4071,

4080, 4081

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

35

456

Rebate of duty on diplomatic importations 9000

457

Importations under inheritance rebate 9000

458

Importations under immigrants rebate 9000

459

Written off/Destroyed goods, etc removed from a bonded

warehouse.

4071

460

Rebate of duty on arts organisation equipment 4000, 4051, 4052, 4071,

4080, 4081

461

Rebate of duty on refuse collection/road maintenance

vehicles.

4000, 4051, 4052, 4071,

4080, 4081

462

VAT Exemption on Agricultural imports. 4000, 4051, 4052, 4071,

4080, 4081

463

Suspension of duty on goods imported by Air Zimbabwe.

4000, 4051, 4052, 4071,

4080, 4081

464 Suspension of duty on spares imported by ZISCO Steel.

4000, 4051, 4052, 4071,

4080, 4081

465 Rebate of duty on motor vehicles imported by serving

members of parliament of Zimbabwe.

4000, 4051, 4052, 4071,

4080, 4081

466 VAT exemption on approved capital equipment imported

into the country.

4000, 4051, 4052, 4071,

4080, 4081

467 Suspension of duty on ZIMRA scanners.

4000, 4051, 4052, 4071,

4080, 4081

468 Surtax on light passenger motor vehicles of chapter

8703.

4000, 4051, 4052, 4071,

4080, 4081

502 Temporary importation of goods for an approved project

5100

503 Temporary importation of aircraft, tools, spare parts and

equipment for use in search, rescue, investigation, repair

or salvage of lost or damaged aircraft

5100, 5200

504 Temporary importation for repair and return

5200, 5271, 5280

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

36

601 Re-importation after outright exportation where

drawback of duty was claimed

6010

602

Re-importation following temporary exportation for

repair of goods where no duty is payable.

6021

604

Re-importation following temporary exportation for

repairs - customs duty and surtax not payable

6021

606 Re-importation following exportation of goods, other

than those attracting an ad-valorem rate of duty, where a

cost of repair is raised.

6021

701 Warehousing of light passenger motor vehicles of

chapter 8703 where surtax is payable.

7100

801 Removal in bond of light passenger motor vehicles of

chapter 8703 where surtax is payable.

8000, 8100

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

37

Appendix 11

Country and Currency Codes

(Boxes 10, 11, 15, 17, 18, 22 and 34 on entry)

Country name 2 Alpha code Currency name 3 Chr.code

(*See note below)

Afghanistan AF * ZZZ

Albania AL * ZZZ

Algeria DZ * ZZZ

American Samoa AS * ZZZ

Andora AD * ZZZ

Angola AO * ZZZ

Anguilla AI * ZZZ

Antarctica AQ * ZZZ

Antigua and Barbuda AG * ZZZ

Argentina AR * ZZZ

Armenia AM * ZZZ

Aruba AW * ZZZ

Australia AU Australian Dollar AUD

Austria AT Austrian Schilling ATS

Azerbaijan AZ * ZZZ

Bahamas BS * ZZZ

Bahrain BH * ZZZ

Bangladesh BD * ZZZ

Barbados BB * ZZZ

Belarus BY * ZZZ

Belgium BE Belgian Franc BEF

Belize BZ * ZZZ

Benin BJ CFA Franc XOF

Bermuda BM * ZZZ

Bhutan BT * ZZZ

Bolivia BO * ZZZ

Bosnia & Herzegovina BA * ZZZ

Botswana BW Pula BWP

Bouvet Island B V * ZZZ

Brazil BR Cruzeiro BRN

British Indian Ocean

Territory I0 US Dollar USD

British Virgin Islands VG US Dollar USD

Brunei Darussalam BN * ZZZ

Bulgaria BG * ZZZ

Burkina Faso BF CFA Franc XOF

Burma BU * ZZZ

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

38

Burundi BI Burundi Franc BIF

Country name 2 Alpha code Currency name 3 Chr.code

(*see note below)

Cameron CM * ZZZ

Canada CA Canadian Dollar CAD

Cape Verde CV * ZZZ

Cayman Islands KY * ZZZ

Central African Republic CF * ZZZ

Chad TD * ZZZ

Chile CL * ZZZ

China CN Remninbi Yuan CNY

Christmas Island CX * ZZZ

Cocos (Keeling) Islands CC * ZZZ

Colombia CO * ZZZ

Comoros KM * ZZZ

Congo CG * ZZZ

Cook Islands CK * ZZZ

Costa Rica CR * ZZZ

Cote d'Ivoire CI CFA Franc XOF

Croatia HR * ZZZ

Cuba CU Peso CUP

Cyprus CY Cypriot Pound CYP

Czechoslovakia CS * ZZZ

Czech Republic CZ * ZZZ

Democratic Yemen YD * ZZZ

Denmark DK Kroner DKK

Djibout DJ * ZZZ

Dominica DM * ZZZ

Dominican Republic DO * ZZZ

East Timor TP * ZZZ

Ecuador EC * ZZZ

Egypt EG Egyptian Pound EGP

El Salvador SV * ZZZ

Equatorial Guinea GQ * ZZZ

Estonia EE * ZZZ

Ethiopia ET Birr ETB

Falkland Islands (Malvinas) FK * ZZZ

Foroe Islands FO * ZZZ

Fiji FJ * ZZZ

Finland FI Markka FIM

France FR Franc FRF

French Guiana GF French Franc FRF

French Polynesia PF * ZZZ

French Southern (Territories) TF French Franc FRF

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

39

Gabon GA * ZZZ

Gambia GM * ZZZ

Georgia GE * ZZZ

Country name 2 Alpha code Currency name 3 Chr. code

(*see note below)

Germany DE Deutschmark DEM

Ghana GH Cedi GHC

Gibraltar GI * ZZZ

Greece GR Drachma GRD

Greenland GL * ZZZ

Grenada GD * ZZZ

Guadeloupe GP French Franc FRF

Guam GU US Dollar USD

Guatemala GT * ZZZ

Guinea GN * ZZZ

Guinea-Bissau GW * ZZZ

Guyana GY * ZZZ

Haiti HT * ZZZ

Heard & McDonald Islands HM Australian Dollar AUD

Honduras HN * ZZZ

Hong Kong HK Hong Kong Dollar HKD

Hungary HU * ZZZ

Iceland IS * ZZZ

India IN Indian Rupee INR

Indonesia ID * ZZZ

Iran (Islamic Republic of) IR * ZZZ

Iraq IQ * ZZZ

Ireland IE Punt IEP

Israel Shekel IL ILS

Italy IT Lira ITL

Jamaica JM * ZZZ

Japan JP Yen JPY

Jordan JO * ZZZ

Kampuchea, (Democratic KH * ZZZ

Peoples Republic)

Kazakhstan KZ * ZZZ

Kenya KE Kenyan Shilling KES

Kiribati KI Australian Dollar AUD

Kuwait KW * ZZZ

Kyrgyzstan KG * ZZZ

Lao People's Democratic LA * ZZZ

Republic

Latvia LV * ZZZ

Lebanon LB * ZZZ

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

40

Country name 2 Alpha code Currency name 3 Chr. code

(* see note below)

Lesotho LS Maluti LSL

Liberia LR * ZZZ

Libian Arab Jamahiriya LY * ZZZ

Liechtenstein LI * ZZZ

Lithuania LT * ZZZ

Luxembourg LU * ZZZ

Macau MO * ZZZ

Madagascar MG * ZZZ

Malawi MW Kwacha MWK

Malaysia MY Ringgit MYR

Maldives MY * ZZZ

Mali ML CFA Franc XOF

Malta MT * ZZZ

Marshall Islands MH US Dollar USD

Martinique MQ French Franc FRF

Mauritania MR * ZZZ

Mauritius MU Mauritian Rupee MUR

Mexico MX * ZZZ

Micronesia FM US Dollar USD

Moldova, (Republic of) MD * ZZZ

Monaco MC French Franc FRF

Mongolia MN * ZZZ

Montserrat MS * ZZZ

Morocco MA * ZZZ

Mozambique MZ Metical MZM

Namibia NA Namibian Dollar NAD

Nauru NR Australian Dollar AUD

Nepal NP * ZZZ

Netherlands NL Guilder NLG

Netherlands Antilles AN * ZZZ

Neutral Zone NT * ZZZ

New Caledonia NC * ZZZ

New Zealand NZ New Zealand Dollar NZD

Nicaragua NI * ZZZ

Niger NE CFA Franc XOF

Nigeria NG Naira NGN

Niue NU New Zealand Dollar NZD

Norfolk Islands NF Australian Dollar AUD

North Korea. KP North Korean Won KPW

Northern Mariana Islands MP US Dollar USD

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

41

Norway NO Kroner NOK

Oman OM * ZZZ

Country name 2 Alpha code Currency name 3 Chr. code

(*see note below)

Pakistan PK Pakistan Rupee PKR

Palau PW US Dollar USD

Panama PA * ZZZ

Papua New Guinea PG * ZZZ

Paraguay PY * ZZZ

Peru PE * ZZZ

Philippines PH * ZZZ

Pitcairn PN New Zealand Dollar NZD

Poland PL * ZZZ

Portugal PT Escudo PTE

Puerto Rico PR US Dollar USD

Qatar QA * ZZZ

Reunion RE French Franc FRF

Romania RO * ZZZ

Russian Federation RU Russian Rouble RUR

Rwanda RW Rwandan Franc RWF

Saint Kitts and Nevis KN * ZZZ

Saint Lucia LC * ZZZ

Saint Vincent & the Grenadines VC * ZZZ

Samoa WS * ZZZ

San Marino SM Italian Lira ITL

Sao Tome and Principe ST * ZZZ

Saudi Arabia SA Riyal SAR

Senegal SN CFA Franc XOF

Seychelles SC * ZZZ

Sierra Leone SL * ZZZ

Singapore SG Singapore Dollar SGD

Slovakia SK * ZZZ

Slovenia ST * ZZZ

Solomon Islands SH * ZZZ

Somalia SO * ZZZ

South Korea KR South Korean Won KRW

South Africa ZA Rand ZAR

Spain ES Peseta ESP

Sri Lanka LK * ZZZ

St Pierre Miquelon PM French Franc FRF

St. Helena SH * ZZZ

Sudan SD * ZZZ

Suriname SR * ZZZ

Svalbard and Jan Mayen Islands SJ Norwegian Kroner NOK

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

42

Swaziland SZ Lilongeni SZL

Sweden SE Swedish Kroner SEK

Switzerland CH Swiss Franc CHF

Country name 2 Alpha code Currency name 3 Chr. code

(*see note below)

Syrian Arab Republic SY * ZZZ

Taiwan TW Taiwanese Dollar TWD

Tajikistan T J * ZZZ

Tanzania TZ Shilling TZS

Thailand TH Baht THB

Togo TG CFA Franc XOF

Tokelau TK New Zealand Dollar NZD

Tonga TO * ZZZ

Trinidad and Tobago TT * ZZZ

Tunisia TN * ZZZ

Turkey TR * ZZZ

Turkmenistan TM * ZZZ

Turks and Caicos Islands TC US Dollar USD

Tuvalu TV Australian Dollar AUD

Uganda UG Ugandan Shilling UGS

Ukraine UA * ZZZ

United Arab Emirates AE Dirham AED

United Kingdom GB Pound Sterling GBP

United States Minor Outer Isles UM US Dollar USD

United States of America US US Dollar USD

Uruguay UY * ZZZ

Uzbekistan UZ * ZZZ

Vanuatu VU * ZZZ

Vatican City State (Holy See) VA Italian Lira ITL

Venezuela VE * ZZZ

Vietnam VM * ZZZ

Virgin Islands VI US Dollar USD

Wallis & Futuna Islands WF * ZZZ

Western Sahara EH Spanish Pesetas ESP

Yugoslavia YU * ZZZ

Zaire ZR * ZZZ

Zambia ZM Kwacha ZMK

Zimbabwe ZW Zimbabwean Dollar ZWD

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

43

Notes:

1. In relation to the currencies and their related codes in the above table the

occurrence of an * followed by the three character "ZZZ" code indicates that the

computer system does NOT hold the relevant rate of exchange for the currency unit

used by that country. Where invoices, freight accounts, AWB's etc in such currencies

the local customs office must be consulted as to the appropriate rate of exchange to

use for the purposes of calculating the equivalent amount in national currency

{Zimbabwe dollars). Any such conversions must be shown on a worksheet attached to

the Bill of Entry.

2. In addition to the countries and their related currencies as shown above certain

other currency codes identifying regional or economic groupings are in existence and

have an exchange rate which is held in the computer system, these are as follows:

Grouping/Currency unit Code

European Community Currency Unit {ECU). XEU

CFA Franc {under the authority of BCEAO XOF

Banque centrale des Etats de l'Afrique de l'Ouest).

Preferential Trade Area for the Eastern PT A

and Southern African States {UAPTA).

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

44

12.0 Detailed descriptive notes on Customs Procedure Codes

** Additional Code 000 is a general code that can be combined with all extended

procedure codes.

- The use of this code in IM4 regime denotes that one is not claiming relief

from duties payable i.e. Customs Duty; Import Tax and Surtax are payable.

- On Re-imports (IM6), Extended Procedures 6010 and 6022 mean that no

duties are payable with the exception of other fees and fines that might be

levied. eg 6022 000.

- The use of 6021 000 will mean that there is no relief from all duties

payable.

** Extended Procedure 4081 will only be used on the authority of the Port Controller

where the bill of entry is to be lodged.

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

45

105 Description: Exportation of goods by the government of Zimbabwe

Legislation: -

Number of copies required: Computer Environment 2

Manual Environment 4

Supporting documents: -

Duties payable: Nil

Special provisions: -

Permitted Extended

Procedures:

1000, 1040, 1052, 1071, 2100, 2171, 2200, 2271, 3040,

3051, 3052, 3071

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

46

120 Description: Exportation of goods on which industrial drawback is

to be claimed.

This procedure caters for the exportation of goods on

which industrial drawback is claimed when such goods

are manufactured in Zimbabwe from duty paid materials

originally imported into Zimbabwe. Upon exportation the

goods must not have undergone any use within

Zimbabwe.

Legislation: Section 99 of the Customs and Excise

(General) Regulations, 2001

Customs and Excise (Industrial Drawbacks) Regulations

1991.

Number of copies required: Computer environment 3

Manual environment 5

Supporting Documents:

Duties Payable: Nil.

Special Provisions: The goods must be exported within two years of the date

upon which duty on importation was paid. Any claim to

drawback must be lodged within thirty days of the date

of exportation of the goods.

Permitted Extended

Procedures:

1040

Zimbabwe Revenue Authority

Asycuda++ Trade Manual 2005 (version 1)

47

125 Description: Exportation of compensating products manufactured

under the Customs and Excise (Inward

Processing)(Rebate) Regulations combined with

materials on which industrial drawback is to be

claimed.

This procedure caters for the exportation of

compensating products manufactured under Inward

Processing Rebate when combined with duty paid stocks

on which industrial Drawback will he claimed. Upon

exportation the goods must not have undergone any use

within Zimbabwe.

Legislation: Section 79 of the Customs and Excise

(General)(Regulations), 2001.

Section 99 of the Customs and Excise

(General)(Regulations), 2001.

Section 4 of the Customs and Excise (Industrial

Drawback) Regulations, 1991.

The Customs and Excise (Inward Processing)(Rebate)

Regulations, 1997.

Number of copies required: Computer environment 4

Manual environment 6

Supporting Documents:

Duties Payable: Nil

Special Provisions: This Additional Code is a combination of codes 120 and