Professional Documents

Culture Documents

Illustration 6

Uploaded by

mknatoo1963Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration 6

Uploaded by

mknatoo1963Copyright:

Available Formats

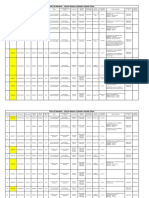

Illustration 6: Gross Value Added Statement and Reconciliation of GVA with PAT

On the basis of the following Income Statement of G Ltd., prepare - (a) Gross Value Added Statement; and

(b) Statement showing reconciliation of Gross Value Added with Prot Before Taxation. (Rs. 000)

Particulars Rs. 000s Rs. 000s

Income:

Sales Less Returns

Dividends and Interest

Miscellaneous Income

15,27,956

130

474

Total Income (A) 15,28,560

Expenditure:

26,054

13,42,010

1. Production & Operational Expenses:

Decrease in Inventory of Finished Goods

Consumption of Raw Materials 7,40,821

Power & Lighting 1,20,030

Wages, Salaries and Bonus 3,81,760

Staff Welfare Expenses 26,240

Excise Duty 14,540

Other Manufacturing Expenses 32,565

2. Administration Expenses:

40,450

7,810

32,640

Directors Remuneration

Other Administration Expenses

3. Interest on:

24,500

14,400 9% Mortgage debentures

Long-Term loan from Financial Institutions 10,000

Bank Overdraft 100

4. Depreciation on Fixed Assets:

50,600

Total Expenditure (B) 14,57,560

Prot before Taxation (A) - (B)

18,212

71,000

Less: Provision for Income Tax 25,470

Prot after Taxation 45,530

6.300 Balance of P & L A/c as per last Balance Sheet

Total available for appropriation 51,830

Transferred to:

43,030

General Reserve 40% of Rs.45,530

Proposed Dividend at 22% 22,000

Tax on Distributed Prots at 12.81% 2,818

Surplus carried to Balance Sheet 8,800

Solution:

Value Added Statement of G Ltd.

Particulars Rs. 000s Rs. 000s %

Sales less Returns

9,34,010

15,27,956

Less: Bought In Materials & Services (13,42,010 - 3,81,760 - 26,240)

Administration Expenses 32,640

Interest on Bank Overdraft 100 9,66.750

Value Added by Manufacturing and Trading Activities 5,61,206

Add: Dividend & Interest Received 130

Miscellaneous Income 474

TOTAL VALUE ADDED (See Note below) 5,61,810

APPLICATION OF VALUE ADDED Rs. 000s Rs. 000s %

a. To Pay Employees: Wages, Salaries & Bonus

Staff Welfare Expenses

b. To Pay Directors: Directors Remuneration

c. To Pay Government: Income Tax

Tax on Distributed Prots

d. To Pay to providers of Capital: Interest on 9% Debentures

Interest on long-term loan from nancial institution

Dividend to Shareholders

e. To provide for maintenance and expansion of the Company:

Depreciation on Fixed Assets

Transfer to General Reserve

Retained Prots (8,800 - 6,300)

3,81,760

26,240

4,08,000

7,810

28,288

46,400

71,312

72.62

1.39

5.04

8.26

12.69

25,470

2.818

14,400

10,000

22.000

50,600

18,212

2,500

TOTAL APPLICATION 5,61,810 100.00

Reconciliation of Total Value Added with Prot before Taxation

Particulars Rs. 000s Rs. 000s

Prot Before Taxation

3,81,760

71,000

Add back: Wages, Salaries & Bonus

Staff Welfare Expenses 26,240

Directors Remuneration 7,810

Interest on 9% Mortgage Debentures 14,400

Interest on Long-Term loan from Financial Institution 10,000

Depreciation on Fixed Assets 50,600 4,90,810

Total Value Added 5,61,810

Note: Excise Duty may alternatively be shown as an application of Value Added under To pay Government.

Illustration 7: GVA Statement Calculation of Excise Duty Nov2004

The following is the Prot and Loss Account of Haalaasi Ltd. for the year ended 31st March. Prepare a GVA

Statement of K Ltd., and show also the reconciliation between Gross Value Added and Prot before Taxation.

Prot and Loss Account for the year ended 31st March

Particulars Rs. Lakhs Rs. Lakhs

Income: Sales 890 945

Other Income 55

Expenditure: Production and operational expenses 641

720 Administration expenses (Factory) 33

Interest 29

Depreciation

17

Prot Before Taxes

45

225

Less: Provision for Taxes

30

Prot After Tax

195

10

Add: Balance as per Balance Sheet

Less: Transferred to General Reserve

205

140

Dividend Paid

95

Surplus carried to Balance Sheet 65

1. Production and Operational Expenses consists of

Consumption of Raw materials 293

Consumption of stores 59

Salaries, Wages, Gratuities etc. (Admn.) 82

Cess and Local taxes 98

Other manufacturing expenses 109

2. Interest Charges Consists of

Int. on loan from ICICI Bank for working capital 9

Interest on loan from ICICI Bank for xed loan 10

Interest on loan from IFCI for xed loan 8

Interest on Debentures 2

3. Administration Expenses include Salaries to

Directors Rs. 9 lakhs. Provision for doubtful debts

Rs. 6.30 lakhs.

4. The charges for taxation Include a transfer of Rs. 3

lakhs to the credit of Deferred Tax Account.

5. Cess and Local Taxes include Excise Duty, which is equal to 10% of cost of bought-in material.

Solution:

Value Added Statement of K Ltd. for year ending 31

st

March

Particulars Rs. Lakhs

Sales 890.00

Less: Cost of Bought in Materials & Services (Note 1) 461.00

Administrative Expenses (Note 2) 17.70

Interest (Note 3) 9.00

Excise Duty (Rs.461 x 10%) 46.10

Value Added from Manufacturing and Trading Activities 356.20

Add: Other Income 55.00

TOTAL VALUE ADDED 411.20

Application of Value Added % Rs. Lakhs

To Pay Employees (Note 4) 20% 82.00

To Pay Directors (Note 5) 2% 9.00

To Pay Government (Note 6) 20% 81.90

To Pay Providers of Capital (Note 7) 28% 115.00

To Provide for Maintenance & Expansion of the Company (Note 8) 30% 123.30

TOTAL APPLICATION 100% 411.20

Working Notes:

a. Cost of bought in materials and services includes Raw materials, stores and other manufacturing expenses, i.e., 293

+ 59 + 109 = Rs.461 Lakhs.

b. Administrative Expenses excludes Commission to Directors and Provision for debts i.e., [Rs.33 - (Rs.9 +

Rs.6.3)] which is Rs. 17.70 Lakhs.

c. Interest on Working Capital - ICIC1 Bank is Rs. 9 Lakhs.

d. Employees: Salaries, Wages, Gratuities etc. is Rs. 82 Lakhs.

e. Directors - Salaries and Commission to Directors is Rs. 9 Lakhs.

f. Payment to Government includes Cess and Local Taxes (Rs.98 Lakhs Less Rs.461 Lakhs x 10%), Deferred

Taxes and Provision for taxation i.e., (Rs.51.9 + Rs.3 + Rs.27 = Rs. 81.9 Lakhs.

g. Payment to Providers of Capital includes interest on Fixed Loan (Rs. 10 Lakhs + Rs. 8 Lakhs), Interest on

Debentures and pividend i.e., Rs. 18 + Rs. 2 + Rs. 95 = Rs. 115 Lakhs.

h. Retained earnings and Depreciation includes depreciation, Transfer to General Reserve, Retained Prot

and Provision for doubtful debts i.e., Rs.17 + Rs.45 + Rs.55 + Rs.6.3 = Rs. 123.30 Lakhs.

Illustration 1: EVA Computation

Compute EVAof Sarin Ltd. for 3 years from the information given (in Rs. Lakhs)

Year 1 2 3

Average Capital Employed 3,000.00 3,500.00 4,000.00

Operating Prot before Interest (adjusted for tax Effect) 850.00 1250.00 1600.00

Corporate Income Taxes 80.00 70.00 120.00

Average Debt+Total Capital Employed (In %) 40.00 35.00 13.00

Beta Variant 1.10 1.20 1.30

Risk Free Rate (%) 12.50 12.50 12.50

Equity Risk Premium (%) 10.00 10.00 10.00

Cost of Debt (Post Tax) (%) 19.00 19.00 20.00

Solution: EVA Statement of Sarin Ltd.

Particulars Year l Year 2 Year 3

1. Cost of Equity (K

e

) = Risk Free Rate+ 12.5+(1.1 x 10) 12.5 + (1.2 x 10) 12.5 +(1.3 x 10)

(Beta x Equity Risk Premium) = 23.50% = 24.50% = 25.50%

2. Cost of Debt (K

d

) (given) 19.00% 19.00% 20.00%

3. Debt Equity Ratio (Debt = given; Equity is bal. g) 40% & 60% 35% & 65% 13% & 87%

4. WACC = [(K

d

) x Debt % + (K

e

) x Equity%] 21.70% 22.58% 24.79%

(23.50x60% + (24.50 x 65% + (25.50 x 87% +

19x40%) 19 x 35%) 20 x 13%)

5. Average Capital Employed (given) 3,000.00 3,500.00 4,000.00

6. Capital Charge (Fair Return to Providers of Capital 3,000x21.70% 3,500 x 22.58% 4,000 x 24.79%

i.e. Average Capital Employed x WACC) (4 x 5) = 651.00 = 790.30 = 991.60

7. Operating Prot before Taxes & Interest 850.00 1,250.00 1,600.00

8. Less: Taxes Paid 80.00 70.00 120.00

9. Operating Prot after Taxes (This is the return to the

Providers of Capital i.e. Debt and Equity)

770.00 1,180.00 1,480.00

10. Capital Charge (computed in 6 above)

651.00 790.30 991.60

11. Economic Value Added (9 - 10)

119.00 389.70 488.40

12. EVA as a % of Average Capital Employed 3.96% 11.13% 12.21%

Illustration 2: EVA Computation using WACC, Equity Risk Premium etc.

The Capital Structure of Himesh Ltd. is as under:

a) 80,00,000 Equity Shares of Rs.10 each = Rs.800 Lakhs

b) 1,00,000 12% Preference Shares of Rs.250 each = Rs.250 Lakhs

c) 1,00,00010% Debentures of Rs.500 each = Rs.500 Lakhs

d) Term Loan from Bank (at 10%) = Rs.450 Lakhs.

The Companys Prot and Loss Account for the year showed a balance PAT of Rs.100 lakhs, after appropriating

Equity Dividend at 20%. The Company is in the 40% tax bracket. Treasury Bonds carry 6.5% interest ad beta factor

for the Company may be taken at 1.5. The long run market rate of return may be taken at 16.5%. Calculate EVA.

Solution:

1. Prot and Loss Statement

Particulars Commutation Rs. Lakhs

Prot before Interest and Taxes

Less: Interest on Debentures

Interest on Bank Term Loan

Prot before Tax

Less: Tax at 40%

Prot after Tax

Less: Preference Dividend

Residual Earnings for Equity Shareholders

Less: Equity Dividend

Net Balance in P & L Account

Balancing gure

10% x Rs.500 Lakhs

10% x Rs.450 Lakhs (Rs.290.00 - 60%)

(Rs.290.00 60%) x 40%

Reverse working

12% x Rs.250 Lakhs

Reverse working

20% x Rs.800 Lakhs

Given

578.33

50.00

45.00

483.33

193.33

290.00

30.00

260.00

160.00

100.00

2. Computation of Cost of Equity: K

e

= Risk Free Rate + Beta x (Market Rate - Risk Free Rate)

= 6.5% + 1.5 (16.5% - 6.5%) = 21.5%.

3. Computation of WACC:

Component Amount Ratio Individual Cost WACC

Equity Rs. 800 Lakhs 800 2000 - 40.0% K

e

=21.5% 8.60%

Preference Rs. 250 Lakhs 250 2000= 12.5% K

p

= 12% 1.50%

Debt Rs. 950 Lakhs 950 2000 = 47.5% K

d

= Interest x (100 - Tax Rate)

= 10% x (100% - 40%) = 6%

2.85%

Total Rs.2,000 Lakhs K

o

= 12.95%

4. Computation of EVA:

Particulars Rs. Lakhs

Prot before Interest and Taxes (from WN 1)

Less: Taxes

578.33

193.33

Net Operating Prot After Taxes i.e. Return to Providers of Capital

Less: Capital Charge (Fair Return to providers of Capital) = WACC x Cap Emp

385.00

2,000 x 12.95% = 259.00

Economic Value Added 126.00

Illustration 3: EVA using Financial Leverage, PE Ratio

From the following information, compute EVA of Auto Ltd. (Assume 35% tax rate)

Solution:

a. Equity Share Capital = Rs.1,000 Lakhs b.

12% Debentures = Rs.500 Lakhs Financial Leverage = 1.5 times

You might also like

- Chemistry Part-I Notes on SolidsDocument2 pagesChemistry Part-I Notes on Solidsmknatoo1963No ratings yet

- Maharashtra SSC 2013 Exam Date SheetDocument1 pageMaharashtra SSC 2013 Exam Date Sheetmknatoo1963No ratings yet

- NDMA India's Pocketbook of Do's and Don'ts For Various DisastersDocument118 pagesNDMA India's Pocketbook of Do's and Don'ts For Various DisastersNdma India100% (2)

- Graduate Engineers' Association: Maharashtra State Power Generation Company Ltd. (M.S.E.B.)Document1 pageGraduate Engineers' Association: Maharashtra State Power Generation Company Ltd. (M.S.E.B.)mknatoo1963No ratings yet

- MknspashtagrahaDocument3 pagesMknspashtagrahamknatoo1963No ratings yet

- Paper 5Document9 pagesPaper 5mknatoo1963No ratings yet

- ) Maharashtra Board SSC-X Algebra Sample Paper 2Document2 pages) Maharashtra Board SSC-X Algebra Sample Paper 2mknatoo1963No ratings yet

- R A & A W: Eactions of Lkenes Lkynes OrksheetDocument2 pagesR A & A W: Eactions of Lkenes Lkynes Orksheetmknatoo1963No ratings yet

- 02 Gravitation PDFDocument6 pages02 Gravitation PDFmknatoo1963No ratings yet

- Clarification Academics DPT 2014Document1 pageClarification Academics DPT 2014mknatoo1963No ratings yet

- Maharashtra Board SSC-X Algebra Sample Paper 1Document2 pagesMaharashtra Board SSC-X Algebra Sample Paper 1mknatoo1963No ratings yet

- February 28Document23 pagesFebruary 28mknatoo1963No ratings yet

- Illustrations: I. Computation and Discharge of Purchase Consideration Illustration - 1Document1 pageIllustrations: I. Computation and Discharge of Purchase Consideration Illustration - 1mknatoo1963No ratings yet

- Taxation Syllabus SolutionsDocument10 pagesTaxation Syllabus Solutionsmknatoo1963No ratings yet

- Financial Reserves and Capital MovementsDocument1 pageFinancial Reserves and Capital Movementsmknatoo1963No ratings yet

- "Darkred" "Red": For To For ToDocument7 pages"Darkred" "Red": For To For Tomknatoo1963No ratings yet

- Clock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following OccasionsDocument5 pagesClock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following Occasionsmknatoo1963No ratings yet

- Financial Reserves and Capital MovementsDocument1 pageFinancial Reserves and Capital Movementsmknatoo1963No ratings yet

- MarutiDocument6 pagesMarutimknatoo1963No ratings yet

- SMDocument1 pageSMmknatoo1963No ratings yet

- General Election 2014 Live ResultsisNULL MAHARASHTRADocument4 pagesGeneral Election 2014 Live ResultsisNULL MAHARASHTRAmknatoo1963No ratings yet

- Study MaterialDocument6 pagesStudy Materialmknatoo1963No ratings yet

- 800 Andalto 800Document15 pages800 Andalto 800mknatoo1963No ratings yet

- Cons Sa P11-S2Document58 pagesCons Sa P11-S2mknatoo1963No ratings yet

- This Program Performs Matrix AdditionDocument6 pagesThis Program Performs Matrix Additionmknatoo1963No ratings yet

- Corporate Laws MyNotesDocument10 pagesCorporate Laws MyNotesmknatoo1963No ratings yet

- Car BrochureDocument2 pagesCar Brochuremknatoo1963No ratings yet

- Clock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following OccasionsDocument5 pagesClock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following Occasionsmknatoo1963No ratings yet

- "Darkred" "Red": For To For ToDocument7 pages"Darkred" "Red": For To For Tomknatoo1963No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Exercises 6 Workshops 9001 - WBP1Document1 pageExercises 6 Workshops 9001 - WBP1rameshqcNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- تاااتتاااDocument14 pagesتاااتتاااMegdam Sameeh TarawnehNo ratings yet

- Wi FiDocument22 pagesWi FiDaljeet Singh MottonNo ratings yet

- Pre Job Hazard Analysis (PJHADocument2 pagesPre Job Hazard Analysis (PJHAjumaliNo ratings yet

- Whisper Flo XF 3 PhaseDocument16 pagesWhisper Flo XF 3 Phasehargote_2No ratings yet

- GMWIN SoftwareDocument1 pageGMWIN SoftwareĐào Đình NamNo ratings yet

- BPL Millipacs 2mm Hardmetrics RarDocument3 pagesBPL Millipacs 2mm Hardmetrics RarGunter BragaNo ratings yet

- Contact and Profile of Anam ShahidDocument1 pageContact and Profile of Anam ShahidSchengen Travel & TourismNo ratings yet

- Nokia MMS Java Library v1.1Document14 pagesNokia MMS Java Library v1.1nadrian1153848No ratings yet

- Radio Frequency Transmitter Type 1: System OperationDocument2 pagesRadio Frequency Transmitter Type 1: System OperationAnonymous qjoKrp0oNo ratings yet

- Analytical Approach To Estimate Feeder AccommodatiDocument16 pagesAnalytical Approach To Estimate Feeder AccommodatiCleberton ReizNo ratings yet

- Surgery Lecture - 01 Asepsis, Antisepsis & OperationDocument60 pagesSurgery Lecture - 01 Asepsis, Antisepsis & OperationChris QueiklinNo ratings yet

- всё необходимое для изучения английского языкаDocument9 pagesвсё необходимое для изучения английского языкаNikita Chernyak100% (1)

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDocument6 pagesLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0No ratings yet

- Experiences from OJT ImmersionDocument3 pagesExperiences from OJT ImmersionTrisha Camille OrtegaNo ratings yet

- Sharp Ar5731 BrochureDocument4 pagesSharp Ar5731 Brochureanakraja11No ratings yet

- John Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JDocument12 pagesJohn Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JFrances Ann TevesNo ratings yet

- Unit 1 TQM NotesDocument26 pagesUnit 1 TQM NotesHarishNo ratings yet

- Lecture02 NoteDocument23 pagesLecture02 NoteJibril JundiNo ratings yet

- GIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyDocument17 pagesGIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyJames DeanNo ratings yet

- Zelev 1Document2 pagesZelev 1evansparrowNo ratings yet

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocument5 pages2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberNo ratings yet

- FINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedDocument22 pagesFINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedMary Cielo PadilloNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet

- Why Genentech Is 1Document7 pagesWhy Genentech Is 1panmongolsNo ratings yet

- Ujian Madrasah Kelas VIDocument6 pagesUjian Madrasah Kelas VIrahniez faurizkaNo ratings yet

- Onan Service Manual MDJA MDJB MDJC MDJE MDJF Marine Diesel Genset Engines 974-0750Document92 pagesOnan Service Manual MDJA MDJB MDJC MDJE MDJF Marine Diesel Genset Engines 974-0750GreenMountainGenerators80% (10)