Professional Documents

Culture Documents

Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)

Uploaded by

priyaradhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)

Uploaded by

priyaradhiCopyright:

Available Formats

Sr No in

Form 15G

Sr No in

Form 15H

PARTICULARS (REQUIRED DETAILS)

ANSWERS

Sr No in

Form 15G

Sr No in

Form 15H

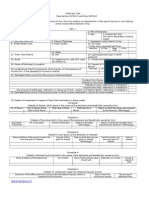

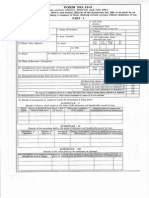

FORM NO. 15H

[See section 197A(1C), 197A(1A) and rule 29C(1A)]

Declaration under section 197A(1C) of the Incometax Act, 1961 to be made by an individual who is of the age of sixty years or more claiming certain

receipts without deduction of tax.

PART - I

1] Name of Assessee (Declareant) : 2] PAN :

AGLPN1819M

M NANDHINI

3] Age :

2014-15

4] Assessment Year : Individual

5] Flat / Door / Block No. : 6] Name of Premises :

7] Assessed in which

Ward / Circle :

1/828,

11] Town / City / District : 12] State :

8] Road / Street / Lane : 9] Area / Locality : 10] AO Code (whom assessed last time) :

11TH STREET, KARTHIKEYAPURAM, Area Code AO Type Range Code AO No.

15] Email : 16] Telephone / Mobile No :

17] Present Ward / Circle : WD I(3) TBM

044-22470442

CHENNAI

TAMILNADU 14] Last Assessment Year in

which assessed :

13] PIN 600091

18] Name of Business / Occupation :

19] Present AO Code (if not same as above):

HOUSEWIFE

20] Jurisdictional Chief Comm. of Income Tax or Comm. of Income Tax (if not

assessed to income tax earlier):

Area Code AO Type Range Code AO No.

CHE W

Interest on securities referred to in Schedule - II X

Interest on sums referred to in Schedule - III

Income form units referred to in Schedule - IV

141

21] Estimated total income from the sources mentioned below: (Please tick the relevant box)

Dividend from shares referred to in Schedule - I

(Details of shares, which stand in the name of the declarant and beneficially owned by him)

No. of Class of shares & face Total value Distinctive numbers Date on which the shares were acquired

The amt of withdrawal referred in clause(a) of subsec2 of sec80CCA referred in Schedule V

22] Estimated total income of the previous year in income mentioned in Col - 21 to be included :

23] Details of investments in respect of which the declaration is being made :

SCHEDULEI

shares value of each share of shares of the shares by the declarant (dd/mm/yyyy)

(Details of the securities held in the name of declarant and beneficially owned by him)

Description of Number of Amount of Date(s) of Date(s) on which the securitues were

SCHEDULEII

securities securities securities securities (dd/mm/yyyy) acquired by declarant (dd/mm/yyyy)

FIXED DEPOSIT ONE Rs.1,30,000.00 02.02.2013 02.02.2008

(Details of the sums given by the declarant on interest)

Name and address of the person to Amount of sums Date on which sums given Period for which sums Rate of

SCHEDULEIII

NIL NIL NIL NIL

whom the sums are given on interest given on interest on Interest (dd/mm/yyyy) were given on interest interest

V

on relevant to the relevant to the assessment year will be nil.

V

Forwarded to the Chief Commissioner or Commissioner of Incometax

SCHEDULE IV (Details of the mutual fund units held in the name of declarant and beneficially owned by him)

Name and address of the Number of Class of units & face Distinctive number Income in

mutual fund units value of each unit of units respect of units

SCHEDULEV (Details of the withdrawal made from National Savings Scheme)

Particulars of the Post Office where the account under the Date on which the account The amount of withdrawal

National Savings Scheme is maintained and the account number was opened (dd/mm/yyyy) from the account

NIL

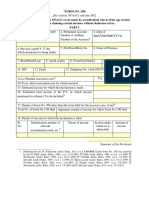

Signature of the Declarant

Declaration / Verification

*I/ We M NANDHINI do hereby declare that I am resident in India within

NIL

Date : 16-May-2014 Signature of the Declarant

PART - II

[For use by the person to whom the declaration is furnished]

1] Name of the person responsible for paying the income referred to in Column 21 of Part I

:

2] PAN of the person indicated in Column 1 of Part II :

meaning of section 6 of the Incometax Act, 1961. I also, hereby declare that to the best of my knowledge and belief what is stated

above is correct, complete and is truly stated and that the incomes referred to in this form are not includible in the total income of

any other person u/s 60 to 64 of the Incometax Act, 1961. I further, declare that the tax my estimated total income, including

*income / incomes referred to in column 21computed in accordance with the provisions of the Incometax Act, 1961, for the previous

year ending

31/03/2014 2014-15

Place : CHENNAI

MADIPAKKAM, CHENNAI - 600091

5] Email : 6] Telephone / Mobile No : 7] Status :

BANK OF INDIA

3] Complete Address : 4] TAN of the person indicated in

VASAN COMPLEX,, BALIAH GARDENS. Column 1 of Part II :

Manager

8] Date on which Declaration is Furnished

(dd/mm/yyyy) :

9] Period in respect of which the dividend

has been declared or the income has been

paid / credited :

10] Amount of income paid :

11] Date on which the income

has been paid / credited

(dd/mm/yyyy) :

Rs. 11,618/-

16-May-2014

Place : CHENNAI Signature of the person responsible for paying the

Date : income referred to in Column 21 of Part I

Rs.967.73 per month

12] Date of declaration, distribution or payment of dividend/withdrawal

under the NSS (dd/mm/yyyy) :

13] Account Number of NSS from which withdrawal has been made :

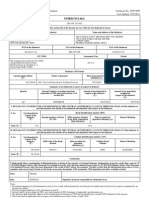

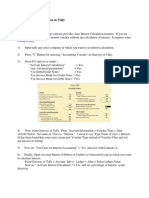

FORM NO. 15G

[See section 197A(1C), 197A(1A) and rule 29C]

Declaration under section 197A(1) and section 197A (1A) of the Incometax Act, 1961 to be made by an individual or Person (not being a company or firm)

claiming certain receipts without deduction of tax.

PART - I

1] Name of Assessee (Declareant) : 2] PAN :

AGLPN1819M

M NANDHINI

3] Assessment Year :

2014-15

6] Status Individual

4] Flat / Door / Block No. : 5] Name of Premises :

7] Assessed in which Ward

/ Circle :

1/828,

11] Town / City / District : 12] State :

8] Road / Street / Lane : 9] Area / Locality : 10] AO Code (whom assessed last time) :

11TH STREET, KARTHIKEYAPURAM, Area Code AO Type Range Code AO No.

15] Email : 16] Telephone / Mobile No : 17] Present Ward / Circle : WD I(3) TBM

044-22470442 18] Residential Status : Resident

CHENNAI

TAMILNADU 14] Last Assessment Year in which

assessed :

13] PIN 600091

19] Name of Business / Occupation :

20] Present AO Code (if not same as above):

HOUSEWIFE

21] Jurisdictional Chief Comm. of Income Tax or Comm. of Income Tax (if not

assessed to income tax earlier):

Area Code AO Type Range Code AO No.

CHE W

Interest on securities referred to in Schedule - II X

Interest on sums referred to in Schedule - III

Income form units referred to in Schedule - IV

141 3

22] Estimated total income from the sources mentioned below:

Dividend from shares referred to in Schedule - I

(Details of shares, which stand in the name of the declarant and beneficially owned by him)

No. of Class of shares & face Total value Distinctive numbers Date on which the shares were acquired

The amt of withdrawal referred in sec-80CCA(2)(a) from National Savings Scheme referred to in Schedule - V

23] Estimated total income of the previous year in income mentioned in Col - 22 to be included :

24] Details of investments in respect of which the declaration is being made :

SCHEDULEI

shares value of each share of shares of the shares by the declarant (dd/mm/yyyy)

(Details of the securities held in the name of declarant and beneficially owned by him)

Description of Number of Amount of Date(s) of Date(s) on which the securitues were

SCHEDULEII

securities securities securities securities (dd/mm/yyyy) acquired by declarant (dd/mm/yyyy)

FIXED DEPOSIT ONE Rs.1,30,000.00 02.02.2013 02.02.2008

(Details of the sums given by the declarant on interest)

Name and address of the person to Amount of sums Date on which sums given Period for which sums Rate of

A/C805642710000006

SCHEDULEIII

NIL

whom the sums are given on interest given on interest on Interest (dd/mm/yyyy) were given on interest interest

NIL NIL NIL

V

for the previous year ending on relevant to the assessment year will be nil.

relevant to the assessment year will not exceed the maximum amount which is not chargeable to income tax.

V

Forwarded to the Chief Commissioner or Commissioner of Incometax ____________________

SCHEDULE IV (Details of the mutual fund units held in the name of declarant and beneficially owned by him)

Name and address of the Number of Class of units & face Distinctive number Income in

mutual fund units value of each unit of units respect of units

Particulars of the Post Office where the account under the Date on which the account Amount of withdrawals

National Savings Scheme is maintained and the account number was opened (dd/mm/yyyy) from the account

SCHEDULEV (Details of the withdrawal made from National Savings Scheme)

NIL

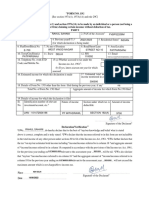

Signature of the Declarant

Declaration / Verification

*I/ We

M NANDHINI

do hereby declare that to the best of knowledge

NIL

Place : CHENNAI

Date : 16-May-2014 Signature of the Declarant

and belief what is stated above is correct, complete and truly stated. *I /We declare that incomes referred to in this form are not includible

in the total income of any other person u/s 60 to 64 of Income Tax Act, 1961. *I/We further, declare that tax *on my / our estimated total

income, including *income/incomes referred to in column 22 above, computed in accordance with provisions of the Income Tax Act 1961,

31/03/2014 2014-15

31/03/2014

2014-15

*I / We also, declare that *my / our *income / incomes referred to in Column 22 for the previous year ending on

3] Complete Address : 4] TAN of the person indicated in

VASAN COMPLEX,, BALIAH GARDENS. Column 1 of Part II :

MADIPAKKAM, CHENNAI 600091

PART - II

[For use by the person to whom the declaration is furnished]

1] Name of the person responsible for paying the income referred to in Column 22

of Part I :

2] PAN of the person indicated in Column 1 of Part II :

BANK OF INDIA

8] Date on which Declaration is Furnished

(dd/mm/yyyy) :

9] Period in respect of which the

dividend has been declared or the

income has been paid / credited :

10] Amount of income

paid:

11] Date on which the

income has been paid /

credited (dd/mm/yyyy) :

Rs. 11,618/-

16-May-2014 Rs.967.73 per month

5] Email : 6] Telephone / Mobile No : 7] Status :

Manager

Place : CHENNAI Signature of the person responsible for paying the

Date : income referred to in Column 21 of Part I

12] Date of declaration, distribution or payment of dividend /

withdrawal under the National Savings Scheme (dd/mm/yyyy) :

13] Account Number of National Saving Scheme from which

withdrawal has been made :

You might also like

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Form 15g NewDocument4 pagesForm 15g NewnazirsayyedNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- PDF Editor: Form No. 15GDocument2 pagesPDF Editor: Form No. 15GImissYouNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- FORM-15G: (Please Tick The Relevant Box)Document4 pagesFORM-15G: (Please Tick The Relevant Box)Kayam BalajiNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Form 15g TaxguruDocument3 pagesForm 15g Taxguruulhas_nakasheNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Form No. 15G: Part - IDocument3 pagesForm No. 15G: Part - ImohanNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocument2 pages"Form No. 15H: Area Code Range Code AO No. AO Typepkw007No ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Form No. 15G: Part - IDocument2 pagesForm No. 15G: Part - Ibalaji stationersNo ratings yet

- Form ITR-VDocument1 pageForm ITR-VSanjeev BansalNo ratings yet

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocument2 pages"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNo ratings yet

- Income Tax DepartmentDocument6 pagesIncome Tax DepartmentRajasekar SivaguruvelNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniNo ratings yet

- Form VAT - 17: Return by A Registered PersonDocument3 pagesForm VAT - 17: Return by A Registered PersonYf WoonNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- 38 Annexure 19Document4 pages38 Annexure 19ashwinrkghadgeNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Form No.15gDocument2 pagesForm No.15gPrakash GowdaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Tds Calculator W.E.F. 1.10.09Document1 pageTds Calculator W.E.F. 1.10.09priyaradhiNo ratings yet

- Tally Auto InterestDocument2 pagesTally Auto InterestpriyaradhiNo ratings yet

- Project ReportDocument5 pagesProject ReportPriya RadhiNo ratings yet

- Shaligrama StotramDocument5 pagesShaligrama StotrampriyaradhiNo ratings yet

- Service Tax Return 3in Excel Format-1Document8 pagesService Tax Return 3in Excel Format-1priyaradhiNo ratings yet

- Pregnancy SlokamDocument1 pagePregnancy SlokampriyaradhiNo ratings yet

- Pro Tools ShortcutsDocument5 pagesPro Tools ShortcutsSteveJones100% (1)

- Manuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Document46 pagesManuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Franzis Jayke BatallantesNo ratings yet

- Leeka Kheifets PrincipleDocument6 pagesLeeka Kheifets PrincipleAlexandreau del FierroNo ratings yet

- DR-2100P Manual EspDocument86 pagesDR-2100P Manual EspGustavo HolikNo ratings yet

- Overcurrent CoordinationDocument93 pagesOvercurrent CoordinationKumar100% (1)

- MLT Torque Ring Field Make-Up HandbookDocument44 pagesMLT Torque Ring Field Make-Up HandbookKolawole Adisa100% (2)

- Vicente, Vieyah Angela A.-HG-G11-Q4-Mod-9Document10 pagesVicente, Vieyah Angela A.-HG-G11-Q4-Mod-9Vieyah Angela VicenteNo ratings yet

- Aman 5Document1 pageAman 5HamidNo ratings yet

- Bank of AmericaDocument1 pageBank of AmericaBethany MangahasNo ratings yet

- MCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingDocument4 pagesMCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingTerry SmithNo ratings yet

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Document3 pagesAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraNo ratings yet

- LICDocument82 pagesLICTinu Burmi Anand100% (2)

- Scope of Internet As A ICTDocument10 pagesScope of Internet As A ICTJohnNo ratings yet

- Simavi - Project Officer PROPOPIDocument4 pagesSimavi - Project Officer PROPOPIAgus NugrahaNo ratings yet

- BPL-DF 2617aedrDocument3 pagesBPL-DF 2617aedrBiomedical Incharge SRM TrichyNo ratings yet

- Preventive Maintenance - HematologyDocument5 pagesPreventive Maintenance - HematologyBem GarciaNo ratings yet

- MCoal Coal July Investor SlidesDocument26 pagesMCoal Coal July Investor SlidesMCoaldataNo ratings yet

- PW Unit 8 PDFDocument4 pagesPW Unit 8 PDFDragana Antic50% (2)

- RetrieveDocument8 pagesRetrieveSahian Montserrat Angeles HortaNo ratings yet

- The Concept of ElasticityDocument19 pagesThe Concept of ElasticityVienRiveraNo ratings yet

- Introduction To AirtelDocument6 pagesIntroduction To AirtelPriya Gupta100% (1)

- EASY DMS ConfigurationDocument6 pagesEASY DMS ConfigurationRahul KumarNo ratings yet

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocument11 pagesPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- Belimo Fire & Smoke Damper ActuatorsDocument16 pagesBelimo Fire & Smoke Damper ActuatorsSrikanth TagoreNo ratings yet

- VP Construction Real Estate Development in NY NJ Resume Edward CondolonDocument4 pagesVP Construction Real Estate Development in NY NJ Resume Edward CondolonEdwardCondolonNo ratings yet

- PanasonicDocument35 pagesPanasonicAsif Shaikh0% (1)

- BACE Marketing Presentation FINALDocument14 pagesBACE Marketing Presentation FINALcarlosfelix810% (1)

- Proposal For Chemical Shed at Keraniganj - 15.04.21Document14 pagesProposal For Chemical Shed at Keraniganj - 15.04.21HabibNo ratings yet

- Powerpoint Presentation R.A 7877 - Anti Sexual Harassment ActDocument14 pagesPowerpoint Presentation R.A 7877 - Anti Sexual Harassment ActApple100% (1)