Professional Documents

Culture Documents

Chapter 07, 08, 09 Non Current Assets

Uploaded by

ali_sattar150 ratings0% found this document useful (0 votes)

41 views8 pagesF3 ACCA Test

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentF3 ACCA Test

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views8 pagesChapter 07, 08, 09 Non Current Assets

Uploaded by

ali_sattar15F3 ACCA Test

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 8

Ali Sattars Non-Current Assets +971-55-1582821

01. At 31 December 2004 Q, a limited liability company, owned a building

that cost $800,000 on 1 anuary 1!!"# $t was being depreciated at two per

cent per year#

%n 1 anuary 200" a re&aluation to $1,000,000 was recogni'ed# At this date

the building had a remaining use(ul li(e o( 40 years#

)hat is the depreciation charge (or the year ended 31 December 200" and

the re&aluation reser&e balance as at 1 anuary 200"*

Depreciation charge +e&aluation reser&e

(or year ended 31 December 200" as at 1 anuary 200"

$ $

A 2",000 200,000

B 2",000 3,0,000

C 20,000 200,000

D 20,000 3,0,000

02. -he plant and machinery account .at cost/ o( a business (or the year

ended 31 December 200" was as (ollows0

1lant and machinery 2 cost

200" 200"

$

$

1 an 3alance 240,000 31 4arch disposal

account ,0,000

30 une 5ash 2 purchase o( plant 1,0,000 31 Dec 3alance

340,000

400,000

400,000

-he company6s policy is to charge depreciation at 207 per year on the

straight line basis, with proportionate depreciation in the years o( purchase

and disposal#

)hat should be the depreciation charge (or the year ended 31 December

200"*

A $68,000

B $64,000

C $61,000

D $55,000

03. )hich o( the (ollowing statements are correct*

.1/ 5apitalised de&elopment e8penditure must be amorti'ed o&er a period

not e8ceeding 9&e years#

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

.2/ 5apitalised de&elopment costs are shown in the balance sheet under

the heading o( :on;current Assets

.3/ $( certain criteria are met, research e8penditure must be recogni'ed as

an intangible asset#

A 2 only

B 2 and 3

C 1 only

D 1 and 3

04. <areth, a sales ta8 registered trader purchased a computer (or use in

his business# -he in&oice (or the computer showed the (ollowing costs related

to the purchase0

$

5omputer 8!0

Additional memory !"

Deli&ery 10

$nstallation 20

4aintenance .1 year/ 2"

1,040

=ales ta8 .1>#"7/ 182

-otal 1,222

?ow much should <areth capitalise as a non;current asset in relation to the

purchase*

A $1,222

B $1,040

C $890

D $1,015

05. )hat is the correct double entry to record the depreciation charge (or a

period*

A D+ Depreciation e8pense

5+ Accumulated depreciation

B D+ Accumulated depreciation

5+ Depreciation e8pense

06. A company6s motor &ehicles at cost account at 30 une 200, is as

(ollows0

4otor &ehicles 2 cost

$ $

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

3alance b@( 3",800 Disposal 12,000

Additions 12,!"0 3alance c@( 3,,>"0

48,>"0 48,>"0

)hat opening balance should be included in the (ollowing period6s trial

balance (or motor &ehicles 2 cost at 1 uly 200,*

A $3,,>"0 D+

B $48,>"0 D+

C $3,,>"0 5+

D $48,>"0 5+

07. 3eta purchased some plant and eAuipment on 1 uly 2001 (or $40,000#

-he estimated scrap &alue o( the plant in ten years6 time is estimated to be

$4,000# 3eta6s policy is to charge depreciation on the straight line basis, with

aproportionate charge in the period o( acAuisition#

)hat should the depreciation charge (or the plant be in 3eta6s accounting

period o( twel&e months to 30 =eptember 2001*

A $>20

B $,00

C $!00

D $,>"

08. At 30 =eptember 2000, the (ollowing balances e8isted in the records o(

Bambda0

$

1lant and eAuipment0 5ost 8,0,000

Accumulated depreciation 3!>,000

During the year ended 30 =eptember 2001, plant with a written down &alue

o( $3>,000 was sold (or $4!,000# -he plant had originally cost $80,000# 1lant

purchased during the year cost $180,000# $t is the company6s policy to

charge a (ull year6s depreciation in the year o( acAuisition o( an asset and

none in the year o( sale, using a rate o( 107 on the straight line basis#

)hat net amount should appear in Bambda6s balance sheet at 30 =eptember

2001 (or plant and eAuipment*

A $",3,000

B $4,>,000

C $"10,000

D $,0,,000

09. )hich o( these statements about research and de&elopment e8penditure

are correct*

1/ $( certain conditions are satis9ed, research and de&elopment e8penditure

must be capitalised#

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

2/ %ne o( the conditions to be satis9ed i( de&elopment e8penditure is to be

capitalised is that the technical (easibility o( the proCect is reasonably

assured#

3/ $( capitalised, de&elopment e8penditure must be amorti'ed o&er a period

not e8ceeding 9&e years#

4/ -he amount o( capitalised de&elopment e8penditure (or each proCect

should be re&iewed each year# $( circumstances no longer Custi(y the

capitalisation, the balance should be written oD o&er a period not e8ceeding

9&e years#

"/ De&elopment e8penditure may only be capitalised i( it can be shown that

adeAuate resources will be a&ailable to 9nance the completion o( the proCect#

A 2 and "

B 3, 4 and "

C 2, 3 and "

D 1, 2 and 3

10. A company6s plant and machinery ledger account (or the year ended 30

=eptember 2002 was as (ollows0

1lant and machinery 2 cost

2001 $ 2002 $

1 %ctober 3alance 381,200 1 une Disposal

account 3,,000

1 December 5ash 2 addition 18,000 30 =eptember

3alance 3,3,200

3!!,200

3!!,200

-he company6s policy is to charge depreciation at 207 per year on the

straight line basis, with proportionate depreciation in years o( purchase and

sale#

)hat is the depreciation charge (or the year ended 30 =eptember 2002*

A $>4,440

B $84,040

C $>2,,40

D $>,,840

11. )hich o( the (ollowing statements about research and de&elopment

e8penditure are correct according to $A=38 $ntangible Assets*

.1/ $( certain conditions are met, an enterprise may decide to capitalise

de&elopment e8penditure#

.2/ +esearch e8penditure, other than capital e8penditure on research

(acilities, must be written oD as incurred#

.3/ 5apitalised de&elopment e8penditure must be amortised o&er a period

not e8ceeding " years#

.4/ 5apitalised de&elopment e8penditure must be disclosed in the balance

sheet under intangible non;current assets#

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

A 1, 2 and 4 only

B 1 and 3 only

C 2 and 4 only

D 3 and 4 only#

12. A business purchased a motor car on 1 uly 2003 (or $20,000# $t is to be

depreciated at 20 per cent per year on the straight line basis, assuming a

residual &alue at the end o( 9&e years o( $4,000, with a proportionate

depreciation charge in the year o( purchase#

-he $20,000 cost was correctly entered in the cash booE but posted to the

debit o( the motor &ehicles repairs account#

?ow will the business pro9t (or the year ended 31 December 2003 be

aDected by the error*

A Fnderstated by $18,400

B Fnderstated by $1,,800

C Fnderstated by $18,000

D %&erstated by $18,400

13. )hich o( the (ollowing statements about goodwill are correct*

.1/ <oodwill may only be re&alued to a 9gure in e8cess o( cost i( there is

rele&ant and reliable e&idence to support the re&aluation#

.2/ $nternally generated goodwill may not be capitalised#

.3/ $mpairment o( goodwill should always be shown separately on the (ace o(

a company6s income statement#

.4/ 1urchased goodwill is the diDerence between the cost o( acAuiring a

company and the (air &alue o( its identi9able net assets#

A 1 and 3 only

B 2 and 3 only

C 1 and 4 only

D 2 and 4 only

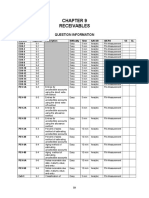

The following info!a"ion ela"e# "o $%e#"ion n%!&e 15 ' 16

Arnold bought a machine (or use in his business on 1 :o&ember 20G4# ?e

ga&e the supplier a cheAue (or $11,">0 and traded in an old machine# -he

supplier allowed him $4,430 in part e8change (or the old machine# Arnold

depreciates machinery on the reducing balance basis at a rate o( 207 per

annum# -he old machine had cost $12,000 and had been depreciated by

$",8",#

14. )hat is the pro9t or loss on trade in o( the old machine*

A A pro9t o( $1,42,

B A pro9t o( $1,>14

C A loss o( $1,42,

D A loss o( $1,>14

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

15. )hat is the depreciation charge on the new machine (or the year to 31

%ctober 20G"*

A $88,

B $1,428

C $2,314

D $3,200

16. An asset cost $100,000# $t is e8pected to last (or ten years and ha&e a

scrap &alue o( $10,000# -he company is going to depreciate this asset at

207 on the reducing balance basis# )hat will be the depreciation charge on

this asset be in its second year*

A $14,400

B $1,,000

C $18,000

D $20,000

17. %n 1 anuary 200" a company purchased some plant#

-he in&oice showed

$

5ost o( plant 48,000

Deli&ery to (actory 400

%ne year warranty co&ering breaEdown during 200" 800

2222222

4!,200

2222222

4odi9cations to the (actory building costing $2,200 were necessary to enable

the plant to be installed# )hat amount should be capitali'ed (or the plant in

the company6s records*

A $"1,400

B $48,000

C $"0,,00

D $48,400

18. -he opening balance on Der& plc6s motor &ehicles at cost account was

$140,000# -he opening balance on depreciation o( motor &ehicles was

$,0,000# -he company purchased new &ehicles costing $30,000 during the

year# :o &ehicles were sold# -he company depreciates &ehicles at 2"7 on

the reducing balance basis, with a (ull year6s depreciation in the year o(

acAuisition and none in the year o( disposal#

)hat is the closing balance on Der& plc6s depreciation o( motor &ehicles

account*

19. )hen 4ichelle purchased a new car, she used her old car in part

e8change# =he has made the correct entry (or the part e8change &alue o(

$3,"00 in the non current asset disposal account#

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

)hat other entry is needed to complete the double entry (or the part

e8change &alue o( $3,"00*

A A debit entry in the motor &ehicles cost account

B A credit entry in the motor &ehicles cost account

C A debit entry in the banE account

D A credit entry in the banE account

20# An organi'ation6s non;current assets register shows a net booE &alue o(

$12",,00#-he non;current assets account in the general ledger shows a net

booE &alue o( $13",,00#

-he diDerence could be due to disposed asset not ha&ing been deducted

(rom the 98ed asset ledger#

A )ith disposal proceeds o( $1"000 and a pro9t on disposal o( $"000

B )ith disposal proceeds o( $1"000 and a net booE &alue o( $"000

C )ith disposal proceeds o( $1"000 and a loss on disposal o( $"000

D )ith disposal proceeds o( $"000 and a net booE &alue o( $"000

21. At 31 December 20G1# -ina owned eAuipment which had cost

$1,8,"00# At that date $,,,"00 had been allowed in respect o( depreciation#

-ina6s accounting policy is to allow depreciation in eAuipment at a rate o(

2"7 in the reducing balance method#

-he depreciation charge to be included in -ina6s income statement (or the

year ended 31 December 20G2 should be $

22. A non current asset was disposed o( (or $2,200 during the last accounting

year# $t had been purchased e8actly three years earlier (or $",000, with an

e8pected residual &alue o( $"00, and had been depreciated on the reducing

balance method, at 207 per annum, -he pro9t or loss on disposal was $

23. Don has sold a machine (or $",300# -he machine had been bought three

years pre&iously at a cost o( $10,000# At the date o( sale the machine had

been depreciated by $4,800# )hat is the pro9t on disposal*

24. )hat is the purpose o( charging the depreciation in accounts*

A -o allocate the cost less residual &alue o( a non current asset o&er

the accounting periods e8pected to bene9t (rom its use

B -o ensure that (unds are a&ailable (or the e&entual replacement o(

the asset

C -o reduce the cost o( the asset in the statement o( 9nancial position

to its estimated marEet &alue

D -o comply with the prudence concept

25. An asset register showed a net booE &alue o( $,>,4,0# A non;current

asset costing $1",000 had been sold (or $4,000, maEing a loss on disposal

w w w . p a c d u b a i . c o m Page 7

Ali Sattars Non-Current Assets +971-55-1582821

o( $1,2"0# :o entries had been made in the asset register (or this

disposal#

)hat is the correct balance on the asset register*

A $42,>10

B $"1,210

C $"3,>10

D $,2,210

w w w . p a c d u b a i . c o m Page 7

You might also like

- Your Statement: Business Transaction AccountDocument7 pagesYour Statement: Business Transaction AccountFine GalleriaNo ratings yet

- Month End Closing ChecklistDocument4 pagesMonth End Closing ChecklistSanjeev AroraNo ratings yet

- Work Together 6-1 6-2 6-3Document1 pageWork Together 6-1 6-2 6-3James SargentNo ratings yet

- Chapter 23 - Impairment of AssetsDocument10 pagesChapter 23 - Impairment of AssetsXiena50% (2)

- Preparing Financial StatementsDocument18 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Unpacking Bleisure - Traveler TrendsDocument39 pagesUnpacking Bleisure - Traveler TrendsTatianaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 14 AdjustmentsssDocument7 pages14 AdjustmentsssZaheer Ahmed SwatiNo ratings yet

- Chapter 5 Sales TaxDocument5 pagesChapter 5 Sales Taxali_sattar15No ratings yet

- ACC 345 Module One Homework Template - StudentDocument37 pagesACC 345 Module One Homework Template - Studenttara50% (10)

- Audit of The Expenditure Cycle: Tests of Controls and Substantive Tests of Transactions - IDocument19 pagesAudit of The Expenditure Cycle: Tests of Controls and Substantive Tests of Transactions - Itankofdoom 4100% (1)

- Senior High School Department: Quarter 3 - Module 2: The Accounting EquationDocument12 pagesSenior High School Department: Quarter 3 - Module 2: The Accounting EquationJaye RuantoNo ratings yet

- 126 Resource MAFA May 1996 May 2001Document267 pages126 Resource MAFA May 1996 May 2001Erwin Labayog MedinaNo ratings yet

- F3 First 11 Chapters TestDocument8 pagesF3 First 11 Chapters TestAliRazaSattarNo ratings yet

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniNo ratings yet

- Tanible Non Current Assets - Short Questions Part IDocument5 pagesTanible Non Current Assets - Short Questions Part Isaba anwarNo ratings yet

- CA CPT June 2014 Accounts and LawDocument11 pagesCA CPT June 2014 Accounts and LawCacptCoachingNo ratings yet

- IAS 36 Impairment of Assets (2021)Document12 pagesIAS 36 Impairment of Assets (2021)Tawanda Tatenda HerbertNo ratings yet

- PAS 36 Impairment of AssetsDocument8 pagesPAS 36 Impairment of AssetswalsondevNo ratings yet

- Depreciation in Final AccountsDocument26 pagesDepreciation in Final Accountsndagarachel015No ratings yet

- Practice Exam 4 - Chapters 8, 9, - Fall 2012Document6 pagesPractice Exam 4 - Chapters 8, 9, - Fall 2012Vincent ChinNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument9 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your Ownkswb12No ratings yet

- Revision Pack 2009-10Document9 pagesRevision Pack 2009-10Tosin YusufNo ratings yet

- CMA Accelerated Program Test 2Document26 pagesCMA Accelerated Program Test 2bbry1No ratings yet

- Financial Statements Analysis & Reporting Assignment IIIDocument3 pagesFinancial Statements Analysis & Reporting Assignment IIImariyaNo ratings yet

- Accounting MCQ UpdatedDocument10 pagesAccounting MCQ UpdatedEttore De CarloNo ratings yet

- Chapter 20Document6 pagesChapter 20Dasun LakshithNo ratings yet

- IAS 36 Impairment Out of Class Practice EN PrintDocument11 pagesIAS 36 Impairment Out of Class Practice EN PrintDAN NGUYEN THENo ratings yet

- Specimen Examen F3 Acca PDFDocument21 pagesSpecimen Examen F3 Acca PDFdanibaybieeNo ratings yet

- Draft Solutions Diploma in IFRS For SMEs Final Exam JD21Document84 pagesDraft Solutions Diploma in IFRS For SMEs Final Exam JD21Vuthy DaraNo ratings yet

- Adjustments To Financial StatementsDocument7 pagesAdjustments To Financial StatementsClemyNo ratings yet

- Tax Depreciation, Amortisation, Pre-Commencement Expenditure ICAP F StudentsDocument10 pagesTax Depreciation, Amortisation, Pre-Commencement Expenditure ICAP F Studentssohail merchantNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Class Exercise: Cash Flow StatementDocument2 pagesClass Exercise: Cash Flow StatementshaunaryaNo ratings yet

- Jaiib Model Questions 1Document8 pagesJaiib Model Questions 1idpraba0% (1)

- Accounting For Long Term Assets Property Plant and Equipment (Ias 16)Document7 pagesAccounting For Long Term Assets Property Plant and Equipment (Ias 16)ZAKAYO NJONYNo ratings yet

- Business Combination - Comprehensive ExamDocument4 pagesBusiness Combination - Comprehensive ExamJulie Ann Canlas100% (1)

- Assessing Martin Manufacturing AnswerDocument4 pagesAssessing Martin Manufacturing AnswerbriogeliqueNo ratings yet

- Practice Midterm Questions JAN 2022 Second With SOLUTIONS v7Document17 pagesPractice Midterm Questions JAN 2022 Second With SOLUTIONS v7Aryan JainNo ratings yet

- Ch9 KCsolutionsDocument3 pagesCh9 KCsolutionsnasim_bigNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument12 pages© The Institute of Chartered Accountants of IndiaMiku JainNo ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- Replacement Examples ImportantDocument7 pagesReplacement Examples Importantsalehin1969No ratings yet

- S 2 Accounting Paper 1 (Final)Document15 pagesS 2 Accounting Paper 1 (Final)Muhammad Salim Ullah KhanNo ratings yet

- Question 1: Tangible Asset Plant Machinery A B C DDocument7 pagesQuestion 1: Tangible Asset Plant Machinery A B C DTrang TranNo ratings yet

- Financial Analysis Test 2Document8 pagesFinancial Analysis Test 2Alaitz GNo ratings yet

- Accounting For Corporations: ACT B861FDocument66 pagesAccounting For Corporations: ACT B861FCalvin MaNo ratings yet

- Principles of Accounts 11Document47 pagesPrinciples of Accounts 11Godfrey LwandoNo ratings yet

- MCQs - 6Document10 pagesMCQs - 6gfxexpert36No ratings yet

- Impairment of AssetsDocument21 pagesImpairment of AssetsSteffanie Granada50% (2)

- Lect 11c Depreciation-Disposals (Part 3)Document17 pagesLect 11c Depreciation-Disposals (Part 3)11Co sarahNo ratings yet

- Cash Flow StatementsDocument8 pagesCash Flow StatementsAloyNireshNo ratings yet

- Ffa/F3 Financial AccountingDocument16 pagesFfa/F3 Financial AccountingArt and Fashion galleryNo ratings yet

- 03 AddDocument13 pages03 AddHà My NguyễnNo ratings yet

- Yonus Brother GroupeDocument15 pagesYonus Brother Groupeasadkabir23No ratings yet

- DocxDocument5 pagesDocxTyson RuvengoNo ratings yet

- PPE Self Grading Gabuelo 2121014Document5 pagesPPE Self Grading Gabuelo 2121014PgumballNo ratings yet

- BADM 1050 Mid-Term MCQ Sample - CLDocument7 pagesBADM 1050 Mid-Term MCQ Sample - CLemilynelson1429No ratings yet

- AMIS 525 Pop Quiz - Chapter 21: A) The Net Present Value of Project C Will Be The HighestDocument3 pagesAMIS 525 Pop Quiz - Chapter 21: A) The Net Present Value of Project C Will Be The HighestDan Andrei Bongo100% (1)

- 02 AddDocument14 pages02 AddHà My NguyễnNo ratings yet

- Solution Financial Reporting May 2013 Solution 1Document10 pagesSolution Financial Reporting May 2013 Solution 1John Bates BlanksonNo ratings yet

- Soalan AccaDocument4 pagesSoalan AccaBhutan ChayNo ratings yet

- Accounting 2 FinalDocument21 pagesAccounting 2 Finalapi-3731801No ratings yet

- Assignment 2Document5 pagesAssignment 2Baburam AdNo ratings yet

- Tutorial Sheet - 1 (UNIT-1)Document5 pagesTutorial Sheet - 1 (UNIT-1)Frederick DugayNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Double Entry BookkeepingDocument1 pageDouble Entry Bookkeepingali_sattar15100% (1)

- Absorption Costing Reconciliation StatementDocument4 pagesAbsorption Costing Reconciliation Statementali_sattar15No ratings yet

- Career Commitment - Sir Ali 2Document10 pagesCareer Commitment - Sir Ali 2ali_sattar15No ratings yet

- 2013 Exam SyllabusDocument12 pages2013 Exam SyllabusIoana PopescuNo ratings yet

- Financial Accounting: ACCA Paper F3Document2 pagesFinancial Accounting: ACCA Paper F3ali_sattar15No ratings yet

- EXAMPLE Basic AccountingDocument1 pageEXAMPLE Basic Accountingali_sattar15100% (1)

- Tesco Financial AnalysisDocument34 pagesTesco Financial AnalysisAli Sattar100% (1)

- Breakeven 350 StudentsDocument2 pagesBreakeven 350 Studentsali_sattar15No ratings yet

- ICAEW Approved EmployerDocument5 pagesICAEW Approved Employerali_sattar15100% (1)

- Scholar Educational Society Aims and ObjectiveDocument1 pageScholar Educational Society Aims and Objectiveali_sattar15No ratings yet

- Pest Analysis of TobaccoDocument5 pagesPest Analysis of Tobaccoali_sattar150% (1)

- ACI DiplomaDocument10 pagesACI Diplomalinkrink6889No ratings yet

- Road Map of Ma-M.sc SubjectsDocument8 pagesRoad Map of Ma-M.sc Subjectsali_sattar15No ratings yet

- HND PresentationDocument18 pagesHND Presentationali_sattar15No ratings yet

- HND PresentationDocument18 pagesHND Presentationali_sattar15No ratings yet

- Economic System in IslamDocument11 pagesEconomic System in Islamali_sattar15No ratings yet

- Student Info Sheet PakistanDocument2 pagesStudent Info Sheet Pakistanali_sattar15No ratings yet

- BCG Matrix KFCDocument3 pagesBCG Matrix KFCrizalstarz90% (31)

- BIMS Partner - Guide - 2011 - EditionDocument12 pagesBIMS Partner - Guide - 2011 - Editionali_sattar15No ratings yet

- Declaration For ACCA QualDocument1 pageDeclaration For ACCA Qualali_sattar15No ratings yet

- Oracle FLEXCUBE Universal Banking 12.0.3: ClearingDocument59 pagesOracle FLEXCUBE Universal Banking 12.0.3: ClearingAmba TiwariNo ratings yet

- Basic Accounting Concept: Topic 2Document58 pagesBasic Accounting Concept: Topic 2WAN FATIN IZZATI BINTI WAN NOOR AMAN MoeNo ratings yet

- Book 1Document127 pagesBook 1MOORTHY.KENo ratings yet

- AC102-002 Midterm ExamDocument4 pagesAC102-002 Midterm ExamArnam ManaNo ratings yet

- Bidvest Grow Account FeesDocument2 pagesBidvest Grow Account FeesBusinessTechNo ratings yet

- CH 005 AIA 5eDocument20 pagesCH 005 AIA 5eNadine MillaminaNo ratings yet

- AccountingDocument14 pagesAccountingMayurdhvajsinh JadejaNo ratings yet

- Amalgamation of Firms ProjectDocument5 pagesAmalgamation of Firms ProjectkalaswamiNo ratings yet

- Retroactive PricingDocument24 pagesRetroactive PricingShalbha MaheshwariNo ratings yet

- 0452 Accounting: MARK SCHEME For The May/June 2014 SeriesDocument8 pages0452 Accounting: MARK SCHEME For The May/June 2014 SeriessimplesaiedNo ratings yet

- Consumer Rights INFOSHEETSDocument39 pagesConsumer Rights INFOSHEETSCharles Vincent Nuñez AlmagroNo ratings yet

- Drill 9.1 Adjusting EntriesDocument7 pagesDrill 9.1 Adjusting EntriesJouhara ObeñitaNo ratings yet

- Chapter 9 SolutionsDocument50 pagesChapter 9 SolutionsValeed ChNo ratings yet

- Account Transactions: Rey Fernan RefozarDocument13 pagesAccount Transactions: Rey Fernan RefozarPaula Bautista75% (4)

- Chapter # 4 Final AccountDocument39 pagesChapter # 4 Final AccountRooh Ullah KhanNo ratings yet

- FAR 2 Old Final Exam - 2011 - Problem SolvingDocument5 pagesFAR 2 Old Final Exam - 2011 - Problem SolvingShiela Mae ReyesNo ratings yet

- Uncle John's Sweet ToothDocument39 pagesUncle John's Sweet ToothAshirt NawayupNo ratings yet

- Topic: Financial Statements 11 Commerce AccountancyDocument14 pagesTopic: Financial Statements 11 Commerce AccountancySneha YadavNo ratings yet

- NG Rtgiso20022Document131 pagesNG Rtgiso20022Jayant KayarkarNo ratings yet

- HandoutDocument4 pagesHandoutZack CullenNo ratings yet

- Ibs Kangar 1 30/06/20Document10 pagesIbs Kangar 1 30/06/20aliuddinNo ratings yet

- IntAcc 1 Reviewer - Module 2 (Theories)Document8 pagesIntAcc 1 Reviewer - Module 2 (Theories)Lizette Janiya SumantingNo ratings yet

- AccountingDocument336 pagesAccountingVenkat GV100% (2)