Professional Documents

Culture Documents

Cayanan Vs North Star

Uploaded by

attorneychen0 ratings0% found this document useful (0 votes)

186 views2 pagesThe petitioner issued checks to North Star International Travel, Inc. totaling over P1.5 million that were dishonored upon presentment. North Star filed criminal charges against the petitioner for violating the Bouncing Checks Law. While the petitioner was acquitted of criminal liability, the Court of Appeals found him civilly liable for the value of the dishonored checks. The Supreme Court affirmed this ruling, finding that the petitioner did not provide sufficient evidence to rebut the presumption that the checks were issued for valuable consideration related to funds sent by North Star on the petitioner's behalf. Therefore, the petitioner was held civilly liable to North Star for the value of the dishonored checks.

Original Description:

Cayanan

Original Title

Cayanan vs North Star

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe petitioner issued checks to North Star International Travel, Inc. totaling over P1.5 million that were dishonored upon presentment. North Star filed criminal charges against the petitioner for violating the Bouncing Checks Law. While the petitioner was acquitted of criminal liability, the Court of Appeals found him civilly liable for the value of the dishonored checks. The Supreme Court affirmed this ruling, finding that the petitioner did not provide sufficient evidence to rebut the presumption that the checks were issued for valuable consideration related to funds sent by North Star on the petitioner's behalf. Therefore, the petitioner was held civilly liable to North Star for the value of the dishonored checks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

186 views2 pagesCayanan Vs North Star

Uploaded by

attorneychenThe petitioner issued checks to North Star International Travel, Inc. totaling over P1.5 million that were dishonored upon presentment. North Star filed criminal charges against the petitioner for violating the Bouncing Checks Law. While the petitioner was acquitted of criminal liability, the Court of Appeals found him civilly liable for the value of the dishonored checks. The Supreme Court affirmed this ruling, finding that the petitioner did not provide sufficient evidence to rebut the presumption that the checks were issued for valuable consideration related to funds sent by North Star on the petitioner's behalf. Therefore, the petitioner was held civilly liable to North Star for the value of the dishonored checks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

[G.R. No.

172954 : October 05, 2011]

ENGR. JOSE E. CAYANAN, PETITIONER, VS. NORTH STAR INTERNATIONAL TRAVEL, INC., RESPONDENT.

Facts:

North Star International Travel Incorporated (North Star) is a corporation engaged in the travel agency

business while petitioner is the owner/general manager of JEAC International Management and

Contractor Services, a recruitment agency. Virginia Balagtas, the General Manager of North Star, in

accommodation and upon the instruction of its client, petitioner herein, sent the amount of US$60,000

to View Sea Ventures Ltd., in Nigeria from her personal account in Citibank Makati.

On March 29, 1994, Virginia again sent US$40,000 to View Sea Ventures by telegraphic transfer, with

US$15,000 coming from petitioner. Likewise, on various dates, North Star extended credit to petitioner

for the airplane tickets of his clients, with the total amount of such indebtedness under the credit

extensions eventually reaching P510, 035. 47. To cover payment of the obligations, petitioner issued five

checks to North Star. When presented for payment, the checks in the amount of P1, 500,000 and P35,

000 were dishonored for insufficiency of funds while the other three checks were dishonored because of

a stop payment order from petitioner.

North Star, through its counsel, wrote petitioner informing him that the checks he issued had been

dishonored. North Star demanded payment, but petitioner failed to settle his obligations. Hence, North

Star instituted Criminal Case Nos. 166549-53 charging petitioner with violation of Batas Pambansa Blg.

22, or the Bouncing Checks Law, before the Metropolitan Trial Court (MeTC) of Makati City. After trial,

the MeTC found petitioner guilty beyond reasonable doubt of violation of B.P. 22. On appeal, the

Regional Trial Court (RTC) acquitted petitioner of the criminal charges. The RTC also held that there was

no basis for the imposition of the civil liability on petitioner. The Court of Appeals reversed the ruling of

the RTC and held petitioner civilly liable for the value of the subject checks.

Issue:

Whether or not the petitioner should be civilly liable to North Star for the value of the checks

Held:

The Court ruled in the affirmative. Petitioner argues that the CA erred in holding him civilly liable to

North Star for the value of the checks since North Star did not give any valuable consideration for the

checks. He insists that theUS$85,000 sent to View Sea Ventures was not sent for the account of North

Star but for the account of Virginias investment. He points out that said amount was taken from Virginia

Balagtas personal dollar account in Citibank and not from North Stars corporate account. Respondent

North Star, for its part, counters that petitioner is liable for the value of the five subject checks as they

were issued for value. Respondent insists that petitioner owes North Star plus interest. Upon issuance of

a check, in the absence of evidence to the contrary, it is presumed that the same was issued for valuable

consideration which may consist either in some right, interest, profit or benefit accruing to the party

who makes the contract, or some forbearance, detriment, loss or some responsibility, to act, or labor, or

service given, suffered or undertaken by the other side. Under Section 24 of the Negotiable Instruments

Law, it is presumed that every party to an instrument acquires the same for a consideration or for value.

As petitioner alleged that there was no consideration for the issuance of the subject checks, it devolved

upon him to present convincing evidence to overthrow the presumption and prove that the checks were

in fact issued without valuable consideration.

However, petitioner has not presented any credible evidence to rebut the presumption, as well as North

Stars assertion, that the checks were issued as payment for the US$85,000 petitioner owed.

Petitioner claims that North Star did not give any valuable consideration for the checks since the

US$85,000 was taken from the personal dollar account of Virginia and not the corporate funds of North

Star. The contention, however, deserves scant consideration. The subject checks, bearing petitioners

signature, speak for themselves. The fact that petitioner himself specifically named North Star as the

payee of the checks is an admission of his liability to North Star and not to Virginia Balagtas, who as

manager merely facilitated the transfer of funds. Indeed, it is highly inconceivable that an experienced

businessman like petitioner would issue various checks in sizeable amounts to a payee if these

are without consideration. WHEREFORE, the present appeal by way of a petition for review on certiorari

is DENIED for lack of merit.

You might also like

- Cayanan Vs North StarDocument1 pageCayanan Vs North StarJoyceNo ratings yet

- Engr Cayanan V North StarDocument1 pageEngr Cayanan V North StarFrances Angelica Domini KoNo ratings yet

- Digest-Bongato vs. MalvarDocument3 pagesDigest-Bongato vs. MalvarJeannie Delfino-BoadoNo ratings yet

- Salas Vs CADocument4 pagesSalas Vs CAjolly verbatimNo ratings yet

- De Ysasi Vs ArceoDocument1 pageDe Ysasi Vs ArceoMabelle ArellanoNo ratings yet

- Consunji vs. EsguerraDocument4 pagesConsunji vs. EsguerraYong Naz100% (1)

- Emilita Solarte Case DigestDocument2 pagesEmilita Solarte Case DigestMarilou GaralNo ratings yet

- Dacuital v. L.M. Camus Engineering Corp. and CamusDocument2 pagesDacuital v. L.M. Camus Engineering Corp. and CamusnabingNo ratings yet

- Prelims ReviewerDocument3 pagesPrelims ReviewerAnny YanongNo ratings yet

- Asiatic Petroleum VDocument1 pageAsiatic Petroleum VChrisel Joy Casuga SorianoNo ratings yet

- SSS V CADocument2 pagesSSS V CARZ ZamoraNo ratings yet

- Digest RULE 39 - PantaleonDocument22 pagesDigest RULE 39 - Pantaleonbookleech100% (1)

- Antonio V SantosDocument2 pagesAntonio V SantosJames Evan I. ObnamiaNo ratings yet

- Heirs of Amparo Del Rosario Vs SantosDocument1 pageHeirs of Amparo Del Rosario Vs SantosfinserglenNo ratings yet

- Dino V Judal-LootDocument3 pagesDino V Judal-LootGabe Ruaro100% (2)

- Allied Bank Corporation Vs CADocument3 pagesAllied Bank Corporation Vs CARitzchelle BelenzoNo ratings yet

- Ting Ho Vs Teng Gui (Jurisdiction)Document9 pagesTing Ho Vs Teng Gui (Jurisdiction)nchlrysNo ratings yet

- Labor Relations Digest 20151216 (61-66)Document11 pagesLabor Relations Digest 20151216 (61-66)James Andrew BuenaventuraNo ratings yet

- Pascual Sr. V Caniogan CreditDocument2 pagesPascual Sr. V Caniogan CreditRaven Claire MalacaNo ratings yet

- Union of Filipro vs. VivarDocument2 pagesUnion of Filipro vs. VivarKC NicolasNo ratings yet

- Leonardo Bognot VsDocument2 pagesLeonardo Bognot VsYolanda Janice Sayan FalingaoNo ratings yet

- Laher v. LopezDocument7 pagesLaher v. LopezHayden Richard AllauiganNo ratings yet

- Monge vs. PeopleDocument5 pagesMonge vs. PeopleAJ AslaronaNo ratings yet

- Sum of Money Owed by PMRDC To Petitioner. The Principal Obligation Therefore Is The Assignment of The Leasehold RightDocument1 pageSum of Money Owed by PMRDC To Petitioner. The Principal Obligation Therefore Is The Assignment of The Leasehold RightJoan Tan-CruzNo ratings yet

- GUIZANO vs. VENERACIONDocument1 pageGUIZANO vs. VENERACIONAMNo ratings yet

- PP Vs VirgilioDocument3 pagesPP Vs Virgiliokrizia marie floresNo ratings yet

- 14 Cession or AssignmentDocument8 pages14 Cession or AssignmentJong PerrarenNo ratings yet

- Yang V CADocument3 pagesYang V CAlarrybirdyNo ratings yet

- Summerville Vs Eugenio Jr. Et Al.Document4 pagesSummerville Vs Eugenio Jr. Et Al.jack package100% (1)

- Cases: SALN 1. Atty. Navarro vs. Ombudsman, GR No. 210128, August 17, 2016 FactsDocument10 pagesCases: SALN 1. Atty. Navarro vs. Ombudsman, GR No. 210128, August 17, 2016 FactsLeeJongSuk isLifeNo ratings yet

- CIR Vs ConstantinoDocument9 pagesCIR Vs ConstantinoJoshua L. De JesusNo ratings yet

- Final Exams CreditDocument2 pagesFinal Exams CreditEmilie DeanNo ratings yet

- Title: Asian Construction and Development Corporation, vs. Sannaedle Co., Ltd. Source: G.R. No. 181676, June 11, 2014 Ponente: Peralta, JDocument4 pagesTitle: Asian Construction and Development Corporation, vs. Sannaedle Co., Ltd. Source: G.R. No. 181676, June 11, 2014 Ponente: Peralta, Jidmu bcpoNo ratings yet

- (Consti 2 DIGEST) 186 - Kho Vs MakalintalDocument5 pages(Consti 2 DIGEST) 186 - Kho Vs MakalintalCharm Divina LascotaNo ratings yet

- D2a - 1 Ibaan v. CADocument2 pagesD2a - 1 Ibaan v. CAAaron AristonNo ratings yet

- 1719 (23) Spouses Ong vs. BPI FamilyDocument1 page1719 (23) Spouses Ong vs. BPI Familyaeron_camaraoNo ratings yet

- Mcmicking Vs Martinez DigestDocument2 pagesMcmicking Vs Martinez DigestDianaVillafuerteNo ratings yet

- BANK OF AMERICA vs. PHILIPPINE RACING CLUB, INC. (PRCI)Document1 pageBANK OF AMERICA vs. PHILIPPINE RACING CLUB, INC. (PRCI)lucky javellanaNo ratings yet

- BPI Vs Royeca (Nego)Document1 pageBPI Vs Royeca (Nego)Jani MisterioNo ratings yet

- Chain of Custody-People Vs Tripoli-SambranoDocument1 pageChain of Custody-People Vs Tripoli-SambranoRome MagbanuaNo ratings yet

- 132 Arambulo V GungabDocument1 page132 Arambulo V GungabLeo TumaganNo ratings yet

- Bank of America V Philippine Racing ClubDocument2 pagesBank of America V Philippine Racing ClubSanjeev J. SangerNo ratings yet

- Novation Dragon Vs MBCDocument2 pagesNovation Dragon Vs MBCDeej JayNo ratings yet

- Final Project in Crefit TransactionDocument58 pagesFinal Project in Crefit TransactionMike KryptoniteNo ratings yet

- Miranda v. PDICDocument2 pagesMiranda v. PDICMonique AngNo ratings yet

- Viesca v. Gilinsky G.R. No. 171698Document1 pageViesca v. Gilinsky G.R. No. 171698Patrick HilarioNo ratings yet

- 50 Willex Plastic Industries Corp vs. CADocument8 pages50 Willex Plastic Industries Corp vs. CAPaoloNo ratings yet

- 0131 G.R. No. 74730 August 25, 1989 Caltex Vs IacDocument6 pages0131 G.R. No. 74730 August 25, 1989 Caltex Vs IacrodolfoverdidajrNo ratings yet

- PNB Vs Manila Oil DigestlDocument1 pagePNB Vs Manila Oil DigestlMelissa Gibson0% (1)

- Sy V. Ca G.R. No. 142293. February 27, 2003. Quisumbing, J. FactsDocument2 pagesSy V. Ca G.R. No. 142293. February 27, 2003. Quisumbing, J. FactsCZARINA ANN CASTRONo ratings yet

- Elements of The Contract of Sale - Nool v. CADocument1 pageElements of The Contract of Sale - Nool v. CAJack Bryan HufanoNo ratings yet

- REPUBLIC v. CABRINI, GREEN & ROSS, INC. (2006)Document1 pageREPUBLIC v. CABRINI, GREEN & ROSS, INC. (2006)Princess CariñoNo ratings yet

- SalesDocument2 pagesSalesAbegail DalanaoNo ratings yet

- Ibaan Rural Bank Inc Vs CADocument4 pagesIbaan Rural Bank Inc Vs CAGlutton ArchNo ratings yet

- Cabaobas V Pepsi Cola DigestDocument1 pageCabaobas V Pepsi Cola DigestL-Shy Kïm100% (1)

- CITIBANK Vs SabenianoDocument5 pagesCITIBANK Vs SabenianoJSNo ratings yet

- Gumabon V PNBDocument5 pagesGumabon V PNBGennard Michael Angelo AngelesNo ratings yet

- ALLANDALE SPORTSLINE INC. v. THE GOOD DEVELOPMENT CORP CONSIGNATIONDocument4 pagesALLANDALE SPORTSLINE INC. v. THE GOOD DEVELOPMENT CORP CONSIGNATIONCML100% (1)

- Associated Bank and Conrado Cruz Vs CA, G.R. No. 89802, May 7, 1992Document1 pageAssociated Bank and Conrado Cruz Vs CA, G.R. No. 89802, May 7, 1992Celinka ChunNo ratings yet

- Cayanan Vs North StarDocument2 pagesCayanan Vs North StarMosarah AltNo ratings yet

- Special Proceeding CasesDocument78 pagesSpecial Proceeding CasesattorneychenNo ratings yet

- Spec Pro CodalDocument56 pagesSpec Pro CodalattorneychenNo ratings yet

- Doj Department Circular No 98Document32 pagesDoj Department Circular No 98attorneychenNo ratings yet

- Detailed Digest of Gamboa Vs Tevez and AganaDocument11 pagesDetailed Digest of Gamboa Vs Tevez and AganaattorneychenNo ratings yet

- ATENEO EvidenceDocument51 pagesATENEO Evidencevanessa pagharion100% (9)

- Class of 2014Document16 pagesClass of 2014attorneychenNo ratings yet

- ATENEO EvidenceDocument51 pagesATENEO Evidencevanessa pagharion100% (9)

- Criminal Law I Syllabus-Prof EsguerraDocument17 pagesCriminal Law I Syllabus-Prof Esguerraalejandrotalledo80% (5)

- Overthrowing WitchcraftDocument10 pagesOverthrowing WitchcraftIg Newman100% (2)

- Francisco Vs FerrerDocument1 pageFrancisco Vs FerrerNath AntonioNo ratings yet

- Napolcom CitizenscharterDocument50 pagesNapolcom Citizenscharterbsulaw23No ratings yet

- PEOPLE OF THE PHILIPPINES v. EMMANUEL OLIVA Et Al.Document2 pagesPEOPLE OF THE PHILIPPINES v. EMMANUEL OLIVA Et Al.Orl TrinidadNo ratings yet

- David Zajac Torrington ArrestDocument3 pagesDavid Zajac Torrington ArrestDavidZajacNo ratings yet

- People v. Burgos DigestDocument2 pagesPeople v. Burgos DigestFrancis Guinoo100% (5)

- William A. Sundel v. Justices of The Superior Court of The State of Rhode Island, 728 F.2d 40, 1st Cir. (1984)Document7 pagesWilliam A. Sundel v. Justices of The Superior Court of The State of Rhode Island, 728 F.2d 40, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- GR No L-19660 THE PEOPLE OF THE PHILIPPINES Vs AMBROCIO CANO Y PINEDADocument4 pagesGR No L-19660 THE PEOPLE OF THE PHILIPPINES Vs AMBROCIO CANO Y PINEDARuel FernandezNo ratings yet

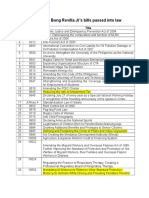

- Passed Into Law RBRJDocument9 pagesPassed Into Law RBRJJamie Dilidili-TabiraraNo ratings yet

- Justice P.B Sawant Moot Court MemorialDocument31 pagesJustice P.B Sawant Moot Court MemorialPrithvi Raj Sinh BarhatNo ratings yet

- Fulton11 7Document6 pagesFulton11 7JamesMurtaghMD.comNo ratings yet

- Chapter 27Document2 pagesChapter 27Ross AuNo ratings yet

- Duties of A LawyerDocument4 pagesDuties of A LawyerNesrene Emy LlenoNo ratings yet

- Consti 2 Digests Custodial InvestigationDocument4 pagesConsti 2 Digests Custodial InvestigationKirsten Rose Boque ConconNo ratings yet

- D441Document75 pagesD441russianuntouchablesNo ratings yet

- People Vs AndanDocument15 pagesPeople Vs AndanNadzlah BandilaNo ratings yet

- U.S. vs. Gamao Digest and Full TextDocument2 pagesU.S. vs. Gamao Digest and Full TextAyban NabatarNo ratings yet

- Dimabayao Vs NLRC Island Biscuit Cheng Suy EhDocument3 pagesDimabayao Vs NLRC Island Biscuit Cheng Suy EhAngie JosolNo ratings yet

- Candell ResponsesDocument8 pagesCandell ResponsesBruceNyeNo ratings yet

- 2000 Bar Examination EthicsDocument12 pages2000 Bar Examination EthicsTeresa CardinozaNo ratings yet

- Theft Vs EstafaDocument4 pagesTheft Vs EstafaSHI LEGALNo ratings yet

- MDOC Profile: Superintendent Jeff Morin and Mountain View Youth Development CenterDocument10 pagesMDOC Profile: Superintendent Jeff Morin and Mountain View Youth Development CenterMaineCorrectionsNo ratings yet

- What Cops Know - Fletcher ConnieDocument196 pagesWhat Cops Know - Fletcher ConnieTruco El Martinez100% (3)

- Correction 2003Document18 pagesCorrection 2003criminologyallianceNo ratings yet

- People of The Philippines vs. Molina and MulaDocument1 pagePeople of The Philippines vs. Molina and MulaJohn Baja GapolNo ratings yet

- Herras Teehankee Vs RoviraDocument2 pagesHerras Teehankee Vs RoviraDanielle Ray V. Velasco100% (2)

- Laci V Pro I Outline CrawfordDocument174 pagesLaci V Pro I Outline CrawfordRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- Death in Venice (Florida) : Flight School Owner Has Shady TiesDocument45 pagesDeath in Venice (Florida) : Flight School Owner Has Shady Tiesworcesteradam83No ratings yet

- Cojuangco Jr. Vs - PalmaDocument2 pagesCojuangco Jr. Vs - PalmaPixie DustNo ratings yet