Professional Documents

Culture Documents

Free Equity Basics Tutorial

Uploaded by

rajnishtrifidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Free Equity Basics Tutorial

Uploaded by

rajnishtrifidCopyright:

Available Formats

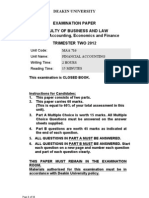

08 AUGUST14

www.trifidresearch.com

S

S

INDEX VALUE CHANGE %

SENSEX 25589 -76 -0.30

NIFTY 7649 -22 -0.30

BANK NIFTY 14986 -22 -0.15

INDIA VIX 14.13

-0.16 -1.11

CATEGORY BUY SELL NET

FII 2714.74 2787.81 -73.07

DII 1290.1

1061.11

228.99

BIG BULLS ACTIVITY

MARKET GOSSIPS FOURTH UMPIRE

Markets traded in choppy manner

with the start of the session and

moved southwards for the second

consecutive session closing flat with

negative bias. Nifty future again

strictly resisted at 7750 and sharp

selling was seen towards 21 day

EMA of 7690. Closing below this

indicates that correction may drag it

towards the crucial support of 7610.

While, if it is able to hold above the

psychological mark 7700 then only it

may move towards the resistance

range of 7750-7770.

TREND: SIDEWAYS

SUPPORT : 7630 & 7590

RESISTANCE: 7720 & 7760

MARKET POSITIONS

Market ends lower aimed

volatility; PNB, SSLT falls.

It shares were down as

Cognizant lowers revenue

growth estimate.

Rail stocks surged on cabinet

nod for FDI in railway

infrastructure.

Jindal steel and power gains

after reported better than

expected Q1 net profit.

SCRIPS @ TARGETS

B/S SL1 T1 T2 T3

GAIL S 414.50 416.50 412.50 410.50 408.50

NTPC S 138.30 139.30 137.30 136.30 135.30

SCRIPS @ TARGETS

B/S SL1 T1 T2 T3

INDIACEM B 109 107.90 110.10 111.20 112.30

UCOBANK

S 98 99 97 96 95

SCRIPS CLOSE R2 R1 S1 S2

RELIANCE FUT 992.80 1070 1030 960 920

ONGC FUT 400.80 410 405 395 390

TATA STEEL FUT 558.25 568 563 553 548

SBI FUT 2452.10 2550 2500 2400 2350

INFY FUT 3510.80 3600 3560 3460 3420

IBREALEST.

OPEN INTEREST 06-AUG-13 07-AUG-14 CHANGE IN OPEN

INTEREST

%

NIFTY

13730150 13092300 -637850 -4.65

FUTURE

CASH

PIVOT TABLE

FUTURES & OPTIONS DATA

SCRIPS IN F&O BAN FOR TRADE

A STEP AHEAD

WWW.TRIFIDRESEARCH.COM

DISCLAIMER

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Unifi Capital PresentationDocument40 pagesUnifi Capital PresentationAnkurNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Principles of Income and Business TaxationDocument3 pagesPrinciples of Income and Business TaxationQueen ValleNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Cooperative ManualDocument35 pagesCooperative ManualPratik MogheNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Presentation On Business Icon: by Ankita Sthapak Roll No.57Document9 pagesPresentation On Business Icon: by Ankita Sthapak Roll No.57Ankita SthapakNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Total 1 473 900.00 1 473 900.00Document4 pagesTotal 1 473 900.00 1 473 900.00Angela GarciaNo ratings yet

- Summary of "Contemporary Strategy"Document12 pagesSummary of "Contemporary Strategy"MostakNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Portfolio Management ServicesDocument24 pagesPortfolio Management ServicesASHI100% (5)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Definition of InflationDocument28 pagesDefinition of InflationRanjeet RanjanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Periodic MethodDocument14 pagesPeriodic MethodRACHEL DAMALERIONo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- T24 System Build Credit V1.0Document30 pagesT24 System Build Credit V1.0Quoc Dat Tran50% (2)

- SaranshYadav Project Report GoldDocument25 pagesSaranshYadav Project Report Goldanon_179532672No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Estmt - 2020 08 21Document8 pagesEstmt - 2020 08 21ventas.gopartNo ratings yet

- KPMG - IFRS vs. US GAAP - RD CostsDocument8 pagesKPMG - IFRS vs. US GAAP - RD CoststomasslrsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Form 3251BDocument2 pagesForm 3251BHarish ChandNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Chapter 15: Risk and Information: - Describing Risky Outcome - Basic ToolsDocument38 pagesChapter 15: Risk and Information: - Describing Risky Outcome - Basic ToolsrheaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Methods of LendingDocument2 pagesMethods of Lendingmuditagarwal72No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Bacc 404 Ass 1Document6 pagesBacc 404 Ass 1Denny ChakauyaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- XLS EngDocument21 pagesXLS EngRudra BarotNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 03Document13 pagesChapter 03ClaraNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Parker Economic Regulation Preliminary Literature ReviewDocument37 pagesParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuNo ratings yet

- "The Way To Make Easy: Hardest Money" 2.0Document74 pages"The Way To Make Easy: Hardest Money" 2.0А. Ариунбаяр86% (21)

- MAA716 - T2 - 2012 v2Document11 pagesMAA716 - T2 - 2012 v2ssusasi4769No ratings yet

- A Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachDocument8 pagesA Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachJedd Virgo100% (2)

- SFM PDFDocument731 pagesSFM PDFRam IyerNo ratings yet

- FranchisorDocument5 pagesFranchisorNaly YanoNo ratings yet

- Accounting Standard 1Document27 pagesAccounting Standard 1Sid2875% (4)

- AACAP - Exercise 2Document4 pagesAACAP - Exercise 2sharielles /No ratings yet

- Advanced Global Trading - AGT Arena #1Document38 pagesAdvanced Global Trading - AGT Arena #1advanceglobaltradingNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Accounting Grade 9: Balance SheetDocument2 pagesAccounting Grade 9: Balance SheetSimthandile NosihleNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)