Professional Documents

Culture Documents

FMS Form 13

Uploaded by

api-19731109Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMS Form 13

Uploaded by

api-19731109Copyright:

Available Formats

FMS Form 13 (rev. Jan.

5, 2004)

Fax completed form to: (205) 912-6155

AUTHORIZATION FOR RELEASE OF INFORMATION

1. TO: U.S. Department of the Treasury, Financial Management Service (FMS)

FROM:

Name (include alias and maiden names): Mailing Address (include street address, p.o. box, suite no. , city, state, zip code):

Social Security Number or Employer Identification Number: Telephone No.: Fax No.

2. I authorize the FMS, its employees, agents, and contractors, to disclose to the following person:

REPRESENTATIVE:

Name of Individual: Mailing Address (include street address, p.o. box, suite no. , city, state, zip code):

Company Name [optional]: Telephone No.: Fax No.

any and all information related to a debt owed by me to the United States Government, to a State, or any debt enforced by a

State, including child support obligations, and/or any payments made or due to me by a Federal agency, and/or any tax return

information disclosed to FMS by the Internal Revenue Service in order to collect tax debt through the levy process under 26

U.S.C. § 6331(h), and to conduct tax refund offset under 26 U.S.C. '' 6402(c), (d), or (e). Tax return information is defined

in 26 U.S.C. ' 6103(b). Information includes, but is not limited to, correspondence and other information related to my debt(s)

or payment(s), including my tax refund payment(s).

3. FMS, its employees, agents, and contractors, are not required to inform me of disclosures made under this authorization.

4. This authorization will be valid for 6 months from the date of signing, unless sooner revoked by me in writing and the

revocation is received and processed by FMS at this address: Supervisor, TOP Help Desk, P.O. Box 1686, Birmingham,

Alabama 35201-1686.

5. A photocopy or facsimile copy of this signed authorization has the same force and effect as an original.

The person named in paragraph 1 must sign below. If signed by a corporate officer, partner, guardian, executor, receiver, administrator, trustee, or party other

than the taxpayer, I certify that I have the authority to execute this form. A separate FMS Form 13 must be provided for each debtor.

Signature of Person Authorizing Disclosure Date

Print Name of Person Authorizing Disclosure Print Title of Person Authorizing Disclosure

Privacy Act Statement: Collection of this information is authorized by 5 U.S.C. '' 552a, 26 U.S.C. '' 6331 and 6402, 31 U.S.C. '' 3716, 3720A and 7701(c).

This information will be used to identify your debts submitted to the Treasury Offset Program for collection by Federal and State agencies and your Federal

payments. This information will be disclosed to persons as authorized by you. Additional disclosures of this information may be to Federal and State agencies

collecting your debt or issuing payments to you. The purpose of the additional disclosures will be to verify the accuracy of the information provided to FMS and

to assist such agencies in collecting your debt. Where the taxpayer identification number is your Social Security Number, collection of this information is required

by 31 U.S.C. ' 7701(c). If you fail to furnish the information requested on this form, including your Social Security Number, FMS will not disclose to third

parties information concerning your debts submitted to the Treasury Offset Program for collection by Federal and State agencies or your Federal payments.

You might also like

- BondedPromissoryNoteExample PackageToPayOffPublicDebtDocument7 pagesBondedPromissoryNoteExample PackageToPayOffPublicDebtLucy Maysonet94% (34)

- IRS Return Presentments RiceMDocument1 pageIRS Return Presentments RiceMapi-3744408No ratings yet

- Money Order SampleDocument1 pageMoney Order SampleJason Henry100% (17)

- Beneficial Ownership STMNTDocument5 pagesBeneficial Ownership STMNTSaba Amir Gondal86% (7)

- Letter To Pay BillDocument1 pageLetter To Pay Billapi-1973110998% (40)

- REMEDY For The People Accepting GiftsDocument3 pagesREMEDY For The People Accepting Giftsin1or96% (27)

- 1040V Tender SetoffDocument2 pages1040V Tender Setoffhelenmckane98% (87)

- Updated Letter To Escrow Holder 1Document3 pagesUpdated Letter To Escrow Holder 1api-19731109100% (25)

- Proof of Claim - IRS Form 4490Document6 pagesProof of Claim - IRS Form 4490Wilde Child88% (16)

- Request Banks To Follow UCC PROOF OF CLAIMDocument4 pagesRequest Banks To Follow UCC PROOF OF CLAIMZIONCREDITGROUP100% (18)

- A Paper - Re 1099-A On 1040Document3 pagesA Paper - Re 1099-A On 1040api-374440897% (116)

- Letter To Include With An Acceptance For ValueDocument1 pageLetter To Include With An Acceptance For ValueRinku Kokiri89% (45)

- Bond To Discharge Attachment For DebtDocument1 pageBond To Discharge Attachment For DebtFreeman Lawyer100% (19)

- Financial Management Service Contact Directory 2008Document4 pagesFinancial Management Service Contact Directory 2008api-19731109100% (4)

- 5 - Acceptance For Value Wording For Birth CertificateDocument1 page5 - Acceptance For Value Wording For Birth Certificateapi-374440894% (86)

- Bond Language With Corrections HighlightedDocument2 pagesBond Language With Corrections Highlightedapi-374440895% (129)

- Bankers Notice of Accept PrestmDocument13 pagesBankers Notice of Accept Prestmapi-374440888% (34)

- My Account Is Paid in FullDocument2 pagesMy Account Is Paid in FullJulie Hatcher-Julie Munoz Jackson95% (78)

- The Evolved A4VDocument3 pagesThe Evolved A4Vlyocco1100% (16)

- 2 - Oid MethodDocument2 pages2 - Oid MethodSovereign62996% (48)

- 1 - Instructions - Enforcement Process (1) OidDocument5 pages1 - Instructions - Enforcement Process (1) Oidchickenlickenhennypenny100% (8)

- Employer Levy AffidavitDocument1 pageEmployer Levy Affidavitapi-3744408100% (4)

- 1099 OidDocument40 pages1099 OidTheeMerovingian98% (50)

- Updated Letter To Escrow Holder 1a Option One 129600Document2 pagesUpdated Letter To Escrow Holder 1a Option One 129600api-1973110986% (7)

- Explanation SheetDocument2 pagesExplanation Sheetjgsellers9128100% (10)

- Birth Certificate Bond Order TemplateDocument2 pagesBirth Certificate Bond Order TemplateKonan Snowden96% (49)

- CUSIP IdentifierDocument4 pagesCUSIP IdentifierFreeman Lawyer97% (33)

- General Post OfficeDocument12 pagesGeneral Post Office11223300616598% (46)

- f1099 OID 1096 TemplateDocument3 pagesf1099 OID 1096 Templatethenjhomebuyer100% (24)

- How To Pay Property TaxesDocument1 pageHow To Pay Property Taxesapi-1973110991% (58)

- Notice of Conditional Acceptance upon Debt VerificationDocument2 pagesNotice of Conditional Acceptance upon Debt VerificationKonan Snowden99% (77)

- Waiver of ImmunityDocument2 pagesWaiver of Immunityapi-3744408100% (11)

- Accounting Instructions PRIVATEDocument1 pageAccounting Instructions PRIVATEapi-374440895% (40)

- Prom Note BlankDocument1 pageProm Note Blankapi-3744408100% (3)

- Acknowledgement of Original Issue of CurrencyDocument16 pagesAcknowledgement of Original Issue of CurrencyMichael Kovach83% (6)

- Credit Validation EXDocument6 pagesCredit Validation EXAndyJackson100% (9)

- 7 - Wording For Accepting Future Offers of ContractDocument1 page7 - Wording For Accepting Future Offers of Contractapi-3744408100% (42)

- Form SS4a2Document2 pagesForm SS4a2rtemplar89% (18)

- Private Bond For Set-Off, Non-Negotiable Value of Bond Is: 100 Trillion DolsDocument1 pagePrivate Bond For Set-Off, Non-Negotiable Value of Bond Is: 100 Trillion DolsKonan Snowden100% (24)

- (Please Make This Viral) "THE PRESENT LAW FORBIDS" Member Banks of The Federal Reserve System To Transact Banking Business, Except...Document2 pages(Please Make This Viral) "THE PRESENT LAW FORBIDS" Member Banks of The Federal Reserve System To Transact Banking Business, Except...in1or95% (20)

- 1099 Oid'sDocument8 pages1099 Oid'sNikki Cofield81% (16)

- 1099 Oid Puzzle by Myron 7-4-2019Document2 pages1099 Oid Puzzle by Myron 7-4-2019ricetech100% (19)

- Affidavit of Status - GenericDocument6 pagesAffidavit of Status - Genericapi-3744408100% (12)

- 1099IODDocument10 pages1099IODpreston_402003100% (28)

- Private Bond Secures $2M DebtDocument1 pagePrivate Bond Secures $2M DebtMichael Kovach95% (42)

- Sample Master Eft Instrument For Set Off of DebtDocument1 pageSample Master Eft Instrument For Set Off of Debtzigzag784261193% (57)

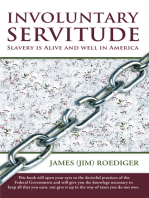

- Involuntary Servitude: Slavery Is Alive and Well in AmericaFrom EverandInvoluntary Servitude: Slavery Is Alive and Well in AmericaNo ratings yet

- Request For Freedom of Information Act FMS 13 DmconsentDocument1 pageRequest For Freedom of Information Act FMS 13 DmconsentFreeman Lawyer100% (1)

- Uthorization For Elease of Nformation: Financial Management ServiceDocument1 pageUthorization For Elease of Nformation: Financial Management ServiceortneraaronNo ratings yet

- HTTPS:/WWW - Fiscal.treasury - gov/files/forms/FS Form13 PDFDocument1 pageHTTPS:/WWW - Fiscal.treasury - gov/files/forms/FS Form13 PDFNelson HarrisNo ratings yet

- Notice Form for Fiduciary RelationshipDocument4 pagesNotice Form for Fiduciary RelationshipMarc LeMeur97% (58)

- Special Form of Request For Payment of United States Savings and Retirement Securities Where Use of A Detached Request Is AuthorizedDocument4 pagesSpecial Form of Request For Payment of United States Savings and Retirement Securities Where Use of A Detached Request Is AuthorizedMalika Shamsid-deenNo ratings yet

- Lots 2Document2 pagesLots 2Kepphie AlinoNo ratings yet

- FS Form 1071 (Statement of Ownership)Document2 pagesFS Form 1071 (Statement of Ownership)Benne James100% (3)

- U.S. Treasury Account Authorization FormDocument1 pageU.S. Treasury Account Authorization Formdarius318100% (3)

- Ssa 7050Document4 pagesSsa 7050tobehode100% (1)

- IRS Form 56 NoticeDocument7 pagesIRS Form 56 NoticeGreg Ward100% (2)

- Identifying Information For Possible Direct Payment of Authorized FeesDocument2 pagesIdentifying Information For Possible Direct Payment of Authorized FeesasdfasdfNo ratings yet

- FS Form 5063 Department of The Treasury Bureau of The Fiscal Service (Revised March 2015)Document1 pageFS Form 5063 Department of The Treasury Bureau of The Fiscal Service (Revised March 2015)MichaelNo ratings yet

- How To Pay Property TaxesDocument1 pageHow To Pay Property Taxesapi-1973110991% (58)

- How To Make A Bill Into A Money OrderDocument1 pageHow To Make A Bill Into A Money Orderapi-1973110982% (95)

- Accepted For ValueDocument1 pageAccepted For Valueapi-19731109100% (5)

- Updated Letter To Escrow Holder 1aDocument3 pagesUpdated Letter To Escrow Holder 1aapi-19731109100% (7)

- USE OF THE 1099-A Plus RadioDocument1 pageUSE OF THE 1099-A Plus Radioapi-19731109100% (1)

- Money Orders - BlankDocument1 pageMoney Orders - Blankapi-1973110984% (32)

- Updated Letter To Escrow Holder 1Document3 pagesUpdated Letter To Escrow Holder 1api-19731109100% (25)

- Financial Management Service Contact Directory 2008Document4 pagesFinancial Management Service Contact Directory 2008api-19731109100% (4)

- Letter To Pay Bill NewDocument1 pageLetter To Pay Bill Newapi-1973110994% (86)

- 1-8-09 - Patrick - Call - Revisited - Final - Version 1Document22 pages1-8-09 - Patrick - Call - Revisited - Final - Version 1api-1973110989% (18)

- Updated Letter To Escrow Holder 1a Option One 129600Document2 pagesUpdated Letter To Escrow Holder 1a Option One 129600api-1973110986% (7)

- How I Fought A Property Tax ForeclosureDocument48 pagesHow I Fought A Property Tax Foreclosureapi-19731109100% (7)

- PERSONDocument3 pagesPERSONapi-19731109100% (2)

- The Straw Man RevealedDocument64 pagesThe Straw Man Revealedapi-1973110986% (58)

- Agents of A Foreign Government: A Bizarre SagaDocument8 pagesAgents of A Foreign Government: A Bizarre Sagaapi-19731109100% (5)

- Solution in CommerceDocument2 pagesSolution in Commerceapi-1973110993% (14)

- Notes For 1099ADocument1 pageNotes For 1099Aapi-1973110914% (7)

- IRS Tax Fraud Reporting F3949aDocument2 pagesIRS Tax Fraud Reporting F3949aTim Bryant100% (2)

- Rideout VideosDocument1 pageRideout Videosapi-19731109No ratings yet

- Negotiable Debt InstrumentsDocument5 pagesNegotiable Debt Instrumentsbrucefarmer88% (8)

- Ucc 3-402 Signiture by RepresentativeDocument1 pageUcc 3-402 Signiture by Representativeapi-19731109100% (6)

- Gruba Transfer Tax Notes PDFDocument30 pagesGruba Transfer Tax Notes PDFDomingo Jonathan CabalongaNo ratings yet

- United States v. Sheik Trice, 4th Cir. (2015)Document7 pagesUnited States v. Sheik Trice, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Hist PP1 Top Prediction Master CyclesDocument31 pagesHist PP1 Top Prediction Master CyclesndedeelvisNo ratings yet

- LiberalismeDocument24 pagesLiberalismeCanNo ratings yet

- Bautista V Auto Plus TradersDocument8 pagesBautista V Auto Plus TradersMarrianne ReginaldoNo ratings yet

- The Quadrilateral Security DialogueDocument16 pagesThe Quadrilateral Security Dialogueram manogarNo ratings yet

- IRS 501 (3) (C) Nonprofit Corporation Disclosure of RecordsDocument21 pagesIRS 501 (3) (C) Nonprofit Corporation Disclosure of Recordsdavidchey4617No ratings yet

- CONREV Case Digest Compilation (Batch 1 & 2)Document18 pagesCONREV Case Digest Compilation (Batch 1 & 2)Francis Ray Arbon FilipinasNo ratings yet

- Administering An EstateDocument14 pagesAdministering An EstateAJ AJ100% (1)

- Exploding Data: Reclaiming Our Cyber Security in The Digital AgeDocument9 pagesExploding Data: Reclaiming Our Cyber Security in The Digital Agewamu885No ratings yet

- KNUT Constitution Rules and RegulationsDocument18 pagesKNUT Constitution Rules and RegulationspeeteoNo ratings yet

- Thayer Background Brief U.S. FONOPS, Vietnam and The South China SeaDocument2 pagesThayer Background Brief U.S. FONOPS, Vietnam and The South China SeaCarlyle Alan ThayerNo ratings yet

- House GOP Letter To Jake SullivanDocument2 pagesHouse GOP Letter To Jake SullivanFox NewsNo ratings yet

- Warren H. Wheeler, an Infant, and J. H. Wheeler, His Father and Next Friend, and C. C. Spaulding, Iii, an Infant, and C. C. Spaulding, Jr., His Father and Next Friend v. Durham City Board of Education, a Body Politic in Durham County, North Carolina, 309 F.2d 630, 4th Cir. (1962)Document5 pagesWarren H. Wheeler, an Infant, and J. H. Wheeler, His Father and Next Friend, and C. C. Spaulding, Iii, an Infant, and C. C. Spaulding, Jr., His Father and Next Friend v. Durham City Board of Education, a Body Politic in Durham County, North Carolina, 309 F.2d 630, 4th Cir. (1962)Scribd Government DocsNo ratings yet

- Attorney General's Report: Sexual Assaults Committed by Priests Against Minors (Manchester, NH - 2003)Document160 pagesAttorney General's Report: Sexual Assaults Committed by Priests Against Minors (Manchester, NH - 2003)Vatican Crimes ExposedNo ratings yet

- Huerta Alba Resort, Inc. vs. Court of AppealsDocument26 pagesHuerta Alba Resort, Inc. vs. Court of AppealsMaria Nicole VaneeteeNo ratings yet

- 01 - 010 Malcaba vs. ProHealth Pharma Philippines, Inc., 864 SCRA 518, June 06, 2018Document41 pages01 - 010 Malcaba vs. ProHealth Pharma Philippines, Inc., 864 SCRA 518, June 06, 2018JENNY BUTACANNo ratings yet

- Colegio de San Juan de Letran vs. Association of Employees and Faculty of Letran (2000)Document2 pagesColegio de San Juan de Letran vs. Association of Employees and Faculty of Letran (2000)Vianca MiguelNo ratings yet

- Application For Registration of TitleDocument2 pagesApplication For Registration of TitleZyreen Kate CataquisNo ratings yet

- 1B Insurance Vs Spouses GregorioDocument3 pages1B Insurance Vs Spouses GregorioJessa LoNo ratings yet

- Civil Mock Trial: I S C B CDocument23 pagesCivil Mock Trial: I S C B CEugene Evan Endaya Uy100% (1)

- Nepal Irrigation Project RFP for Consulting ServicesDocument107 pagesNepal Irrigation Project RFP for Consulting ServicesDEBASIS BARMANNo ratings yet

- Hungary Becomes First European Country To Ban Rothschild BanksDocument25 pagesHungary Becomes First European Country To Ban Rothschild BanksMahathuriya YksNo ratings yet

- Historical Dictionary of Anglo-American RelationsDocument345 pagesHistorical Dictionary of Anglo-American Relationsjerry liangNo ratings yet

- People Vs Narciso Cabungcal, G.R. No. L-28451 PDFDocument2 pagesPeople Vs Narciso Cabungcal, G.R. No. L-28451 PDFjharen lladaNo ratings yet

- 12.2 ISM Internal AuditingDocument3 pages12.2 ISM Internal Auditingsimon_midjajaNo ratings yet

- Atty. Crisostomo A. Uribe: Persons and Family RelationsDocument66 pagesAtty. Crisostomo A. Uribe: Persons and Family RelationsCars CarandangNo ratings yet

- Answers to Interrogatories Form 6.14Document3 pagesAnswers to Interrogatories Form 6.144EqltyMom100% (2)

- Abhishek Raj Tata-HwhDocument2 pagesAbhishek Raj Tata-Hwhabhishek rajNo ratings yet

- Corinthians V Spouses TanjangcoDocument3 pagesCorinthians V Spouses TanjangcoDiane VirtucioNo ratings yet