Professional Documents

Culture Documents

Birla Institute of Technology Noida: Name of Trainee: Organization: Topic of Project

Uploaded by

Vidushi GautamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Birla Institute of Technology Noida: Name of Trainee: Organization: Topic of Project

Uploaded by

Vidushi GautamCopyright:

Available Formats

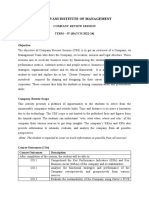

BIRLA INSTITUTE OF TECHNOLOGY

NOIDA

Name of Trainee:

Organization:

Topic of Project:

Following the completion of the summer training of the above trainee, the institute

requests you to kindly fill the following Performa in order assess and verify his/her

performance.

TRAINEE EVALUATION FORM

1. Please evaluate the intern on qualities listed below:-

(Ratings 1-Poor, 2-Fair, 3-Good, 4-Very Good, 5-Excellent)

Please Tick any one.

1 2 3 4 5

Trainees attendance record

Professionalism/Trainees conduct

Willingness to perform assigned work

Willingness to follow instructions

Ability to meet set deadlines

Quality of Trainees work

Ability to work in a team environment

Ability to work Independently

Ability to offer new and innovative ideas

Participation on organizational activities

Eagerness to learn new things

Completion of project report

Overall performance of the Trainee

2. Did the trainee meet your expectations and are you satisfied with his/her

performance? If yes, please explain

3. How strongly do you recommend the candidate for employment in any

organization in future?

1 2 3 4 5

LOW HIGH

4. Any additional comments:-

Name and signature of Industry Mentor

(Seal of the Company/Organization)

MBA 3075 BANK MANAGEMENT

Credits: 3

L-T-P: 3-0-0

Contact Hours: 36-40

Course Outline

This course aims at to provide adequate knowledge in the area of modern banking, which is

an important sector of an active financial system of any country. The banks are presently

working in open and challenging environment evolving unique products to comp ete. At the

end of the course the students will be able to understand the complex and critical role of

modern bankers for economic development of any country.

Module 1

Introduction

Meaning and Definition of Banking, Evolution of Indian Banking system, Features of Banking,

Classification of Banks. Bank Customer relationship, Paying Banker vs. Collecting Banker,

Negotiable Instrument Act,

Module 2

Central Banking system

Definition of Central Bank, Need of Central Banking, Central Banking & Commercial Ban king,

Establishment of Reserve Bank of India, Organization & Administration of RBI, Functions of

RBI.

Module 3

Commercial Banking

Functions of Commercial Banks, Management of Commercial Bank - Board of Director,

Organizational set up of Commercial Banks in India, Role of Commercial Banks in economic

development of India, Profitability of Indian Commercial Banks.

Module 4

Banking Business

Fund Base Business - Meaning and Types of business, Concept of Loans and Advances, Types

of Loans - Cash Credit, Overdraft, Term Loan. Mechanism of Loan Accounts, Management of

Loans and Advances, Primary and Collateral securities, Modes of creating charges on securities -

Hypothecation, Pledge, Mortgage, Lien and Assignment. Non -Fund Base Business - Bank

Guarantee, Letter of Credit.

Module 5

Merchant Banking

Introduction, Concept, Role of Merchant Bankers, Investment Banking, Venture Capital

Funding, Factoring services, Banc assurance.

Module 6

Management of Non-Performing Asset (NPA)

NPA Definition & Concept, Remedial and Corrective measures in managing NPAs.

Prudential Norms - Capital Adequacy, Income Recognition and Assets Classification (IRAC).

Module 7

International Banking

International Regulations of Commercial Bank, Basle Committee & Basle Concordats; Role of

EXIM Bank, Role of IMF, Role of Asian Development Bank.

Minimum 5 cases to be discussed.

Suggested Readings

1. Banking Law and Practice, P.N.Varshney, Sultan Chand

2. Foreign Exchange and Risk Management, C. Jeevanandam , Sultan Chand

3. Indian Banking, R. Parameswaran and S.Natarajan, Vikas Publication

4. Management of Indian Financial Institutions, R.M.Srivastava, Himalaya Publication

5. International Financial Management, Vyptakesh sharan, Prentice Hall of India P vt. Ltd., New

Delhi.

6. Elements of Banking and Insurance, Jyotsna Sethi and Nishwan Bhalla, PHI

You might also like

- Assignment Point - Solution For Best Assignment PaperDocument25 pagesAssignment Point - Solution For Best Assignment PaperMd. Mehedi HasanNo ratings yet

- Course Outline Entrepreneurship BSECO 2K21 by Babar IjazDocument6 pagesCourse Outline Entrepreneurship BSECO 2K21 by Babar IjazNada ImranNo ratings yet

- Reflective Report: Name: Hamza Iqbal SahiDocument15 pagesReflective Report: Name: Hamza Iqbal SahiSalman ZafarNo ratings yet

- A Research On Understanding and Exploring Job Description in Standard Chartered BankDocument59 pagesA Research On Understanding and Exploring Job Description in Standard Chartered BankMd Saimum HossainNo ratings yet

- Business Finance q1m1Document24 pagesBusiness Finance q1m1Lovely Chloe Bandulon100% (1)

- Master of Business Administration (Marketing & Sales) Programme Code: MMSDocument36 pagesMaster of Business Administration (Marketing & Sales) Programme Code: MMSAnurag RathiNo ratings yet

- UntitledDocument82 pagesUntitledSamadhan PatilNo ratings yet

- Research Proposal ODDocument6 pagesResearch Proposal ODAnis Zaman100% (1)

- UBL ReportDocument75 pagesUBL ReportEhsan HaiderNo ratings yet

- AssignmentDocument33 pagesAssignmentFarhadHosenNo ratings yet

- Utkarsh ReportDocument13 pagesUtkarsh ReportYasir AbbasNo ratings yet

- Project Final WorkDocument86 pagesProject Final WorkAman WaghNo ratings yet

- Internship Completion Certificate: (Issued by The Company)Document10 pagesInternship Completion Certificate: (Issued by The Company)Milton StevensNo ratings yet

- Internship Report On ZTBL, Prepared by Wasim Uddin Orakzai Student of Finance 2010, KUSTDocument95 pagesInternship Report On ZTBL, Prepared by Wasim Uddin Orakzai Student of Finance 2010, KUSTWasimOrakzai100% (4)

- Term Paper On Dhaka BankDocument29 pagesTerm Paper On Dhaka BankQuazi Aritra Reyan100% (1)

- VickyDocument14 pagesVickyvickyrajput18696No ratings yet

- National Bank of Pakistan Internship ReportDocument68 pagesNational Bank of Pakistan Internship Reportbbaahmad89100% (2)

- Internship ReportDocument60 pagesInternship Reportraahul7100% (3)

- Imt PMSDocument76 pagesImt PMSkartikNo ratings yet

- Company Review SessionDocument8 pagesCompany Review SessionSyedaNo ratings yet

- Nadia Intern ReportDocument37 pagesNadia Intern ReportJannatul NayeemNo ratings yet

- Module 4 - Work HabitsDocument69 pagesModule 4 - Work HabitsYhan Brotamonte BoneoNo ratings yet

- Entrepreneurship 1Document10 pagesEntrepreneurship 1Dawoodkhan safiNo ratings yet

- Chapter One: 1.1. Introduction of Internship Report:: Kashf Micro-Finance Bank LimitedDocument56 pagesChapter One: 1.1. Introduction of Internship Report:: Kashf Micro-Finance Bank Limitedmunna_bhai_tk7534No ratings yet

- Jhelum River, Group 7, Casestudy 1, Week 3Document3 pagesJhelum River, Group 7, Casestudy 1, Week 3AAKANSHA BUDHANINo ratings yet

- Q3 CGP For Grade 11 Module 4Document5 pagesQ3 CGP For Grade 11 Module 4jessica laranNo ratings yet

- Table of ContentsDocument10 pagesTable of Contentsnaveed_mirzamanNo ratings yet

- SIP GuidelinesDocument27 pagesSIP GuidelinesPrisha VermaNo ratings yet

- Entrepreneurship and New Venture Creation 2009Document2 pagesEntrepreneurship and New Venture Creation 2009Prof Dr Chowdari Prasad100% (1)

- Internship GuidelinesDocument23 pagesInternship GuidelinesVinod KumarNo ratings yet

- Assignment 1st Year HR ManagementDocument4 pagesAssignment 1st Year HR ManagementAjendra Sengar0% (1)

- Corporate Governance Course OutlineDocument15 pagesCorporate Governance Course OutlineMuddasar AbbasiNo ratings yet

- Training Needs Analysis at Bank of Baroda - Zahir Uddin Mohammad Babar - 1910666Document11 pagesTraining Needs Analysis at Bank of Baroda - Zahir Uddin Mohammad Babar - 1910666ZAHIRNo ratings yet

- Internship Report On Credit Adminitraation of Mutual Trust BankDocument140 pagesInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibNo ratings yet

- Philippine Industries and Management: Workbook in IT 20Document27 pagesPhilippine Industries and Management: Workbook in IT 20Jayvee Rañon BalbasNo ratings yet

- Training Manual On Resume WritingDocument22 pagesTraining Manual On Resume WritingAwais Ahmad ShahNo ratings yet

- Project Sharekhan MbaDocument170 pagesProject Sharekhan MbaRajat SharmaNo ratings yet

- Final HRMDocument9 pagesFinal HRMAima ImranNo ratings yet

- Internship Report 2017Document6 pagesInternship Report 2017wasif ajmalNo ratings yet

- THREE 0580-AuditingDocument8 pagesTHREE 0580-AuditingAdnan SaleemNo ratings yet

- Job Satisfaction of The Employees of Mercantile Bank LimitedDocument51 pagesJob Satisfaction of The Employees of Mercantile Bank Limitednasima khatun100% (1)

- Aman Kapoor - Col. KS Mohan Sir - Priority BankingDocument69 pagesAman Kapoor - Col. KS Mohan Sir - Priority Bankingbond11111No ratings yet

- SB Unit 13 Resume Writing Ed2 v2r1Document34 pagesSB Unit 13 Resume Writing Ed2 v2r1Gopal JoshiNo ratings yet

- S. R. Luthra Institute of ManagementDocument8 pagesS. R. Luthra Institute of Managementjigar jainNo ratings yet

- INTERNSHIP REPORT ON JuberDocument21 pagesINTERNSHIP REPORT ON JuberDev TiwariNo ratings yet

- L5 HRM Manual Advance EditionDocument220 pagesL5 HRM Manual Advance EditionEbooks Prints91% (11)

- SME Banking of Agrani Bank LTD PDFDocument49 pagesSME Banking of Agrani Bank LTD PDFjoyNo ratings yet

- Me Ez An Bank Internship ReportDocument11 pagesMe Ez An Bank Internship ReportAaftab SheikhNo ratings yet

- 2k20 MBA 119 - InternshipDocument31 pages2k20 MBA 119 - Internshipshivam prasharNo ratings yet

- Summer Internship Project Report On Analysis of Credit Appraisal at Bank of IndiaDocument128 pagesSummer Internship Project Report On Analysis of Credit Appraisal at Bank of IndiaNuwani PreethikaNo ratings yet

- Training Need AnalysisDocument58 pagesTraining Need AnalysisVinay Singh80% (5)

- Masud Vai 124-08-20Document41 pagesMasud Vai 124-08-20Noman ParvezNo ratings yet

- Competency Method CorreDocument10 pagesCompetency Method CorreprashantNo ratings yet

- Body-3ta-Jubaer-01764118443Document47 pagesBody-3ta-Jubaer-01764118443Riyad HossainNo ratings yet

- The Skill Master's Guide: How to Improve Skills from the BeginningFrom EverandThe Skill Master's Guide: How to Improve Skills from the BeginningNo ratings yet

- Career Development: Tips for finding purpose, advancing in a career, and achieving successFrom EverandCareer Development: Tips for finding purpose, advancing in a career, and achieving successNo ratings yet

- Maze Runner - A Guide to Navigating Each Interview Round with Confidence: Interview Success, #2From EverandMaze Runner - A Guide to Navigating Each Interview Round with Confidence: Interview Success, #2No ratings yet

- Research ProblemDocument7 pagesResearch ProblemVidushi GautamNo ratings yet

- Business LawDocument19 pagesBusiness LawVidushi GautamNo ratings yet

- MBA III SyllabusDocument23 pagesMBA III SyllabusVidushi GautamNo ratings yet

- TM in Oil & Gas IndustryDocument6 pagesTM in Oil & Gas IndustryVidushi GautamNo ratings yet

- Foreign Exchange Management Act 2000Document15 pagesForeign Exchange Management Act 2000Vidushi GautamNo ratings yet

- Cultural Aspects of Global CommunicationDocument14 pagesCultural Aspects of Global CommunicationVidushi Gautam100% (2)

- Performance Management and Appraisal: R L M J H JDocument39 pagesPerformance Management and Appraisal: R L M J H JVidushi GautamNo ratings yet

- Real Estate Marketing' (NCR) : Amity School of Business Internship Report ONDocument41 pagesReal Estate Marketing' (NCR) : Amity School of Business Internship Report ONVidushi Gautam100% (1)

- Profit & Loss - Bimetal Bearings LTDDocument2 pagesProfit & Loss - Bimetal Bearings LTDMurali DharanNo ratings yet

- Unit 2 PDFDocument39 pagesUnit 2 PDFNoorie AlamNo ratings yet

- Lesson Guide 2.2 Beware of Banking FeesDocument4 pagesLesson Guide 2.2 Beware of Banking FeesKent TiclavilcaNo ratings yet

- Case Digest-Mejoff V Director of PrisonersDocument2 pagesCase Digest-Mejoff V Director of PrisonersJestherin BalitonNo ratings yet

- Globalization DesglobalizationDocument10 pagesGlobalization DesglobalizationFarhadNo ratings yet

- Atlas Rutier Romania by Constantin FurtunaDocument4 pagesAtlas Rutier Romania by Constantin FurtunaAntal DanutzNo ratings yet

- Dubai Mall Landside Metro Bus - Dubai Design District Zõ - DC Ó% Ó? - V - C FO Ó% Eï (Ð ( @ (Document1 pageDubai Mall Landside Metro Bus - Dubai Design District Zõ - DC Ó% Ó? - V - C FO Ó% Eï (Ð ( @ (Dubai Q&ANo ratings yet

- Method Statement For BlastingDocument11 pagesMethod Statement For BlastingTharaka Darshana50% (2)

- Kincaid Ravine Report 12 12 2018Document22 pagesKincaid Ravine Report 12 12 2018api-301815693No ratings yet

- E-Learning PCE Question Bank ENG - Oct.2014Document125 pagesE-Learning PCE Question Bank ENG - Oct.2014Saya FarezNo ratings yet

- End of The Earth.......Document3 pagesEnd of The Earth.......Plaban Pratim BhuyanNo ratings yet

- Invoice: Issue Date Due DateDocument2 pagesInvoice: Issue Date Due DateCheikh Ahmed Tidiane GUEYENo ratings yet

- Balintuwad at Inay May MomoDocument21 pagesBalintuwad at Inay May MomoJohn Lester Tan100% (1)

- Chapter 6 Suspense Practice Q HDocument5 pagesChapter 6 Suspense Practice Q HSuy YanghearNo ratings yet

- Spear v. Place, 52 U.S. 522 (1851)Document7 pagesSpear v. Place, 52 U.S. 522 (1851)Scribd Government DocsNo ratings yet

- Citizenship Articles 3Document13 pagesCitizenship Articles 3Jagadish PrasadNo ratings yet

- Registration of Patient Transport VehicleDocument2 pagesRegistration of Patient Transport VehicleMenGuitar100% (1)

- Arts Q2 Module 3 FINAL1Document14 pagesArts Q2 Module 3 FINAL1halemahpacoteNo ratings yet

- Unit 6 (MALAY RESERVATIONS - THE MALAY RESERVE ENACTMENT F.M.S. Cap 142)Document14 pagesUnit 6 (MALAY RESERVATIONS - THE MALAY RESERVE ENACTMENT F.M.S. Cap 142)Zara Nabilah79% (14)

- Comprehensive Study of Digital Forensics Branches and ToolsDocument7 pagesComprehensive Study of Digital Forensics Branches and ToolsDwiki MaulanaNo ratings yet

- Jataka Tales: Stories of Buddhas Previous LivesDocument12 pagesJataka Tales: Stories of Buddhas Previous LivesTindungan DaniNo ratings yet

- Presentasi Bahasa InggrisDocument18 pagesPresentasi Bahasa InggrisIndraPrawiroAdiredjoNo ratings yet

- Majestic Writings of Promised Messiah (As) in View of Some Renowned Muslim Scholars by Hazrat Mirza Tahir Ahmad (Ra)Document56 pagesMajestic Writings of Promised Messiah (As) in View of Some Renowned Muslim Scholars by Hazrat Mirza Tahir Ahmad (Ra)Haseeb AhmadNo ratings yet

- Frank Mwedzi Draft DissertationDocument57 pagesFrank Mwedzi Draft DissertationFrank MwedziNo ratings yet

- Summer Internship ProjectDocument52 pagesSummer Internship ProjectJaskaran SinghNo ratings yet

- ECO269 Module 9Document5 pagesECO269 Module 9Kier BristolNo ratings yet

- 7 Wonders of ANCIENT World!Document10 pages7 Wonders of ANCIENT World!PAK786NOONNo ratings yet

- Chapter One: Perspectives On The History of Education in Nigeria, 2008Document26 pagesChapter One: Perspectives On The History of Education in Nigeria, 2008Laura ClarkNo ratings yet

- RemarksDocument1 pageRemarksRey Alcera AlejoNo ratings yet

- Josefa V MeralcoDocument1 pageJosefa V MeralcoAllen Windel BernabeNo ratings yet