Professional Documents

Culture Documents

Tax - CIR vs. San Roque Power

Uploaded by

Lotus KingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax - CIR vs. San Roque Power

Uploaded by

Lotus KingCopyright:

Available Formats

Morales, David Gil A.

3-Manresa

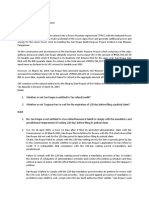

COMMISSIONER OF INTERNAL REVENUE vs. SAN ROQUE POWER CORP.

G.R. No. 187485 February 12, 2013

707 SCRA 66 Supreme Court En Banc

FACTS:

On October 11, 1997, San Roque Power Corporation (San Roque) entered into a Power

Purchase Agreement (PPA) with the National Power Corporation (NPC) by building the San

Roque Multi-Purpose Project in San Manuel, Pangasinan.

The San Roque Multi-Purpose Project allegedly incurred, excess input VAT in the amount of

P559,709,337.54 for taxable year 2001 which it declared in its Quarterly VAT Returns filed

for the same year.

San Roque duly filed with the BIR separate claims for refund, amounting to

P559,709,337.54, representing unutilized input taxes as declared in its VAT returns for

taxable year 2001.

However, on March 28, 2003, San Roque filed amended Quarterly VAT Returns for the year

2001 since it increased its unutilized input VAT To the amount of P560,200,283.14. San

Roque filed with the BIR on the same date, separate amended claims for refund in the

aggregate amount of P560,200,283.14.

On April 10, 2003, a mere 13 days after it filed its amended administrative claim with the

CIR on March 28, 2003, San Roque filed a Petition for Review with the CTA.

CIR alleged that the claim by San Roque was prematurely filed with the CTA.

ISSUE:

WON San Roque is entitled to tax refund? NO.

HELD:

No. San Roque is not entitled to a tax refund because it failed to comply with the mandatory

and jurisdictional requirement of waiting 120 days before filing its judicial claim.

On April 10, 2003, a mere 13 days after it filed its amended administrative claim with the

CIR on March 28, 2003, San Roque filed a Petition for Review with the CTA, which showed

that San Roque did not wait for the 120-day period to lapse before filing its judicial claim.

Compliance with the 120-day waiting period is mandatory and jurisdictional, under RA

8424 or the Tax Reform Act of 1997. Failure to comply renders the petition void.

It violates the doctrine of exhaustion of administrative remedies and renders the petition

premature and without a cause of action, with the effect that the CTA does not acquire

jurisdiction over the taxpayers petition.

Article 5 of the Civil Code provides, "Acts executed against provisions of mandatory or

prohibitory laws shall be void, except when the law itself authorizes their validity."

Thus, San Roques petition with the CTA is a mere scrap of paper.

Well-settled is the rule that tax refunds or credits, just like tax exemptions, are strictly

construed against the taxpayer.

Whether the Atlas doctrine or the Mirant doctrine is applied to San Roque is immaterial

because what is at issue in the present case is San Roques non-compliance with the 120-day

mandatory and jurisdictional period, which is counted from the date it filed its administrative

claim with the CIR. The 120-day period may extend beyond the two-year prescriptive period,

as long as the administrative claim is filed within the two-year prescriptive period. However,

San Roques fatal mistake is that it did not wait for the CIR to decide within the 120-day

period, a mandatory period whether the Atlas or the Mirant doctrine is applied.

Section 112(D) of the 1997 Tax Code is clear, unequivocal, and categorical that the CIR has

120 days to act on an administrative claim. The taxpayer can file the judicial claim

(1) Only within 30 days after the CIR partially or fully denies the claim within the 120-

day period, or

(2) only within 30 days from the expiration of the 120- day period if the CIR does not act

within the 120-day period.

Even if, contrary to all principles of statutory construction as well as plain common sense, we

gratuitously apply now Section 4.106-2(c) of Revenue Regulations No. 7-95, still San Roque

cannot recover any refund or credit because San Roque did not wait for the 60-day

period to lapse, contrary to the express requirement in Section 4.106-2(c).

SC granted the petition of CIR to deny the tax refund or credit claim of San Roque.

You might also like

- 14 - CIR v. San Roque Power Corp, GR No. 187485Document2 pages14 - CIR v. San Roque Power Corp, GR No. 187485Lloyd Liwag100% (4)

- CIR vs. San Roque Power Corp (2013)Document2 pagesCIR vs. San Roque Power Corp (2013)Xavier BataanNo ratings yet

- CIR V San Roque Power Corp and MR DigestDocument4 pagesCIR V San Roque Power Corp and MR DigestLuis Teodoro PascuaNo ratings yet

- CIR Denies Tax Refund Claim for Failure to Comply with 120-Day PeriodDocument2 pagesCIR Denies Tax Refund Claim for Failure to Comply with 120-Day PeriodCaroline A. LegaspinoNo ratings yet

- Case 1 Tridharma Marketing Corp. Vs CTA and CIRDocument2 pagesCase 1 Tridharma Marketing Corp. Vs CTA and CIRlenvfNo ratings yet

- CIR Vs MICHEL LHUILLIER PAWNSHOP DigestDocument2 pagesCIR Vs MICHEL LHUILLIER PAWNSHOP DigestJay Ribs100% (5)

- CIR vs San Roque Power Corp - Input VAT Refund CaseDocument27 pagesCIR vs San Roque Power Corp - Input VAT Refund CaseDeb Bie50% (2)

- CIR vs. Ayala Securities Corp., GR No. L-29485Document1 pageCIR vs. Ayala Securities Corp., GR No. L-29485Alyza Montilla BurdeosNo ratings yet

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- 123 CIR v. Mirant Pagbilao CorporationDocument3 pages123 CIR v. Mirant Pagbilao CorporationLuis PerezNo ratings yet

- CIR-vs-SM-Prime-Holdings DIGESTDocument3 pagesCIR-vs-SM-Prime-Holdings DIGESTMiguel100% (1)

- MEDICARD PHILIPPINES V CIR DIGESTDocument3 pagesMEDICARD PHILIPPINES V CIR DIGESTMiguel100% (1)

- CIR v. Philippine Health Care Providers - ARGONZA - C DoneDocument2 pagesCIR v. Philippine Health Care Providers - ARGONZA - C DoneVince Llamazares Lupango100% (2)

- CIR vs. Burmeister 153205Document1 pageCIR vs. Burmeister 153205magenNo ratings yet

- British American Tobacco v. Camacho Case DigestDocument3 pagesBritish American Tobacco v. Camacho Case DigestMak Francisco100% (1)

- Coconut Oil Refiners Association Vs TorresDocument2 pagesCoconut Oil Refiners Association Vs TorresShiela Pilar100% (1)

- CIR v Amex Philippines VAT RefundDocument3 pagesCIR v Amex Philippines VAT RefundTini GuanioNo ratings yet

- Fort Bonifacio Dev Corp Vs CIR DigestDocument1 pageFort Bonifacio Dev Corp Vs CIR DigestChristian John Dela CruzNo ratings yet

- Abello vs. CIR & CA (Case Digest)Document1 pageAbello vs. CIR & CA (Case Digest)Vince Leido100% (6)

- Smi-Ed vs. Cir - 2016Document2 pagesSmi-Ed vs. Cir - 2016Anny Yanong100% (3)

- Atlas Consolidated Mining V CIR (Case Digest)Document2 pagesAtlas Consolidated Mining V CIR (Case Digest)Jeng Pion100% (1)

- CIR Vs Lingayen ElectricDocument2 pagesCIR Vs Lingayen ElectricRobert Quiambao100% (2)

- Deutsche Bank Ag Manila Branch vs. CirDocument2 pagesDeutsche Bank Ag Manila Branch vs. CirSalma Gurar100% (3)

- Camp John Hay vs. CBAADocument2 pagesCamp John Hay vs. CBAAGeorgina100% (1)

- CIR vs. Basf CoatingDocument2 pagesCIR vs. Basf CoatingMarife Minor100% (1)

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- (SPIT) (CIR v. Benguet Corp.)Document3 pages(SPIT) (CIR v. Benguet Corp.)Matthew JohnsonNo ratings yet

- CIR Vs de La SalleDocument2 pagesCIR Vs de La SalleOlenFuerte100% (6)

- Case Digest of CIR v. Aichi ForgingDocument4 pagesCase Digest of CIR v. Aichi ForgingJeng Pion100% (1)

- Chevron Entitled Tax Refund Excise Taxes Paid Petroleum Products Sold CDCDocument2 pagesChevron Entitled Tax Refund Excise Taxes Paid Petroleum Products Sold CDCannedefrancoNo ratings yet

- CIR V BurmeisterDocument1 pageCIR V BurmeisterMark Wong delos ReyesNo ratings yet

- Psalm Corp. v. Cir DigestDocument3 pagesPsalm Corp. v. Cir Digestkathrynmaydeveza100% (3)

- Executive Construction Power Limited by Equal ProtectionDocument3 pagesExecutive Construction Power Limited by Equal ProtectionWilma CruzNo ratings yet

- CIR Vs PLDT DigestDocument3 pagesCIR Vs PLDT DigestKath Leen100% (2)

- Air Canada v. CIR DigestDocument2 pagesAir Canada v. CIR Digestpinkblush717100% (3)

- Deutsche Bank AG Manila Branch v. CIRDocument3 pagesDeutsche Bank AG Manila Branch v. CIRDonna DumaliangNo ratings yet

- CIR vs. Hantex - DigestDocument2 pagesCIR vs. Hantex - DigestZiazel Therese67% (3)

- Tolentino Vs Secretary of FinanceDocument2 pagesTolentino Vs Secretary of FinanceMatthew Chandler100% (2)

- CIR v. Liquigaz Case DigestDocument3 pagesCIR v. Liquigaz Case DigestKian Fajardo100% (2)

- Abakada Guro Party List Case DigestDocument2 pagesAbakada Guro Party List Case DigestCarmelito Dante Clabisellas100% (1)

- Bonifacia Sy Po Vs CTADocument2 pagesBonifacia Sy Po Vs CTACarl Montemayor50% (2)

- CIR vs Magsaysay Lines on VAT on sale of vesselsDocument2 pagesCIR vs Magsaysay Lines on VAT on sale of vesselsmisscyu100% (1)

- ABAKADA GURO PARTY LIST V ERMITA DigestDocument4 pagesABAKADA GURO PARTY LIST V ERMITA DigestAndrea Tiu100% (3)

- Tax Treaties and International Double TaxationDocument4 pagesTax Treaties and International Double TaxationHannah Desky100% (1)

- CIR Vs Japan AirlinesDocument1 pageCIR Vs Japan AirlinesJR BillonesNo ratings yet

- Abakada Guro vs Ermita VAT caseDocument29 pagesAbakada Guro vs Ermita VAT caseMario P. Trinidad Jr.100% (2)

- CIR v. Hantex Trading (Digest)Document4 pagesCIR v. Hantex Trading (Digest)Tini GuanioNo ratings yet

- Caltex v. COA - DigestDocument2 pagesCaltex v. COA - DigestChie Z. Villasanta71% (7)

- Metrobank refund deniedDocument2 pagesMetrobank refund deniedReena MaNo ratings yet

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate Garo100% (2)

- Kepco's Claim for Tax Refund Dismissed Due to Non-Compliance of Substantiation RequirementsDocument2 pagesKepco's Claim for Tax Refund Dismissed Due to Non-Compliance of Substantiation RequirementsJeremiah Trinidad100% (2)

- Mindanao II Geothermal vs. CIRDocument2 pagesMindanao II Geothermal vs. CIRMia100% (1)

- Cs Garment, Inc. vs. Commissioner of Internal RevenueDocument1 pageCs Garment, Inc. vs. Commissioner of Internal RevenueKia Bi100% (1)

- Philex Mining Vs Cir DigestDocument3 pagesPhilex Mining Vs Cir DigestRyan Acosta100% (2)

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- Team Energy Corporation V CIR - DigestDocument1 pageTeam Energy Corporation V CIR - DigestKate GaroNo ratings yet

- "Commissioner of Internal Revenue v. San Roque Power Corporation, G.R. No. 187485, 8 October 2013Document1 page"Commissioner of Internal Revenue v. San Roque Power Corporation, G.R. No. 187485, 8 October 2013chescasantosNo ratings yet

- CIR V San RoqueDocument2 pagesCIR V San RoqueCharity Lasi MagtibayNo ratings yet

- CIR vs San Roque Power Corporation Tax Refund CaseDocument2 pagesCIR vs San Roque Power Corporation Tax Refund CaseROSE ANNE SUANNo ratings yet

- CIR v San Roque Power CorporationDocument2 pagesCIR v San Roque Power Corporationmacmac116No ratings yet

- Judicial Affidavit - Calo-Oy - With Cross ExaminationDocument3 pagesJudicial Affidavit - Calo-Oy - With Cross ExaminationLotus KingNo ratings yet

- INCOME TAXATION - Deductions and Personal Exemptions SyllabusDocument3 pagesINCOME TAXATION - Deductions and Personal Exemptions SyllabusLotus King0% (1)

- Prac Court - July11Document2 pagesPrac Court - July11Lotus KingNo ratings yet

- 5 - Pioneer vs. GuiadezDocument10 pages5 - Pioneer vs. GuiadezAnj Meris100% (1)

- Banking Laws TableDocument1 pageBanking Laws TableLotus KingNo ratings yet

- Prac Court - 8 CasesDocument13 pagesPrac Court - 8 CasesLotus KingNo ratings yet

- Manufacturers Hanover Trust vs. GuerreroDocument2 pagesManufacturers Hanover Trust vs. GuerreroLotus King100% (1)

- 5 - Pioneer vs. GuiadezDocument10 pages5 - Pioneer vs. GuiadezAnj Meris100% (1)

- Conflicts of Law - Corpuz vs. Sto. TomasDocument3 pagesConflicts of Law - Corpuz vs. Sto. TomasLotus KingNo ratings yet

- Filipino Citizenship Reacquisition RequirementsDocument3 pagesFilipino Citizenship Reacquisition RequirementsLotus KingNo ratings yet

- Conflict of Laws - Quita vs. CADocument2 pagesConflict of Laws - Quita vs. CALotus KingNo ratings yet

- Filipino Citizenship Reacquisition RequirementsDocument3 pagesFilipino Citizenship Reacquisition RequirementsLotus KingNo ratings yet

- Allied Bank vs BPI Banking Corporation DisputeDocument3 pagesAllied Bank vs BPI Banking Corporation DisputeLotus KingNo ratings yet

- PALE - Final Exam 2bDocument3 pagesPALE - Final Exam 2bLotus KingNo ratings yet

- Locus Standi and Taxation Powers in Planters Products vs FertiphilDocument2 pagesLocus Standi and Taxation Powers in Planters Products vs FertiphilLotus KingNo ratings yet

- Validity of Wills and Testamentary Dispositions UpheldDocument3 pagesValidity of Wills and Testamentary Dispositions UpheldLotus KingNo ratings yet

- Banking - AMLA 4 LawsDocument28 pagesBanking - AMLA 4 LawsLotus KingNo ratings yet

- PALE - Linsangan vs. TolentinoDocument2 pagesPALE - Linsangan vs. TolentinoLotus KingNo ratings yet

- Sux (5th Set) - Celso vs. CelsoDocument1 pageSux (5th Set) - Celso vs. CelsoLotus KingNo ratings yet

- TORTS - St. Francis High School vs. CADocument3 pagesTORTS - St. Francis High School vs. CALotus King100% (1)

- Saving A Saving - A - Fading - Puppy - Docfading PuppyDocument3 pagesSaving A Saving - A - Fading - Puppy - Docfading PuppyLotus KingNo ratings yet

- IRR of Revised AMLADocument11 pagesIRR of Revised AMLAChe Poblete CardenasNo ratings yet

- TORTS - Jarco Marketing vs. COL Realty CorpDocument1 pageTORTS - Jarco Marketing vs. COL Realty CorpLotus KingNo ratings yet

- SUX - Sec 1 Subsec 5-8Document1 pageSUX - Sec 1 Subsec 5-8Lotus KingNo ratings yet

- Allied Bank vs BPI Banking Corporation DisputeDocument3 pagesAllied Bank vs BPI Banking Corporation DisputeLotus KingNo ratings yet

- Trusts - Saltiga vs. CADocument1 pageTrusts - Saltiga vs. CALotus KingNo ratings yet

- PALE - Linsangan vs. TolentinoDocument2 pagesPALE - Linsangan vs. TolentinoLotus KingNo ratings yet

- Sux - Lopez vs. LiboroDocument1 pageSux - Lopez vs. LiboroLotus KingNo ratings yet

- Prov Rem - DP Lub vs. NicolasDocument3 pagesProv Rem - DP Lub vs. NicolasLotus KingNo ratings yet

- Sux - Cagro vs. CagroDocument1 pageSux - Cagro vs. CagroLotus KingNo ratings yet

- Proof of Service First Class Mail Pos030Document2 pagesProof of Service First Class Mail Pos030Kamal H KhanNo ratings yet

- m2 - Discuss Legal and Ethical RequirementsDocument3 pagesm2 - Discuss Legal and Ethical Requirementsapi-4657373590% (1)

- Bus-Org Cases-31 To 40Document7 pagesBus-Org Cases-31 To 40Dashy CatsNo ratings yet

- Change of Principal Business AddressDocument1 pageChange of Principal Business AddressBlu KurakaoNo ratings yet

- The Director of Lands and Heirs of The Deceased Homesteaders, Namely, Ignacio Bangug, Pascual Bangug, Eusebio Gumiran, Santiago Aggabao and Antonio Deray V CADocument2 pagesThe Director of Lands and Heirs of The Deceased Homesteaders, Namely, Ignacio Bangug, Pascual Bangug, Eusebio Gumiran, Santiago Aggabao and Antonio Deray V CAJohn YeungNo ratings yet

- 01 Razon vs. IACDocument1 page01 Razon vs. IACJanlo FevidalNo ratings yet

- G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, Vs - THE HON. COURT OF APPEALS and OSCAR LAZO, Respondents. REYES, J.B.L., J.Document77 pagesG.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, Vs - THE HON. COURT OF APPEALS and OSCAR LAZO, Respondents. REYES, J.B.L., J.Grachelle SerranoNo ratings yet

- Arigo Vs SwiftDocument12 pagesArigo Vs SwiftRA MorenoNo ratings yet

- EXECUTIVE ORDER NO 508 Presidential Lingkod Bayan AwardDocument2 pagesEXECUTIVE ORDER NO 508 Presidential Lingkod Bayan AwardSalvador C. Vilches100% (1)

- DMC 68 s2020Document3 pagesDMC 68 s2020Brian PaulNo ratings yet

- Hatun Willakuy English VersionDocument470 pagesHatun Willakuy English VersionRoberto FerriniNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Civil Procedure CodeDocument15 pagesDr. Ram Manohar Lohiya National Law University Civil Procedure CodeHarmanSinghNo ratings yet

- ICTAB-The Manual (As of 2207-845am)Document15 pagesICTAB-The Manual (As of 2207-845am)Thet LwinNo ratings yet

- Contracts 1Document23 pagesContracts 1Mani RajNo ratings yet

- G.R. No. 180016 LITO CORPUZ Vs PEOPLEDocument33 pagesG.R. No. 180016 LITO CORPUZ Vs PEOPLERuel FernandezNo ratings yet

- Hand-Out - P.D. 1829 (Penalizing Obstruction of Apprehension and Prosecution of Criminal Offenders)Document3 pagesHand-Out - P.D. 1829 (Penalizing Obstruction of Apprehension and Prosecution of Criminal Offenders)CL DelabahanNo ratings yet

- MP-IK Signature Sheet - IKTVADocument3 pagesMP-IK Signature Sheet - IKTVAwangruiNo ratings yet

- Agustin vs. Inocencio Supreme Court caseDocument2 pagesAgustin vs. Inocencio Supreme Court caseJose IbarraNo ratings yet

- Sexual Harassment Policy Review Committee FINAL REPORT 040716Document6 pagesSexual Harassment Policy Review Committee FINAL REPORT 040716Anonymous VuGMp3T0No ratings yet

- Isidro Carino Vs Commission On Human Rights - GR No. 96681 - December 2, 1991Document5 pagesIsidro Carino Vs Commission On Human Rights - GR No. 96681 - December 2, 1991BerniceAnneAseñas-ElmacoNo ratings yet

- Kevin K. Ogden v. San Juan County Detention Center Kob-Tv, Inc., Channel 4 Kobf-Tv, Channel 12 Farmington Dailey Times State of New Mexico City of Farmington, 104 F.3d 368, 10th Cir. (1996)Document16 pagesKevin K. Ogden v. San Juan County Detention Center Kob-Tv, Inc., Channel 4 Kobf-Tv, Channel 12 Farmington Dailey Times State of New Mexico City of Farmington, 104 F.3d 368, 10th Cir. (1996)Scribd Government DocsNo ratings yet

- Reviewer Consti IIDocument5 pagesReviewer Consti IIKarisse ViajeNo ratings yet

- United States v. Hernan Francisco Perez-Tosta, Gustavo Javier Correa-Patino, Erasmo Perez-Aguilera, Luis Guillermo Rojas-Valdez, 36 F.3d 1552, 11th Cir. (1994)Document21 pagesUnited States v. Hernan Francisco Perez-Tosta, Gustavo Javier Correa-Patino, Erasmo Perez-Aguilera, Luis Guillermo Rojas-Valdez, 36 F.3d 1552, 11th Cir. (1994)Scribd Government DocsNo ratings yet

- Pomperada v. Jochico y Pama, B.M. No. 68 (Resolution), (November 21, 1984), 218 PHIL 289-297Document15 pagesPomperada v. Jochico y Pama, B.M. No. 68 (Resolution), (November 21, 1984), 218 PHIL 289-297Kristina B DiamanteNo ratings yet

- Thien Thin Nguyen, A073 279 229 (BIA May 16, 2017)Document12 pagesThien Thin Nguyen, A073 279 229 (BIA May 16, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Raghavendra Letter To Judge Hon. PitmanDocument10 pagesRaghavendra Letter To Judge Hon. PitmanIvyGateNo ratings yet

- Javellana Vs Executive SecretaryDocument5 pagesJavellana Vs Executive Secretarydabigbigbang100% (18)

- Haskell v. Kansas Natural Gas Co., 224 U.S. 217 (1912)Document5 pagesHaskell v. Kansas Natural Gas Co., 224 U.S. 217 (1912)Scribd Government DocsNo ratings yet

- Autopsy WaiverDocument5 pagesAutopsy WaiverAngela CanaresNo ratings yet

- Joseph O. Regalado V Emma de La Rama Vda. Dela Peña Et. AlDocument2 pagesJoseph O. Regalado V Emma de La Rama Vda. Dela Peña Et. Alroilene check100% (1)