Professional Documents

Culture Documents

FCUSA Complaint

Uploaded by

nomaxim0 ratings0% found this document useful (0 votes)

738 views17 pagesSEC Complain against FCUSA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSEC Complain against FCUSA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

738 views17 pagesFCUSA Complaint

Uploaded by

nomaximSEC Complain against FCUSA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

IN THE UNITED STATES DISTRICT COURT

FOR THE NORTHERN DISTRICT OF GEORGIA

ATLANTA DIVISION

SECURITIES AND EXCHANGE :

COMMISSION, :

:

Plaintiff :

:

vs. :

: Civil Action File No.

THOMAS J. LAWLER and :

FREEDOM FOUNDATION USA LLC :

dba FREEDOM CLUB USA, :

:

Defendants, :

:

DIVINE SPIRIT LLC, :

ORDER PROCESSING LLC, :

PROSPERITY SOLUTIONS LLC, and :

VIOLET BLESSINGS LLC, :

:

Relief Defendants. :

:

COMPLAINT FOR INJUNCTIVE AND OTHER RELIEF

Plaintiff Securities and Exchange Commission (the Commission)

files this complaint and alleges as follows:

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 1 of 17

2

SUMMARY

1. Since as early as 2004, Thomas J . Lawler (Lawler) and his

company, Freedom Foundation USA LLC dba Freedom Club USA

(Freedom Foundation) (collectively defendants) have been offering and

selling fictitious securities. Specifically, defendants offer investors the

opportunity to eliminate their debts and collect lucrative profits through the

purchase of so called administrative remedies (ARs)

2. Defendants sell ARs in one thousand dollar increments, from $1,000

up to $10,000. In addition to canceling the investors debt, a $1,000

administrative remedy will supposedly return $325,000 and a $10,000

investment purportedly entitles the investor to receive $1 million when the

AR is funded.

3. Lawler has sold approximately 2,000 ARs over ten years and the

offering is actively ongoing. Not one investor in this scheme has received

any of the promised returns. But defendants continue to tell investors that

funding of the ARs is imminent.

4. Defendants have engaged in acts and practices, and unless restrained

and enjoined by this Court, will continue to engage in acts and practices

which constitute and will constitute violations of Sections 5(a), 5(c) and

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 2 of 17

3

17(a) of the Securities Act of 1933 (Securities Act) [15 U.S.C. 77e(a),

77e(c) and 77q(a) ] Section 10(b) of the Securities Exchange Act of 1934

(Exchange Act) [15 U.S.C. 78j(b)] and Rule 10b-5 thereunder [17 C.F.R.

240.10b-5].

JURISDICTION AND VENUE

5. The Commission brings this action pursuant to authority conferred

upon it by Sections 20 and 22 of the Securities Act [15 U.S.C. 77t and

77v] and Sections 21(d) and 21(e) of the Exchange Act [15 U.S.C.

78u(d)-(e)] seeking to permanently enjoin the defendants from engaging in

the transactions, acts, practices and courses of business alleged in this

complaint, and transactions, acts, practices and courses of business of similar

purport and object, for disgorgement of illegally obtained funds, and for

other equitable relief, including civil money penalties.

6. This Court has jurisdiction over this action pursuant to Sections 20

and 22 of the Securities Act [15 U.S.C. 77t and 77v] and Sections 21(d),

21(e), and 27 of the Exchange Act [15 U.S.C. 78u(d), 78u(e), and 78aa].

7. Venue lies in this Court pursuant to Section 20(b) of the Securities

Act [15 U.S.C. 77t(b)] and Section 27 of the Exchange Act [15 U.S.C.

78aa], because certain of the transactions, acts, practices and courses of

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 3 of 17

4

business constituting violations of the Exchange Act and Securities Act

occurred within the Northern District of Georgia. Among other things,

Defendant Lawler resides in this district.

DEFENDANTS AND RELIEF DEFENDANTS

8. Thomas J . Lawler, age 69, claims to be an ordained minister and

refers to himself as Reverend Tom. He is the founder and manager of

Freedom Foundation. He claims that a severe illness that struck one of his

sons cost him his career and drove him into debt, at which point he began

investigating the banking system and supposedly made the discoveries that

underpin the story that he tells to prospective purchasers of the securities at

issue in this matter.

9. Freedom Foundation USA LLC is a Nevada limited liability company

created by Lawler.

10. Divine Spirit LLC (Divine Spirit) is a Georgia limited liability

company created by Lawler to pay the bills of Freedom Foundation.

Typically, Lawler transfers money from the purchase of ARs to Divine

Spirit, which writes checks or uses a debit card to pay the bills.

11. Order Processing LLC (Order Processing) is a Missouri limited

liability company with its principal place of business in Snellville, Georgia

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 4 of 17

5

created by Lawler to receive money for the purchase of ARs. Those who

buy ARs are instructed to make their checks payable to Order Processing.

12. Prosperity Solutions LLC (Prosperity Solutions) is a Georgia

limited liability company created by a former Freedom Foundation

employee. All Freedom Foundation payroll has been processed through

Prosperity Solutions. Lawler would transfer a sufficient amount of money

every two weeks, and the employee who created the LLC would then

process the payroll.

13. Violet Blessings LLC (Violet Blessings) is a limited liability

company owned and controlled by Lawlers wife, Diane Lawler. The staff

has documented a total of $55,000 transferred from Freedom Foundation to

Violet Blessings.

FACTS

A. The Investment Scheme

14. Freedom Foundation, operated by Lawler, promises to turn $1,000

into at least $325,000. It accepts larger payments in increments of $1,000 up

to $10,000, for which it promises $1 million.

15. Lawler uses the Freedom Foundation website,

http://www.freedomclubusa.com, conference calls, and YouTube videos to

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 5 of 17

6

convince investors that Freedom Foundation can deliver on its fantastic

promises. Lawler authored the Freedom Foundation website.

16. To attract investors, defendants represent that an account is

established for each person at their birth in their name. This account is

sufficient to fund all future borrowing by that individual. Where, by whom,

and in what amount the supposed account is established are details that

defendants do not disclose.

17. According to defendants, when people later borrow from a bank, they

are not borrowing the banks money nor its depositors money, but rather

that persons own money that resides in their own account. In an act of rank

injustice, says Lawler, banks charge people interest on the use of their own

money.

18. Freedom Foundation and Lawler offer people a way to correct this

injustice, eliminate the supposed indebtedness they have incurred to

creditors, and secure the promised payouts.

19. To all who believe this story, Lawler offers a solution: the above-

mentioned AR. The AR is described as a unique and proprietary

process through which Lawler and/or his staff prepare a series of three

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 6 of 17

7

notices to a creditor identified by the AR purchaser. Investors need do

nothing but supply the funds.

20. Lawler represents that, by operation of the Uniform Commercial Code

and international admiralty law, these notices cancel the AR purchasers

debt to that creditor. The AR then enters what Lawler calls the payment

cycle, in which all AR purchasers await a series of unspecified international

events including a papal decree which will trigger a massive payment

from the U.S. Treasury to Freedom Foundation for at least the amount of all

ARs.

21. Defendants claim that that they have worked with government and

financial system[s] to establish high level of access to process loans.

22. Upon information and belief, defendants have sold approximately

2,000 ARs since the offering of these investments began in 2004, at prices

ranging from $1,000 to $10,000.

23. Lawler sold an AR as recently as J une, 2014.

24. Defendants employ a sales force to keep AR sales flowing. Lawler

calls his salespeople Ambassadors, trains them and pays them a 25 percent

commission on AR sales. To date, all AR sales have been through

Ambassadors.

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 7 of 17

8

25. Lawler uses some of the proceeds from AR sales to to motivate the

Ambassadors with 25 percent commissions, to pay for phone service, for

website design and maintenance, for payroll, for postage, for rent, and for

other business expenses.

26. Lawler also uses AR sales to fund certain personal expenses.

Specifically, he has spent funds from AR sales on chiropractor visits,

expensive powder with supposed powers of rejuvenation (marketed by a

company that sells super-oxygenated water), and at least one beach vacation.

27. Lawler also paid at least $55,000 of AR sales proceeds to an LLC

controlled by his wife, Violet Blessings LLC, in supposed consideration for

work done for Freedom Foundation, although Mrs. Lawler denies giving

consideration for the money.

28. Lawler transferred at least some money from AR purchasers overseas

to New Zealand, to an account controlled by an employee of Freedom

Foundation.

29. Lawler has also used several limited liability companies to handle

discrete parts of his scheme. At various times, there have been bank

accounts in at least three of these LLCs names, Order Processing, Prosperity

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 8 of 17

9

Solutions, and Divine Spirit and each of those three entities received some

investor funds.

B. Defendants Misrepresentations and Omissions

30. Defendants misrepresent that their story about the U.S. banking

system is true. They tell prospective purchasers that they owe their creditors

nothing, and that the purchase of an AR can establish the fact legally.

31. Defendants tell investors that they can expect to receive $325,000 for

the purchase of a $1,000 AR, and $1 million for the purchase of a $10,000

AR.

32. Even though no investor has received their promised returns since the

offering began approximately 10 years ago, defendants continue to tell

investors that the funding of the ARs is imminent. Lawler has told some

investors that certain events need to unfold to unlock the riches and begin

the flow of cash.

33. After receiving a subpoena to testify before the staff of the

Commission, Lawler added a statement on the Freedom Foundation website

that Freedom Foundation was not under investigation by any government

agency. Lawler removed that misrepresentation after his testimony.

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 9 of 17

10

34. Defendants recently added an offering designed to bring in more

revenue. Specifically, the maintenance program promises a $10,000

bonus at funding for anyone who pays $300 per year or $30 per month.

35. Defendants have also recently launched a new entity called Golden

Ray LLC, which they describe as an entity designed to bring the benefits of

ARs to organizations.

COUNT IUNREGISTERED OFFERING OF SECURITIES

Violations of Sections 5(a) and 5(c) of the Securities Act

[15 U.S.C. 77e(a) and 77e(c)]

36. Paragraphs 1 through 35 are hereby realleged and are incorporated

herein by reference.

37. No registration statement has been filed or is in effect with the

Commission pursuant to the Securities Act and no exemption from

registration exists with respect to the transactions described herein.

38. Since as early as 2004 through the present, defendants singly and in

concert, have:

(a) made use of the means or instruments of transportation or

communication in interstate commerce or of the mails to sell securities,

through the use or medium of a prospectus or otherwise;

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 10 of 17

11

(b) carried securities or caused such securities to be carried through

the mails or in interstate commerce, by any means or instruments of

transportation, for the purpose of sale or for delivery after sale; and

(c) made use of the means or instruments of transportation or

communication in interstate commerce or of the mails to offer to sell or offer

to buy securities, through the use or medium of any prospectus or otherwise,

without a registration statement having been filed with the Commission as to

such securities.

39. By reason of the foregoing, defendants, directly and indirectly, singly

and in concert, have violated Sections 5(a) and 5(c) of the Securities Act [15

U.S.C. 77e(a) and 77e(c)].

COUNT IIFRAUD

Violations of Section 17(a)(1) of the Securities Act

[15 U.S.C. 77q(a)(1)]

40. Paragraphs 1 through 35 are hereby realleged and are incorporated

herein by reference.

41. Since as early as 2004 through the present, defendants, in the offer

and sale of the securities described herein, by the use of means and

instruments of transportation and communication in interstate commerce and

by use of the mails, directly and indirectly, employed devices, schemes and

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 11 of 17

12

artifices to defraud purchasers of such securities, all as more particularly

described above.

42. Defendants knowingly, intentionally, and/or recklessly engaged in the

aforementioned devices, schemes, and artifices to defraud.

43. While engaging in the course of conduct described above, the

defendants acted with scienter, that is, with an intent to deceive, manipulate,

or defraud or with a severely reckless disregard for the truth.

44. By reason of the foregoing, defendants, directly and indirectly, have

violated and, unless enjoined, will continue to violate Section 17(a)(1) of the

Securities Act [15 U.S.C. 77q(a)(1)].

COUNT IIIFRAUD

Violations of Sections 17(a)(2) and 17(a)(3) of the Securities Act[15

U.S.C. 77q(a)(2) and 77q(a)(3)]

45. Paragraphs 1 through 35 are hereby realleged and are incorporated

herein by reference.

46. Since as early as 2004 through the present, defendants, in the offer

and sale of the securities described herein, by use of means and instruments

of transportation and communication in interstate commerce and by use of

the mails, directly and indirectly:

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 12 of 17

13

(a) obtained money and property by means of untrue statements of

material fact and omissions to state material facts necessary in order to make

the statements made, in light of the circumstances under which they were

made, not misleading; and

(b) engaged in transactions, practices and courses of business

which would and did operate as a fraud and deceit upon the purchasers of

such securities.

47. By reason of the foregoing, the defendants, directly and indirectly,

have violated and, unless enjoined, will continue to violate Sections 17(a)(2)

and 17(a)(3) of the Securities Act [15 U.S.C. 77q(a)(2) and 77q(a)(3)].

COUNT IV--FRAUD

Violations of Section 10(b) of the Exchange Act, 15 U.S.C. 78j(b), and

Rule 10b-5, 17 C.F.R. 240.10b-5, Thereunder

48. Paragraphs 1 through 35 are hereby realleged and are incorporated

herein by reference.

49. Defendants, in connection with the purchase of securities described

herein, by the use of the means or instrumentalities of interstate commerce

or by use of the mails, or of any facility of any national securities exchange,

directly and indirectly:

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 13 of 17

14

(a) employed devices, schemes, and artifices to defraud;

(b) made untrue statements of material facts and omitted to

state material facts necessary in order to make the statements made, in

light of the circumstances under which they were made, not

misleading; and

(c) engaged in acts, practices, and courses of business which

would and did operate as a fraud and deceit upon other persons,

as more particularly described above.

50. Defendants, knowingly, intentionally, and/or recklessly engaged in the

aforementioned devices, schemes and artifices to defraud, made untrue

statements of material facts and omitted to state material facts, and engaged

in fraudulent acts, practices and courses of business. In engaging in such

conduct, defendants acted with scienter, that is, with an intent to deceive,

manipulate or defraud or with a severe reckless disregard for the truth.

51. By reason of the foregoing, defendants directly and indirectly

violated, and unless permanently restrained and enjoined will continue to

violate Section 10(b) of the Exchange Act [15 U.S.C. 78j(b)] and Rule 10b-

5 [17 C.F.R. 240.10b-5] thereunder.

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 14 of 17

15

PRAYER FOR RELIEF

WHEREFORE, Plaintiff Commission respectfully prays that the

Court:

I.

Make findings of fact and conclusions of law in accordance with Rule

52 of the Federal Rules of Civil Procedure, finding that the defendants named

herein committed the violations alleged herein.

II.

Enter a temporary restraining order, and preliminary and permanent

injunctions enjoining the defendants, their officers, agents, servants,

employees, and attorneys, and those persons in active concert or participation

with them who receive actual notice of the order of injunction, by personal

service or otherwise, and each of them, from violating, directly or indirectly

Sections 5(a), 5(c), and 17(a) of the Securities Act [15 U.S.C. 77e(a),

77e(c) and 77q(a)], Section 10(b) of the Exchange Act [15 U.S.C. 78j(b)]

and Rule 10b-5 thereunder [17 C.F.R. 240.10b-5].

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 15 of 17

16

III.

Enter an order requiring an accounting of the use of proceeds of the

sales of the securities described in this complaint and the disgorgement of all

ill-gotten gains or unjust enrichment with prejudgment interest, to effect the

remedial purposes of the federal securities laws, and an order freezing the

assets, preserving documents of the defendants, expediting discovery to

preserve the status quo, and an order requiring defendants and relief

defendants to repatriate any investor funds transferred overseas.

IV.

An order imposing a constructive trust and requiring disgorgement by

the relief defendants of all sums by which they have been unjustly enriched

V.

An order pursuant to Section 20(d) of the Securities Act [15 U.S.C.

77t(d)] and Section 21(d)(3) of the Exchange Act [15 U.S.C. 78u(d)(3)]

imposing civil penalties against defendants.

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 16 of 17

17

VI.

Such other and further relief as this Court may deem just, equitable, and

appropriate in connection with the enforcement of the federal securities laws

and for the protection of investors.

Dated: July 31, 2014

RESPECTFULLY SUBMITTED,

/s/ Pat Huddleston

M. Graham Loomis

Regional Trial Counsel

Georgia Bar No. 457868

Email: loomism@sec.gov

404-842-7622

Pat Huddleston

Senior Trial Counsel

Georgia Bar No. 373984

Email: huddlestonp@sec.gov

404-842-7616

COUNSELS FOR PLAINTIFF

U. S. SECURITIES AND EXCHANGE COMMISSION

950 East Paces Ferry Road, Suite 900

Atlanta, Georgia 30326

Case 1:14-cv-02468-AT Document 1 Filed 07/31/14 Page 17 of 17

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Filing of Criminal ComplaintDocument28 pagesFiling of Criminal Complaintbaleno100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Employer liability for wrongful actsDocument14 pagesEmployer liability for wrongful actsshaniahNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 18-2868 - Documents 1Document1,129 pages18-2868 - Documents 1Marc Robert LicciardiNo ratings yet

- Republic Vs Sandiganbayan - DigestDocument6 pagesRepublic Vs Sandiganbayan - DigestLylo BesaresNo ratings yet

- 2018.12.28. Motion To Dismiss Rule 12 (B)Document10 pages2018.12.28. Motion To Dismiss Rule 12 (B)doczharNo ratings yet

- People vs. Orlando Frago.: C. Presumption of InnocenceDocument1 pagePeople vs. Orlando Frago.: C. Presumption of InnocenceEileen Eika Dela Cruz-LeeNo ratings yet

- How To Request For Legal Opinion From DOJDocument3 pagesHow To Request For Legal Opinion From DOJstaircasewit450% (2)

- Tax Remedies Under The NircDocument119 pagesTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- Maquilan Vs MaquilanDocument1 pageMaquilan Vs MaquilanJoshua OuanoNo ratings yet

- People vs. Narvaez, 121 Scra 389 (1983) DigestedDocument2 pagesPeople vs. Narvaez, 121 Scra 389 (1983) DigestedJacquelyn AlegriaNo ratings yet

- Alfelor SR., V. IntiaDocument1 pageAlfelor SR., V. IntiaBerenice Joanna Dela CruzNo ratings yet

- Plaintiff'S Opposition To Defendant'S Motion For Leave To File SurreplyDocument5 pagesPlaintiff'S Opposition To Defendant'S Motion For Leave To File SurreplynomaximNo ratings yet

- Plaintiff'S Opposition To Defendant'S Motion For Leave To File SurreplyDocument5 pagesPlaintiff'S Opposition To Defendant'S Motion For Leave To File SurreplynomaximNo ratings yet

- Lawler Doc 61Document3 pagesLawler Doc 61nomaximNo ratings yet

- Lawlerdoc74 1Document5 pagesLawlerdoc74 1nomaximNo ratings yet

- doc31-03-20117-FAM. Ver2Document4 pagesdoc31-03-20117-FAM. Ver2nomaximNo ratings yet

- Lawler 58Document13 pagesLawler 58nomaximNo ratings yet

- Doc419 02 22198 JemDocument6 pagesDoc419 02 22198 JemnomaximNo ratings yet

- Doc424 02 22198 JemDocument5 pagesDoc424 02 22198 JemnomaximNo ratings yet

- Lawler 57Document2 pagesLawler 57nomaximNo ratings yet

- Scoville 1Document6 pagesScoville 1nomaximNo ratings yet

- Lawler 59Document1 pageLawler 59nomaximNo ratings yet

- Doc27 03 20117 FamDocument6 pagesDoc27 03 20117 FamnomaximNo ratings yet

- USAvs GorcycaDocument6 pagesUSAvs GorcycanomaximNo ratings yet

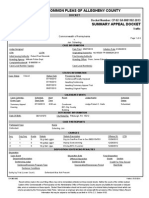

- Allegheny County Court of Common Pleas Court Summary: Scherling, JonDocument1 pageAllegheny County Court of Common Pleas Court Summary: Scherling, JonnomaximNo ratings yet

- Lawler 46Document4 pagesLawler 46nomaximNo ratings yet

- CourtSummaryReport3 AshxDocument1 pageCourtSummaryReport3 AshxnomaximNo ratings yet

- Case 110-mi-00045-CA-doc9-3Document2 pagesCase 110-mi-00045-CA-doc9-3nomaximNo ratings yet

- Daley 148Document7 pagesDaley 148nomaximNo ratings yet

- Court of Common Pleas of Allegheny County: Docket Docket Number: CP-02-CR-0014093-2003Document7 pagesCourt of Common Pleas of Allegheny County: Docket Docket Number: CP-02-CR-0014093-2003nomaximNo ratings yet

- Court of Common Pleas of Allegheny County: Docket Docket Number: CP-02-SA-0001428-2014Document2 pagesCourt of Common Pleas of Allegheny County: Docket Docket Number: CP-02-SA-0001428-2014nomaximNo ratings yet

- Allegheny County Court of Common Pleas Court SummaryDocument4 pagesAllegheny County Court of Common Pleas Court SummarynomaximNo ratings yet

- Hansendoc91 1Document42 pagesHansendoc91 1nomaximNo ratings yet

- Case 110-cv-00759-CAP-Doc41Document2 pagesCase 110-cv-00759-CAP-Doc41nomaximNo ratings yet

- Court of Common Pleas of Allegheny County: Docket Docket Number: CP-02-SA-0001102-2013Document4 pagesCourt of Common Pleas of Allegheny County: Docket Docket Number: CP-02-SA-0001102-2013nomaximNo ratings yet

- 209cv00259BSJ ComplaintDocument64 pages209cv00259BSJ ComplaintnomaximNo ratings yet

- Hansen Doc 119Document4 pagesHansen Doc 119nomaximNo ratings yet

- Case 1:10-cv-00759-CAP Document 1-1Document9 pagesCase 1:10-cv-00759-CAP Document 1-1nomaximNo ratings yet

- Case 110-cv-00759-CAP-doc42Document4 pagesCase 110-cv-00759-CAP-doc42nomaximNo ratings yet

- Diamond 2Document1 pageDiamond 2nomaximNo ratings yet

- United States v. Charles Garland Johnson, 66 F.3d 317, 4th Cir. (1995)Document2 pagesUnited States v. Charles Garland Johnson, 66 F.3d 317, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- Introduction To Criminal Justice System-REVIEWERDocument12 pagesIntroduction To Criminal Justice System-REVIEWERLeo james BosiNo ratings yet

- Ram Gulam and Anr. Vs Government of U.P. On 22 August, 1949Document7 pagesRam Gulam and Anr. Vs Government of U.P. On 22 August, 1949abhijitdasnitsNo ratings yet

- Contract Coercion ProjectDocument14 pagesContract Coercion ProjectNitin Sherwal100% (1)

- Adobe Scan Jul 17, 2023Document18 pagesAdobe Scan Jul 17, 2023RitaNo ratings yet

- People Vs CalantiaoDocument13 pagesPeople Vs CalantiaoApril AnielNo ratings yet

- G.R. No. 186101 - Gina A. Domingo v. People of The PhilippinesDocument14 pagesG.R. No. 186101 - Gina A. Domingo v. People of The PhilippinesJoses Nino AguilarNo ratings yet

- Labor Case Digest Mar 5Document10 pagesLabor Case Digest Mar 5RL N DeiparineNo ratings yet

- 08 - Chapter 3 PDFDocument128 pages08 - Chapter 3 PDFAnonymous VXnKfXZ2PNo ratings yet

- CRPC ProjectDocument28 pagesCRPC ProjectDevendra DhruwNo ratings yet

- Street Hype Newspaper January 1-18, 2015Document24 pagesStreet Hype Newspaper January 1-18, 2015Patrick MaitlandNo ratings yet

- Paulding County Progress March 11, 2015 PDFDocument18 pagesPaulding County Progress March 11, 2015 PDFPauldingProgressNo ratings yet

- Pflugerville Pflag Story On Death Row Exoneree Anthony Graves Receiving $3,000 in Donations From Texas Moratorium Network (Page 1 of 2)Document1 pagePflugerville Pflag Story On Death Row Exoneree Anthony Graves Receiving $3,000 in Donations From Texas Moratorium Network (Page 1 of 2)Scott CobbNo ratings yet

- Motion Reconsideration COA RulesDocument2 pagesMotion Reconsideration COA Rulesjarleysu_558227727No ratings yet

- Communication. - The Following Persons Cannot: Section 24. Disqualification by Reason of PrivilegedDocument5 pagesCommunication. - The Following Persons Cannot: Section 24. Disqualification by Reason of PrivilegedNicole Stephanie WeeNo ratings yet

- 324 PPC 497Document4 pages324 PPC 497Alisha khanNo ratings yet

- PDF Counter Affidavit Nico LuizDocument4 pagesPDF Counter Affidavit Nico LuizSheron BiaseNo ratings yet

- Cayetano Vs TejanoDocument9 pagesCayetano Vs Tejanolala reyesNo ratings yet

- Remorse and Expectations of The LawDocument59 pagesRemorse and Expectations of The LawPrachiNo ratings yet