Professional Documents

Culture Documents

Time Value of Money Review

Uploaded by

Sagar BansalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Value of Money Review

Uploaded by

Sagar BansalCopyright:

Available Formats

Review:

Time Value of Money

MGF 641

Financial Policies and Strategies

Outline

Mapping costs and benefits into cash flows with a

timeline

Three rules of time travel

Valuing a stream of cash flows & Net present value

Special cash flow patterns: Perpetuities and Annuities

Spreadsheet exercises

From Costs and Benefits to Cash Flows (1)

Common sense decision making process

Identify the costs and benefits of an investment

If the benefits outweigh costs, it is a good investment

Decision to get an Master in Finance while working as a

corporate financial analyst

Costs: tuition; efforts to study; sacrifice of leisure &

family time; less time for work

Benefits: better career opportunities; higher salaries;

becoming an enlightened person

From Costs and Benefits to Cash Flows (2)

In financial analysis, we monetize these costs and benefits

and call them cash flows

Costs:

Tuition: cash outflow of $3,000 each year for 3 years

(after taking into account employer reimbursement)

Efforts to study: cash outflow of $4,000 each year for 3

years

Sacrifice of leisure & family time: cash outflow of

$3,000 each year for 3 years

Less time for work: (?)

From Costs and Benefits to Cash Flows (3)

Benefits:

Better career opportunities and higher salaries: cash

inflow of $20,000 each year for 10 years after getting

the degree

Being enlightened: (?)

Time Line

+: cash inflows; -: cash outflows

Time 0: current date (decision making time)

Assuming cash flows taking place at the end of each year

Why the timeline? Because time value of money matters

Year 0 1 2 3 4 5 6 7 8 9 10 11 12

Tuition -3 -3 -3

Efforts -4 -4 -4

Time -3 -3 -3

Career & salaries +20 +20 +20 +20 +20 +20 +20 +20 +20 +20

Three Rules of Time Travel

Rule 1: Only values at the same point in time can be

compared or combined

Rule 2: To move a cash flow forward in time, compound it

Rule 3: To move a cash flows back in time, you must

discount it

r: interest rate (discount rate)

n

n

r C FV ) 1 (

0

+ =

n

n

r

C

PV

) 1 ( +

=

Future Value (FV) of Cash Flow

If the interest rate is r, then the FV of C dollars

one period from today is C(1+r),

two periods from today is C(1+r)

2

, and

n periods from today is C(1+r)

n

Date 0 1 2 n

| | | |

Value C C(1+r) C(1+r)

2

C(1+r)

n

FV

n

= C(1+r)

n

(1+r)

n

is known as the future value interest factor

(FVIF)

Example:

The employee profit sharing program of your company

allows you to deduct a certain amount from the payroll

each month. It earns 0.5% per month. How much is the

$50 I deduct from my first paycheck worth when I quit 6

years later?

Answer: $50x(1+0.005)

72

= $71.60

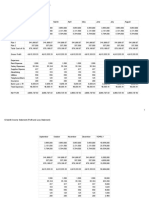

Future Value (FV) of a $100 Cash Flow

2.5% 0.05 0.1 0.2

Year r=2.5% r=5.0% r=10.0% r=20.0%

1 103 $ 105 $ 110 $ 120 $

2 105 $ 110 $ 121 $ 144 $

3 108 $ 116 $ 133 $ 173 $

4 110 $ 122 $ 146 $ 207 $

5 113 $ 128 $ 161 $ 249 $

10 128 $ 163 $ 259 $ 619 $

20 164 $ 265 $ 673 $ 3,834 $

50 344 $ 1,147 $ 11,739 $ 910,044 $

100 1,181 $ 13,150 $ 1,378,061 $ 8,281,797,452 $

Future Value (FV) of a $100 Cash Flow:

Power of Compounding

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

0 5 10 15 20

F

u

t

u

r

e

V

a

l

u

e

Years

r=2.5%

r=5.0%

r=10.0%

r=20.0%

Present Value (PV) of a Cash Flow

If the interest rate is r%, then the PV of C dollars received

at date n

one period before date n is C/(1+r),

two periods before n is C/(1+r)

2

, and

today is C/(1+r)

n

Date 0 1 n-1 n

| | | |

Value C/(1+r)

n

C/(1+r)

n-1

C/(1+r) C

PV = C

n

/(1+r)

n

1/(1+r)

n

is known as the present value interest factor

(PVIF)

Example

A zero-coupon bond is a bond that pays no coupon and

sells at a discount (less than face value)

Suppose IBM issues a zero-coupon bond that promises to

pay $1000 after 28 years

The interest rate is 9.5%

How much is the bond worth today?

PV = 1000/(1+0.095)

28

= $78.78

Present Value (PV) of a $100 Cash Flow

2.5% 0.05 0.1 0.2

Years r=2.5% r=5.0% r=10.0% r=20.0%

1 97.56 $ 95.24 $ 90.91 $ 83.33 $

2 95.18 $ 90.70 $ 82.64 $ 69.44 $

3 92.86 $ 86.38 $ 75.13 $ 57.87 $

4 90.60 $ 82.27 $ 68.30 $ 48.23 $

5 88.39 $ 78.35 $ 62.09 $ 40.19 $

10 78.12 $ 61.39 $ 38.55 $ 16.15 $

20 61.03 $ 37.69 $ 14.86 $ 2.61 $

50 29.09 $ 8.72 $ 0.85 $ 0.01 $

Present Value (PV) of a $100 Cash Flow

Valuing a Stream of Cash Flows

When an investment involves multiple cash flows, the

present value of the cash flows {C

t

} is given by the

following:

= +

=

+

+ +

+

+

+

=

n

t

t

r

t

C

n

r

n

C

r

C

r

C

PV

1 ) 1 (

) 1 (

...

2

) 1 (

2

) 1 (

1

Example: Work Training

Suppose you work 3 nights a week in a bar

Plan to continue for the next 9 months

They offer to train you to tend bar and pay you an extra

$125 a month after you are trained

Suppose further, r=0.5% per month

What is the present value of the training to you?

Example (contd)

The present value of all 9 payments of $125 is:

PV

$125

(1.005)

$125

(1.005)

$125

(1.005)

$125

(1.005)

$125

(1.005)

$125

(1.005)

$125

(1.005)

$125

(1.005)

$125

(1.005)

$1,097.38

2 3

4 5 6

7 8 9

= + + +

+ + +

+ +

=

Net Present Value

The present value of all costs (cash outflows) and

benefits (cash inflows) combined is the Net Present

Value (NPV)

NPV = PV(benefits) PV(costs)

Positive NPV indicates a good investment: its benefits

outweigh the costs in terms of present values

Example

At an interest rate of 10% per year, what is the NPV of

getting your MSF?

NPV = -10 + (-10)/1.1 + (-10)/1.1

2

+ 20/1.1

3

+ 20/1.1

4

+ 20/1.1

5

+ 20/1.1

6

+ 20/1.1

7

+ 20/1.1

8

+ 20/1.1

9

+ 20/1.1

10

+ 20/1.1

11

+ 20/1.1

12

= $74,207.72

Special Cash Flow Patterns

Perpetuity

Annuity

Growing Perpetuity

Growing Annuity

Perpetuity

A perpetuity is a constant payment of $C every period

forever

0 1 2 3 4 t

| | | | | |

C C C C C

The present value of a perpetuity is:

r

C

t

r

C

r

C

r

C

r

C

PV = +

+

+ +

+

+

+

+

+

= ...

) 1 (

...

3

) 1 (

2

) 1 (

) 1 (

Perpetuity Examples

University endowments

Console bonds

Preferred stocks

Common stocks with fixed dividends

Example: Lottery

Suppose the Iowa lottery offers you a choice if you win in

their new game

If you win, you may choose

A single payment of $2,500 or

A perpetuity prize of $100 per year forever!

What is the value of the perpetuity prize if the annual

interest rate is 5%?

The value is: $100/(.05) = $2,000!

Annuity

An annuity is a constant payment C every period until

date t

0 1 2 3 t-1 t t+1

| | | | | | |

C C C C C 0

The present value of an annuity running from now

until date t is:

( ) ( )

|

|

.

|

\

|

(

+

=

(

+

=

t t

r

r

PVIFA

r

r

C

PV

1

1

1

1

1

1

1

Annuity Examples

Lotteries

Bonds

Payroll saving plans

Loans and installment plans

Example

Recall the work training example

Another way to calculate the present value of all 9

payments of $125 is using the annuity formula:

. 38 . 097 , 1 $

) 005 . 0 1 (

1

1

005 . 0

125 $

9

=

(

+

= PV

Example: Lottery

Suppose the Iowa lottery offers you three choices if you

win in their new game:

A single payment of $2,500 or

A perpetuity prize of $100 per year forever or

An annuity with an annual payment of $175 for 30 years!

What is the value of the perpetuity prize if you can borrow

and lend at 5% interest?

The value is: $100/(.05) = $2,000!

What is the value of the annuity prize?

The value is:

. 18 . 690 , 2 $

) 05 . 0 1 (

1

1

05 . 0

175 $

30

=

(

+

= PV

EXCEL Functions

EXCEL has convenient functions for annuity calculations

PMT(rate, nper, pv, [fv], [type]): solve for periodic payment C:

PV(rate, nper, pmt, [fv], [type]): solve for PV of annuity

FV(rate, nper, pmt, [pv], [type]): solve for FV of annuity

RATE(nper, pmt, pv, [fv], [type]): solve for interest rate

NPER(rate, pmt, pv, [fv], [type]): solve for number of periods

Note:

[ ] : optional input

[type]: 0 or omitted for cash flows at the beginning of a

period; 1 for cash flows at the end of a period

Negative numbers for PV and PMT indicate cash outflows

Growing Perpetuity

The payment on a growing perpetuity grows at the

rate g:

0 1 2 3 4 t

| | | | | |

C C(1+g) C(1+g)

2

C(1+g)

3

C(1+g)

t-1

The present value of a growth perpetuity is:

g r

C

t

r

t

g C

r

g C

r

g C

r

C

PV

= +

+

+

+ +

+

+

+

+

+

+

+

= ...

) 1 (

1

) 1 (

...

3

) 1 (

2

) 1 (

2

) 1 (

) 1 (

) 1 (

Example

A benefactor proposes to endow a chair

at the School of Management at the

University at Buffalo

The proposal is to provide $150,000

initially plus a raise of 5% each year

Suppose the interest rate earned by

endowments is 10%. How much should

the benefactor donate?

Answer: A lot!

PV = 150,000/(10%-5%) = $3,000,000

Growing Annuity

The present value of a growing annuity with the initial

cash flow c, growth rate g, and interest rate r is

defined as:

1 1

1

( ) (1 )

| |

| | +

| =

|

|

+

\ .

\ .

N

g

PV C

r g r

Example

Recall the endowment example. If the endowment plans to

last for only 10 years. How much should the benefactor

donate?

PV = 150,000/(10%-5%)*[1- (1.05/1.1)

10

]

= $1,115,972

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Isaca: Questions & Answers (Demo Version - Limited Content)Document7 pagesIsaca: Questions & Answers (Demo Version - Limited Content)Sagar BansalNo ratings yet

- Apple Repurchases $14 Billion of Own Shares in Two Weeks CEO Cook Says Company Wanted To Be 'Aggressive' and 'Opportunistic'Document4 pagesApple Repurchases $14 Billion of Own Shares in Two Weeks CEO Cook Says Company Wanted To Be 'Aggressive' and 'Opportunistic'Sagar BansalNo ratings yet

- D&T Case AnalysisDocument3 pagesD&T Case AnalysisSagar Bansal100% (1)

- Macroeconomics IndicatorsDocument10 pagesMacroeconomics IndicatorsSagar BansalNo ratings yet

- International MarketingDocument13 pagesInternational MarketingSagar BansalNo ratings yet

- General Info About ChileDocument4 pagesGeneral Info About ChileSagar BansalNo ratings yet

- Summer Finance Institute - Ethics PresentationDocument9 pagesSummer Finance Institute - Ethics PresentationSagar BansalNo ratings yet

- Problem Set - Cost of CapitalDocument19 pagesProblem Set - Cost of CapitalSagar Bansal100% (1)

- H611N03Document2 pagesH611N03Sagar BansalNo ratings yet

- Name of The Ratio Formula Remarks Liquidity RatiosDocument3 pagesName of The Ratio Formula Remarks Liquidity RatiosSagar BansalNo ratings yet

- Quiz 2Document357 pagesQuiz 2Sagar BansalNo ratings yet

- International MarketingDocument8 pagesInternational MarketingSagar BansalNo ratings yet

- Exam 1 With Solutions Version 1Document7 pagesExam 1 With Solutions Version 1Sagar BansalNo ratings yet

- General Info About ChileDocument4 pagesGeneral Info About ChileSagar BansalNo ratings yet

- ManzanaDocument2 pagesManzanaSagar BansalNo ratings yet

- Organizational BehaviorDocument3 pagesOrganizational BehaviorSagar BansalNo ratings yet

- Microsoft Nears End To CEO Search - WSJDocument3 pagesMicrosoft Nears End To CEO Search - WSJSagar BansalNo ratings yet

- International Financial Management Problem Set 2 SolutionsDocument15 pagesInternational Financial Management Problem Set 2 SolutionsSagar Bansal67% (3)

- Microeconomics Class XiiDocument21 pagesMicroeconomics Class XiiDharmaraj KanwarNo ratings yet

- Problem Set - Cost of CapitalDocument19 pagesProblem Set - Cost of CapitalSagar Bansal100% (1)

- Problem Set - Cost of CapitalDocument19 pagesProblem Set - Cost of CapitalSagar Bansal100% (1)

- Microeconomics Class XiiDocument21 pagesMicroeconomics Class XiiDharmaraj KanwarNo ratings yet

- After-Class Exercise For Pro Forma Financial StatementsDocument2 pagesAfter-Class Exercise For Pro Forma Financial StatementsSagar BansalNo ratings yet

- Solvency Indicators:: Shareholders' Equity /shareholders' Equity. The Higher The Ratio, The Higher Is The GearingDocument2 pagesSolvency Indicators:: Shareholders' Equity /shareholders' Equity. The Higher The Ratio, The Higher Is The GearingSagar BansalNo ratings yet

- Assignment ProblemsDocument4 pagesAssignment ProblemsSagar BansalNo ratings yet

- Sample Quiz ThreeDocument2 pagesSample Quiz ThreeSagar BansalNo ratings yet

- Managerial AccountingDocument13 pagesManagerial AccountingSagar BansalNo ratings yet

- Practice MidtermDocument7 pagesPractice MidtermSagar BansalNo ratings yet

- MGA 603 Sample Quiz #2 Professor GU Student NameDocument1 pageMGA 603 Sample Quiz #2 Professor GU Student NameSagar BansalNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Statement (FS) AnalysisDocument41 pagesFinancial Statement (FS) AnalysisJasy Nupt GilloNo ratings yet

- Chapter 22 Fiscal Policy and Monetary PolicyDocument68 pagesChapter 22 Fiscal Policy and Monetary PolicyJason ChungNo ratings yet

- Jenga Inc Solution Year 1 Year 2: © Corporate Finance InstituteDocument2 pagesJenga Inc Solution Year 1 Year 2: © Corporate Finance InstitutePirvuNo ratings yet

- Concord Reuse Project For Naval Weapons Station Staff ReportDocument70 pagesConcord Reuse Project For Naval Weapons Station Staff ReportBill Gram-ReeferNo ratings yet

- Ms09 - Capital Budgeting (Reviewer's Copy)Document19 pagesMs09 - Capital Budgeting (Reviewer's Copy)Mikka Aira Sardeña100% (1)

- Sammad Rubber WorksDocument69 pagesSammad Rubber WorksNabeel Safdar29% (7)

- NLG - Annual Report 2016Document48 pagesNLG - Annual Report 2016Kiva DangNo ratings yet

- Cost - Management Accounting - A - B - Vineet SwarupDocument3 pagesCost - Management Accounting - A - B - Vineet SwarupAbhishek RaghavNo ratings yet

- Tep's Tones Tax Notes 1 and 2Document80 pagesTep's Tones Tax Notes 1 and 2Paul Dean MarkNo ratings yet

- VAT and SD Rules 2016 EnglishDocument59 pagesVAT and SD Rules 2016 EnglishSadia Yasmin100% (3)

- Capital Budgeting MethodsDocument19 pagesCapital Budgeting MethodsAnonymous KYjEOO2nGNo ratings yet

- Integrichain Offer Letter ArtifactDocument3 pagesIntegrichain Offer Letter Artifactapi-449844328No ratings yet

- Power Points Sets Milgrom&Roberts Chapter7Document12 pagesPower Points Sets Milgrom&Roberts Chapter7Neel ChakravartyNo ratings yet

- Gujranwala Electric Power Company: Say No To CorruptionDocument1 pageGujranwala Electric Power Company: Say No To CorruptionQaswer AbbasNo ratings yet

- Allianz SE (ALVG - De) Understanding Buy-Back CapabilitiesDocument13 pagesAllianz SE (ALVG - De) Understanding Buy-Back CapabilitiesYang LiNo ratings yet

- Case Incident 1 Motivation Concepts-300713 - 085437Document3 pagesCase Incident 1 Motivation Concepts-300713 - 085437Azie100% (1)

- The Home Depot IncDocument12 pagesThe Home Depot IncKhushbooNo ratings yet

- Case Competition SummaryDocument3 pagesCase Competition SummaryRichard WangNo ratings yet

- F6.TX-irl-j23-d23 Syllabus and Study GuideDocument22 pagesF6.TX-irl-j23-d23 Syllabus and Study GuideJÉSSICA PEREIRA LOPES COSTANo ratings yet

- Comprehensive Income Statement BreakdownDocument42 pagesComprehensive Income Statement BreakdownClove WallNo ratings yet

- IA3 Balance SheetDocument6 pagesIA3 Balance SheetJoebin Corporal LopezNo ratings yet

- Economy 1 PDFDocument163 pagesEconomy 1 PDFAnil Kumar SudarsiNo ratings yet

- Income Statement (Accrual) PT ManunggalDocument1 pageIncome Statement (Accrual) PT ManunggalDelia OktaNo ratings yet

- Audit Documentation GuideDocument12 pagesAudit Documentation Guideagnymahajan100% (1)

- Scenario Analyzer Mountain Man StudentDocument6 pagesScenario Analyzer Mountain Man StudentCarlos Romani PolancoNo ratings yet

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Document2 pages12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- Sibanye Gold - BNP Cadiz Initiating ReportDocument40 pagesSibanye Gold - BNP Cadiz Initiating ReportGuy DviriNo ratings yet

- Buying and SellingDocument19 pagesBuying and SellingNeri SangalangNo ratings yet

- Evangelita Vs Spouses Andolong III Et - Al.Document1 pageEvangelita Vs Spouses Andolong III Et - Al.Lara CacalNo ratings yet

- Case 8 - 2 - 826315Document4 pagesCase 8 - 2 - 826315fitriNo ratings yet