Professional Documents

Culture Documents

Payment N Settlem, Ent

Uploaded by

Nandini JaganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment N Settlem, Ent

Uploaded by

Nandini JaganCopyright:

Available Formats

The commercial banks serve as the king pin of the financial system of the

country. They render many valuable services. The important functions of the

Commercial banks can be explained with the help of the following chart.

Primary Functions

The primary functions of the commercial banks include the following:

A. Acceptance of Deposits

1. Time Deposits:

These are deposits repayable after a certain fixed period. These deposits are not

withdrawn able by cheque, draft or by other means. It includes the following.

(a) Fixed Deposits:

The deposits can be withdrawn only after expiry of certain period say years, !

years or "# years. The banker allows a higher rate of interest depending upon

the amount and period of time. $reviously the rates of interest payable on fixed

deposits were determined by %eserve &ank.

$resently banks are permitted to offer interest as determined by each bank.

'owever, banks are not permitted to offer different interest rates to different

customers for deposits of same maturity period, except in the case of deposits of

%s. "! lakhs and above.

These days the banks accept deposits even for "! days or one month etc. In

times of urgent need for money, the bank allows premature closure of fixed

deposits by paying interest at reduced rate. (epositors can also avail of loans

against )ixed (eposits. The )ixed (eposit %eceipt cannot be transferred to

other persons.

(b) Recurring Deposits:

In recurring deposit, the customer opens an account and deposit a certain sum of

money every month. *fter a certain period, say " year or years or ! years, the

accumulated amount along with interest is paid to the customer. It is very

helpful to the middle and poor sections of the people. The interest paid on such

deposits is generally on cumulative basis. This deposit system is a useful

mechanism for regular savers of money.

(c) Cash Certificates:

Cash certificates are issued to the public for a longer period of time. It attracts

the people because its maturity value is in multiples of the sum invested. It is an

attractive and high yielding investment for those who can keep the funds for a

long time.

It is a very useful account for meeting future financial requirements at the

occasion of marriage, education of children etc. Cash certificates are generally

issued at discount to face value. It means a cash certificate of %s. ", ##,###

payable after "# years can be purchased now, say for %s. +#,###.

2. Demand Deposits:

These are the deposits which may be withdrawn by the depositor at any time

without previous notice. It is withdraw able by cheque,draft. It includes the

following:

(a) Saings Deposits:

The savings deposit promotes thrift among people. The savings deposits can

only be held by individuals and non-profit institutions. The rate of interest paid

on savings deposits is lower than that of time deposits. The savings account

holder gets the advantage of liquidity .as in current a,c/ and small income in the

form of interests.

&ut there are some restrictions on withdrawals. Corporate bodies and business

firms are not allowed to open 0& *ccounts. $resently interest on 0& *ccounts is

determined by %&I. It is 1.! per cent per annum. Co-operative banks are

allowed to pay an extra #.! per cent on its savings bank deposits.

(b) Current Account Deposits:

These accounts are maintained by the people who need to have a liquid balance.

Current account offers high liquidity. 2o interest is paid on current deposits and

there are no restrictions on withdrawals from the current account.

These accounts are generally in the case of business firms, institutions and co-

operative bodies. 2owadays, banks are designing and offering various

investment schemes for deposit of money. These schemes vary from bank to

bank.

It may be stated that the banks are currently working out with different

innovative schemes for deposits. 0uch deposit accounts offer better interest rate

and at the same time withdraw able facility also. These schemes are mostly

offered by foreign banks. In 30*, Current *ccounts are known as 4Checking

*ccounts4 as a cheque is equivalent to check in *merica.

!. Adancing of "oans

The commercial banks provide loans and advances in various forms. They are

given below:

1. #erdraft:

This facility is given to holders of current accounts only. This is an arrangement

with the bankers thereby the customer is allowed to draw money over and above

the balance in his,her account. This facility of overdrawing his account is

generally pre-arranged with the bank up to a certain limit.

It is a short-term temporary fund facility from bank and the bank will charge

interest over the amount overdrawn. This facility is generally available to

business firms and companies.

2. Cash Credit:

Cash credit is a form of working capital credit given to the business firms.

3nder this arrangement, the customer opens an account and the sanctioned

amount is credited with that account. The customer can operate that account

within the sanctioned limit as and when required.

It is made against security of goods, personal security etc. 5n the basis of

operation, the period of credit facility may be extended further. 5ne advantage

under this method is that bank charges interest only on the amount utili6ed and

not on total amount sanctioned or credited to the account.

%eserve &ank discourages this type of facility to business firms as it imposes an

uncertainty on money supply. 'ence this method of lending is slowly phased

out from banks and replaced by loan accounts. Cash credit system is not in use

in developed countries.

$. Discounting of !i%%s:

(iscounting of &ills may be another form of bank credit. The bank may

purchase inland and foreign bills before these are due for payment by the

drawer debtors, at discounted values, i.e., values a little lower than the face

values.

The &anker4s discount is generally the interest on the full amount for the

unexpired period of the bill. The banks reserve the right of debiting the accounts

of the customers in case the bills are ultimately not paid, i.e., dishonored.

The bill passes to the &anker after endorsement. (iscounting of bills by banks

provide immediate finance to sellers of goods. This helps them to carry on their

business. &anks can discount only genuine commercial bills i.e., those drawn

against sale of goods on Credit. &anks will not discount *ccommodation &ills.

&. "oans and Adances:

It includes both demand and term loans, direct loans and advances given to all

type of customers mainly to businessmen and investors against personal security

or goods of movable or immovable in nature. The loan amount is paid in cash or

by credit to customer account which the customer can draw at any time.

The interest is charged for the full amount whether he withdraws the money

from his account or not. 0hort-term loans are granted to meet the working

capital requirements where as long-term loans are granted to meet capital

expenditure.

$reviously interest on loan was also regulated by %&I. Currently, banks can

determine the rate themselves. 7ach bank is, however required to fix a

minimum rate known as $rime 8ending %ate .$8%/.

C%assification of "oans and Adances

8oans and advances given by bankers can be classified broadly into the

following categories:

.i/ *dvances which are given on the personal security of the debtor, and for

which no tangible or collateral security is taken9 this type of advance is given

either when the amount of the advance is very small, or when the borrower is

known to the &anker and the &anker has complete confidence in him .Clean

*dvance/.

(ii) *dvances which are covered by tangible or collateral security. In this section

of the study we are concerned with this type of advance and with different types

of securities which a &anker may accept for such advances .0ecured *dvance/.

(iii) *dvances which are given against the personal security of the debtor but for

which the &anker also holds in addition the guarantee of one or more sureties.

This type of advance is often given by &anker to persons who are not known to

them but whose surety is known to the &anker. &ankers also often take the per-

sonal guarantee of the (irectors of a company to whom they agree to advance a

clean or unsecured loan.

.iv/ 8oans are also given against the security of )ixed (eposit receipts.

'. (ousing Finance:

2owadays the commercial banks are competing among themselves in providing

housing finance facilities to their customers. It is mainly to increase the housing

facilities in the country. 0tate &ank of India, Indian &ank, Canara &ank, $un:ab

2ational &ank, has formed housing subsidiaries to provide housing finance.

The other banks are also providing housing finances to the public. ;overnment

of India also encourages banks to provide adequate housing finance.

&orrowers of housing finance get tax exemption benefits on interest paid.

)urther housing finance up to %s. ! lakh is treated as priority sector advances

for banks. The limit has been raised to %s. "# lakhs per borrower in cities.

). *ducationa% "oan Scheme:

The %eserve &ank of India, from *ugust, "<<< introduced a new 7ducational

8oan 0cheme for students of full time graduate,post-graduate professional

courses in private professional colleges.

3nder the scheme all public sector banks have been directed to provide

educational loan up to %s. "!,### for free seat and %s. !#,### for payment seat

student at interest not more than "+ per cent per annum. This loan is on clean

basis i.e., without calling for security.

This loan is available only for students whose annual family income does not

exceed %s. ", ##,###. The loan has to be repaid together with interest within

five years from the date of completion of the course. 0tudies in respect of the

following sub:ects,areas are covered under the scheme.

(a) =edical and dental course.

(b) 7ngineering course.

(c) Chemical Technology.

(d) =anagement courses like =&*.

(e) 8aw studies.

.f/ Computer 0cience and *pplications.

This apart, some of the banks have other educational loan schemes against

security etc., one can check up the details with the banks.

+. "oans against Shares,Securities:

Commercial banks provide loans against the security of shares,debentures of

reputed companies. 8oans are usually given only up to !#> value .=arket

?alue/ of the shares sub:ect to a maximum amount permissible as per %&I

directives. $resently one can obtain a loan up to %s."# lakhs against the physical

shares and up to %s. +# lakhs against demateriali6ed shares.

-. "oans against Saings Certificates:

&anks are also providing loans up to certain value of savings certificates like

2ational 0avings Certificate, )ixed (eposit %eceipt, Indira ?ikas $atra, etc. The

loan may be obtained for personal or business purposes.

.. Consumer "oans and Adances:

5ne of the important areas for bank financing in recent years is towards

purchase of consumer durables like T? sets, @ashing =achines, =icro 5ven,

etc. &anks also provide liberal Car finance.

These days banks are competing with one another to lend money for these

purposes as default of payment is not high in these areas as the borrowers are

usually salaried persons having regular incomeA )urther, bank4s interest rate is

also higher. 'ence, banks improve their profit through such profitable loans.

1/. Securiti0ation of "oans:

&anks are recently trying to securities a part of their part of loan portfolio and

sell it to another investor. 3nder this method, banks will convert their business

loans into a security or a document and sell it to some Investment or )und

=anager for cash to enhance their liquidity position.

It is a process of transferring credit risk from the banker to the buyer of

securiti6ed loans. It involves a cost to the banker but it helps the bank to ensure

proper recovery of loan. *ccordingly, securiti6ation is the process of changing

an illiquid asset into a liquid asset.

11. #thers:

Commercial banks provide other types of advances such as venture capital

advances, :ewel loans, etc.

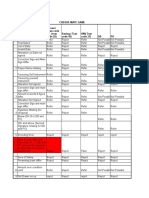

". 7ffective 5ctober "B, "<<1 banks were free to determine their own prime

lending rates .$8%s/ for credit limit over %s. + lakh. (ata relate to public sector

banks.

+. The stipulation of minimum maturity period of term deposits was reduced

from # days to "! days, effective *pril +<, "<<B. (ata relate to public sector

banks.

. The change in the &ank %ate was made effective from the close of business

of respective dates of change except *pril +<, "<<B.

1. 7ffective *pril +<, "<<B.

C. Credit Creation

Credit creation is one of the primary functions of commercial banks. @hen a

bank sanctions a loan to the customer, it does not give cash to him. &ut, a

deposit account is opened in his name and the amount is credited to his account.

'e can withdraw the money whenever he needs.

Thus, whenever a bank sanctions a loan it creates a deposit. In this way the bank

increases the money supply of the economy. 0uch functions are known as credit

creation.

Secondary Functions

The secondary functions of the banks consist of agency functions and general

utility functions.

A. Agency Functions

*gency functions include the following:

1i2 Co%%ection of che3ues4 diidends4 and interests:

*s an agent the bank collects cheques, drafts, promissory notes, interest,

dividends etc., on behalf of its customers and credit the amounts to their

accounts.

Customers may furnish their bank details to corporate where investment is made

in shares, debentures, etc. *s and when dividend, interest, is due, the companies

directly send the warrants,cheques to the bank for credit to customer account.

(ii) Payment of rent4 insurance premiums:

The bank makes the payments such as rent, insurance premiums, subscriptions,

on standing instructions until further notice. Till the order is revoked, the bank

will continue to make such payments regularly by debiting the customer4s

account.

(iii) Dea%ing in foreign exchange:

*s an agent the commercial banks purchase and sell foreign exchange as well

for customers as per %&I 7xchange Control %egulations.

(iv) Purchase and sa%e of securities:

Commercial banks undertake the purchase and sale of different securities such

as shares, debentures, bonds etc., on behalf of their customers. They run a

separate 4$ortfolio =anagement 0cheme4 for their big customers.

(v) Act as trustee4 executor4 attorney4 etc:

The banks act as executors of @ill, trustees and attorneys. It is safe to appoint a

bank as a trustee than to appoint an individual. *cting as attorneys of their

customers, they receive payments and sign transfer deeds of the properties of

their customers.

(vi) Act as correspondent:

The commercial banks act as a correspondent of their customers. 0mall banks

even get travel tickets, book vehicles9 receive letters etc. on behalf of the

customers.

(vii) Preparations of 5ncome6Tax returns:

They prepare income-tax returns and provide advices on tax matters for their

customers. )or this purpose, they employ tax experts and make their services,

available to their customers.

!. 7enera% 8ti%ity Serices

The ;eneral utility services include the following:

(i) Safety "oc9er faci%ity:

0afekeeping of important documents, valuables like :ewels are one of the oldest

services provided by commercial banks. 48ockers4 are small receptacles which

are fitted in steel racks and kept inside strong rooms known as vaults. These

lockers are available on half-yearly or annual rental basis.

The bank merely provides lockers and the key but the valuables are always

under the control of its users. *ny customer cannot have access to vault.

5nly customers of safety lockers after entering into a register his name account

number and time can enter into the vault. &ecause the vault is holding important

valuables of customers in lockers, it is also known as 40trong %oom4.

(ii) Payment :echanism or :oney Transfer:

Transfer of funds is one of the important functions performed by commercial

banks. Cheques and credit cards are two important payment mechanisms

through banks. (espite an increase in financial transactions, banks are

managing the transfer of funds process very efficiently.

Cheques are also cleared through the banking system. Correspondent banking is

another method of transferring funds over long distance, usually from one

country to another. &anks, these days employ computers to speed up money

transfer and to reduce cost of transferring funds.

7lectronic Transfer of funds is also known as 4Chequeless banking4 where funds

are transferred through computers and sophisticated electronic system by using

code words. They offer =ail Transfer, Telegraphic Transfer .TT/ facility also.

1iii2 Trae%ers; che3ues:

Travelers Cheques are used by domestic travelers as well as by international

travelers. 'owever the use of traveler4s cheques is more common by interna-

tional travelers because of their safety and convenience. These can be also

termed as a modified form of traveler4s letter of credit.

* bank issuing travelers cheques usually have banking arrangement with many

of the foreign banks abroad, known as correspondent banks. The purchaser of

traveler4s cheques can encase the cheques from all the overseas banks with

whom the issuing bank has such an arrangement.

Thus traveler4s cheques are not drawn on specific bank abroad. The cheques are

issued in foreign currency and in convenient denominations of ten, twenty, fifty,

one hundred dollar, etc. The signature of the buyer,traveler is written on the face

of the cheques at the time of their purchase.

The cheques also provide blank space for the signature of the traveler to be

signed at the time of encashment of each cheque. * traveler has to sign in the

blank space at the time of drawing money and in the presence of the paying

banker.

The paying banker will pay the money only when the signature of the traveler

tallies with the signature already available on the cheque.

* traveler should never sign the cheque except in the presence of paying banker

and only when the traveler desires to encash the cheque. 5therwise it may be

misused. The cheques are also accepted by hotels, restaurants, shops, airlines

companies for respectable persons.

7ncashment of a traveler cheque abroad is tantamount to a foreign exchange

transaction as it involves conversion of domestic currency into a foreign

currency.

@hen a traveller cheque is lost or stolen, the buyer of the cheques has to give a

notice to the issuing bank so that stop order can be issued against such

lost,stolen cheques to the banks where they are permitted to be encased.

It is also difficult to the finder of the cheque to draw cash against it since the

encasher has to sign the cheque in the presence of the paying banker. 3nused

travellers cheques can be surrendered to the issuing bank and balance of cash

obtained.

The issuing bank levies certain commission depending upon the number and

value of travellers cheques issued.

(iv) Circu%ar <otes or Circu%ar "etters of Credit:

3nder Circular 8etters of Credit, the customer,traveller negotiates the drafts

with any of the various branches to which they are addressed. Thus the traveller

can obtain funds from many of the branches of banks instead only from a

particular branch. Circular 8etters of Credit are therefore a more useful method

for obtaining funds while travelling to many countries.

It may be noted that travellers letter of credit are usually paid for in advance. In

other words, the traveller first makes payments to the issuing bank before

obtaining the Circular 2otes.

(v) 5ssue =Trae%%ers Che3ues=:

&anks issue travellers cheques to help carry money safely while travelling

within India or abroad. Thus, the customers can travel without fear, theft or loss

of money.

(vi) "etters of Credit:

8etter of Credit is a payment document provided by the buyer4s banker in favour

of seller. This document guarantees payment to the seller upon production of

document mentioned in the 8etter of Credit evidencing dispatch of goods to the

buyer.

The 8etter of Credit is an assurance of payment upon fulfilling conditions

mentioned in the 8etter of Credit. The letter of credit is an important method of

payment in international trade. There are primarily 1 parties to a letter of credit.

The buyer or importer, the bank which issues the letter of credit, known as

opening bank, the person in whose favour the letter of credit is issued or opened

.The seller or exporter, known as 4&eneficiary of 8etter of Credit4/, and the

credit receiving,advising bank.

The 8etter of Credit is generally advised,sent through the seller4s bank, known

as 2egotiating or *dvising bank. This is done because the conditions mentioned

in the 8etter of Credit are, in the first instance9 have to be verified by the

2egotiating &ank. It is mostly used in international trade.

(vii) Acting as Referees:

The banks act as referees and supply information about the business

transactions and financial standing of their customers on enquiries made by

third parties. This is done on the acceptance of the customers and help to

increase the business activity in general.

(viii) Proides Trade 5nformation:

The commercial banks collect information on business and financial conditions

etc., and make it available to their customers to help plan their strategy. Trade

information service is very useful for those customers going for cross-border

business. It will help traders to know the exact business conditions, payment

rules and buyers4 financial status in other countries.

(ix) AT: faci%ities:

The banks today have *T= facilities. 3nder this system the customers can

withdraw their money easily and quickly and +1 hours a day. This is also known

as 4*ny Time =oney4. Customers under this system can withdraw funds i.e.,

currency notes with a help of certain magnetic card issued by the bank and

similarly deposit cash,cheque for credit to account.

(x) Credit cards:

&anks have introduced credit card system. Credit cards enable a customer to

purchase goods and services from certain specified retail and service

establishments up to a limit without making immediate payment. In other

words, purchases can be made on credit basis on the strength of the credit card.

The establishments like 'otels, 0hops, *irline Companies, %ailways etc., which

sell the goods or services on credit forward a monthly or fortnightly statements

to the bank.

The amount is paid to these establishments by the bank. The bank subsequently

collects the dues from the customers by debit to their accounts. 3sually, the

bank receives certain service charges for every credit card issued. ?isa Card,

&5& card are some examples of credit cards.

(xi) 7ift Che3ues:

The commercial banks offer ;ift cheque facilities to the general public. These

cheques received a wider acceptance in India. 3nder this system by paying

equivalent amount one can buy gift cheque for presentation on occasions like

@edding, &irthday.

(xii) Accepting !i%%s:

5n behalf of their customers, the banks accept bills drawn by third parties on its

customers. This resembles the letter of credit. @hile banks accept bills, they

provide a better security for payment to seller of goods or drawer of bills.

(xiii) :erchant !an9ing:

The commercial banks provide valuable services through their merchant

banking divisions or through their subsidiaries to the traders. This is the

function of underwriting of securities. They underwrite a portion of the $ublic

issue of shares, (ebentures and &onds of Coint 0tock Companies.

0uch underwriting ensures the expected minimum subscription and also convey

to the investing public about the quality of the company issuing the securities.

Currently, this type of services can be provided only by separate subsidiaries,

known as =erchant &ankers as per 07&I regulations.

(xiv) Adice on Financia% :atters:

The commercial banks also give advice to their customers on financial matters

particularly on investment decisions such as expansion, diversification, new

ventures, rising of funds etc.

(xv) Factoring Serice:

Today the commercial banks provide factoring service to their customers. It is

very much helpful in the development of trade and industry as immediate cash

flow and administration of debtors4 accounts are taken care of by factors. This

service is again provided only by a separate subsidiary as per %&I regulations.

&alance sheet is a statement of assets and liabilities on a given date. In India,

banks have to publish their balance sheets according to the preformed i.e., 4)orm

*4 given in the III schedule of the &anking %egulation *ct, "<1<. The study of

the balance sheet along with its profit and loss account reveals its financial

soundness.

* customer has to carefully study these statements to choose his banks. The

combined balance sheet of all banks in the country reveals certain economic

trends. * specimen of a &ank4s &alance 0heet is given at the end of this chapter.

You might also like

- PanchatantraDocument10 pagesPanchatantraBinaya SahooNo ratings yet

- Chapter 5 EditedDocument10 pagesChapter 5 EditedSeid KassawNo ratings yet

- Asgment BankingDocument7 pagesAsgment Bankingkiena1991No ratings yet

- F O C B ' B L: Unctions F Ommercial ANK S Anking AWDocument15 pagesF O C B ' B L: Unctions F Ommercial ANK S Anking AWRavi AnandNo ratings yet

- What Is BankDocument19 pagesWhat Is BankSunayana BasuNo ratings yet

- Sources of FinanceDocument3 pagesSources of FinanceBurhan AhmedNo ratings yet

- Banking - ch-3333Document13 pagesBanking - ch-3333FantayNo ratings yet

- Banking Pricnciples and Practices Lecture Notes ch3Document17 pagesBanking Pricnciples and Practices Lecture Notes ch3ejigu nigussieNo ratings yet

- Chapter - 9 Opening and Operating Bank AccountsDocument12 pagesChapter - 9 Opening and Operating Bank AccountsMd Mohsin AliNo ratings yet

- Role of Commercial BanksDocument16 pagesRole of Commercial BanksJayant MishraNo ratings yet

- Type of BanksDocument31 pagesType of BanksKasthuri SelvamNo ratings yet

- Functions of Commercial BanksDocument10 pagesFunctions of Commercial BanksGaganjot KaurNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- Risk-Weighted AssetsDocument6 pagesRisk-Weighted AssetsSalman Kabir AbidNo ratings yet

- Banking EcoDocument27 pagesBanking EcomayankgoylllNo ratings yet

- Important Functions of Bank: What Is A Bank?Document3 pagesImportant Functions of Bank: What Is A Bank?Samiksha PawarNo ratings yet

- Commercial BankDocument29 pagesCommercial BankMahesh RasalNo ratings yet

- Chapter Three Commercial Banking: 1 by SityDocument10 pagesChapter Three Commercial Banking: 1 by SitySeid KassawNo ratings yet

- UNIT 2 DetailDocument10 pagesUNIT 2 DetailShaifali ChauhanNo ratings yet

- Chap 1. Banking System in IndiaDocument24 pagesChap 1. Banking System in IndiaShankha MaitiNo ratings yet

- UNIT 2 Process and DocumentationDocument27 pagesUNIT 2 Process and DocumentationAroop PalNo ratings yet

- Functions of Commercial Banks ReportDocument14 pagesFunctions of Commercial Banks ReportAryan Khan50% (2)

- MBF - Unit 4 5Document11 pagesMBF - Unit 4 5Sachin TiwariNo ratings yet

- Functions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsDocument3 pagesFunctions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsBalaji GajendranNo ratings yet

- Lecture 3 - Loans & AdvancesDocument16 pagesLecture 3 - Loans & AdvancesEmmanuel MwapeNo ratings yet

- Banking Interview QuestionDocument6 pagesBanking Interview Questionberihun admassuNo ratings yet

- Functions of Commercial BanksDocument52 pagesFunctions of Commercial BanksPulkit_Saini_789No ratings yet

- What Is A Bank?Document6 pagesWhat Is A Bank?Bhabani Sankar DashNo ratings yet

- What Are The Functions of BanksDocument15 pagesWhat Are The Functions of BanksppperfectNo ratings yet

- Loans MeaningDocument20 pagesLoans MeaningrichabhanushaliNo ratings yet

- Banking: Islamic Banking: Institute of Business Administration (Iba), JuDocument8 pagesBanking: Islamic Banking: Institute of Business Administration (Iba), JuYeasminAkterNo ratings yet

- 5 Consumer Financ-2Document13 pages5 Consumer Financ-2thullimilli leelaprasadNo ratings yet

- Banks: Deposits AccountsDocument11 pagesBanks: Deposits AccountsMukesh AroraNo ratings yet

- Functions of BanksDocument3 pagesFunctions of BanksEbne FahadNo ratings yet

- Commercial BankingDocument12 pagesCommercial BankingwubeNo ratings yet

- Banking and Insurance PPT Unit-2,3 and 4Document88 pagesBanking and Insurance PPT Unit-2,3 and 4d Vaishnavi OsmaniaUniversityNo ratings yet

- Banking PortfolioDocument25 pagesBanking Portfolioranahaider081315No ratings yet

- Private Sector BanksDocument3 pagesPrivate Sector BanksBalaji GajendranNo ratings yet

- Short Term FinanceDocument11 pagesShort Term Financethisispurva100% (1)

- Chapter - : Money and Banking: Best Higher Secondary SchoolDocument11 pagesChapter - : Money and Banking: Best Higher Secondary Schoolapi-232747878No ratings yet

- A. Primary Functions of BanksDocument15 pagesA. Primary Functions of Bankshansdeep479No ratings yet

- Pbi 2019Document19 pagesPbi 2019dhanush.rNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementindhumathigNo ratings yet

- Credit Sources and Credit CardsDocument11 pagesCredit Sources and Credit CardsPoonam VermaNo ratings yet

- Project Report On Bank Deposit Schemes: Types of Deposit AccountsDocument3 pagesProject Report On Bank Deposit Schemes: Types of Deposit AccountsAmit SinghNo ratings yet

- Unit IiDocument29 pagesUnit IiMRIDUL JAINNo ratings yet

- Bank CreditDocument5 pagesBank Creditnhan thanhNo ratings yet

- A Study On Loans and Advances by Rohit RDocument178 pagesA Study On Loans and Advances by Rohit RIram Fatmah100% (1)

- Money and CreditDocument11 pagesMoney and CreditDaksh SharmaNo ratings yet

- (A.) Commercial Banks - FunctionsDocument3 pages(A.) Commercial Banks - FunctionsEPP-2004 HaneefaNo ratings yet

- Banking Products Assignment FINAL 2Document19 pagesBanking Products Assignment FINAL 2satyabhagatNo ratings yet

- Assignment 2 Fin536Document6 pagesAssignment 2 Fin536mypinkladyNo ratings yet

- Commercial Banks and NBFIsDocument17 pagesCommercial Banks and NBFIsAbhishek kumarNo ratings yet

- What Are The Functions of Commercial Banks?Document8 pagesWhat Are The Functions of Commercial Banks?Anusha RaoNo ratings yet

- Banking System: Commercial BanksDocument15 pagesBanking System: Commercial BanksAAMIR IBRAHIMNo ratings yet

- ProjectDocument72 pagesProject9463684355No ratings yet

- Lecture 3 - Loans - AdvancesDocument16 pagesLecture 3 - Loans - AdvancesYvonneNo ratings yet

- Presentation of B&i (1) - 1Document23 pagesPresentation of B&i (1) - 1Manish ChauhanNo ratings yet

- Locus of ControlDocument8 pagesLocus of ControlNandini JaganNo ratings yet

- NightDocument20 pagesNightNandini JaganNo ratings yet

- Unit Xiii - Analysis of Time Series: Notes StructureDocument15 pagesUnit Xiii - Analysis of Time Series: Notes StructureNandini JaganNo ratings yet

- Social SkiilDocument9 pagesSocial SkiilNandini JaganNo ratings yet

- An Empirical Study On Student's Learning Through e - Learning Modules Offered by Corporate Through Colleges in MumbaiDocument17 pagesAn Empirical Study On Student's Learning Through e - Learning Modules Offered by Corporate Through Colleges in MumbaiNandini JaganNo ratings yet

- Quality of Women Employees in Private Sector Banking Industry in GobichettipalayamDocument11 pagesQuality of Women Employees in Private Sector Banking Industry in GobichettipalayamNandini JaganNo ratings yet

- Paper 513Document9 pagesPaper 513Nandini JaganNo ratings yet

- Paper 570Document9 pagesPaper 570Nandini JaganNo ratings yet

- Role of IT in BanksDocument48 pagesRole of IT in BanksNandini JaganNo ratings yet

- Innovations in Banking and InsuranceDocument1 pageInnovations in Banking and InsuranceNandini JaganNo ratings yet

- Cheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Document1 pageCheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Nandini JaganNo ratings yet

- Ramniranjan Jhunjhunwala College, Ghatkopar-Mumbai 400086 DATE: 26/09/2016 TIME: 10.30 To 1.00pm Subject: Marketing Marks: 75Document2 pagesRamniranjan Jhunjhunwala College, Ghatkopar-Mumbai 400086 DATE: 26/09/2016 TIME: 10.30 To 1.00pm Subject: Marketing Marks: 75Nandini JaganNo ratings yet

- Crop InsuranceDocument41 pagesCrop InsuranceNandini JaganNo ratings yet

- Columbia NY MBA-brochure 2018 FinalDocument20 pagesColumbia NY MBA-brochure 2018 FinalData CentrumNo ratings yet

- Leasing Sector in BangladeshDocument8 pagesLeasing Sector in BangladeshImtiaz AhmedNo ratings yet

- Post Contract ManagementDocument19 pagesPost Contract ManagementRajanRanjanNo ratings yet

- International Coal VenturesDocument3 pagesInternational Coal VenturesNeerajKumarNo ratings yet

- Association of Mutual Funds in IndiaDocument8 pagesAssociation of Mutual Funds in Indiakunwar16No ratings yet

- Report On Lankabangla Finance Limited by TowhidulDocument31 pagesReport On Lankabangla Finance Limited by TowhidulTowhidul Alam Pavel55% (11)

- Accounting Edexcel FINALDocument6 pagesAccounting Edexcel FINALClifford PeraltaNo ratings yet

- Struktur OrganisasiDocument27 pagesStruktur OrganisasiCipta DimensiaNo ratings yet

- Future Trends in LNG Project Finance - M FilippichDocument36 pagesFuture Trends in LNG Project Finance - M Filippichmichael_filippich2No ratings yet

- CEMCO Holdings Vs National Life Insurance CoDocument1 pageCEMCO Holdings Vs National Life Insurance CoCE SherNo ratings yet

- Key Drivers of Growth in Indian RetailDocument24 pagesKey Drivers of Growth in Indian RetailPinaki BasuNo ratings yet

- Pineapple Processing PlantDocument25 pagesPineapple Processing PlantMidul Khan100% (3)

- KPMGs Guide To Going Public PDFDocument84 pagesKPMGs Guide To Going Public PDFVenp PeNo ratings yet

- Types of Corporate RestructuringDocument2 pagesTypes of Corporate Restructuringrohitboy123100% (2)

- Risk Management of SbiDocument30 pagesRisk Management of SbiTanay Pandey100% (2)

- FIM Vietnam Bonds MarketsDocument10 pagesFIM Vietnam Bonds MarketstnthuyoanhNo ratings yet

- Analysis of Financial Statements: BY Rana Asghar AliDocument31 pagesAnalysis of Financial Statements: BY Rana Asghar AliMaxhar AbbaxNo ratings yet

- Resumen Chapter 19 - Intermediate AccountingDocument7 pagesResumen Chapter 19 - Intermediate AccountingDianaa Lagunes BlancoNo ratings yet

- Mva & EvaDocument8 pagesMva & Evathexplorer008No ratings yet

- Tender 25Document114 pagesTender 25ram5128No ratings yet

- Role of District Industrial Centers in Entrepreneurship DevelopmentDocument5 pagesRole of District Industrial Centers in Entrepreneurship DevelopmentPinky KusumaNo ratings yet

- Bank Simpanan Nasional Act 1974 - Act 146Document26 pagesBank Simpanan Nasional Act 1974 - Act 146peterparkerNo ratings yet

- EEM QuizDocument8 pagesEEM Quizlokesh_bhatiyaNo ratings yet

- Small Business Corporation - GOCC - Financial Papers 2017Document56 pagesSmall Business Corporation - GOCC - Financial Papers 2017Kristelle Louise SantanderNo ratings yet

- Financial Statement AnalysisDocument44 pagesFinancial Statement AnalysisAbu KalilNo ratings yet

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioNo ratings yet

- Farmland Is The Next Big Thing in REITs - Farmland Partners Inc (NYSEMKT - FPI) - Seeking AlphaDocument10 pagesFarmland Is The Next Big Thing in REITs - Farmland Partners Inc (NYSEMKT - FPI) - Seeking AlphaDobromir StoyanovNo ratings yet

- Main FileDocument65 pagesMain FileKomal MansukhaniNo ratings yet

- Adv Acc NADocument31 pagesAdv Acc NAimianmoralesNo ratings yet

- Crisostomo Vs SEC DigestDocument1 pageCrisostomo Vs SEC Digestmelaniem_1No ratings yet