Professional Documents

Culture Documents

Sunga-Chan v.CA

Uploaded by

Hanna QuiambaoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sunga-Chan v.CA

Uploaded by

Hanna QuiambaoCopyright:

Available Formats

21. Sunga-Chan v. C.A.

Facts:

Lamberto Chua & Jacinto Sunga formed a partnership to engage in the marketing of liquefied petroleum

gas under the name Shellite Gas Appliance Center (Shellite). When Jacinto died, his widow petitioner

Cecilia Sunga and daughter Lilibeth Sunga-Chan continued with the business without Chuas consent.

Since Chuas demands for accounting and winding up were unheeded, he filed a complaint for Winding

Up of a Partnership Affairs, Accounting, Appraisal & Recovery of Shares & Damages with Writ of

Preliminary Attachment with the RTC of Zamboanga.

The RTC ruled in his favor and the same was upheld by the CA. Chua then asked the trial court to

commission a CPA to undertake accounting work but later moved to withdraw and asked for the

admission of an accounting report by CPA Cheryl A. Gahuman. The petitioners submitted their own CPA

accounting report which limited Chuas entitlement from the winding up of partnership to

P3,154,736.65 only but the RTC rejected it and approved the new computation claims of Chua.

Issue:

Whether or not RTC can impose interest on a final judgment of unliquidated claims.

Held: Petitioners are partly correct.

As may be recalled, the trial court admitted and approved Chuas computation of claims amounting to

PhP 8,733,644.75, but rejected that of petitioners, who came up with the figure of only PhP

3,154,736.65. We highlight the substantial differences in the accounting reports on the following items,

to wit: (1) the aggregate amount of the partnership assets bearing on the 50% share of Chua thereon;

(2) interests added on Chuas share of the assets; (3) amount of profits from 1988 through May 30,

1992, net of alleged payments made to Chua; and (4) interests added on the amount entered as profits.

Forbearance is described as a contractual obligation of a lender or creditor to refrain, during a given

period of time, from requiring the borrower or debtor to repay the loan or debt then due and payable.

1. When an obligation is breached, the contravenor can be held liable for damages.

2. Regarding award of interest in the concept if actual & compensatory damages, the rate of

interest, as well as accrual thereof is imposed as follows:

a. Obligation(payment of a sum of money) interest due should be stipulated in writing.

Interest due shall itself earn legal interest from the time it is judicially demanded. Absence

of stipulation, rate shall be 12% p.a. to be computed from default.

b. Obligation(not loans or forbearance of money) is breached, interest on the amount of

damages awarded may be imposed at discretion of court at the rate 6% p.a. No interest on

unliquidated claims or damages except when or until the demand can be established with

reasonable certainty

c. Judgment(award sum of money) becomes final & executor, rate of legal interest shall be

12% p.a.

Guided by the foregoing rules, the award to Chua of the amount representing earned but unremitted

profits must earn interest at 6% p.a. the total monthly profits inclusive of the add on 6% shall earn 12%

p.a.

We agree with petitioners that Chuas share & interest on partnership assets partake of an unliquidated

claim and shall not earn interest until reasonably determined. Considering Chuas computation of claim

was submitted only Oct. 15, 2002, no interest in his favor can be added to his share of the partnership

assets.

The obligation of petitioners is Solidary because of the impossibility of quantifying how much of the

partnership assets or profits was misappropriated by each petitioner.

The levying and selling at public auction of the property of petitioner Sunga Chan to answer for the

obligation of petitioners is also proper since an absolute community property may be held liable for the

obligations contracted by either spouse.

Petition is Partly Granted.

You might also like

- Facebook - DCF ValuationDocument9,372 pagesFacebook - DCF ValuationDibyajyoti Oja0% (2)

- Case Digest 159785Document2 pagesCase Digest 159785Levi IsalosNo ratings yet

- Lahom Vs Sibulo Civil Review DigestDocument2 pagesLahom Vs Sibulo Civil Review DigestRhea Mae A. Sibala100% (1)

- Republic entitled to dividends from sequestered sharesDocument20 pagesRepublic entitled to dividends from sequestered sharessirynspixeNo ratings yet

- Legislative Process FlowchartDocument3 pagesLegislative Process FlowchartHanna Quiambao100% (3)

- Donnina Halley v. Printwell IncorporationDocument2 pagesDonnina Halley v. Printwell IncorporationKayee KatNo ratings yet

- Francisco v. GSISDocument2 pagesFrancisco v. GSISLoi VillarinNo ratings yet

- CONSOLIDATED BANK AND TRUST CORP Vs CADocument2 pagesCONSOLIDATED BANK AND TRUST CORP Vs CARmLyn MclnaoNo ratings yet

- Lim Tanhu v. RamoleteDocument2 pagesLim Tanhu v. RamoleteMaria Lourdes DatorNo ratings yet

- Valino V AdrianoDocument3 pagesValino V AdrianoMiguel CastricionesNo ratings yet

- Electricity Account Tax Invoice SummaryDocument2 pagesElectricity Account Tax Invoice SummaryHamza HanifNo ratings yet

- Judge, Clerk Fined for Illegal MarriagesDocument3 pagesJudge, Clerk Fined for Illegal MarriagesYodh Jamin OngNo ratings yet

- People of Philippines v Francisco JumawanDocument1 pagePeople of Philippines v Francisco JumawanPACNo ratings yet

- Juan Sevilla Salas, JR., Petitioner, V. Eden Villena AguilaDocument2 pagesJuan Sevilla Salas, JR., Petitioner, V. Eden Villena AguilaFred Michael L. Go100% (1)

- Republic v. Court of Appeals and WongDocument1 pageRepublic v. Court of Appeals and WongJettBrunoNo ratings yet

- Boopathi Citibank Savings Account Statement-01August2019-31October2019Document10 pagesBoopathi Citibank Savings Account Statement-01August2019-31October2019VandanaNo ratings yet

- Ugalde V YsasiDocument2 pagesUgalde V Ysasiralph_atmosferaNo ratings yet

- Gonzales v. Salvador DigestDocument1 pageGonzales v. Salvador DigestHanna QuiambaoNo ratings yet

- Estate of Ferdinand Marcos v. RepublicDocument27 pagesEstate of Ferdinand Marcos v. RepublicKym AlgarmeNo ratings yet

- 2016 Revised Small Claims - Sample FormsDocument34 pages2016 Revised Small Claims - Sample FormsHanna QuiambaoNo ratings yet

- Implications of The Global Financial Crisis For Financial Reform and Regulation in AsiaDocument296 pagesImplications of The Global Financial Crisis For Financial Reform and Regulation in AsiaADBI PublicationsNo ratings yet

- Maxey Vs CA Case DDocument3 pagesMaxey Vs CA Case DVince MokeNo ratings yet

- Financial & Marketing ManagementDocument159 pagesFinancial & Marketing ManagementGuruKPONo ratings yet

- Risk and ReturnDocument19 pagesRisk and ReturnLeny MichaelNo ratings yet

- Digest Author: A. Rodriguez: DoctrineDocument2 pagesDigest Author: A. Rodriguez: DoctrineMaria Alyssa RodriguezNo ratings yet

- Pana vs. Heirs of Juanite, Sr. (2012)Document2 pagesPana vs. Heirs of Juanite, Sr. (2012)xxxaaxxxNo ratings yet

- Barba v. Liceo de Cagayan University - G.R. No. 193857 - November 28, 2012 - VILLARAMA, JR., JDocument3 pagesBarba v. Liceo de Cagayan University - G.R. No. 193857 - November 28, 2012 - VILLARAMA, JR., JVianca MiguelNo ratings yet

- Test Bank - Mgt. Acctg 2 - CparDocument16 pagesTest Bank - Mgt. Acctg 2 - CparChristian Blanza LlevaNo ratings yet

- SANTOS vs. SPS. REYESDocument2 pagesSANTOS vs. SPS. REYESAnn CatalanNo ratings yet

- Ramos Vs Caoibes 1954Document4 pagesRamos Vs Caoibes 1954Ram Migue SaintNo ratings yet

- Historical Background Benguet Consolidated Mining Co. vs. Mariano Pineda G.R. No. L-7231 March 28, 1956 REYES, J. B. L., J.Document15 pagesHistorical Background Benguet Consolidated Mining Co. vs. Mariano Pineda G.R. No. L-7231 March 28, 1956 REYES, J. B. L., J.Mae EstanisloaNo ratings yet

- 9 Lee vs. Ilagan PDFDocument9 pages9 Lee vs. Ilagan PDFpa0l0sNo ratings yet

- in Re - Petition For Probate (Santiago)Document3 pagesin Re - Petition For Probate (Santiago)Carie LawyerrNo ratings yet

- CHAPTER 6 Caselette - Audit of InvestmentsDocument30 pagesCHAPTER 6 Caselette - Audit of InvestmentsCharlene Mina0% (1)

- Alpen Bank Case StudyDocument4 pagesAlpen Bank Case StudyAnson Heryanto0% (1)

- (Corrected) Constitutional Law - Defensor-Santiago-vs-COMELEC G.R. No. 127325Document2 pages(Corrected) Constitutional Law - Defensor-Santiago-vs-COMELEC G.R. No. 127325MeylneHimmoldangNo ratings yet

- KEY DOCTRINE: Under The Calling-Out Power, The President May SummonDocument3 pagesKEY DOCTRINE: Under The Calling-Out Power, The President May SummonHanna QuiambaoNo ratings yet

- Polymer Rubber Corp and Ang v. SalamudingDocument2 pagesPolymer Rubber Corp and Ang v. SalamudingHanna QuiambaoNo ratings yet

- Republic of The Philippines vs. Hon. Migrinio and Troadio Tecson (G.R. No. 89483. August 30, 1990)Document1 pageRepublic of The Philippines vs. Hon. Migrinio and Troadio Tecson (G.R. No. 89483. August 30, 1990)Benitez GheroldNo ratings yet

- Chuan vs. Uy (Counterclaim)Document3 pagesChuan vs. Uy (Counterclaim)Hanna Quiambao0% (1)

- Corpo Full CasesDocument105 pagesCorpo Full CasesGGT InteriorsNo ratings yet

- In Re Petition For Authority To Continue Use of Firm Name Sycip Salazar Feliciano Hernandez CastilloDocument8 pagesIn Re Petition For Authority To Continue Use of Firm Name Sycip Salazar Feliciano Hernandez CastillossNo ratings yet

- Miciano V BrimoDocument1 pageMiciano V BrimonayowmeeNo ratings yet

- SEC Ruling on Dissolution of Philippine Blooming MillsDocument2 pagesSEC Ruling on Dissolution of Philippine Blooming MillsAJ DimaocorNo ratings yet

- GSIS Family Bank name dispute with BPI Family BankDocument14 pagesGSIS Family Bank name dispute with BPI Family BankJerry SerapionNo ratings yet

- The Insufficiency of Filipino NationhoodDocument10 pagesThe Insufficiency of Filipino NationhoodFerdinand PiñonNo ratings yet

- Cagayan Fishing Dev't Corp vs Sandiko Land Sale ValidityDocument1 pageCagayan Fishing Dev't Corp vs Sandiko Land Sale ValidityPingLomaadEdulanNo ratings yet

- ONG Vs CA (New)Document1 pageONG Vs CA (New)Liaa AquinoNo ratings yet

- Baldoza V Dimaano DigestDocument2 pagesBaldoza V Dimaano Digestyukibambam_28No ratings yet

- Leonilo Antonio Vs Marie Ivonne F. Reyes, G.R. No. 155800, March 10, 2006, Criminal Law, Book 2, FullDocument2 pagesLeonilo Antonio Vs Marie Ivonne F. Reyes, G.R. No. 155800, March 10, 2006, Criminal Law, Book 2, FullKris CaraanNo ratings yet

- #51 PNB Vs CA and MataDocument1 page#51 PNB Vs CA and MataEleasar Banasen PidoNo ratings yet

- Cruz vs. Cruz (G.R. No. 173292 Dated 1 September 2010)Document5 pagesCruz vs. Cruz (G.R. No. 173292 Dated 1 September 2010)Gia DimayugaNo ratings yet

- SME Bank employees illegally dismissed after change in ownershipDocument3 pagesSME Bank employees illegally dismissed after change in ownershipJerickson A. ReyesNo ratings yet

- Jordan Paz vs. Jeanice Paz Case DigestDocument2 pagesJordan Paz vs. Jeanice Paz Case DigestRein DyNo ratings yet

- BPI v. LeeDocument3 pagesBPI v. LeeHanna QuiambaoNo ratings yet

- BLO Unit 1-1Document24 pagesBLO Unit 1-1Mohammad MAAZNo ratings yet

- Taborite v. Sollesta DigestDocument2 pagesTaborite v. Sollesta DigestHanna QuiambaoNo ratings yet

- CIR V SM PRIMEDocument2 pagesCIR V SM PRIMENezte VirtudazoNo ratings yet

- Algarra v. Sandejas: Actual Damages Include Lost ProfitsDocument2 pagesAlgarra v. Sandejas: Actual Damages Include Lost ProfitsHanna Quiambao100% (1)

- West Tower V FIrst Phil IndDocument74 pagesWest Tower V FIrst Phil IndnobocNo ratings yet

- Joslin Vs NewzealandDocument1 pageJoslin Vs NewzealandADNo ratings yet

- Ugalde V YsasiDocument2 pagesUgalde V YsasiAlicia BanhagNo ratings yet

- de Leon v. de Leon - IBP Zamboanga Del Norte ChapterDocument5 pagesde Leon v. de Leon - IBP Zamboanga Del Norte ChapterCeazar Leo BartolomeNo ratings yet

- Digest Ansaldo V SheriffDocument1 pageDigest Ansaldo V SheriffJaylou BobisNo ratings yet

- Saguid Vs Court of Appeals GR 150611 FACTS: Seventeen-Year Old Gina S. Rey Was MarriedDocument2 pagesSaguid Vs Court of Appeals GR 150611 FACTS: Seventeen-Year Old Gina S. Rey Was MarriedShimi FortunaNo ratings yet

- Sasa-Akiyama V Sps CasalDocument2 pagesSasa-Akiyama V Sps CasalRobert RosalesNo ratings yet

- Prats V CADocument2 pagesPrats V CAAnonymous zki1KYndaNo ratings yet

- People vs. PrunaDocument13 pagesPeople vs. PrunaBeda Maria Geyrozaga EnriquezNo ratings yet

- Philippine National Bank & National Sugar Development Corporation vs Andrada ElectricDocument2 pagesPhilippine National Bank & National Sugar Development Corporation vs Andrada Electricjcfish07No ratings yet

- Ignacio Vicente vs Ambrosio Geraldez: Lawyers' Authority to Compromise for CorporationDocument2 pagesIgnacio Vicente vs Ambrosio Geraldez: Lawyers' Authority to Compromise for CorporationJayson Lloyd P. MaquilanNo ratings yet

- RTC V AlmelorDocument1 pageRTC V AlmelorM ANo ratings yet

- Case Digest in CorporationDocument13 pagesCase Digest in Corporationianmaranon2No ratings yet

- Lyceum of the Philippines vs. Court of Appeals - Use of "LyceumDocument1 pageLyceum of the Philippines vs. Court of Appeals - Use of "LyceumLea AndreleiNo ratings yet

- Ros V PNBDocument1 pageRos V PNBDan CarnaceteNo ratings yet

- #80 Maxey vs. CADocument8 pages#80 Maxey vs. CATani AngubNo ratings yet

- Phil. Health Care Providers, Inc. (MAXICARE) v. ESTRADA / CARA ServicesDocument2 pagesPhil. Health Care Providers, Inc. (MAXICARE) v. ESTRADA / CARA ServicesManuel Rodriguez IINo ratings yet

- Pentacapital V MahinayDocument3 pagesPentacapital V MahinayHector Mayel Macapagal0% (1)

- Republic Glass v. QuaDocument3 pagesRepublic Glass v. QuaKbuy ClothingNo ratings yet

- Affidavit of Undertaking Blank FormDocument1 pageAffidavit of Undertaking Blank FormHanna QuiambaoNo ratings yet

- Affidavit of Acknowledgement SampleDocument1 pageAffidavit of Acknowledgement SampleHanna QuiambaoNo ratings yet

- Ong v. Roban Lending Corporation: FactsDocument1 pageOng v. Roban Lending Corporation: FactsHanna QuiambaoNo ratings yet

- Political Law Cases (Digested)Document17 pagesPolitical Law Cases (Digested)Hanna QuiambaoNo ratings yet

- Borlongan v. Peña Full TextDocument1 pageBorlongan v. Peña Full TextHanna QuiambaoNo ratings yet

- San Diego v. Hernandez DigestDocument1 pageSan Diego v. Hernandez DigestHanna QuiambaoNo ratings yet

- Oblicon Summary TableDocument1 pageOblicon Summary TableHanna QuiambaoNo ratings yet

- Ey The Next Phase of Digital Lending in IndiaDocument52 pagesEy The Next Phase of Digital Lending in IndiaArindam MondalNo ratings yet

- Ifamr2019 0030Document22 pagesIfamr2019 0030RizkiMartoba SitanggangNo ratings yet

- CurrencyDocument3 pagesCurrencySarthak ShrivastavaNo ratings yet

- Card Dispute FormDocument1 pageCard Dispute FormAmitesh AgrawalNo ratings yet

- International Financial Management 5Document53 pagesInternational Financial Management 5胡依然100% (1)

- Sad - Text - en - Xls - r1Document17 pagesSad - Text - en - Xls - r1Samuel SantanaNo ratings yet

- Invoice 1173385957 I0119F2000029537Document2 pagesInvoice 1173385957 I0119F2000029537Sharma PappuNo ratings yet

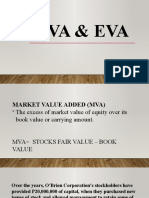

- Mva EvaDocument11 pagesMva EvaRian ChiseiNo ratings yet

- (Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Document156 pages(Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Vignesh KathiresanNo ratings yet

- Mekidelawit Tamrat MBAO9550.14BDocument4 pagesMekidelawit Tamrat MBAO9550.14BHiwot GebreEgziabherNo ratings yet

- Masala BondsDocument3 pagesMasala BondsRashmi BihaniNo ratings yet

- Sprott Gold Report: The Gold Investment Thesis RevisitedDocument8 pagesSprott Gold Report: The Gold Investment Thesis RevisitedOwm Close CorporationNo ratings yet

- Difference Between Coupon and Yield To MaturityDocument2 pagesDifference Between Coupon and Yield To MaturitySACHINNo ratings yet

- Insular-Life-Financial-Statement-AnalysisDocument5 pagesInsular-Life-Financial-Statement-AnalysisKrizel DANo ratings yet

- United States v. John Napoli, A/K/A John Bianco, A/K/A "Vince," Barry D. Pincus Robert San Filippo Darrin Wigger, 179 F.3d 1, 2d Cir. (1999)Document25 pagesUnited States v. John Napoli, A/K/A John Bianco, A/K/A "Vince," Barry D. Pincus Robert San Filippo Darrin Wigger, 179 F.3d 1, 2d Cir. (1999)Scribd Government DocsNo ratings yet

- Inflation in 2022Document2 pagesInflation in 2022Lea Moureen KaibiganNo ratings yet

- Loan AgreementDocument10 pagesLoan AgreementManoj KolanNo ratings yet

- Motilal OswalDocument12 pagesMotilal OswalRajesh SharmaNo ratings yet

- Identify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetDocument1 pageIdentify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetTitser JeffNo ratings yet

- Tutorial 1Document8 pagesTutorial 1malak aymanNo ratings yet