Professional Documents

Culture Documents

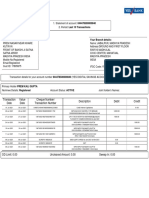

Accounting Entries in Oracle Purchasing and Payables

Uploaded by

saqi22Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Entries in Oracle Purchasing and Payables

Uploaded by

saqi22Copyright:

Available Formats

Accounting entries in Oracle Purchasing and Payables

This document gives in detail different accounts used and the accounting impact of

various transactions that take place in Oracle Purchasing and Oracle Payables. Both

Standard costing and Average costing methods are considered. The accounts are

Oracle Applications specific and might differ from the conventional accounting names.

Examples are given wherever required for better understanding of the concept. The

sources of these accounts are given.

PURCHASING: Receiving For Accrual Process for perpetual Accruals

Receipts for inventory purchases are always accrued upon receipt. And also use

perpetual accruals for expense purchases you want to record uninvoiced purchase

liabilities immediately upon the receipt of the expense goods.

Receiving Account (Receiving Account)

To record the current balance of the material in receiving and inspection.

Where to define in Apps: Define Organization

Define Receiving Options

Inventory AP Accrual Account

Used to accrue your inventory accounts payable liability when you receive your items.

This account represents your uninvoiced receipts and is usually a part of your accounts

payable liabilities in the balance sheet. Payable relieves this account when the invoice

is matched and approved.

Where to define in Apps: Define Organization Parameters

Expense AP Accrual Account

Used to accrue your expense accounts payable liability when you receive your items.

This account represents your uninvoiced receipts when your Expense Accrual Option is

On Receipt and is usually a part of your accounts payable liabilities in the balance

sheet. Payable relieves this account when the invoice is matched and approved.

Where to define in Apps: Define Purchasing Options

Purchase Price Variance Account

To Accumulate purchase price variance for the organization. PPV account is usually an

expense account, which you record at the time you receive an item into the inventory

and is the difference between the purchase order cost and the items standard cost.

PPV account is not used for average costing.

Where to define in Apps: Define Organization Parameters

Invoice Price Variance Account

To Accumulate invoice price variance for the organization. IPV account is usually an

expense account, which is used at the time of creating requisition or PO. When a

corresponding invoice is matched and approved, AP uses this account from PO to record

the invoice price variance entries. It is the difference between the purchase order price of

the inventory item and the actual invoice price multiplied by the quantity invoiced.

Where to define in Apps: Define Organization Parameters

Exchange Rate Gain or Loss Account

To Accumulate purchase exchange rate gains or losses for the organization. This account is

usually an expense account, which you use to record the difference between the exchange

rate used for purchase order cost and the exchange rate used for invoice

Where to define in Apps: Define Financial Options

ACCOUNTING ENTRIES

A). Purchase Order receipt to the Receiving Inspection Location. When the goods are

received into Inspection Location.

When you receive material from a vendor into receiving inspection, Apps uses the quantity

received and the PO price to update the following accounts.

Accounting Entry Debit Credit

Source

Receiving inspection account @ PO price xx At Define Organization/

Receiving Options

Inventory A/P Accrual account @ PO

price

xx At Organization

Parameters

(for receiving Inventory Items)

Receiving inspection account @ PO price xx At Define Organizations

Expense A/P Accrual account @ PO

price

xx At Define Purchasing

Options

(for receiving expense items)

B). Delivery from Receiving Inspection to Inventory under Standard Costing. Recorded at

the time, when the goods are transferred from Receiving Inspection to Inventory

With Enter Receiving form, you can move material from receiving inspection to inventory.

Case#1: If the standard cost is greater than purchase order price then the PPV is

favourable and Apps records this expense as a credit (negative expense).

Accounting Entry Debit Credit

Source

Sub-inventory accounts @ Std. Cost xx At Define Sub-inventory

Receiving Inspection account @ PO

price

xx At Define Organization

Purchase Price Variance Account (Negative Expense) xx At Define Organization

Parameters

Case#2: If the standard cost is less than the PO price then the variance is unfavourable and

Apps record this as a debit (positive expense)

Accounting Entry Debit Credit

Source

Sub-inventory accounts @ Std. Cost xx At Define Sub-inventory

Purchase Price Variance Account (Positive Expense) xx At Define Organization

Parameters

Receiving Inspection account @ PO

price

xx At Define Organization/

Define Receiving Options

(C). Purchase Order receipt to the Receiving Inspection at Average Cost. When the goods

are received into Inspection Location at the Enter Receipts form.

If you use average costing, the actual cost is picked from the PO and hence you do not

have any PPV.

Accounting Entry Debit Credit

Source

Receiving inspection account @ PO price xx At Define Organization/

Define Receiving Options

Inventory A/P Accrual account @ PO

price

xx At Organization Parameters

(for receiving Inventory Items)

(D). Delivery from Receiving Inspection to Inventory under Average Costing. Recorded at

the time, when the goods are transferred from Receiving Inspection to Inventory

After inspection, you deliver the inventory items to the inventory at the Enter Receiving

Transactions form.

Accounting Entry Debit Credit

Source

Sub-inventory accounts @ PO price xx At Define Sub-inventory

Receiving Inspection account @ PO

price

xx At Define Organisation/

Define Receiving Options

(for delivering to the inventory at

actual POcost)

To record the actual Landed cost (Average Cost)

The goods are received into Landed Organisation first and then are transferred to actual

organisations with the addition of landed cost recorded as the transfer charges. This step is

performed in Inventory as Inter-organisations transfers and the accounting impact is:

Accounting Entry Debit Credit

Source

Inter-Org Receivable account

@ Purchase order cost + actual Landed

cost

xx At Define Inter-Org transfers

Networks

Sub-inventory Material account

@ Purchase order Cost

xx At Define Sub-inventories /

Define Organisation

Inter-Org transfer charges account

@ Amount of actual Landed cost

xx At Define Inter-Org transfers

Networks

E). Delivery from Receiving Inspection to Expense. Recorder at the time, when the goods

are transferred from Receiving Inspection to Expense Destination

With Enter Receiving form, you can also move material from receiving inspection to

expense destinations.

Oracle Purchasing uses the transaction quantity and the PO price of the delivered item to

update the receiving inspection and expense charge account.

Accounting Entry Debit Credit

Source

PO distribution charge accounts @ PO

price

xx At individual item level

Receiving inspection account @ PO price xx At Define Receiving Options

(F). Purchase Order receipt to the Inventory without inspection at Standard Cost. When the

goods are received into Inspection Location at the Enter Receipts form and delivered to

inventory directly in one step.

In this case, Apps performs both receipt and delivery in one step. Purchasing uses quantity

ordered and PO price to update the following accounts. At the same time, Oracle Inventory

uses the quantity and the standard cost of the received item to update the receiving

inspection and the sub-inventory balances (The accounting impact is the same except as

the case of inspection & deliver, except this one is arrived with one operation/step).

Accounting Entry Debit Credit

Source

Receiving inspection account @ PO price xx At Define Organisation/

Receiving Options

Inventory A/P Accrual account @ PO

price

xx At Organisation Parameters

(for receiving Inventory Items)

Case # 1

Sub-inventory accounts @ Std. Cost xx At Define Sub-inventory

Receiving Inspection account @ PO

price

xx At Define Organisation

Purchase Price Variance Account (Negative Expense) xx At Define Organisation

Parameters

(Delivered into inventory when the

Std.cost is more than the PO price)

Case # 2

Sub-inventory accounts @ Std. Cost xx At Define Sub-inventory

Purchase Price Variance Account (Positive Expense) xx At Define Organisation

Parameters

Receiving Inspection account @ PO

price

xx At Define Organisation/

Define Receiving Options

(Delivered into inventory when the

Std.cost is less than the PO price)

(G). Purchase Order receipt to the Inventory without inspection at Average Cost. When the

goods are received into Inspection Location at the Enter Receipts form and delivered

directly in one step.

If you use average costing, the actual cost is picked from the PO and hence you do not

have any PPV (The accounting impact is the same except as the case of inspection &

deliver, except this one is arrived with one operation/step).

Accounting Entry Debit Credit

Source

Receiving inspection account @ PO price xx At Define Organisation/

Receiving Options

Inventory A/P Accrual account @ PO

price

xx At Organisation Parameters

(for receiving Inventory Items)

Sub-inventory accounts @ PO price xx At Define Sub-inventory

Receiving Inspection account @ PO

price

xx At Define Organisation/

Define Receiving Options

(for delivering to the inventory at

actual POcost)

(H). Purchase Order receipt to the Expense destinations without inspection. When the

goods are received into Inspection Location at the Enter Receipts form and delivered to

inventory directly in one step.

Accounting Entry Debit Credit

Source

Receiving inspection account @ PO price xx At Define Organisation/

Define Receiving Options

Expense account @ PO price xx At Define Items

(for receiving expense items)

PO distribution charge account @ PO price xx From Purchase Order

Receiving inspection account @ PO

price

xx At Define Organisation/

Define Receiving Options

(for delivering to the expense

destinations directly)

Return to Vendor from Receiving Inspection at

Standard Cost.

For a return from inspection, Purchasing decreases the receiving inspection balance, and

reverses the accounting entry created for the original receipt.

Accounting Entry Debit Credit

Source

Inventory A/P Accrual account @ PO price xx At Organisation Parameters

Receiving inspection account @ PO price xx At Define Organisation/

Receiving Options

(for returning Inventory Items)

Expense A/P Accrual account @ PO price xx At Define Purchasing

Options

Receiving inspection account @ PO price Xx At Define Organizations

(for returning expense items)

Return to Vendor from Inventory (to Receiving

Inspection) at Standard Cost.

If you use receiving inspection and delivered material into inventory and if you want to

return material from the same inventory, you must first return the material to Receiving

Inspection from inventory before you can return to your vendor. For a return from

inspection, Purchasing decreases the receiving inspection balance, and reverses the

accounting entry created for the original receipt. This is two step process.

Case # 1: Incase of Std.cost is less than PO price of the returned item when it was received

into the inventory.

Accounting Entry Debit Credit

Source

Step#1: When you return goods from

inventory to receiving location

Receiving Inspection account @ PO price xx At Define Organisation/

Define Receiving

parameters

Sub inventory accounts @ Std. Price xx At Define Sub-inventory

Purchase Price Variance xx At Define Org. Parameters

(for reversing the entry when the items

is returned from SI to Receiving

Inspection)

Step#2: When you return goods from

receiving inspection location to the supplier

Inventory A/P Accrual account @ PO price xx At Organisation Parameters

Receiving inspection account @ PO price xx At Define Organisation/

Receiving Options

(for returning Inventory Items from

Receiving inspection to the vendor)

Case # 2: Incase of Std.cost is more than PO price of the returned item when it was

received into the inventory.

Accounting Entry Debit Credit

Source

Step#1: When you return goods from

inventory to receiving location

Receiving Inspection account @ PO price xx At Define Organisation/

Define Receiving

parameters

Purchase Price Variance xx At Define Org. Parameters

Sub inventory accounts @ Std. Price Xx At Define Sub-inventory

(for reversing the entry when the items

is returned from SI to Receiving

Inspection)

Case #2: When you return goods from the

receiving inspection location to the supplier

Inventory A/P Accrual account @ PO price Xx At Organisation Parameters

Receiving inspection account @ PO price Xx At Define Organisation/

Receiving Options

(for returning Inventory Items from

Receiving inspection to the vendor)

(I). Return to Vendor from Inventory when the items

are received through Direct Receipt without

inspection at Standard Cost.

The accounting impact is the same as in the previous inspection case, except all the

accounting is done in one step.

Case # 1: Incase of Std.cost is less than PO price of the returned item when it was received

into the inventory.

Accounting Entry Debit Credit

Source

Receiving Inspection account @ PO price xx At Define Organisation/

Define Receiving

parameters

Sub inventory accounts @ Std. Price xx At Define Sub-inventory

Purchase Price Variance xx At Define Org. Parameters

(for reversing the entry that is made

when the items is received & delivered

directly)

Inventory A/P Accrual account @ PO price xx At Organisation Parameters

Receiving inspection account @ PO price Xx At Define Organisation/

Receiving Options

(for returning Inventory Items from

Receiving inspection to the vendor)

Case #2: Incase of Standard cost is more than PO price of the returned item when it was

received into the inventory.

Accounting Entry Debit Credit

Source

Receiving Inspection account @ PO price xx At Define Organization/

Define Receiving

parameters

Purchase Price Variance xx At Define Org. Parameters

Sub inventory accounts @ Std. Price Xx At Define Sub-inventory

(for reversing the entry that is made

when the items are received & delivered

directly)

Inventory A/P Accrual account @ PO price Xx At Organization Parameters

Receiving inspection account @ PO price Xx At Define Organization/

Receiving Options

(for returning Inventory Items from

Receiving inspection to the vendor)

Same Procedure has to be followed for returning the expense items also.

ACCOUNTS PAYABLE

Invoice Booking at Standard Costing at Algorithm

For Actual Supplier Invoice

When matched with the PO both Inventory AP Accrual account and Liability accounts come

from the related Purchase order. If it s an unmatched invoice, you have to give the Inventory

AP Accrual account and the liability account is defaulted from the supplier definition

When the Invoice Price is more than the Purchase order Price

Accounting Entry Debit Credit

Source

Inventory AP Accrual account @ PO price Xx Comes from Purchase

Order / and Entered in the

Distributions

Invoice Price Variance account

@ Invoice quantity * (Invoice price -

PO price)

Xx At Define Org. Parameters

AP liability account @ Invoice price *

Invoice qty

xx At individual Define

Suppliers

When the Invoice Price is less than the Purchase order Price

Accounting Entry Debit Credit

Source

Inventory AP Accrual account @ PO price xx Comes from Purchase

Order / and Entered in the

Distributions

AP liability account @ Invoice price *

Invoice qty

Xx At individual Define

Suppliers

Invoice Price Variance account

@ Invoice quantity * (Invoice price -

PO price)

Xx At Define Org. Parameters

For Other Cost Invoices like Clearing Agent payments, Insurance, Freight, etc.

Different invoices are booked for each supplier invoice. 1.Supplier invoice 2.Clearing Agent

invoice 3.Insurance invoice 4.Freight invoice. As these are booked as four different

invoices this accounting entry is impacted that many times and the payments are made

separately for each invoice.

Accounting Entry Debit Credit

Source

Inventory AP Accrual account @ Actual

costs

xx Comes from Purchase

Order / and Entered in the

Distributions

AP liability account @ Invoice price Xx At individual Define

Suppliers

Invoice Booking at Average Costing at DU

While making the inter-organization transfer (to record the landed cost) from Landed cost

organization to Pharma or Non Pharma organizations, the Landed cost Clearing Account is

credited with the landed costs as the Transfer Charges. The same account is debited at the

time of invoice booking as an expense account.

Accounting Entry Debit Credit

Source

Inventory AP Accrual account @ PO price xx Comes from Purchase

Order / and Entered in the

Distributions

Landed Cost Clearing Account

@ the actual landed cost

xx

AP liability account @ Invoice price *

Invoice qty

Xx At individual Define

Suppliers

Payment of the Invoices booked

As mentioned above payment is done separately for each invoice.

Accounting Entry Debit Credit

Source

AP liability account @ Amount paid xx Comes from Purchase

Order / and Entered in the

Distributions

Bank account @ Amount paid xx At individual Define Banks

Incase of Debit and Credit Memo

When you enter a credit note and match it with a purchase order the following entry is

created.

Accounting Entry Debit Credit

Source

AP liability account @ Amount of credit

note

xx At individual Define Banks/

and comes from the related

invoice

Inventory AP Accrual account @ Amount of credit note xx Comes from Purchase

Order / and Entered in the

Distributions

When you pay the invoice, applying the credit/debit note, the following entry is created with

the difference in the amounts.

Accounting Entry Debit Credit

Source

AP liability account

@ (Invoice Amount Credit/Debit note

amount)

xx At individual Define Banks/

and comes from the related

invoice

Inventory AP Accrual account

@ (Invoice Amount Credit/Debit note amount)

xx Comes from Purchase

Order / and Entered in the

Distributions

Prepayment Advance to Suppliers

The complete cycle of transaction relating to Prepayment to suppliers and their accounting

impact is detailed under.

Step-1: When you pay Prepayment to the supplier (one prepayment account is maintained

for all suppliers and on liability account is maintained for all suppliers in Algorithm).

Payables keep track of individual supplier balances and the individual application of

prepayments to the invoices.

Accounting Entry Debit Credit

Source

Prepayment to Suppliers account

@ Amount of Prepayment paid

xx At individual Define

Suppliers

Bank account @ Amount of credit note xx At individual Define Banks

Step-2: When you receive invoice from the supplier and booked. Invoice Price Variance

account @ Invoice quantity * (Invoice price - PO price) is debited or credited by Payables

according the invoice price variances.

Accounting Entry Debit Credit

Source

Inventory AP Accrual account @ PO price xx Comes from Purchase

Order / and Entered in the

Distributions

AP liability account @ Invoice price *

Invoice qty

xx At individual Define

Suppliers

Step-3: When you apply the existing prepayment to the invoice booked. The amount of the

application depends on the amount you want to apply from the prepayment to the invoice.

Accounting Entry Debit Credit

Source

AP liability account

@ (Prepayment amount applied)

xx At individual Define Banks/

and comes from the related

invoice

Prepayment to Suppliers account

@ (Prepayment amount applied)

xx Comes from Define

suppliers / Entered in the

related Invoices

Step-4: When the Invoice amount is less than the Prepayment amount, you can apply the

remaining amount to the future invoice (the accounting impact is same as above). In other

way, If the Invoice amount is more than the Prepayment amount, then the difference

amount has to be paid to the supplier with the following accounting impact.

Accounting Entry Debit Credit

Source

AP liability account

@ (Invoice amount Prepayment amount)

xx Comes from Purchase

Order / and Entered in the

Distributions

Bank account @ Amount paid xx At individual Define Banks

Employee Advances

The complete cycle of transaction relating to Prepayment to suppliers and their accounting

impact is detailed under.

Step-1: When you pay Advance to the supplier (one Advance/prepayment account is

maintained for all employees and on liability account is maintained for all employees in

Algorithm). Payables keep track of individual employee balances and the individual

application of advances/prepayments to the invoices.

Accounting Entry Debit Credit

Source

Advances to Employee account

@ Amount of advance paid

xx At individual Define

Employees as Suppliers

Bank account @ Amount of advance xx At individual Define Banks

Step-2: When you receive Expense report from the employee, an invoice is booked from it.

Accounting Entry Debit Credit

Source

Expense account @ Expense cost xx Comes from Define

Expense Reports

AP liability account @ Expense cost xx At individual Define

Employees defined as

Suppliers

Step-3: When you apply the existing advance to the invoice booked. The amount of the

application depends on the amount you want to apply from the advance to the invoice.

Accounting Entry Debit Credit

Source

AP liability account

@ (Advance amount applied)

xx Comes from the invoice to

which the advance is

applied

Advances to Employees account

@ (Advance amount applied)

xx Comes from Define

suppliers / Entered in the

related Invoices

Step-4: When the Expense report/Invoice amount is less than the Advance amount, the

employee has to return the money back to the company.

For that, create an adjustment invoice against the same employee for the difference amount

he/she has to pay, debiting the Advance to employee account. The accounting impact in

Payables is detailed under.

Accounting Entry Debit Credit

Source

Advances to Employees account

@ (Amount to be paid by the employee)

xx Has to be given manually

AP liability account

@ (Amount to be paid by the employee)

xx Comes from Define

suppliers / Entered in the

related Invoices

Then you apply the remaining amount of the advance to the new invoice created. In

payables you have the following accounting impact.

Accounting Entry Debit Credit

Source

AP liability account

@ (Remaining advance amount applied)

xx Comes from the invoice to

which the advance is

applied

Advances to Employees account

@ (Remaining advance amount applied)

xx Comes from Define

suppliers / Entered in the

related Invoices

The accounting impact in Receivables receive a miscellaneous receipt crediting the same

Advances to Employee account which was debited while booking the adjustment invoice.

The accounting impact is detailed under.

Accounting Entry Debit Credit

Source

Bank account

@ (Amount to be paid by the employee)

xx Comes from Payment

methods

Advances to Employees account

@ (Amount to be paid by the employee)

xx At Define Receivables

Activities

In other way, If the Invoice amount is more than the Prepayment amount, then the

difference amount has to be paid to the employee with the following accounting impact.

(All the remaining entries are same as the above advance application except the Step-4)

Step-4

Accounting Entry Debit Credit

Source

AP liability account

@ (Amount to be paid to employee)

xx At individual Define

Employees defined as

Suppliers

Bank account

@ (Amount to be paid by the employee)

xx Comes from Payment

methods

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 29th July 2022Document2 pages29th July 2022Morena hartnettNo ratings yet

- Statement of Purpose (Electronic Engineering) UWODocument4 pagesStatement of Purpose (Electronic Engineering) UWOsaqi220% (1)

- Agreement of TakeoverDocument4 pagesAgreement of TakeoverMadhurima DuttaNo ratings yet

- Partnership Deed (2K18LWUM01001-2)Document5 pagesPartnership Deed (2K18LWUM01001-2)anoushka singh100% (4)

- Decennial Liability InsuranceDocument6 pagesDecennial Liability InsurancesoumenNo ratings yet

- Manufacturing From Financial PerspectiveDocument17 pagesManufacturing From Financial Perspectivesaqi22No ratings yet

- Hajj and Its SpiritDocument85 pagesHajj and Its Spiritsaqi22No ratings yet

- Statement 16-MAR-23 AC 63755886 18042921Document6 pagesStatement 16-MAR-23 AC 63755886 18042921Shauna DunnNo ratings yet

- Is It Worth It UAE Qatar Expenses Vs PackageDocument29 pagesIs It Worth It UAE Qatar Expenses Vs Packageandruta1978No ratings yet

- SWIFT MessagesDocument5 pagesSWIFT MessagesRajesh GuptaNo ratings yet

- Invoice Statement ExplanationDocument2 pagesInvoice Statement ExplanationIbrahim El AminNo ratings yet

- Role of Self Help Groups in Financial InclusionDocument6 pagesRole of Self Help Groups in Financial InclusionSona Kool100% (1)

- Oracle Applications 11i: Bill of MaterialsDocument79 pagesOracle Applications 11i: Bill of Materialssaqi22No ratings yet

- Sales Case Digest - DoublesalesDocument12 pagesSales Case Digest - DoublesalesMichael JoffNo ratings yet

- Cost BookDocument1 pageCost Booksaqi22No ratings yet

- Useful Ebusiness Suite QueryDocument14 pagesUseful Ebusiness Suite QueryVinay KumarNo ratings yet

- Manufacturing Cycle in Oracle Apps R12Document15 pagesManufacturing Cycle in Oracle Apps R12saqi22No ratings yet

- SQL Handout v8Document6 pagesSQL Handout v8saqi22No ratings yet

- Interface Tables Vs Base TablesDocument2 pagesInterface Tables Vs Base TablessubindrabanNo ratings yet

- How to setup outside processing and use in WIP for standard costingDocument28 pagesHow to setup outside processing and use in WIP for standard costingsaqi22100% (1)

- 1000 WordsDocument26 pages1000 WordswholesoulazNo ratings yet

- Regional Rural BankDocument4 pagesRegional Rural BanksrikanthuasNo ratings yet

- Pallab Biswas CG Checklist 220713Document7 pagesPallab Biswas CG Checklist 220713Maverick VohsonNo ratings yet

- Chevron HeadquartersDocument2 pagesChevron HeadquartersGunjan DoshiNo ratings yet

- Microfinance Provision in Ethiopia: September 2020Document11 pagesMicrofinance Provision in Ethiopia: September 2020yeshitilaNo ratings yet

- Statement of account transactionsDocument1 pageStatement of account transactionsSagar GuptaNo ratings yet

- Wage Account November 2020M HN-1Document12 pagesWage Account November 2020M HN-1Pavel ViktorNo ratings yet

- New File-5.09.2023Document3 pagesNew File-5.09.2023vasivanathNo ratings yet

- How To Pay by DBSDocument2 pagesHow To Pay by DBSYe GaungNo ratings yet

- SMEFinancingDocument60 pagesSMEFinancingKhan Jewel100% (4)

- Í (Zkfè Pagayunan Lemuelâââââ R Ç 3) 24lî Mr. Lemuel Rutaquio PagayunanDocument4 pagesÍ (Zkfè Pagayunan Lemuelâââââ R Ç 3) 24lî Mr. Lemuel Rutaquio PagayunanJohn Robertson DayaoNo ratings yet

- Internship Report On Loan & Deposit Policy of HBLDocument52 pagesInternship Report On Loan & Deposit Policy of HBLLochan Khanal100% (3)

- Rti Annexure 2Document9 pagesRti Annexure 2talk2hemi2598No ratings yet

- Anico TermsiDocument1 pageAnico Termsiapi-263039410No ratings yet

- The System Archetypes in Organizational AnalysisDocument7 pagesThe System Archetypes in Organizational AnalysisAbhishek Gupta100% (1)

- Book Report Bank of BarodaDocument13 pagesBook Report Bank of BarodaYash HemnaniNo ratings yet

- Tender Input Form: (A) Basic DetailsDocument4 pagesTender Input Form: (A) Basic DetailsSanjay MahatoNo ratings yet

- TAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Document84 pagesTAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Dushyant SinghaniaNo ratings yet

- Procedure for Issue and Allotment of SharesDocument35 pagesProcedure for Issue and Allotment of SharesManav KohliNo ratings yet

- Financial Inclusion PDFDocument6 pagesFinancial Inclusion PDFVamshiKrishna100% (2)

- Macroeconomics: Case Fair OsterDocument33 pagesMacroeconomics: Case Fair OsterThalia SandersNo ratings yet