Professional Documents

Culture Documents

Anosha

Uploaded by

Iqra JawedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anosha

Uploaded by

Iqra JawedCopyright:

Available Formats

WACC Solution

1. (A)

The payback is 35,000/5,000= 7 years

Computation of the NPV :

15

NPV= -35,000 + 5,000 / ( 1 + 12%)^ 15

i=1

NPV = $- 947. 67

Computation of the IRR :

15

0= -35,000 + 5,000 / ( 1 + IRR)^ 15

i=1

IRR= 11.49%

The NPV of this project is negative and the IRR is lower than the Cost of Capital of 12%

so Rainbow products shouldnt go for this investment opportunity.

1. (B)

Based on the perpetuity formula we can calculate the present value:

Computation of the PV:

PV= Cash flow per year/ cost of capital

=4,500 / 0.12

= $37,500

Computation of the NPV:

NPV= -Initial investment + PV

= -35,000 + 37,500

NPV=$2,500

Rainbow products could buy this machine with the service contract as it has a positive

NPV of $2,500.

1.(C)

Computation of the PV :

PV= C/ k-g

In this case C (end of year perpetuity payout) = 5,000-1,000= $4,000 k= 12%, discount

rate

g= 4%, growing rate at perpetuity

PV= 4,000 / (0.12-0.04) = $50,000

Computation of the NPV :

NPV= -35,000+ 50,000 = $15,000

The rainbow products company should invest in this project because its NPV is largely

positive because of the reinvestment of 20% of the annual cost, even though this is in a

very long term vision..

Questions Covered

1. What factors should Ameritrade management consider when evaluating

the proposed advertising program and technology upgrades? Why?

2. How can the Capital Asset Pricing Model be used to estimate the cost

of capital for a real (not financial) investment decision?

3. What is the estimate of the risk-free rate that should be employed

in calculating the cost of capital for Ameritrade?

4. What is the estimate of the market risk premium that should be

employed in calculating the cost of capital at Ameritrade?

5. In principle, what are the steps for computing the asset beta in the

CAPM for the purposes of calculating the cost of capital for a project?

6. Ameritrade does not have a beta estimate because the firm has been

publicly traded for only a short time period. Exhibit 4 provides various

choices of comparable firms. What comparable firms do you

recommend as the appropriate benchmarks for evaluating the risk of

Ameritrades planned advertising and technology investments?

7. Using the stock price and returns data in Exhibits 4 and 5, and the

capital structure information in Exhibit 3, calculate the asset betas for

the comparable firms.

8. How should Joe Ricketts, the CEO of Ameritrade, view the cost of

capital you have calculated?

Dear Andy! Sorry for my second delay with the case it is all the preparation to

universityexams. I shall try to finish Friendly Cards in time.So I used to make parallels

from cases to our real life and economic situation in Ukraine. At thetime we do not

have such companies as Ameritrade in Ukraine, because this kind of businessdoes not

have its customers right now. This is a new thing to our country, and as usual, all

thenew things are taken distrustfully.I can recall only one example : it is FOREX, but it

actually deals with the currency exchangerates, buying and selling currency. The only

same thing all the processes are being held online.

1 . Wh a t f a c t o r s s h o u l d A me r i t r a d e c o n s i d e r wh e n e v a l u a t i n g

t h e p r o p o s e d a d v e r t i s i n g program and technology upgrades?Ameritrade

needs a cost of capital to evaluate new projects. Firms maximize their value by taking

all positive NPV projects.

( )

( )

+=

iii

r CF E NPV

*

1

...,2,1,0

=

i

( )

i

CF E

is the expected cash flow in period

i

*

r

is the discount rateTo calculate an NPV, we need a discount rate. In the A-Rod case we

used 8%. In theOcean Carriers case we used 9%. In this case we will learn how to

determine anappropriate rate.If Ameritrade analysts use a discount rate that is too high,

good projects may be rejected.If they use a discount rate that is too low, bad projects

may be accepted.Also the Ameritrade analysts should consider, that their companys

internal discount ratewas often used as 15%, but some managers felt appropriate the

rate of 8-9%. At this time,the external discount rate, used by Credit Swiss First Boston

was 12%.

Goodobservation.

So actually computing the NPV earlier, Ameritrade analysts accepted only the

best projects which fitted their high requirements.

Now at the end of your analysis, we seethat Ameritrade has a cost of capital close to 22%. This

high hurdle rate means thatAmeritrade should only accept projects with a very high potential

rate of return (aslong as they are of similar risk levels).

2 . Ho w c a n t h e Ca p i t a l A s s e t P r i c i n g Mo d e l ( CA P M) b e u s e d

t o e s t i ma t e t h e c o s t o f c a p i t a l for a real investment decision? (Note: A

real

investment decision here is contrastedfrom a

financial

investment decision. We are talking about real projects, with investmentin people and

technologies, etc.)

You might also like

- Annual Report 2016Document58 pagesAnnual Report 2016Iqra JawedNo ratings yet

- Alif Allah Aur Insaan by Qaisra Hayat 1Document321 pagesAlif Allah Aur Insaan by Qaisra Hayat 1shahidirfanNo ratings yet

- Auto Finance Analytics PDFDocument6 pagesAuto Finance Analytics PDFIqra JawedNo ratings yet

- Business Intelligence: Making Decisions Through Data AnalyticsDocument16 pagesBusiness Intelligence: Making Decisions Through Data AnalyticsBusiness Expert Press92% (12)

- Discounted Dividend Valuation: Presenter Venue DateDocument46 pagesDiscounted Dividend Valuation: Presenter Venue DateAinie IntwinesNo ratings yet

- Proxy Form EnglishDocument1 pageProxy Form EnglishIqra JawedNo ratings yet

- CtrypremDocument212 pagesCtrypremIqra JawedNo ratings yet

- Auto Finance Analytics PDFDocument6 pagesAuto Finance Analytics PDFIqra JawedNo ratings yet

- Sources of Short-Term Financing Options Like Trade Credit, Commercial PaperDocument14 pagesSources of Short-Term Financing Options Like Trade Credit, Commercial PaperIqra JawedNo ratings yet

- How Your Credit Score Is DeterminedDocument3 pagesHow Your Credit Score Is DeterminedIqra JawedNo ratings yet

- btn20140526 DLDocument36 pagesbtn20140526 DLIqra JawedNo ratings yet

- SnlworkbookDocument28 pagesSnlworkbookIqra JawedNo ratings yet

- Engro Foods Annual Report 2011 PDFDocument89 pagesEngro Foods Annual Report 2011 PDFIqra JawedNo ratings yet

- CH 06Document56 pagesCH 06Iqra JawedNo ratings yet

- Corp First Quarterly Report 2015Document21 pagesCorp First Quarterly Report 2015Iqra JawedNo ratings yet

- Docslide - Us - John e Hanke Dean W Wichern Business Forecasting 8th Edition 2005 Pearson PDFDocument2 pagesDocslide - Us - John e Hanke Dean W Wichern Business Forecasting 8th Edition 2005 Pearson PDFIqra JawedNo ratings yet

- E Corp Q3 Accounts 2016Document28 pagesE Corp Q3 Accounts 2016Iqra JawedNo ratings yet

- IdahoDocument4 pagesIdahoIqra JawedNo ratings yet

- E Corp Half Yearly Report 2016Document29 pagesE Corp Half Yearly Report 2016Iqra JawedNo ratings yet

- E-Corp Q1 Accounts2016Document26 pagesE-Corp Q1 Accounts2016Iqra JawedNo ratings yet

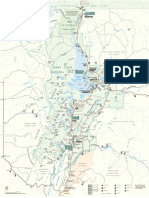

- GrandTeton Park Map 2011-2 PDFDocument1 pageGrandTeton Park Map 2011-2 PDFIqra JawedNo ratings yet

- q1 Accounts 2017 EngroDocument24 pagesq1 Accounts 2017 EngroIqra JawedNo ratings yet

- Nasa - Gov-Chasing The Total Solar Eclipse From NASAs WB-57F JetsDocument45 pagesNasa - Gov-Chasing The Total Solar Eclipse From NASAs WB-57F JetsIqra JawedNo ratings yet

- Engro Fertilizers Annual Report 2016 PDFDocument173 pagesEngro Fertilizers Annual Report 2016 PDFIqra JawedNo ratings yet

- Slackers Guide To The 2017 Solar EclipseDocument3 pagesSlackers Guide To The 2017 Solar EclipseIqra JawedNo ratings yet

- Here Are The Most Amazing Photos and Videos of The 2017 Solar EclipseDocument5 pagesHere Are The Most Amazing Photos and Videos of The 2017 Solar EclipseIqra JawedNo ratings yet

- Yellowstone Official Road Map - 2016 2 PDFDocument1 pageYellowstone Official Road Map - 2016 2 PDFIqra JawedNo ratings yet

- August 21 2017 Great American Eclipse Total Solar EclipseDocument5 pagesAugust 21 2017 Great American Eclipse Total Solar EclipseIqra JawedNo ratings yet

- The Best Places in America To Watch The Total Solar EclipseDocument5 pagesThe Best Places in America To Watch The Total Solar EclipseIqra JawedNo ratings yet

- Nasa - Gov-Preparing For The August 2017 Total Solar EclipseDocument48 pagesNasa - Gov-Preparing For The August 2017 Total Solar EclipseIqra JawedNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BW ControversyDocument5 pagesBW ControversyJacquelyn RamosNo ratings yet

- Chapter 19 Basic Earning Per ShareDocument16 pagesChapter 19 Basic Earning Per ShareToni Marquez100% (1)

- Question Paper 11 Accounts Time: 3Hrs Max Marks: 80Document5 pagesQuestion Paper 11 Accounts Time: 3Hrs Max Marks: 80manish jangidNo ratings yet

- Cash BudgetDocument3 pagesCash Budgetkeshav madamNo ratings yet

- Banking Law Long QuestionsDocument4 pagesBanking Law Long QuestionsDEEPAKNo ratings yet

- Functions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)Document41 pagesFunctions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)kim byunooNo ratings yet

- All Accounting Questions For Homework and Assessment Answers Provided HelpfulDocument17 pagesAll Accounting Questions For Homework and Assessment Answers Provided HelpfulChloe OberlinNo ratings yet

- Option Chain (Equity Derivatives)Document2 pagesOption Chain (Equity Derivatives)sudhakarrrrrrNo ratings yet

- Moller Maersk PDF FinalDocument10 pagesMoller Maersk PDF Finalanna sNo ratings yet

- Indenture PDVSA 2020Document16 pagesIndenture PDVSA 2020Miguel ZajíaNo ratings yet

- Bindura Nickel Corporation Limited PDFDocument1 pageBindura Nickel Corporation Limited PDFBusiness Daily ZimbabweNo ratings yet

- Financial Statistical Summary: Attock Refinery LimitedDocument2 pagesFinancial Statistical Summary: Attock Refinery Limitedabrofab123No ratings yet

- PFWIQ Motion Bar Unasserted Claims + TerminateDocument119 pagesPFWIQ Motion Bar Unasserted Claims + TerminatemilesNo ratings yet

- Chapter 6 Soalan Subjektif & Jawapan For FasiDocument6 pagesChapter 6 Soalan Subjektif & Jawapan For FasiCHUAH CHEE XIAN MoeNo ratings yet

- Working Capital - LupinDocument13 pagesWorking Capital - Lupinprashantrikame1234No ratings yet

- Provision For DepreciationDocument10 pagesProvision For DepreciationAsh InuNo ratings yet

- Enron CaseDocument6 pagesEnron CaseShakil AhmedNo ratings yet

- Corporation PDFDocument8 pagesCorporation PDFKAMALINo ratings yet

- CGT F6 Fa 20Document35 pagesCGT F6 Fa 20Wajih RehmanNo ratings yet

- Finlord Traders RatiosDocument6 pagesFinlord Traders RatiosMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- Banking Business DefinitionDocument6 pagesBanking Business Definitiontai JtNo ratings yet

- Fabm 1-PTDocument12 pagesFabm 1-PTMaxene YbañezNo ratings yet

- Chapter 1 Partnership Formation, Operations, Dissolution-PROFE01Document7 pagesChapter 1 Partnership Formation, Operations, Dissolution-PROFE01Steffany RoqueNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument16 pagesModule 1 - Cash and Cash EquivalentsJehPoy0% (1)

- Para and Luman: Partnership InvestmentDocument6 pagesPara and Luman: Partnership InvestmentDaphne RoblesNo ratings yet

- PR-Akuntansi Manufaktur - RevisiDocument4 pagesPR-Akuntansi Manufaktur - Revisisafira annisaNo ratings yet

- MRCB BerhadDocument24 pagesMRCB BerhadPiqsamNo ratings yet

- Accounting Chapter 13 Corporation TestDocument5 pagesAccounting Chapter 13 Corporation TestBingyi Angela ZhouNo ratings yet

- Accounting Equation WorksheetDocument1 pageAccounting Equation Worksheetapi-367095294100% (1)

- Directors' Resolution Approving Transfer of SharesDocument1 pageDirectors' Resolution Approving Transfer of SharesLegal Forms100% (2)