Professional Documents

Culture Documents

MCB Internship Report

Uploaded by

Jaikrishan RajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCB Internship Report

Uploaded by

Jaikrishan RajCopyright:

Available Formats

INTERNSHIP REPORT

ON

MUSLIM COMMERCIAL BANK

Instructed by:

Mr. Naveed Ahmed

Lecturer

Comsats Institute of Information Technology

Presented by:

Muhammad Hussain

MBA-A

Roll No.!

"emester #

Muslim Commercial Bank

DEDICATION

I dedicate $hole of my education along $ith my life to my %eloved &arents and

res&ected teachers' $ho $ere al$ays (ind to me.

May )od Bless Them *Aamin+.

Muhammad Hussain

2

Muslim Commercial Bank

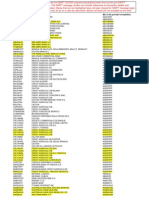

TABLE OF CONTENTS

1. Preface

2. Introduction Of Bank

3. Types of Bank

,. Executive Summary of MB

!. !istory of MB

. "ision # Mission Statement of MB

-. ommercia$ Bank

%. Branc&es # 'TMs 1(

(. Product # Services21

1). *epartment in MB2+

11. Mana,ement !ierarc&y2%

12. Investment Bankin,

13. -no. /our ustomer

10. 1emittance *epartment

.!. /inancial "tatements

.. "01T analysis

.-. 0or( 2erformed By Me

.3. /indings

.4. Recommandations

3

Muslim Commercial Bank

PREFACE

Ban(ing sector o$es a &ivotal im&ortance in the economy of any country through

its variant functions. This %asic motivator that stressed me to 5oin any %an( for

Internshi& Training. Moreover' the e6&erience and &ractice learned during this

tenure also &rove very hel&ful and facilitating in the forthcoming &rofessional life.

This re&ort is the result of t$o months Internshi& $ill' Muslim Commercial %an('

7ot /areed' "ahi$al. The motive %ehind selecting this %an( is that it is one of the

To& .8 Asia' Ban(9s. The fact remains that Muslim Commercial %an(' &osses an

e6cel:cut and historical im&ortance %eing the most senior and leading in terms

fluids and services to 2a(istan at all ages of life.

I had $ith the strong %elief that this re&ort $ill guide and facilitate the readers to

understand the functioning of %an(ing system and more im&ortantly have good

(no$ledge a%out Muslim Commercial %an(. My utmost efforts to ela%orate this

re&ort $it' material read' listened and o%served. ;et' I feel that this &eriod $as

not long enough to learn and understand the com&le6 and $ides&read

functioning of %an(ing sector.

I am really than(ful to the entire staff mem%ers of the aforesaid %ranch for the

friendly and coo&erative %ehavior during my internshi&.

Muh!!d Huss"n

MBA#A

R$%% N$&'(

4

Muslim Commercial Bank

ell-develo&ed %an(ing setu& &lays very significant role in the economic

develo&ment of a country. Ban(ing sector is &recondition for the

develo&ment of any country. The %an(ing sector hel&s in &ro&er

utili<ation of resources of the country %y financing the less develo&ed sector. It

also hel&s to (ee& cumulative demand in &ro&er %alance $ith the su&&ly of those

resources' $hich are res&onsive to monetary demand.

$

DEFINITION OF BANK .

A bank is an institution, which deals in money.

I BROADL) SPEAKIN*

=Ban(s dra$ sur&lus money from the &eo&le $ho are not using it at that time' and

lend to those $ho are in a &osition to use it for &roductive &ur&oses.>

+ IN OTHER ,ORDS

=Ban( also acce&ts the de&osits from &u%lic re&aya%le on demand or other$ise

and $ithdra$al %y che?ues. @rafts order and include any &ost office saving

%an(.>

BANK .

5

Muslim Commercial Bank

The $ord %an( is said to have %een derived from the Italian $ords =Bancus> or

=Ban?ue>. The History of %an(ing is transacted to %e as early as A88 B.C.

PEGE! "EF#$##%$&

no one any%ody. Cor&orate or other$ise can %e a %an(er $ho does notB

I 1&en current account

A 2ay che?ues dra$n on him

# Collect che?ues for his customers.

HARTS DEFINITION&

=A han(er is one $ho is in the ordinary course of his %usiness' honors che?ues

dra$n u&on his %y &ersons from and for $hom he receives money on current

account.>

ACCORDIN* TO THE BANKIN* COMPANIES ORDINANC- ./'+:

SECTION (0B1:

=Ban(er means a &erson transacting the %usiness of acce&ting' for the &ur&ose

of lending or investment' of de&osits from the &u%lic' and $ithdra$al %y che?ues'

drafts' order of other$ise' and inclined any &ost office saving %an(s.>

#MP%RA$CE %F 'A$(#$G.

Ban(s &lay very im&ortant role in the economic life of a nation. The gro$th of the

economy is de&endent u&on the soundness of its %an(ing system. Although

%an(s so not create ne$ $ealth %ut %orro$' e6change and consume. These

ma(e generation of $ealth. In this $ay. They %ecome most effective &artners in

the develo&ment of that country. To encourage the ha%it of saving and to mo%ili<e

these savings is its %asic &ur&ose. Ban(s de&osit sur&lus from the &u%lic and

then advances the sur&luses in the form of loans to the industrialists'

agriculturists' %usinessmen and unem&loyed &eo&le under different schemes so

that they setu& their o$n %usiness. Thus %an(s hel& in ca&ital formation

if there are no %an(s' and then there $ould %e concentration of $ealth in fe$

hands great &ortion of $ealth of a country $ould %e idle. In the fe$er develo&ing

countries rate of saving is very lo$ and due to this rate of investment and rate of

gro$th is very lo$. 0e can ta(e han( 5ust li(e a heart in the economic structure

6

Muslim Commercial Bank

and ca&ital &rovided %y it is li(e %lood in it. As long as the %lood is in circulation'

the organs $ill remain sound and healthy. If the %lood is not &rovided to any

organ then the organ $ould %ecome useless. "o if the finance is not &rovided to

agriculture sector or to industrial sector' it $ills he destroyed.

Loan facility &rovided %y %an( $or(s as an incentive to the &roducer to increase

&roduction. Ban(s &rovide transfer of &ayment facility' $hich is chea&er' ?uic(er

and safe. Many difficulties in the international &ayment have %een overcome and

volume of transactions has %een increased. These facilities are very much

hel&ful for the develo&ment of trade and commerce.

E)%*+#%$ %F 'A$(#$G #$ #$"% PA( !+',C%$#$E$&

The Indian society $as ?uite familiar $ith the %an(ing' right for the %eginning.

There is also sufficient evidence to sho$ that during !.h century &eo&le $ere

accustomed to use .-lounds as a credit investment. Loans $ere given to the

&eo&le against &ersonal and other "ecurities such as ornaments' goods and

other immova%le &ro&erties.

-PE! %F 'A$(&

/ollo$ing is the list of various ty&es of %an(sB

Central Ban(

Commercial Ban(

C6change Ban(

Industrial Ban(

Agriculture Ban(

#. C%MMERC#A* 'A$(&

The %an(s in any country s&eeded over $ith an o%5ective to get the e6cessive

money /orm the &u%lic in the form of de&osits and &roviding finance to the

investors. These Ban(s are in the ground for &rofit earning motive and in

com&etition $ith each other. These %an(s are &roviding the %asic services to the

customers in the form of de&osits' Advances' remittances and others.

Comme.cial 'ankin/ !cena.io #n Pakistan&

At the time of Inde&endence in .4,-.ther $ere #3 scheduled %an(s $ith .4!

7

Muslim Commercial Bank

offices in 2a(istan. But %y @ecem%er #l>' .4-# there $ere ., scheduled

2a(istani Commercial Ban(s $ith #A## Branches in 2a(istan and -, Branches in

the /oreign Countries Nationali<ation of %an(s $as done on .st Danuary .4-,

under the Nationali<ation Ac . 4,- due to certain o%5ectives. But it had negative

effects on the efficiency of the %an(ing sector. After$ards' a 2rivati<ation

Commission $as set u&on Danuary AAnd' .44.. The Commission transferred

many %an(s to the &rivate sector' i.e.' Muslim commercial Ban( and Allied Ban(

Limited. The )ovt. a&&roved and &ermitted the esta%lishment of . 8 ne$ &rivate

%an(s in August .44.

Functions o0 comme.cial 'anks&

I %orro$ing of money from customers in sha&e of term de&osits *2L" "aving

Current @e&osits and Notice @e&osits+.

A Lending of money to %orro$ers in sha&e of finances' short-term finances' and

long-term finances under various names such as @emand /inance' "mall

/inance' Cash /inance.

# Agency services.

, Remittance of money.

! /oreign e6change %usiness' foreign currency de&osits. LC"' Im&orts and

e6&orts etc.

R%*E %F C%MMERC#A* 'A$(! #$ HE EC%$%M#C "E)E*%PME$ %F A

C%+$R-&

Ban(s &lay an im&ortant role in the economic develo&ment of a country. If the

%an(ing system is unorgani<ed and inefficient' it creates mar(et ad5ustments and

im&ediments in the &rocess of develo&ment. In 2a(istan' the %an(ing system is

organi<ed in $ell manner. The "tate Ban( of 2a(istan since Duly .st. .43,

stands at the a&e6 and is res&onsi%le of the o&eration of the %an(ing system.

The other %ands' $hich form the %an(ing structure in 2a(istan' are &laying role in

hEthe economic develo&ment of the country.

The role of the commercial %an( in the gro$th and develo&ment of the economy

on sound and steady footings is discussed %riefly as follo$sB

Mobili1ation o0 Resou.ces&

The commercial %an(s are the most efficient organi<ation of the economy in the

mo%ili<ation the resources and ma(ing a &rofita%le &ool of these resources.

Ta(ing the Money from the savers and lending it to the investors is the most

&rominent 5o% of the han(

8

Muslim Commercial Bank

Financin/ "e2elo3ment P.o4ects&

The %an(s and other financial institutions advance loans for the develo&ment

&ro5ects that enhance the &ace of overall develo&ment of the country. These

advances are made in %oth &u%lic and &rivate sectors for the &ur&ose of

achieving a good and strong economic field to catty on the other activities of

trade and %usiness.

C.eatin/ Climate Fo. Ca3ital Fo.mation&

Ca&ital formation is done %y the act of acce&ting &eo&leFs money and &utting into

2rofita%le ventures. This money so accumulated' ma(e &ossi%le the availa%ility of

the needed ca&ital %y the investors. The investors on the other hand are a%le to

get the needed funds that shortfall their re?uirements.

Planned "e2elo3ment&

0ith the hel& of $ell-organi<ed %an(ing sector the government is a%le to ma(e

good Im&lementation of its economic &lanning and can e6ecute develo&mental

activities for the $elfare of the society.

P.omotion o0 !a2in/ Habit&

There are &ersons $ho have money %ut cannot &ut them in &rofita%le use. The

%an(s attract these &ersons %y offering a variety of accounts. They &rovide them

not only the safety of the funds %ut also higher returns on them. The %an(s' in

this $ay' &romote the ha%it of saving among the &eo&le.

E00ecti2e #m3lementation o0 Moneta.y Policy&

0ith the hel& of a good %an(ing system in the country the government and the

central Ban(s regulate the monetary su&&ly and demand of the money. A good

system hel&s in the im&lementation of the &olicies that are formulated %y the

9

Muslim Commercial Bank

government. l through these %an(s using different techni?ues of credit control

ma(es credit e6&ansion and contraction.

$a..owin/ Re/ional "is3a.ity&

The %an(s hel& in %ridging the country. The sur&lus fund of on Region is sent to

the centers of deficit. The less develo&ed areas ac?uire funds' &ut them into

&roductive channel and increase &roduction. The %an(s hel& in a %alanced

gro$th the economy.

E5ecuti2e !umma.y

C%RP%RAE PR%F#*E

Mian Mohammad Mansha Chairman

".M.Muneer Gice Chairman

Tari? Rafi

"hah<ad "aleem

"armad Amin

Afta% Ahmad 7han

Atif ;aseen

@r. Muhammad ;a?u%

Mian Ra<a Mansha

Atif Ba5$a 2resident : CC1

'oa.d Committees &

Audit Committee

10

Muslim Commercial Bank

@r. Muhammad ;a?u% Chairman

Tari? Rafi Mem%er

Mian Ra<a Mansha Mem%er

Atif ;aseen Mem%er

HR Committee

Mian Muhammad Mansha Chairman

@r. Muhammad ;a?u% Mem%er

Mian Ra<a Mansha Mem%er

Atif Ba5$a Mem%er

Risk Mana/ement Committee

Mr. Tari? Rafi Chairman

".M. Muneer Mem%er

Mian Ra<a Mansha Mem%er

Afta% Ahmed 7han Mem%er

Committee on Physical Plannin/, # !ystem and Contin/ency

A..an/ements

"armad Amin Chairman

Atif ;aseen Mem%er

Afta% Ahmad 7han Mem%er

Atif Ba5$a Mem%er

'usiness !t.ate/y 6 "e2elo3ment Committee

Mian Mohammad Mansha Chairman

11

Muslim Commercial Bank

".M. Muneer Mem%er

Tari? Rafi Mem%er

Mian Ra<a Mansha Mem%er

Atif Ba5$a Mem%er

C.edit Committee

"hah<ad "aleem Chairman

"armad Amin Mem%er

Tari? Rafi Mem%er

Mian Ra<a Mansha Mem%er

Chie0 Financial %00ice.

Tahir Hassan Hureshi

Com3any !ec.eta.y

A%dus "."ami

Audito.s

72M) Taseer Hadi I Co Chartered Accountants

Ria< Ahmed I Co. Chartered Accountants

*e/al Ad2iso.s

Mandvi$alla I Jafar Advocates I Legal Consultants

12

Muslim Commercial Bank

Histo.y o0 Muslim Comme.cial 'ank

The Muslim Commercial Ban( Limited $as incor&orated on 4

th

Duly .4,- in

Calcutta in Bengal. After &artition' the Registered 1ffice of the %an( $as shifted

to @ha(a $here it commenced %usiness from August .4,3. The Ban( transferred

its registered:Head office from @ha(a to 7arachi in .4!. In .444' its registered :

Head office $as transferred to Islama%ad and 7arachi office $as named as

&rinci&al office. The government transferred a AK management sta(e to a grou&

of leading industrialists' collectively named National )rou& of $hich Mian

Mohammad Mansha is the Ma5or sta(eholder. In .44A a further A,K $as sold to

the National )rou&. The current shareholding structure is !8K National )rou&'

A!K government and A!K floated on %ourses.

NATIONALI2ATION OF MCB NATIONALI2ATION OF MCB

13

Muslim Commercial Bank

Muslim Commercial Ban( Limited $as nationali<ed %y the )overnment of

2a(istan in Danuary .4-, under the Ban(s Nationali<ation Act' .4-,. "u%se?uent

to nationali<ation the o&erations of &remium Ban( Limited $ere merged $ith the

Muslim Commercial Ban( Limited in Dune .4-,.

PRI3ATI2ATION OF MCB PRI3ATI2ATION OF MCB

The &revious )overnment declared the &rivati<ation &olicy as one of its main

o%5ectives and in accordance $ith its &olicy' the )overnment offered Muslim

Commercial Ban( Limited for &rivati<ation. The Ban( $as the first 2u%lic sector

%an(' $hich $as &rivati<ed on A

nd

A&ril .44.. The )overnment of 2a(istan

transferred management of the %an( to 2rivate Industrialists and Cntre&reneurs'

LNational )rou&L %y selling AK shares of the Ban( at Rs.! &er share.

P.esent !tatus

1ver the years Muslim Commercial %an( fostered strong %onds $ith its

customers. MCB understands themM their needs. They feel comforta%le $ith

MCBM its their %an(M it res&onds to themM listens to themM &artners $ith themM

gro$s $ith them. That is $hy it is one of the leading commercial %an(s of the

country' &roviding a $ide range of modem %an(ing services. At &resent' the

%an(ing net$or( consists of over .888 %ranches along $ith N controlling offices

(no$n as Area Head offices and Regional Head offices. These controlling offices

are res&onsi%le for the smooth o&eration of the %an( on National I international

levels. The entire financial and o&erational o%5ectives are achieved $ith the

Human Resources strength over .A888 em&loyees. The %an( is (no$n as the

ma5or credit &rovider' %est &lace of $or(ing and &aymaster in the financial

*money mar(et+ of the country. 1ver the &ast fe$ years' MCBOs &rofits have %een

hit %y the need to increase &rovisions coverage and restructuring costs

associated $ith the do$nsi<ing of the $or(force and %ranch net$or(' $hilst there

is some need to %oost &rovisions' these charges *necessary to %ring the %an(

14

Muslim Commercial Bank

%ac( into sha&e+ are largely over. It has also slo$ly received &ermission from the

"B2 to shut do$n a num%er of un&rofita%le %ranches.

In .444 CPR1 M1NC; recogni<ed MCB as the %est domestic %an( in 2a(istan.

The %an(ing sector has %een $orst hit %y the e6ternal account crisis that

Cngulfed the country follo$ing the nuclear tests. @ue to the nature of %an(s as a

Medium for de%t transactions the countryOs technical default and su%se?uent

rating do$ngrade im&acted them the most. Those core concerns are still not fully

alleviated in the vie$ of the investors. The closest that investors have come to

&ositive e6&ectations regarding e6ternal account sustaina%ility and a &ossi%le re-

rating $as %ac( in the fourth ?uarter of the year .444' and this led to MCB

clim%ing to 2a(istani ru&ees ! &er share. Resum&tion of the IM/ funding and a

&ossi%le rescheduling of %ilateral de%t $ill &ositively im&act the %an(ing sector

and es&ecially MCB.

"tate Ban( of 2a(istan continued the &rocess of Ban(ing Reforms' $hich

included strengthen of 2rudential Regulations and focus on recovery of defaulted

loans. In .444 return on )overnment "avings "cheme and Treasury Bills $as

reduced' $hich led to a lo$ering of lending rates' resulting in erosion of margins

for %an(s %ut it is li(ely to give a %oost to economic activity.

MCB Ru&ee travelers Che?ues continued to maintain their leadershi& &osition in

the industry and sales registered a ,!K gro$th over last year. MCB successfully

introduced the Rs..88' 888 denomination che?ue country$ide and introduced

RTC dialu& tele-verification facility from Lahore city as $ell.

Mainly there are three ty&es of Ban(ing in MCB. These areB

15

Muslim Commercial Bank

CORPORATE AND IN3ESTMENT BANKIN* CORPORATE AND IN3ESTMENT BANKIN*

Cor&orate Ban(ing )rou& of MCB is focusing on to& tier local cor&orate grou&s

and multinationals in a structured and focused manner %uilding relationshi&s

leading to increased mar(et share.

Branches having Advances of Rs..88' 888'888 &er &arty relationshi& and

monitoring such advances are called as Cor&orate Branches. These %ranches

include cor&orate clients and their re?uirements are loo(ed after. There are a%out

A8 cor&orate %ranches of MCB in 2a(istan.

%+R )#!#%$ 6 M#!!#%$ %+R )#!#%$ 6 M#!!#%$

)ision !tatement )ision !tatement

T$ be the %ed"n4 5"nnc"% ser6"ces 7r$6"der- 7rtner"n4 8"th $ur cust$!ers T$ be the %ed"n4 5"nnc"% ser6"ces 7r$6"der- 7rtner"n4 8"th $ur cust$!ers

5$r !$re 7r$s7er$us nd secure 5uture 5$r !$re 7r$s7er$us nd secure 5uture. .

Mission !tatement Mission !tatement

,e re te! $5 c$!!"tted 7r$5ess"$n%s- 7r$6"d"n4 "nn$6t"6e nd ,e re te! $5 c$!!"tted 7r$5ess"$n%s- 7r$6"d"n4 "nn$6t"6e nd

e55"c"ent 5"nnc"% s$%ut"$ns t$ crete nd nurture %$n4#ter! re%t"$nsh"7s e55"c"ent 5"nnc"% s$%ut"$ns t$ crete nd nurture %$n4#ter! re%t"$nsh"7s

8"th $ur cust$!ers& In d$"n4 s$- 8e ensure tht $ur shreh$%ders cn 8"th $ur cust$!ers& In d$"n4 s$- 8e ensure tht $ur shreh$%ders cn

"n6est "n us 8"th c$n5"dence& "n6est "n us 8"th c$n5"dence&

16

Muslim Commercial Bank

C%MMERC#A* 'A$(#$G C%MMERC#A* 'A$(#$G

The Commercial Ban(ing )rou& of MCB continues to service the trading

Community and middle mar(et' $ith sustained focus on develo&ing ne$

customer relationshi&s and increasing the asset &ortfolio.

C%$!+MER 'A$(#$G C%$!+MER 'A$(#$G

The Consumer Ban(ing )rou& focuses on the lo$er end of the mar(et and micro

credit. Individual customer needs are %eing serviced through the introduction of

diverse lifestyle consumer loans and introduction of ne$ &roducts and

&artnershi&s $ith service &roviders. Customers $ill continue to use the e6tensive

%ranch net$or(' $hich in turn $ill generate de&osits to feed the asset

develo&ment and li?uidity re?uirements of the Ban( through its diversified and

sta%le de&osit %ase.

AM ECH$%*%G- AM ECH$%*%G-

17

Muslim Commercial Bank

At MCB' technology has a direct relationshi& $ith the needs of the customers' it

is a mean of creating value and convenience for the customer. 1ver the last fe$

years MCB has invested heavily into strengthening its technology %ac(%one.

Today it is leading the $ay in %an(ing technology and setting ne$ standards for

the %an(ing industry' &enetrating into the local mar(et' listening to the needs of

the &eo&le. MCBFs strength lies in &roviding technological %ase at a grass root

levels of the society $ith a challenge to educate and assimilate such systems

across vast cultural and economic %ac(grounds. 0ith over -3 automated

%ranches' A,# online %ranches' over .!. MCBFs ATMs in A- cities nation$ide

and a net$or( of over . %an(s on the MNet ATM s$itch' MCB continuously

innovates ne$ &roducts and services that harness technology for the customerFs

%enefits.

Additionally in order to enhance the utility of the ATM services they successfully

lin(ed their ATM net$or( to the MasterCard' Cirrus and Maestro' effectively

%ecoming &art of the largest ATM net$or( in the $orld. MasterCard and

Cirrus:Maestro users can no$ access their ATMOs net$or(. Together $ith the

a%ove MCB made a strategic decision to esta%lish an ATM s$itch and o&en their

ATM net$or( to other %an(s. The ATM s$itch has %een named MNCT. It has

follo$ing %an(s in MNCT s$itchB

"tandard Chartered

Citi Ban(

MCB ATM SER3ICES

MCB ATM Crd

0elcome to a $orld of convenience $ith the MCB ATM A,- Hour "mart Card. LIt

0or(s. Anytime in 2a(istan and a%road.L

0ith an ever gro$ing num%er of ATMs o&erating across the nation' the MCB ATM

18

Muslim Commercial Bank

Net$or( is the largest and most advanced of its (ind in the country' and is &art of

MCBOs continuing efforts to &rovide you $ith convenience that suits your

re?uirements most. And no$ the MCB ATM has gone glo%al. MCBOs affiliation

$ith Master Card International %rings a%out added facilities for the MCB traveler

a%road $ith the Cirrus and Maestro net$or(s.

"o go aheadQ Pse your MCB ATM A,- Hour Cash Card day or night' at home or

a%road.

MCB ATM Re4u%r Crd

The MCB ATM Regular Card allo$s $ithdra$al of u& to Rs. .8'888 &er day and a

ma6imum of # $ithdra$als &er day &er card.

'RA$CHE! 6 AMs

Mnet

MNCT ena%les all the mem%er %an(s to share their electronic net$or(s. 0hich

means customers of mem%er %an(s can use MNCT as $ell as .-Lin( ATMs

Nation$ide. MNCT mem%er %an(s ATM machines acce&t cards issued %y MCB

Ban( Ltd' Citi%an(' "tandard Chartered' H"BC' "audi 2a( Ban( Limited' Ha%i%

Metro&olitan Ban(' D" Ban(' @eutsche Ban(' "MC Ban(' Arif Ha%i% Ru&ali Ban(

and /irst 0omen Ban(. MNCT customers can use over 88'888 ATMs $orld$ide

that carry the logo and sho& at over ! million outlets that carry the logo.

M-Net s$itch has currently .A ATMs in !8 cities. 0e &lan to have the net$or(

gro$ in faster &ace in future as MCB itself $ill %e adding more ATMs %y the end

of the year. The ATM de&loyment has %een &lanned in such a manner that a

customer $ill %e only a fe$ minutes a$ay from an ATM in ma5or cities. This

cou&led $ith geogra&hic coverage &rovides the largest convenient s&read in the

country' %ecause of $hich $e are very strongly concentrating on @iverse

Coverage I Convenience.

M-Net "$itch ATMs are &resent in all the ma5or cities of the country. They are

availa%le in the hilliest and northern areas of the country such as Murree'

19

Muslim Commercial Bank

A%%otta%ad and "$at etc thus &roviding convenience of accessing A, hours cash

to the customers across the country.

M-Net s$itch also has its "ervice Centers in the main cities of the country

&roviding su&&ort to mem%er %an(s customers. M-Net "$itch ATMs are also

&resent in all # main Air&orts of 2a(istan i.e.' Dinnah Terminal *7arachi+' Allama

I?%al International Air&ort *Lahore+ I Islama%ad International Air&ort.

MEM'ER 'A$(! 6 thei. AM *ocations

In 2a(istan' the ATM facilities can %e availed at any of the follo$ing locationsB

MCB Ban( Ltd. "tandard Chartered

CITIBAN7 "audi 2a( Ban( limited

H"BC Ha%i% Metro&olitin Ban(

Arif Ha%i% Ru&ali Ban( @eutsche Ban(

/irst 0omen Ban( "MC Ban(

C%RP%RAE #MAGE '+#*"#$G C%RP%RAE #MAGE '+#*"#$G

In vie$ of )oals esta%lished through mission and vision statement' the first ste&

ta(en $as to change the cor&orate image of the Ban(' $hich inclined follo$ing

as&ectsB

In .44. Ban( changed its logo from

to current logo $hich isB

0hich signifies the gro$th and &ros&erityR The change of logo $as &art of effort

to change image of the Ban( as a &rogressive %an( in the minds of &eo&le of

country.

20

Muslim Commercial Bank

A com&rehensive electronic media cam&aign $as launched $ith a logo 9*$$d

Bn:"n4 4ett"n4 e6en better9 stressing on the im&rovement.

An on going &rocess of /ace Lifting and renovation of MCB %ranches $as started

$hich is still going on. The &ur&ose of it $as to ensure the overall outloo( of the

%an( changes and em&loyees get a %etter environment to $or( and customers of

the %an( feel more comforta%le.

$E7 PR%"+C! A$" !ER)#CE! !#$CE PR#)##8A#%$ $E7 PR%"+C! A$" !ER)#CE! !#$CE PR#)##8A#%$

In order to achieve long-term goals of e6&ansion and &enetration in the mar(et.

Ban( introduced various ne$ &roducts for its customers' $hich cater to the needs

of various segments of the society. In order to do so' a constant &rocess of

mar(et research' evaluation and develo&ment of Ne$ &roducts $as started

$hich resulted in introduction of various ne$ &roducts $hich $ere earlier not

introduced %y any other Ban( in the country. Introduction of these &roducts $as

indeed a ma5or source of &enetration for the %an( and turned out to %e a

differential factor as com&ared to other %an(sB

Pr"!e Currency Acc$unts - /or foreign currency de&osits' *since .44.+

Mhn Khush%" Sche!e # A monthly income &lan through de&osit of a fi6ed

sum in the account' *since .44.+

H;; Mubr": Sche!e - /or intending 2ilgrims' *since .44.+

21

Muslim Commercial Bank

C7"t% *r$8th Cert"5"ctes - It dou%les the de&osit of de&ositor in ! years. It

offers high rate of return and $as introduced for fetching long-term de&osit'

*since .44.+

PLS <'( S6"n4s Acc$unts& - Introduced high earning &roduct $ith feature of

calculation of &rofit on daily &roduct %asis. No restriction on de&osit $ithdra$als

and Minimum de&osit of Rs.#88'888:- *since .44A+

Fund Mn4e!ent Sche!e - To generate funds to develo& secondary mar(et

for )overnment "ecurities *from .44. to .44A+

MCB Khush%" Bcht Acc$unts - "avings accounts $ith added value to

customers due to &rofit a&&lication of daily &roduct %asis.

MCB D$%%r Khush%" Acc$unts - /or foreign currency de&osits' *launched in

.44#+

FA=PRESS # A fast inter-city Remittance "ervice' *since .44.+

MCB Ru7ee Tr6e%ers Che>ues - The most &o&ular &roduct of MCB' introduced

Ru&ee Traveler che?ue for the very first time in the country and it immediately

fetched high share of the mar(et and MCB share is still gro$ing - *launched in

.44#+

C$nsu%tncy Ser6"ces /or intending %uyers of "tate-o$ned enter&rises %eing

&rivati<ed' *since .44.+

Se%5#F"nnc"n4 Sche!e - Mar(-u& free finance from !888 to A!888. *since

.44.+

N"4ht Bn:"n4 Ser6"ces 0s"nce .//.1

Ut"%"ty B"%%s C$%%ect"$n Centers # "e&arate utility Bills collection centers $ere

esta%lished for collection of utility %ills *since .44,+

MCB MsterCrd # *since .44,+

E=PORTMOR - /inancing facility for e6&orter *since .44,+

REMITE=PRESS - A fast remittance service %et$een 2a(istan and Middle Cast.

*"ince .44,+

Pers$n% Bn:"n4 Ser6"ces# In order to &romote Consumer Ban(ing system in

the country a &ro&er &ersonal Ban(ing service $as started for High Net $orth

clients of Ban( in selected %ranches *since .44!+

22

Muslim Commercial Bank

MCB Cust$d"n Ser6"ces # Launched for local and international ca&ital mar(et

clients.

On%"ne# The largest net$or( of %ranches in the country and gro$ing. 2roviding

customers $ith A,6- real time online facilities.

MCB C%% Center# Call no$ for ans$ers to your ?ueries-%an(ing services' ATM

services' mo%ile %an(ing services' RTC services' tele%an(ing services and MCB

&roduct information. The state of the art MCB call center is the right choice to

(ee& you in ste& $ith your ever hectic schedule %y &roviding you services

relating to your account and "mart card at any &oint in time.

1ur $ell-a%reast and friendly call center team is availa%le A, 6 -' #! days a

year to ensure that your daily financial o%ligations are ta(en care of

guaranteeing you a good nightFs slee&.

Csh P%us#Cash management services for cor&orate customers hel& customers

su%stantially reduce their receiva%le collection time frame' im&rove cash flo$ and

%usiness management.

Is%!"c bn:"n4 ser6"ces through e6clusive units: %ranches offering a range of

lia%ility and asset %ased sharia com&liant &roducts li(e mushari(a' mura%aha'

i5ara and istasana.

MC' Mobile bankin/,

Ban(ing at your figure ti&s. @ial in anytime to get information regarding %alance

and mini statements.

At the forefront of technological e6cellence' MCB &roudly introduces MCB

M1BILC BAN7IN). The convenience of accessing your account %alance

information and mini statements $henever you $ant or $herever you may need

them' $ith comfort and &eace of mind.

MCB Mo%ile Ban(ing service is availa%le to all MCB ATM cardholders' A, hours -

#! days.

23

Muslim Commercial Bank

Dust call our Hel& Line on ...-888-MCB*AA+ or any MCB online %ranch for

assistance.

M$b"%e Bn:"n4 t *%nce

MCB Mo%ile Ban(ing gives you easy and ?uic( access to your account*s+ at a

time you find convenient' including all holidays.

Bn:"n4 t y$ur F"n4ert"7s

0ith MCB Mo%ile Ban(ing you canB

Chec( your %alance

Gie$ the last , transactions of your MCB account*s+.

A Free Ser6"ce

MCB Mo%ile Ban(ing is a free service for MCB account holders $ho have an

ATM card. All you &ay for is the cost of an "M" message if charged %y the

service &rovider.

MCB %$c:ers# The %est &rotection for your valua%les. Loc(ers of different

ca&acities are availa%le nation$ide.

Pyr 4hr# /le6i%le and com&etitive home financing facility $ith o&tions of

home &urchase' construction and renovation.

MCB cr csh# Car financing and leasing at com&etitive rates $ith fle6i%le

o&tions.

Lr4est ATM Net8$r:# of .88 ATMs connected to $orld$ide ATM net$or( of

a%out #!8'888 ATMs along $ith Cirrus and Maestro facility ena%ling MCB ATM

card to %e used All over the $orld I any$here in the country.

CUSTOMER SATISFACTION CUSTOMER SATISFACTION

24

Muslim Commercial Bank

/or any organi<ation to succeed' it is e6tremely vital to ensure Customer

"atisfaction. Ban(s %eing in service sector' it is highly im&ortant that high service

standards %e maintained and real value to their money is &rovided to its

customers. In order to do so MCB too( three revolutionary ste&sB

2rovision of com&aratively %atter service to its customers as com&ared to other

%an(s through value added features of lo$ cost' ?uic( dis&osal of $or( and

friendly environment. Moderni<ation' Com&uteri<ation of most of the %ranches

ena%led Ban( stay a%reast $ith the technology and &rovision of %etter service at

the root level to its customers.

Ban( also started an ongoing &rocess of Branch face lifting creating a %etter

congenial environment for its customers. In order to %e more customersO

conscious' MCB started a very effective and timely action system on Customer

Com&laints

De7rt!ents "n MCB De7rt!ents "n MCB

Brief functions and res&onsi%ilities of de&artments at MCB are as follo$s.

25

Muslim Commercial Bank

Hu!n Res$urces nd %e4% 4r$u7:

Recruitment.

Training.

Transfer I &osting.

2romotions.

@is&utes.

"taff loans.

Bn:s $7ert"$ns 4r$u7:

2olicy.

2remises.

Ca&ital I o&erating e6&enses &rocessing.

Return I consolidation.

Reconciliation.

2roduct sales.

Relationshi& co-ordination.

"ervice standards.

Customer com&laints.

F"nnc"% Inst"tut"$n ? $6erses 4r$u7:

Inter-%an( e6&osure.

/ore6 licensing.

26

Muslim Commercial Bank

F"nnc"% c$ntr$% ? Aud"t 4r$u7:

Audit I internal control.

Budgeting I &lanning.

Monitoring of e6&enses.

/inancial re&orts.

Cred"t ? r"s: !n4e!ent 4r$u7:

Credit &ro&osal evaluation I analysis.

2ro5ect financing.

Monitoring of credit &ortfolio of %an(.

.

C$r7$rte bn:"n4 4r$u7:

2lacement of all multi-national I &u%lic sector com&anies.

C$nsu!er bn:"n4 4r$u7:

2enetration in high net-$orth customers.

Carning increase.

Customer retention.

C$!!erc"% bn:"n4 4r$u7:

Conduction of normal retail o&erations.

27

Muslim Commercial Bank

Tresury ? F= 4r$u7:

/unds management.

Investment management.

Assets !n4e!ent 4r$u7@ Frud c$ntr$% 4r$u7:

Classified &ortfolio loo(s after.

"&ecial assets management.

Restructuring : Rescheduling.

1ut of court settlements

In5$r!t"$n techn$%$4y 4r$u7:

ATM : CIRRP" facilities.

I.T. related franchise management.

"0I/T system.

1n-line %ranches net$or( loo( after.

Hard$are : soft$are su&&ort.

28

Muslim Commercial Bank

MCBFs Management Hierarchy MCBFs Management Hierarchy

29

President

(M. Aftab Manzoor)

Human Resource Group

Inorma!ion "ec#nolo$% Group

&sse!s Mana$emen!'(rau)

Con!rol Group

"reasur% * (+ Group

Consumer Bankin$ Group

Cre)i! * Risk Mana$emen!

Group

(inancial Con!rol * &u)i!

Group

(inancial Ins!i!u!ion Group

Bank ,pera!ion Group

-e$al Group

Commercial Bankin$./ou!#

Commercial Bankin$.0or!#

Corpora!e Bankin$ Group

Corpora!e

South

Corpora!e

North

Raheel Ijaz

(GM)

Corpora!e

Central

Bashir Khan

(AVP-Admn.)

Hamid Yasin

(AVP-Credit)

Mall Branc#

R12

(CM)

Blue &rea

Branc# I/B

Nadeem Elahi

(CM)

G.8'4 Branc#

I/B

(CM)

Cre)i!

Hameed

Durrani

(AVP)

(orei$n

34c#an$e

Abdul Majeed

(OG-2)

,pera!ions

Raja Khaliq

(AVP)

Muslim Commercial Bank

Business of MCB Business of MCB

MCB is in itFs over !8 years of o&eration. It has net$or( of over .'.88 %ranches

all over the country $ith %usiness esta%lishments in Bangladesh' "ri Lan(a and

Bahrain. The %ranch %rea(-u& &rovince $ise is 2un5a% *!-K+' "indh *A.K+'

N0/2 *.4K+ and Baluchistan *#K+ res&ectively.

MCB has an edge over other local %an(s' as it $as the first &rivati<ed %an(. The

"tate Ban( of 2a(istan has restricted the num%er of The Consumer Ban(ing of

MCB &rovides customers $ith innovative saving schemes' &roducts and

services. The ATM net$or( of MCB is the largest in 2a(istan and the 2a( Ru&ee

Travelers Che?ues are mar(et leaders. MCB $as the first to introduce the 2hoto

Card $ith the launch of the MCB MasterCard.

The Cor&orate Ban(ing of MCB ensures assistance from a dedicated team of

&rofessional financial advisors for under$riting' &ro5ect finance or cor&orate

advisory services.

0hen it comes to %an(ing &ractices' the consumer can de&end on MCB'

%ecause itOd %een around for over fifty years.

The "tate Ban( of 2a(istan has restricted the num%er of %ranches that can %e

o&ened %y foreign %an(s' an advantage that MCB ca&itali<es %ecause of its

e6tensive %ranch net$or(.

Cight years after &rivati<ation' MCB is no$ in a consolidation stage designed to

loc( in the gains made in recent years and &re&are the ground$or( for future

gro$th. The %an( has restructured its asset &ortfolio and rationali<ed the cost

structure in order to remain a lo$ cost &roducer.

30

Muslim Commercial Bank

MCB no$ focuses on three core %usinesses namely Cor&orate' Commercial and

Consumer Ban(ing. Cor&orate clientele includes &u%lic sector com&anies as $ell

as large local and multi national concerns. MCB is also catering to the gro$ing

middle class %y &roviding ne$ asset and lia%ility &roducts. The Ban( &rovides A,

hour %an(ing convenience $ith the largest ATM net$or( in 2a(istan covering 4

cities $ith around .88 ATM locations. The Ban(Os Ru&ee Traveler Che?ues have

%een mar(et leaders for the &ast si6 years.

MCB loo(s $ith confidence at year A88A and %eyond' ma(ing strides to$ards

fulfillment of its mission' Lto %ecome the &referred &rovider of ?uality financial

services in the country $ith &rofita%ility and res&onsi%ility and to %e the %est

&lace to $or(L.

C$r7$rte Bn:"n4 C$r7$rte Bn:"n4

MCBOs Cor&orate Ban(ing Team consists of dedicated &rofessionals $ith the

re?uisite e6&ertise to ta(e care of the %an(ing needs. The Cor&orate Ban( $ith

A8 %ranches has its &resence in all ma5or cities of 2a(istan. The Area 1ffices are

located in 7arachi' Lahore and Islama%ad.

Cor&orate 2latforms have %een esta%lished in the three &rinci&al cities $here

teams of dedicated Relationshi& Managers have %een &osted. These

Relationshi& Managers have %een entrusted $ith the com&lete res&onsi%ility for

managing the ris( of their allocated &ortfolios' acting as allusion %et$een the

customer and the %an(' and &roviding you $ith the entire range of

&roducts:services offered %y the %an(.

The &roducts:services of the Cor&orate Ban( are %roadly divided into the

follo$ing categoriesB

7o.kin/ Ca3ital *oans&

31

Muslim Commercial Bank

The $or(ing ca&ital loan includes Running /inance' Cash /inance' C6&ort

Refinance' 2re-shi&ment and 2ost-shi&ment etc.

e.m *oans&

1ffer "hort to Medium Term /inance to meet ca&ital e6&enditure of the customer

%usiness needs.

.ade Finance !e.2ices&

Trade finances services that include an entire range of im&ort and e6&ort

activities including issuing Letters of Credit *L:Cs+' &urchasing e6&ort documents'

&roviding guarantees and other su&&ort services.

Cash Mana/ement&

The net$or( of a%out ..88 %ranches in 2a(istan ena%les the %an(ers to collect

and dis%urse &ayments efficiently $ith the MCB cash management services. This

also ena%les. the %an(ers to offer the customerFs choice of &a&er %ased or

electronic fund transfer solutions including collection amounts' rose %ranch on-

line transactions etc.

32

Muslim Commercial Bank

In6est!ent In6est!ent Bn:"n4 Bn:"n4

The Investment Ban(ing Team of MCB has emerged as a leading &layer in

2a(istanOs investment %an(ing arena. The Team handles advisory' cor&orate

finance and ca&ital mar(ets related transactions. 0ithin these areas' the

investment %an(ing team of the MCB has develo&ed e6&ertise in the follo$ing

areas of the investmentB

P.i2ate Placements

"ebt9E:uity +nde.w.itin/

e.m Finance Ce.ti0icates

*oan !yndication

A..an/ement o0 $on, Fund Facilities

Me./e.s and Ac:uisitions

F"nnc"% F"nnc"% H"4h%"4hts H"4h%"4hts

The results for the year A88. are reflective of sustaining all-around efforts over

the fe$ years' to maintain &rofita%le gro$th along $ith &rudent and &roactive ris(

management and e6&ansion of &roduct range of customers.

2re-&rofit for the year A88. $as Rs.A..8 %illion as against Rs...#A %illion in A888-

a healthy increase of !4K.

)ro$th in &rofita%ility is &rimarily due to fund-%ased activities through efficient

assets and lia%ility management. /ee %ased income $as lo$er des&ite increase

in volumes due to com&etitive &ricing and discontinuation of charges on 2L"

accounts.

Administrative e6&enses gre$ %y #K generally attri%uted to a%sor% effect of

inflation and enhancement in )ovt. levies. 2ragmatic efforts are' ho$ever' under

33

Muslim Commercial Bank

$ay to manage costs in relation to revenues to further im&rove the

revenue:e6&ense ratio. Higher level of &rovisions $as in the line $ith the Ban(Fs

&olicy to u&front recogni<e &ro%lem lending. In A88.' the Ban( managed to

recover Rs.A..4 %illion as against Rs...4- %illion in A888.

The %alance sheet footings have increased to Rs..3- %illion from Rs..-! %illion

&rimarily %ased on de&osit gro$th. @e&osits have registered a su%stantial

increase of .,K and stand at Rs..!,.! %illion in A88. as against Rs..# %illion in

A888. @es&ite of lo$ 2L" de&osit rates' %ranch net$or( has sho$n a

commenda%le &erformance %y increasing and managing the de&osit mi6. This

has %een &ossi%le %y im&rovement in customer services and targeted sales of

&roducts li(e ATM cards.

Net advances as at @ecem%er #.' A88. stood at Rs.-. %illion' a reduction of

Rs.4.3 %illion. @emand for credit from manufacturing and e6&ort clients fell

considera%ly' &ost "e&tem%er ..'A88.' $hich led to a reduction in advances as

on the %alance sheet date from a higher level during the year.

*eade.shi3 in Ru3ee .a2ele.s Che:ues& "ales have gro$n %y AK in the

year A88. and continue to reflect meteoric gro$th. 0ith the e6tension of the

generic %rand' increase in the range of denomination %ac(ed %y a &o$erful

verification system and over 488 %ranches involved in this %usiness.

*eade.shi3 in AM;s& 0ith around .88 ATMs and .-8 online %ranches' MCB is

again an undou%ted Indus leader $ith connectivity e6tended to . cities of

2a(istan. In the year A88A further ATM $ill %e de&loyed and connectivity

increased to other cities. MCB ATMs not only serve A,-hour cash convenience

%ut also im&rove on the counter services and turn around time at cash counters.

The MCB ATM Master Card $ith Maestro and Cirrus net$or(s has %ecome a

glo%al service furthering the convenience to our customers. Traveling customers

34

Muslim Commercial Bank

can access their account from a large num%er of internationally de&loyed ATMs

and &oint of "ale *21"+ units.

The MCB ATM "$itch - MNCT is no$ o&erational. IT )R1P2 of MCB has %een

a%le to create the largest net$or( for secure electronic financial transactions in

2a(istan. Local %ranches of si6 international %an(s are connecting to this

net$or(. This $ill ena%le &artici&ating %an(s to use each othersO ATMs resulting

in an increased convenience to MCB customers and customers of other %an(s.

The IT )rou& is currently e6&anding the net$or( ca&a%ility to &rovide the

customers access to %an(ing through

multi&le electronic channels.

Ame.ican E53.ess 'ank ente.s into an AM sha.in/ alliance with Muslim

Comme.cial 'ank&

Muslim Commercial Ban( Limited and American C6&ress Ban( Ltd. signed a

Memorandum 1f Pnderstanding creating a mutually %eneficial alliance' $hich $ill

ena%le customers of American C6&ress Ban( to use ATM facilities offered %y

Muslim Commercial Ban(. Mr. Taufi? A. Hussain' Country Manager' American

C6&ress Ban( Ltd.' 2a(istan in a sim&le ceremony in 7arachi' signed the M1P.

MCB has setu& an ATM "$itch called MNCT and American C6&ress Ban( is the

fourth foreign %an( to sign the sharing M1P.

"&ea(ing at the ceremony - ACB Country Manager said' LCustomer service

?uality is the cornerstone of ACBOs &hiloso&hy and this initiative $ill significantly

enhance our customer service ca&a%ility for our consumer %an(ing clientsL. He

added LAfter having considered various routes to ac?uire this ca&a%ility ACB

selected MCB as an ideal &artner (ee&ing in vie$ the large net$or( ca&a%ility

and long standing relationshi& $ith MCBL.

MCB $ith a net$or( of over .888 %ranches in the largest &rivate sector %an( of

the country. The Ban( is a mar(et leader in A, hour %an(ing convenience $ith

35

Muslim Commercial Bank

the largest nation$ide ATM net$or( covering .. ma5or cities in all &rovinces of

the country.

C## bank and Muslim Comme.cial 'ank si/n AM sha.in/ a/.eement&

Muslim Commercial Ban( and CITI Ban( signed an ATM sharing agreement

today. By the middle of this year' %oth Ban(sF customers $ill %e a%le to use the

services of either Ban(Os ATMs. "een at the signing ceremony are Mr. Haroon

Basheer "hei(h' Head of Consumer Ban(ing and Information Technology - MCB

and Mr. Nadeem Hussain' )eneral Manager )lo%al Manager )lo%al Consumer

Ban(ing N CITI Ban( 2a(istan $ith their res&ective team mem%ers.

!tanda.d Cha.te.ed G.indlays and Muslim Comme.cial 'ank to launch co,

b.anded c.edit ca.d&

Rated as 2a(istanOs %est %an(s *OdomesticO and foreignO res&ectively+ %y Curo

money maga<ine Muslim Commercial Ban( *MCB+ and "tandard Chartered

)rindlays signed a Memorandum of Pnderstanding to launch the first-ever 5oint

servicing co-%randed credit card in 2a(istan. Pnder the arrangement the

&artnering %an(s $ill have shared as $ell as distri%uted res&onsi%ilities to service

the customers in line $ith their res&ective strengthOs.

The 2artnershi& $ill derive its strength %y com%ining the large diversified

customer %ase of MCB and the trac( record of "tandard Chartered )rindlays in

managing a successful credit card %usiness in 2a(istan. MCB' the largest 2rivate

Ban( in 2a(istan' has over four million accounts domiciled in ..88 %ranches

across the country.

"tandard Chartered )rindlays' the largest foreign %an( in 2a(istan' has over

ninety thousand satisfied card mem%ers and is a leading international &layer in

the cards %usiness. 0ith this ne$ initiative the customers &roduct of the t$o

leading %an(s in 2a(istan. This agreement further strengthens the relationshi&

%et$een these t$o %an(sM earlier this year "tandard Chartered )rindlays signed

an agreement to 5oin MCBOs s$itch:ATM net$or(' the largest in the country.

36

Muslim Commercial Bank

FA-!A* 'A$( *#M#E" to sell Muslim Comme.cial 'ank;s Ru3ee t.a2ele.;s

che:ues&

Muslim Commercial Ban( Limited and /aysal Ban( Limited signed an agreement

for the "ale and &urchase of MCB Ru&ee Travelers Che?ues at all .. /aysal

Ban( %ranches in 2a(istan.

37

Muslim Commercial Bank

Main categories of Account o&ening formB

Ty&e of Account

There is a category of =Ty&e of Account =' the customer can chec( any o&tion to

o&en a certain account.

/ollo$ing are certain (inds of accountsB

Current

2L"-"aving

MCB "aving-#!

7hushali Bachat

2L" Term @e&osit

Ne$ /oreign Currency Account *Current:"aving+

Currency

There is a category of =Currency> in the formB

In this section there are four (inds of currencies are given in $hich MCB o&ens

account. They areB

2a(istani Ru&ee

P" dollar

Nture $5 Acc$unt

There is a category of =nature of account> i.e.

Individual

2artnershi&

"ole &ro&rietor

Doint stoc( com&any

Intr$duct"$n

Before o&ening an account a %an(er should ascertain $eather or not the &erson

desirous of o&ening the account is a desira%le customer. There is Reference

section in the form in $hich the &erson $ho $ants to o&en an account must

&rovide a reference of a &erson $ho has already an account $ith MCB. /or

current account only reference of current account holder is acce&ted $hereas for

saving account reference of any $hether current or saving is allo$ed. 2reliminary

investigation is necessary %ecause of the follo$ing reasonsB

38

Muslim Commercial Bank

To avoid frauds

"afe guard against unintended overdrafts

To avoid negligence

To re&lay in?uiries against clients

To com&ly $ith 2rudential Regulations:La$s

There is a s&ecimen signature card $ith the %an( on $hich the signature of

account holder is to %e ta(en $hile o&ening of his account. And then he is issued

$ith a che?ue %oo(.

It is advised that one must (ee& his che?ue %oo( under &ro&er care %ut there are

cases that &eo&le sometimes lost their che?ue %oo(s. In that case there is an

a&&lication form in the name of manager is availa%le and the customer $ho

$ants to get a ne$ che?ue %oo( fills that form and gives it to the manager then

he is &rovided $ith a ne$ che?ue %oo(. In other case a re?uisition sli& is &resent

in the che?ue %oo( and $henever the customer $ants a ne$ che?ue %oo( he

sim&ly fills that re?uisition sli& and &resents it to manager and gets a ne$ che?ue

%oo(.

Kn$8 y$ur Cust$!er Kn$8 y$ur Cust$!er

In vie$ of recent heightened glo%al efforts to &revent the &ossi%le use of the

%an(ing sector for money laundering' terrorist financing' transfer of illegal:ill-

gotten monies and as a conduit for $hite collar crime etc' the im&ortance of

=7no$ your Customer> has increased. The o%5ective of (no$ing a customer is to

have a fair idea a%out the identity' financial resources and general information

a%out the customer at the time $hen the relationshi& is esta%lished. A %an(er

must have follo$ing information a%out the customerB

<

39

Muslim Commercial Bank

Custome.;s $ame&

Cnter com&lete name as mentioned in original Identity Card:other %usiness

documents.

$atu.e o0 'usiness9P.o0ession&

If the customer is of salaried class then %an(er $ill enter his em&loyerFs name. If

the customer is a %usinessman' trader' sole &ro&rietor' then the %an(er $ill enter

the %usiness name. Also enter the customerFs title:&osition and address of the

em&loyer:%usiness. Addresses $ith 2.1. Bo6 are not acce&ta%le. "imilarly

remar(s li(e =2rivate "ervice>' =Business> are not acce&ta%le' rather s&ecify $hat

ty&e of com&any:%usiness the customer is associated $ith.

In case of individual his attested 2hotoco&y of national identity card or &ass&ort

is re?uired' in case of salaried &erson' attested &hotoco&y of his sarvice card. In

case of &artnershi& attested &hotoco&y of identity cards of all &artners is re?uired

and attested &hoto co&y of =2artner shi& @eed> along $ith a co&y of Registration

certificate $ith registrar of firms. In case of Com&any' Memorandom and Article

of association' certificate of incor&oration' certificate of commencement of

%usiness and attested &hotoco&y of identity cards of all the directors is re?uired.

Add.ess&

Cnter the com&lete residential:%usiness address. 0ithin the %rac(ets you may

also &rovide &rominent address identification mar(s for ease of &hysically

locating the address.

Contact $umbe.&

Cnter home' official' mo%ile' fa6 num%ers and e-mail address *if availa%le+.

40

Muslim Commercial Bank

!3ecial #nst.uctions&

Clear-cut o&erational instructions must %e o%tained from the customers. If the

customer has not given any s&ecial instructions in s&ecified column' the column

must %e cancelled %y dra$ing a line' as this column must not %e left %lan( under

any circumstances.

The %an(ers considered the follo$ing &oints $hile o&ening the accountsB

Re!"ttnces De7rt!ent Re!"ttnces De7rt!ent

The ne6t de&artment I $or(ed in is Remittances de&artment. The incharge of this

de&artment' Mr. 7halid told me that there are four (inds of remittances they deal

inB

Telegra&hic Transfer

Mail transfer

@emand @raft

2ay order

Another tas( of this de&artment $as to issue the traveler che?ue and to give the

ATM card num%ers.

Here is a little detail of all of these $or(sB

Telegra&hic TransferB

It is a facility &rovided %y the %an( through $hich a customer can send or transfer

any amount immediately. The &rocedure for the customer is sim&le. And more

im&ortantly the &erson $ho $ants to transfer the funds may not have the account

in the %an( even then he can avail this facility. The &rocedure is li(e this' a

customer $al(s in and fills an a&&lication form named as =A22LICATI1N /1R

RCMITTANCC> in $hich he mentions the %an( to $hich he $ants to transfer the

funds also the name of the &ayee' his account num%er' also he has to mention

41

Muslim Commercial Bank

his o$n address etc. then there are charges for this s&ecial facility &rovided %y

the %an( and the %an( receives these from the &erson $ho is sending the funds.

/urther there are t$o (inds of telegra&hic transfersB

1rdinary TT

TT

The ordinary TT reaches to its destination after t$o days of its dis&atchment

$hereas sim&le TT reaches to its &ayee immediately %ecause the &ayee %ranch

is informed immediately through tele&hone and fa6.

/or ordinary TT only t$o vouchers are &re&aredB

Commission Goucher

2ostage Goucher

0hereas for TT three vouchers are &re&aredB

Commission

2ostage

Te%e7h$ne chr4es

In the a&&lication form of TT there are t$o o&tions availa%le for the &erson $ho is

sending the funds i.e $hether the &ayees account is credited for the same

amount or &ayee is sim&ly to receive the &ayment in hand.

D$cu!ents Pre7red:

The documents that are &re&ared for the TT areB

TT register

Remittances

Confirmation of ca%le sent

And after$ards $hole of these information are recorded in a %ig register named

asB

Branch out$ard remittance register

And after this &rocedure the res&ective %ranch is informed through tele&hone.

42

Muslim Commercial Bank

Recommendations

This $hole &rocedure is ?uite lengthy and hectic. "o the only recommendation

that could %e given is' it must %e com&uteri<ed

Another tas( of the accounts de&artment is to give the customers the ATM card

num%er. The &rocedure is li(e this that $hen a customer a&&lies for the ATM

card' he is given a certain time to collect the card. 1n due date the customers

gets his card from manager and for safety &ur&ose the ATM num%er remains $ith

the account de&artment and the customer gets his num%er from there.

Tr6e%er che>ue

In account de&tt there are t$o &eo&le $or(ing. 1neFs 5o% is to issue the traveler

che?ue and the other is su&&ose to ma(e the &ayment of TC. This $or( is

se&arated for the &ur&ose of safety and to &revent the frauds.

0hen RTC is issued it is $ritten in Traveler che?ue register and $hen it is &aid it

is &osted in MBI". Traveler che?ue register is used to maintain the stoc( of

RTCFs.

0hen RTC is issued H1 RTC de&tt. Is credited and $hen RTC is &urchased it is

de%ited.

1ne of the &erson has the com&lete register of staffFs salary he maintains a staff

salary register.

The remittance facilities of the MCB are according to the need of the customer.

;our %eneficiary $ill receive the amount even if he:she does not have an MCB

account. The Remit C6&ress facilities the MCB can %e avail in the follo$ing

Ban(:Com&aniesB

43

Muslim Commercial Bank

"emand "emand d.a0t d.a0t

@emand @raft can %e e6&lained as the instrument $hich is &aya%le on demand

as its name im&lies the same' the value of $hich has already %een received. This

instrument is issued %y one %ranch and &aya%le at other %ranch of same %an( or

other %an(Fs %ranch e.g. @@ issued %y MCB &aya%le %y ACBL.

P.ocedu.e o0 issuance&

The customer $ants to ma(e the @@ fills in the same form or a&&lication i.e of

remittances in $hich he mentions the @@' the %eneficiaryFs name' the &lace' the

mode of &ayment i.e' $hther he $ants the &ayee to receive the cash' che?ue or

de%it his account' signature and his name and address

Chec( the a&&lication form.

Commission is charged as &er %an( &olicy. Also e6cise duty I $ithholding ta6 are

recovered as &er a&&lica%le rates.

Cntry is then made in @@ issued register. In the @@ issued register' se&arate folio

is allotted for each dra$ee %ranch and a serial control num%er is a&&lied.

The entries made is @@ &aya%le account is credited and cash is de%ited and

$hen the &ayee receives the cash against @@' @@ &aya%le account is de%ited

and cash is credited.

P.ocedu.e o0 Cancellation o0 ".".

1n receiving the a&&lication for cancellation in $riting along $ith original @@ the

signature of the a&&licant is verified This signature should tally $ith the signature

on @@ a&&lication form. Then cancellation is mar(ed in @@ issued register and

the dra$ee %ranch is Informed a%out cancellation.

#ssuance o0 "u3licate "" #n case o0 *ost9!to3 Payment&

44

Muslim Commercial Bank

A&&lication is received and signature is verified' then the dra$ee %ranch is

informed a%out the loss of @@ and further they are advised to tell the %ranch the

status of @@ i.e $hether it has %een &aid or not. Then a du&licate of @@ is issued

$ith L@u&licate in lieu of original @@ NoSSSS dtedSSSS re7$rted %$st9 $ritten

on its face. The du&licate @@ $ill have the same control num%er.

PA- %R"ER!& PA- %R"ER!&

2ay order is a (ind of instrument issued and &aid in the same %ranch. It is

normally issued for &ayment in the same city.

2rocedure of Issuance of 2ay orderB

The customer fills the remittances a&&lication form and mar( chec( on &ay order.

1n receiving a&&lication he is issued $ith a &ay order after receiving charges. All

&ay orders are crossed i.e =2ayees a:c only>

P.ocedu.e o0 Cancellation o0 Pay o.de.&

1n receiving a&&lication for cancellation of &ay order along $ith the &ay order' it

is cancelled and cancellation charges are recovered.

"u3licate Pay %.de.&

If the &ayment of &ay order has not yet %een made a du&licate co&y of it can %e

made on receiving a&&lication from the customer. The du&licate charges are

recovered from customer.

45

Muslim Commercial Bank

Clearing @e&artment Clearing @e&artment

CLEARIN*: CLEARIN*:

Clearing im&lies a system %y $hich %an(s e6change che?ues and other

negotia%le instruments dra$n on each other $ithin a s&ecified area and there%y

secure &ayment for their clients through the clearing house at s&ecified time in an

efficient $ay.

C%er"n4 H$use:

In &ast "tate %an( $as indulged in clearing function i.e for the settlement of

mutual o%ligations of different commercial %an(s. As all %an(s have their

accounts and (ee& a certain &ercentage of the cash de&osits as a reserve $ith

Central Ban(' it %ecome easy to set u& their mutual o%ligations %y off-setting their

accounts.

The claim of %an(s against each other is settled %y sim&le transfers from and to

their accounts. These methods of settling accounts though the central %an('

a&art from %eing convenient is economical as regards the use of cash since

account are ad5usted through accounts' there is usually no need for cash.

At &resent this function of state %an( is &erformed %y NI/T. And no$ clearing

house is a &lace $here NI/TFs re&resentatives of all scheduled %an(s sit together

and interchange their claims against each other $ith the hel& of controlling staff

of "tate Ban( of 2a(istan and $here there is no %ranch of "tate Ban( of 2a(istan

the designated %ranch of National Ban( of 2a(istan acts as controlling mem%er

instead of "tate Ban( of 2a(istan.

46

Muslim Commercial Bank

Reasons o0 Cancellation o0 Membe.shi3&

0hen a %an( is no longer a scheduled %an(.

0hen any %an( fails to meet its lia%ilities.

0hen It is &rohi%ited to receive fresh de&osits %y "tate Ban( of 2a(istan or

Central )overnment.

Ad6nt4es $5 C%er"n4:

T As clearing does not involve any cash etc and all the transaction ta(es

&lace through %oo( entries' the num%er of transactions can %e unlimited.

T No cash is needed' as such the ris(s of ro%%ery' em%e<<lements and

&ilferage are totally eliminated.

T As ma5or &ayments are made through clearing' the %an(s came manage

cash &ayments at the counters $ith a minimum amount of cash in vaults.

T A lot of time' cost and la%or are saved. "ince it &rovides an e6tra service

to the customers of %an(s $ithout any service charges or costs' more and

more &eo&le are inclined and attracted to$ards %an(ing.

47

Muslim Commercial Bank

Rules 6 Re/ulations o0 Clea.in/ House&

TimingB - Monday through "aturday

.st Clearing .8.88 A.M.

And Clearing A.#8 2.M.

Che?ues and other negotia%le instruments are sent through NI/TFs

re&resentative for e6change.

All the che?ues and negotia%le instruments must %e &ro&erly stam&ed and

suita%ly discharged

Cach and every Che?ue must %e accom&anied %y an o%5ection memo

$hen returned un&aid duly initialed.

Cach %an( is re?uired to maintain sufficient funds in the &rinci&al account

$ith "B2 to meet the &ayment o%ligations.

The "tate Ban( of 2a(istan de%its the account of each mem%er of the

clearinghouse $ith the &ro&ortionate $or(ing e6&enses incurred on the

o&eration of clearing house. These e6&enses are very nominal.

Funct"$n"n4 $5 C%er"n4 H$use:

All the scheduled %an(s $hich are the mem%er of clearing house' must maintain

accounts $ith "B2' %y de%it and credit to $hich the clearing settlements are

made. If on a &articular day' a %an( delivers Che?ue and other negotia%le

instruments $orth more than the total amount of Che?ue received %y it that

%an(s account $ith "tate Ban( of 2a(istan $ill %e credited $ith the differential

amount. If on the other hand the total amount of Che?ue and other negotia%le

instruments dra$n on a certain %an( %y other %an(s is more than the total

48

Muslim Commercial Bank

amount receiva%le %y it from other %an(s' then this %an(Os account $ill %e de%ited

on that day.

The Che?ue delivered to the other %an(s through NI/TFs re&resentatives for

clearing are called out$ard clearingM $hereas Che?ue received from the

re&resentatives of other %an(s for &ayment are called in$ard clearing.

H$8 sett%e!ent "s d$ne "n NIFTA

2resume that MCB got the Che?ue' $hich are dra$n on PNI1N BAN7' PBL and

ACBL for amounts Rs.!8'888:-' Rs.#8'888:-' Rs..!'888:- res&ectively' its total

%eing Rs.4!'888:-. It means that this amount is to %e credited to MCB A:c $ith

".B.2. 1n the other hand the Che?ues dra$n on MCB are from PNI1N BAN7'

PBL I ACBL of Rs..!'888:- Rs.-!'888:- and Rs.#8'888:- res&ectively' its total

%eing Rs..'A8'888:-. It means that this amount is to %e de%ited from MCB A:c.

The difference %et$een Rs. 4!.888:- credit and Rs..A8.888:- de%it is Rs.

A!'888:- de%it' $hich means the house' is against MCB for Rs. A!'888:-.

If $e se&arately sho$ it then'

MCB has to receive Rs.!8'888:- from PNI1N BAN7 and to &ay Rs..!'888:- to

PNI1N BAN7 so difference is Rs.#!'888:- credit.

MCB has to receive Rs.#8'888:- from PBL and to &ay Rs.-!'888:- to PBL so

difference is Rs.,!'888:- de%it.

MCB has to receive from ACBL Rs..!'888:- and to &ay Rs.#8'888:- to MCB so

difference is Rs..!'888:- de%it.

*RAND TOTAL: U #!'888' - ,!'888' -.!'888 V -A!'888

i.e. Rs.A!'888:- de%it.

49

Muslim Commercial Bank

Hence MCB A:c $ith "tate Ban( of 2a(istan $ill %e de%ited $ith Rs.A!'888:- and

the contra $ill %e other %an(s accounts res&ectively. This is called as L@e%it and

Credit RuleL.

The amounts and num%er of instruments received are entered in the House Boo(

from the main schedules of the res&ective %an(s.

The "tate Ban( of 2a(istan maintains t$o ma5or %oo(s for clearing house

&ur&ose B-

HOUSE RE*ISTER&

This %oo( contains the information a%out the amounts and num%er of che?ues

received and delivered %y each %an( is noted do$n. Its columns are 5ust li(e our

clearing house-&age.

HOUSE BALANCE BOOK:

This %oo( contains the amount and num%er of che?ues received and delivered

%y each %an( as $ell as the amounts $hich are to %e received and &aid to

res&ective %an(s through their accounts %y "tate Ban( of 2a(istan is $ritten

do$n. This %oo( has the follo$ing columnsB-

In"t"%

T$ Py

A!$un

t

N$& $5 Che>ues

Rece"6ed@De%"6ere

d

N!

e $5

Bn:

Rece"6e

d

A!$unt

T$

Rece"6e

d

A!$unt

In"t"%s

Both sides of this %oo( are %alanced. Gouchers are &re&ared from the sli&s

received from the res&ective %an(s and the amounts are com&ared $ith this

%alance %oo(.

"ummary of Clearing House 0or(ingB

50

Muslim Commercial Bank

The $or(ing of clearing house may %e summari<ed as underB-

The instruments are delivered to the res&ective %an(s.

The instruments dra$n on our Ban( are received from other %an(s.

The amount and num%er of instruments received are entered in the House

Boo( from the main schedules of res&ective %an(s.

The amount of instruments delivered' received and the difference is

$ritten on a /igure sli& &rovided in the clearinghouse and the sli& is

returned to the su&ervisor.

The instruments are arranged %ranch-$ise.

"chedules are detached and (e&t safely.

OUT,ARD CLEARIN* AT THE BRANCH:

The follo$ing &oints are to %e ta(en into consideration $hite an instrument is

acce&ted at the counter to %e &resented in 1ut$ard ClearingB

The name of the %ranch a&&ears on its face $here it is dra$n on.

It should not %e stale or &ost dated or $ithout date.

Amount in $ords and figures does not differ.

"ignature of the dra$er a&&ears on the face of instrument.

Instrument is not mutilated.

There should %e no material alteration if so' it should %e &ro&erly

authenticated.

If order instrument' suita%ly endorsed and the last endorseeOs account

%eing credited.

Cndorsement is in accordance $ith the crossings if any.

The amount of the instrument is same as mentioned on the &aying-in-sli&

and counterfoil.

The title of account on the &aying-in-sli& is that of &ayee or endorsee *$ith

the e6ce&tion of %earer che?ue+.

51

Muslim Commercial Bank

If an instrument is in order then our %an(Os s&ecial crossing stam& is affi6ed

across the face of the instrument. Clearing stam& is affi6ed on the face of the

instruments' &aying-in-sli& and counterfoil *The stam& is affi6ed in such a manner

that half a&&ears on &aying-in-sli& and half on counterfoil+. The instrument is

suita%ly discharged' $here a %earer che?ue does not re?uire any discharge and

also an instrument in favor of a %an( need not %e discharged. The instrument

along $ith &aying-in-sli& is retained $hile the counterfoil is given to the customer

duly signed. Then the follo$ing ste&s are to %e ta(enB-

The &articulars of the instruments and the &ay-in-sli&s or credit vouchers

are entered in the 1ut$ard Clearing Register.

"erial num%er is given to each voucher.

The register is %alanced' the credit vouchers are se&arated from the

instruments and are released to res&ective de&artments against

ac(no$ledgement in the register.

The instruments are arranged %an(-$ise.

The schedules are &re&ared in tri&licate' t$o co&ies of $hich are attached

$ith the relevant instruments and the third is (e&t as office co&y.

The house &age is &re&ared from schedules in tri&licate.

The 1fficer Incharge $ith %ranch stam& signs the schedules and house

&ages.

The grand total of the house &age is ta(en and agreed $ith that of the

out$ard clearing register.

The instruments along $ith du&licate schedules and house-&age are sent

to the Main 1ffice.

Ho$ever the amount is (e&t in float till final status of various instruments is

(no$n from res&ective &aying %an(s in second dealing.

52

Muslim Commercial Bank

The entry of the instruments returned un&aid is made in Che?ues Returned

Register. If the instrument is not to %e &resented again in clearing then a covering

memo is &re&ared. The covering memo along $ith returned instrument and

o%5ection memo is sent to the customer $ho de&osited the same in his account.

IN,ARD CLEARIN* OF THE BRANCH:

The &articulars of the instruments are com&ared $ith the list.

The instruments are detached and sorted out de&artment-$ise.

The entry is made in the In$ard Clearing Register *"erial Num%er'

instrument num%er' Account num%er and amount of instrument is $ritten+.

The instruments are sent to the res&ective de&artments against

ac(no$ledgement in the In$ard Clearing Register.

The instruments are scrutini<ed in each res&ect %efore honoring the same.

OUT,ARD CHEBUES RETURNED UNPAID:

These are the che?ues returned un&aid %y us &resented to us in In$ard Clearing

due to some o%5ections.

IN,ARD CHEBUES RETURNED UNPAID:

These are the che?ues returned un&aid to us' $hich $ere lodged %y us in

1ut$ard Clearing.

RETURN OF CHEBUES AFTER CLEARIN* HOUSE:

"u&&ose all che?ues received in the in$ard clearing are &assed and later on it is

found that a che?ue should have %een returned. In such cases' $e contact the

collecting %ranch and re?uest them not to ma(e &ayment against the &roceeds of

the che?ue $hich $as not returned un&aid %y us in due time. The che?ue $ith

53

Muslim Commercial Bank

o%5ection memo along $ith a covering letter is sent to the collecting %ranch'

ma(ing re?uest to issue a &ayment order in our favor.

To %alance the cash-cum-day %oo( $e may de%it "us&ense A:c "undry @e%tors

$ith the a&&roval of the manager. 0hen the &ayment order is received' it is

lodged in clearing and the "us&ense A:c -"undry @e%tor is ad5usted accordingly.

SPECIAL CLEARIN*:

In addition to the normal clearing function at Clearing House it is mutually agreed

to hold an e6tra clearing at the Clearing House on a &articular day and time'

$hich is (no$n' as L"&ecial ClearingL. It is arranged due to rush of $or( arising

out of say' more holidays declared %y the Central )overnment at a time' %ut

normally s&ecial clearing is held on last $or(ing day of our half yearly and yearly

closing' i.e. #8th Dune and #.st @ecem%er every year.

'ills Collection&

The %ills collection is the (ey de&artment in each and main %ranch. The o%5ective

of this de&artment is to receive the che?ue of different %an( of different area.

1ften the che?ue is dra$n to the customer of another %an( or account holder of

the MCB and similarly the customer of another %an( dra$ che?ue to MCB

account. In %oth cases the che?ue is cleared' endorsement conformed' or ta(es

the dis%ursed guarantee. And then de&osit to the corres&onding de&artment or

%an(s or $hatever the case may %e.

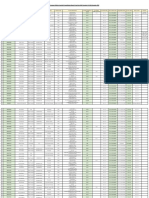

F"nnc"% Stte!ents

54

Muslim Commercial Bank

S,OT ANAL)SIS

55

Muslim Commercial Bank

!RE$GH!

MCB is "uccessive and Mar(et oriented.

MCB investing huge sums on HR develo&ment and training.

Customer default rate is lo$er as com&ared to other %an(s.

MCB has the largest ATM net$or( in the country.

Meeting the challenges of latest Technology %y introducing "mart card remit

e6&ress' mo%ile %an(ing etc.

1ne of the ma5or strengths of MCB is that it has very sta%le de&osit %ase.

MCB is largest &rivate %an( in 2a(istan $ith around .888 %ranches' $hich

cover almost every &art of 2a(istan.

The %an( en5oys com&etitive advantage over other %an(s in 2a(istan.

The %an( en5oys com&etitive &rofita%ility in the industry.

MCB has ca&tured ma5ority of &otential customers in 2a(istan.

MCB has the accounts of %ig organi<ations li(e 1)@CL' 2TCL' C/P' 2TC

etc.

56

Muslim Commercial Bank

7EA($E!!E!

Lo$ motivational levelM non-aggressive mar(eting.

Cm&loyeesF dissatisfaction due to ill treatment and im&ro&er re$ard

system.

/avoritism and Ne&otism in recruitment.

Interest rate is very meager.

@ecision ma(ing &rocess is very slo$.

It is not having greater no. of %ranches a%road.

Though ATM net$or( is the largest in 2a(istan' still some &otential areas

donFt have the ATM.

MCB RTC is usea%le only in 2a(istan.

"ome management &ositrons needed are not &rofessional.

Although most of the %ranches are com&uteri<ed no$' still some im&ortant

%ranches donFt have com&uters.

%33o.tunities&

Leasing sector is gro$ing in 2a(istan for the last t$o to three years $hich

&rovides o&&ortunity to MCB to go ahead in this area as $ell.

MCB is &roviding Consumer /inances at com&aratively lo$er rates $hich

&aves a $ay to gra% more customers

/inancing to small:medium cottage industries $ill definitely increase its

advances and &rofita%ility as $ell.

57

Muslim Commercial Bank

Islamic Trading Based Ban(ing can enhance the %usiness of the %an(.

HREA!

1ther &rivate commercial %an( $ith sound &rofita%ility is also a threat to

MCB e.g. PBL' Alfalah' HBL etc.

/or the last of many years' 2a(istan is facing economic and &olitical

insta%ility $hich is a %ig threat.

Afghan $ar and Ira? $ar has a dee& effect on the economy of 2a(istan'

$hich may affect MCB.

/oreign %an(s are flourishing in field of consumer financing.

2eo&le donFt &refer %an(ing culture. They mostly &refer cash transactions

58

Muslim Commercial Bank

,$r: Per5$r!ed By Me

I 5oined Muslim Commercial Ban(' 7ot /areed Branch' "ahi$al .3

th

Duly A883.

/irst day I reached there at 4F1 cloc( and re&orted to manager $ho introduced

me a%out the functioning of the %ranch and its staff. @uring these t$o months I

$or(ed in different sections of the %ranch to learn the ma6imum &ractices of

%an(ing system.

GE$ERA* 'A$(#$G

/irst of all' I $as as(ed to $or( in different sections of )eneral Ban(ing. Here I

$as attached Mr. Aya< Ahmad $ho has good command on this section. Here $e

dealt $ith ne$ customers $ho $anted to get information a%out the %ranch and

$ill to deal $ith the %ranch. This is a very interesting de&artment %ecause here

$e met &eo&le of different ty&es and deal $ith them accordingly.

In this section' I o%served the follo$ing functionsB

CHE=+E A C%+$ER.

A che?ue is &resented on the counter $ith the t$o signatures of the %earer on

the %ac( of the che?ue. 1&erationFs manager verifies the follo$ing &ointsB

The che?ue num%er

Che?ue @ate

The che?ue signature $ith the signature s&ecimen card &osition in the officer

signature

received at the time of o&ening the customerFs account in the &resence of the

officer

Che?ue amount in figure and $ords

Branch stam& in the front of the che?ue

Chec( the nature of che?ue' %earer che?ue' cross che?ue etc.

CHE=+E PA-ME$ PR%CE"+RE.

Receiving and scrutini<ing the che?ue

/i6ing the stam&

"cri&ting and recei&t %y the authori<ed officer

59

Muslim Commercial Bank

#!!+A$CE %F "EMA$" "RAF

A demand draft is &rovided to the client in $hom he has to s&ecify that on $hich

%an( it is dra$n. The amount %oth in $ords and figures is $ritten on the demand

draft.

'#**! C%**EC#%$! "EPARME$

I s&ent second $ee( of my training in %ills collection de&artment.

Miss "umaira is the in charge of this section. Here $e collected utility %ills li(e

electricity %ill.

'#**! REM#A$CE "EPARME$.

It is most im&ortant and interesting de&artment. This section deals $ith the

transfer of money from one %ranch to another %ranch. Nearly si6 drafts issued

daily from this de&artment.