Professional Documents

Culture Documents

Housing Scenario in Pakistan

Uploaded by

Ghulam Mohey-ud-dinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Housing Scenario in Pakistan

Uploaded by

Ghulam Mohey-ud-dinCopyright:

Available Formats

8/15/2014 Housing scenario in Pakistan - News

http://www.thefinancialdaily.com/NewsDetail/179589.aspx 1/3

Friday, Aug 15 2014

Headlines: Taliban suicide attack on military bus kills five in Kabul - Dar congratulates FBR team for achieving revenue target - KP police nabs TTP commander involved in firing on PIA plane

Home Trading History Payout History Mutual Fund Rate E-Paper Mock Trading Dhiyan

News Financial Reports Members Info Announcements Live Forex Rates Live Commodities Rates Investor's Guide

News Details

www.thefinancialdaily.com

Housing scenario in Pakistan

Ismat Sabir

The population of Pakistan is growing more than 2 percent per annum and reached 184 million in 2013 as compares to 166

million in 2008, i.e.with in two years an increase of about 18 million people in total population.

The world population was growing at the rate of 1.4pc in 2011 reduced to 1pc in 2012. However, in spite of the decrease

about 71 million people were added in global population, and the total world population crossed the figure of 7 billion at the end

of June 2012.

According to official figures, Pakistan is the sixth most populous country in the world and the second largest country in South

Asia with an estimated population of 184.35 million, 2012-13. The growth rate of population during 2012-13 was 2.0 percent. It

was expected that Pakistan will have fifth position in the world, in terms of total population, in 2050.

Although working age population can become asset of a country but they need more food, education, and health and shelter.

It is estimated that median age in Pakistan is 22 years which means Pakistan is a young country. Out of the total population

the working population was 110 million which is 60 percent of the total population.

Urbanization

The world is undergoing the largest wave of urban growth in history. In 2008, for the first time in history more than half of the

world's population was residing in towns and cities. By 2030 this number will rose to 5 billion. Population growth and

urbanization go together and economic development is closely correlated with urbanization. The more urbanized a country the

higher is the level of individual income. No country has ever reached high income levels with low urbanization and mostly rich

countries have higher levels of urbanization.

Population growth together with rural urban migration increases density and creates higher urban agglomeration. This is the

phenomenon which is critical for achieving sustained growth as large urban centers allow for innovation and increase economies

of scale.

The population in urban areas increased from 58.74 million in 2008 to 69.87 million in 2013.

Table-12.6 gives the detail, of urban and rural population in Pakistan during the last six years. If the current pattern of

urbanization continues, the urban population of Pakistan will cross the figure of 122 million in 2030, which would be 50pc of

total population of the country.

The major contributor of urbanization was migration, which is the process of movement of people in search of social and

economic opportunity. Cities generate jobs and income. With good governance they can deliver education, health care and

other services more efficiently than less densely settled areas simply because of their advantages of scale and proximity. Cities

also present opportunities for social mobilization and women's empowerment.

Furthermore, the density of urban life can relieve pressure on natural habitats and areas of biodiversity.

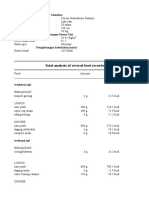

Table - 1

Urban Rural Population in Pakistan

Year Urban Population Rural Population Total Population

2008 58.74 107.67 166.41

2009 60.87 109.07

2010 63.05 110.46

2011 65.28 111.82

2012 67.55 113.16

2013 69.87 114.48 184.35

Source: Economic Survey

As the population increases, the demand for housing units is increased. Housing is one of the three basic needs of human

being. Providing shelter to every family is a big issue for government that has been resulted due to rapid urbanization and

higher population growth. But on the other hand, the production of housing units has not kept the pace with the above factors

and resulted in the deterioration of living condition, increased health hazards and rapid growth of slums and squatter

settlements, Katchi Abadies.

Housing for all

To overcome ever increasing demand for housing units some innovative methods are needed to be employed to make a major

breakthrough in this area.

Due to the strong linkage of the housing sector to the economy, the income multiplier is generally very high, and the private

and informal sector can play a vital role in national development. The sector also generates direct employment especially

absorb rural labor and provide opportunity for seasonal employment for farm workers, enhance participation of women workers,

and activate small scale and mostly self employed industries such as building construction materials, equipment, fittings and

fixtures.

According to the 1998 Census, there were 19.3 million households in Pakistan, the average household size was 6.6 persons and

occupancy was 3.3 persons per room. The overall housing stock comprised 39 percent Kucha houses mostly without proper

water supply, 40 percent semi Pucca houses mostly without planned sanitation or sewerage system, and only 21 percent

Pucca houses.

8/15/2014 Housing scenario in Pakistan - News

http://www.thefinancialdaily.com/NewsDetail/179589.aspx 2/3

Pucca houses.

The demand for housing is estimated at 570,000 units annually, as against this only about 300,000 units were being built

annually, mostly in urban areas. The housing backlog was estimated at 4.3 million units in 1998 that has increased to around 6

million units in 2005.

About half of the urban population is living in slums and Katchi Abadis, with inadequate housing and living conditions. The share

of housing in the public sector programmes has progressively decreased from 10.9 percent in the 1960s to 5.9 percent in

1990s, with limited institutional finance continuing to be a major constraint in housing production and maintenance of old

dilapidated housing stock.

According to housing census, the housing backlog was about 4.30 million that was projected to reach 6.19 million in 2010. It

was estimated that to address the backlog and to meet the housing shortfall in the next 20 years the overall housing

production has to be increased to 500,000 housing units per annum. The present housing stock is also rapidly aging and it was

indicated that more than 50 percent stock is over 50 years old. Meeting the backlog in housing, besides replacement of out

lived housing units is beyond the financial resources of the Government. This necessitates putting in place a framework to

facilitate financing in the formal private sector and mobilize non-government resources for a market based housing finance

system. The government, therefore, encourages participation of local as well as foreign investors and developers and private

sector companies in housing sector to build more and more housing projects to meet the demands of a vast segment of

society, claimed government.

In addition, more than 80 percent of the total population cannot afford the financing terms provided by the House Building

Finance Corporation (HBFC) and other housing finance institutions. Resultantly, the construction of low income housing has

been much slower than the incremental demand.

Problems

The following are the major issues in the housing sector:

i) The households below poverty line have remained neglected.

ii) Inadequate supply of developed land and its skyrocketing prices, particularly in large cities, is making housing ownership

beyond the affordability limits of the majority of population. Related barriers also include poor land administration with

inadequate legal and regulatory systems, and high cost of property transactions.

iii) Housing for rural population, constituting two third of the total population, has not received adequate importance.

iv) More than 30 percent housing is in dilapidated condition requiring improvement /replacement.

v) An overemphasis on Katchi Abadis regularization in urban areas has encouraged further encroachments.

vi) Limited supply of housing finance, with weak mortgage collateral, does not encourage institutional credit based housing

development.

vii) Traditional approaches of reliance on the Government have not resulted in an increase in housing construction to match

the needs.

viii) Low public confidence in the housing development industry.

ix) Most of the Local Governments lack required skills to effectively manage the urban growth, provide basic utility service and

maintain the infrastructure, especially in low income areas/Katchi Abadis.

x) Lack of comprehensive planning at national, provincial, regional and local levelds without effective coordination among

various Government departments, development agencies and other bodies has impeded housing development.

Housing Strategy Recommendations

In addition to the backlog of 6 million housing units, the incremental housing need during the MTDF will be 3 million housing

units. Increasing the house construction from 300,000 units in 2005 to 800,000 units by 2010 will only cater to the incremental

needs during 2005-10. A much larger mass housing construction will be required if the housing backlog is to be reduced during

the MTDF. Accordingly, the strategy will be to undertake mass housing programme with enhanced supply of institutional

finance and long term fixed rate financing options; increase availability of developed land; enhance proportion of small size

plots for low income groups; undertake high rise condominium development, where possible, to utilize land more effectively;

build capacity for land administration; discourage speculation in land; improve house construction technology including

standardization of components for mass production; regularize notified Katchi Abadis complemented by policies to restrain the

emergence of new Katchi Abadis; increase community participation in housing and service delivery; provide sufficient and

affordable credit for rural housing to meet the needs of shelterless poor: invest in human capital to improve the quality of

construction; and put in place legal and regulatory framework to facilitate the development of housing both in urban and rural

areas.

The MTDF housing programmes were to be developed as per the recommendations of National Housing Policy, by the Ministry of

Housing and Works in consultation with the Provincial Governments and, both financially and environmentally, with replicable

models. The Government would assume the role of a facilitator for the implementing of housing programmes rather than being

the developer. Land Banks was to be set up at the federal and provincial levels, and innovative techniques were to be

developed to effectively involve the private sector. It was recommended that auction policy for disposal of residential plots/

sites should be discontinued to arrest land speculation, and also to capture a share of rising land values resulting from

speculation to meet the housing needs of low income groups. Low Income Housing Funds would be established at the provincial

levels, and opportunities capitalized from the effective implementation of proposed Spatial Planning Systems for development of

rural and urban areas in the country.

The improvement of slums and katchi abadies and provision of affordable housing to shelter less people will not only help to

alleviate the urban and rural poverty but also increase the productivity of the low income population through improvement in

their health. Every Government committed to give priority to housing sector and has promised to allocate enough resources to

accelerate its development and support 30 to 40 allied industries. The multiple effects of the housing and construction sector

have the potential to create maximum employment opportunities besides generating industrial, commerce and trade activities.

But no improvement has been seen during the last 4 decades therefore housing shortage is increasing day by day.

The present government also claimed, in its Budget 2013-14, that a 'roof over the head' is the right of every Pakistani. The

Finance Minister said unfortunately, the housing gap is rising very fast in the country. While the private sector land developers

have catered for the needs of the middle and upper middle classes, i.e. nothing has been done to provide decent housing for

the low and lower middle classes. With no prospect of profit making, it is quite understandable that the private sector remained

oblivious to the needs of these, otherwise very important societal groups.

He said during the last tenure of present government, it introduced housing schemes for the poorest of poor allover the

country, especially in the rural and semi urban areas. Under these schemes, land was provided free of cost. The Ministry of

Housing and Works is developing the detailed plan, but FM explained the main features of the policy on provision of housing to

the poor:

(1) Wherever possible, 3-Marla housing schemes will be developed on government land for the homeless, to whom plots will be

given free of cost.

(2) At least 1,000 clusters of 500 houses each will be developed for low income families through public private partnerships.

(3) To ensure cost effective access to credit for housing, government will bear a portion of the financing cost on behalf of the

borrower. A provision of Rs5 billion is kept in the Budget for this purpose. Now the Budget 2014-15 is approaching but nothing

has been done in this direction.

(4) Schemes on the model of Ashiyana Housing Scheme will also be developed in which the government will provide

8/15/2014 Housing scenario in Pakistan - News

http://www.thefinancialdaily.com/NewsDetail/179589.aspx 3/3

Terms of service | Privacy guidelines | License our content | About us | Contact us

Copyright (c) 2010-2013 The Financial Daily

Site developed and maintained by MDI Datanet.

Email: imran.sharif@thefinancialdaily.com

A subsidiary of Data Research & Communication

111-C, Jami Commercial, Phase VII, D.H.A. Karachi.

Tel: (+92)-(021)-35388428; Fax: (+92)-(021)-35388427;

Mob#: (+92)-302-969-9892

(4) Schemes on the model of Ashiyana Housing Scheme will also be developed in which the government will provide

opportunities to low income families to own their house on payment of easy installments.

The other feature is that persons per household are increasing some houses so conjested that about 16 people live in a

dwelling; table-1 and 2.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Student ChecklistDocument9 pagesStudent Checklistapi-251493243No ratings yet

- Adhi Wardana 405120042: Blok PenginderaanDocument51 pagesAdhi Wardana 405120042: Blok PenginderaanErwin DiprajaNo ratings yet

- The List InditexDocument126 pagesThe List InditexRezoanul Haque100% (2)

- Naming Alcohols, Aldehydes. EtcDocument1 pageNaming Alcohols, Aldehydes. Etcim_mikezNo ratings yet

- EarthmattersDocument7 pagesEarthmattersfeafvaevsNo ratings yet

- Radiesthesia and The Major ArcanaDocument72 pagesRadiesthesia and The Major ArcanaStere Stere67% (3)

- Question Bank Chemistry (B.Tech.) : Solid StateDocument10 pagesQuestion Bank Chemistry (B.Tech.) : Solid StatenraiinNo ratings yet

- Gulayan Sa Barangay OrdinanceDocument2 pagesGulayan Sa Barangay OrdinancekonsinoyeNo ratings yet

- Amniotic Fluid DisordersDocument16 pagesAmniotic Fluid DisordersLytiana Williams100% (2)

- Achievement Test Science 4 Regular ClassDocument9 pagesAchievement Test Science 4 Regular ClassJassim MagallanesNo ratings yet

- Accomplishment Report Rle Oct.Document7 pagesAccomplishment Report Rle Oct.krull243No ratings yet

- Vinegar Intake Reduces Body Weight Body Fat Mass and Serum Triglyceride Levels in Obese Japanese SubjectsDocument8 pagesVinegar Intake Reduces Body Weight Body Fat Mass and Serum Triglyceride Levels in Obese Japanese SubjectsZaphan ZaphanNo ratings yet

- ICT ContactCenterServices 9 Q1 LAS3 FINALDocument10 pagesICT ContactCenterServices 9 Q1 LAS3 FINALRomnia Grace DivinagraciaNo ratings yet

- Unit Plan Adult Health Nursing Unit IIDocument7 pagesUnit Plan Adult Health Nursing Unit IIDelphy VargheseNo ratings yet

- 134.4902.06 - DM4170 - DatasheetDocument7 pages134.4902.06 - DM4170 - DatasheetVinicius MollNo ratings yet

- Research Paper DraftDocument45 pagesResearch Paper DraftMelissa SpamNo ratings yet

- Writing Workshop G7 PDFDocument12 pagesWriting Workshop G7 PDFJobell AguvidaNo ratings yet

- Excerpts From Roe v. Wade Majority OpinionDocument2 pagesExcerpts From Roe v. Wade Majority OpinioncatherinewangcNo ratings yet

- Case Diagnosis For RomanDocument4 pagesCase Diagnosis For RomanChris Marie JuntillaNo ratings yet

- Clipsal RCD Tester 486D PDFDocument4 pagesClipsal RCD Tester 486D PDF322399mk7086No ratings yet

- Screenshot 2019-10-30 at 12.44.00Document25 pagesScreenshot 2019-10-30 at 12.44.00Miền VũNo ratings yet

- Aplication Pipe and Tube - Nippon SteelDocument29 pagesAplication Pipe and Tube - Nippon Steelmatheus david100% (1)

- Management of AsthmaDocument29 pagesManagement of AsthmaAbdullah Al ArifNo ratings yet

- 15-Statutory Report Statutory Define Law (Legal Protection) Statutory MeetingDocument2 pages15-Statutory Report Statutory Define Law (Legal Protection) Statutory MeetingRaima DollNo ratings yet

- RX Gnatus ManualDocument44 pagesRX Gnatus ManualJuancho VargasNo ratings yet

- Tugas Gizi Caesar Nurhadiono RDocument2 pagesTugas Gizi Caesar Nurhadiono RCaesar 'nche' NurhadionoNo ratings yet

- Guia Laboratorio Refrigeración-2020Document84 pagesGuia Laboratorio Refrigeración-2020soniaNo ratings yet

- Performance Management and Strategic Planning:: Organization's Strategic PlanDocument7 pagesPerformance Management and Strategic Planning:: Organization's Strategic PlanSara AbidNo ratings yet

- ANNEX I of Machinery Directive 2006 - 42 - EC - Summary - Machinery Directive 2006 - 42 - CE - Functional Safety & ATEX Directive 2014 - 34 - EUDocument6 pagesANNEX I of Machinery Directive 2006 - 42 - EC - Summary - Machinery Directive 2006 - 42 - CE - Functional Safety & ATEX Directive 2014 - 34 - EUAnandababuNo ratings yet